- Home

- »

- Communication Services

- »

-

Geographic Information System Market Size Report, 2030GVR Report cover

![Geographic Information System Market Size, Share & Trends Report]()

Geographic Information System Market (2024 - 2030) Size, Share & Trends Analysis Report By Components, By Usage (Surveying, Mapping, Navigation), By Vertical, By Devices, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-015-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Geographic Information System Market Summary

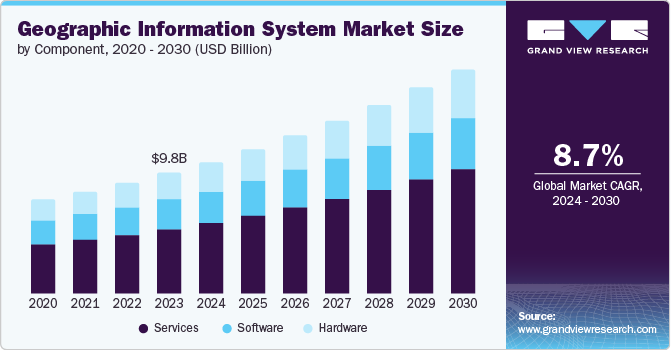

The global geographic information system market size was estimated at USD 9.80 billion in 2023 and is projected to reach USD 17.76 billion by 2030, growing at a CAGR of 8.7% from 2024 to 2030. The increasing investments in urban infrastructure, such as smart city projects, and the increasing applications of the geographic information system (GIS) in geology, defense, environmental, and disaster management are major factors driving market growth.

Key Market Trends & Insights

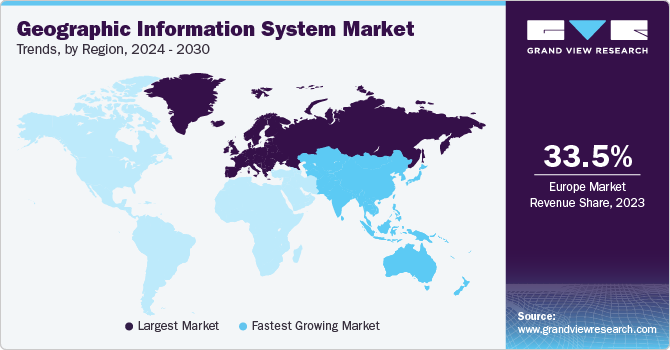

- The Europe geographic information systems (GIS) market dominated the market and accounted for a share of 33.5% in 2023.

- The U.S. geographical information system (GIS) market is expected to grow significantly over the forecast period.

- The Asia Pacific market is expected to grow at the fastest CAGR over the forecast period.

- By usage, the navigation segment accounted for the largest market share of 47.1% in 2023.

- By devices, the desktop segment dominated the market with a share of 60.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 9.80 Billion

- 2030 Projected Market Size: USD 17.76 Billion

- CAGR (2024-2030): 8.7%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

The Pan American Health Organization uses geographic information systems in detecting, assessing, analyzing, and addressing health emergencies, under the Health Information and Risk Assessment Unit of the Health Emergencies Department. According to an article published by the organization in November 2023, in the past decades, the GIS significantly helped prepare for and respond to health emergencies and disasters. Growing health concerns worldwide and the significant role of GIS in managing emergencies are expected to boost their demand over the forecast period.

The increasing applications of GIS in different sectors and the development and adoption of advanced GIS systems across the globe are further likely to help in the market growth. For instance, in March 2024, Mauritius's Central Water Authority (CWA) implemented Geographic Information System (GIS) technology developed by Esri across its departments and customer service operations. The implementation facilitated an efficient complaint-logging process, pinpointing client locations, and network mapping, which is likely to lead to efficient resource utilization and enhance decision-making.

Component Insights

The services segment dominated the market with 53.9% market share in 2023 and is expected to grow at the fastest CAGR over the forecast period from 2024 to 2030. The increasing adoption of geographic information systems and the activities by key players to expand globally is expected to foster growth in the market. For instance, in July 2024, VertiGIS and Esri entered a multinational partnership that included reselling, co-selling, and co-marketing, and aligning business and technical strategies. Such partnerships are expected to increase the demand for GIS services globally and drive market growth.

