- Home

- »

- Next Generation Technologies

- »

-

Drone Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Drone Market Size, Share & Trends Report]()

Drone Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Product, By Technology, By Payload Capacity, By Power Source, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-263-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Drone Market Summary

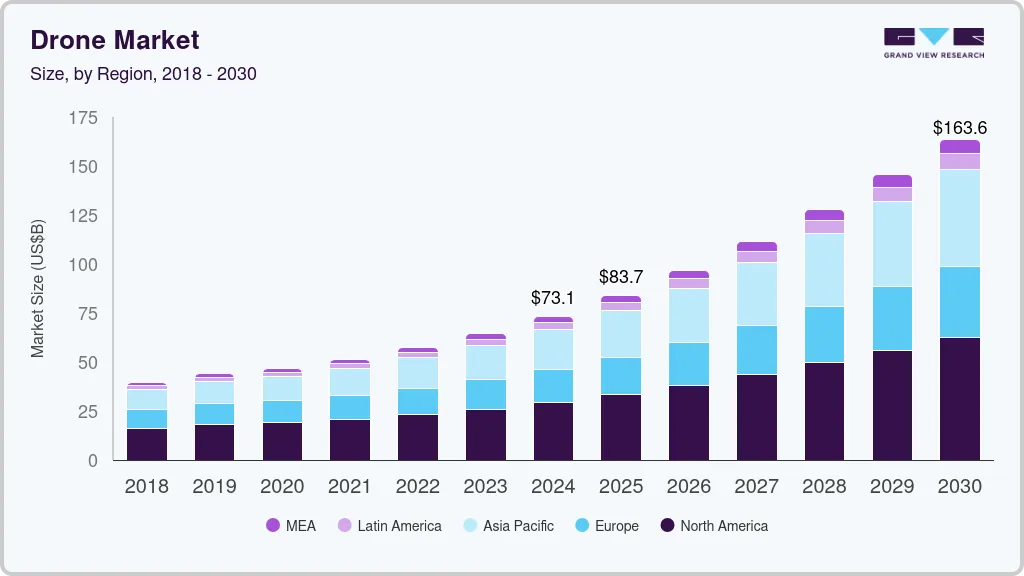

The global drone market size is estimated at USD 73.06 billion in 2024 and is projected to reach USD 163.60 billion by 2030, growing at a CAGR of 14.3% from 2025 to 2030. This growth is largely driven by rapid advancements in drone technology, improvements in battery efficiency, AI-powered autonomous systems, and enhanced imaging sensors, which is further expanding the capabilities of drones across industries.

Key Market Trends & Insights

- The North America drone industry dominated the market in 2024 with a share of over 39%.

- The U.S. drone industry is expected to grow at a CAGR of 13% from 2025 to 2030.

- By component, the hardware segment accounted for the largest revenue share of over 58% in 2024.

- By product, the multi-rotor segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 73.06 Billion

- 2030 Projected Market Size: USD 163.60 Billion

- CAGR (2025-2030): 14.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These technological innovations are boosting the performance and functionality of drones, allowing them to undertake more complex tasks. Additionally, the shift towards fully autonomous drones and the incorporation of hybrid product systems that combine the strengths of both fixed-wing and multi-rotor designs is expected to further propel the drone industry expansion in the coming years.

The increasing adoption of drones across various industries such as agriculture, logistics, construction, and infrastructure inspection are accelerating the drone industry expansion. The growing need for real-time data collection, surveillance, and monitoring capabilities is one of the major drivers behind this trend. In agriculture, drones are being used for crop monitoring, pesticide spraying, and soil analysis, while in logistics, they are streamlining last-mile deliveries. This surge in demand across industries is expected to be one of the key growth drivers for the drone market in the coming years, especially as drone technology becomes more accessible and affordable.

Another significant trend in the drone industry is the rise of Drone-as-a-Service (DaaS), where businesses can rent drones and drone-related services instead of purchasing them outright. This model is popular in industries that require drone services only periodically or in specific use cases, such as infrastructure inspection, surveying, or mapping. The ability to access drone technology without heavy upfront investment is democratizing the use of drones and making them more accessible to small businesses and industries with niche needs.

