- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Functional Foods Market Size & Trends Analysis Report, 2030GVR Report cover

![Functional Foods Market Size, Share & Trends Report]()

Functional Foods Market (2024 - 2030) Size, Share & Trends Analysis Report By Ingredient (Carotenoids, Prebiotics & Probiotics, Fatty Acids, Dietary Fibers), By Product, By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-195-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Functional Foods Market Summary

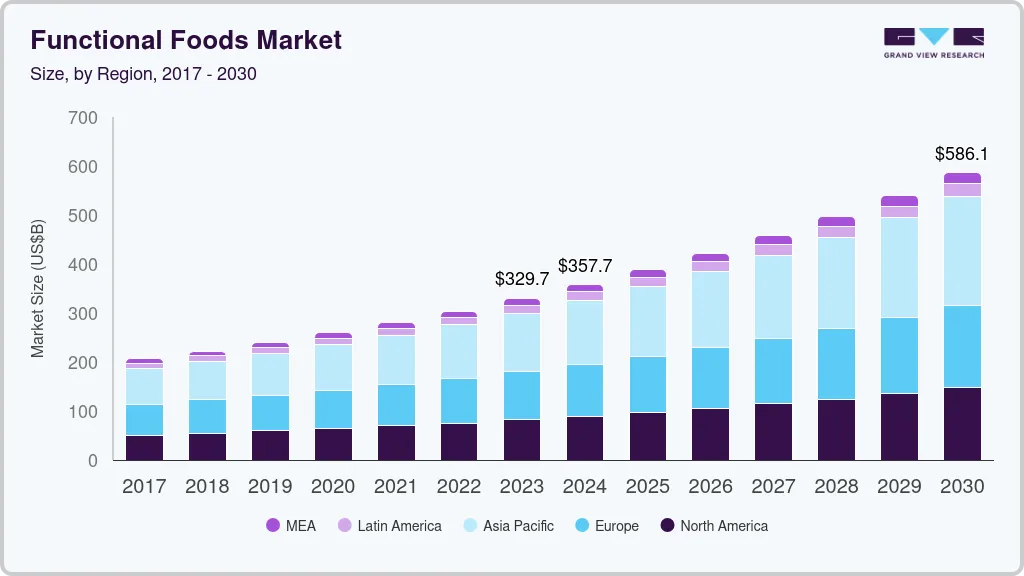

The global functional foods market size was estimated at USD 329.65 billion in 2023 and is projected to reach USD 586.06 billion by 2030, growing at a CAGR of 8.6% from 2024 to 2030. The rising demand for nutritional and fortifying food additives is expected to propel market growth over the forecast period.

Key Market Trends & Insights

- North America accounted for over 24.7% of the global market for functional foods in 2021.

- Based on ingredient, carotenoids in the ingredient segment are projected to expand at a cagr of 7.2% from 2022 to 2030.

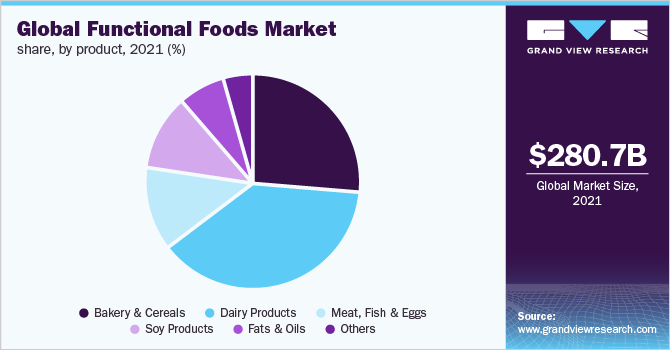

- Based on product, the dairy products segment had the highest market share of more than 38% in terms of revenue in 2021.

- Based on application, the global functional foods market offers products for a number of application areas, including sports nutrition.

