- Home

- »

- Next Generation Technologies

- »

-

Managed Services Market Size, Share, Industry Report 2033GVR Report cover

![Managed Services Market Size, Share & Trends Report]()

Managed Services Market (2026 - 2033) Size, Share & Trends Analysis Report By Solution (Managed Data Center, Managed Security), By Managed Information Service (MIS), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-815-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Managed Services Market Summary

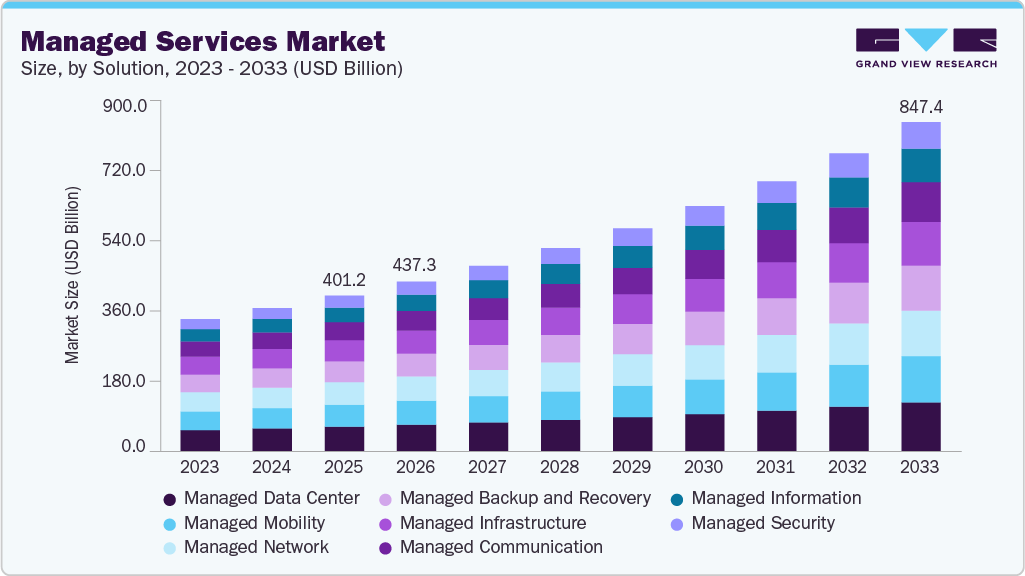

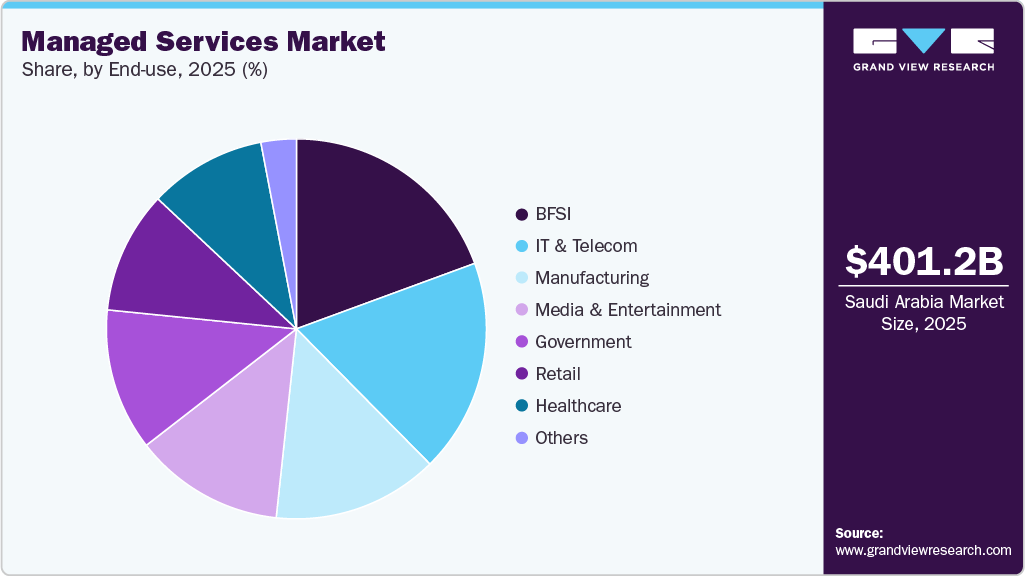

The global managed services market size was estimated at USD 401.15 billion in 2025 and is projected to reach USD 847.41 billion by 2033, growing at a CAGR of 9.9% from 2026 to 2033. Managed services reduce downtime redundancy and provide customized value-added services such as application testing, service catalog building, and expert consultancy.

