- Home

- »

- Specialty Polymers

- »

-

Flexible Packaging Market Size, Share, Industry Report 2033GVR Report cover

![Flexible Packaging Market Size, Share & Trends Report]()

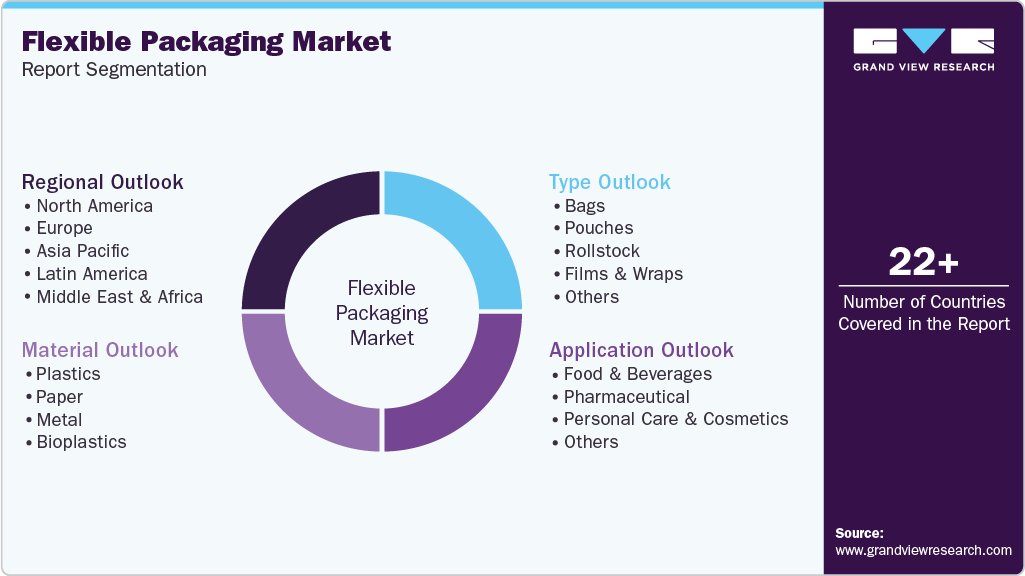

Flexible Packaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (Plastics, Paper, Metal, Bioplastics), By Type (Pouches, Bags, Rollstock), By Application (Food & Beverages, Pharmaceutical, Personal Care & Cosmetics), By Region, And Segment Forecasts

- Report ID: 978-1-68038-504-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flexible Packaging Market Summary

