- Home

- »

- Consumer F&B

- »

-

Snacks Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Snacks Market Size, Share & Trends Report]()

Snacks Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Frozen & Refrigerated, Fruit, Bakery, Savory, Confectionery, Dairy), By Packaging, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-196-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Snacks Market Summary

The global snacks market size was estimated at USD 719.18 billion in 2024 and is projected to reach USD 922.08 billion by 2030, growing at a CAGR of 4.3% from 2025 to 2030. The increasing prevalence of on-the-go consumption, particularly among the urban and younger demographics, has significantly contributed to its market growth.

Key Market Trends & Insights

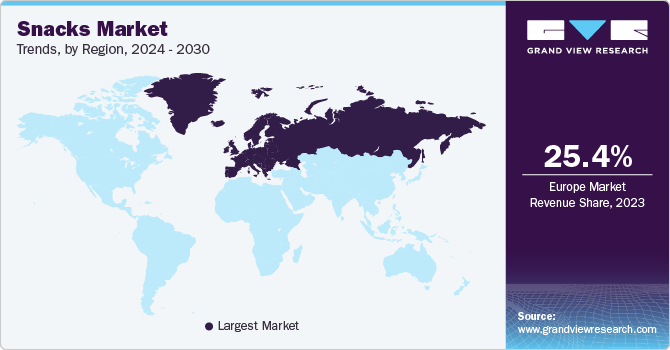

- The Europe dominated the global snacks market and accounted for a revenue share of 25.41% in 2023.

- The snacks market in the U.S. is expected to grow at a CAGR of 3.4% over the forecast period.

- By product type, the savory snacks segment accounted for a revenue share of 30.22% in 2023.

- By packaging, the bags & pouches segment accounted for a revenue share of 33.51% in 2023.

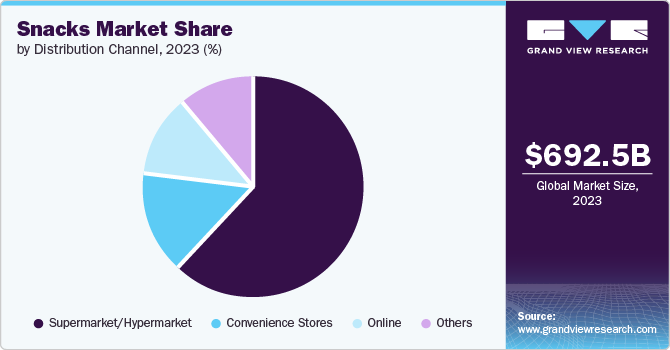

- By distribution channel, the hypermarkets & supermarkets segment held the largest share of 62.09% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 719.18 Billion

- 2030 Projected Market Size: USD 922.08 Billion

- CAGR (2025-2030): 4.3%

- Europe: Largest market in 2023

Consumers are attracted to the wide array of flavors and varieties available in snacks, catering to their diverse preferences. Moreover, the shift toward healthier and more convenient snack options has been a key driver in market growth. Consumer preferences have undergone a notable transformation in recent years, with a growing inclination towards the convenience and portability of snacks. Consumers who are often pressed for time seek snacks that can be easily consumed while on the move or during short breaks.This trend has increased the demand for snacks that offer convenience without compromising taste or nutritional value. In June 2022, Kellogg’s Special K introduced a new line of protein snack bars to provide a delicious and convenient option for individuals with busy lifestyles. These are available in two delicious flavors: Berry Vanilla and Brownie Sundae. These new bars are designed to offer a portable and satisfying snack option rich in protein, making them ideal for busy lifestyles where quick and nutritious choices are essential. Consumers often prefer a wide range of flavors to cater to diverse tastes. Offering unique and innovative flavor options can attract consumers looking for exciting taste experiences.