There is an increasing prevalence of small teams managing drone operations. This shift is primarily driven by advancements in technology that allow smaller groups to efficiently conduct complex drone missions. As regulatory frameworks evolve, more companies are obtaining approvals for advanced operations, including beyond visual line of sight (BVLOS) missions. This has led to a rise in specialized services, particularly in mapping and surveying, which account for a substantial portion of commercial drone applications. The ease of access to sophisticated drone technology enables these small teams to compete effectively, fostering innovation and agility within the drone industry.

The growing integration of advanced technologies such as 5G, IoT, and augmented reality (AR) into drone operations is driving the drone industry expansion. The incorporation of 5G enhances real-time data transmission and control over longer distances, while IoT improves automation and connectivity in applications like logistics and surveillance. Additionally, AR overlays are being utilized to enhance user experience in complex tasks such as construction mapping and disaster management. These technological advancements not only boost the operational capabilities of drones but also expand their applications across various sectors, driving further adoption in both consumer and commercial markets.

Component Insights

The hardware segment accounted for the largest revenue share of over 58% in 2024. As hardware technology advances in areas such as imaging sensor resolution and wireless connectivity capabilities, market players are increasingly introducing advanced drones with enhanced features like high-resolution cameras, long-range connectivity, and autonomous flight. Technological progress and the decreasing prices of drones are driving the growth of the hardware segment.

The services segment is expected to experience the fastest growth of over 15% from 2025 to 2030, driven by the growing demand for aerial photography and videography services. Drones equipped with high-resolution cameras and stabilized gimbals offer exceptional flexibility and maneuverability for capturing aerial images and videos. These capabilities are particularly in demand across industries such as real estate, construction, tourism, and entertainment, where aerial footage provides valuable insights, enhances marketing efforts, and supports project planning and monitoring.

Product Insights

The multi-rotor segment accounted for the largest revenue share in 2024. Multi-rotor drones, like quadcopters and hexacopters, are valued for their stability and portability, making them ideal for tasks that require precise navigation and close-quarters operations. Industries including construction, energy, telecommunications, and utilities are increasingly adopting multi-rotor drones for routine inspections, preventive maintenance, and asset monitoring.

The hybrid segment is projected to experience the fastest growth from 2025 to 2030. Hybrid drones, which combine fixed-wing and multi-rotor designs, offer the flexibility of Vertical Take-Off and Landing (VTOL) along with the endurance and efficiency of fixed-wing flight. This segment's growth is driven by the adaptability of hybrid drones across diverse environments, as well as advancements in hybrid product systems and energy management technologies. Manufacturers continue to innovate to improve the efficiency, reliability, and performance of hybrid product systems, optimizing the balance between electric and combustion power sources.

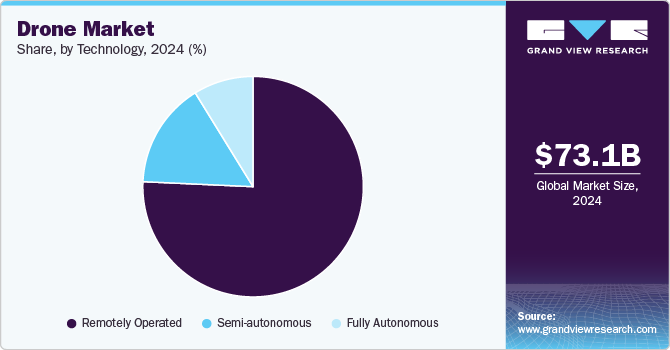

Technology Insights

The remotely operated segment accounted for the largest revenue share in 2024, owing to the increasing adoption of drones for surveillance and security applications. As global security concerns rise, governments, law enforcement agencies, and private entities are deploying drones equipped with high-resolution cameras, thermal imaging sensors, and real-time video streaming capabilities for monitoring and protecting critical infrastructure, public events, and borders.

