- Home

- »

- Power Generation & Storage

- »

-

Fuel Cell Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Fuel Cell Market Size, Share & Trends Report]()

Fuel Cell Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Stationary, Transportation, Portable), By Product (PEMFC, PAFC, SOFC), By Region, And Segment Forecasts

- Report ID: 978-1-68038-087-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fuel Cell Market Summary

The global fuel cell market size was estimated at USD 9 billion in 2024 and is projected to reach USD 34 billion by 2033, growing at a CAGR of 15.3% from 2025 to 2033. Fuel cells are electrochemical devices that convert the chemical energy of hydrogen or other fuels directly into electricity, emitting only water and heat as byproducts.

Key Market Trends & Insights

- Asia Pacific fuel cell market held the largest share of 74.39% of the global market in 2024.

- The fuel cell market in the U.S. is expected to grow significantly over the forecast period.

- By application, the stationary segment held the highest market share of 68.8% in 2024.

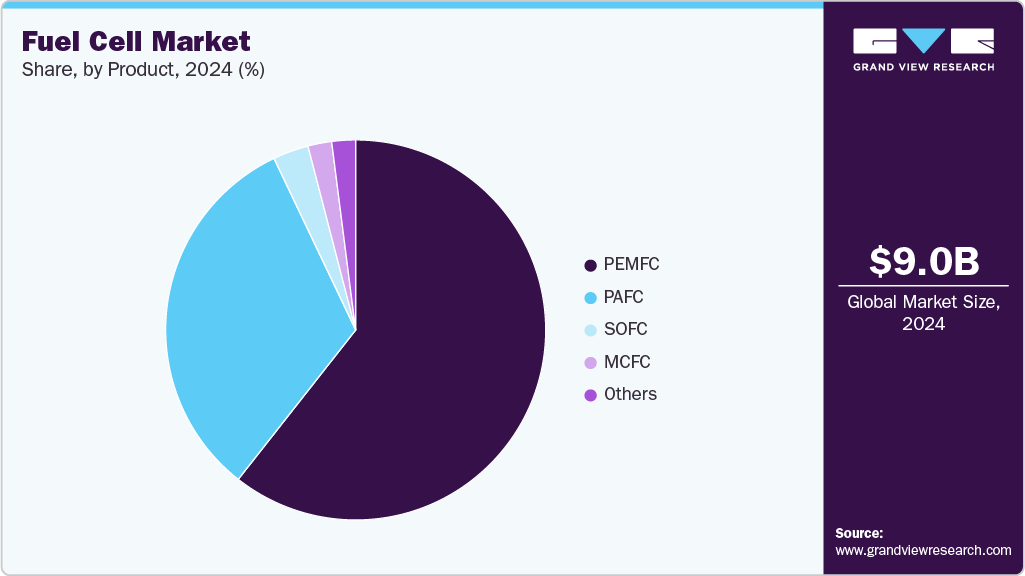

- Based on product, the PEMFC segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9 Billion

- 2033 Projected Market Size: USD 34 Billion

- CAGR (2025-2033): 15.3%

- Asia Pacific: Largest market in 2024

- MEA: Fastest growing market

With rising concerns over greenhouse gas emissions and fossil fuel dependency, fuel cells are gaining traction as a clean energy solution across stationary, transportation, and portable power applications. The market’s growth is primarily driven by increased adoption of hydrogen fuel cell technologies, government incentives for zero-emission vehicles, and growing investments in clean energy infrastructure. Advancements in fuel cell efficiency, durability, and cost reduction, especially in proton exchange membrane (PEM) and solid oxide fuel cell (SOFC) technologies, also enhance their commercial viability across industries.

Fuel cells are widely used in sectors focused on high energy efficiency, reliability, and sustainability. In transportation, they are increasingly utilized in fuel cell electric vehicles (FCEVs), buses, trucks, and trains, while stationary applications include backup power, combined heat and power (CHP) systems, and microgrids. Fuel cells are also adopted in industrial settings to reduce carbon emissions and comply with environmental regulations. Key regions for growth include the United States, Japan, South Korea, Germany, and China, where governments actively promote hydrogen-based technologies through national roadmaps and funding initiatives. Additionally, expanding hydrogen refueling networks and collaborations among automotive, energy, and utility companies are speeding up commercialization. As the global energy landscape shifts toward low-carbon options, fuel cells are expected to play a vital role in reaching long-term climate targets, especially in sectors that are difficult to electrify.

