- Home

- »

- Automotive & Transportation

- »

-

Connected Car Market Size & Share, Industry Report, 2030GVR Report cover

![Connected Car Market Size, Share & Trends Report]()

Connected Car Market (2025 - 2030) Size, Share & Trends Analysis Report By Connectivity Solutions (Embedded, Integrated, Tethered), By Technology, By Application, By Sales Channel (OEM, Aftermarket), By Region, And Segment Forecasts

- Report ID: 978-1-68038-648-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Connected Car Market Summary

The global connected car market size was estimated at USD 12,843.0 million in 2024 and is projected to reach USD 26,470.7 million by 2030, growing at a CAGR of 12.8% from 2025 to 2030. The market is being driven by the rising integration of advanced driver assistance systems (ADAS), intelligent navigation capabilities, and immersive digital cockpit technologies aimed at enhancing vehicle performance and user experience.

Key Market Trends & Insights

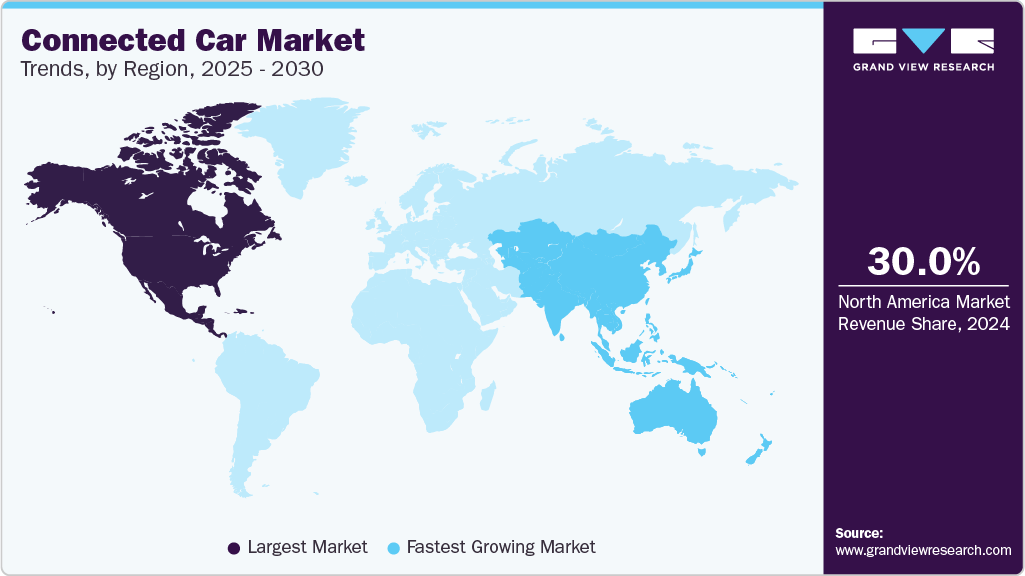

- North America connected car industry held a significant market share of over 30% in 2024.

- The U.S. connected car industry dominated the market with a share of 66% in 2024.

- By connectivity solutions, the embedded segment held the largest market share of over 48% in 2024.

- By technology, the 5G segment is expected to witness the fastest CAGR from 2025 to 2030.

- By application, the driver assistance segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12,843.0 Million

- 2030 Projected Market Size: USD 26,470.7 Million

- CAGR (2025-2030): 12.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing adoption of electric and autonomous vehicles is further accelerating the demand for seamless connectivity and real-time data processing within vehicles. In addition, regulatory mandates, government incentives, and evolving safety and emission standards are catalyzing the rollout of connected infrastructure across developed and emerging markets. These advancements are collectively propelling the growth of the connected car industry.The connected car industry is revolutionizing how drivers and passengers interact with their vehicles. With advanced infotainment systems, voice control, and personalized services, cars are becoming more integrated with everyday life. Enhanced connectivity features like seamless smartphone integration and smart assistant technologies are increasingly embedded into new vehicles. This shift provides users with a more intuitive and enjoyable driving experience, making connected cars an essential part of modern transportation.

