- Home

- »

- Medical Devices

- »

-

Needles Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Needles Market Size, Share & Trends Report]()

Needles Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Product (Pen, Suture, Blood Collection, Dental, Ophthalmic), By Delivery Mode, By Raw Material, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-720-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Needles Market Summary

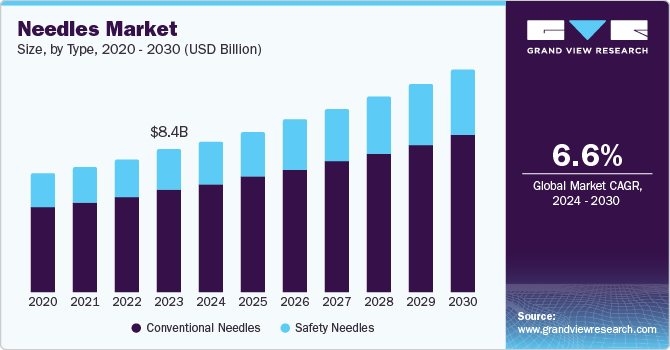

The global needles market size was valued at USD 8.37 billion in 2023 and is expected to reach USD 20.19 billion by 2030, growing at a CAGR of 6.6% from 2024 to 2030. One of the key growth drivers for this market is the rising prevalence of chronic diseases, leading to the growing need for vaccines, diagnosis via blood sampling, and regular injection treatments.

Key Market Trends & Insights

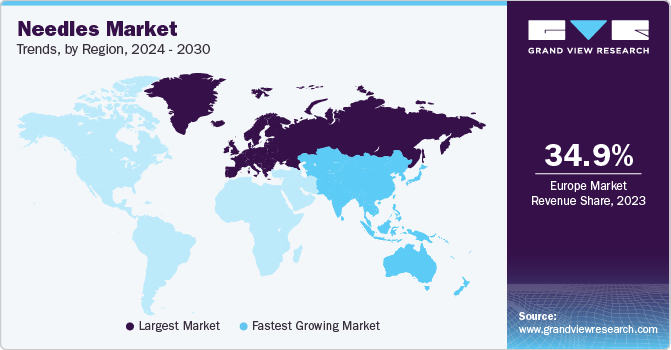

- Europe needles market dominated the global market with a revenue share of 34.9% in 2023.

- The U.S. needles market dominated the regional industry and accounted for the largest revenue share in 2023.

- Based on type, the conventional needles segment dominated the global industry and accounted for a revenue share of 71.8% in 2023.

- Based on product, the pen needle segment accounted for the largest revenue share in 2023.

- Based on raw material, the stainless steel segment dominated the global industry in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.37 Billion

- 2030 Projected Market Size: USD 20.19 Billion

- CAGR (2024-2030): 6.6%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

In addition, the growing geriatric population in multiple regions, increasing inclination towards minimally invasive procedures, and the emergence of self-administrative medications in recent years are expected to drive growth for this industry in the approaching years. The increasing prevalence of cancer worldwide is contributing to the rising demand for this market in the healthcare industry. According to the Pan American Health Organization, the cancer burden worldwide is expected to increase by nearly 60% in the next two decades and reach approximately 30 million newly diagnosed cases by 2040. The needles are extensively used in treatments and therapies such as radiofrequency ablation (RFA), intralesional chemotherapy, biopsies, injection treatments, acupuncture, and others.

The global demand for injectable medications is on the rise due to factors such as the increasing rates of chronic illnesses, the demand for specific treatments, and the expanding geriatric population. Faster recovery assistance provided by injectable drugs, growing use during emergency treatments, effectiveness, and increasing need for insulin for diabetes patients have also contributed to the rising demand for this market. According to the World Health Organization, nearly 422 million individuals have diabetes worldwide.

Expanding vaccination programs initiated by multiple organizations and governments are expected to fuel the growth of the global needles market. Immunization is one of the most cost-effective interventions by public health initiatives. Numerous organizations worldwide work on immunization initiatives, including the World Health Organization, the United Nations International Children's Emergency Fund (UNICEF), and the Center for Disease Control.

Type Insights

Based on type, the conventional needles segment dominated the global industry and accounted for a revenue share of 71.8% in 2023. The market growth is attributed to the rising demand for conventional needles, the availability of conventional needles at lower cost, and the ease of handling due to their convenient design. These needles are widely used for various pharmaceutical and medical applications such as administering vaccines, collecting blood samples for diagnostic testing, drawing fluids, and delivering fluids, medications, or nutrients directly into the bloodstream. The rising cases of chronic diseases and numerous disease control initiatives by government and welfare organizations boost the demand for this segment.

Safety needles are expected to register the fastest CAGR during the forecast period. The increasing inclination towards these products is attributed to the reduced risk of needle stick injuries. Safety needles lessen the possibility of infection and expenses while providing improved convenience and usability. Some of the other growth driving factors for this segment include regulatory mandates, growing awareness regarding occupational hazards, technological advancements, increased significance of infection control due to risks such as HIV infections, and rising prevalence of chronic diseases.

