- Home

- »

- Clinical Diagnostics

- »

-

In Situ Hybridization Market Size, Share, Growth Report 2030GVR Report cover

![In Situ Hybridization Market Size, Share & Trends Report]()

In Situ Hybridization Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (FISH, CISH), By Probe Type (DNA, RNA), By Product (Instrument, Consumables & Accessories, Software, Services), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-109-2

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

In Situ Hybridization Market Summary

The global in situ hybridization market size was estimated at USD 1.60 billion in 2023 and is projected to reach USD 2.55 billion by 2030, growing at a CAGR of 7.2% from 2024 to 2030. Growing demand for molecular diagnostic tools is anticipated to boost the adoption of in situ hybridization (ISH) technology over the coming years.

Key Market Trends & Insights

- North America held the largest share of 44.04% of the ISH market in 2023.

- Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

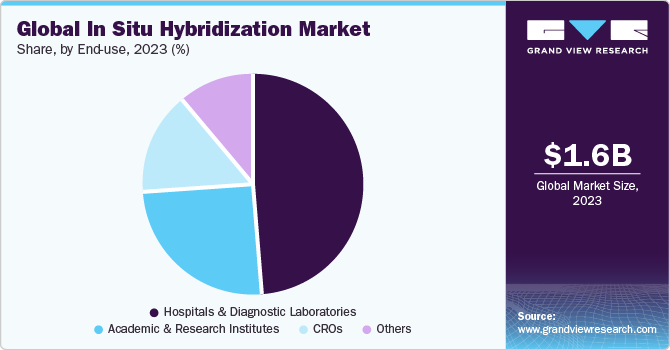

- Based on end-use, hospital & diagnostic laboratories segment held the largest share of 49.4% in 2023.

- Based on technology, FISH segment held the largest market share of 53.84% in 2023.

- Based on probe type, DNA segment held the largest share of 57.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.60 Billion

- 2030 Projected Market Size: USD 2.55 Billion

- CAGR (2024-2030): 7.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The increasing prevalence of cancer, approvals of multiple targeted drugs, and advancements in ISH technology are driving the market growth. The increasing number of cases has prompted governments of developing countries to adopt technologically advanced diagnostic procedures, such as ISH, for the early detection of cancer. The high incidence of cancer has also urged government authorities to develop and invest in advanced diagnostic alternatives.

An increasing number of cancer cases can be attributed to smoking and unhealthy eating habits, which is a high-impact rendering driver of the market growth. According to the National Cancer Institute (NCI), in 2021, there were an estimated 1,898,160 new cancer cases and 608,570 cancer-related deaths in the U.S. As per World Health Organization (WHO), by September 2021, 70% of deaths due to cancer are reported in low and middle-income countries. In 2020, cancer was the leading cause of death, with approximately 100 million deaths worldwide. Breast cancer remains the most common cancer in terms of new cases and deaths in 2020, with 2.26 million cases and 685,000 deaths.

Favorable research conclusions, ease of usage, reduced procedural time, and greater probe labeling efficiency are some of the associated benefits expected to boost market demand. Furthermore, the integration of fluorescence in situ hybridization (FISH) imaging equipment with other advanced technologies, such as high-throughput automated imaging systems, as well as software that yields faster, highly efficient, and clear results, is expected to accelerate growth in the coming years. It is also anticipated to create new opportunities for growth in research applications.

For instance, ISH research applications have facilitated the viewing of complex genomic structures and revealed their functions in various biological processes. This technological upgrade will facilitate real-time analysis of fluctuations in disease progression. These factors are anticipated to serve as key factors contributing to the growth of market over the forecast period.

