- Home

- »

- Next Generation Technologies

- »

-

Drone Data Services Market Size And Share Report, 2030GVR Report cover

![Drone Data Services Market Size, Share & Trends Report]()

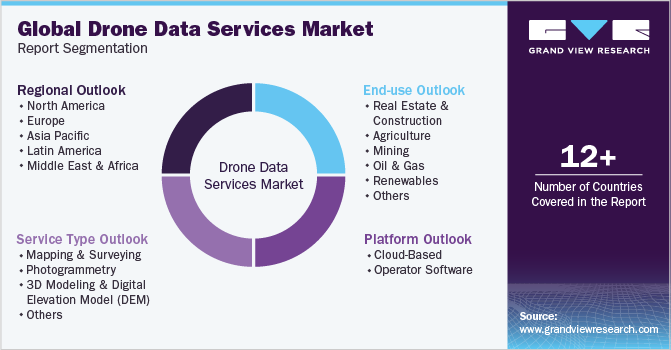

Drone Data Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Service Type (Mapping & Surveying, Photogrammetry, 3D Modeling), By Platform (Cloud-Based, Operator Software), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-476-5

- Number of Report Pages: 126

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global drone data services market size was valued at USD 1.05 billion in 2022 and is anticipated to grow at a CAGR of 39.0% from 2023 to 2030. The market growth is attributed to the increasing need for drone information analysis amongst businesses worldwide to perform various critical tasks remotely, such as automated mapping, cadastral surveying, corridor surveying, volumetric calculations, and LiDAR mapping. Unmanned Aerial Vehicle (UAV) imagery service providers have been offering innovative opportunities for businesses in the construction & agriculture industries and widening their potential application base to enable predictive and actuation capabilities. These capabilities offer significant advantages, such as quality improvements, risk mitigation, and cost reduction, thereby providing a competitive advantage to adopters.

Drones and their sensors provide companies with significant data, multiplying applications and capabilities within their business processes. Analyzing the obtained information improves predictive/preventive maintenance and operational intelligence. Companies increasingly adopt data management platforms to process and analyze information for detecting and classifying notable events and creating reports.

Drone data service providers are expected to gain prominence by empowering companies globally to utilize UAV imagery better. This can be achieved by converting it into actionable information in simple 3D models, Digital Elevation Models (DEMs), and orthomosaic maps. An increasing number of companies are now seeking to enter the UAV software space and develop software to provide aerial imagery analysis and mapping solutions for the commercial sector.

Companies such as Parrot SA and 3D Robotics have consciously decided to transform their business from manufacturing UAVs to developing UAV software. Moreover, 3D Robotics has emerged as a company exclusively involved in developing UAV software and providing drone imagery services for civil engineering, construction, and mapping & surveying applications.

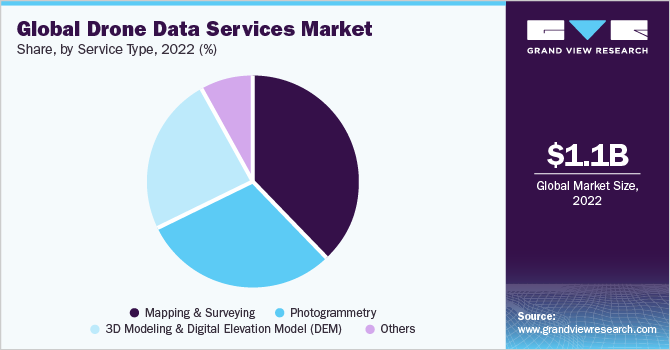

Service Type Insights

The four primary types analyzed in the report include mapping & surveying, photogrammetry, 3D modeling & DEM, and others. Others include volume measurements, change detection, spectral imaging, and object recognition. Mapping & surveying accounted for the largest market share of USD 402.5 million in 2022 and is poised to remain the dominating service type over the forecast period.

Land surveyors and mapping service providers are increasingly using drones to augment their resources of measuring instruments, creating a large amount of information that requires analysis. The geo-referencing digital images obtained by drones provide precise data with a higher resolution of 1.5 cm per pixel.

Businesses worldwide are increasingly using drones across a wide range of industries. Farmers are utilizing maps generated with drone software to identify areas of damage & crop variation, diagnose the potential causes for damages, such as pests, equipment malfunctioning, and irrigation problems, and prescribe solutions such as variable-rate nitrogen applications.

The 3D modeling & DEM segment is expected to grow at the fastest CAGR of 40.5% during the forecast period. The advancements in drone technology have enabled the collection of high-resolution aerial data, which can be processed to create detailed and precise 3D models and DEMs. It has significantly enhanced the accuracy and efficiency of data analysis and decision-making processes in industries that rely on geospatial information.

