- Home

- »

- Automotive & Transportation

- »

-

Advanced Driver Assistance System Market Report, 2030GVR Report cover

![Advanced Driver Assistance System Market Size, Share & Trends Report]()

Advanced Driver Assistance System Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution (Adaptive Cruise Control, Blind Spot Detection System), By Component (Processor, Sensors, Software, Others), By Vehicle, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-082-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Advanced Driver Assistance System Market Summary

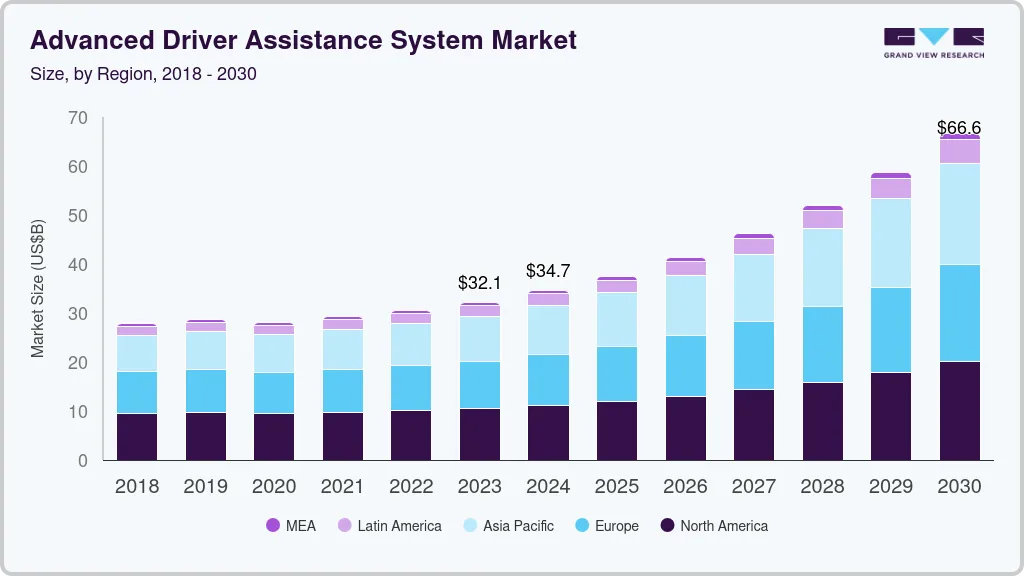

The global advanced driver assistance system market size was estimated at USD 34.65 billion in 2024 and is anticipated to reach USD 66.56 billion by 2030, growing at a CAGR of 12.2% from 2025 to 2030. The growing application of advanced driver assistance systems (ADAS) in compact passenger cars is a key growth driver for this market.

Key Market Trends & Insights

- North America advanced driver assistance system market dominated the global industry with a revenue share of 32.1% in 2024.

- The advanced driver assistance system market in the U.S. accounted for the largest revenue share of the regional industry in 2024.

- By solution, the Adaptive Cruise Control (ACC) segment dominated the market with a revenue share of 19.9% in 2024.

- By component, sensors held the largest revenue share of the advanced driver assistance system market in 2024.

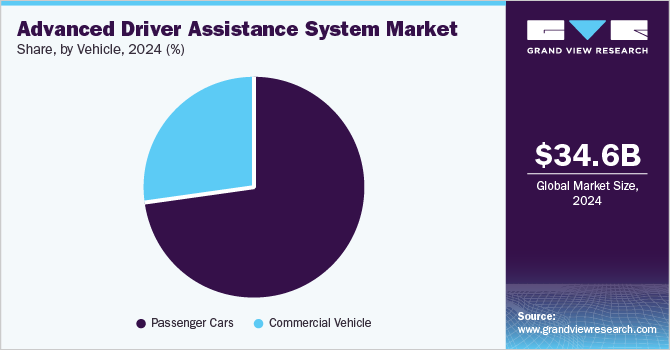

- By vehicle, passenger cars segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 34.65 Billion

- 2030 Projected Market Size: USD 66.56 Billion

- CAGR (2025-2030): 12.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing government regulations for mandatory ADAS implementation in vehicles is anticipated to drive the demand further. Growing disposable income, economic stability, and a rising preference for materialistic lifestyles drive the sales of luxury vehicles worldwide. The number of road accidents, safety measure malfunctions, and car hits has increased significantly in recent years. According to the World Health Organization, nearly 1.19 million deaths are recorded due to road traffic crashes each year worldwide. It is reported as one of the leading death causes for children and young individuals, particularly those aged from 5 to 29 years. Road traffic accidents cost up to 3.0% of the GDP of numerous countries. The constant increase in such incidences and growing awareness regarding driver & passenger safety have stimulated automotive industry manufacturers to embrace various technologies and tools to provide increased assistance and ensure improved safety measures.