End-use Insights

Based on end-use, the market is segmented into hospitals & diagnostic laboratories, CROs, academic & research institutes, and others. Hospital & diagnostic laboratories segment held the largest share of 49.4% in 2023 due to increasing applications of ISH in diagnostics. The clinical urgency to meet diagnostic needs in developing countries is one of the major factors responsible for expediting the penetration of ISH. The aforementioned factors are cumulatively responsible for a higher share held by this segment. Clinical applications of ISH include cancer and diagnosis of infectious diseases. ISH is predominantly used in various clinical studies for the detection of leukemia, chromosomal abnormalities, visualization of precancerous lesions in cervical cancer, and assessing the risk of Human Papillomavirus (HPV), myelodysplastic syndrome (MDS), and multiple myeloma. Therefore, ISH serves as a critical technology to study cancer progression, which is anticipated to further fuel the adoption of ISH in pre-cancer and cancer screening programs.

Contract research organizations (CROs) are expected to grow at the fastest CAGR over the forecast period. Numerous organizations outsource their research and clinical trials to CROs and factors such as a specialized workforce, which reduces the expenses for companies, and improvement in efficiency can encourage companies and other organizations to outsource their clinical research to CROs. An increasing number of outsourcing activities such as FISH imaging and analysis are contributing to the growth of this segment. Reveal Biosciences is one of the major CROs in ISH, immunohistochemistry (IHC), immunofluorescence (IF), and histopathology. The organization employs proprietary technologies such as whole-slide imaging, multiplexing, and ImageDx image analysis software. In May 2019, Roche and Bio-Techne expanded their partnership in the U.S. to offer new CISH detection options for mRNA tissue analysis to drug discovery researchers.

Market Dynamics

Technological advancements in imaging systems have led to many advantages over conventional methods. These benefits include limited risk of contamination, which is higher in the case of other technologies; greater reagent stability; cost efficiency; ability to test archival specimens; and simultaneous observation of tissue morphology. These imaging systems also facilitate the viewing of multicolor fluorescence ISH and multicolor banding, which are advanced chromosome painting techniques. These painting techniques are increasingly used to enhance accuracy in determining cryptic chromosome rearrangements.

Correct identification of rearrangement has proven to be useful in the identification of infant leukemia. This enhanced diagnostic precision can lead to early intervention and tailored treatment, driving increased adoption of these technologies and contributing to the growth of the market.

Various players are undertaking numerous strategic initiatives to synergize their resources for technological advancements. For instance, in October 2022, the commercialization of novel automated co-detection assays created particularly for the Roche DISCOVERY ULTRA Platform, allowing simultaneous identification of RNA and protein on the same tissue section, was announced by Bio-Techne Corporation as part of the further development of the Advanced Cell Diagnostics-branded RNAscope in ISH portfolio. Theradiag SA will provide autoimmune reagents and quality controls, while Quotient Limited is expected to grow its MosaiQ platform.

Regional Insights

North America held the largest share of 44.04% of the ISH market in 2023. This can be attributed to extensive adoption of ISH in R&D across this region. The presence of technologically upgraded infrastructure is also responsible for increased adoption of ISH, which enables early diagnosis of diseases. For instance, according to an article published by the American Society for Clinical Pathology (ASCP) on using FISH imaging technologies, such as fluorescence microscopes and Charge-coupled Device (CCD) cameras in breast cancer, the technique represents a promising option for diagnostic settings. Such applications are expected to broaden the scope of use of ISH and contribute to market growth in North America.

Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. An increase in investments by manufacturers & government, supportive government initiatives in biotechnology sector, and the presence of untapped opportunities are among the key factors anticipated to propel market growth. In addition, continuous R&D in cancer treatment is expected to boost the demand for ISH in cancer research, which is expected to fuel market growth.

Technology Insights

Based on technology, the market is segmented into FISH and CISH. FISH segment held the largest market share of 53.84% in 2023. FISH has a wide range of applications, such as detecting chromosomal aberrations, aneuploidy, solid tumors, and others. Technological advancements have led to the development of multiplex FISH, which can simultaneously detect several genes or regions, using different colors. FISH probes are also used for the detection of microorganisms causing infections. FISH probes are finding broad application in breast cancer, among other types of cancers. For instance, in February 2020, Multiplex DX announced its plans to introduce a new combined FISH and NGS test for the diagnosis of breast cancer. The test named Multiplex8+ has also received EU funding. The combination of the two technologies will help eliminate misdiagnosis and will help in guiding personalized treatment.

