- Home

- »

- Medical Devices

- »

-

Pathology Laboratories Market Size And Share Report, 2030GVR Report cover

![Pathology Laboratories Market Size, Share & Trends Report]()

Pathology Laboratories Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Hospital-based, Standalone Labs), By Testing Services (General Physiological & Clinical Tests, COVID-19 Test), By End-use (Physician Referrals), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-987-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pathology Laboratories Market Summary

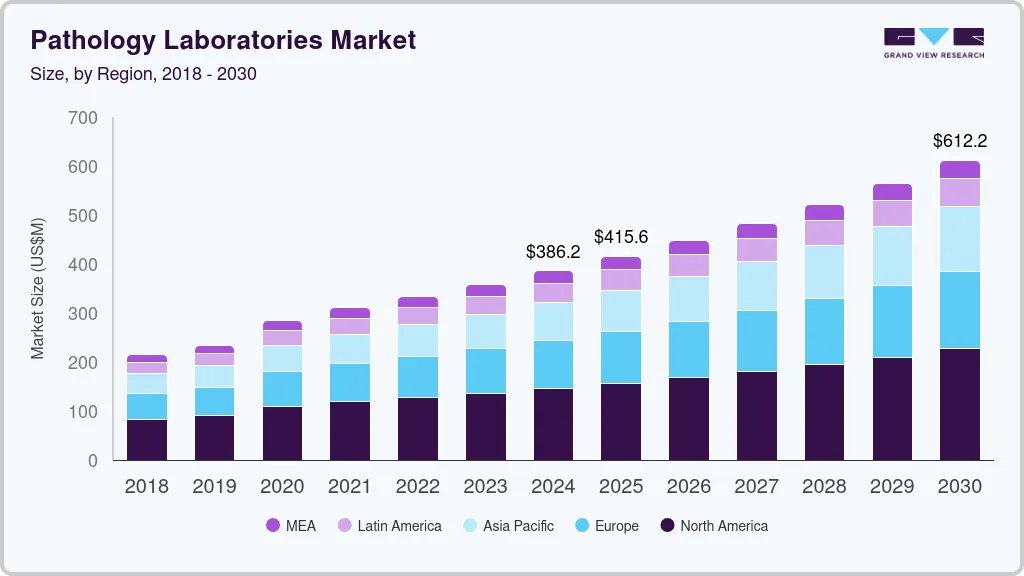

The global pathology laboratories market size was estimated at USD 386.2 million in 2024 and is projected to reach USD 612.2 million by 2030, growing at a CAGR of 8.1% from 2025 to 2030. The market is significantly influenced by the expansion of healthcare facilities in developing countries, the heightened demand for regular medical examinations, and enhancements in the reimbursement policies for diagnostic tests.

Key Market Trends & Insights

- The North America pathology laboratories market dominated the overall global market and accounted for 37.87% of revenue share in 2024.

- The pathology laboratories market in U.S. held a significant share of the North American market in 2024.

- By type, the hospital-based segment dominated the market and accounted for the largest revenue share of 55.7% in 2024.

- By testing services, the general physiological & clinical tests segment accounted for the largest market share of 39.2% in 2024.

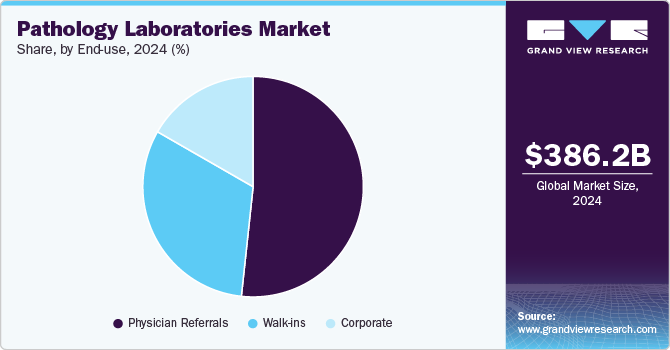

- By end use, the physician referrals segment accounted for 51.7% of the overall market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 386.2 Million

- 2030 Projected Market Size: USD 612.2 Million

- CAGR (2025-2030): 8.1%

- North America: Largest market in 2024

Additionally, the growth of the elderly population and the rising incidence of chronic diseases are contributing to the market's development. Furthermore, the market is also driven by the opening of new labs across emerging markets. For instance, in August 2024, Neuberg Diagnostics opened its new laboratory facility in Puducherry (India), providing radiology, wellness, and pathology services.

