- Home

- »

- Agrochemicals & Fertilizers

- »

-

Fertilizer Additives Market Size, Global Industry Report, 2020 - 2025GVR Report cover

![Fertilizer Additives Market Size, Share & Trends Report]()

Fertilizer Additives Market Size, Share & Trends Analysis Report By Function (Corrosion Inhibitors, Hydrophobic Agents), By End-product (Urea, Ammonium Nitrate), And Segment Forecasts, 2020 - 2025

- Report ID: GVR-2-68038-845-9

- Number of Pages: 129

- Format: Electronic (PDF)

- Historical Range: 2014 - 2018

- Industry: Bulk Chemicals

Report Overview

The global fertilizer additives market size was estimated at USD 3.25 billion in 2019 and is expected to grow at a CAGR of 3.1% over the forecast period. The robust growth of the fertilizer industry along with rising population & decreasing per capita arable land is expected to drive the demand.

The ability of the product to prevent loss of key nutrients such as phosphorous, sulfur, potassium and nitrogen is expected to augment the growth over the forecast period. Moreover, it is used during transportation and storage of fertilizers to inhibit the caking and corrosion. It is also used to prevent the moisture and lump formation in fertilizers, which are generally caused by the humid climatic condition.

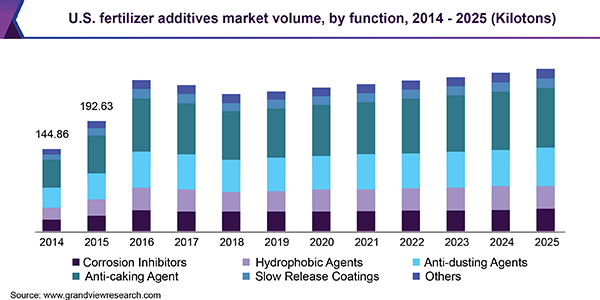

The U.S. is one of the major markets in North America. The country has witnessed a revival in the agricultural sector which has led to the growing demand. The product is most commonly used as an anti-caking agent in the U.S. due to variations in storage temperatures.

The nutrition level of fertilizers is enhanced by the utilization of additives as they help in reducing nitrogen, potassium, sulfur, and phosphorous ion losses caused due to immobilization, denitrification, leaching, and volatilization. Among all additives, nitrogen-based products are considered highly important as nitrogen is a very crucial component for the growth of a plant.

They are mixed with readily available or water-soluble fertilizers which enhances the ability of nitrogen ions to remain in the soil for a longer duration of time. These are added shortly before adding the fertilizer to the soil or during its manufacturing process.

The demand for fertilizer additives depends significantly on the consumption of fertilizers in the agrochemical market. The future growth of fertilizer additives, both from a volumetric perspective as well as a value-based standpoint, is highly dependent on harmonizing agricultural standards across the globe and the indoctrination of novel farming practices among farmers, especially in the economically backward regions of Africa, India, and Latin America. Going by empirical data on agricultural output, it is, highly evident that the rise in food demand is expected to drive the production of food, which, in turn, is likely to generate a demand for fertilizer additives across the industry.

Fertilizer Additive Market Trends

Fertilizer additives refer to chemicals that are added to fertilizers to improve their function or to make structural modifications. Changing agricultural practices and awareness regarding the quality & quantity of fertilizers is likely to fuel the utilization of additives in the coming years. Agriculture is a primary sector and is a major factor in determining the GDP of the economies such as India, China, Bangladesh, and, Sri Lanka. Leading market participants are Clariant, Filtra Catalysts & Chemicals Ltd., KAO Corporation, Novochem Group, and Solvay, among others.

Fertilizer additives are witnessing high demand globally due to the adoption of sustainable agriculture practices across emerging economies and attempts to enhance crop yield per hectare. Companies operational in the ecosystem are investing heavily in research & development activities to enhance the quality of feed additives and make them suitable for changing agricultural practices.

The technology trends in the market are influenced by the regulations and feedstock supply. A large number of players depend upon petroleum derivatives; they are expected to look out for new alternatives owing to the supply-demand imbalance. The bio-based fertilizer trend is expected to impact the process innovation and further manufacturing processes. The raw materials used in the manufacturing of fertilizer additives are inorganic chemicals. The popularity of these chemicals is expected to remain in the market owing to the lack of efficient alternatives. The stringent regulations imposed on organic chemicals have impacted their consumption in the manufacturing of fertilizer additives.

Fertilizers are used to improve the yield of soil. They can be classified into two types: organic and inorganic. Manure, fish meal, granite meal, and seaweed are organic fertilizers while nitrogen, phosphorous, and potassium are inorganic fertilizers. The ability of inorganic fertilizers to act faster as compared to organic fertilizers is likely to fuel their growth.

