- Home

- »

- Renewable Energy

- »

-

Solid Oxide Fuel Cell Market Size, Industry Report, 2033GVR Report cover

![Solid Oxide Fuel Cell Market Size, Share & Trends Report]()

Solid Oxide Fuel Cell Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Transportation, Portable, Stationary), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-1-68038-685-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Solid Oxide Fuel Cell Market Summary

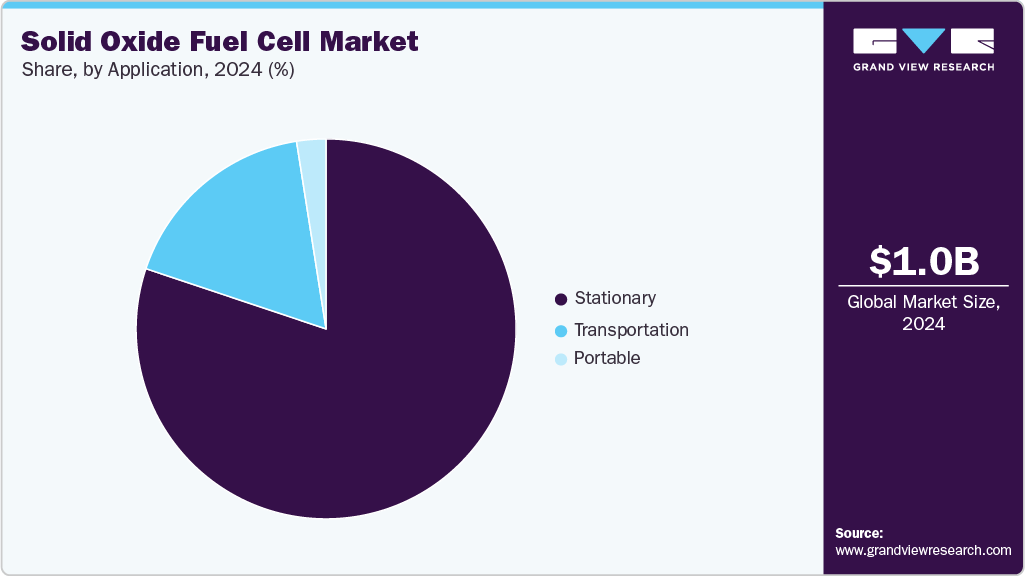

The global solid oxide fuel cell market size was estimated at USD 1.0 billion in 2024 and is anticipated to reach USD 4.7 billion by 2033, growing at a CAGR of 15.7% from 2025 to 2033. Rising demand for clean and efficient energy generation systems, especially in decentralized and off-grid applications, is a key factor driving the adoption of SOFC technology.

Key Market Trends & Insights

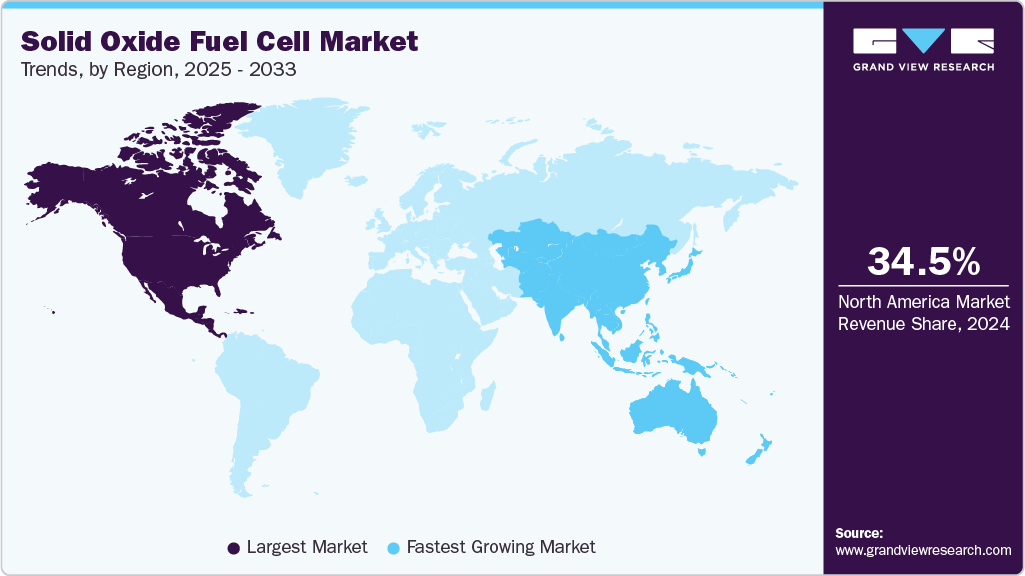

- North America solid oxide fuel cell market held the largest share of 34.52% of the global market in 2024.