Key Market Trends & Insights

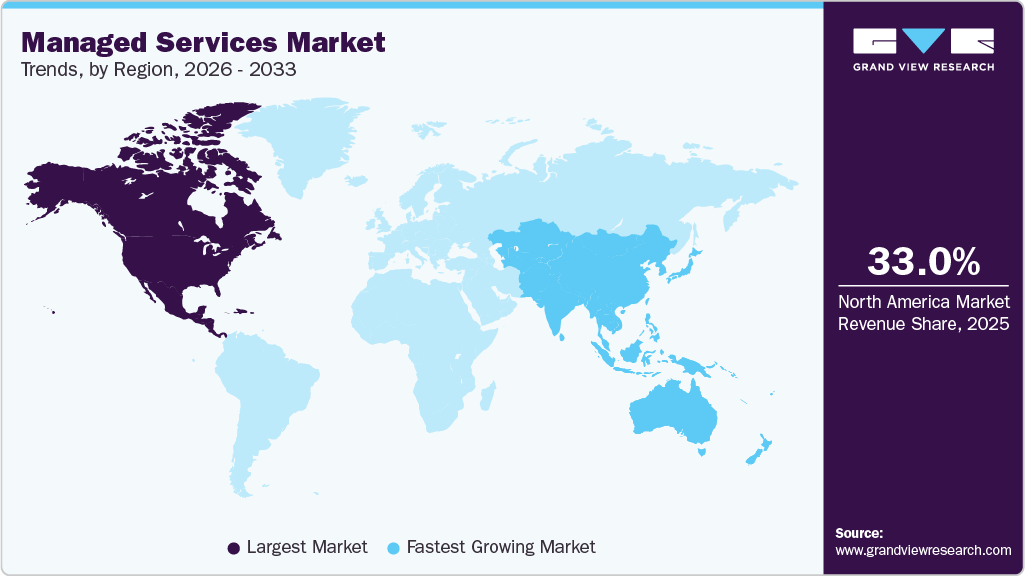

- North America held 33.0% revenue share of the managed services market.

- The U.S. dominated the managed services market in 2025.

- By solution, the managed data center segment held the largest revenue share of 15.0% in 2025.

- By managed information service (MIS), the business process outsourcing (BPO) segment held the largest revenue share in 2025.

- By deployment, the on-premise segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 401.15 Billion

- 2033 Projected Market Size: USD 847.41 Billion

- CAGR (2026-2033): 9.9%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Multiple monitoring tools and several layers of infrastructure managed by isolated teams contribute to market growth. Furthermore, to streamline infrastructure and reduce costs, enterprises globally are migrating to the cloud platform and adopting managed IT services to optimize their infrastructure costs. Professional and managed services help enterprises compete with this digital transformation faster and more efficiently. Market players are focusing on unveiling innovative managed services for enterprise businesses to acquire a significant share of managed services market.The companies operating in the managed services industry are establishing strategic partnerships to provide their cloud & infrastructure managed services to the client for increased security & compliance and enhanced business performance. For instance, in April 2023, Sinch, a Microsoft Operator Connect partner, announced a partnership with Synoptek to provide managed and professional services for the Microsoft Teams Phone System, which is integrated with direct routing or Operator Connect. Factors such as improving operational efficiency by focusing more effectively on core competencies, cutting operating expenses, and increasing the use of cloud-based technologies such as automation, IoT, blockchain, and cloud computing are driving market growth.

Managed services involve outsourcing management functions to a third party to advance business operations. The introduction of cloud-based technologies and their technological proliferation have led to managed services. Managed services assist businesses in improving operational efficiency and cutting down on companies' operating expenses. Moreover, an increasing preference for outsourcing management functions to cloud service providers and managed service providers is anticipated to drive the market's growth over the forecast period.