Connected car technology is transforming vehicle maintenance by enabling real-time data collection and analysis. Manufacturers and service providers can now monitor vehicle health remotely and diagnose issues before they become critical. The ability to predict and preemptively address mechanical failures through data-driven insights minimizes downtime and enhances vehicle longevity. This technology is reshaping the way car owners interact with their vehicles, improving reliability and reducing costly repairs.

In the connected car industry, safety has become a paramount concern. Advanced safety features powered by real-time data transmission, such as automatic emergency braking and lane-keeping assistance, are significantly improving road safety. Connectivity allows for faster response times during critical moments, reducing the likelihood of accidents. These innovations in the connected car industry make vehicles not just smarter but safer for everyone on the road.

The growing demand for connected cars is paving the way for advancements in autonomous driving technologies. By leveraging sensors, machine learning, and data sharing, connected vehicles are becoming more adept at performing automated functions. Vehicle-to-cloud communication and over-the-air updates are ensuring that self-driving capabilities continue to evolve at a rapid pace. As these technologies progress, the demand for connected cars is expected to surge, bringing us closer to a future where cars can operate autonomously with minimal human intervention.

Connected cars are playing a key role in the development of smart cities, where vehicles communicate with urban infrastructure to optimize traffic flow and reduce congestion. Traffic signals, road signs, and even parking spaces are becoming integrated with vehicle systems, allowing for smarter route planning and more efficient travel. This synergy between connected vehicles and urban environments is set to reshape how cities operate, ensuring smoother and more sustainable transportation systems in the future.

Connectivity Solutions Insights

The embedded segment held the largest market share of over 48% in 2024, owing to rising demand for real-time vehicle services and compliance with safety regulations. Automakers are increasingly equipping vehicles with embedded connectivity solutions. These systems enable critical functionalities such as over-the-air (OTA) updates, emergency services, and real-time navigation support. By embedding telematics units, OEMs gain better control over data flow and service ecosystems, enhancing both brand differentiation and customer retention. The partnerships between car manufacturers, telecom operators, and cloud providers are expanding to deliver robust, scalable connectivity infrastructures.

The integrated segment is expected to witness a significant CAGR of over 11% from 2025 to 2030, driven by the demand for flexible and user-friendly connectivity. Automakers are increasingly adopting platform-agnostic integrated systems compatible with a wide range of smartphones and applications. Rather than relying on proprietary interfaces, many OEMs are integrating middleware that supports multiple mobile ecosystems and cloud-based services. This ensures that users have consistent digital experiences regardless of device brand or software updates. The result is greater adaptability, lower development overhead for OEMs, and enhanced digital longevity of in-vehicle systems.

Technology Insights

The 4G segment held the largest market share in 2024, driven by the wide availability and affordability of 4G networks. OEMs are actively embedding 4G LTE modules into mid-range and entry-level vehicles to extend connected offerings across a broader customer base. This approach is enabling brands to deliver scalable digital services such as diagnostics, tracking, and infotainment without waiting for full 5G readiness. With 4G infrastructure firmly in place, manufacturers are leveraging it as a dependable bridge for real-time connectivity and service continuity. For volume-focused segments, 4G continues to be a strategic asset in accelerating digital feature deployment at scale.

The 5G segment is expected to witness the fastest CAGR from 2025 to 2030. The surging demand for high-bandwidth applications like HD infotainment streaming and real-time navigation updates is pushing OEMs to prioritize 5G integration across next-generation connected vehicles. Automakers are partnering with telecom providers and cloud vendors to deploy ultra-low-latency networks that support seamless in-cabin digital experiences. This shift is also enabling faster over-the-air software updates, reducing recall risks, and enhancing product lifecycle management. As competitive differentiation hinges on digital performance, 5G is becoming a core pillar in connected vehicle strategies across premium and mid-range segments.

