- Home

- »

- Consumer F&B

- »

-

Coffee Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Coffee Market Size, Share & Trends Report]()

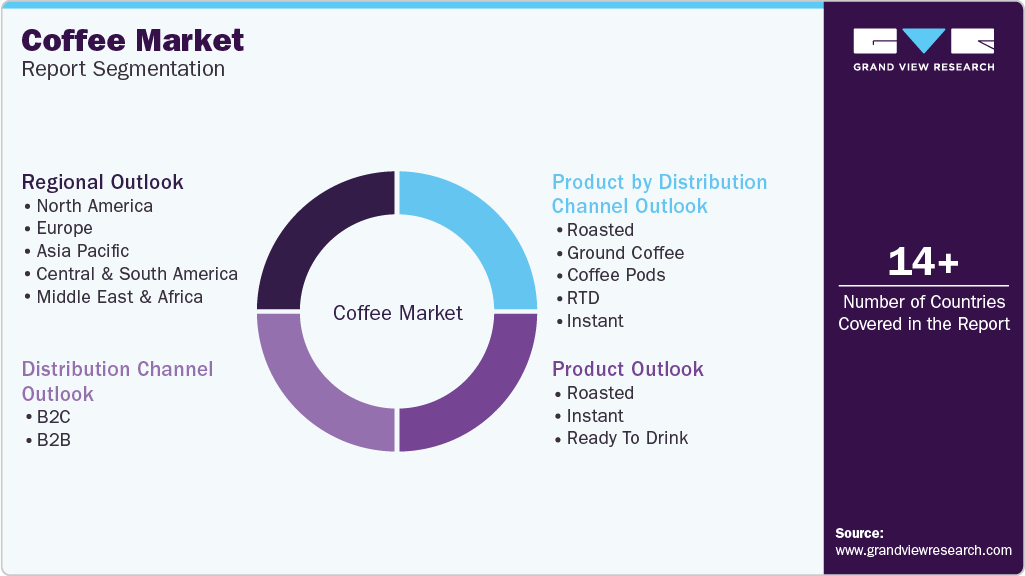

Coffee Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Roasted, Instant, Ready to Drink), By Distribution Channel (B2B, B2C), By Region (North America, Europe, Asia Pacific, MEA, CSA), And Segment Forecasts

- Report ID: GVR-4-68040-153-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Coffee Market Summary

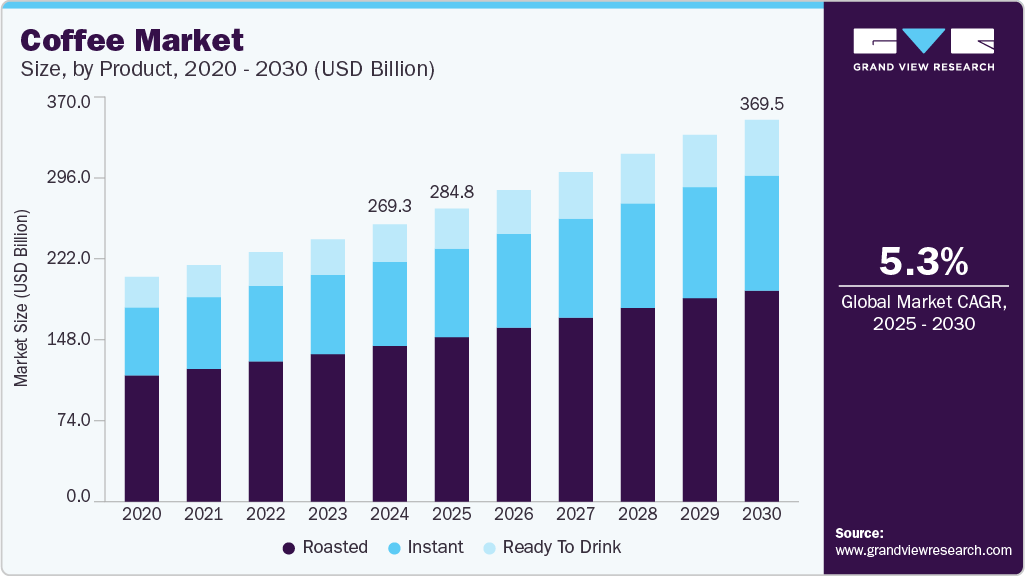

The global coffee market size was estimated at USD 269.27 billion in 2024 and is projected to reach USD 369.46 billion by 2030, growing at a CAGR of 5.3% from 2025 to 2030. The overall demand for coffee is a significant driver of the market.

