- Home

- »

- Clinical Diagnostics

- »

-

Point Of Care Diagnostics Market Size, Industry Report, 2030GVR Report cover

![Point Of Care Diagnostics Market Size, Share & Trends Report]()

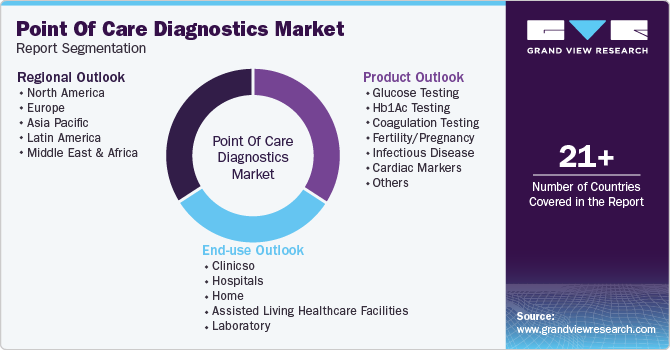

Point Of Care Diagnostics Market Size, Share & Trends Analysis Report By Product (Infectious Diseases, Glucose Testing, Cardiac Markers), By End-use (Clinics, Home, Hospitals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-046-0

- Number of Report Pages: 295

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Point Of Care Diagnostics Market Trends

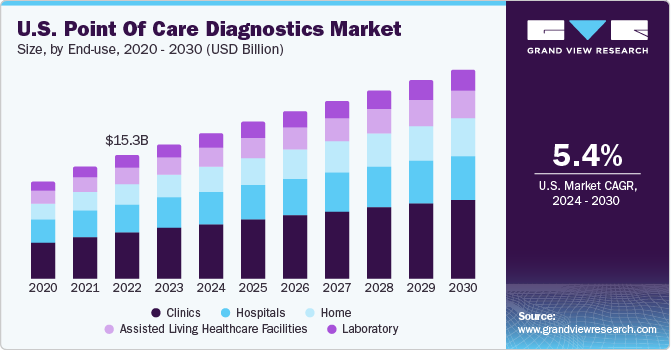

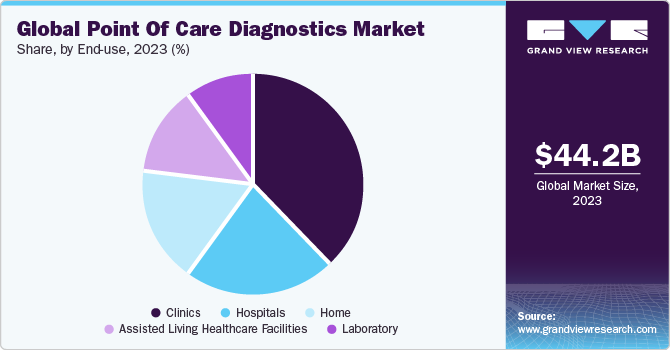

The global point of care diagnostics market size was valued at USD 44.24 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.1% from 2024 to 2030. The increasing geriatric population and the ability of point of care (POC) diagnostic tests to provide immediate results is expected to fuel market demand. Furthermore, the increasing adaptability of mobile diagnostic devices in middle-income countries is also one of the key factors for the growth of point of care testing. In addition, a rise in funding from government & private institutions is a key trend driving the growth of this market. For instance, in September 2022, Unitaid announced that it would invest USD 30 million to accelerate the introduction of advanced diagnostic technologies, which would further enhance screening efforts and expand testing availability at lower tiers of the healthcare system.

The increasing prevalence of genetic disorders is likely to drive the PoC diagnostics market in the coming years. According to a report published by the CDC, congenital heart defects were the most common birth defects in the U.S., affecting approximately 1% of births every year. Early detection of genetic variations via prenatal testing can help in rapid disease diagnosis, prevention, and selection of suitable treatment. Changing lifestyles and environmental factors are increasing the incidence of genetic diseases. The incidence of breast and ovarian cancers is increasing in many regions. For instance, according to the Breast Cancer Research Foundation, in 2023, approximately 300,590 people are expected to be diagnosed with breast cancer in the U.S. Thus, the growing incidence of various diseases is likely to boost the market over the forecast period.

Moreover, the geriatric population is rapidly increasing across the globe. According to a UN report, in 2020, there were about 727 million people aged 65 & above globally. In addition, the number of individuals aged 80 and above is projected to double by 2050, which is over 1.5 billion. Aging has become a substantial risk factor for numerous diseases, including obesity and diabetes, which, in turn, significantly increase the risk of infectious diseases. The geriatric population is susceptible to numerous diseases such as cancer, cardiovascular diseases, obesity, neurological disorders, and diabetes. Thus, the growing geriatric population globally is anticipated to be a high-impact rendering driver of the market.

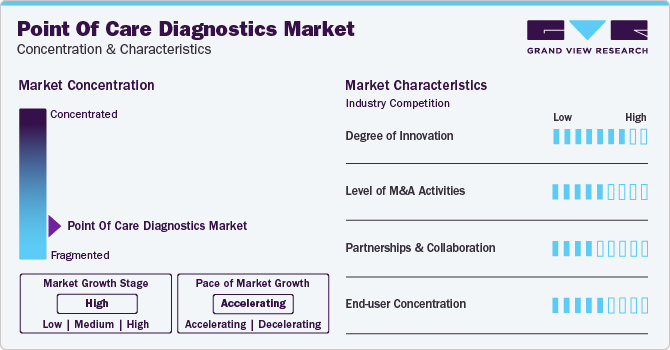

Market Concentration & Characteristics

Market growth stage is high, and the pace of market growth is accelerating. The market is characterized by a high degree of innovation owing to rapid technological advancements and the launch of novel products by key players in the market. For instance, in February 2023, Huwel Lifesciences designed a portable RT-PCR machine to test types of viruses. The company claimed that the test takes around 30 minutes and can be used to detect respiratory and other infections using blood and gastrointestinal samples.