Application Insights

The driver assistance segment held the largest market share in 2024. The increasing demand for real-time, data-driven driving support is accelerating the deployment of connected driver assistance technologies. Features such as adaptive cruise control, traffic sign recognition, and collision avoidance are now powered by continuous data updates from cloud networks, ensuring they remain accurate and reliable. This evolving tech allows vehicles to dynamically respond to changing road conditions, making driving safer and less stressful. As drivers rely more on these intelligent systems, automakers are prioritizing seamless software updates and continuous system improvement.

The safety segment is expected to witness a significant CAGR from 2025 to 2030, driven by advancements in artificial intelligence (AI) and machine learning. The safety segment is seeing an evolution in predictive safety systems. These systems can now anticipate potential risks by analyzing real-time data from cameras, sensors, and vehicle behavior, offering preemptive alerts and interventions. By integrating machine learning, these systems continuously improve their ability to predict and prevent accidents, enhancing the overall safety profile of connected vehicles. This shift toward proactive safety measures is rapidly becoming a standard feature in next-generation vehicles, ensuring a higher level of driver and passenger protection.

Sales Channel Insights

The aftermarket segment held a significant market share in 2024. The growing demand for personalized and data-driven vehicle management is fueling the expansion of aftermarket telematics services. Consumers are looking for ways to monitor and optimize their vehicle performance, including tracking maintenance schedules, fuel efficiency, and real-time diagnostics. Aftermarket telematics solutions, which integrate with smartphones and cloud platforms, are allowing drivers to gain deeper insights into their vehicles, improving both operational efficiency and vehicle longevity. This trend is creating new business opportunities for aftermarket providers to offer subscription-based services and value-added features that keep vehicles connected and performing optimally.

The OEM segment is expected to witness the fastest CAGR from 2025 to 2030. The growing demand for seamless in-vehicle connectivity is pushing OEMs to integrate advanced telematics systems across a wide range of vehicle models. Consumers increasingly expect features such as real-time navigation, over-the-air software updates, and enhanced infotainment as part of their driving experience. OEMs are responding by investing in robust connectivity platforms that not only enhance the user experience but also allow for continuous service improvements and customization. This trend is driving automakers to collaborate with telecom and tech companies to ensure their vehicles remain competitive in a highly connected world.

Regional Insights

North America connected car industry held a significant market share of over 30% in 2024, primarily driven by the widespread adoption of 5G technology. North America's market is progressing rapidly with an emphasis on high-speed, low-latency communication and over-the-air software optimization. Heightened consumer expectations for seamless digital experiences are encouraging OEMs to expand cloud-based infotainment platforms and personalized in-car services. The integration of AI-powered driver assistance systems is gaining momentum, reinforcing the region’s push toward safety-focused innovation. In parallel, strategic collaborations between automakers and technology firms are accelerating the deployment of scalable connectivity architectures across diverse vehicle segments.

U.S. Connected Car Market Trends

The U.S. connected car industry dominated the market with a share of 66% in 2024, driven by the growing popularity of electric vehicles (EVs), the U.S. is seeing a surge in connected car technology that supports in-car infotainment, vehicle diagnostics, and real-time maintenance services. The strong presence of technology companies like Apple and Google has accelerated the integration of voice assistants and cloud-based solutions in vehicles. In addition, the push for autonomous driving and enhanced safety features is prompting OEMs to integrate telematics and connected services.

Europe Connected Car Market Trends

Europe connected car industry is expected to grow at a CAGR of over 11% from 2025 to 2030, owing to stringent regulatory requirements such as the eCall mandate and evolving safety standards, Europe remains a leading market for connected car technology, particularly in emergency response integration and advanced telematics services. The growing demand for real-time navigation enhancements, usage-based insurance, and predictive maintenance is reshaping how connectivity is leveraged across the vehicle lifecycle. Increased emphasis on cybersecurity compliance and data protection is prompting automakers to adopt secure-by-design architectures.

The UK connected car industry is expected to grow at a significant rate in the coming years, driven by government-backed initiatives and a push for smart mobility; the UK is advancing the development of connected and autonomous vehicles through testing and regulatory support. The demand for seamless in-car experiences, such as AI-powered infotainment and driver assistance systems, is leading automakers to incorporate cutting-edge connectivity solutions. Moreover, collaborations between tech firms and automotive manufacturers are fueling the rollout of connected services that enhance user experience and safety.