Intelligent features and capabilities provided by the Advanced Driver Assistance System (ADAS), such as automatic emergency braking, adaptive cruise control, forward collision warnings, lane departure warning, blind spot detections, intersection assistance, rear cross-traffic alerts, and others, assist users and ensure safety and security during drives. Changing traffic volumes, especially in urban areas, frequent exposure to high-speed traffic areas on highways, and increasing road accidents have resulted in a growing need for such technologies.

The competitive landscape of the automotive industry has gone beyond attractive assistance features and is concentrated around technologies that ensure both safety and comfort. This has led to a growing inclination among manufacturers to include the most advanced systems equipped with innovation-based technologies that provide fail-proof assistance, emergency alerts, superior control over the vehicle, and easy-to-comprehend operations. Technologies such as voice control, artificial intelligence, connected devices, and others are among the top trends in the ADAS industry.

The availability of components such as sensors, processors, software solutions, and others also plays a vital role in the growth experienced by the ADAS market. Sensors, including visual sensors, ultrasonic sensors, GPS/GNSS sensors, and others used in ADAS, are easily made available by global suppliers to cater to increasing demand. The entry of multiple global enterprises in the software component industry for ADAS and the launch of numerous solutions associated with ADAS have also positively influenced this market. For instance, in February 2025, Elitek Vehicle Services, LKQ Corporation’s company, launched the ADAS MAP (Advanced Driver Assistance Systems Mapping) solution. The solution enables repairers and vehicle maintenance service providers to correctly calibrate Advanced Driver Assistance Systems (ADAS).

The rising demand for advanced systems such as road sign recognition, night vision, and drowsiness monitoring systems is expected to impact the overall market growth in the forthcoming years. The demand for traditional ADAS systems, including autonomous emergency braking systems and adaptive cruise control systems, is expected to grow exponentially due to increased government regulations to improve road safety and reduce road accidents. For instance, the European Union (EU) passed a bill that mandated implementing adaptive cruise control systems in all heavy commercial vehicles by 2020. Such mandates and regulations are projected to provide lucrative growth opportunities for the advanced driver assistance systems market over the forecast period.

Solution Insights

Based on solution, the Adaptive Cruise Control (ACC) segment dominated the market with a revenue share of 19.9% in 2024. This is attributed to increased demand for safety features, technological advancements such as sensor and radar technology, and government regulations that mandate the inclusion of ACC systems in certain vehicles, such as commercial vehicles. Significant increases in the use of electric and hybrid vehicles also contribute to the growth experienced by this segment.

Blind Spot Detection System (BSD) is expected to experience the fastest CAGR from 2025 to 2030. BSD systems use sensors to detect vehicles in a driver's blind spot, and they alert the driver with visual or audible warnings. This helps to prevent accidents caused by drivers changing lanes without checking their blind spots. In addition to the increasing demand for safety features, the BSD segment is also growing due to technological advancements. It has become more affordable and reliable in recent years.

Component Insights

Sensors held the largest revenue share of the advanced driver assistance system market in 2024. Sensors play a vital role in the active functioning of ADAS. Sensors gather information regarding the vehicle's surroundings, detect objects, pedestrians, lanes, and other vehicles, and identify potential hazards, allowing systems to provide insights and assistance to drivers. The functioning of ADAS is primarily dependent on sensors and their functional accuracy. LIDAR, RADAR, ultrasonic, camera, and other sensors work together to perform the desired assistance and safety function.

The processor segment is expected to expand at a significant CAGR over the forecast period. The growth is attributed to the increasing demand for more powerful and sophisticated ADAS features. ADAS systems require powerful processors to run the complex algorithms that are used to detect objects, track movement, and make decisions. More powerful processors can enable ADAS systems to perform more complex tasks, such as lane-keeping assistance and adaptive cruise control.

