- Home

- »

- Next Generation Technologies

- »

-

Warehouse Management System Market Size Report, 2033GVR Report cover

![Warehouse Management System Market Size, Share & Trends Report]()

Warehouse Management System Market (2026 - 2033) Size, Share & Trends Analysis Report By Component, By Deployment (On-premise, Cloud), By Function, By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-151-1

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Warehouse Management System Market Summary

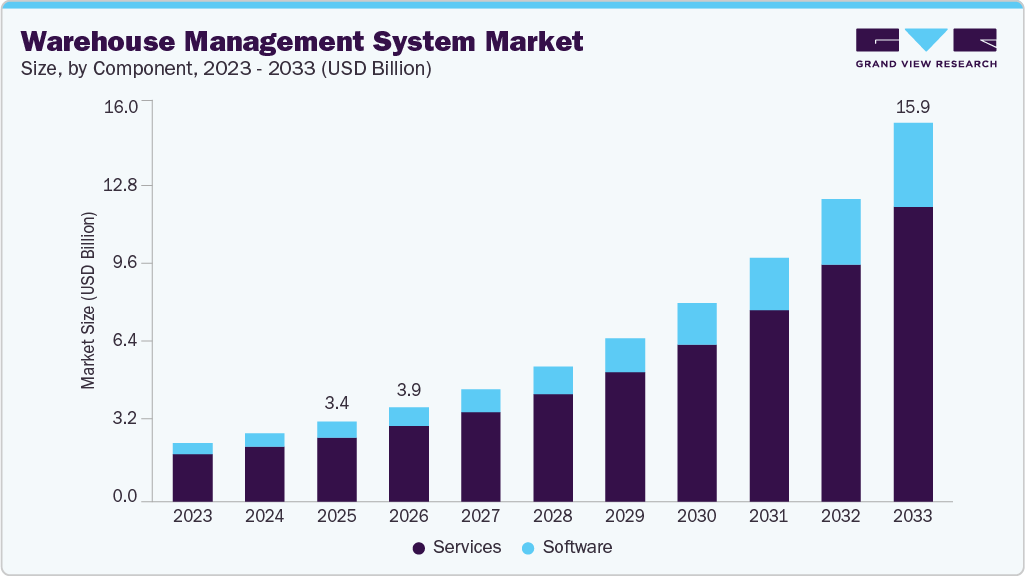

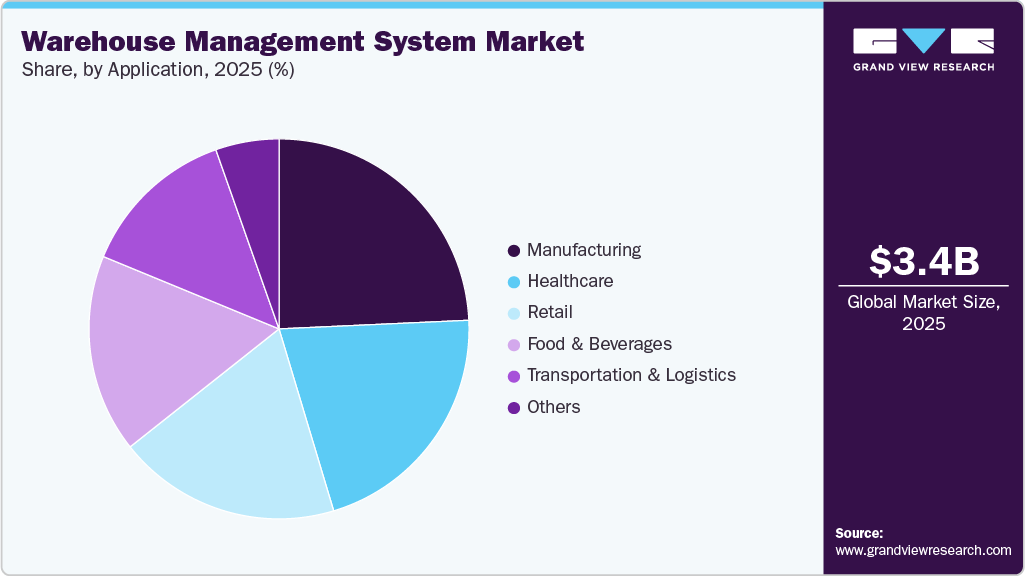

The global warehouse management system market size was estimated at USD 3.38 billion in 2025 and is projected to reach USD 15.95 billion by 2033, growing at a CAGR of 21.9% from 2026 to 2033. Growing economies across the globe have propelled various sectors such as healthcare, manufacturing, and retail to achieve highly efficient operations in order to increase their output and meet consumer demand.

Key Market Trends & Insights

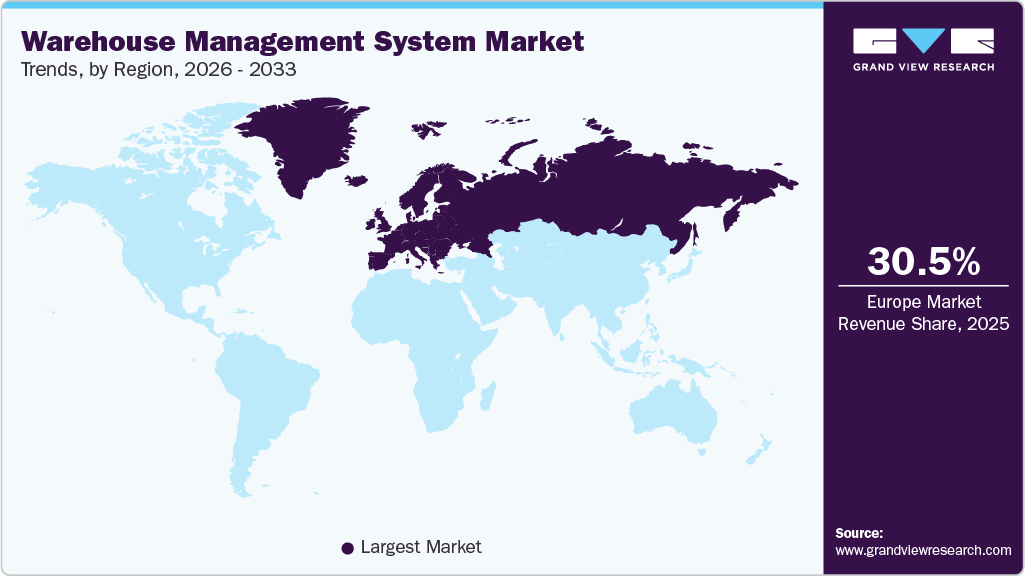

- Europe dominated the global warehouse management system market with the largest revenue share of 30.5% in 2025.

- Based on deployment, the cloud segment accounted for the largest market revenue share in 2025.

- Based on function, the analytics & optimization segment is expected to grow at the fastest CAGR during the forecast period.

- Based on application, the transportation & logistics segment is expected to grow at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 3.38 Billion

- 2033 Projected Market Size: USD 15.95 Billion

- CAGR (2026-2033): 21.9%

- Europe: Largest market in 2025

In an effort to meet growing demands, logistics companies are continually adapting to overcome challenges posed by fluctuating product markets and shipping schedules. The demand for warehousing has increased due to the rising trend of online purchasing. The implementation of lockdowns, social distancing, and various other safety measures in response to the pandemic has led consumers to pursue online purchasing. Therefore, several multinational companies are setting up new warehouses across numerous countries to accommodate this upsurged demand. This has led to the increasing adoption of warehouse management systems in the e-commerce and third-party logistics industries. E-commerce companies such as Amazon.com, Inc., Alibaba.com, and eBay Inc. are ramping up the demand for WMS as they continue to set up new warehouses across the globe.