The fully autonomous segment is expected to experience the fastest growth from 2025 to 2030, driven by advancements in Artificial Intelligence (AI) and Machine Learning (ML) technologies. These developments enable drones to operate autonomously by analyzing data from onboard sensors, navigating complex environments, and making real-time decisions. For instance, in April 2023, MIT researchers in the U.S. developed a brain-inspired system that helps drones navigate difficult terrains by mimicking the human brain’s neural networks. The system processes raw data to identify relevant information and discard unnecessary details.

Payload Capacity Insights

The up-to-2KG segment accounted for the largest revenue share in 2024. Drones with up to 2KG payload capacity are ideal for last-mile deliveries in urban areas. For instance, in February 2024, Aviant launched the first long-distance home delivery service operated by autonomous drones with a payload capacity of up to 2KG in Lillehammer, Norway. The service is designed to deliver food, medicines, and groceries directly to residents' doorsteps using the Kyte drone service.

The 2KG to 19KG segment is expected to experience the fastest growth from 2025 to 2030, driven by the widespread deployment of drones with payloads between 2KG and 19KG for public safety and emergency response applications. Fire departments, search and rescue teams, and law enforcement agencies use drones equipped with specialized payloads, such as thermal imaging cameras, gas detectors, and loudspeakers, to assist in disaster management, surveillance, and reconnaissance missions.

Power Source Insights

The battery-powered segment accounted for the largest revenue share in 2024, owing to advancements in battery technology. Improvements in energy density, charge/discharge rates, and overall battery performance are extending flight times and enhancing the operational capabilities of battery-powered drones. As drones become increasingly integral to various industries, such as agriculture, logistics, and infrastructure inspection, the demand for longer flight durations and improved battery efficiency is driving innovation in battery technology.

The hydrogen fuel cell segment is expected to witness the fastest growth, driven by advancements in fuel cell technology. Hydrogen fuel cells offer several advantages over conventional lithium-ion batteries, such as higher energy density, longer flight times, and faster refueling capabilities. As fuel cell technology advances, drone manufacturers are increasingly incorporating it into their products. For instance, in September 2023, the National Renewable Energy Laboratory (NREL) and Honeywell Aerospace collaborated to produce a cartridge-based hydrogen fuel storage solution for Unmanned Aerial Vehicles (UAVs).

End Use Insights

The military segment accounted for the largest revenue share in 2024. Military drones are widely used by defense forces worldwide for investigation, intelligence gathering, surveillance, target acquisition, and combat operations. The increasing focus on enhancing military capabilities and strengthening border security and counter-terrorism efforts is encouraging countries to invest in developing and acquiring refined drone technologies.

The consumer segment is expected to witness the fastest growth from 2025 to 2030 owing to the increasing affordability and accessibility of recreational drones. Technological advancements have enabled the development of compact and user-friendly drones equipped with high-definition cameras, intuitive controls, and automated flight features, making them appealing to hobbyists, enthusiasts, and amateur photographers. As the capabilities of consumer drones improve and they become more affordable, consumers are expected to procure recreational drones for aerial photography, videography, and recreational flying.

Regional Insights

The North America drone industry dominated the market in 2024 with a share of over 39%, driven by the widespread adoption of drones for various commercial uses, particularly in sectors like agriculture, construction, and oil & gas. Companies in this region are leveraging drones for tasks such as crop monitoring, land surveying, infrastructure inspection, and pipeline monitoring. The rapid integration of advanced drone capabilities, coupled with supportive regulatory frameworks in countries like the U.S. and Canada, is significantly enhancing the adoption of drone technology across diverse industries.

U.S. Drone Market Trends

The U.S. drone industry is expected to grow at a CAGR of 13% from 2025 to 2030. This growth can be attributed to favorable government initiatives and supportive regulations that promote safe and responsible drone operations while fostering innovation. The Federal Aviation Administration (FAA) has established clear guidelines through regulations such as Part 107, which facilitate commercial drone operations and ensure compliance with safety standards. Such initiatives by government are expected to drive the market growth in the U.S.

