- Home

- »

- Power Generation & Storage

- »

-

Proton Exchange Membrane Fuel Cell Market Report, 2033GVR Report cover

![Proton Exchange Membrane Fuel Cell Market Size, Share & Trends Report]()

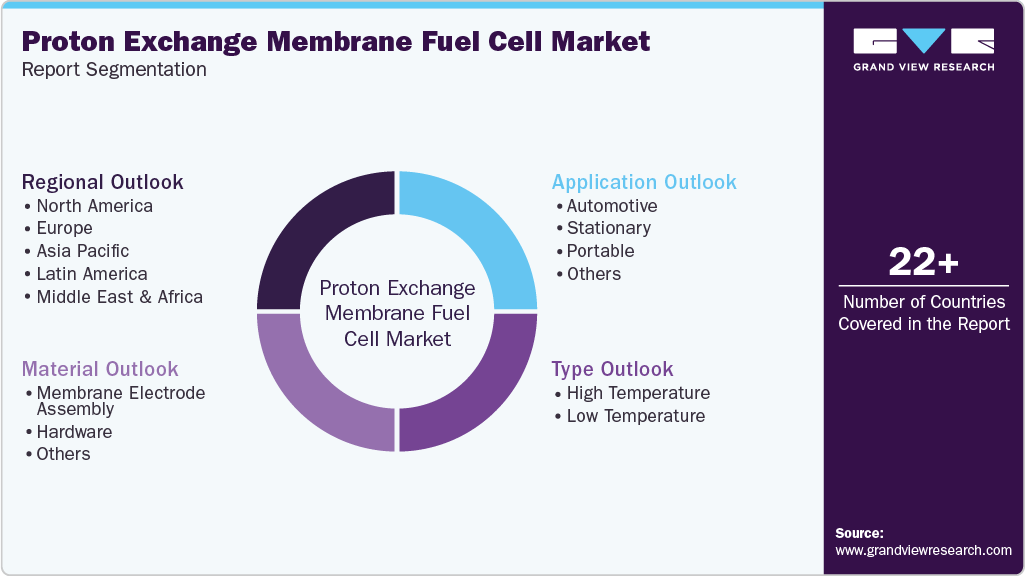

Proton Exchange Membrane Fuel Cell Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Automotive, Stationery, Portable), By Type (High Temperature, Low Temperature), By Material, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-998-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Proton Exchange Membrane Fuel Cell Market Summary

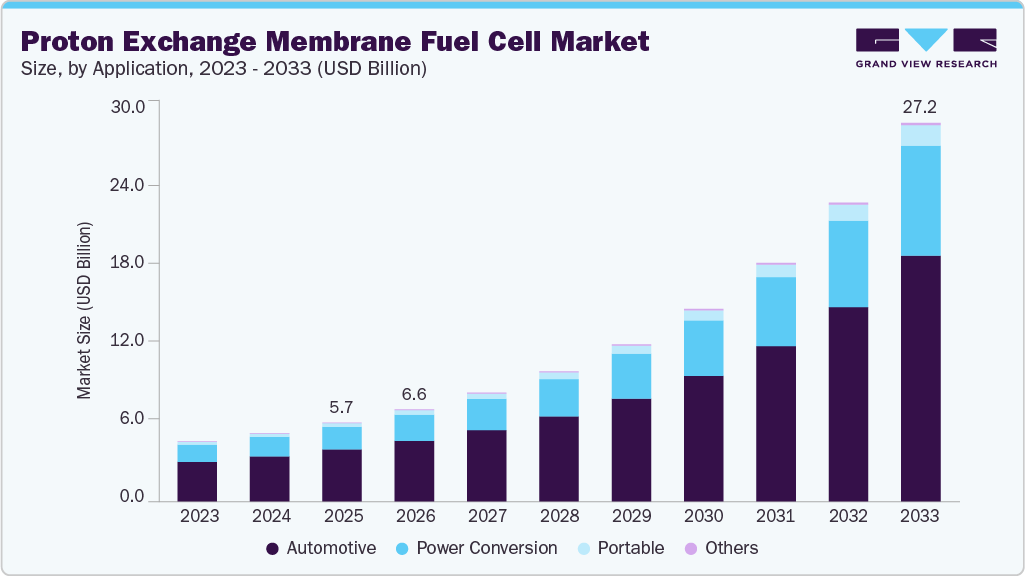

The global proton exchange membrane fuel cell market size was at approximately USD 5.68 billion in 2025 and is projected to reach USD 27.23 billion by 2033, growing at a CAGR of 22.4% from 2026 to 2033. The market is experiencing significant expansion, primarily driven by the urgent global imperative to decarbonize the transportation and energy sectors.