Market Size & Forecast

- 2023 Market Size: USD 329.65 Billion

- 2030 Projected Market Size: USD 586.06 Billion

- CAGR (2024-2030): 8.6%

- North America: Largest market in 2021

The functional foods market was moderately impacted by the COVID-19 pandemic. The demand for functional foods fortified with essential nutrients increased due to their health benefits, such as boosting immunity. However, the supply chain was disrupted due to lockdowns imposed in various countries globally, which in turn affected overall production. The market is gaining pace steadily as companies focus on rigorous and positive marketing to promote functional foods and expand their online distribution, which may positively impact the market in the coming years.

Rising demand for nutrient-rich food due to hectic lifestyles and increased consumer awareness of the health advantages of these food items are expected to drive market growth in the U.S. Furthermore, geriatric population concerns about maintaining good health, rising medical costs, and increased consumer interest in the link between well-being and healthier eating are driving functional foods demand in the country.

Life expectancy has steadily increased in recent years, owing to the emphasis on quality of living. Consumers are becoming more aware of their health and have begun to pay more attention to their lifestyles and healthy diets, which has increased the demand for functional foods globally. Furthermore, rising awareness campaigns by government agencies, nongovernmental organizations, and companies have also further boosted consumer awareness about the nutritional benefits of functional foods, which, in turn, is projected to fuel market growth.

Manufacturers in the food & beverages industry are fortifying products with nutritional additives, including fibers, omega-3 fatty acids, vitamins, and minerals. The primary reason for including such additives in food & beverage manufacturing is to increase the nutritional content of food items. Functional dairy products such as milk, yogurt, cheese, and frozen dessert (such as functional ice cream) are some of the trending functional foods.

Functional ingredients such as omega-3 fatty acids and probiotics are commonly found in fish oils and yogurt to lower the risk of cardiovascular disease and enhance the quality of intestinal microflora. Furthermore, during the COVID-19 pandemic, an increasingly concerned population relied on various pharmaceutical and food products that promised to boost immunity or provide disease resistance. This type of trend is predicted to fuel the market in the coming years.

The majority of the companies in the functional food market are introducing new products to attract and meet consumer needs. The launch of new products in the market is helping these players to improve their sales and capture a greater share of the functional food market. For instance, in March 2021, the Coca-Cola Company’s Vitaminwater launched two new variants of soft drinks to its brand, namely ‘Look’ - a blueberry hibiscus flavor, and ‘Gutsy’ - a watermelon & peach flavor which is fortified with vitamins.

Ingredient Insights

Carotenoids in the ingredient segment are projected to expand at a CAGR of 7.2% from 2022 to 2030. They are available in a variety of forms in the market, including lutein, beta-carotene, lycopene, astaxanthin, zeaxanthin, canthaxanthin, and annatto. The importance of carotenoids in the treatment of eye disorders, cancer, and diabetes is the primary driver for the industry. Increased R&D for the production of high-value natural carotenoids is anticipated to create new market opportunities during the forecast period.

Fiber consumption is associated with numerous benefits, including maintaining bowel health, cholesterol reduction, and blood sugar control. These benefits, combined with the expanding functional food market, are anticipated to play a major role in the expansion of the dietary fiber segment. Dietary fiber, which is found primarily in fruits, vegetables, legumes, and whole grains, is most well-known for its capability to prevent or alleviate constipation. Fiber-rich foods can provide additional health benefits, such as maintaining a healthy weight and reducing the risk of diabetes and coronary disease, which will positively impact the market growth.

The vitamin-based functional foods segment is expected to expand significantly with a CAGR of 9.7% during the projected timeframe. These functional ingredients are available in multiple forms, including vitamin A, also known as Retinols and carotenoids; vitamin B, also known as Folic acid; vitamin C, known as Ascorbic acid; and vitamin D, known as Cholecalciferol. Consumer interest in the relationship between diet and health has increased the demand for vitamin-based functional foods. Factors fueling interest in these supplements include the increasing awareness regarding preventive healthcare as a result of the COVID-19 pandemic, rapid advances in science and technology, rising interest in attaining wellness through diet, an aging population, changes in food laws affecting product claims and labels, and increasing healthcare costs, among others.