Key Market Trends & Insights

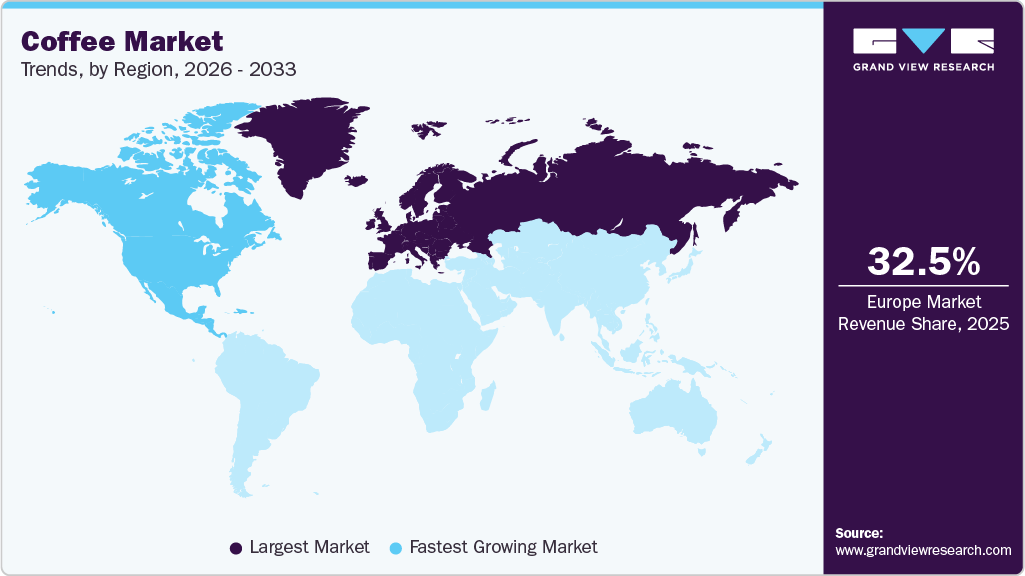

- The coffee market in Europe dominated the global market with the largest revenue share of 34.1% in 2024.

- The coffee market in Germany led the Europe market in 2024.

- By product, roasted coffee accounted for the largest share of 56.1% of the global revenue in 2024.

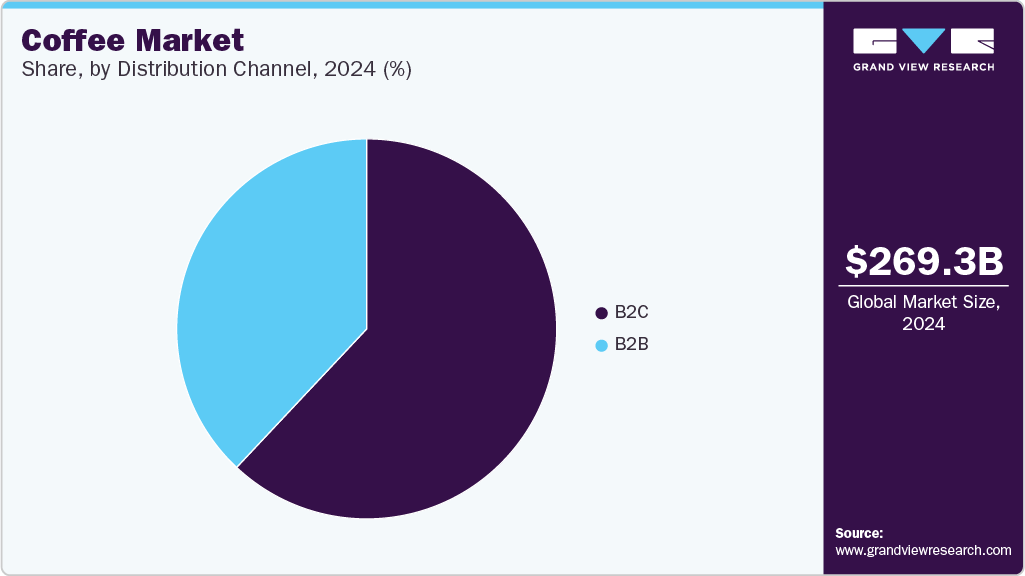

- By distribution channel, the sales of coffee through the B2C channel account for the largest share of 62.4% of the global revenue in 2024.

