- Home

- »

- Clinical Diagnostics

- »

-

Molecular Diagnostics Market Size, Industry Report, 2033GVR Report cover

![Molecular Diagnostics Market Size, Share & Trends Report]()

Molecular Diagnostics Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Instruments, Reagents, Others), By Test Location (Point Of Care, Self-Test), By Technology (PCR, ISH, INAAT), By Application (Oncology, Infectious Diseases), By Region, And Segment Forecasts

- Report ID: 978-1-68038-086-6

- Number of Report Pages: 270

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Molecular Diagnostics Market Summary

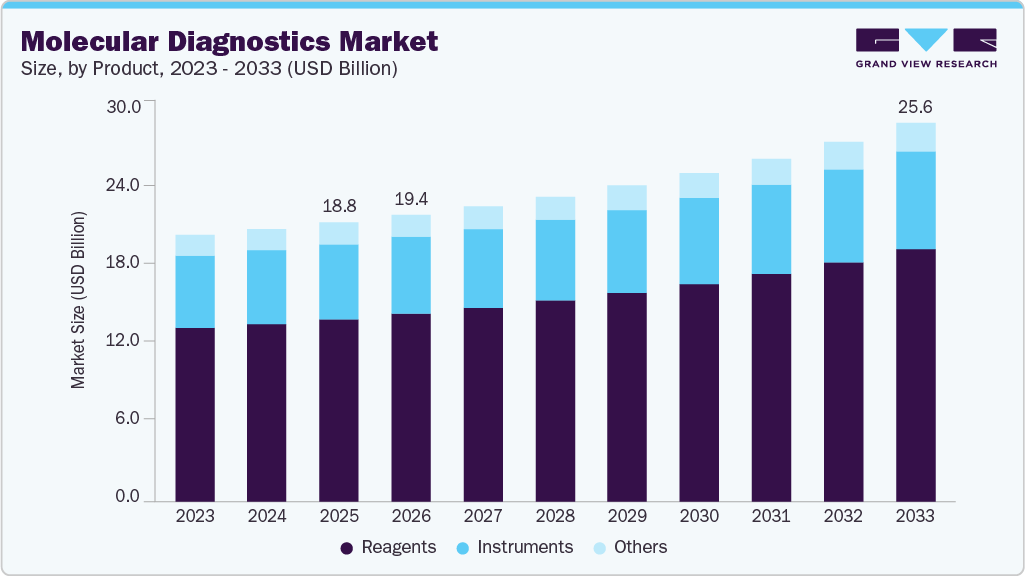

The global molecular diagnostics market size was estimated at USD 18.85 billion in 2025 and is projected to reach USD 25.59 billion by 2033, growing at a CAGR of 4.06% from 2026 to 2033. Key drivers of this growth include ongoing technological advancements, a steadily aging population, and rising demand for precise, efficient genetic testing solutions.

Key Market Trends & Insights

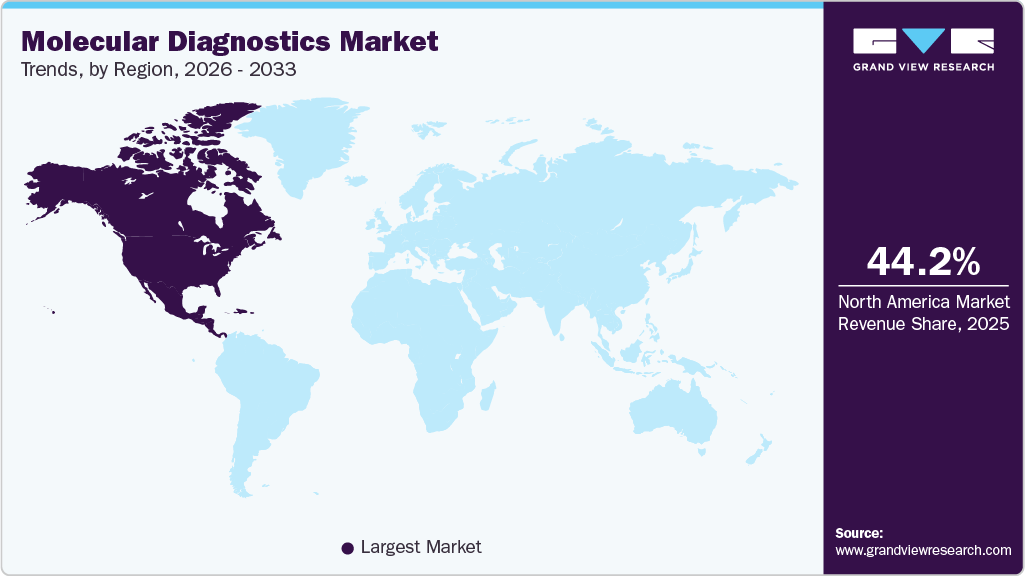

- North America global molecular diagnostics industry held the largest share of 44.06% of the global market in 2025.