In May 2024, Pringles, a popular brand of potato crisps known for its unique packaging and flavors, introduced three new snacks to its lineup. These new additions aim to excite consumers with fresh taste experiences and limited-edition offerings. The first of the two new flavors introduced by Pringles is Carnitas Taco. This flavor offers pork carnitas with a mix of spices, such as onion, cumin, garlic, and oregano. The second new flavor is All Dressed, which offers a blend of sweet, savory, and tangy flavors. In addition to the two flavors, Pringles has also unveiled The Limited Edition Minecraft Spicy TNT. With a growing focus on health-conscious choices, consumers are increasingly seeking snacks that are perceived as healthier options. This includes snacks with low sugar content, natural ingredients, organic certifications, or specific health benefits.

According to the Mondelez International State Of Snacking 2021 Global Consumer Snacking Trends Study, a majority of consumers claim that making better snacking choices would be possible if the snacks were gluten-free (23%), natural/organic (40%), low in sugar, carbs, or fat, (43%), support gut health (44%), high in protein(44%), boost immunity (46%), and vitamin-rich (48%). Busy lifestyles have made convenience a key factor in snack selection. Consumers look for snacks that are easy to grab on the go, require minimal preparation, and fit into their fast-paced routines. Moreover, the packaging of snacks plays a significant role in consumer preferences. Portable and resealable packaging options are favored by consumers for convenience and freshness, especially for snacking occasions outside the home.

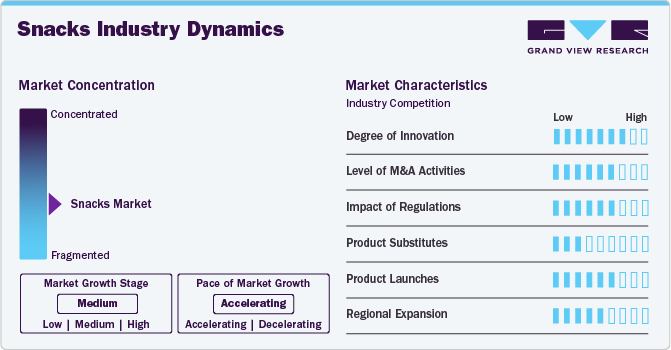

Market Concentration & Characteristics

Manufacturers in the snacks industry are actively engaged in various initiatives to meet evolving consumer demands and market trends.

The degree of innovation is high in the snacks industry. There's a growing demand for healthier snack options. Innovations include the usage of natural ingredients, reduced sugar, high protein, gluten-free, and plant-based snacks. Companies are focusing on sustainable practices, such as using eco-friendly packaging, reducing waste, and sourcing ingredients responsibly.

The snacks industry has witnessed a significant level of merger and acquisition (M&A) activities in recent years. This trend is driven by several factors, including the desire for companies to expand their product portfolios, enter new markets, achieve economies of scale, and innovate by integrating new brands and technologies.

Regulations in the snacks market significantly impact various aspects of the industry, including product formulation, labeling, marketing, and overall business operations. Manufacturers must comply with stringent food safety and quality standards set by regulatory bodies, such as the U.S. Food & Drug Administration (FDA) and the European Food Safety Authority (EFSA). These regulations ensure that snacks are safe for consumption and free from contaminants.

In the snacks industry, several product substitutes are available that consumers may consider based on their nutritional needs, dietary preferences, and lifestyle choices. Consumers increasingly seek these substitutes to align their snack choices with their health goals, dietary restrictions, and lifestyle preferences, leading to a more diverse and dynamic snack market. Snack packs (nuts, cheese, fruits), protein shakes, and meal replacement bars are typical substitutes in the market.

In recent years, the snacks market has seen a variety of product launches, reflecting consumer demand for healthier, more diverse, and more convenient snack options. These launches often focus on incorporating trending ingredients, addressing specific dietary needs, and offering innovative flavors and textures.

Regional expansion in the snacks industry involves companies strategically entering new geographic markets to capitalize on growth opportunities, expand their customer base, and diversify their revenue streams.