The market is also characterized by a high level of strategic initiatives such as collaborations, partnerships, and merger & acquisition (M&A) by leading players. For instance, in March 2023, Werfen acquired Immucor, Inc. to establish a strong presence in Specialized Diagnostics. The deal was valued at USD 2 billion. Similarly, in May 2023, Siemens Healthcare GmbH partnered with Unilabs, with an agreed value exceeding USD 200 million. Within the partnership, Unilabs will purchase 400 laboratory analyzers to improve patient care infrastructure. Operating players in the market leverage these strategies to increase their product capabilities and promote the reach of their offerings.

End-user concentration is a significant factor in the point of care diagnostics industry. Since there are several end-user that are driving demand for point of care diagnostic solutions. The concentration of demand in clinics and hospitals creates opportunities for companies that focus on developing point of care diagnostics. Moreover, point of care diagnostic products for home care are anticipated to witness widespread adoption due to the cost-effectiveness and comfort they offer in conducting diagnostic tests at home for patients.

Product Insights

Infectious disease led the market and accounted for 27.8% of global revenue share in 2023. Growth of the segment is attributed to increasing demand for rapid tests, which has encouraged industry players to deliver point of care solutions to decentralized regions and launch innovative solutions. For instance, in May 2023, Sensible Diagnostics announced plans to launch a POC PCR instrument that can perform PCR in 10 minutes by 2024, with an initial focus on infectious diseases. Moreover, Abbott has announced the launch of ID NOW, the world's fastest molecular POC test, which offers COVID-19 results in 13 minutes and can be used in a range of dispersed healthcare settings, such as doctor offices & urgent care clinics. Moreover, the implementation of government initiatives aimed at curbing healthcare expenditure by restricting the growth of the incidence of infectious diseases will serve this industry as a driver.

The cancer segment is expected to register the fastest CAGR during the forecast period. The growing use of markers in cancer diagnostics is the primary factor likely to boost the cancer markers segment during the forecast period. The rising global prevalence of cancer is driving the need for early disease detection, and is also expected to propel the market. For instance, according to Cancer.org, approximately 1.9 million new cases of cancer were diagnosed in the U.S. in 2021, with 608,570 cancer deaths. Moreover, key players in the market are introducing novel products to meet untapped opportunities in the market. For instance, in October 2022, F. Hoffman-La Roche Ltd., was approved for the first companion diagnostic by the U.S. FDA to detect patients with HER2 low metastatic breast cancer eligible for ENHERTU.

End-use Insights

The clinic end-use segment led the market and accounted for the highest revenue share in 2023. Point of care diagnostics in primary care settings ranges from simple glucose testing to complex coagulation testing. In several clinics, professionals are switching to point of care diagnostics from conventional lab testing, and this helps shorten the time taken to decide whether further tests are required by avoiding delays during specimen preparation and transport. Other advantages of point of care diagnostics are rapid availability of results, lower costs, and better outcomes. The market has grown rapidly in the past few years, especially in the U.S. and European countries, owing to increased awareness regarding various issues such as medical & organizational concerns and economic advantages of point of care diagnostics.

Home sector is projected to witness the highest growth rate over the forecast period owing to the comfort level and cost-effectiveness of point of care diagnostics provided to patients at home. POC in the home healthcare sector also allows patients to address healthcare challenges at home and make decisions instantly. Moreover, with the rise in the aging population, which is more susceptible to chronic diseases, the demand for healthcare services is likely to show steady growth in the coming years. This will boost the home healthcare sector, which can improve the overall access and reach to medical care while helping avoid unnecessary visits, hospital admissions, and readmissions, as well as time & costs associated with traveling to meet healthcare providers.

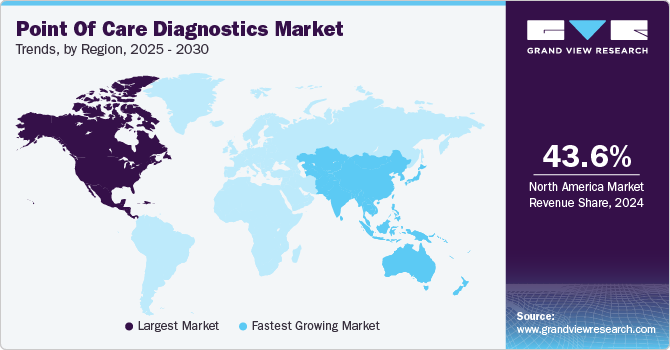

Regional Insights

North America dominated the market and accounted for a 42.9% share in 2023. The growing geriatric population and the presence of higher healthcare expenditure are some key trends contributing to its largest share. Furthermore, technological advancements such as the launch of miniaturized diagnostic equipment offering accurate and rapid results and increasing market penetration of Picture Archiving and Communication Systems (PACS) and Electronic Medical Records (EMRs) are anticipated to propel market growth during the forecast period. Moreover, the presence of key players such as Abbott, BIOMERIEUX, BD, Siemens Healthineers AG, QIAGEN, Quidel Corporation, and Quest Diagnostics is positively influencing market growth. For instance, in April 2023, Abbott announced that the U.S. FDA cleared reader for FreeStyle Libre 3 integrated continuous glucose monitoring system.

Asia Pacific is anticipated to witness significant growth in point of care diagnostics market. Development of healthcare infrastructure coupled with a higher prevalence of chronic and targeted diseases, such as diabetes and cancer along with infectious conditions including HIV, syphilis, and RSV, are expected to drive market in Asia Pacific countries. Adoption of POC diagnostics in operating rooms, emergency rooms, intensive care units, path labs, and hospitals is expected to rise owing to early and efficient results. Moreover, presence of a strong product pipeline pertaining to infectious and cardiac markers segment is estimated to enhance market through to 2030.

