- Home

- »

- Clinical Diagnostics

- »

-

Blood Culture Test Market Size, Share & Growth Report 2030GVR Report cover

![Blood Culture Test Market Size, Share & Trends Report]()

Blood Culture Test Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Consumables, Instruments), By Technique (Conventional, Automated), By Application, By Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-825-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Blood Culture Test Market Size & Trends

The global blood culture test market size was estimated at USD 5.92 billion in 2023 and is expected to growat a compound annual growth rate (CAGR) of 12.3% from 2024 to 2030. Increasing approval of novel products by regulatory bodies for bloodstream infection (BSI) diagnosis and increasing prevalence of BSIs are some of the major factors expected to drive market growth. Sepsis is a type of BSI and according to a study published by NIH in 2023, around 1.7 million people in the U.S. sufferfrom sepsis each year. Moreover, according to the World Health Organization, around 250,000 cases of BSI occur in the U.S. each year.

As a result, advanced products for detecting mycobacterial infections, fungal, and bacterial are in high demand in hospitals and clinical diagnostics laboratories. Furthermore, according to data published by the World Health Organization in 2023, globally, 1 out of 6 people suffering from bacterial meningitis die each year. In addition, occurrence of bacterial meningitis is substantial in sub-Saharan Africa. A recent outbreak of COVID-19 witnessed massive demand for blood culture tests to analyze specimens. As the percentage of COVID-19 infections in 2021 and 2022 rose worldwide, government agencies actively engaged to procure blood culture tests. These factors positively impacted the blood culture tests market growth during the pandemic.

In addition, new product launches and collaborations among market players also played a major role in market growth. For instance, in September 2023, BD collaborated with Navigate BioPharma Services, Inc. This collaboration is expected to allow both companies to develop and commercialize new blood culture tests more quickly. A considerable number of market players are focusing on R&D investments to advance their product capabilities. Vendors' investment in R&D for development of novel products is a critical strategy for long-term growth of their businesses.

Healthcare-associated infections are increasing, and it is a key driver for the bloodstream infection market. COVID-19 had a positive impact on the bloodstream infection market in North America. Due to the pandemic, there is increased demand for self-care options. BD and Abbott are key players operating in the bloodstream infection market. Intellectual property protection and FDA regulations are major barriers for new and emerging players in the bloodstream infection market of North America. Development of technology is a current trend taking place in this market. More accurate results are the scope for improvement for bloodstream infection products available in the market. Bloodstream infection diseases can be claimed in insurance, but it depends on insurance policy norms and company

Market Dynamics

Automated blood culture systems are becoming increasingly popular because they offer several advantages over manual systems, such as increased accuracy, reduced contamination, and faster turnaround time. Rapid blood culture tests are being developed that can provide results within minutes or hours. This is important for clinical settings where quick diagnosis is critical.

Blood culture bottles are becoming smaller and more portable. This makes them more convenient and easier to use in a variety of settings. Molecular diagnostic tests are being developed that can detect specific types of microorganisms in blood culture samples. It can help to provide more accurate and timely diagnoses of bloodstream infections.

Increased awareness among healthcare professionals about the importance of early and accurate diagnosis of bloodstream infections has contributed to market growth. This awareness has led to higher testing rates and improved patient outcomes.

Regulatory bodies aim to harmonize and standardize regulations to ensure consistency and facilitate global market access for blood culture tests. This includes efforts to align with international standards and practices-regulatory authorities such as International Regulatory Harmonization focus on ensuring the quality, safety, and performance of blood culture tests. Companies are required to adhere to rigorous quality control and assurance standards throughout the development, manufacturing, and distribution processes.

Product Insights

The consumables segment held thelargest share of 59.99% of the blood culture tests market in 2023 and is estimated to grow at a fastest CAGR over the forecast period. Growing number of blood culture tests, rising incidence of infectious diseases, and growing awareness about the benefits of the procedure are major factors responsible for market dominance. Technological advancements and existing product enhancements are anticipated to offer a favorable environment for segment growth. For instance, in February 2022, Kurin, Inc. announced launch of its proprietarypush-button needle system for advanced safety.

Software systems are developed to eliminate any false positives during the process, which ultimately results in wrong diagnosis. Incorrect diagnosis substantially increases healthcare costs and may result in fatalities due to wrongly prescribed medications. These are also used to determine the degree of relatedness between various strains analyzed, providing highly reproducible and discriminatory data. Thus, software systems have become an integral part of automated blood culture systems, expected to witness lucrative growth over the forecast period.