Product Type Insights

The savory snacks segment accounted for a revenue share of 30.22% in 2023. The rising trend of snacking occasions replacing or supplementing traditional meals is another crucial factor propelling the market. As cultural norms and work patterns shift, consumers are embracing a more flexible approach to eating, leading to an increased frequency of snacking throughout the day. With their versatility and diverse flavor profiles, savory snacks align perfectly with this trend, offering consumers various options to satisfy their cravings between meals. A survey conducted by Whisps, renowned for its high-protein snacks made from 100% real cheese, unveiled shifting trends in American snacking habits. The survey, encompassing over 2,000 American adults in April 2023, revealed a significant trend of people substituting an average of 4 meals per week with snacks.

The frozen & refrigerated snacks segment is expected to grow at a CAGR of 5.5% from 2024 to 2030. There is a growing demand for convenient food options that require minimal preparation time as consumer lifestyles are becoming busier and more fast-paced. Furthermore, frozen and refrigerated snack manufacturers are constantly innovating to meet consumer demands for new flavors, ingredients, and formats. This focus on product innovation drives consumer interest and encourages the trial of new snack offerings, contributing to market growth. In November 2023, Golden West Food Group partnered with The Hershey Company to introduce a new line of Hershey's Frozen Fruit treats. The snacks, featuring real fruit coated in chocolate, include Hershey's Cookies 'N' Creme fruit strawberries, Reese's frozen fruit banana slices, and Hershey's White Creme & Milk Chocolate frozen fruit blueberries and raspberries.

Packaging Insights

The bags & pouches segment accounted for a revenue share of 33.51% in 2023. With increasing awareness about environmental issues, including plastic pollution and waste management, there is a growing demand for sustainable packaging solutions. Brands are transitioning toward eco-friendly materials for snack packaging, such as recyclable plastics, compostable films, or biodegradable pouches. Consumers are more likely to choose snacks that come in environmentally friendly packaging options as part of their commitment to sustainability. In April 2024, PepsiCo introduced new paper outer bags for all Snack A Jacks multipacks. These eco-friendly bags are widely recyclable in home recycling bins and can be collected at kerbside. The implementation of paper packaging is projected to reduce the greenhouse gas (GHG) emissions of each pack by approximately 52%.

The cans segment is expected to grow at a CAGR of 4.5% from 2024 to 2030. Packing snacks in cans is becoming increasingly popular due to many benefits catering to manufacturers' needs and consumer preferences. For manufacturers, cans offer the advantage of extending the shelf life of snacks due to their airtight and lightproof nature, which preserves freshness and nutritional value without the need for added preservatives. The durability and protection afforded by cans also minimize spoilage and damage during transportation, ensuring the product's integrity upon reaching consumers.

Distribution Channel Insights

The hypermarkets & supermarkets segment accounted for a revenue share of 62.09% in 2023. Consumers exhibit a preference for supermarkets and hypermarkets when it comes to selecting snacks, and this inclination is attributed to several factors. These retail establishments present a diverse range of nutritious snack options, including roasted nuts, seeds, and fruits, effectively meeting the growing consumer demand for snack variety. Moreover, the sheer volume of supermarkets and hypermarkets globally allows them to dominate the market in terms of the distribution channel. For instance, 7-Eleven—one of the largest supermarket chains in the world—has more than 71,100 stores in more than 17 countries. The rapid progress of retail infrastructure across developing economies will likely accentuate the segment growth further.

The online channels segment is expected to register a CAGR of 6.3% from 2024 to 2030. The convenience and accessibility provided by online platforms significantly contribute to their popularity for purchasing snacks. Consumers can easily browse and buy a wide array of products from the comfort of their homes, eliminating the need to visit physical stores. This convenience factor is especially appealing to those with busy lifestyles, limited time for grocery shopping, or those residing in areas with limited access to specialty health food stores. According to a survey commissioned by mobile app developer Bryj and conducted by Dynata, in 2024, 39% of shoppers prefer buying groceries through an app. Similarly, a Bank of America survey noted that 61% of respondents plan to shop for groceries online in 2024. These findings suggest that many consumers prefer buying snacks and groceries online.

