- Home

- »

- Agrochemicals & Fertilizers

- »

-

Organic Fertilizers Market Size, Share, Growth Report, 2030GVR Report cover

![Organic Fertilizers Market Size, Share & Trends Report]()

Organic Fertilizers Market Size, Share & Trends Analysis Report By Source (Plant, Animal, Microbial), By Form (Dry, Liquid), By Crop Type (Oilseed & Pulses, Fruits & Vegetables), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-145-9

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Organic Fertilizers Market Size & Trends

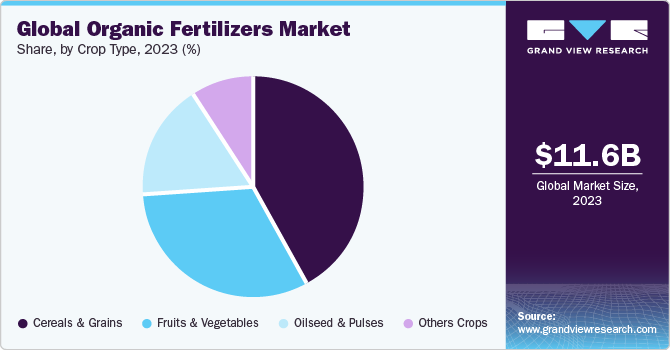

The global organic fertilizers market size was valued at USD 11.6 billion in 2023 and is expected to grow at a CAGR of 5.9% from 2024 to 2030. The market is expected to witness substantial growth from 2024 to 2030 owing to increasing awareness among people regarding the detrimental effects of synthetic chemicals on humans and the environment. In addition, there is a rising demand for the product with an increasing shift of people towards organic food, which, in turn, will boost the demand for organic agricultural practices globally. Organic fertilizers are generally made from residue or waste of plants, animals, and minerals. The plant-based sources include compost, alfalfa meal, soybean meal, and seaweed among others.

Whereas animal-based sources include manure, bone meal, blood meal, and fish meal among others. The product is getting promoted by various regulatory bodies at regional and international levels as it increases carbon sequestration in the soil and also helps in reducing greenhouse gas (GHG) emissions. Organic fertilizers improve soil health, resulting in better yields and less dependence on chemical fertilizers and pesticides. Furthermore, the product increases soil microbial activity, resulting in enhanced nutrient availability and improved plant growth. As they contain no synthetic chemicals, they are less likely to pollute the environment.

The major challenge faced by the product industry includes their comparatively less efficiency as compared to traditional and chemical-based products. Farmers in countries like Vietnam, which are more prone to climate change and global warming, find it difficult to rely entirely on organic products. Hence, some farmers use chemical as well as organic products to maximize their output. Other challenges involved in the market include establishing a consistent supply chain for high-quality organic raw materials. It can be challenging, especially in a region with limited organic waste management infrastructure. Moreover, the product distribution networks are often less developed compared to conventional products, limiting the accessibility of the farmers.

Market Concentration & Characteristics

The global market is moderately fragmented with many small- and large-scale players operating in the industry. This makes the market competitive with players focusing more on different strategies including product differentiation, mergers, acquisitions, and R&D. For instance, in 2022, Corteva Agriscience finalized the acquisition of Symborg, a Spanish company specializing in microbiological technologies. This strategic acquisition marks a significant step forward for Corteva’s ongoing effort to build a best-in-class biological portfolio, which it views as a crucial component of its integrated solution for farmers.

Key players are constantly involved in R&D for more effective and targeted products. For instance, in 2022, The Bangladesh Institute of Nuclear Agriculture (BINA) and ACI Biolife Fertilizer signed a Memorandum of Understanding for the development and testing of Trichoderma. With BINA's support, ACI Fertilizer is developing a Biofertilizer Lab at Jhikorgacha, Jessore.

Source Insights

The animal-based product segment dominated the market with a revenue share of 56.2% in 2023 owing to its excellent source of readily available nitrogen. Animal-based product is made using residue from animal slaughtering including bone and blood meal and animal manure. The animal-based product is rich in nitrogen content and hence is best suited for leafy plants. A few of the animal-based products include milk, urea (urine), and fish emulsion. Mineral-based products add nutrients to the soil and maintain the pH balance as per the plant growth. Some of the mineral-based products include calcium and Epsom salt.

The plant-based products are made from residue and agricultural by-products including cottonseed meal, cover crop, compost tea, seaweed, kelp, and green manure among others. In addition, the products work best when soil is biologically active and regularly enriched with compost, cover crops, and decomposing mulch.

