- Home

- »

- Sensors & Controls

- »

-

Automotive Embedded Telematics Market Size Report, 2030GVR Report cover

![Automotive Embedded Telematics Market Size, Share & Trends Report]()

Automotive Embedded Telematics Market (2023 - 2030) Size, Share & Trends Analysis Report By Solution, By Component (Hardware, Services, Connectivity), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-472-7

- Number of Report Pages: 121

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

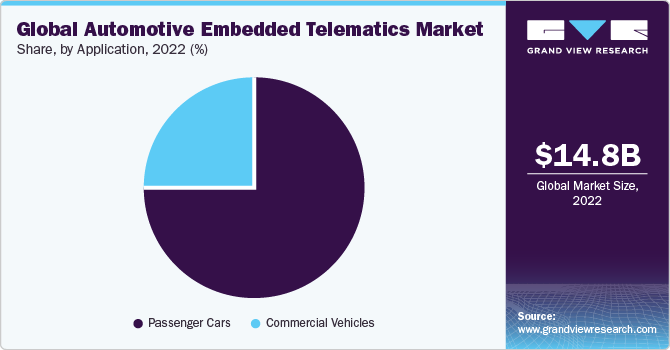

The global automotive embedded telematics market size was valued at USD 14.79 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 18.6% from 2023 to 2030. The rising integration of wireless communications with automotive, the need for fleet management, and the extensive adoption of advanced driver assistance systems are expected to fuel market growth. Installing these systems in passenger and commercial vehicles is expected to reduce road accidents and offer greater passenger security.

Stringent government policies about installing vehicle safety systems are anticipated to be prominent in driving market growth. The rising emphasis on research and development initiatives and safety rating upgrades also contributes to market expansion. For instance, in November 2021, the U.S. National Highway Traffic Safety Administration (NHTSA) announced the Infrastructure Investment and Jobs Act. The NHTSA aims to improve existing safety standards and conduct thorough research to address emerging safety concerns. By implementing these changes, the NHTSA seeks to ensure the continued protection of drivers, passengers, and pedestrians on the country’s roadways.

An increase in sales of passenger vehicles, Sports Utility Vehicles (SUVs), and high-end luxury vehicles is expected to be a significant growth driver for the automotive embedded telematics industry. Automobile manufacturers are integrating these systems to enhance vehicle safety and security. For instance, Toyota launched the Toyota Safety Connect and Toyota Fleet Management, which offer an array of beneficial features and services, including emergency assistance, stolen vehicle locator, automatic collision notification, roadside assistance, and monitoring of driver behavior.

The need for safety and operational efficiency is expected to encourage companies to adopt embedded telematics technologies. These technologies help users to aggregate comprehensive vehicle information related to vehicle components, physical proximity to other vehicles, and roadside devices. This information can improve troubleshooting during a mishap or component malfunction, improving logistics efficiency. Leading companies invest in R&D to design, develop, and test the systems. They form partnerships to boost their competencies and share resources & expertise. Moreover, collaborations strengthen a company’s operational capacity.

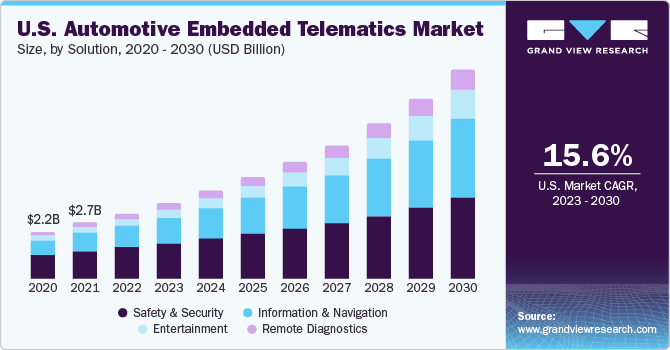

Solution Insights

Based on solution, the global automotive embedded telematics market is segmented into safety & security, information & navigation, entertainment, and remote diagnostics. The safety & security segment captured the highest revenue share of around 47.9% in 2022. Increasing concerns about road safety and rising accident cases have driven the demand for advanced vehicle safety systems.

Automotive-embedded telematics enables the real-time monitoring and analysis of vehicle data, allowing for proactive safety measures such as collision detection, lane departure warning, and emergency assistance. These features enhance driver and passenger safety, making vehicles equipped with embedded telematics systems more appealing to consumers.

The remote diagnostics segment is estimated to register the highest CAGR of 22.2% over the forecast period. Remote vehicle diagnostics help the user detect and resolve vehicle malfunctions and thus prevent or reduce vehicle downtime. Diagnostics involves determining single or multiple issues with a particular set of tools and performing minimal tests. The introduction of cloud diagnostic solutions is further expected to contribute to the extensive use of remote diagnostic solutions in automotive embedded telematics systems.