Chromogenic in situ hybridization (CISH) segment is anticipated to grow at the fastest CAGR during the forecast period. CISH probes are labeled with digoxigenin or biotin and can be detected using a bright-field microscope. Reagents used in CISH are more stable, owing to which, the sample can be stored for a longer duration and can be examined multiple times. Moreover, companies are launching new products in the market to meet the increasing demand. For instance, in April 2021, Bio-Techne announced the commercial launch of its Novel DNAscope ISH assay for chromogenic detection of structural variations and DNA copy numbers. Unlike others, the commercially available assays, DNAScope enables high resolution and targeted detection of small genomic regions or single gene locus with its proprietary signal amplification system coupled with oligo probes.

Probe Type Insights

Based on probe type, the market is segmented into DNA and RNA. DNA segment held the largest share of 57.0% in 2023. The increasing adoption can be attributed to associated benefits, such as high-volume testing and presence of automated devices equipped to facilitate tests with greater speed and accuracy. ISH uses labeled complementary single-stranded DNA as a probe that attaches to a specific sequence on the target DNA. Major benefits associated with DNA probes include the rapid speed of performing assays, which has rendered this technique as one of the pivotal cytogenetic diagnostic procedures. DNA probes are also used for research purposes. For instance, in May 2022, KromaTiD launched their KromaTiD Pinpoint FISH DNA probes. These probes are designed for easier detection of biomarkers and quantification of structural variants, chromosomal rearrangements, and mutations all while providing researchers with better sensitivity as compared to bacterial artificial chromosome (BAC) FISH probes.

The RNA segment is expected to grow at the fastest CAGR over the forecast period.RNA probes are used in the detection of specific mRNA sequences in the cell by hybridizing them with the sequence of interest. mRNAs have been extensively researched and validated to be predictive markers for cancer and other genetic disorders. miRNA in ISH is commonly used for cellular detection and involves similar processing steps to the classical FISH. Major companies manufacturing FISH probes are concentrating on the development of disorder-specific mRNA probes. RNA-specific FISH probes majorly include rRNA FISH probes. rRNA FISH probes are especially useful in the identification of microbial culture in the patient population suffering from infectious diseases.

Product Insights

Based on product, the market is segmented into instruments, consumables & accessories, software, and services. Instruments segment held the largest share of 35.7% in 2023.Instruments for ISH include microscopes, strainers, automated cell analyzers, high-content imaging systems, fluorescence scanners, and others. Increased demand for better imaging of FISH, CISH, and ISH samples is expected to boost the demand for better microscopes and imaging systems. Potential benefits, such as higher cost-efficiency, ease of usage, and portability have made these instruments a preferred choice among researchers and pathologists for ISH techniques. In addition, an increase in the number of collaborations among emerging players to expand their product portfolios and establish a competitive position in the market is anticipated to expand growth opportunities in the coming years. For instance, in June 2020, Abbott Molecular Inc. introduced a Multiplex fast FISH assay to detect biomarkers of lung cancers using BioView image analysis. Major companies providing instruments include PerkinElmer, Inc., Leica Biosystems Nussloch GmbH, and Thermo Fisher Scientific, Inc.

The services segment is expected to grow at the fastest CAGR over the forecast period. Many companies have entered this space and offered a wide array of services, such as developing fluorescent-labeled probes, conducting various tests, and providing analysis of these tests. Increasing outsourcing to ensure high adherence to quality standards and improved operational functionalities is contributing to the lucrative growth of this segment. Associated advantages include enhanced productivity, increased efficiency of services, cost benefits, and a higher focus on core areas of development that are critical to a company’s growth. Market players are in the process of developing a range of services to simplify the overall FISH processes, such as probe designing, tissue procurement, and gene expression studies.