Furthermore, rise in adoption of miniaturized models and measures adopted for reducing stays in hospitals and clinics especially in India are expected to fuel the demand for India point of care diagnostic industry.Moreover, rapid technological advancements, high prevalence of chronic & infectious diseases, and continuous efforts by local companies as well as organizations are driving the market in India. For instance, in January 2023, Cipla Limited, based in India, launched Cippoint, a POC testing device that offers a wide array of testing parameters, such as diabetes, cardiac markers, fertility, infectious diseases, inflammation, thyroid function, coagulation markers, and metabolic markers.

Key Point Of Care Diagnostics Company Insights

Some of the key players operating in the market include Abbott; F. Hoffmann-La Roche Ltd., Inc.; Siemens Healthcare GmbH, and Danaher Corporation. Established players focus majorly on innovation & technology advancements to develop cutting-edge diagnostic solutions and partner with emerging players to leverage their technology. Mature players also have a strong global presence with a diverse portfolio of PoC products and a well-established brand reputation which gives them a competitive edge.

Emerging players however focus on launching products in limited countries and then expanding regionally. Some operating strategies also include strategic partnerships, acquisitions, or collaborations to enhance their capabilities and market presence. Additionally, these players may be more flexible and agile than established players in terms of responding and changing to market needs and demands, allowing them to quickly adapt and develop new technologies.

Key Point Of Care Diagnostics Companies:

The following are the leading companies in the point of care diagnostics market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these point of care diagnostics companies are analyzed to map the supply network.

- F. Hoffmann-La Roche Ltd.

- Qiagen

- Danaher Corporation

- Becton Dickinson (BD)

- bioMérieux

- Abbott

- Siemens Healthcare GmbH

- Werfen

- Nova Biomedical

- Trividia Health, Inc.

- QuidelOrtho Corporation

- Trinity Biotech

- Sekisui Diagnostics

- Orasure Technologies, Inc.

- Spectral Medical, Inc.

- EKF Diagnostics Holdings plc.

- Anbio Biotechnology Co., Ltd.

- AccuBioTech Co., Ltd

- ALPHA LABORATORIES.

Recent Developments

-

In October 2023, QIAGEN gained CE certification for IVD kit and automated testing platform, NeuMoDx. This initiative positively impacted the company’s revenue and share in the market

-

In May 2023, Danaher Corporation, introduced Dxl 9000 Access Immunoassay Analyzer, which can run up to 215 test per hour. This initiative expanded the company’s point of care diagnostics offering

-

In May 2023, BD announced 510k clearance for the BD Kiestra Methicillin-resistant Staphylococcus aureus (MRSA) imaging application that uses AI software. This launch would increase the turnaround time of tests results as the software eliminates the time-intensive task of determining bacterial growth using petri dishes

-

In March 2023, Trinity Biotech, TrinScreen HIV was included in the New Kenyan HIV Testing Algorithm. This initiative was aimed at increasing access to the product for HIV patients

-

In March 2023, F. Hoffman-La Roche Ltd entered into a strategic partnership with Eli Lilly to develop former’s Elecsys Amyloid Plasma Panel (EAPP). This collaboration would benefit both the companies and would target an important area of unmet medical need as this panel has the potential to streamline patients journey from diagnosis to treatment and treatment management

Point Of Care Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 47.8 billion

Revenue forecast in 2030

USD 68.5 billion

Growth Rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada, Germany; U.K.; France; Italy; Spain; Russia; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd.; Qiagen; Danaher Corporation; Becton Dickinson (BD); bioMérieux; Abbott; Siemens Healthcare GmbH; Werfen; Nova Biomedical; Trividia Health, Inc.; QuidelOrtho Corporation; Trinity Biotech; Sekisui Diagnostics; Orasure Technologies, Inc.; Spectral Medical, Inc.; EKF Diagnostics Holdings Plc.; Anbio Biotechnology Co., Ltd.; AccuBioTech Co., Ltd.; ALPHA LABORATORIES

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Point Of Care Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global point of care diagnostics market report based on product, end use, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Glucose Testing

-

Hb1Ac Testing

-

Coagulation Testing

-

Fertility/Pregnancy

-

Infectious Disease

-

HIV POC

-

Clostridium Difficile POC

-

HBV POC

-

Pneumonia or Streptococcus Associated Infections

-

Respiratory Syncytial Virus (RSV) POC

-

HPV POC

-

Influenza/Flu POC

-

HCV POC

-

MRSA POC

-

TB and Drug-resistant TB POC

-

HSV POC

-

COVID-19

-

Other Infectious Diseases

-

-

Cardiac Markers

-

Thyroid Stimulating Hormone

-

Hematology

-

Primary Care Systems

-

Decentralized Clinical Chemistry

-

Feces

-

Lipid Testing

-

Cancer Marker

-

Blood Gas/Electrolytes

-

Ambulatory Chemistry

-

Drug of Abuse (DOA) Testing

-

Autoimmune Diseases

-

Urinalysis/Nephrology

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clinics

-

Hospitals

-

Home

-

Assisted Living Healthcare Facilities

-

Laboratory

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global point of care diagnostics market size was estimated at USD 44.24 billion in 2023 and is expected to reach USD 47.8 billion in 2024.

b. The global point of care diagnostics market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 68.5 billion by 2030.

b. The infectious disease segment dominated the point of care diagnostics market with a share of 27.85% in 2023. The rising prevalence of HIV/AIDS, influenza, RSV, and other diseases is leading to an increase in the number of people being diagnosed.

b. Some key players operating in the POC diagnostics market include F. Hoffmann-La Roche Ltd.; Abbott; Siemens; Danaher; bioMérieux SA; Johnson and Johnson; Abaxis, Inc.; QIAGEN; Nova Biomedical; Trividia Health, Inc.; Quidel Corporation; OraSure Technologies Inc.; Becton Dickinson and Company; Spectral Medical, Inc.; and Nipro.