Crop Type Insights

The cereals & grains application segment dominated the market with the highest revenue share of 42.3% in 2023. The product is majorly used for cereals and grains in North America and Asia Pacific owing to the high cultivation of wheat and corn in countries, such as China and the U.S. Moreover, as per the Organisation for Economic Co-operation and Development (OECD), by 2032, global cereal production is projected to grow by about 320 Mt, mostly due to maize and rice. This is further expected to drive product demand. The product demand is augmented by the rising consumption of cereal and grains like rice, corn, wheat, oats, sorghum, and barley in different regions.

The increasing focus of farmers on fruits and vegetables is expected to drive market growth. According to a report published by the Ministry of Agriculture & Farmers Welfare of India, production of fruits and vegetables in the country was 108.34 million tons in 2022-23 as compared to 107.51 million tons in the previous years. Thus, with increasing production of fruits and vegetables in countries with an agriculture-based economy is expected to drive product demand.

Form Insights

The dry form segment dominated the market with a revenue share of 68.1% in 2023 owing to their long shelf life and easy storage & transportation. Moreover, dry products allow the plant to gradually absorb nutrients, reducing the risk of burning or leaching. In addition, they also improve the soil structure and drainage over time due to organic matter content. The liquid form of the product is precisely applied through various methods.

Some of these methods include foliar spraying and drip irrigation, supporting precision farming practices. Liquid form applications are becoming more efficient and effective with the integration of digital technologies, such as precision agriculture tools and data analytics. Although dry products are less expensive as compared to liquid-form products, they are still required in larger amounts as the plants do not absorb them entirely.

Regional Insight

The organic fertilizers market in North America is expected to witness significant demand for products owing to the growing awareness of the negative environmental impact of chemical fertilizers. The United States Department of Agriculture (USDA) plays an important role in promoting the adoption of organic fertilizers in the region.

U.S. Organic Fertilizers Market Trends

The U.S. organic fertilizers market is experiencing significant growth driven by increasing consumer demand for sustainable and eco-friendly bio-based products. Consumers in the country are becoming more aware of the potential threat of conventional fertilizers on their health and environment. In addition, the government is conducting various programs to promote the use of organic fertilizers. For instance, the National Organic Program (NOP) sets the standards for organic food production and certification. California Organic Fertilizers is one of the major players in the product market in the U.S. offering a wide variety of products. Apart from this, Dr. Earth and Espoma are a few of the major players operating in the market.

Asia Pacific Organic Fertilizers Market Trends

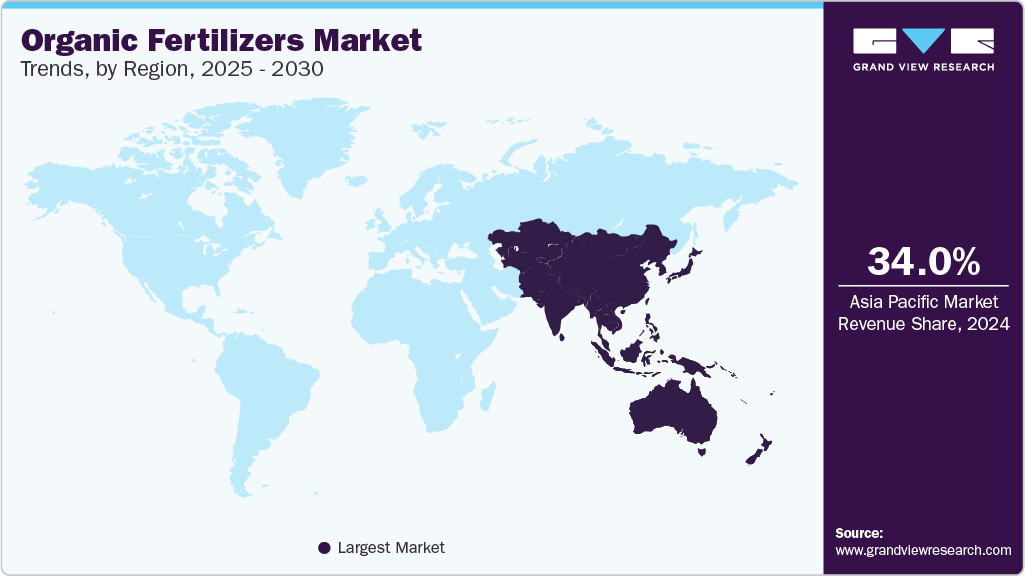

The organic fertilizers market in Asia Pacific dominated the global industry with a revenue share of 40.15% in 2023, which is attributed to rising awareness among farmers about the benefits of bio-based and organic residue-based fertilizers.