- The solid oxide fuel cell industry in the U.S. is expected to grow significantly over the forecast period.

- By application, the stationary segment held the highest market share of 80.13% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.0 Billion

- 2033 Projected Market Size: USD 4.7 Billion

- CAGR (2025-2033): 15.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Solid oxide fuel cells offer high fuel-to-electricity conversion efficiency, low emissions, and fuel flexibility, making them increasingly attractive in sectors ranging from industrial and commercial power generation to auxiliary power units for transportation. In recent years, heightened concerns about energy security and decarbonization have accelerated the deployment of Solid oxide fuel cells (SOFC) systems in both stationary and mobile energy infrastructures, particularly in countries advancing toward net-zero goals. The SOFC market benefits from ongoing federal investments in hydrogen infrastructure and resilient grid technologies in the United States.

Several pilot projects have demonstrated the role of SOFCs in enhancing microgrid reliability and lowering carbon intensity in commercial buildings. The country’s growing shift from centralized fossil-fuel-based systems to localized clean energy alternatives is expected to stimulate demand for SOFC installations further. In addition, supportive policy frameworks, increasing private sector collaboration, and strategic partnerships with energy utilities enhance the scalability of SOFC deployments in urban and industrial zones. These trends point toward long-term adoption across the distribution of energy and backup power applications.

Japan continues to lead the global SOFC market, owing to its strong focus on hydrogen utilization and energy efficiency. The country has heavily invested in residential fuel cell systems like ENE-FARM. It is actively scaling up its hydrogen supply chain infrastructure to support the broader adoption of fuel cell technologies. SOFCs are increasingly being integrated into smart home systems and combined heat and power (CHP) units, contributing to widespread use. With national targets to become carbon-neutral by 2050 and ongoing R&D efforts aimed at cost reduction and performance optimization, Japan will likely maintain a dominant position in the global SOFC landscape during the forecast period.

Solid oxide fuel cells provide a sustainable and highly efficient power solution with minimal environmental impact. Their versatility in using various fuels such as hydrogen, biogas, and natural gas adds to their appeal in an evolving energy ecosystem. As grid stability, resilience, and emissions reduction become top priorities globally, SOFC technology is emerging as a cornerstone of next-generation energy systems, offering robust performance in centralized utilities and localized, self-sustained networks.

Drivers, Opportunities & Restraints

The global market for solid oxide fuel cell (SOFC) is primarily driven by the increasing demand for high-efficiency, low-emission energy systems across industrial, commercial, and residential sectors. The growing need to decarbonize power generation, improve energy reliability, and transition toward cleaner fuels, particularly hydrogen, has placed SOFC technology at the forefront of sustainable energy solutions.

Governments worldwide support fuel cell R&D through public-private partnerships, subsidies, and clean energy mandates, enhancing the market outlook. Additionally, SOFCs offer fuel flexibility and quiet, modular operation, making them ideal for backup power, combined heat and power (CHP) applications, and off-grid energy generation in high-demand sectors such as data centers and healthcare.

Opportunities within the SOFC market are expanding rapidly, particularly with the global pivot toward hydrogen economies. Advancements in material science and system integration are driving down costs and improving thermal efficiency, making SOFC systems more commercially viable. Emerging applications in distributed power systems, marine propulsion, and auxiliary power units for electric vehicles offer new avenues for growth.

Furthermore, increasing investments in green hydrogen infrastructure and electrolyzer integration highlight SOFCs' potential in reversible energy systems. However, several restraints continue to affect large-scale adoption. High upfront capital costs, long start-up times, and technical complexity in system maintenance remain significant challenges. Limited hydrogen distribution networks, regulatory uncertainty, and slow commercialization timelines constrain market expansion, especially in developing regions.