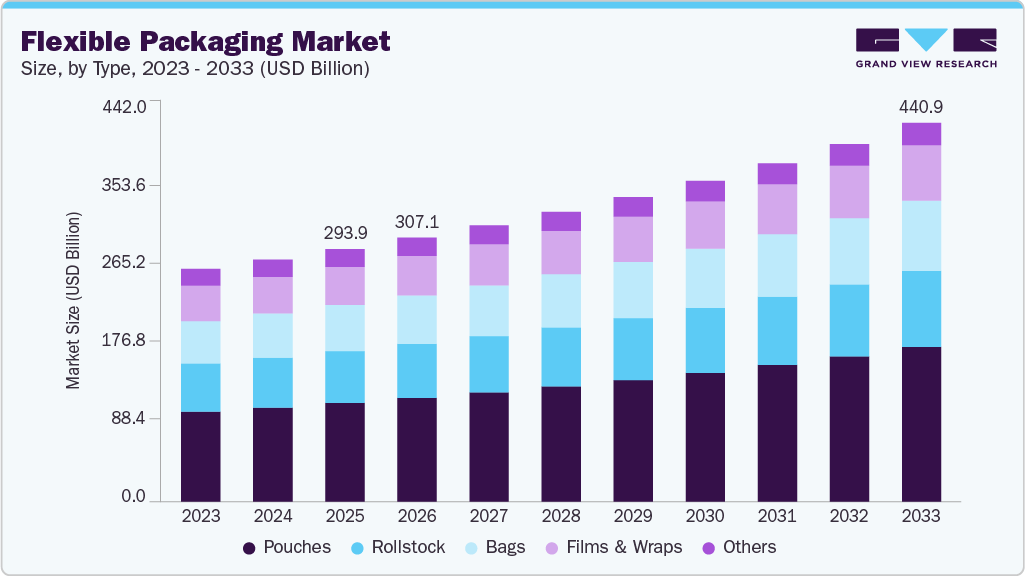

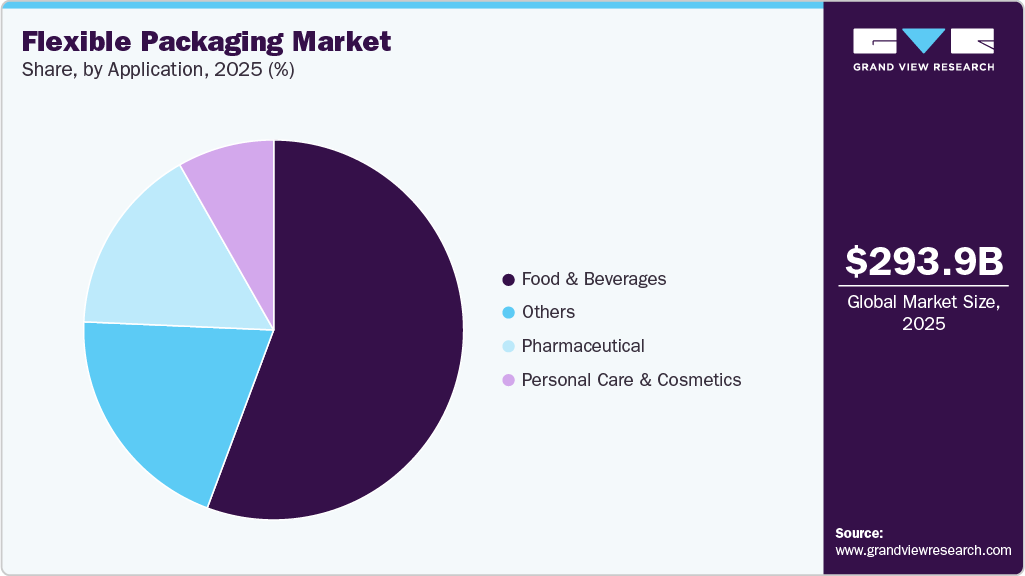

The global flexible packaging market size was estimated at USD 293.92 billion in 2025 and is projected to reach USD 440.88 billion by 2033, growing at a CAGR of 5.3% from 2026 to 2033. The market is driven by rising demand for convenient, lightweight, and cost-efficient packaging from food & beverage, pharmaceuticals, and personal care sectors, supported by e-commerce growth.