Germany’s connected car industry is largely driven by the country’s automotive giants, including Volkswagen and BMW, which are investing heavily in digital transformation and connected mobility services. The push towards electric vehicles (EVs) and integrated connectivity solutions, such as predictive maintenance and autonomous driving technologies, is reshaping the automotive landscape. Furthermore, Germany's focus on developing intelligent transportation systems and V2X communication is propelling the widespread adoption of connected vehicles.

Asia Pacific Connected Car Market Trends

The Asia Pacific connected car industry is expected to grow at the fastest CAGR of 15% from 2025 to 2030, owing to rapid urbanization and technological advancements, Asia Pacific is experiencing significant growth in the connected car industry, driven by both domestic automakers and global players investing in connectivity solutions. The region's high demand for smart mobility and electric vehicles is accelerating the integration of connected technologies, particularly in China and Japan. Moreover, the rollout of 5G infrastructure lays the foundation for next-generation autonomous driving and vehicle-to-infrastructure (V2I) communication.

The China connected car industry is gaining traction, driven by aggressive government policies and initiatives to promote autonomous driving and connected vehicles. China is leading the way in the connected car industry. The country’s significant investments in 5G infrastructure and smart city development are enabling the rapid adoption of V2X communication and real-time traffic management solutions. In addition, the rise of domestic EV manufacturers and the integration of AI in vehicles are boosting the demand for advanced connected car features.

The Japan connected car industry is rapidly expanding, driven by its technological expertise in electronics and robotics. Japan is advancing the connected car industry with innovations in autonomous driving and vehicle-to-everything (V2X) communication. The country’s aging population is fueling the demand for advanced driver assistance systems (ADAS) and smart mobility solutions that enhance accessibility and safety. Collaborations between automakers, tech companies, and government bodies are pushing the development of intelligent transportation systems and connected vehicle platforms.

Key Connected Car Company Insights

Some of the key players operating in the market are BMW AG and Apple Inc., among others.

-

BMW AG is a premium automotive manufacturer recognized for its commitment to digital transformation in mobility. It has been a pioneer in integrating connected car technologies, such as BMW iDrive, real-time traffic updates, and over-the-air (OTA) software updates. The company has also advanced the development of Level 2+ driver assistance features and data-driven mobility services. BMW’s strategic partnerships with tech firms support its goal to deliver a luxury digital driving experience through innovative vehicle connectivity.

-

Apple Inc. is a global technology leader known for its innovation in smart devices and software ecosystems. In the connected car space, Apple specializes in CarPlay, which enables seamless smartphone-to-vehicle integration and enhances driver safety and convenience. The company is reportedly developing its autonomous vehicle platform under “Project Titan,” signaling its ambitions in mobility transformation. Apple’s deep expertise in user interface design and ecosystem integration positions it as a key enabler in the future of in-car infotainment and connected driving experiences.

Aptiv and NXP Semiconductors are some of the emerging market participants in the connected car industry.

-

Aptiv is an emerging player that designs and manufactures components for autonomous and connected vehicles. The company focuses on software-defined architectures, advanced driver assistance systems (ADAS), and smart vehicle electrical systems. Aptiv's modular platforms enable faster development and integration of connected services across OEMs. Its agile approach and strong R&D investments are propelling it to the forefront of intelligent mobility solutions.

-

NXP Semiconductors is a semiconductor innovator with growing influence in the connected car industry through its vehicle-to-everything (V2X) communication chips, microcontrollers, and secure connectivity solutions. The company plays a pivotal role in enabling vehicle data processing, cybersecurity, and autonomous driving features. Its portfolio supports compliance with emerging safety regulations and connected infrastructure requirements. NXP's deep automotive partnerships are enabling scalable and secure connectivity at the silicon level.