Application Insights

Stationary segment held the revenue share of over 80.13% in 2024. The stationary segment held the largest revenue share of approximately 80.13% in 2024. This dominance is attributed to the growing deployment of SOFC systems in stationary power generation across commercial buildings, data centers, hospitals, and utility-scale energy projects. These systems are increasingly favored for their high efficiency, fuel flexibility, and ability to provide continuous, low-emission electricity and heat. As demand for decentralized energy solutions rises, stationary SOFCs are being adopted for combined heat and power (CHP) applications, especially in regions with aging grid infrastructure or stringent emission regulations.

The adoption of stationary SOFCs is further driven by industries and institutions prioritizing energy resilience, cost savings, and carbon reduction. For instance, many corporate campuses and critical facilities are investing in SOFC-powered microgrids to ensure uninterrupted power during outages while reducing reliance on diesel generators. Additionally, their compatibility with hydrogen and biogas makes stationary SOFCs a strategic fit for net-zero and low-carbon energy transition goals. As urban power loads grow due to increasing electrification, digitalization, and climate adaptation needs, the stationary segment will remain the cornerstone of SOFC market growth over the forecast period.

Regional Insights

North America held over 34.52% revenue share of the Global Solid Oxide Fuel Cell market. North America SOFC industry held the largest global revenue share in 2024, driven by robust investments in clean energy technologies, growing demand for resilient power infrastructure, and increasing emphasis on hydrogen economy development. The United States is leading regional growth with widespread adoption of SOFC systems across commercial, industrial, and utility-scale applications.

SOFCs are deployed as reliable, low-emission alternatives to traditional power sources, from powering data centers and healthcare facilities to enabling off-grid microgrids. Federal support for fuel cell R&D, tax credits, and public-private partnerships continue to accelerate technology commercialization and scale.

The region benefits from an advanced energy ecosystem, strong innovative networks, and the presence of major SOFC manufacturers and system integrators. Companies increasingly integrate SOFCs with combined heat and power (CHP) units, leveraging their high efficiency and fuel flexibility, especially in states promoting decarbonization through clean hydrogen and renewable natural gas.

Ongoing grid modernization efforts and the push for energy decentralization have further enhanced the relevance of SOFCs in North America's energy transition strategy. With favorable regulatory frameworks, maturing technology, and expanding industrial use cases, North America is expected to maintain its leadership in the global SOFC market throughout the forecast period.

U.S. Solid Oxide Fuel Cell Market Trends

The United States solid oxide fuel cell (SOFC) industry is growing rapidly, driven by strong federal support, state-level clean energy goals, and increasing interest in distributed, low-emission power generation. Legislative frameworks like the Inflation Reduction Act have created favorable conditions for fuel cell investments, offering tax credits and funding for hydrogen infrastructure, microgrid development, and zero-emission technologies.

With growing pressure to decarbonize power systems and strengthen energy reliability, SOFCs are gaining traction in commercial, industrial, and institutional applications particularly for combined heat and power (CHP), data center backup, and off-grid operations.

Rising demand for energy efficiency, grid resilience, and fuel flexibility is accelerating the adoption of SOFC technology in the U.S. The country is also advancing green hydrogen initiatives and electrolyzer integration, reinforcing SOFCs’ role in the emerging hydrogen economy. Leading energy companies and research institutions heavily invest in next-generation SOFC systems, focusing on cost reduction, thermal efficiency, and long-term durability.

As clean hydrogen production scales and distributed energy solutions become more widespread, the U.S. is positioned to remain a key global market for SOFC deployment throughout the forecast period, supported by innovation, regulatory backing, and a growing base of commercial use cases.

Asia Pacific Solid Oxide Fuel Cell Market Trends

The Asia Pacific solid oxide fuel cell industry growth is driven by the large-scale investments in hydrogen infrastructure and a growing focus on low-emission technologies. The region is witnessing increased adoption of SOFC systems as part of its broader clean energy transition, with countries like Japan, South Korea, and China leading national efforts to deploy advanced fuel cell technologies.

Government-backed programs, decarbonization mandates, and strategic investments in distributed power systems support this momentum. Integration of SOFCs into residential energy units, commercial CHP systems, and pilot hydrogen projects is steadily expanding, reinforcing the region’s role in global SOFC development.

Policy-driven initiatives, rapid urbanization, and strong manufacturing capabilities continue to shape the Asia Pacific SOFC market. Japan remains a frontrunner with its ENE-FARM residential fuel cell initiative, while China and South Korea are scaling up SOFC production capacity and demonstration projects.

