- Home

- »

- Pharmaceuticals

- »

-

Enteral Feeding Formulas Market Size, Industry Report, 2030GVR Report cover

![Enteral Feeding Formulas Market Size, Share & Trends Report]()

Enteral Feeding Formulas Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Flow Type, By Stage (Adults, Pediatrics), By Indication (Cancer Care, Diabetes), By End-user (Hospitals, Home Care), By Sales Channel, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-060-6

- Number of Report Pages: 177

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Enteral Feeding Formulas Market Summary

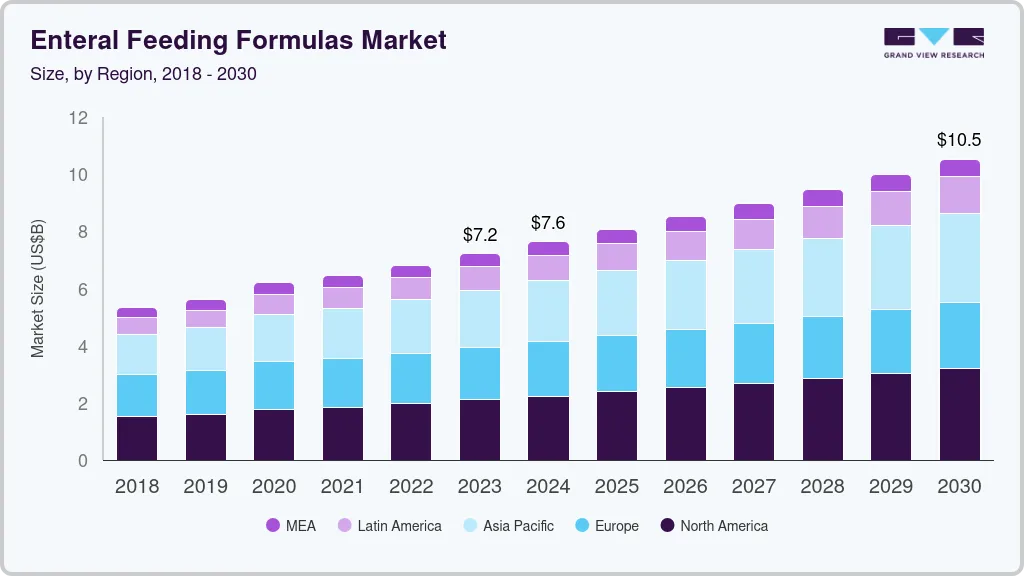

The global enteral feeding formulas market size was estimated at USD 7.64 billion in 2024 and is projected to reach USD 10.52 billion by 2030, growing at a CAGR of 5.43% from 2025 to 2030. The increasing prevalence of chronic diseases, including cancer, stroke, multiple sclerosis, dementia, chronic liver disease, chronic obstructive pulmonary disease (COPD), and diabetes, is anticipated to increase the demand for products addressing oral intake challenges.

Key Market Trends & Insights

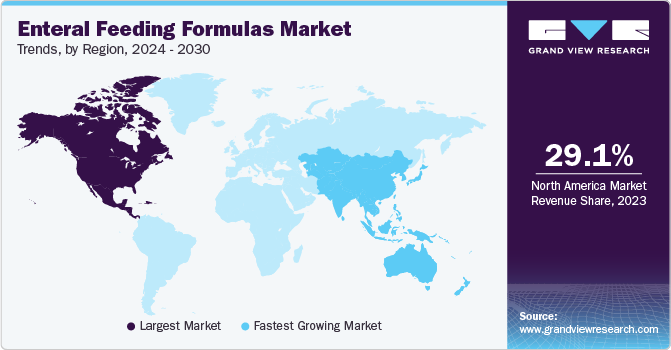

- North America dominated the enteral feeding formulas market with the largest revenue share of 30.85% in 2024.

- The enteral feeding formulas market in the U.S. is experiencing robust growth.

- Based on product, the standard formula segment led the market with the largest revenue share of 53.7% in 2024.

- Based on flow type, the intermittent feeding flow segment accounted for the largest revenue share in 2024.

