- Home

- »

- Organic Chemicals

- »

-

Ammonium Nitrate Market Size, Share, Industry Report, 2033GVR Report cover

![Ammonium Nitrate Market Size, Share & Trends Report]()

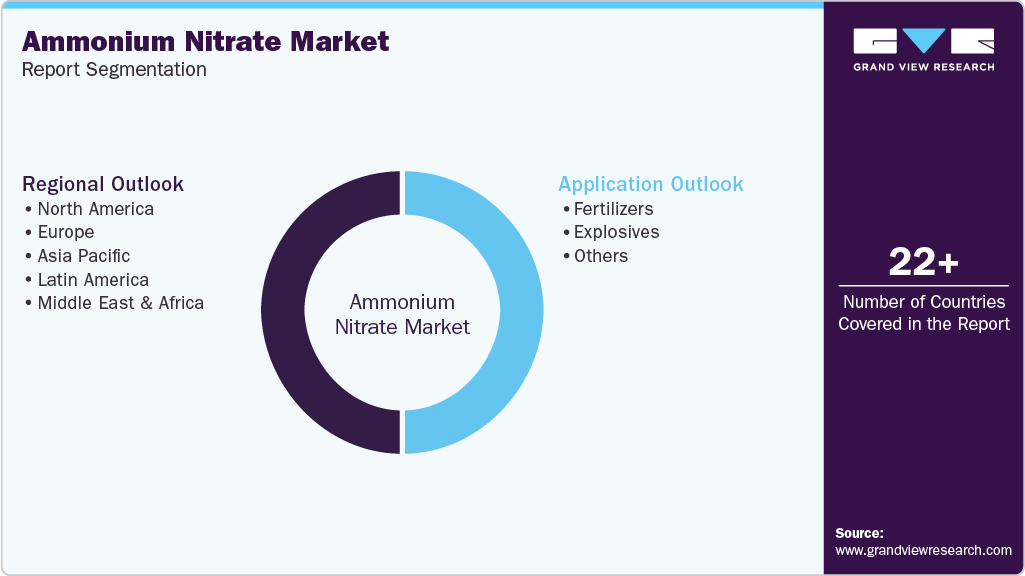

Ammonium Nitrate Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Fertilizers, Explosives, Others), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-2-68038-263-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ammonium Nitrate Market Summary

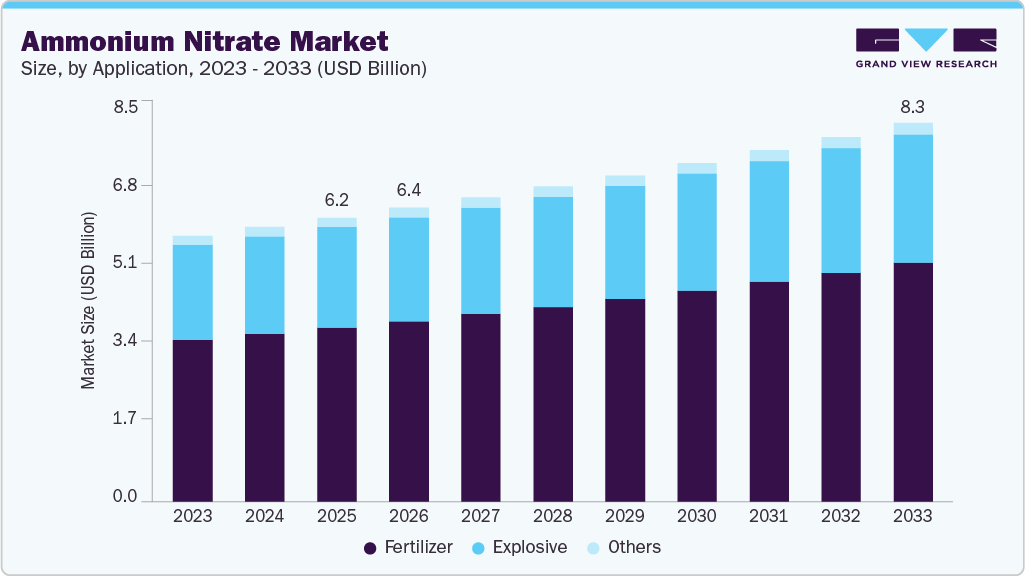

The global ammonium nitrate market size was estimated at USD 6,181.2 million in 2025 and is projected to reach USD 8,250.8 million by 2033, growing at a CAGR of 3.7% from 2026 to 2033. Market growth is primarily driven by rising demand for high-nitrogen fertilizers to enhance agricultural productivity amid growing food security concerns.