Key Connected Car Companies:

The following are the leading companies in the connected car market. These companies collectively hold the largest market share and dictate industry trends.

- ALE International, ALE USA Inc.

- Apple Inc.

- AT&T Intellectual Property

- AUDI AG

- BMW AG

- Aptiv

- Ford Motor Company

- General Motors

- Google LLC

- NXP Semiconductors

Recent Developments

-

In February 2025, May Mobility launched its first commercial driverless transportation service in Georgia, marking its third autonomous deployment in the U.S. The service, developed in partnership with Curiosity Lab, T-Mobile, and the City of Peachtree Corners, features autonomous Toyota Sienna vehicles powered by proprietary Multi-Policy Decision Making (MPDM) technology. It aims to advance urban mobility by providing AI-driven public rides across eight designated city stops.

-

In January 2025, XPENG partnered with Volkswagen Group China to jointly develop one of the largest super-fast electric vehicle charging networks in China. The collaboration grants shared access to over 20,000 charging stations across 420 cities, utilizing both companies’ advanced high-power liquid-cooled charging technologies to significantly improve the user experience. The partnership also includes plans to explore the rollout of co-branded charging stations, supporting the rapid growth of EV infrastructure across the country.

-

In January 2025, Deloitte partnered with May Mobility to enhance autonomous transportation services through a strategic alliance. This collaboration integrates Deloitte’s data analytics and AI capabilities with May Mobility’s Multi-Policy Decision Making (MPDM) technology to improve safety, efficiency, and accessibility in autonomous vehicle deployments globally. The partnership builds upon their initial joint efforts in Detroit’s Accessibili-D program, which utilized data-driven insights to support mobility solutions for older adults and individuals with disabilities.

Connected Car Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.49 billion

Revenue forecast in 2030

USD 26.47 billion

Growth rate

CAGR of 12.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Connectivity solutions, technology, application, sales channel, region

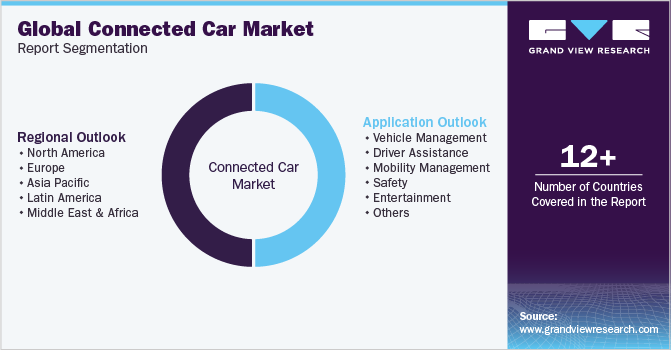

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; U.A.E.

Key companies profiled

ALE International, ALE USA Inc.; Apple Inc.; AT&T Intellectual Property; AUDI AG; BMW AG; Aptiv; Ford Motor Company; General Motors; Google LLC; NXP Semiconductors

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Connected Car Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global connected car market report based on connectivity solutions, technology, application, sales channel, and region:

-

Connectivity Solutions Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated

-

Embedded

-

Tethered

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

3G

-

4G

-

5G

-

Satellite

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Vehicle Management

-

Driver Assistance

-

Mobility Management

-

Safety

-

Entertainment

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global connected car market size was estimated at USD 12.84 billion in 2024 and is expected to reach USD 14.49 billion in 2025.

b. The global connected car market is expected to grow at a compound annual growth rate of 12.8% from 2025 to 2030 to reach USD 26.47 billion by 2030.

b. North America dominated the global connected car market with a share of 30% in 2024. This is attributable to the presence of major automobile manufacturers and technology providers in the region.

b. Some of the key players in the global connected car market include AT&T; Audi AG; BMW AG; Delphi Automotive; Ford Motor Company; General Motors; Continental AG; and HARMAN International among others.

b. The market's growth is due to the increasing connectivity features, like real-time data streaming and enhanced safety systems. Moreover, the push towards autonomous vehicles and the need for efficient traffic management systems are key drivers propelling this market's growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.