b. Key factors that are driving the point of care diagnostics market growth include robust government initiatives, the presence of favorable regulations, and the advent of next-generation point of care diagnostics technologies.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Product

1.2.2. End Use

1.2.3. Regional scope

1.2.4. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for primary interviews in Latin America

1.4.5.5. Data for Primary interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product outlook

2.2.2. End Use outlook

2.2.3. Regional outlook

2.3. Competitive Insights

Chapter 3. Point Of Care Diagnostics Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Introduction of CLIA waived tests

3.2.1.2. Rise in funding from government and private institutions

3.2.1.3. Growing geriatric population base

3.2.1.4. Growing prevalence of target diseases

3.2.1.5. Growing demand for home healthcare and the introduction of advance technology enabled products

3.2.2. Market restraint analysis

3.2.2.1. High procedure costs coupled with limited adoption of POC devices in certain emerging regions

3.2.2.2. Presence of ambiguous regulatory as well as reimbursement frame work for primary care setting

3.2.3. Market challenge analysis

3.2.3.1. POC device pose challenges in maintaining the quality standards

3.2.4. Market opportunity analysis

3.2.4.1. Networking & remote integration of POC diagnostics products

3.2.4.1.1. Smartphone orientation

3.2.4.1.2. Embedded vision based solutions

3.2.4.1.3. Digital technologies

3.3. Point Of Care Diagnostics Market Analysis Tools

3.3.1. Industry Analysis - Porter’s Five Forces

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

3.4. Pricing Analysis, By Product

3.4.1. Glucose Testing

3.4.2. Hb1Ac Testing

3.4.3. Coagulation Testing

3.4.4. Fertility/Pregnancy

3.4.5. Infectious Disease

3.4.6. HIV POC

3.4.7. Clostridium Difficile POC

3.4.8. HBV POC

3.4.9. Pneumonia or Streptococcus Associated Infections

3.4.10. Respiratory Syncytial Virus (RSV) POC

3.4.11. HPV POC

3.4.12. Influenza/Flu POC

3.4.13. HCV POC

3.4.14. MRSA POC

3.4.15. TB and Drug-resistant TB POC

3.4.16. HSV POC

3.4.17. COVID-19

3.4.18. Other Infectious Diseases

3.4.19. Cardiac Markers

3.4.20. Thyroid Stimulating Hormone

3.4.21. Hematology

3.4.22. Primary Care Systems

3.4.23. Decentralized Clinical Chemistry

3.4.24. Feces

3.4.25. Lipid Testing

3.4.26. Cancer Marker

3.4.27. Blood Gas/Electrolytes

3.4.28. Ambulatory Chemistry

3.4.29. Drug of Abuse (DOA) Testing

3.4.30. Autoimmune Diseases

3.4.31. Urinalysis/Nephrology

Chapter 4. Point Of Care Diagnostics Market: Product Estimates & Trend Analysis

4.1. Product Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Global Point Of Care Diagnostics Market by Product Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Glucose Testing

4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.2. Hb1Ac Testing

4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.3. Coagulation Testing

4.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.4. Fertility/Pregnancy Testing

4.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5. Infectious Disease

4.4.5.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5.2. HIV POC

4.4.5.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5.3. Clostridium Difficile POC

4.4.5.3.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5.4. HBV POC

4.4.5.4.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5.5. Pneumonia or Streptococcus Associated Infections

4.4.5.5.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5.6. Respiratory Syncytial Virus (RSV) POC

4.4.5.6.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5.7. HPV POC

4.4.5.7.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5.8. Influenza/Flu POC

4.4.5.8.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5.9. HCV POC

4.4.5.9.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5.10. MRSA POC

4.4.5.10.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5.11. TB and drug resistant TB POC

4.4.5.11.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5.12. HSV POC

4.4.5.12.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5.13. COVID-19

4.4.5.13.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5.14. Other infectious diseases

4.4.5.14.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.6. Cardiac Markers

4.4.6.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.7. Thyroid Stimulating Hormone

4.4.7.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.8. Hematology

4.4.8.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.9. Primary Care Systems

4.4.9.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.10. Decentralized Clinical Chemistry

4.4.10.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.11. Feces

4.4.11.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.12. Lipid Testing

4.4.12.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.13. Cancer Marker

4.4.13.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.14. Blood Gas/Electrolytes

4.4.14.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.15. Ambulatory Chemistry

4.4.15.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.16. Drug of Abuse (DOA) Testing

4.4.16.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.17. Autoimmune diseases

4.4.17.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.18. Urinalysis/Nephrology

4.4.18.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 5. Point Of Care Diagnostics Market: End Use Estimates & Trend Analysis

5.1. End Use Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Global Point Of Care Diagnostics Market by End Use Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Clinics

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD billion)

5.4.1.2. Pharmacy & Retail Clinics

5.4.1.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.1.3. Physician Office

5.4.1.3.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.1.4. Urgent Care Clinics

5.4.1.4.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.1.5. Non-practice Clinics

5.4.1.5.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.2. Hospitals

5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.3. Home

5.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.4. Assisted Living Healthcare Facilitates

5.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.5. Laboratory

5.4.5.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 6. Point Of Care Diagnostics Market: Regional Estimates & Trend Analysis