Key Market Trends & Insights

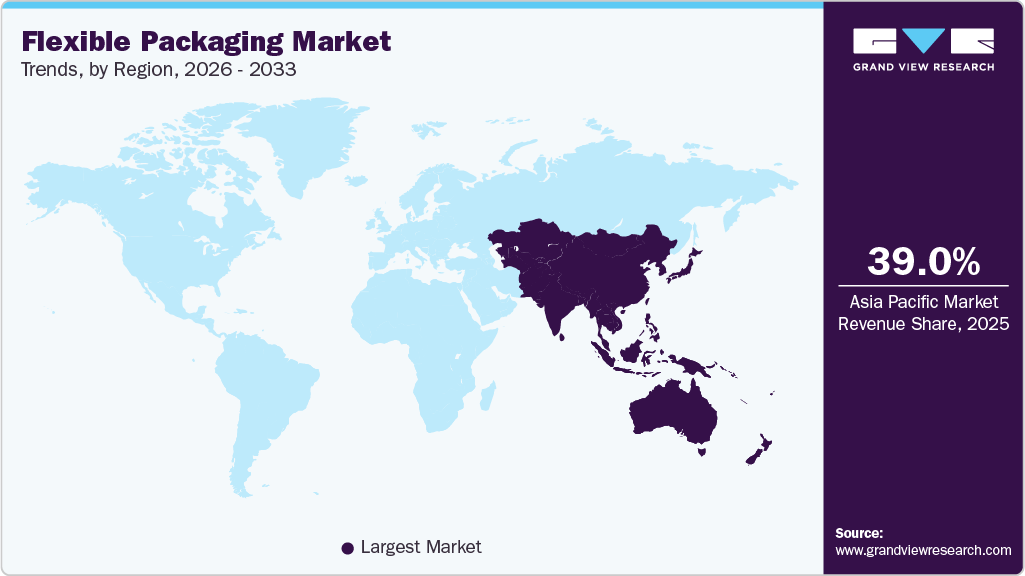

- Asia Pacific flexible packaging industry dominated the global market with the largest revenue share of over 39.0% in 2025.

- The flexible packaging industry in the U.S. is expected to grow at a substantial CAGR of 4.6% from 2026 to 2033.

- By material, the bioplastics segment is expected to grow at a considerable CAGR of 6.7% from 2026 to 2033 in terms of revenue.

- By type, the pouches segment is expected to grow at a considerable CAGR of 5.9% from 2026 to 2033 in terms of revenue.

- By application, the pharmaceutical segment is expected to grow at a considerable CAGR of 6.1% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 293.92 Billion

- 2033 Projected Market Size: USD 440.88 Billion

- CAGR (2026-2033): 5.3%

- Asia Pacific: Largest Market in 2025

In addition, sustainability trends, including recyclable mono-material structures, downgauging, and reduced carbon footprint compared to rigid packaging, are accelerating adoption worldwide. Flexible packaging provides effective barrier performance, longer shelf life, portion control, and lightweight formats such as pouches, sachets, and wraps. These advantages make it highly suitable for packaged foods, snacks, dairy, beverages, and frozen products. Rapid urbanization, rising disposable incomes, and the expansion of organized retail and e-commerce channels, particularly in emerging economies, continue to accelerate market demand.

Cost efficiency and supply chain optimization are key factors supporting the adoption of flexible packaging over rigid alternatives. Flexible formats require lower material consumption, reduce transportation and storage costs due to lighter weight, and enable high-speed manufacturing. Brand owners increasingly adopt flexible packaging to enhance shelf presence through advanced printing and customization while improving operational efficiency. Technological advancements in digital printing and smart packaging further support faster product launches, shorter production cycles, and improved brand communication.

Sustainability considerations and regulatory requirements are also significant drivers of market growth. Increasing emphasis on recyclability, waste reduction, and carbon footprint management is encouraging the development of mono-material structures, recyclable films, bio-based plastics, and paper-based flexible solutions. Flexible packaging is often favored for its lower material usage and its role in minimizing food waste, supporting its adoption across food, pharmaceutical, personal care, and household product applications.