The adoption of cloud services has particularly increased as businesses remain keen on ensuring business scalability. Most companies are renewing their contracts with managed cloud service providers in anticipation of cloud migration becoming more common among enterprises and, in some cases, even gaining traction. Furthermore, businesses and organizations strongly emphasize adopting the latest technologies, such as machine learning and augmented reality, along with their existing IT infrastructure, as part of the efforts to encourage digital transformation.

As cyber threats become more prevalent, organizations are adopting managed security services (MSSs) into their business models. There is an increase in cyber threats in government sectors and enterprises. Thus, forcing managed service providers (MSPs) to develop advanced offerings that can detect and address cyber risks. For instance, in April 2023, Aeries Technology, a consulting and professional services provider, announced the launch of cybersecurity managed services. The new offering includes application security services; data security & privacy; identity & access management; cloud & infrastructure security; governance, risk, & compliance; security operations center services; enterprise security design & implementation; and audit & compliance certifications.

Solution Insights

The managed data center segment dominated the managed services market with a market share of over 15.0% in 2025. The accelerated shift toward hybrid and multi-cloud environments drives segment growth. Many organizations are adopting hybrid models that combine on-premises infrastructure with private and public cloud services. Managed data centers play a crucial role in this ecosystem by acting as centralized hubs that enable seamless data exchange, application deployment, and workload management across diverse platforms. They also help organizations manage vendor relationships, optimize cloud resources, and ensure consistent performance and security across the entire IT stack.

The managed security segment is projected to be the fastest-growing segment from 2026 to 2033. This growth is mainly due to the need for constant monitoring and quick response to security incidents. Cyber threats are becoming more advanced and require 24/7 attention to stop attacks or reduce their impact. Managed security services offer continuous protection through security operations centers (SOCs) that work around the clock. These centers use AI-based tools, threat intelligence, and automated responses to identify and stop threats in real time. This continuous monitoring is important because faster detection and response greatly reduce the damage caused by security breaches.

Managed Information Service (MIS) Insights

The business process outsourcing (BPO) segment accounted for the largest revenue share of over 40.0% in 2025. The integration of automation and digital tools within BPO services is driving segment growth. Managed service providers are increasingly incorporating robotic process automation (RPA), artificial intelligence (AI), analytics, and cloud-based solutions into their offerings. These technologies enable faster, more accurate processing of high-volume tasks and allow businesses to gain real-time insights into performance. As a result, outsourcing no longer means just labor arbitrage. It means gaining access to technology-driven process optimization, which leads to better outcomes and enhanced decision-making.

The business support systems segment is expected to register the highest CAGR of 10.5% during the forecast period. The shift toward cloud-based BSS platforms further supports the growth of this segment. Many organizations are moving away from traditional, on-premises systems in favor of flexible, cloud-native BSS solutions offered as managed services. This transition provides not only scalability and faster time-to-market but also continuous updates, stronger data security, and better compliance with regulations such as GDPR or industry-specific data protection standards. Managed service providers can ensure smooth migration and long-term management of these platforms, minimizing disruption and risk.

Deployment Insights

Based on deployment, the on-premise segment led the managed services market with the largest revenue share in 2025. This growth can be attributed to the increasing use of mobile devices and advancements in information-sharing technologies. In addition, organizations with strict data security, regulatory compliance, and latency requirements continue to prefer on-premise deployments to maintain greater control over their IT infrastructure. The need for customized solutions and integration with legacy systems is also supporting adoption. Cloud-based managed services solutions allow end-use industries to adapt to evolving markets in effective and efficient ways. Simultaneously, increasing private and public investments in cloud-based technology are anticipated to create a lucrative environment for segment growth in the forecast period.

The hosted segment is expected to register the highest CAGR during the forecast period. This growth is driven by organizations increasingly shifting toward hosted deployment models to reduce infrastructure costs and operational complexity. Hosted solutions allow businesses to outsource IT management to service providers while retaining flexibility, scalability, and faster deployment compared to traditional on-premise systems. As enterprises focus more on digital transformation and remote operations, hosted managed services are becoming an attractive option across industries. Key drivers for the hosted segment include lower upfront capital expenditure, predictable operating costs, and ease of scalability as business needs change. The growing adoption of cloud and hybrid IT environments, increasing demand for secure remote access, and limited availability of in-house IT expertise are further accelerating demand.