Key Market Trends & Insights

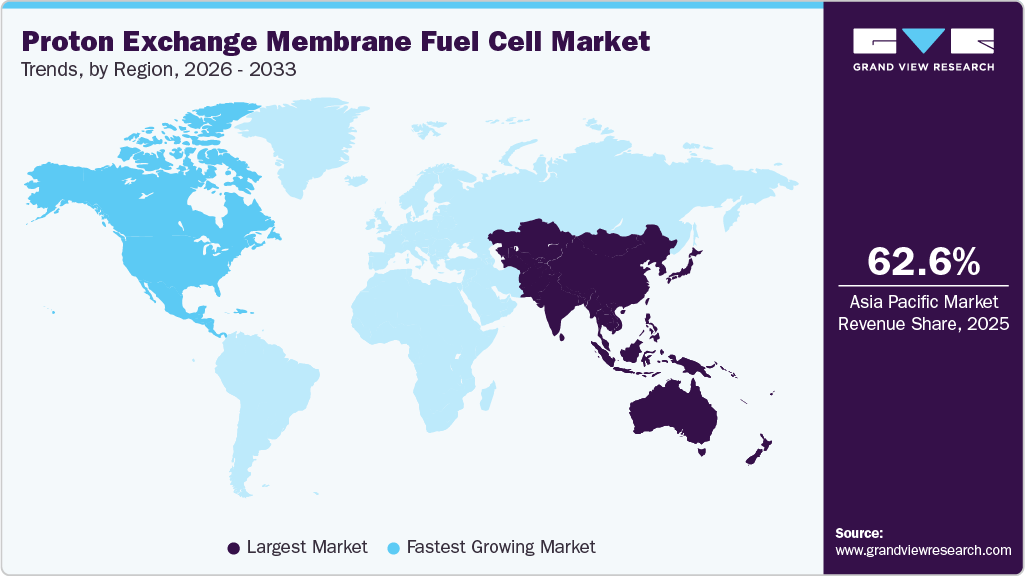

- Asia Pacific proton exchange membrane fuel cell industry held the largest share of 62.6% of the global market in 2025.

- By application, automotive held the largest market share of 65.8% in 2025.

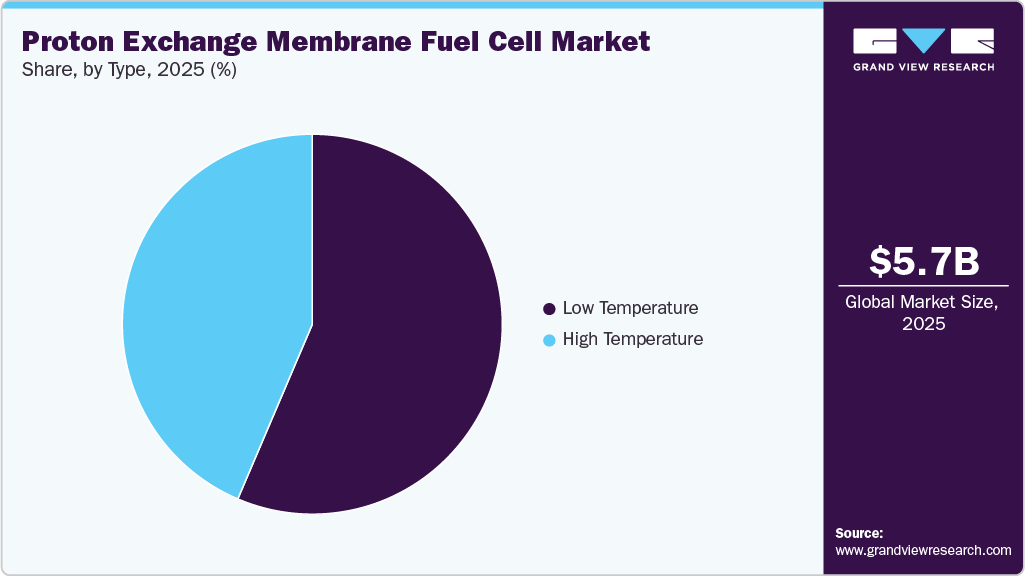

- Based on type, the low temperature segment held the largest market share in 2025.