As the prevalence of chronic diseases increases, so does the need for effective healthcare systems. Timely diagnosis plays a crucial role in managing these chronic conditions, leading to a growing demand for clinical diagnostics. According to the World Health Organization, the senior population is projected to grow from 1 billion in 2020 to 1.5 billion by 2030, representing one in six individuals aged 60 and older worldwide. Chronic diseases are particularly common among older adults; for instance, the National Council on Aging reports that 80% of U.S. adults over 65 have at least one chronic condition, highlighting the significant need for regular medical check-ups in this demographic.

Moreover, there is an increasing trend for routine health examinations. Given the high rates of chronic diseases, regular health check-ups are advised for individuals over 40. Additionally, the rising occurrence of chronic illnesses among younger adults has led to a growing demand for preventive check-ups in this age group as well. Heightened awareness about health issues has prompted many individuals to prioritize routine medical check-ups.

Furthermore, in several countries, employers are required to conduct annual medical evaluations for their employees, which generates more opportunities for diagnostic laboratories. In addition, the increase in healthcare expenditures aimed at enhancing existing infrastructure in developing nations has led to the creation of numerous new hospitals and diagnostic laboratories, as well as improvements to current facilities. For example, in March 2022, the government of Delhi announced plans to upgrade 15 hospitals and construct four new hospital facilities in the city, contributing to the expansion of hospital-based diagnostic centers.

Type Insights

The hospital-based segment dominated the market and accounted for the largest revenue share of 55.7% in 2024. Hospital-based laboratories are experiencing significant growth due to several key factors. The rising prevalence of chronic diseases necessitates timely and accurate diagnostic services, prompting hospitals to expand their laboratory capabilities. Secondly, advancements in technology have improved testing efficiency and accuracy, making it essential for hospitals to offer a wider range of tests. The increasing focus on patient-centered care has driven hospitals to integrate laboratory services more closely with clinical operations, enhancing patient outcomes. Additionally, favorable reimbursement policies and the growing demand for routine health screenings further support the expansion of hospital-based laboratories in the healthcare landscape.

The diagnostic chains segment is expected to emerge as the most lucrative segment and is likely to grow at a CAGR of 8.9% over the forecast period. Diagnostic chains provide a patient-focused selection of tests through annual packages or bundled offerings. The services available across various centers in a region or country tend to be consistent, prompting these chains to emphasize quality by securing accreditations from reputable organizations such as the International Organization for Standardization (ISO), the National Accreditation Board for Testing and Calibration Laboratories (NABL), and the College of American Pathologists (CAP)

Testing Services Insights

The general physiological & clinical tests segment accounted for the largest market share of 39.2% in 2024. These tests, including blood counts, metabolic panels, and urinalysis, are foundational for diagnosing various conditions and monitoring patients’ health status. Their widespread application in primary care, outpatient settings, and hospitals ensures a steady demand, as they are critical for the early detection of diseases and effective treatment planning.

Additionally, advancements in testing technologies and methodologies have increased the accuracy and efficiency of these tests, further driving their adoption. The growing awareness of preventive healthcare and regular health check-ups also contributes to the increasing volume of general physiological and clinical tests. As healthcare systems emphasize patient-centered care, the demand for these essential tests continues to grow, solidifying their dominance in the pathology laboratories market.

The esoteric tests segment is projected to grow at a CAGR of 10.4% over the forecast period. This category encompasses various types of testing, including those for infectious diseases, endocrinology, oncology, genetics, toxicology, immunology, and neurology. Among these, testing for infectious diseases and oncology is anticipated to see the greatest demand due to the increasing prevalence of infectious diseases and cancer in the population. The urgency of early diagnosis for cancer and other critical conditions is expected to further increase the demand for these specialized tests.

End-use Insights

The physician referrals segment accounted for 51.7% of the overall market share in 2024. Approximately 70% of medical decisions made by physicians rely on the results of pathological and diagnostic tests, contributing significantly to the growth of this sector. The increasing prevalence of targeted diseases across various age groups is expected to further drive this segment's expansion.