Key Market Trends & Insights

- Europe dominated the ammonium nitrate market with the largest revenue share of 42.6% in 2025.

- The market in China is expected to grow at the highest CAGR of 4.9% from 2025 to 2033.

- By application, the fertilizer segment held the largest revenue share of 61.2% in 2025 in terms of value.

Market Size & Forecast

- 2025 Market Size: USD 6,181.2 Million

- 2033 Projected Market Size: USD 8,250.8 Million

- CAGR (2026-2033): 3.7%

- Europe: Largest market in 2025

- Asia Pacific: Fastest growing market

Within the broader product landscape, products linked to the calcium and urea ammonium nitrate industry, and limestone ammonium nitrate LAN market continue to support overall demand due to their wide usage in modern farming practices. In addition, increasing mining and construction activities, particularly in developing economies, are driving product consumption for explosives applications. The global market presents strong growth opportunities, supported by the rising need for efficient and sustainable fertilizer solutions. Advances in fertilizer formulations and application technologies relevant across the urea ammonium nitrate industry and other derivatives are improving nutrient efficiency and safety. At the same time, expanding mining operations and large-scale infrastructure projects in the Asia Pacific, Latin America, and Africa are expected to reinforce long-term demand for ammonium nitrate-based blasting agents, further strengthening market growth.

Despite its extensive applications, the global market faces challenges from stringent regulations related to production, storage, and transportation, driven by safety and security concerns. Environmental issues such as nitrogen runoff and groundwater contamination are also influencing usage patterns, including those associated with the limestone ammonium nitrate (LAN) market. Moreover, fluctuations in raw material prices and geopolitical instability in key producing regions can affect supply chains and pricing dynamics across the market.

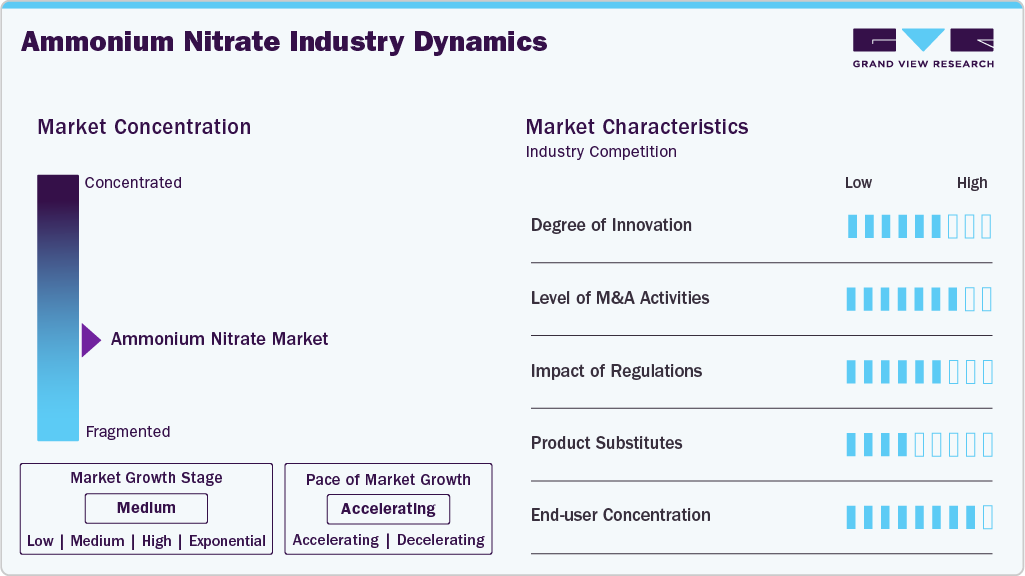

Market Concentration & Characteristics

The ammonium nitrate industry is moderately fragmented, with a limited number of global players, including Orica Limited, Incitec Pivot Limited, Neochim PLC, and URALCHEM holding a significant share. These companies benefit from scale, integrated operations, and diversified portfolios that include both fertilizer and industrial grades. Niche applications, such as those associated with the ceric ammonium nitrate industry, further reflect the breadth of product usage without altering the market’s core structure.