6.1. Regional Market Share Analysis, 2023 & 2030

6.2. Regional Market Dashboard

6.3. Global Regional Market Snapshot

6.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

6.5. North America

6.5.1. U.S.

6.5.1.1. Key country dynamics

6.5.1.2. Regulatory framework/ reimbursement structure

6.5.1.3. Competitive scenario

6.5.1.4. U.S. market estimates and forecasts 2018 to 2030 (USD Billion)

6.5.2. Canada

6.5.2.1. Key country dynamics

6.5.2.2. Regulatory framework/ reimbursement structure

6.5.2.3. Competitive scenario

6.5.2.4. Canada market estimates and forecasts 2018 to 2030 (USD Billion)

6.6. Europe

6.6.1. Germany

6.6.1.1. Key country dynamics

6.6.1.2. Regulatory framework/ reimbursement structure

6.6.1.3. Competitive scenario

6.6.1.4. Germany market estimates and forecasts 2018 to 2030 (USD Billion)

6.6.2. UK

6.6.2.1. Key country dynamics

6.6.2.2. Regulatory framework/ reimbursement structure

6.6.2.3. Competitive scenario

6.6.2.4. UK market estimates and forecasts 2018 to 2030 (USD Billion)

6.6.3. France

6.6.3.1. Key country dynamics

6.6.3.2. Regulatory framework/ reimbursement structure

6.6.3.3. Competitive scenario

6.6.3.4. France market estimates and forecasts 2018 to 2030 (USD Billion)

6.6.4. Italy

6.6.4.1. Key country dynamics

6.6.4.2. Regulatory framework/ reimbursement structure

6.6.4.3. Competitive scenario

6.6.4.4. Italy market estimates and forecasts 2018 to 2030 (USD Billion)

6.6.5. Spain

6.6.5.1. Key country dynamics

6.6.5.2. Regulatory framework/ reimbursement structure

6.6.5.3. Competitive scenario

6.6.5.4. Spain market estimates and forecasts 2018 to 2030 (USD Billion)

6.6.6. Russia

6.6.6.1. Key country dynamics

6.6.6.2. Regulatory framework/ reimbursement structure

6.6.6.3. Competitive scenario

6.6.6.4. Russia market estimates and forecasts 2018 to 2030 (USD Billion)

6.6.7. Norway

6.6.7.1. Key country dynamics

6.6.7.2. Regulatory framework/ reimbursement structure

6.6.7.3. Competitive scenario

6.6.7.4. Norway market estimates and forecasts 2018 to 2030 (USD Billion)

6.6.8. Sweden

6.6.8.1. Key country dynamics

6.6.8.2. Regulatory framework/ reimbursement structure

6.6.8.3. Competitive scenario

6.6.8.4. Sweden market estimates and forecasts 2018 to 2030 (USD Billion)

6.6.9. Denmark

6.6.9.1. Key country dynamics

6.6.9.2. Regulatory framework/ reimbursement structure

6.6.9.3. Competitive scenario

6.6.9.4. Denmark market estimates and forecasts 2018 to 2030 (USD Billion)

6.7. Asia Pacific

6.7.1. Japan

6.7.1.1. Key country dynamics

6.7.1.2. Regulatory framework/ reimbursement structure

6.7.1.3. Competitive scenario

6.7.1.4. Japan market estimates and forecasts 2018 to 2030 (USD Billion)

6.7.2. China

6.7.2.1. Key country dynamics

6.7.2.2. Regulatory framework/ reimbursement structure

6.7.2.3. Competitive scenario

6.7.2.4. China market estimates and forecasts 2018 to 2030 (USD Billion)

6.7.3. India

6.7.3.1. Key country dynamics

6.7.3.2. Regulatory framework/ reimbursement structure

6.7.3.3. Competitive scenario

6.7.3.4. India market estimates and forecasts 2018 to 2030 (USD Billion)

6.7.4. South Korea

6.7.4.1. Key country dynamics

6.7.4.2. Regulatory framework/ reimbursement structure

6.7.4.3. Competitive scenario

6.7.4.4. South Korea market estimates and forecasts 2018 to 2030 (USD Billion)

6.7.5. Australia

6.7.5.1. Key country dynamics

6.7.5.2. Regulatory framework/ reimbursement structure

6.7.5.3. Competitive scenario

6.7.5.4. Australia market estimates and forecasts 2018 to 2030 (USD Billion)

6.7.6. Thailand

6.7.6.1. Key country dynamics

6.7.6.2. Regulatory framework/ reimbursement structure

6.7.6.3. Competitive scenario

6.7.6.4. Thailand market estimates and forecasts 2018 to 2030 (USD Billion)

6.8. Latin America

6.8.1. Brazil

6.8.1.1. Key country dynamics

6.8.1.2. Regulatory framework/ reimbursement structure

6.8.1.3. Competitive scenario

6.8.1.4. Brazil market estimates and forecasts 2018 to 2030 (USD Billion)

6.8.2. Mexico

6.8.2.1. Key country dynamics

6.8.2.2. Regulatory framework/ reimbursement structure

6.8.2.3. Competitive scenario

6.8.2.4. Mexico market estimates and forecasts 2018 to 2030 (USD Billion)

6.8.3. Argentina

6.8.3.1. Key country dynamics

6.8.3.2. Regulatory framework/ reimbursement structure

6.8.3.3. Competitive scenario

6.8.3.4. Argentina market estimates and forecasts 2018 to 2030 (USD Billion)

6.9. MEA

6.9.1. South Africa

6.9.1.1. Key country dynamics

6.9.1.2. Regulatory framework/ reimbursement structure

6.9.1.3. Competitive scenario

6.9.1.4. South Africa market estimates and forecasts 2018 to 2030 (USD Billion)

6.9.2. Saudi Arabia

6.9.2.1. Key country dynamics

6.9.2.2. Regulatory framework/ reimbursement structure

6.9.2.3. Competitive scenario

6.9.2.4. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Billion)

