- Home

- »

- Next Generation Technologies

- »

-

Collision Avoidance System Market Size, Share Report, 2030GVR Report cover

![Collision Avoidance System Market Size, Share & Trends Report]()

Collision Avoidance System Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Radar, Camera, Ultrasound, LiDAR), By Application (ACC, BSD, FCWS, LDWS, Parking Assistance), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-750-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Collision Avoidance System Market Trends

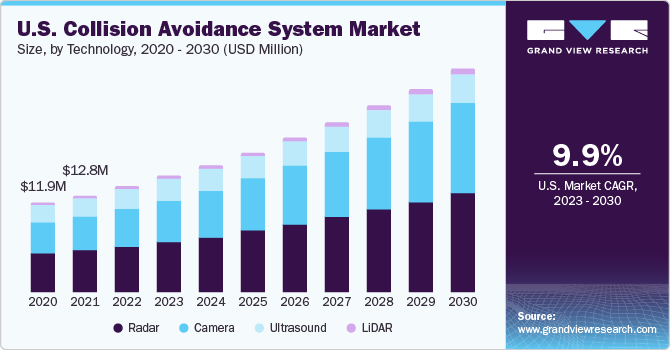

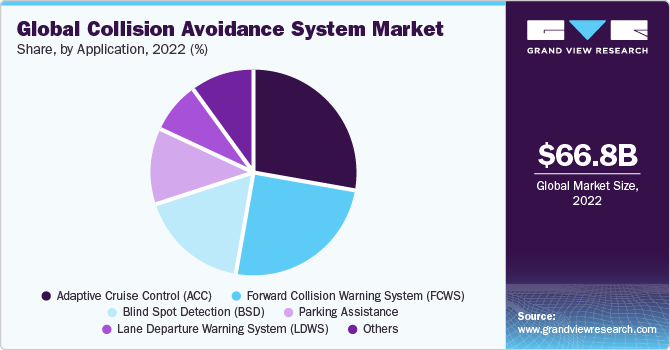

The global collision avoidance system market size was valued at USD 66.80 billion in 2022 and is projected to reach USD 157.47 billion by 2030, growing at a CAGR of 11.4% from 2023 to 2030. The market has grown over the past few years due to high development of LiDAR, camera, radar, and ultrasound technologies. Luxury automakers continue to exploit the potential of such systems as a part of their active safety package.

The growing sports, utility, and luxury vehicle sales are expected to grow the anti-collision systems industry. Some major automakers have already integrated basic collision avoidance systems into their mass-market models. For instance, in March 2021, NASA and SpaceX entered into a contract to share data and coordinate flight safety measures. The agreement primarily focuses on avoiding potential collisions and ensuring the safety of NASA spacecraft through the extensive network of SpaceX Starlink satellites. The collaboration aims to address concerns related to conjunction avoidance and launch collision avoidance, fostering a safer environment for space missions conducted by both entities.

Collision avoidance setup enables reduced road accidents and mitigates impact of such accidents on vehicle occupants and pedestrians. Increasing consumer awareness, updated ratings of safety agencies, and extensive R&D by industry players have fueled the anti-collision systems market's growth. For instance, in May 2021, Toyota Motor Corp unveiled a partnership agreement with ZF and Mobileye to collaborate on developing and providing advanced driver assistance systems (ADAS). These systems will be integrated into various vehicle platforms across Toyota Group, ensuring enhanced safety and driving assistance functionalities for future vehicles.

Market Dynamics

In recent years, the market has witnessed the emergence of notable technological trends driven by increasing demand for safer and more efficient transportation across industries such as railways, airports, construction, and mining. One of these trends is the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms into collision avoidance systems. These algorithms analyze real-time data from cameras, sensors, and radar to predict collisions and proactively prevent accidents. This has led to more reliable and responsive collision avoidance systems that can adapt to various driving conditions and scenarios.

Another significant trend is the increasing adoption of advanced sensors and Light Detection and Ranging (LiDAR) technology, which has increased the demand for high-quality optical materials such as specialized glass and precision lenses. These components are crucial for enhancing the accuracy and performance of collision avoidance systems in various applications, including automotive and aerospace. In addition, the market is witnessing a growing emphasis on sustainability and environmental protection. This has led to a shift toward using eco-friendly and recyclable materials in collision avoidance systems. Manufacturers are exploring alternatives to traditional plastics and metals, opting for bio-based polymers and lightweight composite materials. These eco-conscious choices have a lower environmental impact and align with the increasing demand for energy-efficient solutions in the transportation and industrial sectors.

Technology Insights

Based on technology, industry is segmented into radar, ultrasound, camera, and LiDAR. The radar segment held a significant market share of 43.3% in 2022. Radars are preferred in the setup that requires accurate determination of distance and location of any obstacle. They use radio waves to detect objects' position, distance, and velocity, making them effective in various weather conditions and environments. Technology-based collision avoidance systems, such as radar, ultrasound, camera, and LiDAR, offer motor vehicles active safety and pre-crash mitigation capabilities. Vision and infrared cameras have a shorter field of view than radars but help identify type of obstacle.

The LiDAR segment is estimated to register a significant CAGR of 16.1% over the forecast period. LiDAR technology can detect objects at long distances, typically ranging from tens to hundreds of meters. This extended range allows collision avoidance systems to detect potential hazards early, providing more time for a vehicle to react and avoid collisions. LiDAR-based anti-collision systems offer wide-view field and detailed imagery but are expensive and bulky for mass automobile production.

Application Insights

Adaptive Cruise Control (ACC) segment dominated the market with a revenue share of over 27% in 2022. Such systems employ long, short, and medium-range radars to adjust the vehicle’s speed automatically. ACC systems provide convenience and comfort to drivers by automatically controlling the speed and maintaining a safe following distance. The system takes over the task of constantly adjusting the speed to match the traffic flow, reducing driver fatigue, and allowing for a more relaxed driving experience. This convenience factor appeals to consumers and contributes to the growing market demand for ACC.

Blind Spot Detection (BSD) segment is estimated to register the highest CAGR over the forecast period. The advancement of sensor technologies, such as radar, ultrasonic sensors, and cameras, has significantly improved the accuracy and reliability of BSD systems. These sensors can detect vehicles or objects in blind spots and provide real-time alerts to drivers. Additionally, development of sophisticated algorithms and artificial intelligence has enhanced the performance of BSD systems, making them more effective in collision avoidance.

On the other hand, industry's growth is fueled by the rising sales of Advanced Driver Assistance Systems (ADAS), such as adaptive cruise control, blind spot detection, forward collision warning setup, lane departure warning, and parking assistance. Vehicles equipped with parking assistance use an array of ultrasound and vision-based anti-collision systems. For instance, for parking assistance, BMW, Mercedes-Benz, Audi, and Infiniti have integrated surround-view cameras and ultrasonic systems in their cars.

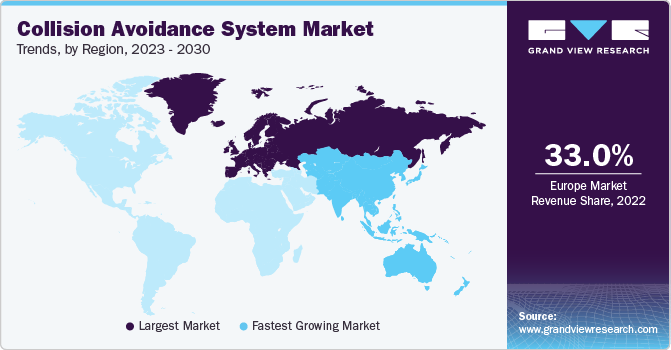

Regional Insights

Europe accounted for the highest market share of over 33.0% in 2022. There is a strong awareness and demand for safety features among European consumers. European countries have experienced many road accidents, creating a greater awareness of the importance of safety technology in vehicles. European consumers are more likely to prioritize collision avoidance systems when purchasing a car, leading to higher market demand.

Asia Pacific is expected to register the highest growth rate over the forecast period. This growth can be attributed to increased emphasis on implementing rigorous safety rules. The increase in purchasing power, GDP growth, high standard of living, and rising premium car sales are expected to drive regional growth in the Asia Pacific regions.

Key Companies & Market Share Insights

The market is highly competitive, and players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in June 2023, Wabtec introduced its Generation 3 Collision Avoidance System, which aims to bolster safety and productivity while delivering an advanced level of performance through its rules and intelligence capability. The new system provides heightened safety measures and improved efficiency, equipping vehicles with cutting-edge technology to prevent collisions and optimize operations. With its enhanced intelligence and rule-based functionality, the Generation 3 Collision Avoidance System sets a new standard for performance in collision avoidance systems. Some of the key companies operating in the collision avoidance system market include:

-

Analog Devices, Inc.

-

BorgWarner Inc.

-

Continental AG

-

DENSO CORPORATION

-

Infineon Technologies AG

-

Murata Manufacturing Co., Ltd.

-

NXP Semiconductors (Freescale Semiconductor, Inc.)

-

Panasonic Holdings Corporation

-

Robert Bosch Manufacturing Solutions GmbH

-

ZF Friedrichshafen AG (TRW automotive)

Recent Developments

-

In June 2023, Nissan incorporated intersection collision avoidance into its upcoming driver-assistance technology, which utilizes advanced LiDAR technology. The system employs ground-truth perception technology, powered by next-generation LiDAR, to accurately determine an object's speed, position, and the likelihood of a collision from a lateral direction. With its instantaneous responsiveness, the system can promptly adapt to dynamic scenarios by executing actions like emergency brake application or releasing the brakes when the risk of collision has been averted. This innovative control logic enhances safety by effectively addressing intersection-related risks.

-

In March 2023, Kennametal Inc. announced an addition to abrasive blast nozzles for advanced surface preparation, named Blast Ninja. The product was developed in collaboration with Oceanit, an innovative 'Mind to Market' company based in Honolulu. The introduction of the Blast Ninja marks a significant milestone for the abrasive blasting industry. This nozzle minimizes noise at its source without compromising blasting efficiency by decreasing air exit velocity while retaining particle velocity.

-

In November 2022, TORSA released its next-generation Collision Avoidance System for shovels, haul trucks, auxiliary vehicles, and light vehicles. The new system builds upon the system’s first version that was installed at Antamina in Peru. According to the company, based on the feedback received from users, the new update also included a user interface to help in streamlining the information needed for both operators of the vehicles and equipment and the personnel operating through control rooms to reduce the information noise while ensuring a minimally intrusive system.

Collision Avoidance System Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 73.88 billion

Revenue forecast in 2030

USD 157.47 billion

Growth rate

CAGR of 11.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Continental AG; BorgWarner Inc.; DENSO CORPORATION; Analog Devices, Inc.; Murata Manufacturing Co., Ltd.; NXP Semiconductors (Freescale Semiconductor, Inc.); Infineon Technologies AG; Panasonic Holdings Corporation; Robert Bosch Manufacturing Solutions GmbH; ZF Friedrichshafen AG (TRW automotive)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

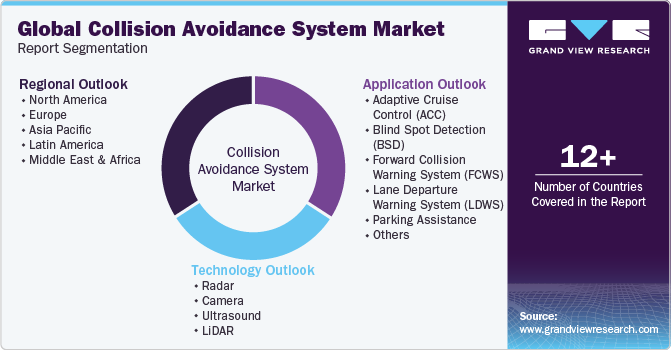

Global Collision Avoidance System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global collision avoidance system market based on technology, application, and region:

-

Technology Outlook (Revenue in USD Million, 2017 - 2030)

-

Radar

-

Camera

-

Ultrasound

-

LiDAR

-

-

Application Outlook (Revenue in USD Million, 2017 - 2030)

-

Adaptive Cruise Control (ACC)

-

Blind Spot Detection (BSD)

-

Forward Collision Warning System (FCWS)

-

Lane Departure Warning System (LDWS)

-

Parking Assistance

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global collision avoidance system market size was estimated at USD 66.80 billion in 2022 and is expected to reach USD 73.88 billion in 2023.

b. The global collision avoidance system market is expected to grow at a compound annual growth rate of 11.4% from 2023 to 2030 to reach USD 157.47 billion by 2030.

b. Europe dominated the collision avoidance system market with a share of over 32% in 2022. This is attributable to the government in the region has been actively promoting road safety through various initiatives. THINK! campaign, for instance, aims to increase awareness of the negative effects that even slight speeding on country roads can have. .

b. Some key players operating in the collision avoidance system market include Continental AG; Delphi Automotive; Denso Corporation; Murata Manufacturing Co. Ltd.; Freescale Semiconductor, Inc.; Infineon Technologies; and Robert Bosch GmbH.

b. The market has witnessed the emergence of notable technological trends driven by the increasing demand for safer and more efficient transportation across industries such as railways, airports, construction, and mining. One of these trends is the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms into collision avoidance systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.