- Home

- »

- Automotive & Transportation

- »

-

Freight Transport Market Size, Share & Growth Report, 2030GVR Report cover

![Freight Transport Market Size, Share & Trends Report]()

Freight Transport Market (2022 - 2030) Size, Share & Trends Analysis Report By Offering (Solution, Services), By Mode Of Transport, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-008-3

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Freight Transport Market Summary

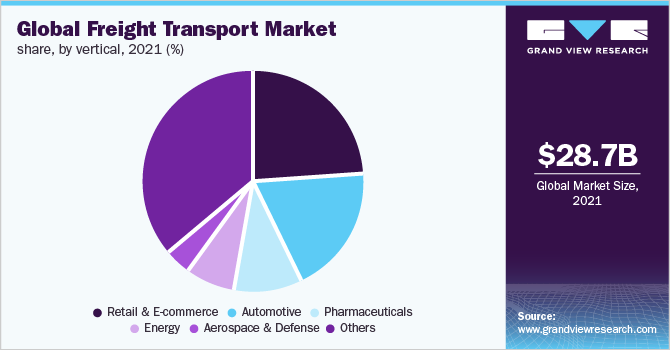

The global freight transport market size was estimated at USD 28.66 billionin 2021 and is projected to reach USD 72.97 billion by 2030, growing at a CAGR of 11.3% from 2022 to 2030. The growth of the market is attributed to the reasonable shipping prices assigned by freight transport service providers and various free trade agreements among countries.

Key Market Trends & Insights

- North America led the overall market in 2021 and is anticipated to retain its dominance during the forecast period.

- Asia-Pacific is expected to develop substantially by the projection period and expand at the highest CAGR throughout the forecast period.

- In terms of offering, the market is classified into solutions and services. The service segment held the major revenue share in 2021.

- Based on the mode of transport, the freight transport market has been segmented into roadways, railways, waterways, and airways.

Market Size & Forecast

- 2021 Market Size: USD 28.66 Billion

- 2030 Projected Market Size: USD 72.97 Billion

- CAGR (2022-2030): 11.3%

- North America: Largest market in 2021

For example, the European Union signed a comprehensive economic trade agreement with Canada. Under this agreement, the Canadian government is eradicating 98% of tariffs on the European goods traded between Europe and Canada. Such agreements contribute to the growth of the freight transport market by reducing commodity prices, which automatically increases the demand for freight transportation. End-users and manufacturers in emerging countries such as India lack the internal control required for addressing logistics issues, which can be addressed by using various freight transportation management solutions, such as fleet tracking & maintenance, security & monitoring system, warehouse management system, and 3PL solutions. This factor fuels the growth of the overall target market.

Further, the growth of e-commerce and entrepreneurial ventures has propelled the demand for specialized freight transport and supply chain execution capabilities. Shippers gain benefits from contracting freight transport services through the reduction in logistics costs, inventory costs, and fixed costs. Globalization has resulted in the outsourcing of freight transport functions by several companies as they are incapable of managing worldwide supply chain operations. Cargo transport companies provide improved and innovative ways to optimize the effectiveness of services which includes advantages such as less capital expense, door-to-door service, flexibility, and less risk of damage during transit.

The industry has remarkably evolved across the U.S. and Europe owing to the accessibility of good supply chain management, the presence of key market players in the e-commerce industry, and the required infrastructure. The capability to track various products and freight in transit provides a complete view of the inventory and activities to the e-commerce firms, thus influencing the demand for freight transport solutions. Furthermore, handling goods in motion, minimizing disruptions, proactive status updates, and risk mitigation help shippers improve customer service and control costs. Therefore, it is anticipated that the supply chain will grow robust due to sufficient visibility.

COVID-19 Impact On The Freight Transport Market

The COVID-19 pandemic has negatively impacted supply chain operations globally. The crisis placed an unprecedented strain on transportation and logistics resources. Due to the implementation of lockdowns in various countries, the shippers had to face uncertainty in the transportation of goods. The supply and demand imbalance and the absence of long-haul and last-mile fulfillment service capacity disrupted the logistics networks, which hampered the growth of the freight transport market. The demand side has also shown a downfall in consumption. Due to the low demand and the inability to manage their finances at a time of declining cargo and shipping demand, various small marine and shipping businesses have failed.