- The molecular diagnostics industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the reagents segment held the largest market share of 65.53% in 2025.

- By technology, the PCR segment held the largest market share of 62.16% in 2025.

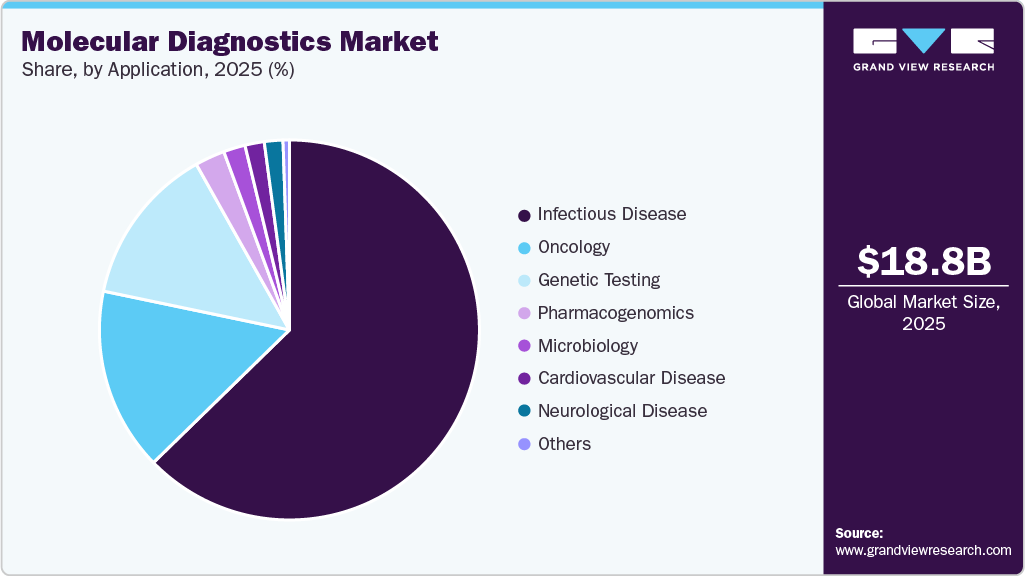

- By application, the infectious disease segment held the largest market share in 2025.

- By test location, the central laboratories segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 18.85 Billion

- 2033 Projected Market Size: USD 25.59 Billion

- CAGR (2026-2033): 4.06%

- North America: Largest market in 2025

In addition, the increasing adoption of Point-of-Care (POC) testing driven by the need for convenient self-diagnostic tools and greater patient awareness of the benefits of rapid results is encouraging companies to innovate and introduce new testing products.As demand for point-of-care testing (POCT) continues to grow, several emerging trends are reshaping the market and strengthening its role within molecular diagnostics. One major shift is the increasing specialization of clinical departments, prompting the development of tailored POCT solutions for diverse medical applications. This aligns with the broader movement toward healthcare decentralization, where advanced diagnostic technologies are becoming more accessible in smaller facilities. As a result, POCT systems are being designed with greater precision, speed, and cost-efficiency.

Market players are actively developing innovative POCT products to capitalize on new opportunities. For example, in November 2024, Texas launched a pilot program focused on self-collected HPV screening to expand access to cervical cancer testing in underserved regions. Conducted at Su Clinica Federally Qualified Health Center (FQHC) in collaboration with The University of Texas MD Anderson Cancer Center, the initiative aims to evaluate the real-world effectiveness of self-collection screening. Using the FDA-approved BD Onclarity HPV Assay, the program addresses geographic and socioeconomic barriers to cervical cancer detection and examines strategies to improve healthcare delivery. By demonstrating the practicality of self-collection methods in resource-limited environments, the program supports broader adoption of POCT solutions and reinforces trust among providers and policymakers.

Companies such as Sigma Aldrich and QIAGEN are leveraging advanced technologies like TMA and LAMP for tumor diagnostics, while next-generation sequencing (NGS) remains one of the fastest-growing segments due to its widespread use in genomic research. The introduction of new systems-such as Thermo Fisher’s 5500x1 genetic analyzer and Illumina’s NextSeq CN500-along with the rising use of multiplex and real-time PCR platforms (e.g., QIAGEN’s EpiTect Methyl II PCR) continues to stimulate market expansion.

Through focused R&D and strategic collaborations, leading manufacturers are broadening their portfolios of qPCR and disease-specific diagnostic tests. Notable advancements in oncology and infectious disease testing include Roche’s Cobas HPV assay and Cepheid’s GeneXpert Xpert assay for tuberculosis. Adoption of technologies such as FISH and ELISA is also increasing, enhancing diagnostic diversity and expanding clinical applications.