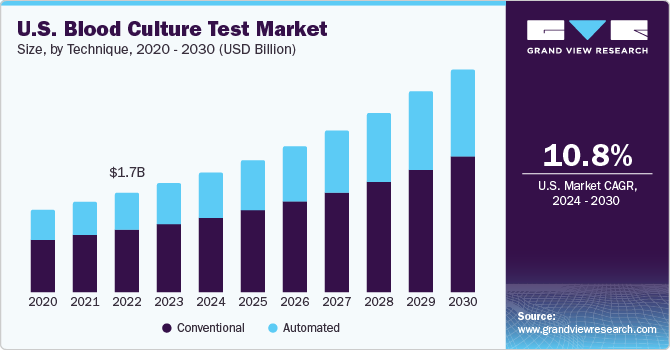

Technique Insights

Based on techniques, the market has been further segmented into conventional and automated. The conventional blood culture technique segment held the largest share of 64.78% in 2023 of the blood culture tests market due to its extensive use in hospitals, pathology laboratories, and clinical laboratories. Furthermore, an increasing number of research & development activities to develop efficient blood culture tests is expected to drive market growth. For instance, in December 2022, a collaborative research work conducted by the Great Ormond Street Institute of Child Health (GOSH) and Wyss Institute for Biologically announced successful results of their reengineered procedures for identification of pathogens associated with pediatric sepsis.

The automated blood culture technique segment is estimated to register the fastest growth rate during the forecast period. Key companies majorly focus on the launch of advanced instruments and consumables to provide highly efficient and reliable tests to their customers. For instance, in January 2023, QIAGEN launched the EZ2 Connect MDx platform. This platform is designed for automated sample processing in diagnostic labs, making the whole process more efficient.

Technology Insights

The culture-based technology segment dominated the market with a share of 67.27% in 2023 of the blood culture tests market attributable to enhanced capabilities of this technology for pathogen detection. In addition, increasing prevalence of infectious diseases and growing research & development investments in developing countries are expected to boost the segment growth. High usage of this technology in various end-use locations, such as hospitals, physician office laboratories, reference, and, pathology is further expected to drive segment growth.

The molecular technology segment is expected to register the highest CAGR during the forecast period. Molecular technologies such as blood cultures and nucleic acid amplification & probe tests have significantly improved the accuracy and speed of results and turnaround time in BSIs. Novel paradigms for rapid BSI diagnosis such as automated AST from positive blood culture bottles manufactured by Accelerate Diagnostics and direct from peripheral blood pathogen detection manufactured by T2 Biosystems with an expected turnaround time of less than 6 hours. The approval of these tests is expected to produce more informative, cheaper, and faster results to help manage BSI.

Application Insights

The bacterial infections application segment held the largest share of 71.18% in 2023 and is estimated to grow at a highest CAGR over the forecast period majorly attributed to increasing cases of bacterial infections, globally. Strategic partnerships among market players to launch new products & technologies are also projected to accelerate segment growth. For instance, in April 2023, bioMerieux partnered with Oxford Nanopore Technologies plc. The partnership is expected to develop new faster, more accurate, and easier-to-use blood culture tests, which improve the diagnosis and treatment of infectious diseases.

The fungal infections segment is anticipated to witness significant growth over the coming years due to prevalence of BSIs and rising number of sepsis cases worldwide. For instance, Candida species are predominant agents of fungal sepsis, which accounts for around 10% to 15% of healthcare-related infections.

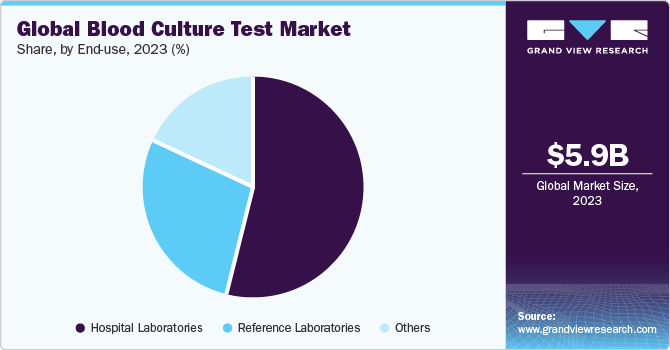

End-use Insights

The hospital laboratories segment accounted for the largest share of 54.30% of the blood culture tests market in 2023 owing to an increasing rate of hospitalizations and growing cases of Hospital-acquired Infections (HAIs). According to an article published by WHO in 2022, 7 patients and 15 patients out of every 100 patients in an acute-care hospital setting in high-income and low & middle-income countries respectively, will acquire at least one HAI at the time of their stay in hospital. Typically, in such settings, prompt detection allows the physicians to plan a proper treatment regimen for the patient. In underdeveloped and developing countries, which lack access to rapid diagnostic tests, hospitals serve as primary testing facilities.