The cargo volumes significantly decreased during the pandemic owing to the restriction on the movement of heavy-duty and medium-duty vehicles, resulting in a huge loss for the trucking industry as well as increased unemployment. Moreover, various airlines had to use passenger planes to transport cargo due to the limitations on foreign passenger flights.

Offering Insights

In terms of offering, the market is classified into solutions and services. The service segment held the major revenue share in 2021. The service offering can be divided into managed services, business services, and system integration. The segment growth is mainly attributed to the increasing demand for freight management services that enable businesses to deliver freight and complete the supply chain efficiently and affordably. These services allow businesses of all sizes to fulfill orders through just-in-time manufacturing, ensuring that minimal storage spaces and low shipping inventories can be maintained.

The solution segment is anticipated to witness the fastest growth throughout the forecast period. This can be attributed to the rapid adoption of innovative freight transport management systems globally. Freight transportation management systems help businesses across a range of industries bring down their cargo transportation costs, improve the efficiency of shipments, and provide real-time supply chain visibility. Cloud-based solutions allow users to efficiently manage logistics processes, connect & collaborate with trading partners, and reuse and share supply chain data to enhance time-to-value.

Mode Of Transport Insights

Based on the mode of transport, the freight transport market has been segmented into roadways, railways, waterways, and airways. The roadways segment accounted for a significant revenue share in 2021 and is expected to retain its dominance during the forecast period owing to the fastest door-to-door services for short distances. It also ensures cost efficiency as it involves lower capital investment compared to other modes of transportation. Additionally, this mode of transport offers a large carrying capacity, which makes it a preferred choice for freight transport. The increasing efforts taken by governments across the globe to promote road transport are also contributing to segment growth. For instance, the government of India has introduced a national logistics policy to facilitate the ease of doing business and reduce transportation costs. As part of this initiative, the government is constructing a highway network from the port area to the remote site of the country to reduce fuel consumption, which is considered the most cost-impacting factor when it comes to freight transport.

On the other hand, the airways segment is expected to register promising growth during the forecast period. The growth of this segment can be attributed to faster delivery, rapid airport construction in developing countries, and the adoption of sustainable aviation fuels concerning climate change. For instance, the Airports Authority of India (AAI) and private airport operators are planning to invest USD 11 billion by 2025, which will increase the total number of airports in the country to 357 by 2025.

Vertical Insights

Based on vertical, the freight transport market is segmented into retail & e-commerce, automotive, aerospace & defense, pharmaceuticals, energy, and others. The retail & e-commerce segment accounted for a significant revenue share in 2021 and is expected to continue to dominate the market during the forecast period owing to increasing cross-border e-commerce sales and a growing freight transport market. Freight transport within the retail & e-commerce sector involves transporting products such as groceries, gadgets, personal care products, furniture, and clothing. The retail & e-commerce segment has considerable scope for expansion. To realize this potential, Venture Capitalists (VC) across the globe fund e-commerce logistics startups on a large scale. Lalamove, an Asian startup, received USD 1.5 billion in January 2021, and J&T Express, an Indonesian company, received USD 2.5 billion in VC funding

The pharmaceutical segment is anticipated to grow at a considerable CAGR throughout the forecast period. Since the goods being transported are intended for human consumption, pharmaceutical transport forms the most crucial link in a logistics chain. Complete control of the entire distribution chain is required to ensure that the medicines reach the end consumer appropriately. The segment witnessed growth in the last two years owing to the outbreak of COVID-19.

Regional Insights

North America led the overall market in 2021 and is anticipated to retain its dominance during the forecast period owing to the presence of various major freight solution providers, logistics players, and e-commerce giants in the U.S. and Canada. Furthermore, factors such as the continued evolution and adoption of new technologies, such as artificial intelligence, near-field communication, and machine learning, contribute to market growth. For instance, United Parcel Service of America, Inc. recently joined the Blockchain In Transport Alliance (BITA), a platform for the freight industry's standards and education on blockchain technology. This helped the company establish its smart logistics network. The U.S. is expected to retain its dominance during the forecast period owing to the massive adoption of freight transport services in manufacturing, retail, and e-commerce.

Asia-Pacific is expected to develop substantially by the projection period and expand at the highest CAGR throughout the forecast period. The growth can be attributed to the lucrative opportunities in the region's automotive, packaging, pharmaceutical, and other industrial applications. Increased manufacturing facilities due to various government incentives, cheap labor, and easy land availability supported by large markets are also expected to help the Asia Pacific freight transport market grow.