The persistent burden of infectious diseases continues to elevate the need for rapid molecular diagnostics. During the COVID-19 pandemic, RT-PCR and sequencing played a crucial role in virus detection, supported by innovations such as Biosciences’ Lyo-Ready RT-qPCR mix and Novacyt’s RUO coronavirus assay. Interest in liquid biopsy techniques is also rising, driven by breakthroughs like the 2024 blood test developed by researchers at the University of Chicago and Northwestern University, capable of detecting cancer through circulating DNA fragments.

Molecular diagnostic tools are essential for identifying biomarkers linked to chronic diseases at early stages, enabling timely interventions and improved patient outcomes. According to the CDC, an estimated 129 million Americans were living with at least one major chronic condition in 2024, including heart disease, cancer, diabetes, obesity, or hypertension. Furthermore, 42% of the population manages two or more chronic illnesses, while 12% face five or more. These conditions account for roughly 90% of the nation’s annual USD 4.1 trillion healthcare expenditure. With chronic disease prevalence steadily rising, the demand for effective diagnostic and management solutions will continue to climb. Growing cases of cancer, cardiovascular, neurological, and genetic disorders are expected to further drive market growth.

External funding for molecular diagnostics research also plays a vital role in accelerating product innovation. In September 2025, South Korea’s Seegene Inc., in collaboration with Springer Nature, launched the 2025-2026 “Nature Awards MDx Impact Grants,” offering financial support and access to syndromic PCR assays for developing diagnostics targeting antibiotic-resistant urinary tract infections. Likewise, in April 2023, Promega Corporation awarded USD 15,000 to support academic research using qPCR. Continuous updates to molecular diagnostic test menus are essential, given the evolving nature of infectious diseases and increasing antimicrobial resistance. The COVID-19 outbreak-declared a global health emergency by the WHO in January 2020-underscored the importance of rapid advancements in diagnostic technologies.

Key Funding And Partnerships

Year

Month

Description

2025

September

Seegene and Springer Nature opened applications worldwide for the 2025-2026 Nature Awards MDx Impact Grants, offering up to USD 600,000 and access to PCR technologies for UTI antibiotic-resistance research.

2025

June

QIAGEN expanded its oncology diagnostics portfolio in the Netherlands through partnerships with Tracer Biotechnologies and Foresight Diagnostics, advancing minimal residual disease testing using QIAcuity digital PCR and NGS-based assays.

2025

May

Siemens Healthineers invested USD 150 million in the U.S., expanding manufacturing, supply depots, and a 60,000 sq. ft. Experience Center, creating jobs and enhancing healthcare innovation nationwide.

2025

April

Roche announced a USD 50 billion investment in the U.S., expanding R&D and manufacturing facilities across multiple states, creating over 12,000 jobs, and strengthening its pharmaceuticals and diagnostics footprint nationwide.

2025

January

Geneoscopy raised USD 105 million in a Series C round led by Bio-Rad in the U.S. to launch its FDA-approved ColoSense stool-based colorectal cancer screening test and advance gastrointestinal diagnostic innovations.

2024

August

Cambrian Bioworks, a Bengaluru-based biotechnology startup, successfully raised USD 1.45 million in seed funding. The company focuses on developing innovative solutions tailored for the fast-growing next-generation sequencing (NGS) and molecular diagnostics sectors. These advancements could facilitate broader adoption of NGS technologies, making molecular diagnostics more accessible and efficient.

2024

June

BillionToOne secured USD 130 million in an oversubscribed Series D funding round. Premji Invest led the financing, with notable participation from new investor Neuberger Berman and existing backers such as Adam Street Partners, Baillie Gifford, Hummingbird Ventures, Civilization Ventures, Libertus Capital, and Fifty Years. The company plans to use the funds to scale its prenatal and oncology divisions.

2024

April

PathGen Diagnostik Teknologi announced securing funding from East Ventures and Royal Group Indonesia. This investment will be directed toward several strategic initiatives, including research and development, technological innovation, market expansion, and other critical areas of growth.

2024

May

En Carta Diagnostics secured USD 1.59 million in pre-seed funding. This investment will support the company in advancing preclinical research for a prototype diagnostic kit targeting Lyme disease, a debilitating condition. Additionally, the funding will help ensure the scalability of its technology for industrial production.

2024

June

Fuse Diagnostics announced the successful completion of an oversubscribed seed funding round, raising USD 1.27 million. The investment, backed by a syndicate of angel investors and Innovate UK, will accelerate the development of a groundbreaking new generation of diagnostic products. These innovations aim to combine the accuracy of laboratory-based instruments with the convenience and affordability of rapid, point-of-need testing solutions.