- Based on material, the membrane electrode assembly segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.68 Billion

- 2033 Projected Market Size: USD 27.23 Billion

- CAGR (2026-2033): 22.4%

- Asia Pacific: Largest market in 2025

- North America: Fastest growing market

As nations and corporations commit to ambitious net-zero emissions targets, proton exchange membrane fuel cell (PEMFC) technology has emerged as a critical solution for hard-to-abate applications.Unlike battery electric vehicles (BEVs), PEMFC-powered vehicles, such as buses, trucks, and trains, offer long ranges and rapid refueling times, making them particularly attractive for heavy-duty and commercial fleet applications. This alignment with stringent climate policies and green regulatory frameworks, including subsidies and zero-emission vehicle mandates, is providing a powerful top-down impetus for market growth, encouraging investment and adoption across the globe.

PEMFCs are the primary end use technology for clean hydrogen. Consequently, significant public and private investments in hydrogen production, storage, and refueling stations are creating the necessary ecosystem for PEMFC viability. Initiatives like the European Union's Hydrogen Strategy and the U.S. Department of Energy's Hydrogen Energy Earthshot are funneling billions into the supply chain, reducing the cost of green hydrogen and addressing the critical "chicken-and-egg" challenge. This expanding infrastructure backbone directly fuels confidence and demand for PEMFC applications, from vehicles to stationary power.

Continuous research and development have led to improvements in membrane durability, catalyst efficiency (notably through reduced platinum loading), and system integration. Economies of scale, as manufacturing volumes increase, are driving down the historically high cost of fuel cell stacks and balance-of-plant components. Furthermore, innovations in mass production techniques and the standardization of components are making PEMFC systems more competitive commercially with incumbent technologies, enhancing their value proposition for both mobility and stationary power generation.

The market is further propelled by the growing demand for resilient and clean backup power solutions, especially within the data center, telecommunications, and critical infrastructure sectors. PEMFCs offer distinct advantages over traditional diesel generators, providing quiet, low-emission, and reliable power with longer continuous runtimes. This application is gaining substantial traction as corporate sustainability goals converge with the need for grid-independent, high-quality power. Simultaneously, the material handling equipment market, particularly for forklifts in warehouses and distribution centers, has become a proven and successful early adoption sector, demonstrating the operational and economic benefits of PEMFCs and paving the way for broader industrial acceptance.

Drivers, Opportunities & Restraints

Mandates for zero-emission vehicles, particularly in heavy-duty transport sectors such as trucks, buses, and trains, where batteries are less practical, create robust demand. Simultaneously, substantial public and private investments into green hydrogen production and refueling infrastructure are alleviating a critical adoption barrier, while continuous R&D is improving system efficiency and driving down costs through material innovations and economies of scale. These converging forces are establishing PEMFCs as a vital technology for clean mobility and resilient, off-grid power applications.

Significant opportunities for market expansion lie in new applications and technological frontiers. Beyond transportation, there is growing potential in stationary power for data centers and telecom towers, as well as in marine and aviation sectors, where emissions are hard to abate. Furthermore, the integration of PEMFCs with renewable energy sources for long-duration energy storage presents a major opportunity within the evolving smart grid landscape. The development of platinum-group-metal-free (PGM-free) catalysts and advanced manufacturing techniques also offers the chance to dramatically reduce costs and overcome material dependency, potentially unlocking mass-market adoption.

However, the market faces considerable restraints that challenge its pace of growth. The high upfront capital cost of PEMFC systems, despite recent reductions, remains a barrier compared to incumbent technologies. The scarcity of a widespread, low-cost hydrogen refueling network continues to be a major hurdle, particularly for light-duty vehicles. In addition, technical challenges related to durability in real-world conditions, sensitivity to fuel impurities, and the reliance on expensive, scarce platinum-group metals for catalysts pose ongoing obstacles.

Application Insights

Automotive segment held the largest revenue share of over 65% in 2025. Growth in the automotive segment is propelled by rising demand for clean mobility solutions that deliver a long driving range with quick refueling. Fuel cell electric vehicles suit long-haul and high-utilization operations, which makes them attractive for commercial fleets, buses, and emerging heavy-duty programs. Governments are supporting this shift through incentives, fleet mandates, and expansion of hydrogen corridors, which improves access to fuel and encourages OEMs to scale vehicle production. As refueling networks expand across priority routes, adoption becomes easier for logistics operators and public transport agencies seeking reliable zero-emission options.

The portable segment is advancing as consumers and industries seek compact power solutions that offer longer operating time without dependence on grids or frequent recharging. PEM fuel cells supply steady electricity for outdoor equipment, defense systems, emergency response kits, and recreational devices. Their ability to run quietly with minimal emissions makes them suitable for sensitive environments and mission oriented tasks. Rising use of electronic tools, sensors, and communication devices in remote locations creates consistent demand for reliable portable power that performs well under varied conditions.