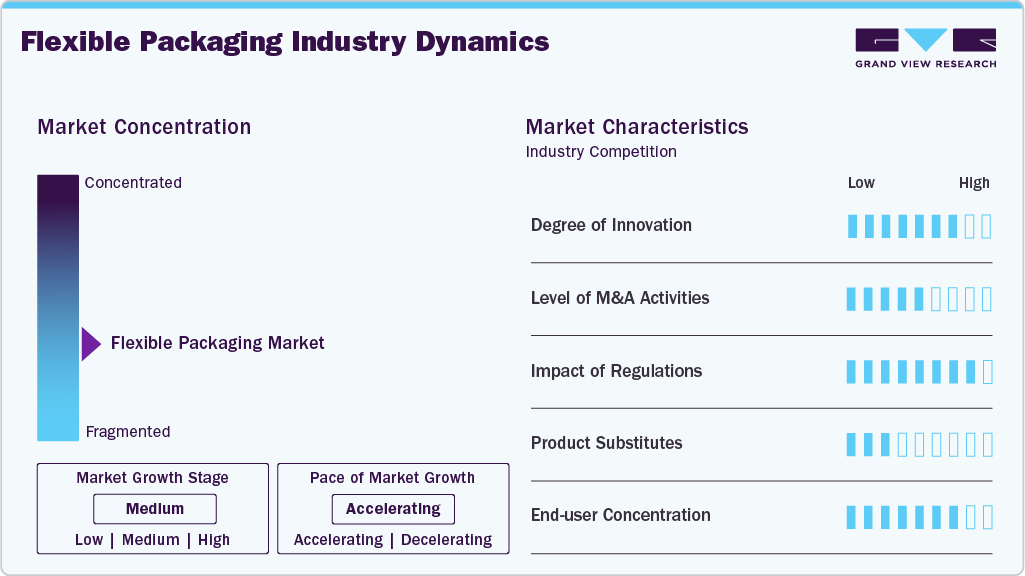

Market Concentration & Characteristics

The industry demonstrates a high degree of innovation and customization, with continuous developments in materials, barrier properties, sealing technologies, and printing quality. Manufacturers focus on lightweighting, downgauging, and functional enhancements such as resealability and shelf-life extension to meet brand owner requirements. Shorter product life cycles and frequent design changes necessitate flexible manufacturing capabilities and close collaboration between converters, brand owners, and retailers.

Regulatory compliance and sustainability requirements significantly influence industry structure and investment priorities. Companies are increasingly aligning their portfolios with recyclable and mono-material solutions while investing in recycling infrastructure and sustainable sourcing. In February 2024, Amcor plc signed a deal with Cadbury to source 1,000 tons of post-consumer recycled plastic to wrap its core Cadbury chocolate range, accelerating Cadbury’s ambitions to reduce its virgin plastic needs. Cadbury aims to use 50% recycled plastic for its wrappers across its chocolate blocks, bars and pieces range produced in Australia.

Material Insights

Plastic accounted for the largest share of over 69.0% in 2025. Plastic was the largest raw material segment in the market and its demand is expected to increase over the next seven years. Plastic flexible packaging is widely used in the food & beverage industry as they can take various forms and shapes which is a crucial advantage in this industry.

Bioplastics are emerging as a strategic material segment within the flexible packaging industry, driven by increasing regulatory pressure, brand sustainability commitments, and consumer preference for environmentally responsible packaging solutions. Derived from renewable resources such as corn starch, sugarcane, and cellulose, bioplastics offer advantages including reduced dependence on fossil fuels and improved carbon footprint performance.

Type Insights

The pouches segment accounted for the largest market share of over 39.0% in 2025 and is anticipated to grow at the fastest CAGR of 5.9% over the forecast period. Pouches are small-sized single-use bags commonly made of plastic, aluminum foil, and occasionally of paper. They consist of two or more plastic films that are laminated together using heat and pressure or adhesives. Pouches are resealable and are considered a cost-effective alternative to metal, cardboard, and glass containers. Most pouches available in the market are multilayered.

Rollstock is a dominant type segment within the flexible packaging industry, widely used for high-volume, automated packaging applications across food, beverage, pharmaceutical, and personal care sectors. Supplied as continuous rolls of flexible films or laminates, rollstock enables efficient form-fill-seal operations, high production speeds, and lower packaging costs per unit. Its flexibility in material composition, barrier performance, and print quality supports diverse product requirements, while reduced material usage and improved logistics efficiency make rollstock a preferred choice for manufacturers focused on operational scalability and cost optimization.

Application Insights

The food & beverages segment recorded the largest market share of over 55.0% in 2025, driven by high consumption volumes, frequent product turnover, and the need for efficient, cost-effective packaging solutions. Flexible packaging offers strong barrier protection, extended shelf life, portion control, and convenience features such as resealability, making it well suited for packaged foods, snacks, dairy, beverages, and frozen products. The segment’s growth is further supported by rising demand for ready-to-eat and convenience foods, expansion of organized retail and e-commerce, and increasing focus on sustainable packaging formats that reduce material usage and food waste.

The pharmaceutical application segment is projected to grow at the fastest CAGR of 6.1% during the forecast period, driven by increasing global healthcare expenditure, rising demand for prescription and over-the-counter medicines, and expanding access to healthcare in emerging markets. Flexible packaging solutions such as blister films, sachets, and strip packs are increasingly adopted due to their superior barrier protection, dosage accuracy, tamper evidence, and compliance with stringent regulatory standards, supporting strong growth momentum in this segment.