2024

May

Nanopath Inc. secured USD 4 million in federal funding, comprising a USD 3 million grant from the National Institutes of Health (NIH) and a USD 1 million grant from the National Science Foundation (NSF). The funding will support the ongoing research and development of the company's point-of-care diagnostic platform for pelvic and gynecologic infections and diseases.

2024

April

The venture capital firms East Ventures and Royal Group Indonesia grant funding to PathGen Diagnostik Teknologi. While the accurate amount was not disclosed, the investment will be used to support research and development, technology implementation, market expansion, and other key initiatives.

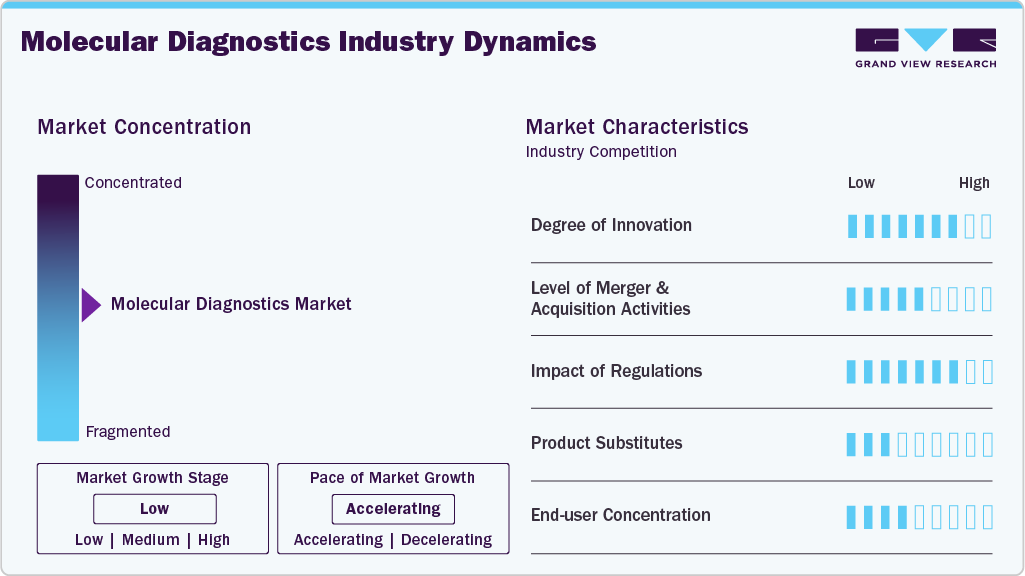

Market Concentration & Characteristics

The market growth stage is low, and the pace of growth is accelerating. The molecular diagnostics industry is characterized by a low degree of growth due to the rising geriatric population base, increasing demand for point-of-care testing, increasing R&D funding, and the increasing introduction of technologically advanced products.

The market for molecular diagnostics is characterized by a high degree of innovation owing to increasing efforts by market players to develop innovative solutions to increase their market presence. For instance, in March 2023, Sysmex Life Science launched the Sentifitr 800 analyzer, a fully automated and high-throughput device designed for fecal immunochemical testing. This new product enhances diagnostic efficiency, supporting laboratories in delivering rapid and accurate results while expanding Sysmex's product offerings in the life sciences sector.

The regulatory landscape significantly influences the market, presenting both challenges and opportunities, as a streamlined regulatory framework can enhance product approval processes, enhance innovation, and ensure high-quality testing. However, stringent regulations may delay product development and increase costs, limiting access to advanced diagnostics. For instance, according to an article published by Yale School of Medicine in February 2024, Yale experts are concerned over the FDA's proposed ruling to regulate laboratory-developed tests (LDTs), fearing it may limit access to crucial diagnostics, particularly for rare diseases. The ruling could hinder rapid responses to pandemics and increase costs, ultimately compromising patient care and safety despite intentions to enhance regulation.

The market is witnessing significant Mergers and Acquisitions (M&A) activity as strategic M&A activities allow companies to enhance their product portfolios and expand their market presence, positioning themselves competitively in the market. For instance, in January 2023, Thermo Fisher Scientific completed its acquisition of The Binding Site Group, enhancing its specialty diagnostics segment, particularly in oncology testing for multiple myeloma. This acquisition is expected to improve patient outcomes through advanced diagnostic technologies.

The threat of substitutes in the molecular diagnostics industry is significant due to the presence of alternative testing methods, such as immunoassays and traditional microbiology tests. However, this threat is not high because molecular diagnostics offer enhanced accuracy and specificity, which are crucial for early disease detection and personalized medicine. Additionally, advancements in technology and the growing demand for point-of-care testing further enhance the demand for molecular diagnostics over substitutes.