Leading players in the industry are focusing on capacity expansions, strategic partnerships, and geographic diversification to strengthen their competitive positions. Investments in modernized manufacturing facilities and compliance-driven upgrades are helping companies improve efficiency and align with regulatory requirements. Additionally, long-term supply agreements with agricultural and mining customers are supporting sustained growth across the market, including demand influenced by the calcium and the urea ammonium nitrate industries.

Application Insights

The fertilizers segment accounted for the largest revenue share of 61.2% in 2025, driven by ammonium nitrate’s high nitrogen content and rapid nutrient availability, which make it highly effective for improving crop yields. As global food demand continues to rise, particularly in densely populated and agriculture-dependent regions such as the Asia Pacific and Latin America, ammonium nitrate remains a critical input for nitrogen-intensive crops, including corn, wheat, and rice. Government-backed agricultural subsidy programs and fertilizer support initiatives in major consuming countries such as India and China have further reinforced the segment’s dominance.

Moreover, the growing emphasis on maximizing agricultural output per unit of land, in response to shrinking arable acreage and increasing climate variability, has accelerated the adoption of efficient, high-performance fertilizers. Ammonium nitrate’s flexibility in both standalone applications and blended formulations, including NPK combinations, has broadened its use across diverse crop types and soil conditions. Rising awareness among farmers regarding balanced nutrient management continues to support sustained demand within this segment.

Regional Insights

The Europe ammonium nitrate market operates within a highly regulated framework focused on safety, sustainability, and environmental compliance, accounting for the largest regional revenue share of 42.6% in 2025. While fertilizer demand faces pressure from the European Union’s push toward greener agricultural practices under the Farm to Fork Strategy, ammonium nitrate remains relevant in precision farming systems and controlled nutrient applications. Meanwhile, demand from the explosives segment remains stable, supported by construction, tunneling, and mining activities across Central and Eastern Europe.

Germany Ammonium Nitrate Market Trends

The ammonium nitrate market in Germany is growing significantly, as the product consumption is largely concentrated in specialized fertilizer applications aligned with precision agriculture and regulated nutrient management. Although overall fertilizer use has declined due to strict environmental policies and nitrogen application limits under the EU Nitrates Directive, demand remains resilient in high-value crop cultivation and greenhouse farming.

Asia Pacific Ammonium Nitrate Market Trends

The ammonium nitrate market in the Asia Pacific held the second-largest revenue share at 26.2% in 2025, supported by its vast agricultural base and accelerating infrastructure development. Strong reliance on nitrogen-based fertilizers to sustain crop productivity, particularly in India, China, and Indonesia, continues to underpin demand in the fertilizer segment. At the same time, expanding mining and construction activities, especially in Southeast Asia and Australia, are driving steady consumption of ammonium nitrate for explosives applications.

China ammonium nitrate market remains one of the largest consumers globally, supported by extensive agricultural activity and robust domestic production capacity. The country’s reliance on nitrogen-rich fertilizers to maintain high yields in staple crops such as rice, wheat, and corn, combined with continued investments in mining, infrastructure, and industrial development, sustains strong overall demand.

North America Ammonium Nitrate Market Trends

The ammonium nitrate market in North America is characterized by steady demand across both agricultural and mining applications, supported by mature infrastructure and a well-established regulatory environment. The region’s mining sector, particularly in Canada and the western United States, continues to drive consumption for explosives. While environmental regulations have curtailed their use in certain agricultural applications, demand for high-efficiency fertilizers remains intact, particularly in large-scale commercial farming operations.

The U.S. ammonium nitrate market demand is primarily driven by mining and construction, where it serves as a key component in industrial explosives. Although agricultural use is subject to tighter regulatory oversight due to environmental and safety concerns, large farming states such as Iowa, Illinois, and Nebraska continue to utilize ammonium nitrate for specific crop requirements. Strong enforcement of safety standards under the Chemical Facility Anti-Terrorism Standards (CFATS) has also prompted investments in advanced storage, handling, and distribution technologies.

