- Home

- »

- Biotechnology

- »

-

Genotyping Market Size, Share And Growth Report, 2030GVR Report cover

![Genotyping Market Size, Share & Trends Report]()

Genotyping Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Technology (PCR, Capillary Electrophoresis, Microarrays, Sequencing, Mass Spectrometry), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-002-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Genotyping Market Size & Trends

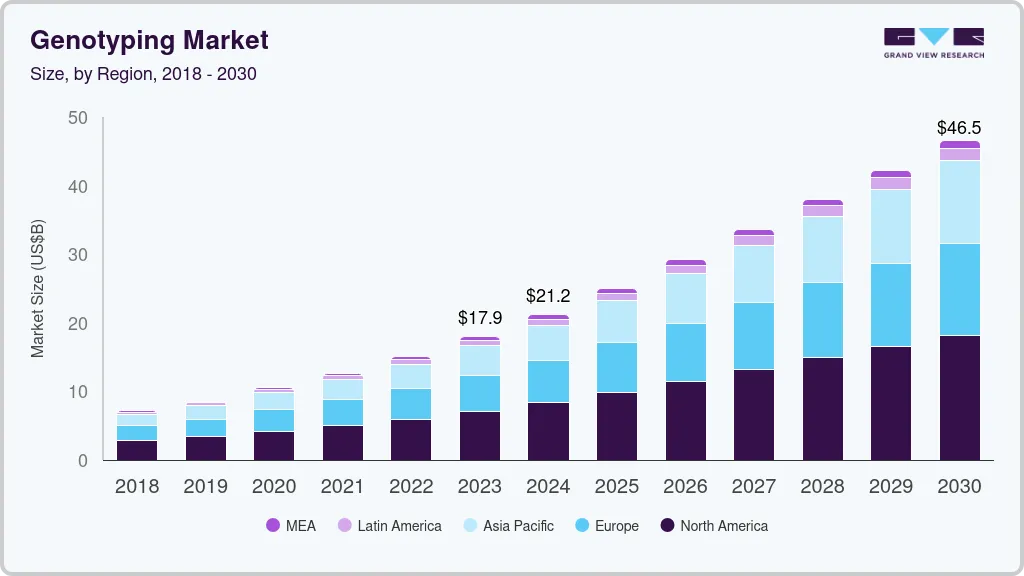

The global genotyping market size was valued at USD 17.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 14.6% from 2024 to 2030. The growth can be attributed to technological advancements, rising prevalence of cancer & genetic disorders, and increasing R&D funding for precision medicine research. COVID-19 has had a positive impact on the genotyping market, as the pandemic led to an increased demand for COVID-19 genotyping kits. SNP genotyping has been used for the detection of genetic variants of COVID-19.

Increase in government funding, especially for genomic research, by government bodies, and pharma & biotechnology companies to accelerate research is expected to drive the genotyping market. For instance, in September 2018, NIH granted USD 28.6 million to the “All of Us Research Program” for establishing three genome centers around the U.S. dedicated to precision medicine research.

The prevalence of chronic diseases such as cancer and genetic disease is increasing worldwide and is expected to drive demand for genotypic-based diagnostic testing. For instance, according to WHO, 19.1 million new cancer cases were diagnosed globally in 2020. Cancer-causing viruses such as Human Papilloma Virus (HPV) and Hepatitis B Virus (HBV)/Hepatitis C Virus (HCV) are also responsible for about 20% of cancer deaths worldwide. The number of cancer cases is expected to increase by around 70% over the next two decades, estimated based on population growth and aging. Therefore, the rising prevalence of cancer is expected to be a high-impact rendering driver of this market.

However, factors such as lack of skilled technicians, especially in developing countries, could hamper market growth, genotyping data analysis and management requires high technical knowhow. Currently, there is a relatively low number of professionals and experts working in this field in developing nations.

Strategic initiatives undertaken by local players are anticipated to contribute to market growth. For instance, in February 2021, VG Acquisition Corp. merged with 23andMe, a U.S.-based genetics and research company actively working with direct-to-consumer genotyping solutions. This merger would provide capital funds for their genetic consumer health business.

Product Insights

The reagents & kits segment held the largest share of 61.77% in 2022. It is expected to grow at a rapid CAGR during the forecast years due to increasing demand for genetic testing, rising investments in R&D, and increasing genotyping testing volumes.

Software & services segment is also anticipated to grow at a significant CAGR of 14.37% from 2023 to 2030 due to rise in the adoption of software-based services by research laboratories and academic institutions. Bioinformatics solutions improve the efficacy of sequencing methods and help avoid errors that occur in traditional sequencing methods. These services find application in agrigenomics, human diseases, animal livestock, and microbes. All the aforementioned factors are anticipated to propel market growth over the forecast period.

Technology Insights

The sequencing segment dominated the market in 2022 with a share of 21.07%. It is expected to grow at a lucrative rate during the forecast period due to improved specificity and better ability to detect low expression & differentially expressed genes than other techniques. Genotyping by sequencing also helps perform comparative analysis across samples without the need for a reference genome.

PCR segment is projected to grow at a CAGR of 11.61% from 2023 to 2030 due to the increasing demand for advanced diagnostic techniques, rising number of CROs, forensic & research laboratories and growing prevalence of diseases such as chronic diseases & genetic disorders are major factors expected to drive market growth.

Application Insights

Diagnostics and personalized medicine segment accounted for the highest share of 33.70% in 2022 owing to the rising adoption of genotyping products for research and the increasing need for the diagnosis of genetic diseases. In addition, strategic collaborations among players are expected to boost market growth. For instance, in February 2019, Centogene entered into a strategic partnership with Sarepta Therapeutics, Inc. to diagnose Duchenne muscular dystrophy patients in the MENA region.