The molecular diagnostics industry has a significant end user concentration, primarily among hospitals, diagnostic laboratories, research institutions, and others. Hospitals are among the key players, benefiting from increased patient hospitalizations and government support for advanced diagnostic technologies. This concentration highlights the crucial role these facilities play in the adoption and utilization of molecular diagnostics.

Product Insights

Reagents held the largest market share of 65.53% in 2025 and are expected to witness the fastest growth at a CAGR of 4.30% over the forecast period. This can be attributed to the increasing demand for accurate and efficient diagnostic tools across various healthcare sectors, including oncology, infectious diseases, and genetic disorders. Reagents, which include enzymes, probes, primers, and buffers, are critical components in molecular diagnostic tests such as PCR, NGS, and digital PCR. Moreover, the continuous innovation and launch of novel products by key industry players are further contributing to the segment growth. For instance, in April 2023, Cepheid, a subsidiary of Danaher, revealed plans to introduce new tests for infectious diseases, including respiratory illnesses and tuberculosis. These advancements are expected to improve efficiency, standardize results, and reduce costs, supporting the overall market expansion.

The instruments segment is expected to witness significant growth owing to the increasing demand for early disease detection, particularly in oncology, infectious diseases, and genetic disorders. Technologies such as PCR, NGS, and microarrays are crucial for diagnosing conditions such as cancer, HIV, and genetic diseases. With the global cancer burden expected to rise to 30 million new cases by 2040 and cancer diagnoses in the Americas predicted to reach 6.23 million, which is a 57% increase, the need for accurate diagnostics is also anticipated to increase significantly.

Test Location Insights

Central laboratories held the largest market share in 2025 owing to advancements in laboratory technology, including automation and integration, which significantly enhance testing efficiency and throughput. Central laboratories are capable of managing a large volume of tests, ensuring faster and more precise diagnoses, and their role in disease detection, monitoring, and personalized medicine continues to drive the market forward. Moreover, key market players are continuously developing and offering laboratory-based molecular diagnostic solutions. For instance, in September 2024, QIAGEN released the QIAcuityDx Digital PCR System, a significant innovation in molecular diagnostics. This system, designed for clinical testing in oncology, provides precise quantification of DNA and RNA, supporting applications such as cancer monitoring through liquid biopsies. With integrated partitioning, thermocycling, and imaging, the QIAcuityDx system reduces laboratory space and costs while offering increased throughput, precision, and faster processing times.

Self-test or OTC is expected to witness the fastest growth over the forecast period. This can be attributed to the increasing consumer demand for at-home health monitoring solutions. This segment enables individuals to perform diagnostic tests in the comfort of their homes, without the need for clinical intervention. The rising focus on convenience, privacy, and cost-effective healthcare solutions has accelerated the adoption of self-test kits for conditions such as infectious diseases, genetic testing, and wellness monitoring. Technological advancements in test accuracy and ease of use are further enhancing the segment's growth, positioning it as a key player in personalized healthcare.

Technology Insights

PCR held the largest market share of 62.16% in 2025. PCR technologies encompass several methods, such as quantitative PCR, reverse transcription PCR, inverse PCR, and multiplex PCR, with multiplex PCR emerging as a preferred method for its ability to detect multiple targets simultaneously. Real-time PCR has become particularly important for cancer marker analysis, contributing to the growing use of high-throughput PCR techniques for cancer detection. The development of digital PCR systems has further fueled segment growth. For instance, Thermo Fisher Scientific's 2023 release of the QuantStudio Absolute Q AutoRun dPCR Suite automates lab processes, improving efficiency and reducing costs, while Roche’s Digital LightCycler System launched significantly advanced cancer detection methods in 2022.

The ISH segment is expected to witness the fastest growth owing to recent launches, including RNAscope ISH probes for B-cell lymphoma and HPV detection, enhance diagnostic precision, support clinical applications, and cater to the rising demand for advanced cancer diagnostic tools. For instance, in May 2023, Bio-Techne launched Kappa and Lambda RNAscope ISH Probes as ASRs for detecting immunoglobulin kappa and lambda light chain mRNA in B-cells. These probes aid in assessing B-cell clonality, which is crucial for diagnosing B-cell lymphomas. Unlike traditional methods, RNAscope probes offer high sensitivity, especially for FFPE tissues. The new probes support laboratory-developed tests (LDTs) and are compliant with GMP standards, enhancing accuracy in clinical diagnostics and research.