The corporate segment is expected to grow at a CAGR of 9.1% over the forecast period. The segment growth is driven by enhancements in employee benefits, including annual medical check-ups. In many countries, government regulations require companies to conduct employee health assessments. For example, in November 2020, the Indian government proposed new labor regulations mandating annual check-ups for employees over the age of 40. Key market players are responding by offering tailored packages for corporate clients. For instance, Quest Diagnostics provided COVID-19 testing and symptom checks for employers in the U.S. as they planned to reopen offices after the pandemic.

Regional Insights

The North America pathology laboratories market dominated the overall global market and accounted for 37.87% of revenue share in 2024. The market is driven by advanced healthcare infrastructure, high adoption of cutting-edge diagnostic technologies, and a well-established regulatory framework. Additionally, the growing prevalence of chronic diseases, strong demand for personalized medicine, and increasing healthcare spending further contribute to its dominance in the global market.

U.S. Pathology Laboratories Market Trends

The pathology laboratories market in U.S. held a significant share of the North American market in 2024, fueled by advanced technology, a high prevalence of chronic diseases, and a strong emphasis on early diagnosis. Robust healthcare spending and extensive insurance coverage further enhance access to diagnostic services, making the U.S. a leader in the pathology sector.

Europe Pathology Laboratories Market Trends

The pathology laboratories market in Europe is experiencing significant growth. Europe's pathology laboratories market benefits from a well-established healthcare system, high standards of quality, and regulatory compliance. The increasing aging population, rising prevalence of chronic diseases, and emphasis on preventive care further drive demand for diagnostic services positioning Europe as a key player in the pathology sector.

The UK pathology laboratories market is likely to show significant growthowing to healthcare improvements and technological developments. The market is characterized by a strong emphasis on public health initiatives, advanced diagnostic technologies, and integrated healthcare services. Increased government investment in healthcare and a growing focus on personalized medicine and early diagnosis are driving demand, making the UK a significant contributor to the European market.

The pathology laboratories market in Germany is experiencing significant growth. The market growth is lucrative due to its advanced healthcare system, robust infrastructure, and commitment to quality standards. The country's high investment in medical technology, a growing aging population, and increasing prevalence of chronic diseases are driving demand for diagnostic services, reinforcing Germany's position as a leader in Europe.

Asia Pacific Pathology Laboratories Market Trends

The pathology laboratories market in Asia Pacific is experiencing rapid growth due to increasing healthcare expenditures, expanding healthcare infrastructure, and a rising prevalence of chronic diseases. The region's large population, growing awareness of preventive healthcare, and improvements in diagnostic technology further enhance demand for pathology services, positioning Asia-Pacific as a vital market.

China pathology laboratories market is growing at a lucrative growth rate, and the growth is driven by significant investments in healthcare infrastructure, advances in diagnostic technologies, and a rising demand for early disease detection. The increasing prevalence of chronic diseases and a growing aging population further boost the need for diagnostic services, establishing China as a key player in the region.

Latin America Pathology Laboratories Market Trends

The pathology laboratories market in Latin America is experiencing significant progress, driven by increased healthcare investments, rising awareness of preventive care, and a growing population with chronic diseases. Improvements in diagnostic technologies and government initiatives aimed at enhancing healthcare access further stimulate demand for pathological services, making the region an emerging market in this field.

Middle East & Africa Pathology Laboratories Market Trends

The pathology laboratories market in the Middle East and Africa is driven by rising healthcare investments, increasing disease prevalence, and advancements in medical technology. Efforts to improve healthcare infrastructure, coupled with a growing focus on diagnostic services, are enhancing access to pathology testing and driving demand across the region.

Saudi Arabia pathology laboratories market is driven by significant government investments in healthcare infrastructure and initiatives to enhance diagnostic services. The rising prevalence of chronic diseases, along with the growing demand for early detection and personalized medicine, is driving the need for advanced pathology services, positioning the country as a regional leader.

Key Pathology Laboratories Company Insights

The competitive scenario in the pathology laboratories market is high, with key players such as Quest Diagnostics Incorporated, Eurofins Scientific, Laboratory Corporation of America Holdings, Exact Sciences Laboratories LLC, Spectra Laboratories, SYNLAB International GmbH, Sonic Healthcare Limited, Dr. Lal Path Labs, Metropolis Healthcare, Kingmed Diagnostics, Healius Limited, BioReference, Centro de Diagnósticos, Falco Holdings, Unilabs holding significant positions. The pathology laboratories market is notably fragmented, featuring numerous large and small companies. Key strategies employed by these market participants include the adoption of innovative diagnostic methods, partnerships, mergers, and geographical expansion. For example, in January 2022, Quest Diagnostics acquired Pack Health, a company focused on patient engagement, to enhance value-based services. Additionally, in May 2021, Quest Diagnostics partnered with Paige to improve the quality of oncology testing through advancements in AI-driven pathology solutions.

Key Pathology Laboratories Companies:

The following are the leading companies in the pathology laboratories market. These companies collectively hold the largest market share and dictate industry trends.

- Quest Diagnostics Incorporated

- Eurofins Scientific

- Laboratory Corporation of America Holdings

- Exact Sciences Laboratories LLC

- Spectra Laboratories

- SYNLAB International GmbH

- Sonic Healthcare Limited

- Dr. Lal Path Labs

- Metropolis Healthcare

- Kingmed Diagnostics

- Healius Limited

- BioReference.

- Centro de Diagnósticos

- Falco Holdings

- Unilabs

Recent Developments

-

In August 2024, Redcliffe Labs announced the set up of 2 new labs in New Delhi, India. The new facilities will help the company expand its business around the Delhi NCR region

-

In March 2024, Metropolis Healthcare Limited launched a new diagnostic laboratory facility in Malegaon, Maharashtra (India). The facility has the capacity to process 3000 samples per month.

Pathology Laboratory Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 415.54 billion

Revenue forecast in 2030

USD 612.22 billion

Growth rate

CAGR of 8.1% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, testing services, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden, China, Japan, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Quest Diagnostics Incorporated; Eurofins Scientific; Laboratory Corporation of America Holdings; Exact Sciences Laboratories LLC; Spectra Laboratories; SYNLAB International GmbH; Sonic Healthcare Limited; Dr. Lal Path Labs; Metropolis Healthcare; Kingmed Diagnostics; Healius Limited; BioReference.; Centro de Diagnósticos; Falco Holdings; Unilabs

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

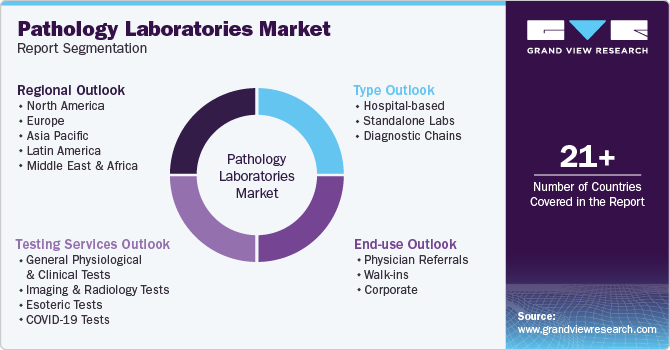

Global Pathology Laboratories Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pathology laboratories market report on the basis of type, testing services, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital-based

-

Standalone Labs

-

Diagnostic Chains

-

-

Testing Services Outlook (Revenue, USD Million, 2018 - 2030)

-

General Physiological & Clinical Tests

-

Imaging & Radiology Tests

-

Esoteric Tests

-

COVID-19 Tests

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Physician Referrals

-

Walk-ins

-

Corporate

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pathology laboratories market size was estimated at USD 386.18 billion in 2024 and is expected to reach USD 415.54 billion in 2025.

b. The global pathology laboratories market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2030 to reach USD 612.22 billion by 2030.

b. North America dominated the pathology laboratories market with a share of 37.87% in 2024. This is attributed to improving reimbursement and developed healthcare infrastructure.

b. Some key players operating in the pathology laboratories market include Quest Diagnostics Incorporated; Eurofins Scientific; Laboratory Corporation of America Holdings; Exact Sciences Laboratories LLC; Spectra Laboratories; SYNLAB International GmbH; Sonic Healthcare Limited; Dr Lal Path Labs; Metropolis Healthcare; Kingmed Diagnostics; Healius Limited; BioReference.; Centro de Diagnósticos; Falco Holdings; Unilabs

b. Key factors that are driving the market growth include increase in the number of healthcare facilities in developing nations, growing demand for routine medical check-ups, and the improvement in the reimbursement for diagnostic tests.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.