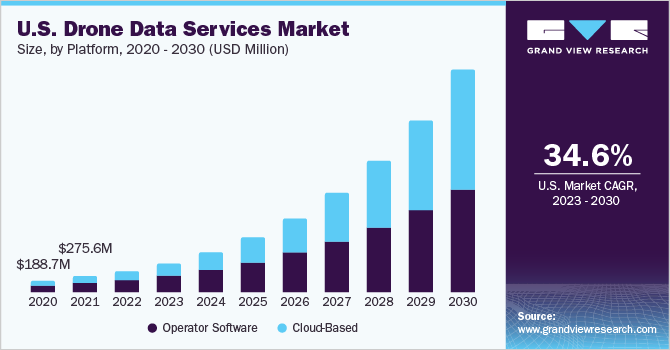

Platform Insights

Based on platforms, the drone data services market has been bifurcated into cloud-based and operator software. The drone industry is rich with a wide range of UAV imagery-based services. The industry comprises various cloud-based services packaged with drones, such as SiteScan, Kespry, and Aerotas. On the other hand, there are numerous server and desktop-based data analytic solutions, such as Pix4D, SimActive, and Drone2Map. Both platforms form an integral part of the overall market.

The operator software segment held the largest revenue share of 58.7% in 2022. Several factors drive the operator software segment. The increasing adoption of drones across various industries, such as agriculture, construction, infrastructure, and public safety, has created a significant demand for effective data management and analysis. Operator software enables drone operators to efficiently collect, organize, and analyze the vast amounts of data captured by drones, allowing them to derive actionable insights and make informed decisions.

Cloud-based UAV data services are expected to witness the fastest growth at a CAGR of 43.5% during the forecast period. These services extend the power of aerial images by leveraging a growing suite of third-party applications within their interfaces on both mobile and desktop devices, thereby making it easy for businesses to sum up, analyze, and share information within their organization.

Implementing cloud computing technology has been a key milestone in the industry. The benefits associated with utilizing cloud-based UAV imagery services, such as real-time optimized operations, enable businesses to shift to cloud technology. These services utilize a virtualized platform that is beneficial for a scalable environment.

End-use Insights

The others segment accounted for the largest revenue share of 43.3% in 2022. The others segment included aerospace & defense, energy & utilities, and media & entertainment. The growth of drone data services in the segment is attributed to the increasing adoption of drones for surveillance, reconnaissance, and intelligence-gathering purposes. Drones enable defense agencies and military organizations to obtain real-time situational awareness, monitor borders and critical infrastructure, and gather vital intelligence for tactical decision-making.

Various industries analyzed in the study include real estate & construction, agriculture, mining, and others. Real estate & construction is expected to account for significant market share over the forecast period. Drones are increasingly being used in construction sites to accomplish the goal faster and cheaper without risking human life.

The analysis of construction activities, which utilizes images acquired through drones, is expected to emerge as a lucrative application area for drones. Businesses in the real estate & construction industry are now able to imprint construction plans onto the UAV acquired real-time information. This is carried out by superimposing building plans, which are created using architectural and planning software and overlapping them on the orthomosaic of the whole site.

The application in precision agriculture has witnessed substantial growth over the last few years. Farmers are using images acquired by UAVs to gather real-time feedback and analyze the results regarding plant health, crop yields, and other data. Drones provide greater precision, cheaper imaging, and prior detection of problems due to total-field scouting and frequent index reporting compared to their counterparts. Agriculture drone data software is used to merge the geotagged imagery into a large mosaic and treated to interpret the amount of light reflected in distinct wavelengths.

The renewable segment is expected to witness the fastest growth at a CAGR of 45.9% during the forecast period. The need for efficient and accurate data collection drives the growth of drone data services in the renewable segment. Drones with advanced sensors and imaging technologies can gather precise data on renewable energy installations, such as solar panels, wind turbines, and hydroelectric plants.

Regional Insights

North America accounted for the largest market share of 39.8% in 2022 and is presumed to retain dominance over the forecast period. The regional growth can be attributed to the increasing adoption of civil aerospace and the rising demand for drones for business purposes. The region's commercial sectors, particularly in the U.S., are experiencing an increasing demand for high-quality and real-time data, along with favorable changes in the regulations about the use of such devices in business processes.

The European market was valued at USD 296.1 million in 2022 and is expected to grow substantially over the forecast period. The inconsistent and confusing patchwork of national regulations regulates the regional UAV market. This uncertainty has led to an increase in the number of UAV operators across the region, which in turn is driving the demand for drone-data-based analytical services amongst businesses across the region.

Poised to grow at a substantial CAGR throughout the forecast period, Asia Pacific is expected to emerge as a significant growing regional market over the next eight years. This growth is attributed to the growth in the commercial sector and enhancements in policy frameworks about using drones in commercial applications.