A warehouse management system helps reduce lead time, increase product delivery speed, and minimize distribution costs. The software is designed to cater to complex, sophisticated warehouse operations as well as tackle less complex resource-constrained operations. Additionally, the WMS software is utilized by various functions, including third-party logistics, B2B distribution companies, and other manufacturing companies.

Demand for WMS is anticipated to experience a sharp rise due to the changing supply chain models of product manufacturers and rapidly growing consumer demand, particularly in the transport & logistics and retail sectors. The need for manufacturers to automate warehouse management processes and curtail costs globally is one of the key trends triggering the market growth. The spiraling demand for the system can be attributed to its ability to ship products in the fastest possible time through the shortest shipping routes.

Customers prefer cloud-based WMS services to on-premise solutions, as the former ensures cost reduction on the service. Software-as-a-Component (SaaS) was introduced to meet the burgeoning demand for cloud-based services as it offers a low upfront cost and enables faster implementation in warehouses. These systems can manage both inbound and outbound freight, as well as cross-docking. These systems are also compatible with other supply chain systems such as business analytics, transportation management systems, slotting management, and yard management.

Furthermore, cloud-based warehouse management system solutions can be accessed from any location through web-based portals. These systems extend supply chains to align fulfillment services and inventory management with advanced purchasing methods, providing real-time visibility into an entire inventory available via browsers and smartphones.

Component Insights

The services segment led the market with the largest revenue share of 80.7% in 2025. The services segment includes consulting, system integration, operation, and maintenance services. Warehouse management can be provided as a service by third-party vendors, which is outsourced by WMS providers. Vendors sell their products by either offering them as a service, which helps the clients to focus on their core business operations, or by selling the software to the client without the service.

The software segment is expected to grow at the fastest CAGR over the forecast period. The growth can be attributed mainly to the increasing adoption of WMS software by small and midsized enterprises (SMEs) worldwide. The software is hosted via a cloud-based computing system. Furthermore, factors such as spurring demand in the retail and manufacturing sectors and high disposable incomes of consumers are major factors expected to support the segment growth in the forthcoming years. Besides, warehouse management system software can be a standalone system or part of a supply chain execution suite, and is widely used as a tactical tool by businesses to meet the unique customer requirements of their supply chain and distribution channel.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2025 and is expected to grow at the fastest CAGR of 22.6% from 2026 to 2033. Cloud-based technology has revolutionized the way businesses function. When deployed on the cloud, WMS offers a reduction in companies' upfront costs and drastically increases warehouses' efficiency. Over the years, cloud deployment has become as secure as on-premise systems, thanks to data sovereignty and the successful curbing of data theft. Companies can now customize and provide a WMS service tailored to the client’s requirements. For instance, the cloud-based WMS enables clients to scale up or downsize the level of operations based on their seasonal demand.

The on-premise segment is expected to grow at a significant CAGR over the forecast period. The on-premise deployment has been prominent since the advent of WMS and is characterized by huge servers and high maintenance costs, ultimately increasing the company’s expenditures. These upfront costs and ownership of maintaining the on-premises server are incredibly high compared to the cloud-based technology. The significant difference between on-premise and cloud-based solutions is the longer time taken in the implementation process of on-premise WMS as compared to the latter.

Function Insights

The systems integration & maintenance segment accounted for the largest market revenue share in 2025. The rising complexity of multi-tiered supply chains fuels the growth of the segment. Modern supply chains span multiple partners, geographies, and fulfillment models. WMS functionality must be integrated with ERP, TMS, LMS, robotics, conveyor controls, and supplier/marketplace APIs. That complexity drives the demand for professional systems integration to ensure data consistency, reliability, and end-to-end visibility, as well as ongoing maintenance to keep all connections healthy as partners and protocols change.

The analytics & optimization segment is expected to grow at the fastest CAGR over the forecast period. E-commerce growth and tight margins force warehouses to squeeze costs from labor, space, and inventory. Analytics that surface root causes and optimize engines that recommend actions (such as dynamic slotting, pick path optimization, and labor scheduling) directly translate into measurable savings, creating strong buyer interest.