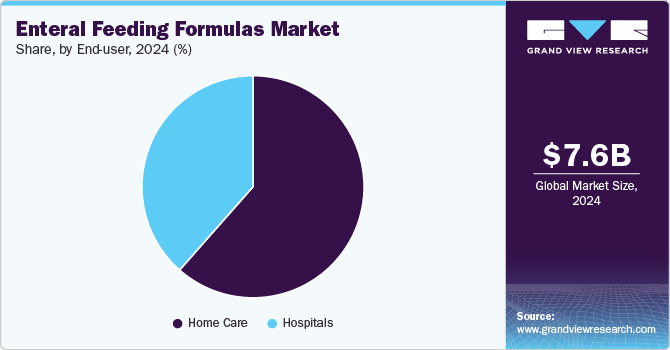

- Based on end user, the home care segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.64 Billion

- 2030 Projected Market Size: USD 10.52 Billion

- CAGR (2025-2030): 5.43%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The Centers for Disease Control and Prevention (CDC) reports published in February 2024 that approximately 34.2 million people have diabetes, with over 1.5 million new cases diagnosed each year.

Sarcopenia, which is a decrease in muscle strength & function, is an aging-related condition, and dietary management in patients suffering from the condition requires enteral foods. According to an article published in BioMed Central in December 2022, the prevalence of sarcopenia was reported to be around 1-29% in older adults and was higher among patients in long-term care. Moreover, the study reported that malnutrition and sarcopenia overlapped in older adults, and patients with a risk of malnutrition were reported to be at high risk of sarcopenia. Enteral nutrition helps treat and prevent aging-induced sarcopenia. Thus, rapid rise in the elderly population and increase in prevalence of age-related chronic diseases & medical conditions are expected to contribute to the market growth.

Rise in preterm births is one of the significant factors boosting the demand for sip feeds to meet the nutritional requirements of newborns. According to the WHO, rate of preterm birth ranges between 5-18% of babies born across the world. In addition, continued rise in nutritional and other deficiencies, including severe deficiency of micronutrients, proteins, and other nutrients, especially in infants and pregnant women, is leading to an increase in the demand for enteral feeding formulas.

However, improper categorization of clinical nutrition is expected to hamper the market growth. Clinical nutrition is always mistaken for nutritional or functional foods that are not intended for treating any specific medical condition. In regions such as the U.S. and certain European countries, clinical nutrition is clearly defined by regulatory bodies. In the U.S., clinical nutrition is recognized under the FDA’s 1988 Orphan Drugs Act Amendments.

In Europe, the European Food Safety Authority recognized clinical nutrition as food for special purposes in 2015. However, in other parts of the world, the regulation for such products is still in progress. Most of the countries follow the Codex Alimentarius standard as regulatory guidelines are under development. In 2006, the Food and Safety Standard Act was passed in India to regulate nutraceutical, dietary supplements, and functional foods. There was no distinct category for clinical nutrition in the law. This, in turn, affects potential research in the clinical nutrition sector. These factors can hamper the market growth.

Case Study: “Real food” enteral formulas in everyday clinical practice

Overview:

Enteral nutrition (EN) is an essential therapy for individuals, particularly children, who cannot consume enough nutrients orally but have a functioning digestive system. The market is dominated by commercial formulas-polymeric, oligomeric, and elemental-developed to meet various dietary needs. Recently, there’s been a rise in demand for “real food” or blended formulas, which combine natural, freeze-dried ingredients with conventional components to enhance digestive comfort and user satisfaction. Although clinical data is still limited, these alternatives are becoming more popular. Globally, the EN market is growing steadily, fueled by rising chronic illnesses, premature births, and increased use of home-based nutritional support, with projected CAGR between 6.5% and 7.1%.

Challenges:

-

Homemade blended diets (HBFs) and non-standardized “real food” formulas pose risks of nutritional inadequacy and microbial contamination, particularly in children with neurological or gastrointestinal conditions.

-

Many health systems do not include blended diets under formal reimbursement policies, limiting their accessibility despite growing caregiver interest.

-

Patients on enteral nutrition often face issues such as regurgitation, constipation, and intolerance, especially when managing multiple health conditions.

-

There is a shortage of robust randomized controlled trials proving the safety and effectiveness of “real food” formulas, slowing their clinical integration.

-

Diverse nutritional needs and the challenge of treating patients with multiple comorbidities make formula selection and feeding strategy implementation more difficult.

Solutions:

This synthesis aligns with the detailed findings of the case study and current market trends, highlighting the evolving landscape of enteral feeding formulas with a focus on safety, efficacy, and patient-cantered innovation.