Regional Insights

Asia Pacific flexible packaging industry dominated the global market and accounted for the largest revenue share of around 39.0% in 2025, driven by strong demand from the food and beverage, pharmaceutical, and personal care sectors across major economies such as China, India, and Southeast Asian countries. The region is also expected to grow at the fastest CAGR of 6.1% over the forecast period, supported by rapid urbanization, population growth, rising disposable incomes, expanding organized retail and e-commerce channels, and increasing investments in flexible packaging manufacturing and sustainable material innovations.

China Flexible Packaging Market Trends

China flexible packaging market has shown rapid development in demand from end use industries, such as food & beverage, pharmaceutical & medical, cosmetics, and household care, which is likely to create a large need for flexible packaging goods in China over the forecast period. Furthermore, the stringent regulations introduced by the government to reduce packaging waste and promote sustainability in packaging can support the growth of flexible packaging in China.

The flexible packaging market in India is anticipated to grow at a CAGR of over 7.0% over the forecast period. Rapidly changing food habits in country coupled with increasing demand for convenience packaging has fueled demand for consumption of flexible packaging products such as stand-up pouches and flat pouches.

North America Flexible Packaging Market Trends

The region has several flexible packaging manufacturers such as Amcor plc, Sealed Air, ProAmpac, Mondi, American Packaging Corporation, Cheer Pack North America, and Eagle Flexible Packaging. These players are constantly engaged in developing sustainable flexible packaging options for various end use industries to strengthen their market presence, which can increase the penetration of flexible packaging solutions in North America. The government programs focused on increasing the labeling and traceability of the packaging circulating in the region is driving end use industry companies to adopt flexible packaging solutions.

U.S. flexible packaging market is expected to grow significantly over the forecast period due to the growing demand for packaging of food & beverage and healthcare products. This market is driven by the steady growth of the healthcare, food & beverage, and personal care industries. Lifestyle and demographic factors are also expected to propel demand for cosmetic products. The application of flexible plastic packaging products in numerous applications has encouraged manufacturers of rigid plastic packaging to shift towards flexible plastic packaging. The consumption of lower energy and a significant decrease in the production of waste has prompted this shift.

Europe Flexible Packaging Market Trends

Europe flexible packaging market is expected to witness increasing demand owing to high growth of food & beverage sector. In food category, industry has benefited from a substantial sale of ready-to-eat food products along with fruit compotes. Packaging requirements for these products is driven by increasing replacement of substitutes for flexible packaging such as glass and metal packaging.

Germany flexible packaging market held over 24.0% share in European market due to various factors such as Germany being the largest food producer in Europe and it encourages the manufacturers of flexible packaging to target the consumers in the county.

The flexible packaging market in the UK is driven by growing innovation in packaging forms and materials. The presence of a large number of industries is contributing to the market growth in this country. The growing emphasis on quality healthcare is expected to drive the demand for packaging products as it would directly impact the demand for medical devices and pharmaceuticals.

Latin America Flexible Packaging Market Trends

Latin America flexible packaging market is anticipated to witness growth over the forecast period. The countries in Latin America such as Brazil, Argentina, and Chile have a well-established tomato puree processing industry. Brazil has a strong presence in the fruit juice market and is one of the leading exporters of fruits. The Latin American countries export and import food & beverage products among themselves and to other regions. The tomato puree and fruit juice concentrates require adequate barrier against oxygen and moisture to prevent spoilage. For export, the processed food & beverage items are packed in liners that have an EVOH coating on the inner side.

Middle East & Africa Flexible Packaging Market Trends

Middle East & Africa flexible packaging market is driven by the food & beverage trends that are undergoing a major transition owing to increasing consumer awareness and the introduction of a large number of soft drinks. These factors have led to an increasing inclination for natural and cleaner diets and a growing preference for packaged natural food which are expected to increase the demand for flexible packaging solutions over the forecast period.