Application Insights

The manufacturing segment accounted for the largest market revenue share in 2025. Traditionally, manufacturers focused on integrating their ERP and WMS platforms to streamline production and inventory workflows. They are now expanding this integration to encompass logistics and transportation management systems, providing end-to-end visibility and enhanced control over the entire supply chain. Furthermore, the increasing adoption of cloud-based technologies is significantly improving the agility, efficiency, and overall performance of supply chain operations within the manufacturing sector.

The transportation & logistics segment is expected to grow at the fastest CAGR of 23.2% from 2026 to 2033. The growth can be attributed to the increased popularity of e-commerce portals, combined with the rising disposable income levels of consumers, particularly in emerging nations such as India and China. Logistics and supply chain companies are rapidly adopting WMS to improve their operations and increase the warehouse's efficiency and productivity. Also, companies understand that having a well-integrated WMS is needed to efficiently run the warehouse operations and meet the consumers' rising demand.

Regional Insights

The warehouse management system market in North America is anticipated to grow at a significant CAGR during the forecast period. In North America, cloud-based WMS solutions are rapidly gaining traction, driven by their scalability, operational flexibility, and cost-effectiveness. These cloud platforms support seamless software updates, enable real-time remote access, and offer easy integration with other enterprise systems such as ERP, CRM, and transportation management platforms. This makes them especially attractive to small and medium-sized enterprises (SMEs) seeking to streamline operations and remain competitive in a rapidly evolving supply chain landscape. The shift to cloud is also helping businesses reduce upfront infrastructure costs while ensuring agility to adapt to fluctuating market demands.

U.S. Warehouse Management System Market Trends

The warehouse management system market in the U.S. accounted for the largest market revenue share in North America in 2025, due to the strong presence of ERP vendors, which support the overall market growth. Moreover, the nation has a high demand for food and beverages across a broad range, which requires continuous supply from warehouses, as this adds quality control, efficiency, and consistency to the process.

Europe Warehouse Management System Market Trends

Europe dominated the global warehouse management system market with the largest revenue share of 30.5% in 2025, followed by Asia Pacific and North America. The advancement in the warehouse management system and increasing awareness of cloud-based warehouse management systems are the primary factors driving the WMS market growth in the European region. Factors such as the presence of wide networks of third-party logistics (3PL) companies & large companies with global distribution operations & warehousing, and sustained growth in the e-commerce industry are propelling the market growth in North America.

The warehouse management system market in the UK is experiencing the growing integration of automation and robotics. Warehouses are increasingly adopting autonomous mobile robots (AMRs), automated storage and retrieval systems (AS/RS), and robotic picking technologies to reduce dependency on manual labor and improve throughput. These systems not only optimize space utilization but also help companies meet the rising demands for fulfillment, especially during peak periods.

Asia Pacific Warehouse Management System Market Trends

The warehouse management system market in the Asia Pacific is projected to grow at the fastest CAGR during the forecast period, owing to the presence of high-growth economies such as China, India, and the Philippines. With the increasing purchasing power of consumers, developing countries are witnessing a growth in the demand for end-use products. This is positively influencing the demand for WMS for an uninterrupted supply of products to users. Moreover, since the Asia Pacific is a price-sensitive region, SaaS is highly preferred by companies using WMS technology. Advantages such as lower entry costs and risks, cost-effective growth, access to the best technology, and dynamic and advanced software features offered by the model are capturing the attention of manufacturers.

The India warehouse management system market is experiencing robust growth, driven by the surge in online retail, the expansion of third-party logistics (3PL) providers, and the modernization of supply chains. The implementation of the Goods and Services Tax (GST) and initiatives like 'Make in India' have further stimulated the warehousing sector, leading to increased demand for advanced WMS solutions.

Key Warehouse Management System Company Insights

The market participants are focusing on several strategies to gain a higher market share. Mergers, acquisitions, partnerships, and other contractual agreements are being announced by them to emerge as the top warehouse management system company. Moreover, these players are investing in research and development activities to bring new services to the market. Some of the key players operating in the market include Made4net, Manhattan Associates, Oracle, and PSI Logistics, among others.