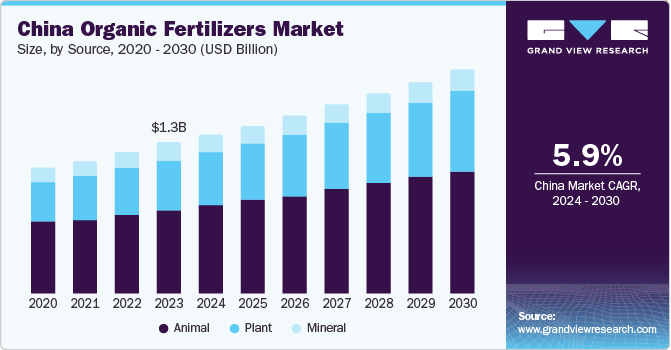

The China organic fertilizers market is the largest product manufacturer and consumer owing to the presence of large- and small-scale manufacturers. Moreover, increasing investments related to the bio-fertilizers are driving its production in the country. For instance, in August 2023, Biolchim SPA, a leading organic fertilizer company from Italy, announced a partnership with a Chinese Company to build a new product manufacturing plant, which is expected to be operational by 2025.

The organic fertilizers market in India is a developing market for bio-based products with ongoing R&D activities in the region. For instance, as per a report published by the government of India, the Indian Council of Agricultural Research (ICAR) has developed efficient strains of products, which are effective for different crops and soil types. This will further increase the crop yield by 10-20%

The Vietnam organic fertilizers market will witness considerable growth in the future as Vietnam is one of the leading agricultural product manufacturers globally. Around 40% of the country’s total land is dedicated to agricultural production where agri-based production contributes to around 18% of the country’s GDP as per the Food & Agriculture Organization of the United States in 2023. The increasing government interest in the country towards sustainable or bio-based alternatives is further expected to drive product demand. For instance, Vietnam had been selected by the U.S. to host the 4th global conference of the Sustainable Food System Programme in April 2023 to discuss the sustainable, resilient, healthy, and inclusive food system.

Europe Organic Fertilizers Market Trends

The organic fertilizers market in Europe is experiencing significant growth due to the easy availability of manure remains, which is the most widely used bio-based product.

The Germany organic fertilizers market is likely to have lucrative growth owing to the rising inclination of regulatory bodies towards sustainable products. For instance, the EU's Nitrate Directive and Organic Farming Regulation sets high standards for fertilizer use, further pushing the market towards organic products. In addition, companies operating in Germany producing bio-based products have to adhere to European regulation (EC) No. 889/2008, which refers to all substances (in products) that may be used as input in organic production in the European Union.

Central & South America Organic Fertilizers Market Trends

The organic fertilizers market in Central & South America is a prominent and dominating market due to the presence of emerging countries, such as Brazil and Argentina. Moreover, large-scale production of soybeans, pulses, and sugarcane in the region will support market growth.

The Brazil organic fertilizers market will haveconsiderable growth in the future. Brazil is the world's largest soybean exporter and the second-largest soybean producer. Soybean is exported to 48 countries and occupied 4.5% of the total arable area of Brazil in 2022. The product demand in Brazil is expected to witness rapid growth owing to a rise in the variety of grains production and consumption like soybeans, cotton, beans, maize, rice, wheat, sorghum, rye, sunflowers, peanut millet, and oilseeds that provide valuable oils, vegetable proteins, and fibers for both humans and animals.

Middle East & Africa Organic Fertilizers Market Trends

The organic fertilizers market in Middle East & Africa is projected to witness lucrative growth from 2024 to 2030 as the consumption of bio-based products is increasing in this region due to rapidly growing agriculture sector.

The South Africa organic fertilizers market will show significant growth in the coming years. The country’s agriculture sector is one of the most diverse sectors consisting of private and corporate-intensive and extensive crop farming systems. According to the U.S. Department of Agriculture (USDA), oilseed production in the country witnessed an upward trend and is expected to account for 2.9 million metric tons in 2022/2023. This growth is driven by increased oilseed prices, local demand-pull, and higher-yielding bio-based products in the country.

Key Organic Fertilizers Company Insights

Some of the key players operating in the market include Rizobacter Argentina S.A, Lallemand Inc., National Fertilizers Limited, T Stanes & Company Limited, and Madras Fertilizers Limited among others.

- The market has been dynamic with the presence of multiple key participants that have been actively engaged in strategic mergers & acquisitions, regional expansion, product developments, and more. For instance, companies, such as Corteva Agrisciences, invested in the acquisition of small-scale players to develop the biological portfolio. These factors are observed to have positively impacted globally

Key Organic Fertilizers Companies:

The following are the leading companies in the organic fertilizers market. These companies collectively hold the largest market share and dictate industry trends.

- PT Pupuk Kalimantan Timur

- Lallemand Inc.

- T Stanes & Company Limited

- Madras Fertilizers Limited

- Cropmate Fertilizers Sdn Bhd

- Midwestern BioAg

- Biostar Renewables, LLC

- NatureSafe

- Biolchim Spa

- Rizobacter Argentina S.A.

- National Fertilizers Limited

- Gujarat State Fertilizers & Chemicals Ltd.