Key Companies & Market Share Insights

The market is highly fragmented, with numerous freight transport service providers operating in the regional market. Key players pursue mergers and acquisitions to expand their market share, broaden their product portfolio, increase their geographic presence, and integrate advanced technologies to reduce the cost of freight operations. The players focus on offering speedy, economic, and secure freight transport services. These companies are also collaborating with e-commerce players and local & regional players to gain a competitive edge over their peers and capture a significant market share. Some prominent players in the global freight transport market include

-

CEVA Logistics,

-

FedEx,

-

United Parcel Service of America, Inc.,

-

Deutsche Post AG,

-

Schneider National, Inc.,

-

Oracle,

-

SAP SE

Freight Transport Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 30.91 billion

Revenue forecast in 2030

USD 72.97 billion

Growth Rate

CAGR of 11.3% from 2022 to 2030

Historic year

2017 - 2020

Base year for estimation

2021

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

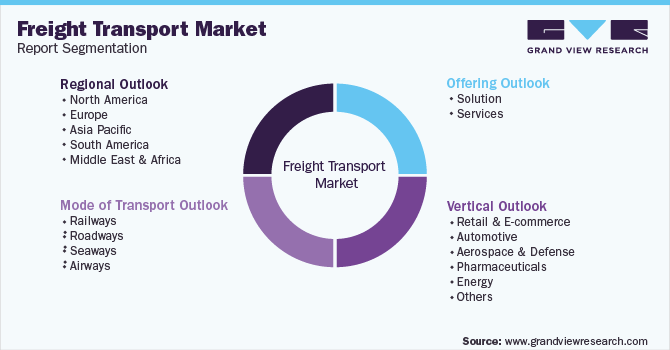

Offering, mode of transport, vertical, region

Regional scope

North America; Europe; Asia-Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Brazil

Key companies profiled

CEVA Logistics; FedEx; DB Schenker Logistics; United Parcel Service of America, Inc.; Deutsche Post AG; Schneider National, Inc.; Oracle; SAP SE; C.H. Robinson Worldwide Inc.; Kuehne + Nagel International AG; DSV PANALPINA A/S; Kerry Logistics Network Limited; Nippon Express Holdings; CJ Logistics Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Freight Transport Market Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global Freight Transport market report based on offering, mode of transport, vertical, and region.

-

Offering Outlook (Revenue, USD Million; 2017 - 2030)

-

Solution

-

Freight Transportation Cost Management

-

Freight Mobility Solution

-

Freight Security & Monitoring System

-

Freight Information Management System

-

Fleet Tracking & Maintenance Solution

-

Freight Operational Management Solutions

-

Freight 3PL Solution

-

Warehouse Management System

-

-

Services

-

-

Mode of Transport Outlook (Revenue, USD Million; 2017 - 2030)

-

Railways

-

Roadways

-

Seaways

-

Airways

-

-

Vertical Outlook (Revenue, USD Million; 2017 - 2030)

-

Retail & E-commerce

-

Automotive

-

Aerospace & Defense

-

Pharmaceuticals

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global freight transport market size was estimated at USD 28.66 billion in 2021 and is expected to reach USD 30,916.35 million in 2022.

b. The global freight transport market is expected to grow at a compound annual growth rate of 11.3% from 2022 to 2030 to reach USD 72,975.05 million by 2030.

b. North America accounted for the largest revenue share in 2021, with the U.S. contributing significantly to the regional market. The growth of the North American market is attributed to the presence of various major freight solution providers, logistics players, and e-commerce giants in North America.

b. Some key players operating in the freight transport market include C.H. Robinson Worldwide Inc; CEVA Logistics; DB Schenker Logistics; Deutsche Post AG; FedEx Corporation; Kuehne + Nagel International AG; United Parcel Service of America, Inc.; Schneider National, Inc.; DSV PANALPINA A/S; Kerry Logistics Network Limited; Nippon Express Holdings., Inc.; CJ Logistics Corporation; Accenture; Oracle; and SAP SE, among others.

b. Key factor driving the growth of the freight transport market include cheaper shipping prices through freight transport service providers, improvisation in the visibility of the supply chain, and emphasis on primary business activities, among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.