Product Insights

The pen needle segment accounted for the largest revenue share in 2023. The increasing number of new cases of diabetes drives the market growth and demand for a variety of insulin pen needles with different widths and lengths. According to the International Diabetes Federation, the total number of individuals diagnosed with diabetes is anticipated to reach 643 million by 2030. Growing demand for self-administrative medications, effective distribution strategies adopted by the key players, and growing demand in emerging economies such as Asia Pacific are expected to increase demand for pen needles during the forecast period.

The ophthalmic needles segment is expected to experience a significant CAGR during the forecast period. Some key growth drivers for this segment are the growing prevalence of eye ailments, technological advancements adopted by manufacturers, and increasing inclination towards ophthalmic surgical procedures. Smaller size, increased sharpness, and special curvature offered in the product add to the growing demand for ophthalmic needles.

Raw Material Insights

The stainless steel segment dominated the global industry in 2023. This segment's growth is attributed to stainless steel's properties, such as corrosion resistance, high biocompatibility, ability to withstand the pressure and force applied during injections, and ability to be easily sterilized and used for various methods. These needles are widely utilized for drug administration, veterinary medicine, injection therapy, blood collection, and other applications, driving the needles market growth. Moreover, the durability and capability to withstand repeated use and sterilization of stainless steel make it ideal for manufacturing stainless steel sutures and standard operating procedures.

The glass segment is expected to experience a significant CAGR during the forecast period. Borosilicate glass is the main glass material utilized in manufacturing needles and syringes. The demand for glass is attributed to its chemical and thermal resistance properties, which are ideal for drug delivery procedures. Moreover, glass is preferred over other raw materials as it offers excellent visibility for precise measurement and medication observation. The rising demand for glass syringes is attributed to their application in scientific research for precise liquid handling and measurements and utilization in the pharmaceutical manufacturing and filling of pre-filled syringes, contributing to the growing market demand for this segment.

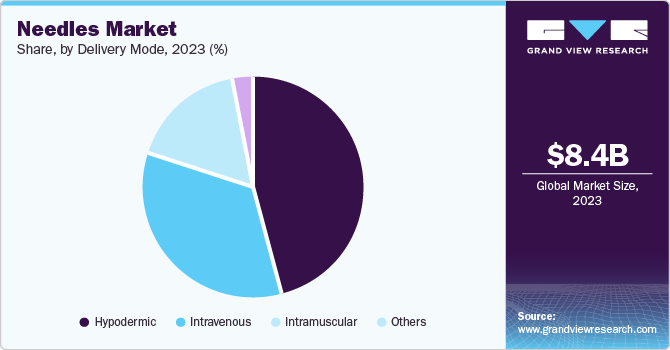

Delivery Mode Insights

The hypodermic delivery mode held the largest revenue share of the global market in 2023. The market is driven by the increasing cases of chronic diseases such as diabetes and the development of needles that work with powerful injection technology and can handle high pressures. Microneedle technology, such as hypodermic needles, is considered the most efficient method to penetrate the skin to administer drugs and other substances into various tissues, such as intramuscular and subcutaneous tissues. The rapid growth of drug discovery, production, and advancements in drug delivery technologies have facilitated the acceptance of new medications and developed novel delivery techniques for current drugs, accelerating the demand for microneedles technology for administering medicines through the skin during clinical trials.

The intravenous (IV) delivery mode is projected to grow at the fastest CAGR over the forecast period. IV administration includes a single injection and inserting a small tube or catheter into a vein. It enables a care provider to give several doses of infused medications without re-inserting needles for each dose. Intravenous needles are hollow and are connected to IV syringes to administer medication and collect samples. They decrease contamination while introducing a sterile substance, contributing to the rising needle demand.

Regional Insights

Europe Needles Market Trends

Europe needles market dominated the global market with a revenue share of 34.9% in 2023. The increasing prevalence of diseases such as diabetes, cancer, and autoimmune disorders necessitates frequent injections, which in turn results in growth in demand for the needles market. Developing new medical procedures and therapies involves needles. This has also contributed to the growing demand for the market. Moreover, the region's vaccination campaigns and public health initiatives have increased the need for needles.

The UK needles market is expected to grow rapidly in the approaching years due to increased healthcare expenditure, leading to higher demand for medical supplies, including needles. For instance, the healthcare expenditure in the UK increased by 5.6% in nominal terms in 2023. Regulations governing medical waste disposal, including used needles, are anticipated to impact product design and usage. This is expected to encourage innovation and drive the market towards sustainability goals during the next few years. Additionally, government-led immunization campaigns, such as the flu or childhood vaccinations, significantly influence needle usage.