Application Insights

Infectious disease held the largest market share in 2025. This can be attributed to the rising demand for rapid and accurate detection of pathogens. Molecular diagnostic techniques, such as polymerase chain reaction (PCR) and next-generation sequencing, have revolutionized the identification of infectious agents, enabling healthcare providers to diagnose conditions such as tuberculosis, HIV, and various viral infections more efficiently than traditional culture methods. Moreover, key market players contribute to the growth of the infectious disease by developing innovative, rapid, and accurate diagnostic technologies. Multiplex PCR is commonly used to diagnose pathogens such as HIV-1, HIV-2 (HIV-AIDS), HSV-1, HSV-2 (meningitis & encephalitis), H. influenzae, S. pneumoniae (respiratory infections), N. gonorrhoeae, C. trachomatis (genital infections), C. parvum (diarrheal diseases), and Leishmania spp. Products such as Roche Diagnostics' Cobas CT/NG, Abbott's RealTime CT/NG Assay, and Hologic's Aptima STIs assist in diagnosing these infections. Advanced products such as the Randox STI assay enable the detection of multiple STIs and are expected to drive demand for more efficient diagnostics in the future

The oncology segment is expected to witness significant growth owing to the increasing demand for early detection, personalized treatment, and monitoring of cancer therapies. The dynamic fields of oncology research & cancer drug discovery have significant advantages in performing molecular diagnosis using specific biomarkers with regard to major cancer-causing genes and their manifestations. Early identification of predictive biomarkers in molecular diagnosis provides opportunities for early diagnosis of cancer-affected patients and helps develop specifically tailored medication for treatment. As a result, the application of molecular diagnosis in oncology holds high growth potential; thus, the segment is expected to grow at the fastest CAGR during the forecast period.

Regional Insights

North America molecular diagnostics industry accounted for the largest global revenue share of 44.16% in 2025, owing to the growing adoption of molecular diagnostics, which are valued for their superior accuracy, sensitivity, and specificity. The rising demand for genetic testing, particularly for personalized healthcare in conditions such as diabetes and cancer, is anticipated to fuel market expansion. Moreover, the increasing regulatory support for advanced solutions further contributes to market growth. In addition, strategic collaborations between prominent pharmaceutical firms and molecular diagnostic companies aimed at developing companion diagnostics are fostering significant growth opportunities in the region. For instance, in November 2024, Fluxergy, a medical diagnostics company, announced its pioneering use of the National Institute of Allergy and Infectious Diseases' (NIAID) in-kind Diagnostics Development Services. This collaboration aims to enhance molecular testing and sample preparation on the Fluxergy platform. Through NIAID's preclinical services, contractors will assess advanced nucleic acid extraction and purification techniques optimized for Fluxergy's Test Card.

U.S. Molecular Diagnostics Market Trends

The molecular diagnostics industry in the U.S. is driven by the presence of key market players, favorable reimbursement policies, developed R&D infrastructure, and the rising prevalence of various health conditions in the country. For instance, according to the American Cancer Society, over 2 million new cancer cases are projected to be diagnosed in the U.S. in 2024. This figure excludes basal and squamous cell skin cancers, which are not mandatory for reporting to cancer registries, as well as noninvasive carcinoma in situ, with the exception of urinary bladder cases. These factors are expected to contribute to the growth of the molecular diagnostics industry in the U.S.

The molecular diagnostics industry in Canada is expected to witness significant growth over the forecast period. The rising number of cancer cases highlights an increasing need for advanced molecular diagnostics to enable early detection and personalized treatment are driving market growth. According to the Canadian Cancer Society, an estimated 247,100 Canadians are expected to be diagnosed with cancer in 2024, up from 239,100 new cases in 2023. This increase is largely attributed to Canada's growing and aging population. Additionally, cancer-related deaths are projected to rise from 86,700 in 2023 to 88,100 in 2024. Such a rise in the prevalence of cancer in the country is expected to fuel the market growth in the country.

Europe Molecular Diagnostics Market Trends

The molecular diagnostics industry in Europe is witnessing significant growth, driven by the increasing prevalence of genetic and cardiovascular disorders and growing investments in proteomics & genomic research initiatives. According to WHO data from 2024, cardiovascular diseases (CVDs) are the leading cause of disability and premature death in the European Region, responsible for over 42.5% of all deaths annually. This equates to approximately 10,000 deaths per day. Thus, the rising CVD population is expected to boost demand for molecular tests during the forecast period.

The molecular diagnostics industry in the UK is experiencing significant growth, driven by the presence of developed healthcare infrastructure, high disposable income, and growing awareness about the benefits of early diagnosis. In April 2024, the rollout of community diagnostic centers (CDCs) across England is set to address long waiting lists, provide better value for taxpayers, and contribute to decarbonizing the NHS. Such efforts to enhance the efficiency of the country’s healthcare sector and services are further expected to fuel the market growth over the forecast period.