Europe Drone Market Trends

Europe drone industry is expected to grow at a CAGR of over 13% from 2025 to 2030, as countries increasingly adopt drone technology to enhance agricultural practices, improve crop yields, and minimize environmental impacts. Drones equipped with advanced sensors allow farmers to monitor crop health effectively and manage resources more efficiently.

The UK drone market is expected to grow at a significant rate in the coming years, as e-commerce and logistics firms increasingly consider drone delivery as a last-mile solution to lower transportation expenses. With ongoing advancements in drone technology and the development of regulatory frameworks, the feasibility and scalability of drone delivery are improving.

The drone market in Germany is driven by a strong focus on innovation and advancements in sensing technology, product systems, and autonomous navigation. The country’s dedication to fostering innovation through collaborations among industry leaders, academic institutions, and government bodies is supporting the growth of the drone sector, attracting investments and talent to develop new and innovative drone solutions.

Asia Pacific Drone Market Trends

Asia Pacific drone industry is expected to grow at the fastest CAGR of over 15% from 2025 to 2030, largely owing to the ongoing expansion of the automotive industry in countries like China, Japan, India, and South Korea. This region is becoming a key hub for automotive manufacturing, supported by increasing production capacities and the presence of numerous global and domestic companies. The demand for connected cars requiring advanced communication systems is expected to present lucrative growth opportunities in the region.

The Japan drone market is gaining traction owing to several key drivers, primarily fueled by rapid advancements in technology, particularly in artificial intelligence, imaging systems, and autonomous navigation. These innovations enable drones to perform complex tasks such as precision agriculture, infrastructure monitoring, and emergency response more effectively.

The drone market in China is rapidly expanding, supported by a thriving ecosystem of manufacturers that benefit from substantial investments in research and development, along with favorable regulatory policies. The commitment of Chinese companies to innovate and produce high-quality drones at competitive prices is allowing China to secure a considerable share of both the domestic and global drone markets.

Key Drone Company Insights

Some of the key players operating in the market are SZ DJI Technology Co., Ltd. and Parrot Drone SAS.

-

SZ DJI Technology Co., Ltd. specializes in the manufacture of commercial unmanned aerial components (drones) primarily for aerial photography and videography, alongside a range of camera systems, gimbal stabilizers, and flight control systems. The company has established itself as a dominant force in the consumer drone market, accounting for over 90% of global sales as of mid-2024. DJI's innovative products, such as the Mavic and Phantom series, are widely utilized across various sectors including filmmaking, agriculture, and emergency services, while also facing scrutiny over privacy and security concerns.

-

Parrot Drone SAS specializes in unmanned aerial components (UAVs) for various applications including agriculture, 3D mapping, surveying, and public safety. Parrot designs and engineers its products primarily in Europe, with notable offerings such as the ANAFI series, which includes models tailored for professional use. The company operates several subsidiaries, including SenseFly and Pix4D, enhancing its capabilities in photogrammetry and mapping solutions.

3DR, Inc. and Pix4D are some of the emerging participants in the drone market.

-

3DR, Inc. specializes in enterprise drone software tailored for construction, engineering, and mining sectors. The company's flagship product, Site Scan, is a leading drone data platform that enables professionals to capture, analyze, and visualize aerial data efficiently. With a commitment to open-source technology, 3DR is recognized for its contributions to the drone industry and continues to innovate within the UAV market.

-

Pix4D is renowned for its advanced photogrammetry software that transforms images captured by drones into high-quality 2D maps and 3D models. The company serves various industries, including construction, agriculture, and surveying, providing tools that enhance data analysis and decision-making processes. The company’s flagship products include Pix4Dmapper, which allows users to create precise georeferenced maps from drone imagery, and Pix4Dfields, designed specifically for agricultural applications.

Key Drone Companies:

The following are the leading companies in the drone market. These companies collectively hold the largest market share and dictate industry trends.

