- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Float Glass Market Size, Share, Trends Analysis Report 2030GVR Report cover

![Float Glass Market Size, Share & Trends Report]()

Float Glass Market Size, Share & Trends Analysis Report By Product (Clear, Reflective, Tinted, Mirror), By End-use (Building & Construction, Energy), By Region (Asia Pacific, Africa), And Segment Forecasts, 2023 - 2031

- Report ID: GVR-4-68040-107-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The global float glass market size was estimated at USD 45.03 billion in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2031. The penetration of the product has expanded from exteriors to interiors. It finds application in flooring, ceiling, reflective & coated windows, tabletops, mirrors, and furniture. In addition, the growing product usage in the automotive & transportation industry is expected to drive market growth over the next seven years. Increasing disposable income coupled with industrialization in emerging economies is primarily expected to be a critical factor driving market growth over the projected period.

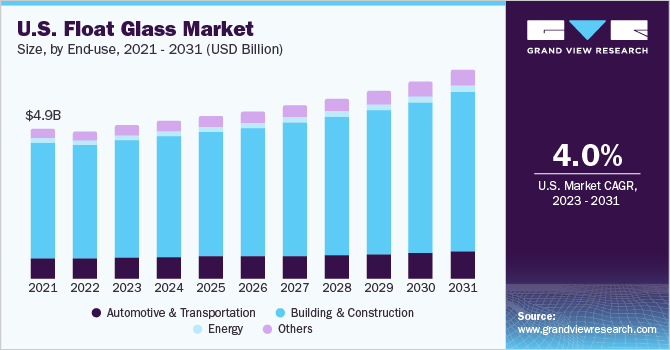

The U.S. is a significant consumer of the product market worldwide, owing to high demand and consumption by the construction and automotive industries in the country. In addition, the increasing production of electric vehicles (EVs) in the country due to the shift toward heightened environmental concerns further boosts market growth. According to the Federal Reserve Board, motor vehicle and parts production in the U.S. increased to 7.8% in March 2022 from 4.6% in February 2022. In March 2022, the total production units of light trucks and cars rose from 8.3 million vehicles in February 2022 to around 9.5 million.

Construction is one of the world’s largest end-use industries in the market. It possesses high strength and quality and offers unique characteristics, such as protection from UV rays, resistance to temperature change, processing into safety glass, and robustness against scratches. These characteristics make it an ideal material for high-rise buildings’ windows, interior partitions, façades, curtain walls, etc. Thus, rising investments in developing high-rise buildings across the globe have become a significant driver for the market’s growth. AI is a key technology that has the potential to revolutionize the industry by unlocking new opportunities, such as automation, enabling better quality control, and improving the production process.

Apart from the product’s manufacturing process, AI also finds scope in applications. The product is enabled with intelligence due to smart functionalities and sensors. These intelligence technologies help produce self-tinting glass, touch-sensitive, and dynamic displays, among others. The fluctuations often hinder market growth & the prices of raw materials. Volatility in raw material prices puts pressure on manufacturers to increase the costs of their products, thereby affecting their usage in various end-use industries. For instance, the recent Russia-Ukraine war caused an energy crisis across the globe. It negatively impacted the costs of float glass as energy prices spiked and further impacted its consumption in end-use applications.

End-use Insights

Based on end-uses, the building & construction segment accounted for the largest revenue share of over 78.0% in 2022. This trend is anticipated to continue over the forecast period. The segment growth can be attributed to a rising emphasis on using energy-efficient materials and sustainable construction practices. Low-E coatings and solar glass have witnessed high demand in recent years as they help reduce energy consumption. Leading architectural & landscape design and structural engineering firms highly prefer high-quality float glass for exterior applications. Rising investments in the construction of housing units in the emerging economies of the Asia Pacific and Middle East regions are anticipated to propel the product demand in this segment over the forecast period. Float glass is of vital significance in the automotive & transportation industry as well.

Favorable policies by governments worldwide are benefiting the industry. The increasing consumer preference toward good design, aesthetics, comfort, and safety are propelling the product demand. Asia Pacific is the largest automotive market in the world, with China accounting for the major share of global vehicle production in 2022. According to the Ministry of Industry and Information Technology of the country, China is the world’s largest vehicle market in terms of both manufacturing output and sales. Domestic production is projected to reach 35 million units by 2025. The rising investment in automotive production and the adoption of sustainable production practices are expected to further augment market growth. These factors are expected to boost the growth of the automotive & transportation segment.

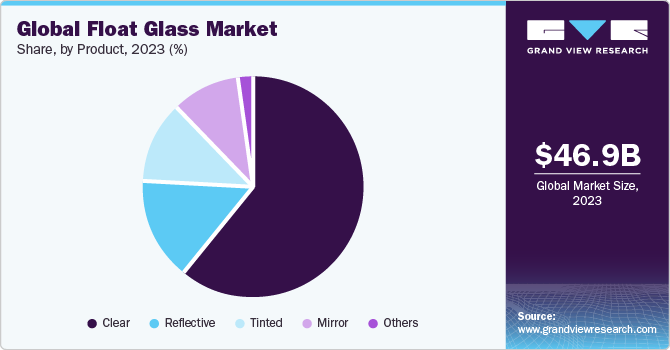

Product Insights

Based on products, the clear glass segment accounted for a revenue share of over 61.0% in 2022 and is anticipated to continue growing over the forecast period. This growth can be attributed to various characteristics of clear glass, such as transparency, uniformity, flatness, thickness, and surface finishing. The growing product demand is encouraging manufacturers to increase their production. For instance, Shandong Glass Tech Industrial Co., Ltd., a China-based company, has partnered with LISEC, a float glass machinery manufacturer, to enhance the former’s machinery and upgrade the production process with advanced technology that improves the quality of the product and increases efficiency.