6.9.3. UAE

6.9.3.1. Key country dynamics

6.9.3.2. Regulatory framework/ reimbursement structure

6.9.3.3. Competitive scenario

6.9.3.4. UAE market estimates and forecasts 2018 to 2030 (USD Billion)

6.9.4. Kuwait

6.9.4.1. Key country dynamics

6.9.4.2. Regulatory framework/ reimbursement structure

6.9.4.3. Competitive scenario

6.9.4.4. Kuwait market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.3. Vendor Landscape

7.3.1. List of key distributors and channel partners

7.3.1.1. Abbott

7.3.1.2. Alere Inc.

7.3.1.3. F. Hoffmann-La Roche Ltd.

7.3.1.4. Siemens Healthcare GmbH

7.3.1.5. Danaher Corporation

7.3.1.6. Werfen

7.3.1.7. BD

7.3.2. Key customers

7.3.3. Key company market share analysis, 2023

7.3.4. Company Profiles

7.3.4.1. F. Hoffmann-La Roche Ltd.

7.3.4.1.1. Company overview

7.3.4.1.2. Financial performance

7.3.4.1.3. Product benchmarking

7.3.4.1.4. Strategic initiatives

7.3.4.2. Qiagen

7.3.4.2.1. Company overview

7.3.4.2.2. Financial performance

7.3.4.2.3. Product benchmarking

7.3.4.2.4. Strategic initiatives

7.3.4.3. Danaher Corporation

7.3.4.3.1. Company overview

7.3.4.3.2. Financial performance

7.3.4.3.3. Product benchmarking

7.3.4.3.4. Strategic initiatives

7.3.4.4. Becton Dickinson (BD)

7.3.4.4.1. Company overview

7.3.4.4.2. Financial performance

7.3.4.4.3. Product benchmarking

7.3.4.4.4. Strategic initiatives

7.3.4.5. bioMérieux

7.3.4.5.1. Company overview

7.3.4.5.2. Financial performance

7.3.4.5.3. Product benchmarking

7.3.4.5.4. Strategic initiatives

7.3.4.6. Abbott

7.3.4.6.1. Company overview

7.3.4.6.2. Financial performance

7.3.4.6.3. Product benchmarking

7.3.4.6.4. Strategic initiatives

7.3.4.7. Siemens Healthcare GmbH

7.3.4.7.1. Company overview

7.3.4.7.2. Financial performance

7.3.4.7.3. Product benchmarking

7.3.4.7.4. Strategic initiatives

7.3.4.8. Werfen

7.3.4.8.1. Company overview

7.3.4.8.2. Financial performance

7.3.4.8.3. Product benchmarking

7.3.4.8.4. Strategic initiatives

7.3.4.9. Nova Biomedical

7.3.4.9.1. Company overview

7.3.4.9.2. Financial performance

7.3.4.9.3. Product benchmarking

7.3.4.9.4. Strategic initiatives

7.3.4.10. Trividia Health, Inc.

7.3.4.10.1. Company overview

7.3.4.10.2. Financial performance

7.3.4.10.3. Product benchmarking

7.3.4.10.4. Strategic initiatives

7.3.4.11. QuidelOrtho Corporation

7.3.4.11.1. Company overview

7.3.4.11.2. Financial performance

7.3.4.11.3. Product benchmarking

7.3.4.11.4. Strategic initiatives

7.3.4.12. Trinity Biotech

7.3.4.12.1. Company overview

7.3.4.12.2. Financial performance

7.3.4.12.3. Product benchmarking

7.3.4.12.4. Strategic initiatives

7.3.4.13. Sekisui Diagnostics

7.3.4.13.1. Company overview

7.3.4.13.2. Financial performance

7.3.4.13.3. Product benchmarking

7.3.4.13.4. Strategic initiatives

7.3.4.14. Orasure Technologies, Inc.

7.3.4.14.1. Company overview

7.3.4.14.2. Financial performance

7.3.4.14.3. Product benchmarking

7.3.4.14.4. Strategic initiatives

7.3.4.15. Spectral Medical, Inc.

7.3.4.15.1. Company overview

7.3.4.15.2. Financial performance

7.3.4.15.3. Product benchmarking

7.3.4.15.4. Strategic initiatives

7.3.4.16. EKF Diagnostics Holdings plc.

7.3.4.16.1. Company overview

7.3.4.16.2. Financial performance

7.3.4.16.3. Product benchmarking

7.3.4.16.4. Strategic initiatives

7.3.4.17. Anbio Biotechnology Co., Ltd.

7.3.4.17.1. Company overview

7.3.4.17.2. Financial performance

7.3.4.17.3. Product benchmarking

7.3.4.17.4. Strategic initiatives

7.3.4.18. AccuBioTech Co., Ltd

7.3.4.18.1. Company overview

7.3.4.18.2. Financial performance

7.3.4.18.3. Product benchmarking

7.3.4.18.4. Strategic initiatives

7.3.4.19. ALPHA LABORATORIES

7.3.4.19.1. Company overview

7.3.4.19.2. Financial performance

7.3.4.19.3. Product benchmarking

7.3.4.19.4. Strategic initiatives

7.3.5. Company Market Positioning Analysis, 2023

7.3.5.1. Glucose Monitoring

7.3.5.2. Cardiac Markers

7.3.5.3. Hematology

7.3.5.4. Coagulation

7.3.5.5. Fertility Testing

7.3.5.6. Infectious Diseases

7.3.5.7. Decentralized Clinical Chemistry

7.3.5.8. Oncology Markers

7.3.5.9. Blood Gas Testing

7.3.5.10. Ambulatory Testing

7.3.5.11. Drug of Abuse

7.3.5.12. Urinalysis

7.3.6. Key Parameters

7.3.6.1. Company Size

7.3.6.2. Geographic Presence

7.3.6.3. Production Portfolio

7.3.6.4. Collaborations

7.3.7. Market Differentiators

7.3.7.1. Application Trends

7.3.7.2. Technology Trends

7.3.7.3. Test Location Trends

7.3.7.4. End-use Trends

7.3.7.5. Regional Trends

7.3.8. Private Companies

7.3.8.1. New Entrants/Emerging Players

7.3.9. Regional Mapping: Public and Private Companies

Chapter 8. Conclusion

List of Tables

Table 1 List of abbreviation

Table 2 North America point of care diagnostics market, by region, 2018 - 2030 (USD Billion)