Application Insights

Based on application, the market is segmented into cancer, cytogenetics, developmental biology, infectious diseases, and others. Cancer diagnosis segment held the largest share of 40.8 % in 2023. Increasing incidence of cancer is expected to boost demand for the use of ISH probes in cancer diagnostics. The prevalence of lung cancer is increasing rapidly. According to statistics published by WHO, several new lung cancer cases reported were 2.21 million in 2020 and the number is expected to reach 2.9 million by 2030. Around 236,740 individuals in the U.S. were anticipated to be diagnosed with lung cancer in 2022. This increase is believed to be a consequence of the adoption of certain habits, such as smoking and unhealthy eating. ISH probes act as a better alternative than potentially hazardous and costly radioactive methods that are used for the detection and research of chromosomal alteration in tumor cells.

Cytogenetics segment is expected to grow at the fastest CAGR over the forecast period.

ISH is being increasingly used in cytogenetics to detect chromosomal abnormalities, identify chromosomes, or determine the location of specific sequences on the chromosome. FISH plays an increasingly important role in a variety of research areas, including gene amplification, cytogenetics, and gene mapping. ISH techniques have facilitated the screening of complete genome through multicolor chromosome probe techniques, including spectral karyotyping or multiplex FISH & CISH.

Key Companies & Market Share Insights

Key players are extensively implementing strategies to sustain their position, which is enhancing competition in the market. Their strategies include mergers & acquisitions, distribution agreements, new product development initiatives, and geographic expansion. Prominent market players are employing various strategies to curb rising operational costs, thereby broadening their prospects for profitability.

-

In February 2023, Molecular Instruments, a spin-off of the California Institute of Technology, launched HCR RNA-CISH kits to enhance automated chromogenic ISH workflows working on RNAscope. These kits provide double turnaround time and half the cost

-

In January 2023, Ikonisys SA partnered with Integrated Gulf Biosystems Group (IGB) to distribute Ikoniscope20 Digital Fluorescence Microscope Solution in the Middle East, including Saudi Arabia, UAE, Kuwait, Bahrain, and South Asian markets. This collaboration aims to expand the reach of Ikonisys' oncology testing solutions

Key In Situ Hybridization Companies:

- Thermo Fisher Scientific, Inc.

- Abbott

- PerkinElmer, Inc.

- BioView

- Agilent Technologies, Inc.

- Merck KGaA

- Bio-Rad Laboratories, Inc.

In Situ Hybridization Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.68 billion

Revenue forecast in 2030

USD 2.55 billion

Growth rate

CAGR of 7.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, probe type, product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Abbott; PerkinElmer, Inc.; BioView; Agilent Technologies, Inc.; Merck KGaA; Bio-Rad Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In Situ Hybridization Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global in situ hybridization market report based on technology, probe type, product, application, end-use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

FISH

-

CISH

-

-

Probe Type Outlook (Revenue, USD Million, 2018 - 2030)

-

DNA

-

RNA

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Consumables & Accessories

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Cytogenetics

-

Developmental Biology

-

Infectious Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Diagnostic Laboratories

-

CROs

-

Academic & Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the in situ hybridization (ISH) market with a share of 44.04% in 2023. This is attributable to the availability of research funds and government initiatives for the development of novel diagnostic tools and the presence of major market players in the region.

b. Some key players operating in the ISH market include Thermo Fisher Scientific; Leica BiosystemsNussloch GmbH; BIOVIEW; Agilent Technologies; Merck KGaA; PerkinElmer, Inc.; Bio-Rad Laboratories, Inc.; NeoGenomics Laboratories, Inc.; Advanced Cell Diagnostics, Inc.; and Oxford Gene Technology.

b. Key factors that are driving the in situ hybridization market growth include growing demand for molecular diagnostic tools, rising cancer incidence globally, and the introduction of advanced probe-based technologies.

b. The global in situ hybridization market size was estimated at USD 1.60 billion in 2023 and is expected to reach USD 1.68 billion in 2024.

b. The global in situ hybridization market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 2.55 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.