The software segment is expected to grow at a significant growth rate over the forecast period. Advancements in GIS technologies and the launch of new software by market players are major factors driving the growth of this segment. For instance, in February 2023, Esri introduced a digital twin software, ArcGIS Reality, that enables the creation of digital twins of various scales and their 3D mapping.

Usage Insights

The navigation segment accounted for the largest market share of 47.1% in 2023. The GIS systems can analyze spatial data, allowing users to visualize routes, assess patterns, and optimize travel times. In addition, the GIS systems can also collect real-time data related to the locations, routes taken, and fuel consumption of a vehicle. It can further help companies to analyze traffic patterns and adjust routes dynamically to avoid delays. These applications of the GIS in navigation are expected to drive segment growth.

The surveying segment is expected to grow at the fastest CAGR over the forecast period from 2024 to 2030. The surveyors use many kinds of tools to analyze and accurately deliver the data. These GIS technologies provide accurate locations, conduct spatial analysis, integrate systems, and drive market growth. In July 2024, the memorandum of understanding was signed between the National Highways Authority of India and the Survey of India, which aims at developing and validating a GIS-based land acquisition plan for a national highway project. Such projects are expected to drive the demand for GIS and foster segment growth.

Devices Insights

The desktop segment dominated the market with a share of 60.6% in 2023. Desktop applications allow users to use advanced tools for data analysis, perform intricate spatial analyses, and create detailed maps. Such features are majorly available in the desktop versions, which drives their demand. For instance, in November 2023, Esri introduced ArcGIS Pro 3.2, an updated desktop GIS application offering 3D Basemaps and 3D Tiles support.

The mobile segment is expected to grow at the fastest CAGR over the forecast period. Mobile applications help in field data collection and real-time updates with GPS integration. The development of advanced mobile applications and features for use in various industries is likely to boost their market growth over the forecast period. For instance, in July 2023, 1Spatial announced the launch of 1Capture, a customizable mobile application for data capture in the field for many jobs, assets, and survey types.

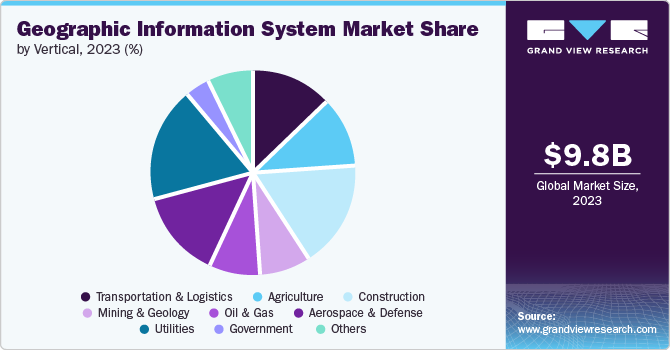

Vertical Insights

The utilities segment accounted for the market share of 17.7% in 2023. The increasing urbanization across the globe and the rise in demand for advanced water, sewage, power lines, telephone lines, and gas mains are driving the growth of the utility segment. In October 2018, BetterGIS introduced the UVARA Platform to help in managing utility and facility infrastructure, including surface, above-ground, and underground assets such as pipes, lines, and structures.

The construction segment is expected to grow at the fastest CAGR from 2024 to 2030. The increasing urbanization and development of road infrastructures have been crucial drivers for the segment's growth. In March 2023, Ground Penetrating Radar Systems, LLC, introduced SiteMap, a GIS for construction platform. Such developments can help advance construction projects, which is further likely to add to the market growth.

Regional Insights

North America accounted for a significant market share in 2023. The rising adoption of advanced technology, the presence of key players, and their development activities are driving market growth in the region. For instance, in May 2023, VertiGIS expanded its business into the utility sector in the U.S. and Canada, which is expected to assist in building solutions for water, gas, and electric utility network operators in visualizing, editing, and integrating their network data. Such developments in the market are likely to boost regional growth.

U.S. Geographic Information System Market Trends

The U.S. geographical information system (GIS) market is expected to grow significantly over the forecast period owing to the presence of key players in the market and efforts to increase the application of GIS in various sectors. For instance, according to the Centers for Disease Control and Prevention, groups such as the U.S. Geospatial Research, Analysis, and Services Program (GRASP) work to provide leadership and education in applying geographic information systems (GIS) to public health research and practice. This is expected to boost the knowledge regarding GIS and increase its use in various sectors.