Drivers, Opportunities & Restraints

The global fuel cell market is primarily driven by the escalating demand for clean, efficient, and sustainable energy solutions across transportation, stationary, and portable power sectors. Governments worldwide are implementing stringent emissions regulations and offering subsidies to promote hydrogen-powered technologies, spurring the adoption of fuel cells. Their high energy conversion efficiency, low environmental impact, and suitability for decentralized power generation make them ideal for diverse applications-from powering electric vehicles to serving as backup systems for data centers and hospitals. Rapid advancements in hydrogen production, storage, and distribution infrastructure further accelerate market growth, particularly in the Asia Pacific, North America, and Europe.

Emerging opportunities in the fuel cell market include integrating fuel cells into heavy-duty transportation (such as trucks, buses, ships, and trains), expanding hydrogen refueling networks, and deploying them in off-grid and hybrid renewable energy systems. The increasing focus on green hydrogen and international cooperation on developing the hydrogen economy also creates future growth opportunities. However, the market faces challenges like high initial costs of fuel cell systems, limited hydrogen infrastructure, and difficulties in scaling up production. Issues such as fuel storage, distribution logistics, and the durability of certain cell types-especially under harsh operating conditions-also restrict wider adoption. Moreover, competition from battery electric systems and the absence of universal standards in hydrogen technologies could slow down commercialization efforts in some regions.

Application Insights

Based on application, the stationary fuel cell segment holds the largest share in the global fuel cell market, accounting for over 68.8% of revenue in 2024. This dominance is due to the increasing demand for reliable, continuous, and clean power generation across residential, commercial, and industrial sectors. Stationary fuel cells are extensively used in applications such as combined heat and power (CHP) systems, backup power for critical infrastructure, and grid support in urban and remote areas. Their high efficiency, low emissions, and ability to operate independently of the traditional grid make them a preferred choice for utilities, data centers, hospitals, and telecommunications facilities seeking energy resilience and sustainability.

The segment’s growth is further driven by increasing investments in hydrogen infrastructure and policies promoting the decarbonization of stationary energy systems. Advances in fuel cell stack design, thermal integration, and system durability have made stationary fuel cells more commercially viable. In emerging markets, they are gaining traction for rural electrification and off-grid renewable integration, where extending the grid is unfeasible or too costly. Additionally, the rising frequency of extreme weather events and the increasing need for energy security are prompting governments and businesses to invest in distributed, fuel cell-based power systems. As a result, the stationary segment is expected to stay dominant throughout the forecast period.

Product Insights

The PEMFC (Proton Exchange Membrane Fuel Cell) segment held the largest revenue share of approximately 60.2% in the global fuel cell market in 2024. This dominance is mainly driven by PEMFC’s versatility, quick start-up, high power density, and relatively low operating temperature, making it suitable for various uses including transportation, stationary backup power, and portable devices. PEMFCs are especially popular in fuel cell electric vehicles (FCEVs), such as cars, buses, and trucks, because of their fast response to load changes and compact size. Their scalability and efficiency also make them ideal for residential and small commercial power systems.

The segment is expected to experience strong growth during the forecast period, driven by rising investments in hydrogen infrastructure and increasing demand for zero-emission mobility solutions. Governments in North America, Europe, and Asia-Pacific are actively supporting hydrogen-powered transportation and funding PEMFC R&D programs to improve system durability and lower costs. Additionally, the growing use of PEMFCs in off-grid and emergency backup power systems helps expand their adoption in both developed and developing economies. Although other fuel cell types like SOFCs and PAFCs serve niche markets, PEMFCs remain the market leaders because of their technological maturity, ongoing cost reductions, and broad commercial applications across industries.