Material Insights

Membrane electrode assembly segment held the largest revenue share of over 58% in 2025. The Membrane Electrode Assembly (MEA) segment is gaining traction because it forms the core performance engine of every PEM fuel cell. Demand rises as industries seek higher power density, longer system life, and stronger output stability across varied operating environments. MEAs influence efficiency, durability, and cost per kilowatt, which makes them central to the commercial success of both low temperature and high temperature PEM systems. As automotive, portable, and stationary applications scale, manufacturers require MEAs with superior water management, improved chemical resilience, and consistent quality, driving steady growth in this material category.

The hardware segment is expanding as system builders focus on components that enhance durability, power output, and reliability across full stack operation. Bipolar plates, end plates, frames, and current collectors play a crucial role in maintaining structural integrity and supporting efficient heat and water management. As deployment grows in automotive, portable, and stationary applications, developers seek hardware that withstands continuous thermal cycles, vibration, and long operational hours while keeping weight and volume under control. This demand pushes suppliers to upgrade material quality and precision engineering, strengthening the growth outlook for the hardware category.

Type Insights

Low temperature segment held the revenue share of over 56% in 2025. Low temperature PEM fuel cells continue to gain momentum because they operate efficiently at modest temperatures, which simplifies system design and supports fast start capability. Their quick response makes them suitable for mobility, portable units, residential power, and backup applications where immediate load following is essential. The lower operating temperature reduces thermal stress on components and allows the use of cost effective materials for balance of plant, creating a pathway for broader commercial deployment. This performance profile has encouraged manufacturers to expand production capacity and refine system configurations for diverse end uses.

High temperature PEM fuel cells are advancing through their ability to operate at elevated temperatures that enhance fuel tolerance and improve heat integration. Their higher thermal range allows efficient handling of impurities in hydrogen streams, which is valuable in industrial settings and distributed power installations where perfect fuel purity is difficult to maintain. Better waste heat recovery supports combined heat and power systems, improving overall efficiency and creating additional value in commercial and residential applications. These characteristics position high temperature PEM systems as strong contenders for sectors seeking dependable performance under more demanding operating conditions.

Regional Insights

Asia Pacific held over 62% revenue share of the global proton exchange membrane fuel cell market. Asia Pacific proton exchange membrane fuel cell industry is advancing rapidly due to strong government involvement and accelerating investment across hydrogen value chains. Countries are establishing national hydrogen roadmaps, large scale funding programs, and fleet adoption targets that push fuel cell deployment in transport, power generation, and industrial sectors. Expansion of hydrogen corridors, refueling stations, and demonstration hubs strengthens confidence among vehicle manufacturers and end users. Growing urbanization and rising energy demand also create openings for cleaner technologies, encouraging adoption of PEM fuel cells as part of regional decarbonization plans.

North America Proton Exchange Membrane Fuel Cell Market Trends

North America proton exchange membrane fuel cell industry is moving forward through strong policy commitments, large scale demonstration programs, and targeted funding for hydrogen infrastructure. Federal and state level initiatives support clean mobility, station deployment, and hydrogen production, which creates a favorable landscape for PEM fuel cell adoption. Incentives for zero emission commercial vehicles, along with procurement programs for public transit and government fleets, stimulate early demand. Growth in renewable energy and rising interest in resilient backup power solutions also encourage industries to integrate fuel cells into broader energy strategies.

U.S. Proton Exchange Membrane Fuel Cell Market Trends

The U.S. proton exchange membrane fuel cell industry is progressing through a mix of policy support, infrastructure investment, and rising commercial interest in hydrogen based technologies. Federal initiatives encourage clean hydrogen production, zero emission vehicles, and resilient energy systems, creating a strong foundation for PEM fuel cell growth. State level programs in California and several northeastern regions add momentum through incentives, fleet mandates, and refueling network expansion. Commercial fleets, transit agencies, and industrial users are beginning to adopt fuel cell platforms for long range transport and reliable backup power in locations where emissions reduction is a priority.

Europe Proton Exchange Membrane Fuel Cell Market Trends

Europe proton exchange membrane fuel cell industry is advancing through comprehensive policy frameworks that prioritize hydrogen as a central pillar of the region’s clean energy transition. The European Union has introduced ambitious targets for hydrogen production, infrastructure development, and zero emission mobility, which create an encouraging environment for PEM fuel cell adoption. Funding programs support large scale projects across transport, industry, and power sectors, while national strategies in countries such as Germany, France, and the Netherlands accelerate deployment through incentives and public procurement. This structured policy landscape strengthens market confidence and supports multiyear investment planning.