Table 3 North America point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 4 North America point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 5 U.S. point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 6 U.S. point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 7 Canada point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 8 Canada point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 9 Europe point of care diagnostics market, by region, 2018 - 2030 (USD Billion)

Table 10 Europe point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 11 Europe point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 12 Germany point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 13 Germany point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 14 UK point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 15 UK point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 16 France point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 17 France point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 18 Italy point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 19 Italy point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 20 Spain point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 21 Spain point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 22 Russia point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 23 Russia point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 24 Denmark point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 25 Denmark point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 26 Sweden point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 27 Sweden point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 28 Norway point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 29 Norway point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 30 Asia Pacific point of care diagnostics market, by region, 2018 - 2030 (USD Billion)

Table 31 Asia Pacific point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 32 Asia Pacific point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 33 China point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 34 China point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 35 Japan point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 36 Japan point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 37 India point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 38 India point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 39 South Korea point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 40 South Korea point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 41 Australia point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 42 Australia point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 43 Thailand point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 44 Thailand point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 45 Latin America point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 46 Latin America point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 47 Brazil point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 48 Brazil point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 49 Mexico point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 50 Mexico point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 51 Argentina point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 52 Argentina point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 53 MEA point of care diagnostics market, by region, 2018 - 2030 (USD Billion)

Table 54 MEA point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 55 MEA point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 56 South Africa point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 57 South Africa point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 58 Saudi Arabia point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 59 Saudi Arabia point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 60 UAE point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 61 UAE point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

Table 62 Kuwait point of care diagnostics market, by product, 2018 - 2030 (USD Billion)

Table 63 Kuwait point of care diagnostics market, by end use, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews in North America

Fig. 5 Primary interviews in Europe

Fig. 6 Primary interviews in APAC

Fig. 7 Primary interviews in Latin America

Fig. 8 Primary interviews in MEA

Fig. 9 Market research approaches

Fig. 10 Value-chain-based sizing & forecasting

Fig. 11 QFD modeling for market share assessment

Fig. 12 Market formulation & validation

Fig. 13 Point of care diagnostics market: market outlook

Fig. 14 Point of care diagnostics competitive insights

Fig. 15 Parent market outlook

Fig. 16 Related/ancillary market outlook

Fig. 17 Penetration and growth prospect mapping

Fig. 18 Industry value chain analysis

Fig. 19 Point of care diagnostics market driver impact

Fig. 20 Point of care diagnostics market restraint impact

Fig. 21 Point of care diagnostics market strategic initiatives analysis

Fig. 22 Point of care diagnostics market: Product movement analysis

Fig. 23 Point of care diagnostics market: Product outlook and key takeaways

Fig. 24 Glucose testing market estimates and forecast, 2018 - 2030

Fig. 25 Hb1Ac testing market estimates and forecast, 2018 - 2030

Fig. 26 Coagulation testing market estimates and forecast, 2018 - 2030

Fig. 27 Fertility/pregnancy market estimates and forecast, 2018 - 2030

Fig. 28 Infectious disease market estimates and forecast, 2018 - 2030

Fig. 29 HIV POC market estimates and forecast, 2018 - 2030

Fig. 30 Pneumonia or streptococcus associated infections market estimates and forecasts, 2018 - 2030

Fig. 31 Respiratory syncytial virus (RSV) POC market estimates and forecasts, 2018 - 2030

Fig. 32 HPV POC market estimates and forecasts, 2018 - 2030

Fig. 33 Influenza/ flu POC market estimates and forecasts, 2018 - 2030

Fig. 34 HCV POC market estimates and forecasts, 2018 - 2030

Fig. 35 MRSA POC market estimates and forecasts, 2018 - 2030

Fig. 36 TB and drug resistant TB POC market estimates and forecasts, 2018 - 2030

Fig. 37 HSV POC market estimates and forecasts, 2018 - 2030

Fig. 38 COVID-19 market estimates and forecasts, 2018 - 2030

Fig. 39 Other infectious diseases estimates and forecasts, 2018 - 2030

Fig. 40 Cardiac markers market estimates and forecasts, 2018 - 2030

Fig. 41 Thyroid stimulating hormone market estimates and forecasts, 2018 - 2030

Fig. 42 Hematology market estimates and forecasts, 2018 - 2030

Fig. 43 Primary care systems estimates and forecasts, 2018 - 2030

Fig. 44 Decentralized clinical chemistry market estimates and forecasts, 2018 - 2030

Fig. 45 Feces market estimates and forecasts, 2018 - 2030

Fig. 46 Lipid testing market estimates and forecasts, 2018 - 2030

Fig. 47 Cancer marker estimates and forecasts, 2018 - 2030

Fig. 48 Blood gas/ electrolytes market estimates and forecasts, 2018 - 2030

Fig. 49 Ambulatory chemistry market estimates and forecasts, 2018 - 2030

Fig. 50 Drug of abuse (DoA) testing market estimates and forecasts, 2018 - 2030

Fig. 51 Autoimmune diseases market estimates and forecasts, 2018 - 2030

Fig. 52 Urinalysis/nephrology market estimates and forecasts, 2018 - 2030

Fig. 53 Point of care diagnostics market: end use movement analysis

Fig. 54 Point of care diagnostics market: end use outlook and key takeaways

Fig. 55 Clinics market estimates and forecasts, 2018 - 2030

Fig. 56 Pharmacy & retail clinics market estimates and forecasts, 2018 - 2030

Fig. 57 Physician office market estimates and forecasts, 2018 - 2030

Fig. 58 Urgent care clinics market estimates and forecasts, 2018 - 2030

Fig. 59 Non-practice clinics market estimates and forecasts, 2018 - 2030

Fig. 60 Hospitals market estimates and forecasts, 2018 - 2030

Fig. 61 Home market estimates and forecasts, 2018 - 2030

Fig. 62 Assisted living healthcare facilities market estimates and forecasts, 2018 - 2030