Vehicle Insights

The passenger cars segment dominated the market in 2024. Rising demand for advanced passenger vehicles, including electric and hybrid cars from urban areas worldwide, primarily contributes to the growth experienced by this segment. Increasing awareness among buyers regarding safety features, safety assistance capabilities, default security measures, and more influences this segment. Several Asian Pacific, North American, and European countries have introduced regulations that mandate the integration of several types of ADAS in the passenger car segment. The European Union has defined Vision Zero as an initiative to decrease road deaths to zero by the end of 2050. The regulatory body has targeted to reduce injuries and fatalities by 50% by the end of 2030. The initiative also mandates main safety features such as automatic emergency braking, lane departure warning, and attention and drowsiness detection in new passenger vehicles by 2022.

The commercial vehicle segment is anticipated to experience substantial growth during the forecast period. Safety and security have become significant elements of commercial vehicles owing to the increasing inclination among transportation and logistics industry participants to embrace advanced technologies. The growth experienced by industries such as e-commerce, online retail, shipping and logistics, agriculture, consumer products, and others has also influenced this segment.

Regional Insights

North America advanced driver assistance system market dominated the global industry with a revenue share of 32.1% in 2024. This is attributed to the technological advancement in the automotive industry and the presence of major players in the region. Furthermore, the higher adoption rate of new technology, along with improved economic conditions in the region, is driving the market growth. The rising fatality rate and increase in sales of high-end vehicles in countries such as Canada and the U.S. in this region are driving the market growth.

U.S. Advanced Driver Assistance System Market Trends

The advanced driver assistance system market in the U.S. accounted for the largest revenue share of the regional industry in 2024. This market is primarily influenced by factors such as the presence of numerous global manufacturers of passenger cars and commercial vehicles in the country, increasing awareness regarding the importance of safety assistance, and strict regulations regarding safety standards of passenger cars in the country. The availability of advanced technologies and the presence of numerous IT & telecom industry companies in the U.S. also contribute to the growth experienced by this market.

Europe Advanced Driver Assistance System Market Trends

The advanced driver assistance system market in Europe was identified as one of the key global advanced driver assistance industry regions in 2024. Regulations regarding the safety capabilities of vehicles in the EU, growing demand for advanced technology-driven passenger cars, increasing inclination towards electric and hybrid vehicles, and presence of multiple automotive manufacturing companies in the region are key growth driving factors for this market.

Germany advanced driver assistance system market accounted for the largest regional market share in 2024. The country's strong manufacturing industry, increasing inclination among manufacturers to include advanced technologies, and growing demand for passenger cars equipped with innovative capabilities are contributing to the growth experienced by this market.

The U.K. advanced driver assistance system market is projected to experience the fastest CAGR during the forecast period. This is attributed to increasing awareness regarding the benefits offered by advanced driver assistance systems, growing innovation in the sector, and the presence of multiple manufacturing facilities in the country. The rising demand for passenger cars with extraordinary safety features increases the segment's growth.

Asia Pacific Advanced Driver Assistance System Market Trends

The advanced driver assistance system market in Asia Pacific is anticipated to experience the fastest CAGR from 2025 to 2030. Increasing demand for luxury vehicles, passenger cars, and commercial vehicles in the region, supported by infrastructural enhancements in countries such as India, China, and others, and the presence of multiple manufacturers in these countries are mainly driving the growth of this market.

China accounted for the largest revenue share of the Asia Pacific advanced driver assistance system market in 2024. China is home to multiple automotive manufacturers and contributes a large share to the global trade of passenger cars and commercial vehicles annually. China exported nearly 1.6 million electric vehicles in 2023. The growing production of vehicles in the country, availability of advanced technologies, and increasing demand by global commercial brands are expected to influence the growth of this market in the forecast period.

The advanced driver assistance system market in India is projected to experience the fastest CAGR during the forecast period. The changing landscape of the country's manufacturing industry, the growing number of global automotive manufacturers setting up facilities in India, and the rising demand for advanced passenger cars from urban areas are primarily driving the growth of this market.