Latin America Proton Exchange Membrane Fuel Cell Market Trends

Latin America proton exchange membrane fuel cell industry is gaining traction as governments and energy companies explore hydrogen pathways to strengthen energy security and reduce dependence on conventional fuels. Several countries are developing national hydrogen strategies that encourage pilot deployments of PEM fuel cells in transport, distributed power, and industrial applications. Growing interest in clean mobility, combined with the need to modernize public transport systems, creates early opportunities for buses and fleet vehicles powered by fuel cells. The region’s abundant renewable resources also support long term plans for green hydrogen production, which aligns well with PEM technology requirements.

Key Proton Exchange Membrane Fuel Cell Company Insights

Some of the key players operating in the global proton exchange membrane fuel cell industry include Altergy, AVL, among others.

-

Altergy is a U.S. based fuel cell manufacturer focused on developing lightweight, reliable, and scalable PEM fuel cell systems. The company emphasizes engineering approaches that simplify system design and reduce production cost, which supports broader use across commercial and industrial settings. Altergy’s technology is shaped by a goal of replacing traditional diesel generators with cleaner and more efficient power units that perform consistently under varied conditions. Over the years, the company has built a reputation for durable solutions suited for telecom, emergency services, and off grid environments.

-

AVL is an Austria based engineering and technology company recognized for its extensive research, testing, and development expertise in advanced propulsion and energy systems. The company operates globally with engineering centers that specialize in fuel cells, hydrogen technologies, batteries, and powertrain optimization. AVL leverages its long history in automotive engineering to advance fuel cell performance through simulation tools, system integration capabilities, and deep materials research. Its work supports OEMs and energy companies seeking faster innovation cycles and reliable commercialization pathways.

Key Proton Exchange Membrane Fuel Cell Companies:

The following are the leading companies in the proton exchange membrane fuel cell market. These companies collectively hold the largest Market share and dictate industry trends.

- Altergy

- AVL

- Ballard Power Systems

- Cummins Inc.

- Horizon Fuel Cell Technologies

- Intelligent Energy Limited

- ITM Power PLC

- Nedstack Fuel Cell Technology BV

- Plug Power Inc.

- PowerCell Sweden AB

Recent Developments

- In December 2025, India launched its first fully indigenous hydrogen fuel cell passenger vessel into commercial service on the Ganga in Varanasi, marking a major milestone in the country’s green maritime push. The 24‑metre catamaran, built by Cochin Shipyard Ltd (CSL) for the Inland Waterways Authority of India (IWAI), is the first in India to demonstrate hydrogen fuel cell propulsion in a maritime environment and is powered by a Low Temperature Proton Exchange Membrane (PEM) fuel cell system that converts stored hydrogen into electricity, emitting only water as a byproduct.

Proton Exchange Membrane Fuel Cell Market Report Scope

Report Attribute

Details

Market Definition

The Proton Exchange Membrane Fuel Cell (PEMFC) market represents the global industry involved in the production, commercialization, and deployment of PEM fuel cell systems used for transportation, stationary power, and portable applications.

Market size value in 2026

USD 6.62 billion

Revenue forecast in 2033

USD 27.23 billion

Growth rate

CAGR of 22.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026-2033

Quantitative Units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, type, material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; Italy; Netherlands; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Altergy; AVL; Ballard Power Systems; Cummins Inc.; Horizon Fuel Cell Technologies; Intelligent Energy Limited; ITM Power PLC; Nedstack Fuel Cell Technology BV; Plug Power Inc.; PowerCell Sweden AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Proton Exchange Membrane Fuel Cell Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global proton exchange membrane fuel cell market report based on application, type, material, and region.

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Stationary

-

Portable

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

High Temperature

-

Low Temperature

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Membrane Electrode Assembly

-

Hardware

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global proton exchange membrane fuel cell market size was estimated at USD 5.68 billion in 2025 and is expected to reach USD 6.62 billion in 2026.

b. The global proton exchange membrane fuel cell market is expected to grow at a compound annual growth rate of 22.4% from 2026 to 2033 to reach USD 27.23 billion by 2033.

b. Based on the application segment, automotive held the largest revenue share of more than 65% in 2025.

b. Some of the key players operating in the global proton exchange membrane fuel cell market include Altergy, AVL, Ballard Power Systems, Cummins Inc., Horizon Fuel Cell Technologies, Intelligent Energy Limited, ITM Power PLC, Nedstack Fuel Cell Technology BV, Plug Power Inc., PowerCell Sweden AB, and others.

b. The proton exchange membrane fuel cell market is primarily driven by growing demand for clean energy solutions across transportation and stationary power applications, rising investments in hydrogen infrastructure, and steady technological improvements that enhance efficiency, durability, and cost competitiveness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.