Latin America Ammonium Nitrate Market Trends

The ammonium nitrate market in Latin America is emerging as a high-potential market, driven by agricultural expansion and the region’s mineral-rich landscape. Countries such as Brazil and Argentina are increasingly adopting high-efficiency fertilizers to improve yields in major crops, including soybeans, corn, and sugarcane, supporting steady demand growth.

Middle East & Africa Ammonium Nitrate Market Trends

The ammonium nitrate market in the Middle East & Africa is experiencing moderate growth, largely supported by rising demand from mining and infrastructure projects, particularly in South Africa and North Africa. Fertilizer consumption is gradually increasing in countries such as Egypt and Morocco, backed by government-led agricultural intensification initiatives. However, arid climatic conditions and limited arable land continue to constrain broader fertilizer adoption across the region.

Key Ammonium Nitrate Company Insights

The market is dominated by established players, including Orica, Incitec Pivot Limited, Neochim PLC, URALCHEM, San Corporation, CF Industries Holdings, Inc., EuroChem Group AG, and Austin Powder Company, which benefit from scale, integrated operations, and diversified end-use exposure.

-

Orica

-

Orica remains a leading multinational, leveraging its global footprint to supply both fertilizer-grade and industrial ammonium nitrate across more than 100 countries. The company has made significant investments in innovation, introducing smart blasting solutions such as ORBS, i-kon III digital detonators, and the Velocity Suite to enhance safety, operational efficiency, and environmental performance in mining. Strategic collaborations, including a low-carbon technical ammonium nitrate initiative with Fertiberia across Europe, the Middle East, and Africa, and a modular ammonium nitrate plant in Western Australia developed with Yara, highlight Orica’s focus on sustainability and localized production. Additionally, its Nitrate Risk Reduction framework, implemented at De Beers’ Gahcho Kué mine in Canada, achieved a 79% reduction in nitrate runoff, underscoring the company’s leadership in environmentally responsible blasting solutions.

-

Key Ammonium Nitrate Companies:

The following are the leading companies in the ammonium nitrate market. These companies collectively hold the largest Market share and dictate industry trends.

- Orica

- Incitec Pivot Limited

- Neochim PLC

- URALCHEM

- San Corporation

- CF Industries Holdings, Inc.

- EuroChem Group AG

- Austin Powder Company

- Vijay Gas Industry P Ltd.

- OSTCHEM Holding

Ammonium Nitrate Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 6,394.9 million

Revenue forecast in 2033

USD 8,250.8 million

Growth rate

CAGR of 3.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; MEA; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Ukraine; Poland; China; Japan; India; South Korea; South Africa; Saudi Arabia; Egypt; Brazil; Argentina

Key companies profiled

Orica; Incitec Pivot Limited; Neochim PLC; URALCHEM; San Corporation; CF Industries Holdings, Inc.; EuroChem Group AG; Austin Powder Company; Vijay Gas Industry P Ltd.; OSTCHEM Holding

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ammonium Nitrate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global ammonium nitrate market report based on application and region:

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2021 - 2033)

-

Fertilizers

-

Explosives

-

Others

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Ukraine

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Egypt

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global ammonium nitrate market size was estimated at USD 6,181.2 million in 2025 and is expected to reach USD 6,394.9 million in 2026.

b. The global ammonium nitrate market is expected to grow at a compound annual growth rate of 3.7% from 2026 to 2033 to reach USD 8,250.8 million by 2030.

b. The fertilizers segment held the largest revenue share in 2025 due to the high global demand for nitrogen-rich fertilizers to boost crop yields amid rising food security concerns and expanding agricultural activities, particularly in Asia Pacific and Latin America. Ammonium nitrate’s fast-acting nitrogen release and compatibility with various soil types made it a preferred choice for intensive farming practices.

b. Some of the key players operating in the ammonium nitrate market include Orica, Incitec Pivot Limited, Neochim PLC, URALCHEM, San Corporation, CF Industries Holdings, Inc., EuroChem Group AG, Austin Powder Company, Vijay Gas Industry P Ltd, and OSTCHEM Holding.

b. Market growth is driven by the rising demand for high-efficiency nitrogen fertilizers to enhance agricultural productivity and the increasing use of ammonium nitrate-based explosives in mining and infrastructure development. Government support through subsidies and expansion of industrial activities in emerging economies further accelerates market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.