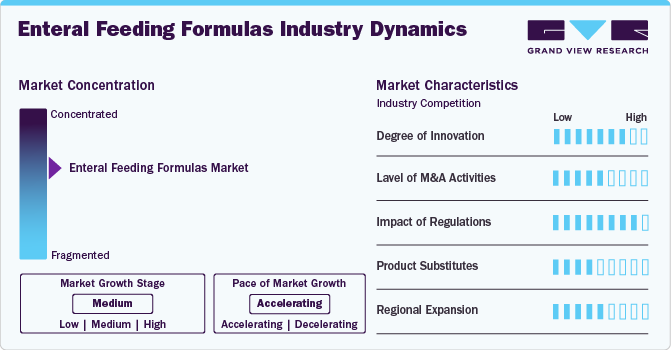

Market Concentration & Characteristics

The enteral feeding industry is experiencing significant innovation driven by nutritional science and technology advancements. Companies are developing specialized formulas tailored to specific medical conditions, such as diabetes or renal diseases, to meet patient needs better. For instance, in May 2023, Otsuka Pharmaceutical Factory, Inc. introduced ENORAS Liquid for Enteral Use in coffee and tea flavors.

M&A activities in the enteral feeding industry are moderate. Companies are forming strategic partnerships to combine expertise and resources. For instance, in May 2024, Danone completed the acquisition of Functional Formularies from Swander Pace Capital. This acquisition enhances Danone’s Medical Nutrition portfolio in the US by expanding its range of enteral tube feeding products as part of its Renew Danone strategy.

Regulatory frameworks play a crucial role in developing and commercializing formulas. In regions such as Europe and North America, enteral feeding formulas must comply with stringent medical device regulations to ensure safety and efficacy. For instance, obtaining CE marking in Europe and FDA approval in the U.S. are significant milestones for enteral feeding manufacturers.

Traditional oral nutritional supplements exist and do not serve as direct replacements for enteral feeding formulas, especially in patients with swallowing difficulties or those requiring tube feeding. Research indicates that blended tube feeds, derived from whole foods, are being explored as alternatives are not yet widely adopted due to safety and standardization concerns.

The enteral feeding industry is expanding globally, with significant growth in several regions. For instance, in April 2023, Danone expanded its market presence in Poland by acquiring ProMedica, a provider of in-home care services.

Product Insights

The standard formula segment led the market with the largest revenue share of 53.7% in 2024. This high share can be attributed to the wide adoption of standard formulas among all types of patients and their associated cost-effectiveness. In addition, easy availability of polymeric nutritional complete formulas, which are suitable for use in both hospitals and home care settings, is anticipated to accelerate segment growth in the coming years. The high preference and recommendations by physicians to consume standard formulas for gastrostomy tube (G-tube) patients to enhance children’s nutrition are supporting the segment's growth.

The disease-specific formulas segment is expected to grow at the fastest CAGR during the forecast period, due to an increase in the prevalence of several chronic disorders, such as diabetes, cancer, and cardiovascular diseases. These formulas provide nutritional support to individuals suffering from specific diseases that are often characterized by organ dysfunction. These formulations are used for patients suffering from hepatic and pulmonary diseases, Chronic Obstructive Pulmonary Disease (COPD), Acute Respiratory Distress Syndrome (ARDS), and diabetes. In addition, an increase in the development and launch of disease-specific nutritional products by manufacturers as per the patient's needs is accelerating segment growth. An increase in the adoption of immune-modulating and disease-specific formulas for the treatment of several chronic diseases is also projected to boost segment growth over the forecast period.

Flow Type Insights

The intermittent feeding flow segment accounted for the largest revenue share in 2024. Intermittent tube feeding is preferred in cases where a nasogastric feeding tube is being used. In the elderly population, malnutrition and dysphagia are common and can lead to nutritional deficiency, thus increasing the need for enteral feeding to provide essential nutrients. As per the Dysphagia Fact Sheet 2019, around 10% of the acutely hospitalized elderly population and 50-75% of nursing home residents suffered from dysphagia in the UK. Furthermore, companies are introducing products for patients on intermittent tube feeding. For instance, Fresubin 1800 Complete by Fresenius Kabi is designed for dysphagia and other conditions, offering nutritional completeness and suitability for intermittent tube feeding.