Lack of awareness is particularly evident in underdeveloped countries such as those in the African region and some countries in the Asia Pacific such as Bangladesh, Nepal, and Bhutan. The countries with traditional farming methods are also responsible for the lack of awareness about fertilizer additives. The rising government attention to losses associated with the storage and transportation of fertilizers is expected to impact the market. These factors are likely to create an obstacle to the growth of the fertilizer additives market. Overcoming these obstacles is going to be a challenge for both additive manufacturers and governments.

Moreover, consumption of water contaminated by the synthetic chemicals present in fertilizers additives and fertilizers can lead to various diseases, such as blue baby syndrome. Fertilizers comprise several chemicals such as carbon dioxide, nitrogen, methane, and ammonia. Their emission leads to global warming and global climate change. Nitrogen element is widely present in fertilizers. Nitrous oxide, which is its byproduct, is the third most significant gas, which contributes to the greenhouse effect after methane and carbon dioxide.

Covid-19 has had a significant impact on global businesses including the agricultural sector, agricultural inputs, fertilizers, and more. The majority of the Asia Pacific countries are agrarian economies and therefore the slowdown in businesses and momentary pause in cross-border trade has reflected a huge impact on the overall operations of companies and farmers, eventually leading to disruptions in the overall agricultural sector across all major countries worldwide.

The demand for crops is growing at a rapid pace driven by rising populations, increasing disposable income, and ongoing urbanization. These factors are a major feature of emerging economies such as Brazil, Russia, India, and China. These economies are also making strong commitments to tackle the problems associated with the rising population. The presence of a diverse agricultural sector in these countries is aiding the efforts of the local governments.

Function Insights

Anti-caking, anti-dusting, corrosion inhibitors, and anti-coating are some of the major functions of the product. The anti-caking function dominated the fertilizer additives market in 2018 as it is observed to be particularly important during monsoon. This is due to the fact that flakes are formed when they are stored during the monsoon season. Safe storage and the transportation of fertilizers is possible by using additives.

Anti-dusting was considered as the second most important function of the product in 2018. Anti-dusting is of utmost importance during the transportation and storage of fertilizers where there is a possibility of them getting exposed to dust.

Hydrophobic agents are also known as water repellents. They do not let moisture in the atmosphere affect the quality of fertilizers. Moisture is said to reduce the content of essential nutrients such as nitrogen, phosphorus, and potassium from fertilizers.

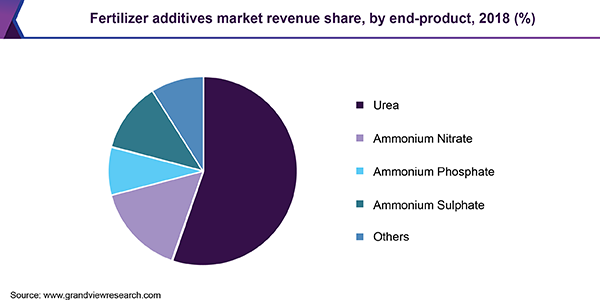

End-Product Insight

The end-product segment was dominated by urea in 2018. Urea is readily available and can be easily synthesized, making it the most commonly used nitrogenous fertilizer. Urea market is expected to witness growing demand from emerging countries such as India and Brazil. It is characterized by high nitrogen content, which has made it a popular option among farmers. Besides, it is easily available in the market and extensively used by farmers, particularly in the emerging Asia Pacific region.

Ammonium nitrate is one of the major sources of nitrogen because it contains both nitrate and ammonia. It has a high proportion of nutritional content and is cost-effective as compared to other nitrogenous product, which has led to its increased popularity among farmers. It is the second most commonly used nitrogenous product after urea. The popularity of ammonium nitrate has grown significantly in emerging economies of Asia Pacific and Latin America, which are considered to be price-sensitive regions. Growing demand for ammonium nitrate can be attributed to its low price and high nitrogen & ammonium content.

Ammonium phosphate has a high content of phosphorus, which is one of the macronutrients essential in fertilizers. However, it is known to take up moisture, both in the field as well as in storage. The hydrophobic properties of fertilizers are used to avoid these occurrences. Based on the application, there are two main grades of ammonium phosphate fertilizers available in the market, namely ammonium polyphosphates (APP) and diammonium phosphate (DAP).

Regional Insights

The Asia Pacific market indicates the highest CAGR of 3.3%, in terms of revenue, from 2018 to 2025. The growth of the agriculture sector in emerging economies such as China and India is projected to boost the demand for additives over the forecast period. Agriculture is a primary sector and is a major factor in determining the GDP of the economies in this region such as India, China, Bangladesh, and, Sri Lanka.