Regional Insights

Rapid industrialization, ambitious renewable energy goals, and increasing demand for clean power technologies in countries such as China, Japan, South Korea, and India drive the region's leadership. National hydrogen strategies and government-supported subsidies are speeding up the adoption of fuel cell technologies in transportation, stationary, and portable uses. Japan and South Korea continue to lead globally in fuel cell vehicle (FCV) deployment, while China is quickly expanding its hydrogen refueling infrastructure and pilot projects in industrial sectors. Additionally, strong manufacturing capabilities, low production costs, and technological partnerships support the large-scale deployment of PEMFC and SOFC systems across various end-use industries.

The increasing need for energy security and decarbonization across APAC drives investments in hydrogen production and fuel cell R&D. Countries also focus on deploying stationary fuel cells in microgrids and combined heat and power (CHP) systems for residential and commercial use. Off-grid electrification in Southeast Asia and modular hydrogen power solutions for disaster-prone and remote areas are opening new market opportunities. As green hydrogen gains momentum, the Asia Pacific will remain at the forefront of fuel cell adoption and innovation throughout the forecast period.

North America Fuel Cell Market Trends

The North American fuel cell market continues to expand, driven by growing decarbonization efforts, clean mobility initiatives, and federal funding for hydrogen infrastructure. The United States remains a key contributor, with large-scale deployments of stationary fuel cells in data centers, government buildings, and backup power systems. California leads with a robust hydrogen vehicle network in the mobility sector, supported by zero-emission mandates and incentives for FCEVs. Integrating fuel cells into hybrid microgrids and commercial fleets further accelerate adoption across industrial and utility industries.

Technological innovation and private-sector investment shape a dynamic market landscape, particularly from automotive and energy majors. Initiatives like the U.S. Department of Energy's Hydrogen Shot are reducing the cost of clean hydrogen, making fuel cells more economically viable. Fuel cells' scalability, environmental benefits, and off-grid reliability position them as a strategic solution for achieving energy resilience and climate goals in North America.

The U.S. represents North America's largest fuel cell market, driven by a strong policy framework, ongoing hydrogen infrastructure development, and wide-ranging use cases. Due to their reliability and minimal emissions, major U.S. corporations and utilities are adopting fuel cells for stationary power and backup systems. Federal and state-level tax incentives and funding, including support through the Inflation Reduction Act, stimulate hydrogen production and distribution investment. FCEVs and hydrogen-powered buses are gaining momentum in the transportation sector, particularly in California, where supportive legislation and public-private partnerships are accelerating deployment.

With increasing attention on grid resilience, energy storage, and industrial decarbonization, the U.S. fuel cell market is poised for significant growth. Expansion of hydrogen hubs and collaboration between national laboratories and private companies foster innovation in fuel cell design, durability, and affordability.

Europe Fuel Cell Market Trends

Ambitious climate targets, hydrogen roadmaps, and green transition policies under frameworks such as the European Green Deal and REPowerEU propel Europe's Fuel Cell market. Countries like Germany, France, and the Netherlands invest heavily in hydrogen production and refueling infrastructure, supporting the widespread use of fuel cells in transportation and industry. Fuel cells are increasingly important in decentralized power systems, particularly in urban environments and logistics hubs where space and emissions are critical constraints.

European manufacturers are also advancing solid oxide and PEM fuel cell technologies for combined heat and power, heavy-duty transport, and maritime applications. The region's commitment to phasing out fossil fuels and deploying green hydrogen positions Europe as a leading innovator and adopter in the global fuel cell landscape.

Latin America Fuel Cell Market Trends

The fuel cell market in Latin America is gaining traction due to the region's growing focus on clean energy, industrial development, and energy reliability. Countries such as Brazil, Chile, and Argentina are exploring hydrogen-based technologies for decarbonizing mining, refining, and energy production. With abundant renewable resources, particularly solar and wind, Latin America has significant potential for green hydrogen production, which supports downstream fuel cell applications.

Fuel cells are being tested for use in remote and off-grid regions. They provide reliable, emission-free power in areas where traditional grid expansion is unfeasible. Fuel cells' modular and low-maintenance characteristics make them well-suited for deployment in Latin America's diverse geographies and industrial environments.

Middle East & Africa Fuel Cell Market Trends

The Middle East and Africa (MEA) region is witnessing a steady rise in fuel cell adoption, led by national visions emphasizing economic diversification and energy innovation. Countries such as Saudi Arabia, the UAE, and South Africa are investing in hydrogen strategies and pilot projects focused on transport, power generation, and industrial decarbonization. Fuel cells offer scalable, off-grid solutions for power generation in mining, construction, and remote communities, making them valuable tools in regions with limited grid access.