The molecular diagnostics industry in Germany is driven by the increasing demand for faster, more accurate diagnostic solutions across various therapeutic areas, particularly infectious diseases, oncology, and genetic disorders. Moreover, the country’s growing geriatric population base further contributes to market growth. According to the UN’s population data, one in every 20 people in Germany is over 80 years old, which is expected to increase to one in every six individuals by 2050. This population has a higher risk of chronic diseases, such as diabetes, cardiovascular diseases, and neurovascular disorders, due to the onset of senescence & decreased immunity levels.

Asia Pacific Molecular Diagnostics Market Trends

The molecular diagnostics industry in the Asia Pacific region is driven by a high burden of various conditions such as TB, drug-resistant TB, multi-drug-resistant (MDR-TB), and rifampicin-resistant (RR-TB) TB cases. For instance, according to the WHO Global TB Report 2023, the WHO South-East Asia (SEA) Region, which was home to approximately one-fourth of the global population, carries a significant burden of tuberculosis (TB), accounting for over 45% of the annual TB incidence. In 2022, more than 4.8 million people in this region fell ill with TB, and over 600,000 people died from the disease, excluding HIV-related TB mortality. This represents more than half of all global TB-related deaths. Moreover, the developing healthcare infrastructure and growing geriatric population further contribute to this growth in the region.

The molecular diagnostics industry in China is driven by the increasing healthcare spending, which is expected to contribute to the rapid growth in the market. Moreover, with its growing population, individuals are more prone to chronic diseases, further fueling market growth. After completing the Human Genome Project (HGP), researchers worldwide seek funds to build a complete human proteins catalog. The information encoded in genomes can help identify the risk and probability of diseases, which is the next step in protein purification. The factors above are expected to improve healthcare services in China and generate new market opportunities for manufacturers. Moreover, the presence of a large geriatric population and improving State Food & Drug Administration (FDA) regulatory policies are expected to drive the market in China.

Latin America Molecular Diagnostics Market Trends

Latin America molecular diagnostics industry includes Brazil, Chile, Peru, Argentina, and Colombia markets. Technological advancements in the Latin America healthcare industry are expected to contribute to market growth. Increasing government expenditure on Research & Development (R&D), the rising focus of multinational medical device companies in the molecular diagnostics sector and growing patient awareness about infectious diseases are expected to drive market growth during the forecast period.

The molecular diagnostic industry in Brazil is experiencing significant growth, driven by a combination of technological advancements, increasing healthcare demands, and supportive government policies. Brazil faces a high burden of infectious diseases such as dengue, Zika, Cancer, HIV, and tuberculosis, which necessitates accurate and rapid diagnostic solutions. Molecular diagnostics, with their superior sensitivity and specificity, are becoming the preferred choice for timely detection and management of these diseases.

Middle East And Africa Molecular Diagnostics Market Trends

The molecular diagnostics industry in the Middle East and Africa (MEA) is experiencing significant growth, driven by the increasing prevalence of chronic conditions, such as cancer, cardiovascular diseases, and other diseases. According to WHO estimates, in 2020, cancer incidence in the Middle East is expected to double by 2030. Around 9 out of 22 countries in the MEA did not have optimal operational facilities to deal with cancer. Economic development and the presence of high unmet healthcare needs-witnessed in emerging markets such as South Africa are also contributing to the market growth.

The molecular diagnostics industry in Saudi Arabia is experiencing significant growth, driven by various factors, such as the rising prevalence of noncommunicable diseases, including cardiovascular diseases (CVDs) and diabetes. According to ScienceDirect, the prevalence of CVDs is estimated to reach 479,500 by 2035. Similarly, according to the International Diabetes Atlas, in 2021, over 4.27 million people in the country had diabetes. In 2023, the nation is anticipated to witness a diagnosis of over 31,000 new cancer cases. Chronic diseases need constant support from diagnostics and immunoassays to make treatment possible. Hence, the growing prevalence is expected to create growth opportunities.

Key Molecular Diagnostics Company Insights

Key market players are adopting various strategic initiatives such as launches, partnerships, collaborations, mergers & acquisitions, approvals, expansion and others to increase their presence in the global molecular diagnostics industry. These advancements in the molecular diagnostics industry are anticipated to boost market growth over the forecast period.

Key Molecular Diagnostics Companies:

The following are the leading companies in the molecular diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- BIOMÉRIEUX

- Bio-Rad Laboratories, Inc.

- Abbott

- Agilent Technologies, Inc.

- Danaher

- Hologic Inc. (Gen Probe)

- Illumina, Inc.

- Grifols

- QIAGEN

- F. Hoffmann-La Roche, Ltd.

- Siemens Healthineers AG

- Sysmex Corporation

- Seegene, Inc.

- EliTechGroup

- CERTEST BIOTEC

Recent Developments

-

In November 2025, Abbott agreed to acquire Exact Sciences for USD 21 billion, strengthening its position in cancer diagnostics and significantly boosting the market through expanded precision oncology capabilities and integrated early-detection solutions.