The continuous feeding flow segment is anticipated to grow at the fastest CAGR during the forecast period. It is recommended for critically ill patients suffering from conditions such as respiratory failure, severe burns, and cancer. For instance, according to an article published in MDPI in January 2022, in a controlled trial, the continuous enteral feeding group achieved more than 80% of the target nutrition requirement more frequently than the intermittent enteral feeding group. Furthermore, gastrointestinal conditions associated with excessive feed administration or decreased bowel motility favor continuous feeding over bolus feeding. For example, Fresubin 1200 Complete, a tube feed from Fresenius Kabi, addresses gastrointestinal diseases or malabsorption by providing essential nutrients for patients.

Stage Insights

The adult segment accounted for the largest market revenue share in 2024. Developed and developing economies are struggling in some or other form to procure food. Lack of consistent access to food has been termed “food insecurity” by the USDA. Moreover, the prevalence of malnutrition and undernourishment is rising globally. Depending on the patient's condition, nasogastric, gastrostomy, or enterostomy feeding is administered.Furthermore, the growing older adult population has led to an increased prevalence of chronic disorders, such as Alzheimer’s disease, sarcopenia, cancer, and diabetes among them. Enteral feeding formulas are frequently used for feeding these patients when they are unable to take food and nutrients naturally.

The adult segment is also projected to grow at the fastest CAGR during the forecast period. According to an article published in PLOS Global Public Health in November 2022, the prevalence of low birth weight globally is estimated to be around 15% to 20% of total births, accounting for more than 20 million births every year. Furthermore, pediatric patients with dysfunctional or nonfunctional gastrointestinal tracts are unable to ingest nutrients orally and, hence, are administered enteral feeding.

Indication Insights

The cancer care segment accounted for the largest market revenue share in 2024, driven by the rising prevalence of cancer globally and the increasing use of nutritional support as an integral component of oncology care. Cancer patients often experience malnutrition due to the disease itself and the adverse effects of treatments like chemotherapy and radiation, which impair appetite and nutrient absorption. Enteral feeding formulas offer a viable solution to maintain nutritional status, improve treatment tolerance, and enhance quality of life. Growing clinical emphasis on personalized nutrition and the introduction of disease-specific formulas are further fueling adoption in this segment.

The other indications segment is expected to grow at the fastest CAGR over the forecast period. Some of the other indications include COPD, respiratory disorders, cystic fibrosis, postoperative stress, inflammation, and infections. Due to an increase in the prevalence of various conditions wherein enteral nutrition can be used for the restoration of nutritional balance, the market is anticipated to grow at a significant rate over the forecast period.

According to an article published in the PLOS Global Public Health forum in November 2022, the prevalence of low birth weight globally is estimated to be around 15-20% of the total births, accounting for more than 20 million births every year. Furthermore, pediatric patients with dysfunctional or non-functional gastrointestinal tracts are unable to ingest nutrients orally and, hence, are administered enteral feeding.

Sales Channel Insights

The institutional sales segment accounted for the largest market revenue share in 2024. Institutions that purchase enteral nutrition products include hospitals, long-term care centers, hospices, and disability facilities. The purchase decision of enteral nutrition formulas is influenced by doctors. Furthermore, a growing number of private and public healthcare institutions and an increasing chronic disease patient population across the globe are impelling the segment's growth.

The online sales channel segment is projected to grow at the fastest CAGR over the forecast period. There is a shift in the trend toward direct selling to customers via e-commerce platforms. The preference for online purchase of enteral feeding formulas is rising owing to the convenience offered by this sales channel. Although consumed under medical surveillance, these products are intended for long-term nutrition management, resulting in growing sales through e-commerce.

End-user Insights

The home care segment accounted for the largest market revenue share in 2024. Home enteral nutrition includes different subtypes such as hospices, home health agencies, nursing homes, adult day care centers, and residential care communities. According to the CDC National Health Statistics Report Number 208 (August 2024), in 2022, there were approximately 5,200 hospices in the U.S. Regarding patients opting for hospice care, about 1.6 million people received hospice services in that year.

The hospital segment is anticipated to grow at the fastest CAGR during the forecast period. The rising number of hospital-associated cases of malnutrition is a notable factor in the growing demand for enteral feeding formulas in hospitals. Tube feeding requires proper training & precision and is recommended to be used under proper guidance; hence, many hospitalized patients are recommended to receive enteral feeding to meet the daily requirement of nutrition.

Regional Insights

North America dominated the enteral feeding formulas market with the largest revenue share of 30.85% in 2024. In the U.S., several individuals are suffering from head & neck cancer, which is expected to boost the adoption of these formulas. For instance, according to the CDC, in 2020, 45,703 new cases of oral cavity and pharynx cancer were reported in the country. Moreover, the increasing incidence of various chronic disorders, such as neurological diseases, is anticipated to increase the applications of enteral feeding formulas during the forecast period.

U.S. Enteral Feeding Formulas Market

The enteral feeding formulas market in the U.S. is experiencing robust growth, driven by innovation, demographic shifts, and evolving regulatory frameworks. The U.S. population in 2023 was approximately 333 million, with the aging segment (65 and older) playing a pivotal role in driving demand; this group is expected to nearly double from 52 million in 2018 to 95 million by 2060. Regulatory factors shape the market, as reimbursement policies under Medicare and other healthcare programs vary, with limited coverage for some orally administered products impacting accessibility and adoption rates across different care settings.

Asia Pacific Enteral Feeding Formulas Market

The enteral feeding formulas market in Asia Pacific is anticipated to register at the fastest CAGR over the coming years. The growing geriatric population in Japan is likely to drive the demand for enteral feeding formulas in the country over the forecast period. According to the World Bank, in 2021, over 30% of the Japanese population was aged 65 & above. According to a UN report, the elderly population will increase twofold from 10% in 2017 to 20% by 2037 in China. Moreover, an increase in the number of hospitalized patients affected by malnutrition in Australia has fueled the market growth.

Europe Enteral Feeding Formulas Market

The enteral feeding formulas market in Europe is driven by advancements in disease-specific formulas and the development of plant-based nutrition products. Manufacturers are focusing on functional, patient-centric formulations that cater to specific nutritional needs, such as peptide-based and renal formulas. In addition, the increasing demand for plant-based nutrition products aligns with the growing trend of plant-based diets and sustainability.

Latin America Enteral Feeding Formulas Market

The enteral feeding formulas market in Latin America is anticipated to register at a significant CAGR over the coming years. The development of oral and enteral feeding formulas characterizes the enteral feeding formula in Latin America. Manufacturers focus on product innovation to meet the growing demand for enteral nutrition. Expansion efforts are concentrated on improving healthcare infrastructure, increasing access to enteral feeding products, and addressing the nutritional needs of the aging population. Regulatory frameworks in Latin American countries are evolving to support the market growth, with a focus on enhancing product availability and affordability.

Middle East & Africa Enteral Feeding Formulas Market

The enteral feeding formulas market in the Middle East & Africais driven by the development of disease-specific formulas, such as renal and hepatic formulas, to address the nutritional needs of patients with specific medical conditions. In addition, the introduction of plant-based nutrition products is gaining traction and aligning with global dietary trends. Expansion strategies in MEA focus on improving healthcare access, particularly in underserved areas, and increasing awareness about the benefits of enteral nutrition.

Key Enteral Feeding Formulas Company Insights

Some key market players include Abbott, Danone S.A., Fresenius Kabi AG, Nestle, Meiji Holdings, and Mead Johnson & Company, LLC. These players utilize various strategies, such as product launches, to maintain market presence. For instance, in September 2021, Abbott addressed the growing demand for enteral nutrition by introducing plant-based protein and organic food ingredients in the relaunch of its PediaSure Harvest and the launch of Ensure Harvest products.

"At Abbott, we know that proper nutrition is a cornerstone of optimal health. Our Harvest products are made with organic fruits and vegetables which can serve as a sole source of nutrition and are packaged for the realities of life on the go, making mealtime more flexible, inclusive and convenient."

- Matt Beebe, divisional vice president and general manager, Abbott’s U.S. Therapeutic Nutrition business.

Key Enteral Feeding Formulas Companies:

The following are the leading companies in the enteral feeding formulas market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Danone S.A

- Fresenius Kabi AG

- Nestlé

- VICTUS

- Primus Pharmaceuticals, Inc.

- Meiji Holdings. Co., Ltd.