Enterprise Size Insights

The large enterprise segment led the market with the largest revenue share in 2025. Global expansion and business diversification are contributing to this trend. Large enterprises often operate in multiple countries, each with its own regulatory environment, market dynamics, and technological infrastructure. Managing IT operations across such diverse environments can be highly complex. Managed service providers offer region-specific knowledge and compliance support, enabling enterprises to standardize operations while ensuring local relevance. They also help deploy and manage global IT projects more efficiently, supporting growth strategies and entering new markets without unnecessary delays or operational risks.

The SMEs segment is expected to grow at the fastest CAGR over the forecast period. The growing complexity of cybersecurity threats is a crucial factor influencing the demand for managed services among SMEs. With the increase of ransomware, phishing, and data breaches, small and medium businesses, often with minimal or outdated security protocols, have become prime targets for cybercriminals. Managed security services offer real-time threat detection, firewall and antivirus management, compliance reporting, and employee training, helping SMEs build a more secure IT environment. Importantly, MSPs also help SMEs meet industry-specific data protection regulations, which are particularly relevant for businesses in healthcare, finance, and retail.

End-use Insights

The BFSI segment dominated the managed services market in 2025. The increasing use of data analytics and AI in financial services is increasing reliance on managed services. BFSI firms are benefiting from real-time data to enhance fraud detection, customer experience, risk management, and investment strategies. Managed service providers enable this by offering the infrastructure and expertise required to deploy big data platforms and AI tools effectively. They assist in data integration across silos, maintain data quality, and ensure that analytics platforms operate optimally, helping financial firms extract meaningful insights without incurring high IT maintenance overheads.

The healthcare segment is expected to grow at the fastest CAGR over the forecast period. The growing demand for telemedicine and remote patient care is driving the segment's growth. With more healthcare interactions happening digitally, hospitals and clinics need a strong IT infrastructure that ensures high availability, low latency, and secure access for remote consultations, diagnostics, and monitoring. Managed services enable the deployment and maintenance of such infrastructure, including cloud-based platforms, virtual desktop environments, and secure communication networks. MSPs also offer 24/7 support, which is essential for maintaining continuous patient services and minimizing disruptions in care delivery.

Regional Insights

North America managed services market dominated the global industry with a revenue share of over 33.0% in 2025. The widespread adoption of cloud computing contributes to market expansion in North America. As companies transition from on-premises infrastructure to hybrid or fully cloud-based environments, the need for continuous cloud management, optimization, and support becomes vital. Managed cloud services are in high demand to help enterprises migrate workloads, manage multi-cloud environments, and ensure performance and scalability. The presence of major cloud service providers such as AWS, Microsoft Azure, and Google Cloud in North America further accelerates the trend, with MSPs often forming partnerships with these giants to deliver integrated, value-added services.

U.S. Managed Services Market Trends

The U.S. dominated the managed services industry in 2025. Technological innovation and the need for specialized expertise drive market growth in the U.S. As technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) gain traction, businesses require MSPs with deep technical expertise to manage, integrate, and optimize these technologies. MSPs provide the necessary infrastructure and expertise to help companies implement and manage these advanced technologies, offering them a competitive edge in their respective markets.

Asia Pacific Managed Services Market Trends

The Asia Pacific managed services industry is expected to be the fastest-growing regional market at a CAGR of 10.9%. Several companies in the Asia Pacific region are predicted to contribute substantially to the market's growth throughout the forecast period by implementing cloud-based solutions and increasing data security investments. Furthermore, growing spending due to organizations' adoption of cutting-edge technologies, such as cloud-based technology and advanced technology for company development, is expected to contribute to market growth. Further, shifting government focus towards digitalization and the proliferation of IT companies is expected to drive market growth.

China managed services market held the largest revenue share of the Asia Pacific region in 2025. In China, the government is supporting the adoption of IoT, cloud computing, and other emerging technologies, which is driving the rollout of cloud computing infrastructure across the country and, subsequently, the popularity of the SaaS delivery model, thereby driving the demand for managed services in the market.

The managed services market in India is expected to witness a high growth rate during the forecast period. The rapid growth of the Indian IT industry and the heavy investments of leading IT companies, such as Google, International Business Machines Corporation, and Microsoft Corporation in India, are expected to fuel the growth of the market for managed services in the country.