Key Flexible Packaging Company Insights

The competitive environment of the flexible packaging industry is highly competitive and moderately consolidated, characterized by the presence of large multinational players alongside numerous regional and local manufacturers. Global companies such as Amcor plc, Mondi, Huhtamaki, Sealed Air, and Constantia Flexibles compete on scale, innovation, and global customer reach, while regional players focus on cost efficiency, customization, and proximity to end users.

The market also witnesses active mergers and acquisitions, as leading players pursue capacity expansion, portfolio diversification, and access to high-growth regions such as Asia Pacific. Overall, intense rivalry, rapid product innovation, and growing regulatory pressure on sustainability continue to shape competitive dynamics in the flexible packaging industry.

-

In April 2025, Amcor plc completed its all-stock acquisition of Berry Global Inc, creating a global packaging leader with around 400 facilities, 75,000 employees, and operations in 140 countries. The merger, valued at approximately USD 13.0 billion, enhances Amcor's portfolio with expanded material science and innovation capabilities, positioning it to deliver more consistent growth and improved margins.

-

In January 2025, International Paper completed its USD 7.2 billion acquisition of DS Smith, creating a global leader in sustainable packaging solutions with a strong presence in North America and Europe. The combined company aims to accelerate growth, improve profitability, and enhance customer offerings with an expected synergy.

-

In April 2024, American Packaging Corporation (APC) launched a new recyclable flexible packaging technology specifically designed for pet food products. This technology is part of their RE Design for Recycle initiative and can be used for various packaging sizes, from small treat pouches to large bags for kibble.

-

In February 2024, Amcor plc partnered with Stonyfield Organic and Cheer Pack North America to introduce the first all-polyethylene (PE) spouted pouch. The pouch is engineered to provide high moisture and oxygen barrier properties, ensuring the freshness of the yogurt. It also features durable seals that maintain product integrity throughout its lifecycle.

Key Flexible Packaging Companies:

The following are the leading companies in the flexible packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Mondi

- Huhtamaki

- Sealed Air

- DS Smith

- Constantia Flexibles

- ProAmpac

- Winpak LTD.

- Cosmo Films

- Coveris

- American Packaging Corporation

- Inteplast Group

- Graphic Packaging International, LLC

- Bischof+Klein SE & Co. KG

- Südpack

- Glenroy, Inc.

Flexible Packaging Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 307.15 billion

Revenue forecast in 2033

USD 440.88 billion

Growth rate

CAGR of 5.3% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Type, material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Amcor plc; Mondi; Huhtamaki; Sealed Air; DS Smith; Constantia Flexibles; ProAmpac; Winpak Ltd.; Cosmo Films; Coveris; American Packaging Corporation; Inteplast Group; Graphic Packaging International, LLC; Bischof+Klein SE & Co. KG; Südpack; Glenroy, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flexible Packaging Market Report Segmentation

This report forecasts revenue & volume growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global flexible packaging market report based on type, material, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Plastics

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyamide (PA)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Others

-

-

Paper

-

Metal

-

Bioplastics

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Bags

-

Pouches

-

Rollstock

-

Films & Wraps

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Pharmaceutical

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flexible packaging market size was estimated at USD 293.92 billion in 2025 and is expected to reach USD 307.15 billion in 2026.

b. The global flexible packaging market is expected to grow at a compound annual growth rate of 5.3% from 2026 to 2033 to reach USD 440.88 billion by 2033.

b. The plastic segment accounted for over 69.0% share in 2025 owing to its cost-effectiveness, superior barrier properties, lightweight nature, design flexibility, and wide applicability across food, pharmaceutical, and consumer goods packaging.

b. The key market players in the flexible packaging market include Amcor plc; Mondi; Huhtamaki; Sealed Air; DS Smith; Constantia Flexibles; ProAmpac; Winpak Ltd.; Cosmo Films; Coveris; American Packaging Corporation; Inteplast Group; Graphic Packaging International, LLC; Bischof+Klein SE & Co. KG; Südpack; and Glenroy, Inc.

b. The key factors that are driving the growth for flexible packaging market include rising demand for low-cost, convenient, shelf appealing, and lightweight packaging by application industries, including food & beverages, pharmaceutical, personal care & cosmetics, and home care, among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.