- Home

- »

- Clinical Diagnostics

- »

-

Europe Molecular Diagnostics Market Size Report, 2030GVR Report cover

![Europe Molecular Diagnostics Market Size, Share & Trends Report]()

Europe Molecular Diagnostics Market Size, Share & Trends Analysis Report By Product (Instruments, Reagents, Software), By Technology (PCR, In Situ Hybridization, INAAT, Chips & Microarrays, Sequencing), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-061-3

- Number of Report Pages: 65

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

The Europe molecular diagnostics market size was valued at USD 8.37 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 2.7% from 2023 to 2030. As a developed region, technology enhancement is enabling the European market to grow further by developing new products. Characterized by a large geriatric population, the region witnessed a gradual increase in the prevalence of chronic diseases, such as diabetes, cancer, cardiovascular, and other non-communicable & genetic diseases.

In addition, the rising awareness and acceptance of personalized medications are propelling the market growth. Moreover, advances in molecular techniques have made diagnosis considerably more affordable and precise. Increasing application of molecular diagnostics (MDx) to perform diagnosis of varied genetic disorders and conduct cancer screening further provides a fillip to this vertical. The most frequently employed technique is DNA sequence analysis, which aids in determining genotypic changes implicated in genetic diseases. The incidence of hospital-acquired infections has been growing alarmingly, a major factor expected to drive demand during the forecast period. Europe is marked by a considerable number of key players involved in the manufacturing of MDx, such as Roche Diagnostics, based in Switzerland.

Factors such as the burden of numerous bacterial and viral epidemics in this region, the rising need for point-of-care diagnostics, and recent developments in pharmacogenomics are anticipated to drive market growth. The well-being and health of millions of people in the WHO European Region were still negatively impacted by HIV infection in 2020, according to the article HIV/AIDS Surveillance in Europe, published in November 2021. According to an article by the World Health Organization (WHO) published in October 2021, around 2.6 million people were living with HIV; out of them, nearly 600,000 people were unaware of their infection. Moreover, according to the British Heart Foundation, in June 2023, around 7.6 million people in the UK lived with a heart or circulatory disease.

Europe molecular diagnostics market has challenges during the forecast period due to varying nucleic acid test criteria in various European nations. In addition, the market expansion was halted by the delays in the approval of molecular diagnostic tests. In addition, because of poor healthcare spending, certain European nations lack adequate facilities, impeding the expansion of the market. Furthermore, the lack of front-line staff with the necessary skills and the public's ignorance of early diagnosis in several regions of Europe restrict market growth.

Product Insights

On the basis of products, the molecular diagnostics market is segmented into reagents, instruments, and other products, which include services and software programs that are helpful in running the instrumentation process. The reagents segment dominated the market in 2022 with a revenue share of more than 60% and is expected to grow at a significant CAGR over the forecast period. The growth of this segment has resulted from technological refinements in the diagnostic procedures employed to investigate multiple diseases. Reagents, including formamide, salts, dextran sulfate or heparin, and SDS, are commonly used in situ hybridization assays. The growing usage of techniques comprising fluorescence in situ hybridization is contributing to the further growth of this sector.

Technology Insights

The PCR segment accounted for the largest revenue share of over 75% in 2022, attributable largely to the increasing application of molecular diagnostics in the field of pharmacogenomics and the growing usage of multiplex PCR technologies. Roche offers PCR tests for the diagnosis of the two most commonly reported sexually transmitted infectious diseases, such as Chlamydia trachomatis and Neisseria gonorrhea testing kits. The development of these rapid testing tools is further expected to propel the growth of this sector in Europe.

The in situ hybridization (ISH) and sequencing segments are expected to grow at the fastest CAGR of 11.3% over the forecast period. ISH is a highly sensitive and specific technique that can be used to detect cancer at an early stage when it is most treatable. This is driving demand for ISH in the cancer diagnostics market. In addition, recent advances in ISH technology are making ISH more attractive to users and are driving market growth. Sequencing determines the order of nucleotides in a DNA or RNA molecule. This information can be used to identify genetic mutations that are associated with diseases. Sequencing is also used to track the evolution of viruses and bacteria.