Regional Insights

The snacks market in North America accounted for a revenue share of 23.12% in 2023. A key factor driving the regional market growth is the continuous innovation and new product development by key players to meet the changing demands of consumers. This includes introducing healthier ingredients, innovative flavors, and convenient packaging options that appeal to a wide range of consumers. For instance, in April 2024, Pop-Tarts, a popular brand known for its toaster pastries, expanded its product line by introducing a new snack product called “Crunchy Poppers.” These Crunchy Poppers come in two delicious flavors: strawberry and brownie. This launch marks an exciting addition to the Pop-Tarts family and offers consumers a convenient and tasty snacking option.

U.S. Snacks Market Trends

The U.S. snacks market is expected to grow at a CAGR of 3.4% from 2024 to 2030. The snacking culture in the U.S. has evolved, with snacking becoming more than just a means of satisfying hunger between meals. Snacks are now seen as indulgent treats, mood boosters, comfort foods, or meal replacements, driving innovation and diversity in the snack segment.

Europe Snacks Market Trends

The Europe snacks market accounted for a revenue share of 25.41% in 2023. There’s a rising demand for natural, organic, and clean-label snacks as consumers become more health-conscious. Products free from artificial additives & preservatives and high in natural ingredients are preferred. Moreover, there is a rising trend of premiumization in the regional market. Gourmet, artisanal, and high-quality ingredients are sought for a more indulgent snacking experience. The rise of plant-based diets is reshaping the snack landscape. As veganism and flexitarianism grow in popularity, snacks derived from legumes, fruits, and vegetables are being embraced. Innovations in plant-based chips and bars have made it possible for consumers to enjoy savory and sweet snacks without compromising their dietary choices.

The snacks market in Germany is expected to grow at a CAGR of 4.3% from 2024 to 2030. Most consumers are willing to try new snack products, driven by factors, such as attractive offers, caloric content, natural ingredients, and the desire for variety. This openness to experimentation encourages manufacturers to innovate and introduce new products, driving market growth. According to Mondelēz International’s annual State of Snacking report, in 2023, approximately 59% of global consumers surveyed identified as “snack adventurers,” expressing a preference for trying new and innovative snack options.

The UK snacks market is expected to grow at a CAGR of 4.4% from 2024 to 2030. Companies in the snacks industry are investing heavily in marketing strategies to promote their products to consumers in the region. These strategies include targeted advertising campaigns, social media promotions, influencer partnerships, and engaging packaging designs. Companies can increase brand awareness and drive sales by effectively reaching out to their target audience through various channels.

Asia Pacific Snacks Market Trends

The snacks market in Asia Pacific is expected to grow with a CAGR of 4.7% from 2024 to 2030. Consumer preferences play a significant role in driving the regional market growth. There has been a notable increase in the consumption of savory snacks, with potato-based snacks, nuts, seeds, and popcorn among the most popular subcategories. Consumers increasingly seek intense flavors and single-flavor packages, indicating a preference for variety and taste innovation.

The China snacks market is expected to grow at a CAGR of 3.9% from 2024 to 2030. The trend of healthy snacking has been on the rise, with more and more people opting for nutritious and wholesome options instead of traditional high-calorie, sugar-laden snacks. This shift toward healthier snacking is not just a transient fad but a conscious effort by the Chinese population to lead a healthier lifestyle.

The snacks market in India is expected to grow at a CAGR of 6.6% from 2024 to 2030. Supermarkets and hypermarkets are also actively promoting and highlighting snacks. They partner with popular snack brands and offer discounts and promotions to attract more consumers. This has increased the sales of snacks and created a space for smaller and local snack brands to reach a wider audience.

Central & South America Snacks Market Trends

The Central & South America snacks market growth is driven by the introduction of innovative product offerings. Companies constantly develop new flavors, textures, and formats to cater to changing consumer preferences. By staying ahead of trends and offering unique snack options, companies can attract new customers and retain existing ones.