Market Size & Forecast

- 2024 Revenue: USD 269.27 Billion

- 2030 Projected Market Size: USD 369.46 Billion

- CAGR (2025-2030): 5.3%

- Europe: Largest market in 2024

- Asia-Pacific: Fastest growing region

Coffee is one of the most consumed beverages worldwide, and its popularity continues to grow, particularly in emerging markets such as Asia Pacific. Increasing disposable incomes, changing lifestyles, and a rising coffee culture among consumers across the globe is contributing to the overall growth of the market. A 2024 report published by the National Coffee Association (NCA) highlighted that coffee was the most consumed beverage in the U.S. after water, recording the daily consumption among adults to be 67%, which was 49% higher since 2004. Consistent consumer demand and evolving consumer preferences have led to a significant increase in market growth.

Factors such as the increasing demand for specialty and gourmet coffees, organic and sustainable sourcing, and the popularity of premium and single-origin coffee varieties impact market dynamics. Specialty coffee and gourmet coffee are often associated with higher quality and unique flavor profiles. Consumers are increasingly willing to pay a premium for these coffees, which drives up the overall value of the coffee market. This demand for specialty and gourmet coffee contributes to increased revenue and profitability for coffee producers, roasters, and retailers. In addition, the rise of convenient coffee formats such as coffee pods and capsules has transformed the market.

Consumers are increasingly prioritizing high-quality and ethically produced coffee, evident in rising demand for specialty, single-origin, organic, and sustainably sourced varieties. This premiumization trend signifies a greater consumer willingness to invest in superior products, thereby stimulating notable market growth. Brazil, Vietnam, and Colombia are among the leading coffee-producing countries, and their production levels influence market dynamics. In December 2024, the USDA forecasted strong 2024/25 global coffee production. Brazil was expected to lead with 66.4 million bags, followed by Vietnam and Colombia. China’s consumption surged by nearly 150% over ten years, projected to reach 6.3 million bags. This increased supply was anticipated to meet growing global demand across commodity and premium segments. Changing demographics, including shifts in age distribution and lifestyles, influence the coffee market. According to a survey The Fall 2021 National Coffee Data Trends (NCDT) found that 65% of Millennials (aged 25 to 39) and 46% of Gen Z-ers (aged 18 to 24) reported consuming coffee in the previous day. Consequently, younger generations, such as millennials and Gen Z, are more likely to be avid coffee consumers and have specific preferences regarding specialty coffee, sustainable sourcing, and unique flavors. The aging population and their evolving tastes impact the market; as older adults may seek milder or decaffeinated options.

Market Concentration & Characteristics

The coffee market is experiencing a high degree of innovation, driven by evolving consumer preferences and technological advancements. Companies are introducing new brewing methods, such as cold brew and nitro coffee, as well as ready-to-drink options that cater to convenience-seeking consumers. The rise of specialty coffee, with single-origin beans, unique flavor profiles, and sustainable sourcing practices, has added a premium aspect to the market.

The coffee market has seen significant merger and acquisition activity, reflecting the industry’s dynamic nature and competitive landscape. Major players are consolidating to expand their portfolios, enter new markets, and leverage synergies for operational efficiency. Acquisitions often involve specialty coffee brands, technology-driven companies, and sustainable coffee ventures, aiming to enhance product offerings and meet evolving consumer demands.

Regulations have a profound impact on the coffee market, shaping both product standards and operational practices. Food safety regulations mandate rigorous quality controls and traceability throughout the supply chain, ensuring that coffee products meet health and safety standards. Environmental regulations influence coffee production practices, encouraging sustainable farming methods and reducing the industry’s carbon footprint.

In the coffee market, product substitutes are increasingly influencing consumer choices and market dynamics. Alternatives such as tea, matcha, and herbal infusions offer varied flavors and caffeine levels, appealing to those seeking different taste experiences or health benefits. In addition, plant-based coffee substitutes, such as chicory and barley-based drinks, cater to individuals with dietary restrictions or those avoiding caffeine. The rise of ready-to-drink beverages and functional drinks, which blend coffee with other ingredients such as protein or vitamins, also serves as a substitute for traditional coffee.