The growing population has decreased land for agriculture, thereby increasing the pressure on farmers and available land. These factors have increased the demand for fertilizers, thus, boosting the additives market. The agricultural sector in China has been witnessing innovations and technological developments over the past years. Due to the population explosion, the amount of arable land in China has reduced severely over the past two decades. This factor has increased the demand for fertilizers, resulting in the growth of the additives market. In 2019, China accounted for over one-fourth of the additive market in the Asia Pacific region.

North America is projected to grow at the second-highest CAGR in the forecasted year. The fertilizer additives market in North America is dominated by the U.S. Urea and ammonium nitrate were the most popular fertilizers in this region in 2018. Crop management planning has become a crucial part of the governments of countries across the region which in turn is likely to positively impact the growth of the fertilizer additives market in the coming years.

The U.S. dominates the North American fertilizer additives market and is the largest producer and exporter of phosphorus in the world. The country has witnessed significant growth in the demand for fertilizers, and in turn, fertilizer additives. Fertilizer additives were most commonly used as anti-caking agents in the U.S., due to variation in storage temperatures.

After the U.S., Canada is the second-largest consumer of fertilizer additives in the region. Anti-caking and anti-dusting agents dominate the additive market in the country. In addition, the cold climatic conditions of Canada facilitate the utilization of water repellants or hydrophobic agents. Moisture in the atmosphere degrades the contents of nutrients such as nitrogen, potassium, and phosphorus from fertilizers. Hence, the use of hydrophobic agents such as mixed aldehyde, polyethylene, and polypropylene is important. This in turn has created a positive influence on the consumption of hydrophobic agents in the country.

In Europe, abundant land availability and suitable weather conditions have facilitated the production of multiple crops. European Commission has set various regulations on the manufacturing and use of the product. For instance, it is mandatory for the additive manufacturers to take the approval of the active ingredients from the commission before launching a product.

The growing agriculture industry, supported by suitable weather conditions and land availability lead to the vast production of multiple crops across the region. The fertilizer additives market in Germany is driven by technological innovations in the agricultural sector as well as growing awareness about the benefits of using the product. The exponential growth of the urban population with the limited arable land area has played a huge role in the growth of the fertilizer additive market.

Key Companies & Market Share Insights

Ongoing research and development in the field of fertilizers have made the market highly consolidated. Leading participants such as KAO Corporation, Novochem Group, Clariant, Solvay, and Filtra Catalysts & Chemicals Ltd are investing in research & development to improve their product offering and acquire a large market share.

The other players such as Forbon Technology, ChemSol LLC, Michelman, Tolsa Group, and Amit Trading Ltd are also trying to expand their presence in the global market by engaging in mergers & acquisitions, collaboration & joint venture and new product development.

Fertilizer Additives Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 3.35 billion

Revenue forecast in 2025

USD 4.01 billion

Growth Rate

CAGR of 3.1% from 2019 to 2025

Base year for estimation

2019

Historical data

2014 - 2018

Forecast period

2020 - 2025

Quantitative units

Revenue in USD million and CAGR from 2020 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function, end-product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Germany, UK, France, Italy, China, Japan, India, Brazil

Key companies profiled

KAO Corporation, Novochem Group, Clariant, Solvay, and Filtra Catalysts & Chemicals Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments covered in the reportThis report forecasts revenue growth at a regional & country level and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research, Inc. has segmented the fertilizer additives market report on the basis of function, end-product and country:

-

Function Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Corrosion Inhibitors

-

Hydrophobic Agents

-

Anti-dusting Agents

-

Anti-caking Agent

-

Slow Release Coatings

-

Urea

-

Ammonium Nitrate

-

Ammonium Phosphate

-

Others

-

-

Others

-

-

End-product Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Urea

-

Ammonium Nitrate

-

Ammonium Phosphate

-

Ammonium Sulphate

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global fertilizer additives market size was estimated at USD 3.35 billion in 2019 and is expected to reach USD 3.45 billion in 2020.

b. The global fertilizer additives market is expected to grow at a compound annual growth rate of 3.1% from 2019 to 2025 to reach USD 4.01 billion by 2025.

b. Asia Pacific dominated the fertilizer additives market with a share of 59.5% in 2019. This is attributable to robust growth of agriculture sector in emerging economies such as China and India .

b. Some key players operating in the fertilizer additives market include KAO Corporation, Novochem Group, Clariant, Solvay, and Filtra Catalysts & Chemicals Ltd.

b. Key factors that are driving the market growth include robust growth of fertilizer industry along with rising population & decreasing per capita arable land.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."