Latin America is expected to grow at the fastest CAGR of 46.4% during the forecast period. The increasing adoption of drones in various industries, including agriculture, construction, mining, and oil and gas, fuels the demand for drone data services. Drones can capture high-resolution imagery, collect data, and perform aerial inspections, providing valuable insights and enhancing operational efficiency across these sectors.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, In May 2023, Thales USA and Northern Plains UAS Test Site, in partnership with Airspace Link, introduced localized surveillance data to registered unmanned Aerial Systems (UAS) operators on Vantis. Vantis is North Dakota's extensive network for unmanned aircraft systems (UAS) beyond visual line-of-sight operations. This strategic partnership aims to effectively manage, distribute, and present Vantis airspace monitoring data in near real-time to registered UAS operators, enabling enhanced situational awareness and operational efficiency. The following are some of the major participants in the global drone data services market:

-

4DMapper

-

Agribotix.com

-

Airware Limited

-

DronecloudTM

-

DroneDeploy

-

DRONIFI

-

Pix4D SA

-

PrecisionHawk Inc.

-

Sentera

-

Skycatch, Inc.

Recent Developments

-

In April 2023, AZUR DRONES, a European provider of automated drone solutions, is expanding its product portfolio and embracing new possibilities by introducing SKEYETECH E2. This innovative platform offers various applications and is designed to deliver precise and consistent aerial data through artificial intelligence.

-

In March 2023, a collaboration between Estonian Air Navigation Services (EANS) and Frequentis resulted in the launch of a new drone platform. This platform aims to streamline operations by reducing manual tasks, specifically focusing on pre-flight authorization. Integrating all airspace users onto a single platform offers a centralized source of accurate information and real-time situational awareness for drone operators, air traffic controllers, and service providers.

-

In March 2023, Vodafone Group Plc, a telecommunications company based in the UK, collaborated with Dimetor to introduce DroNet, a digital data service to assess the risk of commercial drone flights in Germany. This innovative solution enables the company to provide mobile phone data to expedite and enhance the evaluation of ground risk associated with drone operations. By leveraging this service, the assessment process becomes faster, more efficient, and more secure than ever.

-

In March 2022, Asteria Aerospace, an Indian drone manufacturer and solution provider, introduced SkyDeck, an all-in-one drone operations platform. SkyDeck is a cloud-based software solution that delivers Drone-as-a-Service (DaaS) to various industry verticals, including surveying, industrial inspections, agriculture, and surveillance and security.

-

In February 2021, Delta Drone International, a drone-based data services and technology solutions company, extended its operations into Zambia. The expansion aimed to provide a specialized agricultural project for Syngenta, an agricultural science and technology provider. Leveraging its existing partnership with Syngenta since 2018, Delta Drone International's subsidiary, Rocketfarm, will broaden its scope and utilize advanced data capabilities to visualize and analyze crops virtually.

Drone Data Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.50 billion

Revenue forecast in 2030

USD 15.05 billion

Growth Rate

CAGR of 39.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, platform, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

4DMapper; Agribotix.com; Airware Limited

DronecloudTM; DroneDeploy; DRONIFI; Pix4D SA;PrecisionHawk Inc.; Sentera; Skycatch, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drone Data Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global drone data services market report based on service type, platform, end-use, and region:

-

Service Type Outlook (Revenue in USD Million, 2017 - 2030)

-

Mapping & Surveying

-

Photogrammetry

-

3D Modeling & Digital Elevation Model (DEM)

-

Others

-

-

Platform Outlook (Revenue in USD Million, 2017 - 2030)

-

Cloud-Based

-

Operator Software

-

-

End-use Outlook (Revenue in USD Million, 2017 - 2030)

-

Real Estate & Construction

-

Agriculture

-

Mining

-

Oil & Gas

-

Renewables

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global drone data services market size was estimated at USD 1.05 billion in 2022 and is expected to reach USD 1.50 billion in 2023.

b. The global drone data services market is expected to grow at a compound annual growth rate of 39.0% from 2023 to 2030 to reach USD 15.05 billion by 2030.

b. North America dominated the drone data services market with a share of over 39% in 2022, owing to the advanced technological infrastructure, a robust regulatory framework, and a growing demand for drone-based data solutions across various industries, including agriculture, construction, and energy.

b. Some key players operating in the drone data services market include PrecisionHawk, DroneDeploy, DroneCloud, 4DMapper, Sentera, LLC, Pix4D, Skycatch, Inc., Dronifi, Airware, and Agribotix LLC.

b. Key factors driving the drone data services market growth include the cost-efficient and data-rich capabilities of drones across diverse industries. Additionally, regulatory support, technological advancements, and the increasing demand for data-driven decision-making further propel the market's expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.