The managed services market in Japan is expected to grow at a significant CAGR during the forecast period. In Japan, the development and adoption of advanced technology solutions and services for improving business efficiency are gradually gaining traction. The growing preference for advanced technology services is expected to open new opportunities for the growth of the managed service market in the country.

Europe Managed Services Market Trends

The Europe managed services industry is expected to grow at a significant CAGR from 2026 to 2033. The growing need for enhanced cybersecurity across Europe, especially given the increasing volume and complexity of cyberattacks, is driving the market growth. The European Union's General Data Protection Regulation (GDPR) has heightened the importance of data protection and privacy, further motivating businesses to prioritize cybersecurity. Managed security services, such as threat detection, incident response, and security monitoring, are essential for helping companies to meet compliance standards and protect sensitive data. MSPs also offer 24/7 security monitoring and proactive threat intelligence, which are important in the face of evolving cyber threats.

The UK managed services market held a significant revenue share in 2025. The expanding demand for multi-cloud and hybrid cloud environments is contributing to the market growth in the UK. Many businesses are shifting from a single cloud provider to multi-cloud or hybrid cloud strategies to avoid vendor lock-in, optimize performance, and improve data redundancy. This shift presents significant challenges in terms of managing multiple cloud platforms, ensuring seamless integration, and maintaining security across different environments.

The managed services market in Germany is expected to witness a significant growth rate during the forecast period. The growing demand for digital transformation in Germany is also driving the market growth. As the country's industries, particularly manufacturing, automotive, and healthcare, undergo digital transformation, businesses are increasingly relying on advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) to stay competitive. However, the integration and management of these technologies require specialized expertise, which many businesses lack internally. Managed service providers are playing a crucial role in helping German companies implement and optimize these emerging technologies.

The France managed services market is expected to grow at a significant CAGR during the forecast period. The continued digitalization and, subsequently, the growing demand for cloud computing and IT security services are driving the adoption of managed services. Furthermore, the aggressive investments businesses are making in telecommunications and IT services, infrastructure outsourcing services, and wireline voice services are expected to drive the demand for managed services from 2026 to 2030.

Key Managed Services Company Insights

Some of the key companies operating in the market, include Accenture; BMC Software, Inc.; and HP Development Company, L.P. among others are some of the leading participants in the managed services market.

-

Accenture is a global professional services company that has a comprehensive portfolio in strategy, consulting, digital, technology, and operations. Accenture Managed Services are designed to help organizations increase agility, reduce costs, enhance scalability, and improve service delivery. Through these services, clients can shift from reactive problem-solving to proactive, strategic operations with the help of automation, analytics, and artificial intelligence (AI). This enables companies to focus more on their core business objectives while Accenture ensures operational excellence. Accenture operates in more than 120 countries and serves clients across a broad spectrum of industries, including banking, healthcare, energy, public services, consumer goods, and technology.

-

BMC Software, Inc. is an enterprise software solutions company specializing in IT service management (ITSM), IT operations management (ITOM), automation, and digital transformation. The company's managed services encompass a broad spectrum of solutions, including application service provisioning, business process management, and data storage and management services. BMC's offerings are tailored to meet the unique needs of each client, ensuring that IT systems are aligned with business goals and capable of adapting to changing demands.

ARYAKA NETWORKS, INC. and Atera Networks Ltd. are of the emerging market participants in the managed services market.

-

Aryaka Networks, Inc. offers fully managed network and security services. Specializing in Software-Defined Wide Area Networking (SD-WAN) and Secure Access Service Edge (SASE) solutions, Aryaka offers a cloud-first approach to enterprise connectivity. At the core of Aryaka's offerings is its Unified SASE as a Service platform, which seamlessly integrates networking and security functionalities. This includes services such as SD-WAN, WAN optimization, next-generation firewall (NGFW), secure web gateway (SWG), intrusion prevention system (IPS), and cloud access security broker (CASB). By converging these services, Aryaka enables organizations to simplify their IT infrastructure, enhance security postures, and improve application performance across distributed environments.

Key Managed Services Companies:

The following are the leading companies in the managed services market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Atera Networks Ltd.

- ARYAKA NETWORKS, INC.

- AT&T

- BMC Software, Inc.

- Broadcom

- Cisco Systems, Inc.

- DXC Technology Company

- Fujitsu

- HCL Technologies Limited

- HP Development Company, L.P.

- IBM Corporation

- Lenovo

- ScalePad Inc.