Pharmacogenomics is expected to witness the fastest CAGR of 15.34% from 2023 to 2030. Genotyping helps identify patients suitable for a particular drug based on the patients’ genetic make-up. Identifying population subsets that are responsive or non-responsive help deliver tailor-made treatment to these individuals with different genetic makeup and helps reduce clinical trial attrition. Moreover, key players play an active role by providing solutions for pharmacogenomics studies. For instance, RT PCR solution by Thermo Fisher Scientific for pharmacogenomic testing includes TaqMan assays and QuantStudio instruments. It also provides a PharmacoScan solution with a PharmacoScan Assay Kit.

End-use Insights

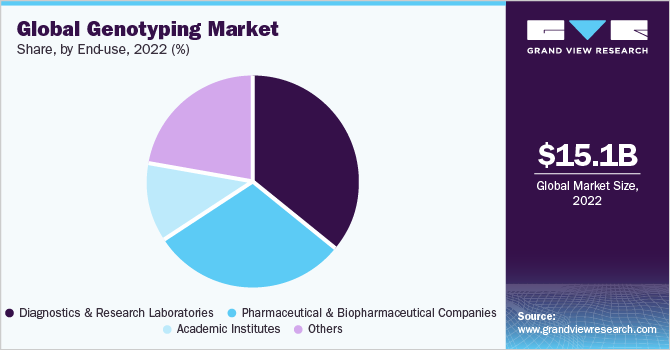

Diagnostics and research laboratories segment held the largest share of 36.24% in 2022 owing to the rising adoption of genotyping products for research and the increasing need for diagnosis of genetic diseases & cancer. In addition, the growing prevalence of cancer also increases the demand for diagnostic tests, such as cancer genotyping assays, which is expected to drive the market.

The pharmaceutical and biopharmaceutical companies segment is expected to grow at a significant CAGR of 14.87% during the forecast period. Growing need for pharmacogenomics in the drug development process and FDA recommendations to include pharmacogenomics studies & genotyping in the drug discovery process are factors expected to drive market growth. Companies actively use pharmacogenomics to develop novel drugs. For instance, Pfizer is conducting a genotyping-based clinical trial to study the efficacy of Talazoparib in patients with somatic BRCA mutant resistant metastatic breast cancer. Thus, the rising number of clinical trials based on pharmacogenomics is likely to drive segment growth.

Regional Insights

North America accounted for the largest market share of 39.51% in 2022 due to the increasing adoption of technologically advanced products, the presence of major pharmaceutical & biopharmaceutical companies, proactive government measures, and advances in healthcare infrastructure. The presence of major players in this region is another key factor responsible for high market share.

Asia Pacific is anticipated to exhibit the fastest CAGR of 15.96% during the forecast period due to the presence of enormous untapped opportunities and increasing number of clinical trials being conducted in this region. This growth can also be attributed to other factors, such as technological advancements and the growing pharma and biopharma sector in the region.

Key Companies & Market Share Insights

Key players are adopting strategies, such as partnerships and new product launches to retain market share. For instance, in January 2023, Thermo Fisher Scientific, Inc. launched its CE-IVD marked TaqPath Seq HIV-1 genotyping kit to broaden its product portfolio and strengthen its market presence in the market. Some of the prominent players in the global genotyping market include:

-

Illumina Inc.

-

Thermo Fisher Scientific Inc.

-

QIAGEN

-

F. Hoffmann-La Roche Ltd.

-

Fluidigm Corporation

-

Danaher Corporation

-

Agilent Technologies

-

Eurofins Scientific Inc.

-

GE Healthcare Inc.

-

Bio-Rad Laboratories Inc.

Genotyping Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 21.16 billion

Revenue forecast in 2030

USD 46.53 billion

Growth rate

CAGR of 14.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Illumina Inc.; Thermo Fisher Scientific Inc.; QIAGEN; F. Hoffmann-La Roche Ltd.; Fluidigm Corporation; Danaher Corporation; Agilent Technologies; Eurofins Scientific Inc.; GE Healthcare Inc.; Bio-Rad Laboratories Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Genotyping Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global genotyping market report on the basis of product, technology, application, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents & Kits

-

Software and Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

PCR

-

Capillary Electrophoresis

-

Microarrays

-

Sequencing

-

Mass Spectrometry

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmacogenomics

-

Diagnostics and Personalized Medicine

-

Agricultural Biotechnology

-

Animal Genetics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biopharmaceutical Companies

-

Diagnostics and Research Laboratories

-

Academic Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global genotyping market size was estimated at USD 15.09 billion in 2022 and is expected to reach USD 17.94 billion in 2023.

b. The global genotyping market is expected to witness a compound annual growth rate of 14.59% from 2023 to 2030 to reach USD 46.53 billion by 2030.

b. North America accounted for the largest market share of 39.51% in 2022 owing to the high extent of research and development activities and increasing healthcare spending in the region.

b. Some key players operating in the genotyping market include Illumina Inc.; Thermo Fisher Scientific Inc.; QIAGEN; F. Hoffmann-La Roche Ltd.; Fluidigm Corporation; Danaher Corporation; Agilent Technologies; Eurofins Scientific Inc.; GE Healthcare Inc.; Bio-Rad Laboratories Inc.

b. The major factors driving genotyping market growth are the rising prevalence of genetic diseases, increasing research on personalized medicine, and rising R&D funding for genomics projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.