Europe Geographic Information System Market Trends

The Europe geographic information systems (GIS) market dominated the market and accounted for a share of 33.5% in 2023. Technological advancements in the region, increasing demand for spatial analytics, and increasing use of GIs in urban development plans and resource management are major factors driving market growth. For instance, Vienna, Austria, has its ViennaGIS tool developed to process and provide local geographical data for City Administration and citizens.

The UK geographic information system (GIS) market is expected to grow significantly over the forecast period. The increasing applications of GIS in various development projects in different sectors is likely to drive the market growth. For instance, in April 2024, Esri UK announced the development of the geospatial platform using Esri’s GIS technology at the London Gatwick Airport in the UK.

Asia Pacific Geographic Information System Market Trends

The Asia Pacific market is expected to grow at the fastest CAGR over the forecast period. The presence of growing economies such as India and China and the increasing urban development initiatives in the various countries are expected to boost the market growth in the region. For instance, in June 2021, Gurugram, India, announced that the geographic information system (GIS) would be used by the Gurugram Metropolitan Development Authority (GMDA) to track the infrastructural development in the city.

India geographic information system (GIS) market is expected to grow significantly over the forecast period owing to the increasing applications of GIS in various industries. For instance, in March 2024, Agribazaar announced the launch of a GIS-based Command Centre for UP farmers under the crop survey project of the Uttar Pradesh Diversified Agriculture Support Project (UPDASP). Such projects are likely to enhance the use of GIS geographic information systems in the country and drive market growth.

Key Geographic Information System Company Insights

The key companies in the geographic information system (GIS) are Autodesk Inc., Bentley Systems, Incorporated, CARTO, etc. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Environmental Systems Research Institute, Inc. is a global company operating in geographic information system technology, software, location intelligence, and mapping. ArcGIS is a software developed by the company is a comprehensive GIS platform designed for capturing, managing, and analyzing geographic data.

-

SuperMap Software Co., Ltd. is a global player in the geographic information system software market, majorly operating in the Asia region. The company developed SuperMap GIS 2023, a GIS platform that can be used for data acquisition, editing, analysis, and visualization.

Key Geographic Information System Companies:

The following are the leading companies in the geographic information system (GIS) market. These companies collectively hold the largest market share and dictate industry trends.

- Autodesk Inc.

- Bentley Systems, Incorporated

- CARTO

- Environmental Systems Research Institute, Inc.

- Hexagon AB

- Pitney Bowes Inc.

- SuperMap Software Co., Ltd.

- TOPCON CORPORATION

- Trimble Inc.

- L3Harris Technologies, Inc.

Recent Developments

-

In July 2024, Ceinsys Tech Ltd. announced the expansion of its GIS services portfolio in the U.S. market with the asset purchase of Virtual Tours, LLC.

-

In May 2024, NV5 Global, Inc. announced the acquisition of GIS Solutions, Inc., which provides enterprise GIS technologies and services such as GIS application development and cloud-based database design.

-

In April 2023, Trimble Inc. launched Trimble Unity AMS solution, which is the GIS-centric electric-based platform developed to manage the lifecycle of asset infrastructure.

Geographic Information System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.76 billion

Revenue forecast in 2030

USD 17.76 billion

Growth rate

CAGR of 8.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Components, usage, devices, vertical, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, South Korea, Australia, Brazil, Mexico, Saudi Arabia, UAE, South Africa

Key companies profiled

Autodesk Inc., Bentley Systems, CARTO, Environmental Systems Research Institute, Inc., Hexagon AB, Pitney Bowes Inc., SuperMap Software Co., Ltd., TOPCON CORPORATION, Trimble Inc., L3Harris Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geographic Information System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global geographic information system market report based on components, devices, usage, verticals, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Surveying

-

Mapping

-

Navigation

-

-

Devices Outlook (Revenue, USD Million, 2018 - 2030)

-

Desktop

-

Mobile

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Utilities

-

Construction

-

Aerospace and Defense

-

Transportation and Logistics

-

Agriculture

-

Mining & Geology

-

Oil & Gas

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.