- Telefonaktiebolaget LM Ericsson

Recent Developments

-

In December 2025, Capgemini acquired Cloud4C to strengthen its cloud managed services portfolio. Cloud4C brings strong expertise in automation-driven and AI-enabled managed services across hybrid, private, public, and sovereign cloud environments. The addition of Cloud4C’s 1,600-member team helps Capgemini expand its presence in the fast-growing cloud managed services market, enhance industry-specific cloud solutions, and improve support for SAP services and cloud migrations using AI and automation.

-

In October 2025, Newmark Group, Inc. acquired RealFoundations, a global professional services firm specializing in real estate management consulting and managed services. The acquisition strengthens Newmark’s managed services capabilities for institutional investor clients by expanding its Investor Solutions suite, including fund and asset management, data services, lease administration, accounting, reporting, and fund administration.

-

In June 2025, NWN Holdings acquired InterVision Systems to strengthen its position in the AI-powered managed services market. InterVision is known for its expertise in AWS-based AI and customer experience solutions. This acquisition helps NWN expand its AI capabilities, especially in cloud and customer experience services, and better support organizations looking to modernize their IT operations using advanced AI technologies.

-

In September 2024, NTT DATA and IBM launched SimpliZCloud. It is a fully managed cloud service built on IBM LinuxONE, designed to support mission-critical workloads in sectors such as financial services. The solution offers high performance, strong security, and high availability while helping enterprises optimize infrastructure and software licensing costs through a subscription-based model. SimpliZCloud enables organizations to accelerate hybrid cloud adoption, consolidate workloads, reduce data center footprints, and improve sustainability.

-

In January 2024, Accenture acquired Navisite to strengthen its managed services business. The deal helps Accenture better support companies in upgrading their IT systems and moving to the cloud, especially as enterprises prepare for AI-driven operations. With this acquisition, Accenture added around 1,500 skilled professionals, including hundreds of certified cloud experts. This expanded expertise allows Accenture to deliver stronger application and infrastructure management services and help clients across industries modernize their digital operations more efficiently.

Managed Services Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 437.26 billion

Revenue forecast in 2033

USD 847.41 billion

Growth rate

CAGR of 9.9% from 2026 to 2033

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, managed information service (MIS), deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Accenture; Atera Networks Ltd.; ARYAKA NETWORKS, INC.; AT&T; BMC Software, Inc.; Broadcom; Cisco Systems, Inc.; DXC Technology Company; Fujitsu; HCL Technologies Limited; HP Development Company, L.P.; IBM Corporation; Lenovo; ScalePad Inc.; Telefonaktiebolaget LM Ericsson

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Managed Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global managed services market report based on solution, managed information service (MIS), deployment, enterprise size, end-use, and region:

-

Solution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Managed Data Center

-

Managed Network

-

Managed Mobility

-

Managed Infrastructure

-

Managed Backup and Recovery

-

Managed Communication

-

Managed Information

-

Managed Security

-

-

Managed Information Service (MIS) Outlook (Revenue, USD Billion, 2021 - 2033)

-

Business Process Outsourcing (BPO)

-

Business Support Systems

-

Project & Portfolio Management

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-premise

-

Hosted

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprise

-

Small & Medium Enterprises (SME)

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Media & Entertainment

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global managed services market size was estimated at USD 401.15 billion in 2025 and is expected to reach USD 437.26 billion in 2026.

b. The global managed services market is expected to grow at a compound annual growth rate of 9.9% from 2026 to 2033 to reach USD 847.41 billion by 2033.

b. North America dominated the managed services market with a share of over 32% in 2025. This is attributable to the concentration of a considerable number of MSPs in the region.

b. Some key players operating in the managed services market include Accenture; Atera Networks Ltd.; ARYAKA NETWORKS, INC.; AT&T; BMC Software, Inc.; Broadcom; Cisco Systems, Inc.; DXC Technology Company; Fujitsu; HCL Technologies Limited; HP Development Company, L.P.; IBM Corporation; Lenovo; ScalePad Inc.; and Telefonaktiebolaget LM Ericsson.

b. Key factors that are driving the managed services market growth include increasing dependence on IT operations and new applications to improve business productivity and the need for specialized MSPs to manage complex IT infrastructure and reduce IT staffing costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.