Product Insights

The dairy products segment had the highest market share of more than 38% in terms of revenue in 2021, followed by the bakery and cereals segment. Other major product segments include meat, eggs, soy products, fish, and fats & oils. Yogurt, milk drinks, and spreads are all excellent delivery systems for functional foods. They are high in beneficial compounds and can be used as functional food ingredients in cooking. The dairy products segment is expected to advance at a CAGR of nearly 7.9% during the forecast period.

The bakery and cereals segment accounted for a 26% market share in 2021 in terms of revenue. New product developments in the bakery and cereals sectors are expected to boost the market in the coming years. Furthermore, rising demand for cereal bars and functional snacks like protein bars, nutrition bars, and energy bars is expected to drive market growth significantly over the forecast period. Fortified cereals are anticipated to proliferate, with companies like Kellogg's launching new product lines such as fiber-rich Crunchy Granola, Special K, Muesli, and Corn Flakes fortified with iron, zinc, and nine essential vitamins, to gain market share.

Population growth leads to higher customer goods demand, which is expected to help boost the supply of meat, poultry, and egg-based functional foods. Consumer preferences and awareness of high-quality meat attributes are expected to drive the global functional foods market for meat, fish, and eggs during the forecast period, with the segment predicted to expand at a CAGR of 9.4%.

Soy products are anticipated to expand at a CAGR of 9.9% from 2022 to 2030. The food industry is anticipated to continue to benefit from the rising demand for gluten-free flours that have a high content of proteins, iron, vitamins, and calcium, along with satisfying flavor characteristics. Additionally, the demand for wholesome foods with clean labels is driving an increase in the use of fats and oils in the food and beverage industry. Fats are organic substances that provide the body with calories and are thought to be necessary for the body to function properly. Increased spending on foods with significant amounts of fats and oils is a result of the growing awareness among consumers of the need to improve their body resistance.

Application Insights

The global functional foods market offers products for a number of application areas, including sports nutrition, clinical nutrition, weight management, cardio health, immunity, and digestive health. The rising demand for functional foods to treat congestive heart failure, cardiovascular diseases, artery hardening, and congenital heart defects is expected to cause the cardio health segment to progress at an estimated CAGR of 8.6% from 2022 to 2030. The importance of maintaining digestive health is anticipated to increase due to the strong interest shown by both men and women, particularly after age 40.

Sports enthusiasts greatly impact the demand for functional foods that contain vitamins and proteins. These products also assist athletes in regaining energy, increasing muscular endurance, and reducing physical wear and tear. A growing number of health goals, such as increasing bone and muscle strength, enhancing weight loss, and improving joint health, are driving up demand for functional foods. By improving digestion and reducing wrinkles, these food items also lower risk factors for cardiovascular disease and type 2 diabetes. These elements are anticipated to increase demand for functional foods in the sports nutrition market, which is projected to expand at a CAGR of 10.0% between 2022 and 2030.

In the immunity application segment, the market for functional foods was valued at USD 57.6 billion in 2021. The immune system defends against environmental pathogens such as bacteria, viruses, fungi, and parasites that cause infectious diseases. The antioxidant vitamins, nucleotides, synbiotics, fatty acids, and L-arginine in functional foods help in developing immune responses. This was especially common during the COVID-19 pandemic when preventive healthcare and immunity boosters became popular around the world. In addition to lowering plasma TAG levels, the aforementioned products also have suppressive effects on cellular immunity. These factors are expected to augment the market growth over the forecast period.

Regional Insights

In terms of revenue, North America accounted for over 24.7% of the global market for functional foods in 2021. The major application segments in the North American market are immunity, weight management, digestive health, and cardio health. This can be attributed to consumers' growing interest in fitness in the U.S., Mexico, and Canada, which is anticipated to increase demand for functional foods and drinks. Additionally, the growing popularity of protein bars, shakes, and cookies among millennials as healthy snacking options is anticipated to increase demand for functional foods in North America over the projected years.

The Asia Pacific has one of the largest markets for functional food products owing to the burgeoning population coupled with rising disposable income, with a market share of 35.8% in 2021 in terms of revenue. Rapidly increasing processed food consumption and rising health and fitness awareness in developing economies are major drivers for the regional market. Consumers’ awareness and concerns about food safety are increasing in the region, especially after the COVID-19 pandemic situation, which influenced consumer behavior and, as a result, drove market growth.