Next-generation sequencing (NGS) technologies are increasingly used in the diagnosis of a wide range of diseases, including cancer, infectious diseases, and genetic disorders owing to a more comprehensive and accurate picture of the genetic makeup of a patient than traditional molecular diagnostic methods. The threat of infectious diseases is also a major driver of the sequencing segment. NGS can be used to identify and track the spread of infectious diseases, and it is also used to develop new vaccines and treatments. For instance, in August 2022, Predicine launched its first CE-IVD marked product PredicineCARE in Europe for genomic profiling in blood & urine. In patients with cancer, the cell-free DNA (cfDNA) assay is a targeted NGS technique for identifying single nucleotide variants, insertions and deletions, DNA rearrangements, and copy number changes. PredicineCARE, according to the company, targets 152 genes, including gene targets suggested by guidelines and associated with treatments or clinical studies currently being tested. The assay has been utilized in patient testing, clinical studies, and the creation of companion diagnostics.

Country Insights

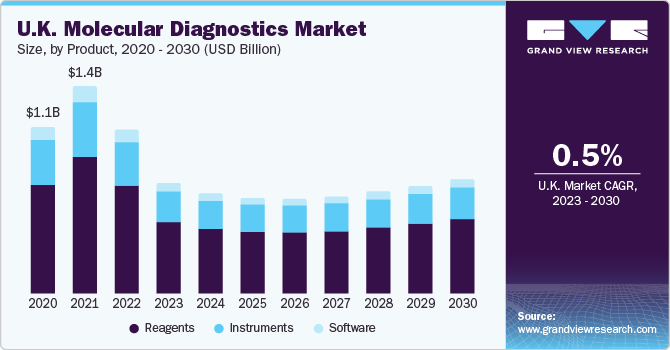

The UK held a significant market revenue share in 2022 due to well-developed healthcare infrastructure, surging disposable income, and rising awareness levels among individuals for the early diagnosis of life-threatening diseases, including cancer and HIV. The UK is home to several leading molecular diagnostics companies, such as Illumina, Thermo Fisher Scientific, and Qiagen. These companies have a strong R&D presence in the UK and are investing heavily in innovative molecular diagnostic techniques.

Germany is expected to grow at a significant CAGR during the forecast period due to its strong base of global companies focusing on developing molecular diagnostics. It is expected that the rising prevalence of chronic diseases like cancer in Germany is likely to aid in the market's growth. In Germany, around 628,519 new cancer cases were reported in 2020, according to the GLOBOCAN data from that year. In the nation, ladies were more likely to develop breast and colorectal cancer than males were to develop lung and prostate cancer. The surge in demand for molecular diagnostics was a direct result of the rising incidence of cancer diseases among the German population over the analyzed period, which also helped to fuel market expansion.

During the forecast period, market growth is likely driven by the nation's development. For instance, in November 2021, at MEDICA, the largest annual medical technology trade fair in the world, which was held in Germany, Medix Biochemica introduced its molecular diagnostic reagents branch, MedixMDx.

Switzerland is expected to grow at the fastest CAGR of 6.1% over the forecast period due to the rising demand for personalized medicine and the strong presence of several leading molecular diagnostics companies, such as Roche, QIAGEN, and LifeCodexx. These companies have a strong research and development presence in Switzerland and are investing heavily in new molecular diagnostic technologies. This is helping to drive the growth of the market. For instance, in March 2023, to improve tumor analysis using next-generation sequencing (NGS), SOPHiA GENETICS, a cloud-native software firm in the healthcare industry, partnered with QIAGEN N.V. QIAseq reagent technology will be combined with the SOPHiA DDM platform. The partnership enabled customers to obtain QIAseq panels processed through SOPHiA DDM, a cloud-based platform for new research perspectives. The partnership focuses on somatic variant identification using QIAseq Targeted DNA Pro panels for homologous recombination repair (HRR), which is a biomarker test for tumors with mutations that may make them subtle to PARP inhibitors in oncology.