-

Mad4net is a global company formed to support the growing demands of both large and small logistics companies with a cost-efficient suite of products designed to address different parts of the value chain. The company offers a comprehensive, all-in-one application suite developed on an exclusive platform utilizing Microsoft technology. The solution is a web-based product that can run on multiple browsers and provide on-premises and cloud deployment options. The company has a global footprint spanning North America, the Middle East, Europe, and Asia.

-

Epicor Software Corporation develops industry-specific enterprise software solutions for businesses operating in manufacturing, distribution, retail, and services, among other industries and industry verticals. The company's product offerings include Supply Chain Management (SCM) software, Customer Relationship Management (CRM) software, Enterprise Resource Planning (ERP) systems, Human Capital Management (HCM) solutions, and Retail Management System (RMS) solutions.

Key Warehouse Management System Companies:

The following are the leading companies in the warehouse management system market. These companies collectively hold the largest market share and dictate industry trends.

- EPICOR

- Körber AG (HighJump)

- Infor

- Made4net

- Manhattan Associates

- Oracle

- PSI Logistics

- Reply

- SAP

- Softeon

Recent Developments

-

In September 2025, SnapFulfil, a provider of cloud-based warehouse management systems (WMS), formed a strategic partnership with Reveal, an embedded analytics platform from Infragistics, to integrate real-time visualization and insights directly into the SnapFulfil ecosystem. This collaboration equips warehouse managers with customizable dashboards for monitoring operations, from inbound receipts to outbound shipments. It offers benefits such as real-time visibility into fulfillment journeys, performance optimization for top performers and areas for improvement, proactive inventory management for both fast- and slow-moving SKUs, and unified data consolidation across multiple sites.

-

In July 2025, Realm Realtime, a logistics technology company, launched its next-generation Warehouse Management System (WMS), engineered for single-facility or multi-site operations to deliver superior visibility, efficiency, and control from inbound receipt to dispatch. The platform offers granular oversight through custom 3D warehouse mapping, real-time tracking of stock by location, weight, and CBM, detailed inbound logging for damaged/missing/surplus items, flexible picking workflows, full audit trails, and barcode/QR scanning via standard iOS/Android mobile phones, eliminating the need for costly hardware.

Warehouse Management System Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3.99 billion

Revenue forecast in 2033

USD 15.95 billion

Growth rate

CAGR of 21.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, function, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

EPICOR; Körber AG (HighJump); Infor; Made4net; Manhattan Associates; Oracle; PSI Logistics; Reply; SAP; Softeon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Warehouse Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global warehouse management system market report based on component, deployment, function, application, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-premise

-

Cloud

-

-

Function Outlook (Revenue, USD Billion, 2021 - 2033)

-

Labor Management System

-

Analytics & Optimization

-

Billing & Yard Management

-

Systems Integration & Maintenance

-

Consulting Services

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Transportation & Logistics

-

Retail

-

Healthcare

-

Manufacturing

-

Food & Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global warehouse management systems market size was estimated at USD 3.38 billion in 2025 and is expected to reach USD 3.99 billion in 2026.

b. The global warehouse management systems market is expected to grow at a compound annual growth rate of 21.9% from 2026 to 2033 to reach USD 15.95 billion by 2033.

b. Europe dominated the WMS market with a share of 30.5% in 2024. This is attributable to the advancement in the warehouse management system and increasing awareness of cloud-based warehouse management systems across the region.

b. Some key players operating in the WMS market include Körber AG (HighJump), Manhattan Associates, Oracle, SAP, Softeon, Synergy Ltd., Tecsys, Reply, Infor, Made4net, Epicor, and PSI Logistics.

b. The key factor that is driving the WMS market growth includes changing supply chain models of product manufacturers and rapidly growing consumer demand, especially in the transport & logistics and retail sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.