Key Companies & Market Share Insights

The functional foods market is highly competitive, with major public and private companies focusing on research & development and product innovations. Public companies have been proactive in initiating strategies to gain competitive advantages in the market. In the near term, privately-held market participants are expected to follow suit. For instance, in October 2020, Amway Corp. invested USD 15 million in its Michigan manufacturing facility to redesign a 90,000-square-foot manufacturing plant to produce sugar-free XS Energy Drinks that are sold globally exclusively. This new plant manufactures XS Energy Drinks for the U.S., Latin America, and Canada.

The functional foods market has been witnessing key developments in terms of product innovation and portfolio expansion, among others, over the past few years. For instance, in March 2021, Arla Foods Ingredients launched a new protein-enriched juice drink concept by introducing Lacprodan ISO for the fortification of beverages. Some of the prominent players in the global functional food market include:

-

The Coca-Cola Company

-

GFR Pharma

-

Arla Foods amba

-

Amway Corp.

-

Herbalife International of America, Inc.

-

Cargill, Incorporated

-

General Mills Inc

-

BASF SE

-

Standard Functional Foods Group Inc.

-

KFSU

-

Nutri-Nation

Functional Foods Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 357.74 billion

Revenue forecast in 2030

USD 586.06 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

The Coca-Cola Company; GFR Pharma; Arla Foods amba; Amway Corp.; Herbalife International of America, Inc.; Cargill, Incorporated; General Mills Inc; BASF SE; Standard Functional Foods Group Inc.; KFSU; Nutri-Nation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Functional Foods Market Segmentation

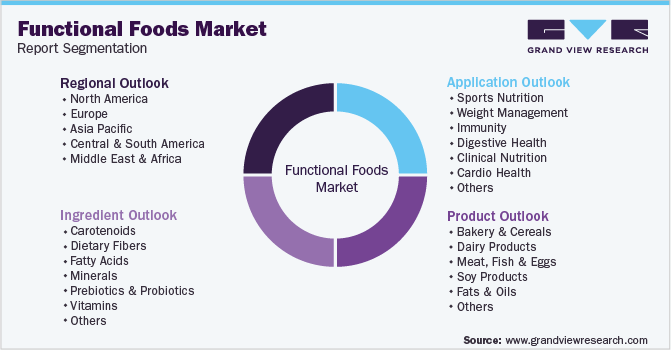

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global functional foods market report on the basis of ingredient, product, application, and region:

-

Ingredient Outlook (Revenue, USD Billion, 2017 - 2030)

-

Carotenoids

-

Dietary Fibers

-

Fatty Acids

-

Minerals

-

Prebiotics & Probiotics

-

Vitamins

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Bakery & Cereals

-

Dairy Products

-

Meat, Fish & Eggs

-

Soy Products

-

Fats & Oils

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Sports Nutrition

-

Weight Management

-

Immunity

-

Digestive Health

-

Clinical Nutrition

-

Cardio Health

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global functional foods market size was estimated at USD 280.7 billion in 2021 and is expected to reach USD 304.2 billion in 2022.

b. The global functional foods market is expected to grow at a compound annual growth rate of 8.5% from 2022 to 2030 to reach USD 586.1 billion by 2030.

b. Asia Pacific dominated the functional foods market with a share of 35.84% in 2021. This is attributable to the rapidly growing consumption of processed food along with rising awareness regarding health and fitness in developing economies.

b. Some key players operating in the functional foods market include BASF SE; Cargill Inc.; General Mills, Inc.; Coca-Cola Co.; Standard Functional Foods Group, Inc.; and GFR Pharma.

b. Key factors that are driving the market growth include increasing demand for nutritional and fortifying food additives is anticipated to drive the growth. Furthermore, food and beverage manufacturers are deploying fortification of nutritional additives such as omega-3 fatty acids, fibers, vitamins, minerals, and others in their product offerings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.