Key Companies & Market Share Insights

The market is fragmented due to several companies operating at global and regional levels. Mergers, acquisitions, new product development, and venture capital investments are a few strategies the leading companies undertake in response to the demanding economic conditions in both developed and developing nations. For instance, in April 2023, Thermo Fisher Scientific launched the first of 37 CE-IVD-marked real-time PCR assay kits for its QuantStudio Dx series, primarily targeting infectious diseases. Thermo Fisher showcased test kits for human papillomavirus & herpes simplex virus screening at the European Congress of Clinical Microbiology and Infectious Diseases held in Copenhagen. All countries with CE markings can access these assays with the CE-IVD-marked QS5 Dx.

In October 2021, Hologic launched a fully automated and on-demand molecular diagnostic platform called Novodiag across Europe to dominate the local molecular diagnostics market after acquiring Mobidiag earlier that year. In addition, in September 2021, Roche announced that it acquired TIB Molbiol Group, a manufacturer of custom oligonucleotides, to enhance its robust range of solutions for molecular diagnostics with a broad range of assays for infectious diseases.

Key Europe Molecular Diagnostics Companies:

- Bio-Rad Laboratories, Inc.

- Abbott Laboratories

- Siemens Healthcare GmbH

- Alere, Inc.

- Dako

- Bayer AG

- Hologic, Inc. (Gen probe)

- Danaher Corporation

- Sysmex Corporation

- Novartis AG

- Johnson and Johnson

- Qiagen N.V.

- Becton, Dickinson and Company

- Roche Diagnostics

- bioMérieux SA

- Cephid

Europe Molecular Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.1 billion

Revenue forecast in 2030

USD 7.4 billion

Growth rate

CAGR of 2.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018- 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, country

Regional scope

Europe

Country scope

UK; Germany; France; Spain; Italy; Belgium; Switzerland; Netherlands; Poland; Austria; Denmark; Sweden; Turkey; Norway; Rest of EU

Key companies profiled

Bio-Rad Laboratories, Inc.; Abbott Laboratories; Siemens Healthcare GmbH; Alere, Inc.; Dako; Bayer AG; Hologic, Inc. (Gen probe); Danaher Corporation; Sysmex Corporation; Novartis AG; Johnson and Johnson; Qiagen N.V.; Becton, Dickinson and Company; Roche Diagnostics; bioMérieux SA; Cephid

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Molecular Diagnostics Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe molecular diagnosticsmarket based on product, technology, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Software

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymerase Chain Reaction (PCR)

-

In Situ Hybridization

-

Isothermal Nucleic Acid Amplification Technology (INAAT)

-

Chips & Microarrays

-

Mass Spectrometry

-

Sequencing

-

Transcription-mediated Amplification (TMA)

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Belgium

-

Switzerland

-

Netherlands

-

Poland

-

Austria

-

Denmark

-

Sweden

-

Turkey

-

Norway

-

-

Frequently Asked Questions About This Report

b. The Europe molecular diagnostics market size was estimated at USD 8.37 billion in 2022 and is expected to reach USD 6.1 billion in 2023.

b. The Europe molecular diagnostics market is expected to grow at a compound annual growth rate of 2.7% from 2023 to 2030 to reach USD 7.4 billion by 2030.

b. Reagents dominated the Europe molecular diagnostics market with a share of 65.7% in 2022. This is attributable to technological refinements in the diagnostic procedures employed to investigate multiple diseases.

b. Some key players operating in the Europe molecular diagnostics market include Bio-Rad Laboratories, Inc., Abbott Laboratories, Siemens Healthcare GmbH, Alere, Inc., Dako, Bayer AG, Hologic, Inc. (Gen probe), Danaher Corporation, Sysmex Corporation, Novartis AG, Johnson and Johnson, Qiagen N.V., Becton, Dickinson and Company, Roche Diagnostics, bioMérieux SA,and Cepheid.

b. Key factors that are driving the market growth include an increase in the prevalence of chronic diseases and increasing application of molecular diagnostics (MDx) to perform diagnosis of varied genetic disorders & conduct cancer screening.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."