Key Advanced Driver Assistance System Company Insights

Some of the key companies in the advanced driver assistance system industry include Altera Corporation (Intel Corporation), Continental AG, DENSO CORPORATION, Garmin Ltd., Robert Bosch GmbH, Valeo SA and others. To address growing competition and increasing demand, the key market participants are embracing strategies such as adopting advanced technologies, research-based innovation, new launches, upgrading existing software solutions, collaborations, and more.

-

Valeo SA, a global automotive supplier and partner to multiple manufacturers, offers a wide range of innovation solutions associated with smart mobility. The company's technology portfolio features vehicle monitoring systems, lighting systems, powertrain electrification, and more. The ADAS portfolio offerings include satellite cameras, turnkey driver assistance system Smart Safety 360, parking assistance system, high definition radar sensor, mid-range radar sensor, car ultrasonic sensors, thermal cameras, computer vision, smart front cameras, windshield rain sensors, and others.

-

Continental AG is a technology company that specializes in innovation-based technology solutions associated with autonomous mobility, automated driving, electric mobility, connectivity, safety technologies, infotainment, fleet management, and more. It offers a wide variety of products and solutions associated with automated mobility, including cameras, sensors, radars, and others.

Key Advanced Driver Assistance System Companies:

The following are the leading companies in the advanced driver assistance system market. These companies collectively hold the largest market share and dictate industry trends.

- Altera Corporation

- Autoliv

- DENSO CORPORATION

- Continental AG

- Garmin Ltd.

- Garmin Ltd.

- Magna International Inc.

- Mobileye

- Robert Bosch GmbH

- Valeo SA

- Wabco Holdings Inc

Recent Developments

-

In January 2025, Garmin presented its latest innovation, Unified Cabin 2025, during the Consumer Electronics Show, hosted in Las Vegas, U.S. Some of the additional features associated with the solution include Ultra-Wide Band (UWB) technology that provides Child Presence Detection (CPD), enhanced blind spot visions, improved computer vision and augmented reality capabilities, and more.

-

In January 2025, Infineon Technologies AG announced the establishment of a new business unit, which aims to combine existing sensor and radio frequency businesses into one organization to strengthen growth in the sensors market. The newly formed SURF (Sensor Units & Radio Frequency) business unit is part of the Power & Sensor Systems (PSS) division.

-

In December 2024, On Semi and DENSO CORPORATION announced that they are strengthening their long-term collaboration on advanced driver assistance systems (ADAS) technologies. DENSO intends to acquire On Semi shares in the open market to further the existing partnership.

Advanced Driver Assistance System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 37.46 billion

Revenue forecast in 2030

USD 66.56 billion

Growth Rate

CAGR of 12.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, component, vehicle, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Germany, U.K., France, China, Japan, India, South Korea, Australia, Brazil, Mexico, Saudi Arabia, UAE, and South Africa

Key companies profiled

Altera Corporation; Autoliv; DENSO CORPORATION; Continental AG; Garmin Ltd.; Infineon Technologies AG; Magna International Inc.; Mobileye; Robert Bosch GmbH; Valeo SA; Wabco Holdings Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Advanced Driver Assistance System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global advanced driver assistance system market report based on solution, component, vehicle and region.

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Adaptive Cruise Control (ACC)

-

Blind Spot Detection System (BSD)

-

Park Assistance

-

Lane Departure Warning System (LDWS)

-

Tire Pressure Monitoring System (TPMS)

-

Autonomous Emergency Braking (AEB)

-

Adaptive Front Lights (AFL)

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Processor

-

Sensors

-

Radar

-

LiDAR

-

Ultrasonic

-

Others

-

-

Software

-

Others

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicle

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global advanced driver assistance system market size was estimated at USD 34.65 billion in 2024 and is expected to reach USD 37.46 billion in 2025.

b. The global advanced driver assistance system market is expected to grow at a compound annual growth rate of 12.2% from 2025 to 2030 to reach USD 66.56 billion by 2030

b. North America dominated the advanced driver assistance system market with a share of 32.1% in 2024. This is attributable to the presence of major players, technological advancement, better infrastructure facilities for manufacturing, enhanced economic conditions, and a higher adoption rate of new technologies in the region.

b. Some key players operating in the advanced driver assistance systems market include Continental AG, Autoliv Inc., Magna international, Mobileye N.V and Hyundai Mobis.

b. Key factors that are driving the advanced driver assistance systems market growth include government initiatives mandating driver assistance systems and deployment of ADAS in low-cost cars.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.