Component Insights

Based on component, the market is segmented into hardware, services, and connectivity. The services segment accounted for the highest revenue share of around 51.4% in 2022 and is expected to witness the fastest CAGR of 21.7% during the forecast period, owing to an increase in service content. Demand for navigation services will rise since these units offer real-time traffic updates and vital information for an improved driving experience.

The hardware segment is expected to expand substantially at a CAGR of 15.6% during the forecast period. The telematics hardware comprises a telematics control unit (TCU), Wi-Fi module, display screen, speaker, GSM/GPRS module, and amplifiers. Increasing focus on Pay-As-You-Drive (PAYD) vehicle insurance services is expected to drive hardware adoption over the forecast period. Also, improved functionalities such as fault diagnostics, field support, and GPS tracking are anticipated to drive hardware adoption over the forecast period.

Application Insights

Based on application, the market is segmented into passenger cars and commercial vehicles. The passenger cars segment accounted for the dominant revenue share of around 74.5% in 2022. The increasing trend of connected cars and the rise of smart cities drive the adoption of embedded telematics in passenger cars. Connected cars, which rely on telematics systems, can communicate with other vehicles, infrastructure, and external networks, enabling features like traffic management, predictive maintenance, and real-time data exchange.

As smart cities develop and infrastructure becomes more interconnected, embedded telematics in passenger cars will play a crucial role in creating efficient transportation systems. The increasing penetration of international automotive brands, such as BMW and Ford, in developing regions is expected to encourage the adoption of automotive embedded telematics systems in vehicles for entertainment and navigation applications. Moreover, connectivity of mobile devices with these systems is anticipated to encourage its demand for passenger cars. Furthermore, the demand for mid-sized cars is expected to fuel market growth over the forecast period.

The commercial vehicles segment is estimated to register the fastest CAGR of 23.6% over the forecast period. This high demand is owing to transport infrastructure development, chiefly in developing regions. The development is expected to encourage the adoption of embedded telematics systems for navigation and communication applications. Moreover, automotive-embedded telematics is also used for monitoring driver behavior in various commercial vehicles, such as trucks and vans.

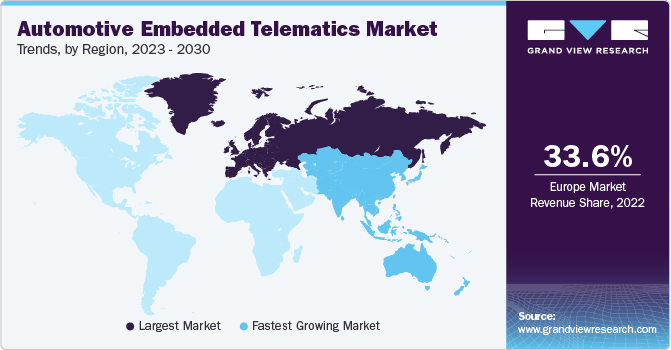

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 33.6% in 2022. The presence of advanced infrastructure and robust telecommunications networks in Europe supports the developing and implementation of embedded telematics systems. The region has well-established mobile networks, high internet penetration rates, and supportive regulatory frameworks, enabling seamless connectivity and data exchange between vehicles and external platforms or services.

Furthermore, stringent government regulations and initiatives focused on road safety and environmental sustainability propel the adoption of embedded telematics in Europe. For instance, in May 2021, the European Road Safety Action Programme (ERSAP) implemented a regulation that mandated the inclusion of the eCall technology for driver assistance in new vehicles. This regulation is a significant development in Europe's efforts to enhance road safety and emergency response capabilities.

Asia Pacific is expected to register the highest CAGR of 23.7% over the forecast period, owing to an increase in disposable income levels in emerging economies such as China and India, leading to a rise in vehicle sales. These factors generate a complementary demand for advanced automotive solutions such as stolen vehicle tracking and vehicle diagnostic systems that are highly beneficial in navigation and telematics applications. Technological advancements such as upgraded GUIs, voice recognition capabilities, and intuitive touchscreens are also poised to drive market expansion over the forecast period.

Key Companies & Market Share Insights

Industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in March 2023, Targa Telematics S.p.A. partnered with Ford Motor Company to broaden its portfolio of connected car solutions by incorporating data from Ford vehicles. Through this partnership, Targa Telematics S.p.A. will work closely with Ford Pro, the division focusing on commercial vehicles and fleet customers.

The objective is to directly integrate fleet data streams into the Targa Telematics S.p.A. platform, allowing for the development of innovative mobility services that utilize embedded devices and leverage a comprehensive range of performance-related information. This partnership will enable enhanced connectivity and value-added solutions for fleet management, benefiting both Targa Telematics S.p.A. and Ford Motor Company customers.