End-user concentration in the coffee market is relatively diverse, reflecting a broad range of consumer segments and preferences. The market caters to both individual consumers and businesses, including coffee shops, restaurants, and offices. Individual consumers, segmented by demographics such as age, income, and lifestyle, drive significant demand for various coffee products, from premium blends to convenient ready-to-drink options.

Product Insights

Roasted coffee accounted for the largest share of 56.1% of the global revenue in 2024, driven by the expansion of international coffee chains, such as Starbucks, and the globalization of coffee culture. Coffee chains have popularized freshly roasted coffee, emphasizing its premium quality and distinct flavor profiles. In addition, the growing interest in craft and specialty coffee has led to consumers seeking unique and high-quality coffee experiences, fueling the demand for artisan, distinctly sourced coffee beans. Moreover, the rise in home brewing has aided market growth positively, as consumers are investing in high-quality products and brewing equipment to replicate the coffee shop experience at home.

Ready-to-drink coffee is projected to grow at the fastest CAGR of 6.1% from 2025 to 2030. In 2024, the NCA also highlighted that ready-to-drink coffee was the third most popular preparation method used, with consumption increasing from 8% to 15% among daily consumers. The rising demand for convenience-focused coffee options aligns with busy consumer lifestyles, providing convenient options without brewing or coffee shop waits. The varied flavors and formulations, along with diverse brewing types, has significantly boosted the popularity of these beverages, catering to varied consumer preferences.

Distribution Channel Insights

The sales of coffee through the B2C channel account for the largest share of 62.4% of the global revenue in 2024. The global rise of specialty coffee culture has led to an increased demand for unique and high-quality coffee beans among consumers. B2C channels allow consumers to explore and purchase specialty coffees directly from hypermarket & supermarkets, convenience stores, specialty stores, or online platforms. The growth of e-commerce has facilitated direct-to-consumer sales models further. Coffee producers, roasters, and brands can now sell their products directly to consumers through online platforms, reaching a wider audience and bypassing traditional retail channels.

The B2B segment is projected to grow significantly over the forecast period. Out-of-home revenue generated through diverse commercial establishments significantly surpasses at-home consumption, relying on efficient B2B distribution to meet consistent demand from cafes, hotels, and offices. The expansion of café culture and specialty coffee, coupled with rising urbanization, necessitates reliable B2B supply chains for high-quality beans and equipment. Moreover, product innovation, including premium instant and RTD coffee, drives B2B demand for varied product ranges. Efficiency, scale, and a growing emphasis on sustainability and corporate responsibility further fuel the expansion of these crucial B2B channels in both emerging and mature markets.

Regional Insights

The North America coffee market accounted for a considerable share of the global market share in 2024. The growing popularity and consumption of roasted coffee in the region are driving the market. The introduction of coffee chains such as Starbucks in North America has made roasted coffee increasingly sought-after, from light roast to dark roast. These chains offer roasted coffee based on customers’ varying individual tastes and preferences, thus fueling the market growth.

U.S. Coffee Market Trends

The coffee market in the U.S. led the North America coffee market with the largest revenue share in 2024. In December 2024, the USDA reported that the U.S. imported the second-largest volume of coffee beans. Imports were projected to increase by 800,000 bags, reaching 22.3 million bags, driven by rising domestic consumption. Moreover, a 2025 article published by Balance Coffee indicated that the daily cumulative consumption of coffee in the U.S. was 400 million cups per day, driven by the widespread presence of local cafes and major chains such as Starbucks and Dunkin’, alongside aggressive brand expansions. The increasing demand for specialty and premium coffees, driven by younger demographics favoring diverse styles and ethical sourcing, also contributes to this growth. The expansion of e-commerce and ready-to-drink options enhances convenience, while coffee’s health benefits contribute to its sustained popularity despite challenges from volatile bean prices and supply chain disruptions.

Europe Coffee Market Trends

The coffee market in Europe led the global market with the largest revenue share of 34.1% in 2024, driven by the significant increase in consumption at specialty coffee shops in Western Europe, which provide primarily high-quality coffees. In April 2024, the Center for the Promotion of Imports (CBI) reported that the European branded coffee shop market grew significantly in 2022, reaching over 40,000 outlets that offer premium or specialty coffee, reflecting growing consumer demand for higher-quality brews. European coffee shops are at the forefront of specialty coffee innovation, driven by increasing consumer interest in diverse taste profiles and origin traceability. Producers are further developing unique cultivation methods and brand narratives behind their coffee, aiding the growth of coffee culture in the region. Emerging trends such as varied processing techniques and the rise of organic certifications are offering significant opportunities for diversification within the market.