The contract for the partnership was agreed upon in 2022 to set up a new LISEC production line, and the operations began in March 2023. The growing popularity of clear glass and the introduction of better-quality products in the market is anticipated to increase its demand over the forecast period. The demand for tinted glass is anticipated to increase owing to the growing demand for façades in buildings, particularly in offices and commercial buildings. It has become an integral part of new-age architectural design, and its demand is expected to grow with changes in the preferences of end-users.

The increasing importance of sustainable architecture and green building practices further propels the demand for tinted glass. For instance, eyrise, a liquid crystal technology brand of Merck KGaA, is providing solar shading glasses for a renovation project to promote sustainable reshaping of the existing commercial space. The project is underway for new external façades utilizing dynamic liquid crystal tinted glazing, which is as per the WELL Building Standard certification and provides solar protection without compromising natural sunlight.

Regional Insights

Asia Pacific dominated the global industry and accounted for over 63.0% revenue share of the global market in 2022. The regional market is projected to expand further at the fastest CAGR during the forecast period. This high share and rapid growth can be attributed to the increasing requirements across various industries, such as residential & commercial construction, automotive & transportation, energy, and electronics. The construction industry in the region has witnessed significant growth over the past few years owing to ongoing industrial development, coupled with its flourishing economies.

The rising construction activities of private and government high-rise buildings are expected to fuel the market growth in the region in the coming years. Furthermore, Asia Pacific countries are aiming to reduce their carbon emissions by shifting their focus toward solar energy. For instance, in October 2022, the government of Bangladesh set an ambitious target to generate 2,277 MW of energy from solar sources by 2030. Similarly, Singapore set a target to generate 2 GW of solar energy by 2030. These developments indicate a positive outlook with respect to the consumption of float glass in the solar industry over the forecast period.

The Middle East & Africa market is anticipated to grow significantly over the forecast period owing to the rising investments in construction activities and automotive production facilities. For instance, in May 2023, Oman’s Sultan Haitham announced the initiation of a new urban project near Muscat, referred to as Sultan Haitham City. The primary objective of this project is to offer affordable housing options for low-income citizens. Upon its completion, the city will have the capacity to accommodate up to 100,000 residents. It will be equipped with essential facilities, including educational institutions, places of worship, healthcare centers, a university, and shopping centers.

Key Companies & Market Share Insights

The key players engage in mergers & acquisitions, capacity expansions, and R&D activities to stay ahead of their competitors. For instance, in May 2023, China Triumph International Engineering Co., Ltd. (CTIEC) announced plans to construct a float glass manufacturing facility with a capacity of about 1,200 tons per day in Indonesia. CTIEC is constructing the facility on behalf of KCC Group, a South Korean building materials and coating production company. Some of the prominent players in the global float glass market include:

-

AGC Inc.

-

Asahi India Glass Ltd.

-

Cardinal Glass Industries, Inc.

-

Central Glass Co., Ltd.

-

Guardian Industries

-

Fuyao Glass Industry Group Co., Ltd.

-

Nippon Sheet Glass Co. Ltd.

-

Saint-Gobain S.A.

-

SCHOTT Group

-

Şisecam Group

-

Viracon

-

Xinyi Glass Holdings Ltd.

Float Glass Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 46.43 billion

Revenue forecast in 2031

USD 67.30 billion

Growth rate

CAGR of 4.6% from 2023 to 2031

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2031

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2031

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; GCC; South Africa

Key companies profiled

AGC Inc.; Asahi India Glass Ltd.; Cardinal Glass Industries, Inc.; Central Glass Co., Ltd; Fuyao Glass Industry Group Co., Ltd.; Guardian Industries; Nippon Sheet Glass Co. Ltd.; Saint-Gobain S.A.; SCHOTT Group; Şisecam Group; Viracon; Xinyi Glass Holdings Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Float Glass Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2031. For this study, Grand View Research has segmented the global float glass market report on the basis of product, end-use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2031)

-

Clear

-

Tinted

-

Reflective

-

Mirror

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2031)

-

Automotive & Transportation

-

Building & Construction

-

Energy

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2031)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East

-

GCC

-

-

Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global float glass market size was estimated at USD 45.03 billion in 2022 and is expected to reach USD 46.43 billion in 2023.

b. The global float glass market is expected to grow at a compound annual growth rate of 4.6% from 2023 to 2031 to reach USD 67.30 billion by 2031.

b. By product, clear glass dominated the market with a revenue share of over 61.0% in 2022.

b. Some of the key vendors of the global float glass market are AGC Inc, Asahi India Glass Limited, Central Glass Co., Ltd., Fuyao Glass Industry Group Co., Ltd, Guardian Industries, Nippon Sheet Glass Co. Ltd, Saint-Gobain S.A., Şisecam Group, among others.

b. The key factor driving the growth of the global float glass market is the rising investments in developing high-rise buildings and the growing automotive industry worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."