Key Snacks Company Insights

The global snacks market is characterized by the presence of numerous well-established players, such as General Mills, Inc.; PepsiCo; the Kraft Heinz Company; Nestlé; the Kellogg Company; Unilever; Conagra Brands, Inc.; Grupo Bimbo; Danone; and Mars, Inc. The market players face intense competition from each other as some of them are among the top snack manufacturers with diverse product portfolios for snacks. These companies have a large customer base due to the presence of established and vast distribution networks to reach out to both regional and international consumers.

Key Snacks Companies:

The following are the leading companies in the snacks market. These companies collectively hold the largest market share and dictate industry trends.

- General Mills, Inc.

- PepsiCo

- The Kraft Heinz Company

- Nestlé

- The Kellogg Company

- Unilever

- Conagra Brands, Inc.

- Grupo Bimbo

- Danone

- Mars, Inc.

Recent Developments

-

In April 2024, Danone North America introduced a new range of yogurt and dairy snacks named Remix, which consists of three brands: Oikos Remix, Too Good & Co. Remix, and Light + Fit Remix. These products offer a yogurt or dairy base with assorted mix-in toppings in different flavors to meet the growing snack demand

-

In April 2024, Magnum, Unilever’s ice cream brand, launched Magnum Pleasure Express, mood-inspired flavored ice creams. Magnum also put up 3D action billboards to promote these ice creams. It collaborated with Mindshare, LOLA MullenLowe, DOOH.com, and Kinetic to deliver the innovative live-action billboard in London, UK. The Pleasure Express 3D OOH creative shows off the brand’s summer campaign to support the launch of NPD Magnum Euphoria Pink Lemonade and Magnum Chill Blueberry Cookie flavored ice creams

-

In March 2024, Nestlé Maggi entered the frozen food category with frozen pops, kebabs, and pockets in India. Maggi would be competing with brands, such as McCain, ITC Master Chef, and Gadre, within the frozen snacks category in the country. The bars are available in five distinct flavors: Chocolate Chip, Peanut Butter Chocolate Chip, Strawberry, Cinnamon Roll, and Oats & Honey

Snacks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 747.65 billion

Revenue forecast in 2030

USD 922.08 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; UAE; South Africa

Key companies profiled

General Mills, Inc.; PepsiCo; the Kraft Heinz Company; Nestlé; the Kellogg Company; Unilever; Conagra Brands, Inc.; Grupo Bimbo; Danone; Mars, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Snacks Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the snacks market report on the basis of product, packaging, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Frozen & Refrigerated

-

Fruit

-

Bakery

-

Savory

-

Confectionery

-

Dairy

-

Others

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bag & Pouches

-

Boxes

-

Cans

-

Jars

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket/Hypermarket

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global snacks market size was estimated at USD 692.52 billion in 2023 and is expected to reach USD 719.18 billion in 2024.

b. The global snacks market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 922.08 billion by 2030

b. Savory snacks emerged as a dominant product in 2023 accounting for 30.22% of global revenue and is expected to retain its dominance over the forecast period. The factors such as flavor variety, convenience, universal appeal, and accessibility have propelled savory snacks to occupy a significant share in the global snacks market, satisfying consumers' cravings for tasty and convenient snacking experiences.

b. Some of the key market players in the snacks market are General Mills, Inc.; PepsiCo; The Kraft Heinz Company; Nestlé; The Kellogg Company; Unilever; Calbee; Intersnack Group GmbH & Co. KG; Conagra Brands, Inc.; ITC Limited; Grupo Bimbo; Danone; Mars, Incorporated

b. The increasing demand for convenient and portable food options, driven by changing lifestyles and busy schedules, has been a significant driver. The growing emphasis on healthier snacking choices and the rising awareness of nutrition have propelled the development of a diverse range of healthier snack alternatives. Furthermore, the influence of cultural diversity and globalization has expanded the array of snack options available worldwide. Additionally, technological advancements and the widespread accessibility of snacks through various retail channels, including online platforms, have contributed to market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.