- SZ DJI Technology, Inc.

- 3DR, Inc.

- AgEagle Aerial Systems Inc

- Airware Limited

- Autel Robotics

- Mapbox

- Parrot Drone SAS

- Pix4D

- RedBird

- Skydio

- Teledyne FLIR LLC

- Yuneec International

Recent Developments

-

In January 2025, SZ DJI Technology Co., Ltd. launched the DJI Flip, a lightweight and foldable drone designed for vloggers, resembling a mini unicycle. Weighing just 249 grams, it features a 1/1.3-inch 48MP CMOS sensor capable of recording 4K HDR videos at 60 fps and slow-motion at 100 fps, along with SmartPhoto technology for enhanced clarity.

-

In January 2025, Pix4D and Freefly Systems announced a partnership aimed at enhancing drone data workflows by integrating Pix4D's advanced photogrammetry software with Freefly's cutting-edge drone technology. This collaboration seeks to streamline the process of capturing, processing, and analyzing aerial data, making it more efficient for industries such as construction, surveying, and agriculture.

-

In May 2024, Droneshield announced the release of DroneSentry C2 Next-Gen v1.00, an advanced command-and-control system that enhances the capabilities of anti-drone systems by providing centralized monitoring and control functionalities. It allows users to efficiently manage multiple sensors and countermeasures to protect critical infrastructure, public events, military installations, and other sensitive areas from potential drone threats.

Drone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 83.73 billion

Revenue forecast in 2030

USD 163.60 billion

Growth rate

CAGR of 14.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, product, technology, payload capacity, power source, end use, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

SZ DJI Technology, Inc.; 3DR, Inc.; AgEagle Aerial Systems Inc.; Airware Limited; Autel Robotics; Mapbox; Parrot Drone SAS; Pix4D; RedBird; Skydio; Teledyne FLIR LLC; Yuneec International

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Drone Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the drone market report based on component, product, technology, payload capacity, power source, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Frames

-

Control system

-

Power & product system

-

Camera system

-

Navigation system

-

Transmitter

-

Wings

-

Others

-

-

Software

-

Services

-

Integration & engineering

-

Maintenance & support

-

Training & education

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed-wing

-

Multi-rotor

-

Single-rotor

-

Hybrid

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Remotely operated

-

Semi-autonomous

-

Fully autonomous

-

-

Payload Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 2KG

-

2KG to 19KG

-

20KG to 200KG

-

Over 200KG

-

-

Power Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Battery-powered

-

Gasoline-powered

-

Hydrogen fuel cell

-

Solar

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer

-

Prosumer

-

Toy/hobbyist

-

Photogrammetry

-

-

Commercial

-

Inspection/maintenance

-

Mapping & surveying

-

Photography/filming

-

Surveillance & monitoring

-

Localization/detection

-

Spraying/seeding

-

Others

-

-

Military

-

Intelligence, Surveillance, Target Acquisition, and Reconnaissance (ISTAR)

-

Communication

-

Combat operations

-

Military cargo transport

-

Precision strikes

-

Others

-

-

Government & law enforcement

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global drone market size was estimated at USD 73.06 billion in 2024 and is expected to reach USD 83.73 billion in 2025

b. The global drone market is expected to grow at a compound annual growth rate of 14.3% from 2025 to 2030, reaching USD 163.60 billion by 2030

b. The hardware segment dominated the market with a revenue share of over 58% in 2024, driven by technological advancements in hardware technology such as imaging sensor resolution and wireless connectivity capabilities.

b. Some key players operating in the drone market include DJI, 3DR, Inc.,AgEagle Aerial Systems Inc, Airware Limited, Autel Robotics, Mapbox, Parrot Drone SAS, Pix4D, RedBird, Skydio, Teledyne FLIR LLC, Yuneec International

b. Factors such as technological advancements, increasing applications across industries, and the growing integration of advanced technologies such as 5G, IoT, and augmented reality (AR) into drone operations are driving the growth of the drone market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.