Regional governments also prioritize fuel diversification and grid resilience, creating favorable conditions for SOFC adoption. With growing energy demand, environmental concerns, and industrial decarbonization targets, Asia Pacific is expected to significantly contribute to the global solid oxide fuel cell industry throughout the forecast period.

Europe Solid Oxide Fuel Cell Market Trends

The European solid oxide fuel cell industry is advancing steadily, supported by the region’s commitment to achieving climate neutrality, hydrogen integration goals, and energy diversification under frameworks like the European Green Deal and REPowerEU. As Europe transitions from fossil fuels, SOFCs are gaining attention for their high efficiency, flexibility, and compatibility with hydrogen-based energy systems. Governments across the region are increasingly funding pilot projects, R&D initiatives, and commercial demonstrations to scale SOFC deployment in industrial decarbonization, distributed power generation, and combined heat and power (CHP) applications.

Rising energy security concerns, driven by geopolitical disruptions and the need to reduce reliance on imported gas, are accelerating investments in clean, decentralized energy technologies. SOFC systems are being adopted in manufacturing, transportation hubs, and large commercial facilities where continuous, low-emission power is critical. Europe’s mature regulatory environment, well-developed infrastructure, and strong public-private collaboration support the commercialization of fuel cell technologies. With growing momentum behind green hydrogen production, cross-border energy integration, and smart energy systems, Europe is expected to play a pivotal role in shaping the global SOFC market throughout the forecast period.

Key Solid Oxide Fuel Cell Company Insights

Some of the key players operating in the SOFC industry include Bloom Energy, Mitsubishi Power Ltd., Ceres, General Electric, FuelCell Energy Inc., and AVL, among others. These companies are actively advancing SOFC technology through strategic partnerships, pilot installations, and fuel-flexible system development.

Key Solid Oxide Fuel Cell Companies:

The following are the leading companies in the solid oxide fuel cell market. These companies collectively hold the largest market share and dictate industry trends.

- Bloom Energy

- Mitsubishi Power Ltd.

- Ceres

- General Electric

- FuelCell Energy Inc.

- Ningbo SOFCMAN Energy

- KYOCERA Corporation

- AVL

- NGK SPARK PLUG CO., LTD.

Recent Developments

-

In March 2025, Bloom Energy announced the successful installation of a 20 MW solid oxide fuel cell system at a major data center campus in Texas, United States. The project, one of the largest global SOFC deployments for digital infrastructure, is designed to deliver uninterrupted, low-emission power while reducing the facility’s reliance on the grid. The system is expected to cut over 45,000 metric tons of CO₂ emissions annually, supporting energy resilience and corporate sustainability targets.

Solid Oxide Fuel Cell Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.4 billion

Revenue forecast in 2033

USD 4.7 billion

Growth rate

CAGR of 15.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, volume in units, capacity in kW, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, capacity forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Rest of World

Country scope

U.S.; Germany; UK; France; China; Japan; South Korea

Key companies profiled

Bloom Energy; Mitsubishi Power Ltd.; Ceres; General Electric; FuelCell Energy Inc.; Ningbo SOFCMAN Energy; KYOCERA Corporation; AVL; NGK SPARK PLUG CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solid Oxide Fuel Cell Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global solid oxide fuel cell market report based on application and region:

-

Application Outlook (Volume, Thousand Units; Capacity, kW; Revenue USD Million, 2021 - 2033)

-

Stationary

-

Transportation

-

Portable

-

-

Regional Outlook (Volume, Thousand Units; Capacity, kW; Revenue USD Million, 2021 - 2033)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Frequently Asked Questions About This Report

b. The global solid oxide fuel cell market size was estimated at USD 1.0 billion in 2024 and is expected to reach USD 1.4 billion in 2025.

b. The global solid oxide fuel cell market is expected to grow at a compound annual growth rate of 15.7% from 2025 to 2033 to reach USD 4.7 billion by 2033.

b. Stationary was the largest segment accounting for a share of about 81.5% of the global SOFC market revenue in 2024 owing to favorable regulations leading to large-scale demand for micro-CHP systems.

b. Some key players operating in the SOFC market include FuelCell Energy Inc, Bloom Energy, Ceres, Mitsubishi Power, Ltd., and others.

b. Key factors driving the growth of the solid oxide fuel cell market include the presence of supporting policies and incentives for SOFC installation in major countries such as Japan, Germany, and the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.