- String Bio

- Rashtriya Chemicals & Fertilizers Ltd

- Agrinos

- Biomax Naturals

- Symborg (Corteva Agriscience)

Recent Developments

-

In January 2023, Sumitomo Chemicals, a global chemical company announced its decision to acquire FBSciences Holding, Inc., which is a leading U.S.-based company specializing in biostimulants and naturally derived agricultural material. The acquisition aimed at strengthening the company’s position in the market, providing innovative and eco-friendly solutions to farmers

-

In November 2023: WRMS launched SecuFarm Vermicompost, an environmentally friendly agrochemical. This organic fertilizer enriched with humus and essential plant nutrients improves soil structure and strengthens roots

Organic Fertilizers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.2 billion

Revenue forecast in 2030

USD 17.2 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, form, crop type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; Russia; China; India; Japan; Vietnam, South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

PT Pupuk Kalimantan Timur; Lallemand Inc.; T Stanes & Company Ltd.; Madras Fertilizers Ltd.; Cropmate Fertilizers Sdn Bhd; Midwestern BioAg; Biostar Renewables, LLC; NatureSafe; Biolchim Spa; Rizobacter Argentina S.A.; National Fertilizers Ltd.; Gujarat State Fertilizers & Chemicals Ltd.; String Bio, Rashtriya Chemicals & Fertilizers Ltd.; Agrinos Biomax Naturals Agriscience

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Fertilizers Market Report Segmentation

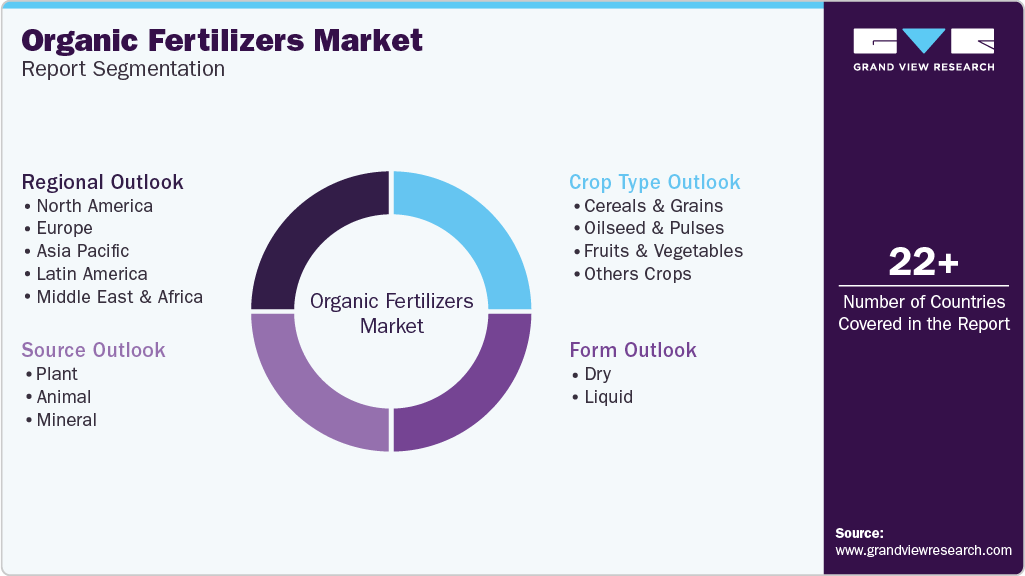

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organic fertilizers market report based on source, form, crop type, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plant

-

Compost

-

Seaweed

-

Cottonseed Meal

-

Other Products

-

-

Animal

-

Blood/ Bone Meal

-

Manure

-

Fish Meal

-

Other Products

-

-

Mineral

-

Green Sand

-

Rock Phosphate

-

Other Products

-

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Dry

-

Liquid

-

-

Crop Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseed & Pulses

-

Fruits & Vegetables

-

Others Crops

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global organic fertilizers market size was estimated at USD 11.30 billion in 2022 and is expected to reach USD 11.94 billion in 2023.

b. The global organic fertilizers market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 17.84 billion by 2030.

b. Asia Pacific dominated the organic fertilizers market with a share of over 34% in 2022. This growth is attributed to the advancing agricultural industry in the region.

b. Some key players operating in the organic fertilizers market include PT Pupuk Kalimantan Timur, Lallemand Inc., T Stanes & Company Limited, Madras Fertilizers Limited, Cropmate Fertilizers Sdn Bhd, Midwestern BioAg, Biostar Renewables, LLC, NatureSafe, Biolchim Spa

b. Key factors that are driving the market growth is attributed to the increasing awareness and concern about the negative environmental impacts of synthetic fertilizers. These are derived from natural sources and are considered more environmentally friendly. They promote sustainable agriculture practices by reducing soil and water pollution, preserving biodiversity, and improving soil health.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."