North America Needles Market Trends

North America was identified as a lucrative region for the global needles market in 2023. Factors fueling the expansion of the needle market in the region include the growing cases of chronic disorders, the rising number of diabetes cases, and numerous new product approvals. Rising preventive healthcare measures such as immunizations, vaccinations, and treatments through injectable drugs and self-administrative devices are expected to generate an upsurge in demand for this market during the forecast period.

U.S. Needles Market Trends

The U.S. needles market dominated the regional industry and accounted for the largest revenue share in 2023. The growth of this market is primarily influenced by factors such as the rising demand for insulin needles and injectors in diabetes treatment, the growing prevalence of cancers leading to increasing demand for related treatments, the increased inclination towards the use of minimally invasive treatments, and the effectiveness attained through injectable medications.

Asia Pacific Needles Market Trends

Asia Pacific needles market is anticipated to witness the fastest CAGR from 2024 to 2030. The fastest growing market for needles includes countries such as Japan, China, India, Australia, South Korea, and Thailand, which have been enhancing healthcare infrastructure to cater to the increasing prevalence of multiple chronic diseases such as cancer, cardiac problems, diabetes, and more. This is anticipated to drive the demand for needles for medical applications and the necessity of vaccination programs in the region. Moreover, the growing medical device and healthcare sector in Asian countries such as India is expected to fuel the regional market's growth. The entry of multiple healthcare providers in the region, growing medical tourism, and immunization drives initiated by different governments and welfare organizations have also contributed to the growth of this market.

China needles market held a substantial revenue share of regional industry in 2023. This is attributed to numerous aspects, such as cost-competitive manufacturing plant bases and the rising population in the country. Continuous investments in research and development activities for new drug discoveries and production have driven the demand for needles utilized in clinical trials and various drug delivery modes. The growth of the pharmaceutical sector, government policies supporting healthcare development, and disease prevention programs are anticipated to influence the needle market positively in the upcoming years.

Key Needles Company Insights

Some key companies operating in needles market include BD, Stryker, Medtronic, Thermo Fisher Scientific Inc., Boston Scientific Corporation, and others. To address the growing competition, the major market participants are adopting strategies such as increased investments in R & D, innovation, enhanced partnerships and collaborations with care providers, geographical expansions and more.

-

BD, one of the prominent organizations in the healthcare safety and technology industry, specializes in manufacturing, developing, and distributing medical devices, equipment, and reagents. The company offers various syringes and needles, such as injection syringes, conventional needles, prefilled saline flush syringes, and an injection immunization portfolio, including the BD Flu+ Syringe with cannula, the BD SoloShot Mini Syringe, the BD Emerald PRO Syringe, and other products.

-

Thermo Fisher Scientific Inc., a renowned company in the healthcare innovation industry, has a significant presence in the life sciences and healthcare-related markets. The company focuses on supplying equipment, reagents, and consumables for research and diagnostic laboratories. It offers Nunc Disposable Loops and Needles, Remel Inoculating Needles, Manual GC Syringes, and others.

Key Needles Companies:

The following are the leading companies in the needles market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- Stryker

- Medtronic

- Ethicon (Johnson & Johnson Services, Inc.)

- Thermo Fisher Scientific Inc.

- Boston Scientific Corporation

- Novo Nordisk A/S

- ICU Medical, Inc. (Smiths Medical, Inc.)

- Hilgenberg GmbH

- Fresenius SE & Co. KGaA

Recent Developments

-

In April 2024, BD India launched UltraTouch, an innovative blood collection device designed to reduce patient discomfort. The blood collection set, BD Vacutainer with an UltraTouch Push Button, utilizes the company's RightGauge technology to enable a smaller needle for blood collection.

-

In July 2024, Fresenius Kabi, a subsidiary of Fresenius, a global company operating in lifesaving medicines and related technologies associated with transfusion infusion and clinical nutrition, launched a subcutaneous form of biosimilar Tyenne (tocilizumab-aazg) in the U.S., providing more affordable treatment choices for chronic autoimmune diseases. Tyenne is the initial tocilizumab biosimilar approved by the FDA in intravenous and subcutaneous forms.

Needles Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.92 billion

Revenue forecast in 2030

USD 13.09 billion

Growth rate

CAGR of 6.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, delivery mode, raw material, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, UAE, Saudi Arabia, Kuwait, and South Africa

Key companies profiled

BD; Stryker; Medtronic; Ethicon (Johnson & Johnson Services, Inc.); Thermo Fisher Scientific Inc.; Boston Scientific Corporation; Novo Nordisk A/S; ICU Medical, Inc. (Smiths Medical, Inc.); Hilgenberg GmbH; Fresenius SE & Co. KGaA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Needles Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global needles market report based on type, product, delivery mode, raw material, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional Needles

-

Safety Needles

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pen Needles

-

Suture Needles

-

Blood collection Needles

-

Dental Needles

-

Ophthalmic Needles

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypodermic

-

Intravenous

-

Intramuscular

-

Others

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Glass

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

Kuwait

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.