Key Automotive Embedded Telematics Companies:

- Ford Motor Company

- Continental AG

- General Motors

- TomTom International BV

- Hyundai Motor Company

- Toyota Motor Corporation

- MiX Telematics

- INFINITI

- BMW Group

- Verizon

Recent Developments

-

In December 2022, CerebrumX Labs Inc. collaborated with Toyota to provide real-time insights to enhance the safety and cost-effectiveness of connected fleet operations. The primary objective of this collaboration is to lower the Total Cost of Ownership (TCO) for fleets by leveraging telematics data obtained from Toyota vehicles that are part of the network. This alliance encourages data-driven decision-making and strives to enhance overall performance

-

In November 2022, CerebrumX Labs Inc. announced the integration of data from Ford connected vehicles. This integration aims to improve its data-focused usage-based insurance (UBI)-as-a-Service model for insurance companies. CerebrumX intends to provide insurers with a faster, more cost-effective approach to launch UBI programs by utilizing integrated telematics created exclusively for eligible Ford and Lincoln connected vehicles

-

In April 2022, Hitachi Solutions collaborated with BitBrew, aiming to merge BitBrew's connected vehicle platform with Hitachi Solutions America's expertise in the insurance industry, enterprise integration, and deployment. This collaboration aims to provide the insurance industry with cutting-edge solutions for analyzing vehicle health and driver behavior, leveraging real-time telematics data streams. By combining their strengths, Hitachi Solutions America can deliver reliable data-driven models and valuable connected services that meet the evolving needs of the insurance sector

-

In March 2022, Geotab Inc. collaborated with Free2move, a subsidiary of Stellantis. Through this collaboration, Geotab aims to provide Stellantis brand vehicles, such as Ram, Jeep, Dodge, and Chrysler, with a Geotab Integrated Solution. The collaborative solution utilizes the embedded telematics in Stellantis cars to enable vehicle information from Free2move servers to be seamlessly integrated into the MyGeotab platform. Fleet executives can access a user-friendly telematics dashboard to develop reports and track important parameters to boost mobility and optimize fleet performance

Automotive Embedded Telematics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 17.70 billion

Revenue forecast in 2030

USD 58.36 billion

Growth rate

CAGR of 18.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, component, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates; Saudi Arabia; South Africa

Key companies profiled

Ford Motor Company; Continental AG; General Motors; TomTom International BV; Hyundai Motor Company; Toyota Motor Corporation; MiX Telematics; INFINITI; BMW Group; Verizon

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

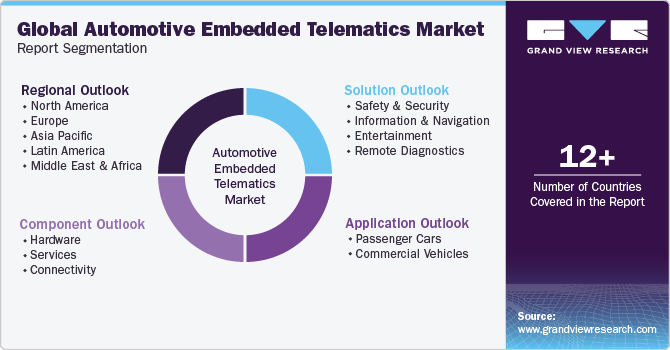

Global Automotive Embedded Telematics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global automotive embedded telematics market report on the basis of solution, component, application, and region:

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Safety & Security

-

Information & Navigation

-

Entertainment

-

Remote Diagnostics

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Services

-

Connectivity

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the automotive embedded telematics market include Ford Motor Company, Continental AG, General Motors Company, TomTom Telematics BV, Hyundai Motor Company, Toyota Motor Corporation, MiX Telematics International Ltd., INFINITI Motor Company Ltd., BMW Group, and Verizon Connect.

b. Key factors driving the market growth are the rising integration of wireless communication with automotive, need for fleet management, and the extensive adoption of advanced driver assistance systems by the automotive vendors. Moreover, stringent government policies pertaining to the installation of vehicle safety systems are anticipated to play a significant role in driving market growth.

b. The global automotive embedded telematics market size was estimated at USD 14.79 billion in 2022 and is expected to reach USD 17.70 billion in 2023.

b. The global automotive embedded telematics market is expected to witness a compound annual growth rate of 18.6% from 2023 to 2030 to reach USD 58.36 billion by 2030

b. Safety & Security segment held the largest share of 47.9% in 2022 due to escalated frequency of road accidents worldwide and strict safety regulations mandated by the governments across the world. Smart locking systems and stolen vehicle tracking systems are among the most widely used security solutions that will boost the growth of embedded telematics systems over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.