The coffee market in Germany led the Europe market in 2024. According to the CBI, Germany was the largest European importer of organic green coffee in 2023, accounting for 44% of total imports at 58 thousand tons, reflecting the robust coffee culture and high per capita consumption of 169 liters annually in the country. The country also boasts a significant coffee roasting industry. Growth in specialty and organic coffee is notable, underpinned by a strong focus on sustainability and quality that drive market growth in the country.

The coffee market in the UK is projected to grow lucratively over the forecast period, witnessing a considerable shift toward specialty and premium coffees. As stated in a report from the British Coffee Association, approximately 95 million cups of coffee are consumed daily in the UK, amounting to an astounding total of 2.8 billion cups annually. A substantial majority of adults, exceeding 80%, engage in regular coffee consumption, with the average individual consuming three cups per day.

Asia Pacific Coffee Market Trends

The Asia Pacific coffee market is projected to grow at the fastest CAGR of 6.2% over the forecast period. Coffee culture is gaining traction in many Asian countries, driven by the influence of Western coffee trends and the rise of a younger, more cosmopolitan population. Urban areas have seen a surge in the popularity of coffee shops. The Asia Pacific region has a large population of young people who are more open to adopting global trends. This demographic is increasingly drawn to the café culture and the experience of specialty coffees.

The coffee market in Japan led the Asia Pacific coffee market in 2024, spurred by the burgeoning coffee culture and a growing preference for specialty coffee. This shift towards higher quality and specialty blends has elevated the demand for premium roasted coffee beans, as consumers seek unique flavors and distinct profiles in their coffee experiences. According to Tokyoesque, Japan was a significant global importer of coffee in 2022, hosting giant coffee chains, such as Starbucks, Excelsior Café, Tully’s Coffee, and Doutor, along with traditional shops (Kissaten).

Key Coffee Company Insights

The coffee market is a highly competitive market characterized by several international brands and local companies. Major players are innovating with premium and specialty offerings, sustainable sourcing, and convenient ready-to-drink options to stand out. Besides, local cafes and restaurants are trying to offer the best coffee experience to their customers with wider flavor profiles backed by exotic and organic coffee beans and other ingredients.

-

Nestlé is a multinational food and beverage company that leverages its strong brand portfolio and international presence to maintain a dominant position. Key brands such as Nescafé and Nespresso allow Nestlé to serve diverse consumer segments, from instant coffee drinkers to premium capsule users.

-

Starbucks Coffee Company is renowned for its premium coffee offerings and distinctive café experience. The company’s product range includes a variety of coffee beverages, teas, pastries, and merchandise, catering to a diverse customer base. Starbucks operates through company-owned stores and licensed outlets.

Key Coffee Companies:

The following are the leading companies in the coffee market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé

- Starbucks Coffee Company

- JDE Peet’s

- Tchibo GmbH

- LUIGI LAVAZZA SPA

- Strauss Coffee BV

- The J.M. Smucker Company

- Melitta Group

- UCC UESHIMA COFFEE CO., LTD.

- Massimo Zanetti Beverage Group

Recent Developments

-

In April 2025, Starbucks announced plans to hire more baristas and reduce automation deployment, following unexpected financial results and a 1% global sales decline. This strategy, initiated by CEO Brian Niccol, aimed to regain customer loyalty in its largest market, the US.

-

In April 2025, Nestlé expanded its Nescafé Ready-to-Drink cold coffee range to India, the MENA region, and Brazil. This initiative targeted young, fast-paced consumers, with cold coffee driving double-digit growth, particularly among Gen Z and Millennials.

-

In March 2025, UCC Ueshima Coffee Co. in Japan began mass-producing coffee roasted with green hydrogen. This innovation, costing approximately 1 billion yen, aimed to reduce CO2 emissions and enhance coffee flavors, with initial sales targeting upscale channels such as hotels and airlines.

-

In November 2024, Nestlé launched a new Nescafé Classic soluble coffee range in Central and Eastern Europe. This innovative product, available in caramel and hazelnut, was designed to dissolve perfectly in both hot and cold water, catering to younger consumers’ increasing preference for cold and flavored coffee beverages.