Initiatives in Africa aimed at enhancing rural electrification and reducing reliance on diesel generators are supporting the integration of stationary fuel cell systems. The MEA region's abundant solar resources and interest in green hydrogen production position it as an emerging market for fuel cell deployment in the coming decade.

Key Fuel Cell Company Insights

Some of the key players operating in the global fuel cell market include Ballard Power Systems, Bloom Energy, Ceres Power Holdings PLC, Doosan Fuel Cell America, Inc., FuelCell Energy, Inc., Hydrogenics Corporation, Nedstack Fuel Cell Technology B.V., Nuvera Fuel Cells LLC, Plug Power, Inc., and SFC Energy AG. These companies are at the forefront of innovation, focusing on advanced fuel cell stack development, system integration, and cost optimization.

Key Fuel Cell Companies:

The following are the leading companies in the fuel cell market. These companies collectively hold the largest market share and dictate industry trends.

- Ballard Power Systems

- Bloom Energy

- Ceres Power Holdings PLC

- Doosan Fuel Cell America, Inc.

- FuelCell Energy, Inc

- Hydrogenics Corporation

- Nedstack Fuel Cell Technology B.V.

- Nuvera Fuel Cells LLC

- Plug Power, Inc.

- SFC Energy AG

Recent Developments

-

In February 2025, Bloom Energy announced the expansion of its modular fuel cell production facility in Frankfurt, Germany. The upgraded plant aims to accelerate the manufacturing of prefabricated, medium- and high-product electrical houses tailored for rapid deployment in industrial, utility, and renewable energy projects. This strategic investment supports the growing global demand for compact, plug-and-play power solutions, especially as infrastructure developers seek faster, more flexible alternatives to traditional on-site substation construction.

Fuel Cell Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11 billion

Revenue forecast in 2033

USD 34 billion

Growth rate

CAGR of 15.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in Units, capacity in MW, Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea;Taiwan; Australia; Brazil; Saudi Arabia

Key companies profiled

Ballard Power Systems; Bloom Energy; Ceres Power Holdings PLC; Doosan Fuel Cell America, Inc.; FuelCell Energy, Inc; Hydrogenics Corporation; Nedstack Fuel Cell Technology B.V.; Nuvera Fuel Cells LLC; Plug Power, Inc.; SFC Energy AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fuel Cell Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global fuel cell market report on the basis of application, product and region:

-

Application Outlook (Revenue, USD Million; Capacity, MW; Volume, Units; 2021 - 2033)

-

Stationary

-

Transportation

-

Portable

-

-

Product Outlook (Revenue, USD Million; Capacity, MW; Volume, Units; 2021 - 2033)

-

PEMFC

-

PAFC

-

SOFC

-

MCFC

-

Others

-

-

Regional Outlook (Revenue, USD Million; Capacity, MW; Volume, Units; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global fuel cell market size was estimated at USD 9.0 million in 2024 and is expected to reach USD 11 million in 2025.

b. The global fuel cell market is expected to grow at a compound annual growth rate of 15.3% from 2025 to 2033 to reach USD 34 million by 2033.

b. Based on the application segment, Stationary fuel cells held the largest revenue share of more than 68.67% in 2024. This dominance is attributed to their high reliability, continuous power output, and ability to operate independently of grid fluctuations, making them ideal for residential, commercial, and industrial backup systems.

b. Some of the key players in the global fuel cell market include Ballard Power Systems, Bloom Energy, Ceres Power Holdings PLC, Doosan Fuel Cell America, Inc., FuelCell Energy, Inc., Hydrogenics Corporation, Nedstack Fuel Cell Technology B.V., Nuvera Fuel Cells LLC, Plug Power, Inc., and SFC Energy AG, among others.

b. The key factors driving the fuel cell market include the growing global emphasis on clean energy, decarbonization, and energy resilience. Fuel cells offer high efficiency, low emissions, and reliable performance across various applications, making them an attractive alternative to conventional combustion-based power systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.