Fig. 63 Laboratory market estimates and forecasts, 2018 - 2030

Fig. 64 Global point of care diagnostics market: Regional movement analysis

Fig. 65 Global point of care diagnostics market: Regional outlook and key takeaways

Fig. 66 Global point of care diagnostics market share and leading players

Fig. 67 North America market share and leading players

Fig. 68 Europe market share and leading players

Fig. 69 Asia Pacific market share and leading players

Fig. 70 Latin America market share and leading players

Fig. 71 Middle East & Africa market share and leading players

Fig. 72 North America: SWOT

Fig. 73 Europe SWOT

Fig. 74 Asia Pacific SWOT

Fig. 75 Latin America SWOT

Fig. 76 MEA SWOT

Fig. 77 North America, by country

Fig. 78 North America

Fig. 79 North America market estimates and forecasts, 2018 - 2030

Fig. 80 U.S. key country dynamics

Fig. 81 U.S. market estimates and forecasts, 2018 - 2030

Fig. 82 Canada country dynamics

Fig. 83 Canada market estimates and forecasts, 2018 - 2030

Fig. 84 Europe

Fig. 85 Europe market estimates and forecasts, 2018 - 2030

Fig. 86 UK country dynamics

Fig. 87 UK market estimates and forecasts, 2018 - 2030

Fig. 88 Germany country dynamics

Fig. 89 Germany market estimates and forecasts, 2018 - 2030

Fig. 90 France country dynamics

Fig. 91 France market estimates and forecasts, 2018 - 2030

Fig. 92 Italy country dynamics

Fig. 93 Italy market estimates and forecasts, 2018 - 2030

Fig. 94 Spain country dynamics

Fig. 95 Spain market estimates and forecasts, 2018 - 2030

Fig. 96 Russia country dynamics

Fig. 97 Russia market estimates and forecasts, 2018 - 2030

Fig. 98 Denmark country dynamics

Fig. 99 Denmark market estimates and forecasts, 2018 - 2030

Fig. 100 Sweden country dynamics

Fig. 101 Sweden market estimates and forecasts, 2018 - 2030

Fig. 102 Norway country dynamics

Fig. 103 Norway market estimates and forecasts, 2018 - 2030

Fig. 104 Asia Pacific

Fig. 105 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 106 China country dynamics

Fig. 107 China market estimates and forecasts, 2018 - 2030

Fig. 108 Japan country dynamics

Fig. 109 Japan market estimates and forecasts, 2018 - 2030

Fig. 110 India country dynamics

Fig. 111 India market estimates and forecasts, 2018 - 2030

Fig. 112 Thailand country dynamics

Fig. 113 Thailand market estimates and forecasts, 2018 - 2030

Fig. 114 South Korea country dynamics

Fig. 115 South Korea market estimates and forecasts, 2018 - 2030

Fig. 116 Australia country dynamics

Fig. 117 Australia market estimates and forecasts, 2018 - 2030

Fig. 118 Latin America

Fig. 119 Latin America market estimates and forecasts, 2018 - 2030

Fig. 120 Brazil country dynamics

Fig. 121 Brazil market estimates and forecasts, 2018 - 2030

Fig. 122 Mexico country dynamics

Fig. 123 Mexico market estimates and forecasts, 2018 - 2030

Fig. 124 Argentina country dynamics

Fig. 125 Argentina market estimates and forecasts, 2018 - 2030

Fig. 126 Middle East and Africa

Fig. 127 Middle East and Africa market estimates and forecasts, 2018 - 2030

Fig. 128 South Africa country dynamics

Fig. 129 South Africa market estimates and forecasts, 2018 - 2030

Fig. 130 Saudi Arabia country dynamics

Fig. 131 Saudi Arabia market estimates and forecasts, 2018 - 2030

Fig. 132 UAE country dynamics

Fig. 133 UAE market estimates and forecasts, 2018 - 2030

Fig. 134 Kuwait country dynamics

Fig. 135 Kuwait market estimates and forecasts, 2018 - 2030

Fig. 136 Market share of key market players- Point of care diagnostics marketWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Point Of Care Diagnostics Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- Point Of Care Diagnostics End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- Point Of Care Diagnostics Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- North America End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- U.S.

- U.S. Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- U.S. End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- U.S. Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Canada

- Canada Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- Canada End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- Canada Product Outlook (Revenue in USD Billion, 2018 - 2030)

- North America Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Europe

- Europe Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- Europe End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- Germany

- Germany Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- Germany End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- Germany Product Outlook (Revenue in USD Billion, 2018 - 2030)

- U.K.

- U.K. Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- U.K. End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- U.K. Product Outlook (Revenue in USD Billion, 2018 - 2030)

- France

- France Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- France End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- France Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Italy

- Italy Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- Italy End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- Italy Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Spain

- Spain Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- Spain End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- Spain Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Russia

- Russia Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- Russia End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- Russia Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Denmark

- Denmark Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- Denmark End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- Denmark Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Sweden

- Sweden Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- Sweden End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- Sweden Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Norway

- Norway Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- Norway End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- Norway Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Europe Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Asia Pacific

- Asia Pacific Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- Asia Pacific End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- Japan

- Japan Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- Japan End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- Japan Product Outlook (Revenue in USD Billion, 2018 - 2030)

- China

- China Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- China End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- China Product Outlook (Revenue in USD Billion, 2018 - 2030)

- India

- India Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- India End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- India Product Outlook (Revenue in USD Billion, 2018 - 2030)

- South Korea

- South Korea Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

- South Korea End Use Outlook (Revenue in USD Billion, 2018 - 2030)

- Clinics

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Clinics

- South Korea Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Australia

- Australia Product Outlook (Revenue in USD Billion, 2018 - 2030)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- HIV POC

- Clostridium Difficile POC

- HBV POC

- Pneumonia or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV) POC

- HPV POC

- Influenza/Flu POC

- HCV POC

- MRSA POC

- TB and Drug-resistant TB POC

- HSV POC

- COVID-19

- Other Infectious Diseases

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases