- Home

- »

- Medical Devices

- »

-

Long-Term Care Market Size, Share & Growth Report, 2030GVR Report cover

![Long-Term Care Market Size, Share & Trends Report]()

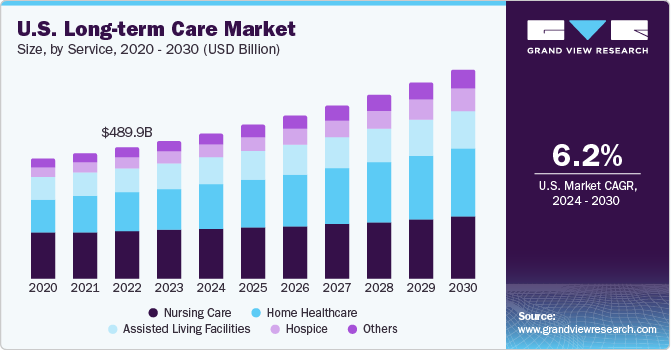

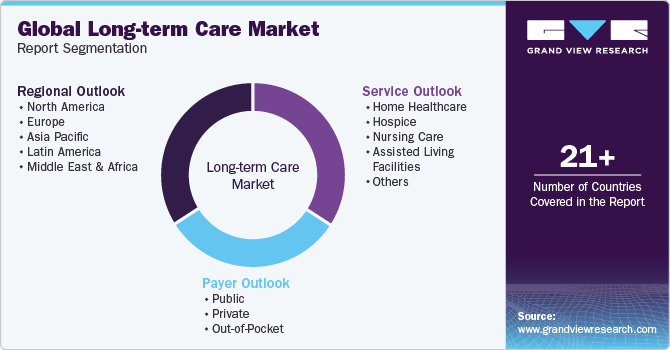

Long-Term Care Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Nursing Care, Hospice, Assisted Living Facilities, Home Healthcare), By Payer (Public, Private, Out-of-Pocket), By Region, And Segment Forecasts

- Report ID: 978-1-68038-952-4

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Long-term Care Market Summary

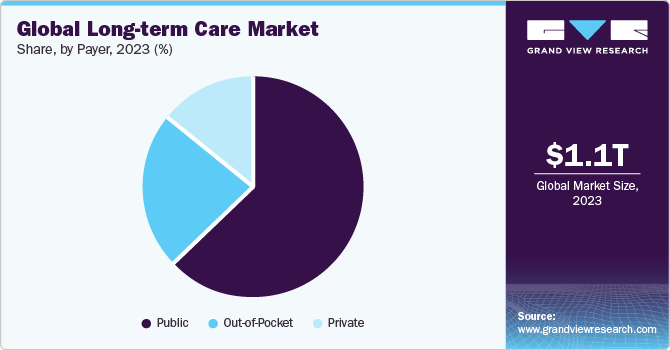

The global long-term care market size was estimated at USD 1.11 trillion in 2023 and is projected to reach USD 1.74 trillion by 2030, growing at a CAGR of 6.6% from 2024 to 2030.The rise in the global geriatric population majorly drives the long-term care (LTC) market.

Key Market Trends & Insights

- North America dominated the overall long-term care market in 2023 with a share of 48.86%.

- The U.S. accounted for the largest share of the long-term care market in North America region in 2023.

- By service, the nursing care segment held the largest share of over 31.73% in 2023.

- By payer, the public segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.11 Trillion

- 2030 Projected Market Size: USD 1.74 Trillion

- CAGR (2024-2030): 6.6%

- North America: Largest market in 2023

- Latin America: Fastest growing market

Moreover, an increase in life expectancy impels the need for services. The unmet needs of older adults also contribute to the industry growth over the forecast period. According to the article published in the BMC Journal in December 2022, around 10.4% of the elderly population globally had unmet needs for healthcare, including LTC. With the provision of personal caution at home, unnecessary hospitalization is avoided, thus preventing the patients from its high cost and degrading quality of life.

The increase in the population of older individuals is a major concern in many countries globally. This has increased the pressure on the governments of these countries to provide them with services. Governments of these countries are reforming their healthcare systems to provide the services senior citizens need at affordable prices. The market is projected to experience growth in the forecast period, propelled by the support of long-term care (LTC) for the elderly through the Medicare and Medicaid systems provided by the U.S. government.

Chronic disease prevalence is increasing at a significant pace globally. Along with general age-related disability, the elderly also suffer from chronic diseases such as cancer, diabetes, Alzheimer’s, dementia, heart problems, and mental stress. Hospitalization for chronic diseases could be expensive and entail unnecessary use of resources, which patients in critical conditions can utilize. Long-Term Care (LTC) facilities offer specialized services catering to the needs of the elderly, and the anticipated growth in the market is driven by a rising awareness of these centers and their advantages over traditional hospitals.

The industry's growth is further propelled by advancements in healthcare delivery technology. Initially, management primarily relied on durable medical devices like walkers, wheelchairs, and safety blankets. During the forecast period, the market is estimated to be driven by developing sophisticated, user-friendly products and services such as internet-enabled home monitoring, telemedicine, and mobile health apps.

The COVID-19 pandemic negatively impacted the industry as older people were more susceptible to the virus, and many nations reduced or banned activities in these centers. According to the Organisation for Economic Co-operation and Development (OECD) article published in December 2021, around 40% of COVID-19 deaths in the OECD nations were at LTC facilities. In addition, the nursing home sector was most affected by the pandemic due to the shortage of nursing staff. The market is expected to benefit from the growing adoption of various new technologies and strategic initiatives. Telehealth technologies can enable LTC providers to avoid emergency admissions of their residents and provide medical aid by analysis of real-time patient data by doctors. Increasing adoption of telephonic consultation with doctors by patients during the COVID-19 pandemic is expected to create opportunities in the market.

Market Concentration & Characteristics

In the long-term care market, innovation is evolving to enhance services for the elderly, focusing on technologies, care models, and personalized approaches to address the unique needs of aging populations.

There is a low to moderate level of M&A activity involved in the market. Several market players, such as Almost Family, Inc., Brookdale Senior Living, Inc., and Extendicare, Inc., such as Almost Family, Inc., Brookdale Senior Living, Inc., and Extendicare, Inc., are involved in merger and acquisition activities. By engaging in merger and acquisitions (M&A) activities, these companies have the opportunity to broaden their geographical footprint and venture into previously untapped territories.

Stringent regulations in the market role is crucial in ensuring the quality of care, patient safety, and adherence to standards, influencing facility operations and compliance measures.

Emerging alternatives, such as home healthcare services and technologically assisted remote solutions, present potential substitutes in the market, providing alternatives to traditional institutionalized care and catering to the growing preference for aging in place.

Companies in the market are pursuing regional expansion strategies, aiming to meet the increasing demand for elderly care services in specific geographic areas.

Service Insights

The nursing care segment held the largest share of over 31.73% in 2023. This can be attributed to the preference for care of the elderly and high demand from developing countries. With the increasing geriatric population and rising incidence & prevalence of chronic diseases, such as heart problems, Alzheimer’s disease, & cancer, the need for nursing care is growing. Adoption of home healthcare is high among people older than 65 years of age, individuals recently discharged from hospitals, mentally challenged adults, mothers of newborns, and individuals who want medical assistance for their parents within their homes. The growing demand for personalized LTC at home and cost-effectiveness impels the growth of the home healthcare segment. Rising healthcare expenditure has made home healthcare the de facto for many patients who need attention. With an increasing demand for home healthcare, suppliers are introducing newer advanced technologies and software to enhance the quality of the services provided.

The hospice segment is expected to show lucrative growth during the forecast period due to the increasing prevalence of chronic diseases and the growing need for 24-hour-medical attention. According to a report published by WHO in 2020, only about 14% of people who needed palliative caution received it. Around 56.8 million people need palliative care each year, of which 98% live in low- and middle-income countries.

Payer Insights

The public segment accounted for the largest revenue share in 2023. This high share of the segment can be attributed to the high public spending by the U.S. and European countries. For instance, in the U.S., more than half of the LTC cost is covered under Medicaid, which varies from state to state. According to the Commonwealth Fund statistics, in 2020, Medicaid paid around USD 200 billion on LTC in the U.S.

The private segment is estimated to register the fastest CAGR over the forecast period.Private LTC insurance providers are penetrating many major countries owing to the increasing opportunities to complement the provision of basic public services. Hence, the segment is expected to witness the fastest growth. According to the 2022 Milliman Long Term Care Insurance Survey, in the U.S., more than 140,000 individuals purchased LTC policies in 2021 compared to 2020.

Regional Insights

North America dominated the overall long-term care market in 2023 with a share of 48.86% due to the availability of LTC centers, improving reimbursement frameworks, and favorable government policies. According to the Kaiser Family Foundation, in 2020, an estimated 5.8 million people in the U.S. used paid LTC services and support at home and community-based care. Around 1.9 million individuals are used in institutional settings. According to the Commonwealth Fund Statistics, in 2021, around 69% of adults used LTC in the U.S. as they age.

The U.S. accounted for the largest share of the long-term care market in North America region in 2023. The U.S. has a rapidly aging population, with of individuals requiring long-term care services, including nursing homes, home healthcare, and assisted living facilities. Furthermore, the country's well-established healthcare infrastructure and high healthcare spending contribute to the accessibility and availability of a wide range of long-term care options.

The Latin America region is expected to grow at the fastest rate during the forecast period. A rising aging population, coupled with an increasing prevalence of chronic diseases, has amplified the demand for comprehensive and specialized long-term care services. Moreover, governments in the region are recognizing the importance of enhancing healthcare infrastructure to meet the evolving needs of their elderly populations. As awareness regarding the benefits of long-term care grows, there is a growing inclination towards adopting these services, contributing to the expansion of the market in Latin America.

Brazil accounted for the largest share of the long-term care market in the Latin America region in 2023. With the largest population in Latin America, Brazil has a substantial elderly demographic, contributing to a significant demand for long-term care services. Additionally, the country has been making strides in healthcare infrastructure development, fostering a conducive environment for the growth of the long-term care sector.

Key Long-term Care Market Company Insights

Leading players such as Brookdale Senior Living, Inc, Extendicare, Inc and Kindred Healthcare, Inc. have been focusing on expanding their service offerings, improving operational efficiency, and adopting advanced technologies. For instance, in February 2021, Atria Senior Living, Inc. assumed the management of 21 Independent Living communities across nine U.S. states, owned by New Senior Investment Group, Inc., leading to business expansion in the U.S.

Emerging market players in the market such as Home Instead, Inc and Diversicare are actively expanding their influence by developing innovative solutions, establishing strategic partnerships, and leveraging technology to address evolving healthcare needs. Their focus is on carving a niche in the competitive landscape and contributing to the growth and transformation of the long-term care sector.

Key Long-term Care Companies:

The following are the leading companies in the long-term care market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these long-term care companies are analyzed to map the supply network.

- Brookdale Senior Living, Inc.

- Knight Health Holdings, LLC

- LHC Group, Inc.

- Atria Senior Living, Inc.

- Sunrise Senior Living

- Extendicare

- Sonida Senior Living

- Diversicare

- Genesis HealthCare

- Home Instead, Inc.

- Amedisys

Recent Developments

-

In September 2023, Singapore Life Limited partnered with Agency for Integrated Care (AIC) and Homage to increase accessibility of customers to long term care in Singapore.

-

In May 2023, Omega Healthcare acquired 18 skilled nursing home facilities in West Virginia for USD 233 million. This expansion expands the capabilities of Omega Healthcare and ensures smooth operations.

-

In February 2022, Extendicare, a Canadian long-term care company, has finalized a deal to purchase a 15% managed interest in 24 long-term care homes previously operated by Revera. Additionally, Extendicare has formed a redevelopment joint venture with Axium, resulting in a doubling of its assisted living portfolio, now comprising a total of 56 long-term care facilities.

Long-term Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.18 trillion

Revenue forecast in 2030

USD 1.74 trillion

Growth rate

CAGR of 6.68% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, Payer, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Brookdale Senior Living, Inc., Knight Health Holdings, LLC, LHC Group, Inc., Atria Senior Living, Inc., Sunrise Senior Living, Extendicare, Sonida Senior Living, Diversicare, Genesis HealthCare, Home Instead, Inc., Amedisys

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Long-Term Care Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global long-term care market report on the basis of service, payer and region:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home Healthcare

-

Hospice

-

Nursing Care

-

Assisted Living Facilities

-

Others

-

-

Payer Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public

-

Private

-

Out-of-Pocket

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global long-term care market size was estimated at USD 1.11 trillion in 2023 and is expected to reach USD 1.18 trillion in 2024.

b. The global long-term care market is expected to grow at a compound annual growth rate of 6.68% from 2024 to 2030 to reach USD 1.74 trillion by 2030.

b. North America dominated the global LTC market in 2023 with a share of 48.86%, owing to the high percentage of the geriatric population, greater government funding, and implementation of a streamlined regulatory framework.

b. Major players in the market for LTC include Brookdale Senior Living, Inc., Knight Health Holdings, LLC (Kindred Healthcare, Inc.), Almost Family, Inc. (LHC Group, Inc.), Sunrise Carlisle, LP (Sunrise Senior Living, LLC), Atria Senior Living Group, Extendicare, Inc., Sonida Senior Living (Capital Senior Living), Diversicare, Genesis HealthCare, Home Instead, Inc., and Amedisys

b. The market for long-term care is expected to boom owing to aging baby boomers, increasing disabilities among the geriatric population, the dearth of skilled nursing staff, government funding, and increased collaborations of private insurers with various governments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.