- Mead Johnson & Company, LLC

- Alcresta Therapeutics

Recent Developments

-

In January 2025, Alcresta Therapeutics' FDA has broadened the approval of the RELiZORB (immobilized lipase) cartridge, now authorizing its use in pediatric patients as young as one year old who suffer from fat malabsorption. RELiZORB is an enzyme-based cartridge that mimics the action of natural lipase by hydrolyzing fats in enteral nutrition formulas. This process enables the efficient delivery of absorbable fatty acids and monoglycerides. Initially approved in 2015 for adult use, the device was later authorized for pediatric patients. In May 2024, a next-generation version of RELiZORB was launched, offering enhanced compatibility with a wider range of enteral formulas.

“Since its commercial availability in May 2024, our second-generation cartridge has expanded use, specifically to patients with short bowel syndrome (SBS), helping address the essential nutritional needs for these patients and many other patients living with rare diseases. We are excited that the expansion of RELiZORB’s indication will help to further expand access, especially in younger populations where nutritional goals associated with growth and development are vitally important.”

-Dan Orlando, Chief Executive Officer at Alcresta Therapeutics.

-

RELiZORB is an enzyme-based cartridge that mimics the action of natural lipase by hydrolyzing fats in enteral nutrition formulas. This process enables the efficient delivery of absorbable fatty acids and monoglycerides. Initially approved in 2015 for adult use, the device was later authorized for pediatric patients. In May 2024, a next-generation version of RELiZORB was launched, offering enhanced compatibility with a wider range of enteral formulas.

-

In September 2023, Abbott announced the plan to boost manufacturing of various adult enteral formulas for the retail market to counteract low supply in the institutional sector.

-

In February 2023, Nestlé and EraCal Therapeutics initiated a research collaboration to identify novel nutraceuticals for controlling food intake.

-

In September 2022, Kate Farms introduced Adult Standard 1.4, a high-calorie medical formula now offered in chocolate. This product is designed to assist in weight gain, weight maintenance, and improved tolerance while providing a delicious taste.

Enteral Feeding Formulas Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.07 billion

Revenue forecast in 2030

USD 10.52 billion

Growth rate

CAGR of 5.43% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment covered

Product, flow type, stage, indication, end-user, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Sweden; Norway; Denmark; Russia; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

Abbott; Danone S.A; Fresenius Kabi AG; Nestlé; VICTUS; Primus Pharmaceuticals, Inc.; Meiji Holdings. Co., Ltd.; Mead Johnson & Company, LLC, Alcresta Therapeutics

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enteral Feeding Formulas Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enteral feeding formulas market report based on product, flow type, stage, indication, end-user, sales channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard Formula

-

Disease-specific Formulas

-

Alzheimer’s

-

Nutrition Deficiency

-

Cancer Care

-

Diabetes

-

Chronic Kidney Diseases

-

Orphan Diseases

-

Dysphagia

-

Pain Management

-

Malabsorption/GI Disorder/Diarrhea

-

Others

-

-

-

Flow Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Intermittent Feeding Flow

-

Continuous Feeding Flow

-

-

Stage Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Pediatrics

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Alzheimer’s

-

Nutrition Deficiency

-

Cancer Care

-

Diabetes

-

Chronic Kidney Diseases

-

Orphan Diseases

-

Dysphagia

-

Pain Management

-

Malabsorption/GI Disorder/Diarrhea

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Cardiology

-

Neurology

-

Critical Care (ICU)

-

Oncology

-

Others

-

-

Home Care

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Sales

-

Retail Sales

-

Institutional Sales

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global enteral feeding formulas market size was estimated at USD 7.64 billion in 2024 and is expected to reach USD 8.07 billion in 2025.

b. The global enteral feeding formulas market is expected to grow at a compound annual growth rate of 5.43% from 2025 to 2030 to reach USD 10.52 billion by 2030.

b. North America dominated the enteral feeding formulas market with a share of 30.85% in 2024. This is attributable to a rise in preterm births, new product launches, and the increasing prevalence of chronic diseases.

b. Some key players operating in the enteral feeding formulas market include Abbott; Danone S.A; Fresenius Kabi AG; Nestlé; VICTUS; Primus Pharmaceuticals, Inc.; Meiji Holdings. Co., Ltd.; Mead Johnson & Company, LLC, Alcresta Therapeutics

b. Key factors that are driving the enteral feeding formula market growth include a rise in the nutritional deficiencies of protein and other micronutrients among infants and women and a growing prevalence of chronic diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.