The reference laboratory segment is anticipated to witness the fastest CAGR during the forecast period. Reference laboratories are often listed by insurance companies for specific tests, requiring patients to provide samples for testing. With an increase in incidence of infectious diseases, volume of blood culture tests has also increased causing a spur in the growth of reference laboratories segment.These laboratories operate privately and are engaged in a high volume of routine and specialty testing. These facilities have several advantages, such as they provide fast results (approximately 3–4 hours); are highly sensitive, specific, scalable, & cost-efficient; and facilitate the testing of many sample types.

Regional Insights

North America held the largest revenue share of 40.13% in 2023 attributable to a well-established clinical diagnostics industry, presence of several key players, availability of government-funded programs, reimbursement structure, awareness initiatives, and new product launches. For instance, in February 2023, BARDA received FDA Approval for the Selux NGP System in partnership with Selux Diagnostics, Inc. The system is designed to allow testing directly from positive blood cultures, which helps to reduce the total test time from 36 hours to 16 hours from whole blood collection.

Asia Pacific is anticipated to witness the highest CAGR during the forecast period owing to an increase in number of hospitalizations, and rising cases of various diseases such as urinary tract infections, bloodstream infections, & ventilator-associated pneumonia. Several key players are geographically expanding into Asian countries such as China and India due to high unmet needs, growing opportunities to gain a higher share in the market, and the presence of the target population.

Key Blood Culture Test Company Insights

Key players in the blood culture tests market are focusing on various strategies to consolidate their position in the market and gain a higher share,

-

In March 2023, T2 Biosystems, Inc. announced its plan to add Candida Auris detection technology to its existing T2Candida panel. The company has already received FDA and CE approval for its T2Candida panel.

-

In April 2023,Bruker Corporation introduced MALDI Biotyper IVD Software. The new software provides a high sample throughput for microbial identification. The software is used in a variety of clinical settings, including hospitals, clinics, and reference laboratories.

Key Blood Culture Test Companies:

- BD

- Terumo Corporation

- Bruker Corporation

- bioMerieux

- T2 Biosystems Inc.

- Luminex Corporation

- Abbott Laboratories

- Siemens Healthineers AG

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

Blood Culture Test Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.60 billion

Revenue forecast in 2030

USD 13.23 billion

Growth rate

CAGR of 12.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Technique, product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; India; China; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

BD; Terumo Corp.; bioMerieux; Bruker Corp.; T2 Biosystems Inc.; Abbott Laboratories; Luminex Corp.; Siemens Healthineers AG; F. Hoffmann-La Roche AG; Danaher Corp.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Blood Culture Test Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blood culture test market report based on product, technique, technology, application, end-user, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumables

-

By Type

-

Bacterial Infections

-

Fungal Infections

-

Mycobacterial Infections

-

-

By Components

-

Blood Culture Media

-

Aerobic

-

Anaerobic

-

Fungi/Yeast

-

Others

-

-

Assay, Kits, and Reagents

-

Blood Culture Accessories

-

-

-

Instruments

-

By Type

-

Bacterial Infections

-

Fungal Infections

-

Mycobacterial Infections

-

-

By Components

-

Laboratory Equipment

-

Incubators

-

Colony Counters

-

Microscopes

-

Gram Stainers

-

-

Automated Blood Culture Systems

-

-

-

Software & Services

-

Bacterial Infections

-

Fungal Infections

-

Mycobacterial Infections

-

-

-

Technique Outlook (Revenue, USD Billion, 2018 - 2030)

-

Conventional

-

Automated

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Culture-based Technology

-

Molecular Technology

-

PCR

-

Microarray

-

PNA-FISH

-

-

Proteomic Technology

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bacterial Infections

-

Fungal Infections

-

Mycobacterial Infections

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Laboratories

-

Reference Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global blood culture test market size was estimated at USD 5.92 billion in 2023 and is expected to reach USD 6.60 billion in 2024.

b. The global blood culture test market is expected to grow at a compound annual growth rate of 12.3% from 2024 to 2030 to reach USD 13.23 billion by 2030.

b. North America dominated the blood culture test market with a share of 40.13% in 2023. This is attributable to local presence of many large healthcare companies such as Becton, Dickinson and Company; bioMérieux SA; Thermo Fisher Scientific, Inc.; and Roche Diagnostics.

b. Some key players operating in the blood culture test market include Becton, Dickinson and Company, bioMérieux SA, Thermo Fisher Scientific, Inc., Danaher Corporation, Luminex Corporation, Roche, Bruker Corporation, and Abbott Laboratories.

b. Key factors that are driving the market growth include increasing prevalence of infectious diseases and growing approval rates for new products, such as instruments and consumables for Bloodstream Infections (BSI) diagnosis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.