-

In October 2024, Starbucks Coffee Company expanded its global effort to protect the future of coffee by adding two new coffee innovation farms in Guatemala and Costa Rica, with future investments planned for Africa and Asia. This initiative aimed to increase productivity, improve farmer profitability, and mitigate climate change impacts on Arabica coffee.

-

In September 2024, Massimo Zanetti Beverage USA (MZB-USA) partnered with Ultramar Caffè - La Natura Lifestyle to install a new aluminum espresso capsule packaging line at its Suffolk, Virginia facility. This initiative aimed to meet the growing US demand, with a projected annual capacity of 100 million capsules.

-

In April 2024, QuattroR acquired a 50% stake in Massimo Zanetti Beverage Group S.p.A. (Italy) through a significant capital increase. This partnership aimed to accelerate the Group’s growth, consolidate its European leadership, and strengthen its global presence in the coffee industry.

-

In February 2024, Tchibo GmbH (Germany) partnered with Enveritas to achieve 100% “responsibly” sourced coffee by 2027. This initiative, targeting 75,000 small farmers in origins such as Guatemala and Vietnam, aims to enhance sustainability beyond existing certifications through agroforestry and climate-resilient varieties.

-

In January 2024, JDE Peet’s completed the acquisition of Maratá’s coffee & tea business in Brazil. This strategic move enhanced JDE Peet’s presence and national coverage in Brazil, a key market offering significant growth potential, by complementing its existing brand portfolio.

Coffee Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 284.76 billion

Revenue forecast in 2030

USD 369.46 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, product by distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; China; Japan; India; South Korea; Australia; Brazil; South Africa; Saudi Arabia

Key companies profiled

Nestlé; Starbucks Coffee Company; JDE Peet’s; Tchibo GmbH; LUIGI LAVAZZA SPA; Strauss Coffee BV; The J.M. Smucker Company; Melitta Group; UCC UESHIMA COFFEE CO., LTD.; Massimo Zanetti Beverage Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coffee Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coffee market report based on product, distribution channel, product by distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Roasted

-

Roast & Ground

-

Pods & Capsules

-

Whole Beans

-

-

Instant

-

Ready To Drink

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2C

-

Grocery Stores/Supermarkets

-

Hypermarkets

-

Convenience Stores

-

Online Retailers

-

Online Direct-to-Consumer (DTC)

-

Others

-

-

B2B

-

Cafes

-

Hotels & Restaurants

-

Offices

-

Bakeries & Coffee Shops

-

Others

-

-

-

Product by Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Roasted

-

B2C

-

Grocery Stores/Supermarkets

-

Hypermarkets

-

Convenience Stores

-

Online Retailers

-

Online Direct-to-Consumer (DTC)

-

Others

-

-

B2B

-

Cafes

-

Hotels & Restaurants

-

Offices

-

Bakeries & Coffee Shops

-

Others

-

-

-

Ground Coffee

-

B2C

-

Grocery Stores/Supermarkets

-

Hypermarkets

-

Convenience Stores

-

Online Retailers

-

Online Direct-to-Consumer (DTC)

-

Others

-

-

B2B

-

Cafes

-

Hotels & Restaurants

-

Offices

-

Bakeries & Coffee Shops

-

Others

-

-

-

Coffee Pods

-

B2C

-

Grocery Stores/Supermarkets

-

Hypermarkets

-

Convenience Stores

-

Online Retailers

-

Online Direct-to-Consumer (DTC)

-

Others

-

-

B2B

-

Cafes

-

Hotels & Restaurants

-

Offices

-

Bakeries & Coffee Shops

-

Others

-

-

-

RTD

-

B2C

-

Grocery Stores/Supermarkets

-

Hypermarkets

-

Convenience Stores

-

Online Retailers

-

Online Direct-to-Consumer (DTC)

-

Others

-

-

B2B

-

Cafes

-

Hotels & Restaurants

-

Offices

-

Bakeries & Coffee Shops

-

Others

-

-

-

Instant

-

B2C

-

Grocery Stores/Supermarkets

-

Hypermarkets

-

Convenience Stores

-

Online Retailers

-

Online Direct-to-Consumer (DTC)

-

Others

-

-

B2B

-

Cafes

-

Hotels & Restaurants

-

Offices

-

Bakeries & Coffee Shops

-

Others

-

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.