-

In November 2025, Roche collaborated with Sapphiros, gaining access to 1 billion lateral flow tests and future molecular point-of-care platforms, expanding rapid molecular diagnostics globally.

-

In November 2025, Hologic launched AI-powered 3DQuorum mammography technology, impacting molecular diagnostics indirectly by integrating AI to improve imaging workflows and detection efficiency for precision diagnostics in breast health.

-

In November 2025, WHO prequalification of BD Onclarity HPV assay expands global access to high-quality screening, strengthening confidence in HPV diagnostics and accelerating adoption of advanced molecular diagnostics in LMICs.

Molecular Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 19.36 billion

Revenue forecast in 2033

USD 25.59 billion

Growth Rate

CAGR of 4.06% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2026 to 2033

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Segments covered

Product, test location, technology, application, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Belgium; Switzerland; Netherlands; Portugal; Denmark; Sweden; Turkey; Norway; China; India; Australia; Indonesia; South Korea; Malaysia; Thailand; Vietnam; Brazil; Colombia; Chile; Peru; Argentina; Ecuador; South Africa; Saudi Arabia; UAE; Kuwait

Report coverage

Revenue, competitive landscape, growth factors, and trends

Key companies profiled

BD; BIOMÉRIEUX; Bio-Rad Laboratories, Inc.; Abbott; Agilent Technologies, Inc.; Danaher; Hologic Inc. Illumina, Inc.; Grifols; QIAGEN; F. Hoffmann-La Roche, Ltd.; Siemens Healthineers AG; Sysmex Corporation; Seegene Inc; EliTechGroup; CERTEST BIOTEC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Molecular Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global molecular diagnostics market report based on product, test location, technology, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Regards

-

Others

-

-

Test Location Outlook (Revenue, USD Million; 2021 - 2033)

-

Point of care

-

Self test or OTC

-

Central laboratories

-

-

Technology Outlook (Revenue, USD Million; 2021 - 2033)

-

Polymerase chain reaction (PCR)

-

PCR, by Procedure

-

Nucleic Acid Extraction

-

Others

-

-

PCR, by Type

-

Multiplex PCR

-

Other PCR

-

-

PCR, by Product

-

Instruments

-

Reagents

-

Others

-

-

-

In Situ Hybridization (ISH)

-

Instruments

-

Reagents

-

Others

-

-

Isothermal Nucleic Acid Amplification Technology (INAAT)

-

Instruments

-

Reagents

-

Others

-

-

Chips and Microarrays

-

Instruments

-

Reagents

-

Others

-

-

Mass Spectrometry

-

Instruments

-

Reagents

-

Others

-

-

Transcription Mediated Amplification (TMA)

-

Instruments

-

Reagents

-

Others

-

-

Others

-

Instruments

-

Reagents

-

Others

-

-

-

Application Outlook (Revenue, USD Million; 2021 - 2033)

-

Oncology

-

Breast Cancer

-

Prostate Cancer

-

Colorectal Cancer

-

Cervical

-

Kidney

-

Liver

-

Blood

-

Lung

-

Other

-

-

Pharmacogenomics

-

Infectious disease

-

MRSA

-

Clostridium difficile

-

Vancomycin-resistant enterococci

-

Carbapenem-resistant bacteria testing

-

Flu

-

Respiratory syncytial virus (RSV)

-

Candida

-

Tuberculosis and drug-resistant TB

-

Meningitis

-

Gastro-intestinal panel testing

-

Chlamydia

-

Gonorrhea

-

HIV

-

Hepatitis C

-

Hepatitis B

-

Other Infectious Diseases

-

-

Genetic testing

-

Newborn screening

-

Predictive and presymptomatic testing

-

Others

-

-

Neurological disease

-

Cardiovascular disease

-

Microbiology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Portugal

-

Switzerland

-

Belgium

-

Turkey

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Malaysia

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Peru

-

Ecuador

-

Chile

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global molecular diagnostics market size was estimated at USD 18.85 billion in 2025 and is expected to reach USD 19.36 billion in 2026.

b. The global molecular diagnostics market is expected to witness a compounded annual rate of 4.06% from 2026 to 2033 to reach USD 25.59 billion by 2033.

b. The reagents segment accounted for the largest revenue share of 65.53% in 2025 in the molecular diagnostics market. It is anticipated to grow at a significant rate in the coming years, owing to its wide adoption in research and clinical settings.

b. The central laboratories segment dominated the molecular diagnostics market and accounted for the largest revenue share in 2025. This growth is attributable to the high market penetration and test volumes.

b. The Polymerase Chain Reaction (PCR) segment dominated the molecular diagnostics market and accounted for the largest revenue share of 62.16% in 2025. This is attributed to its use in the detection of Covid-19.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.