- Home

- »

- Plastics, Polymers & Resins

- »

-

Bio-based Plastics Market Size, Share, Industry Report, 2033GVR Report cover

![Bio-based Plastics Market Size, Share & Trends Report]()

Bio-based Plastics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Bio-PE, Bio-PET, PLA, PHA), By Application (Packaging, Textiles & Fibers), By End Use (Food & Beverage, Healthcare, Agriculture), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-745-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bio-based Plastics Market Summary

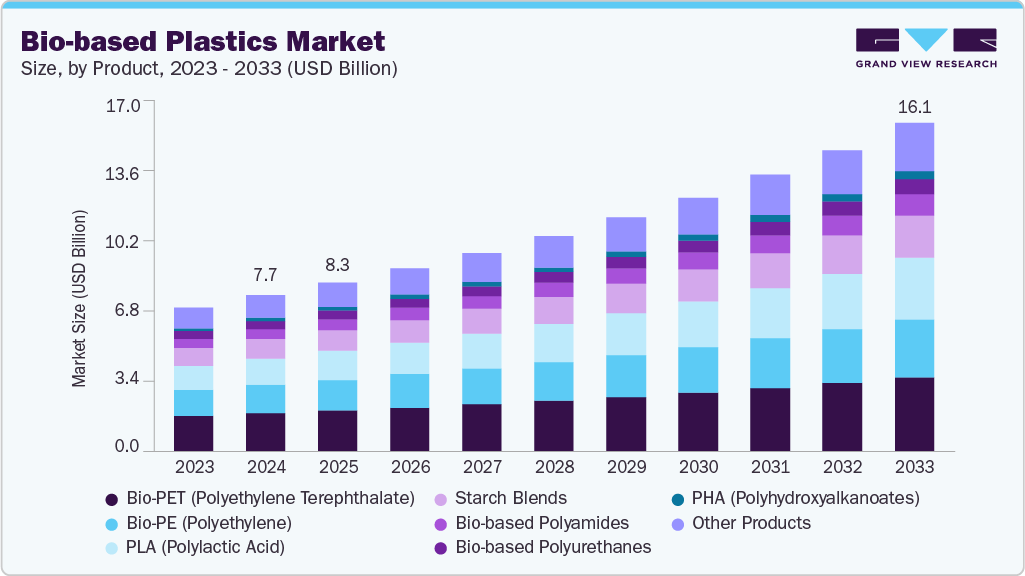

The global bio-based plastics market size was estimated at USD 7.66 billion in 2024 and is projected to reach USD 16.09 billion by 2033, growing at a CAGR of 8.7% from 2025 to 2033. Improvements in bioprocessing and chemical conversion are continually reducing production costs and improving yields.

Key Market Trends & Insights

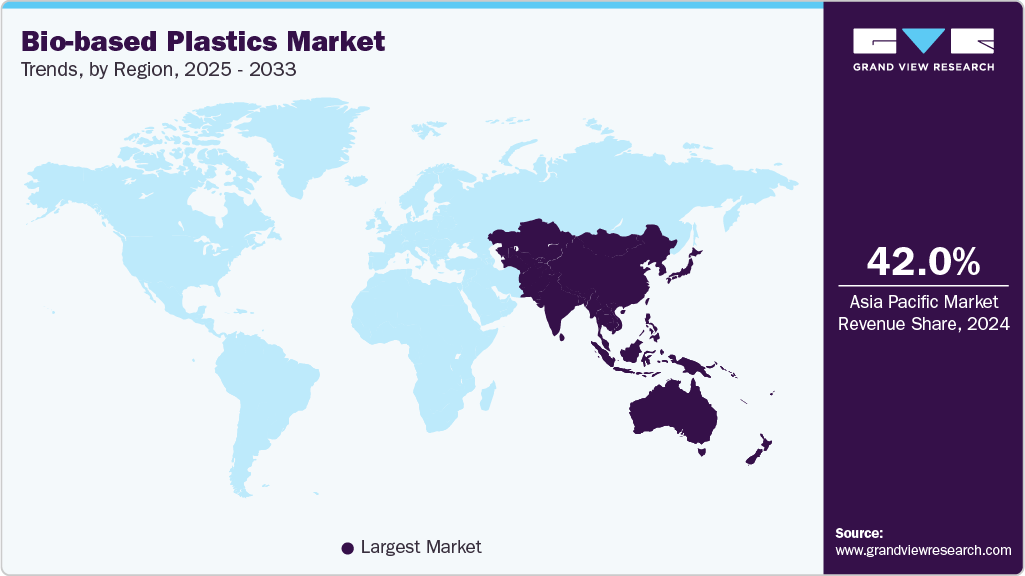

- Asia Pacific dominated the bio-based plastics market with the largest revenue share of 42.02% in 2024.

- The bio-based plastics market in India is expected to grow at a substantial CAGR of 9.9% from 2025 to 2033.

- By product, the PLA (polylactic acid) segment is expected to grow at a considerable CAGR of 9.8% from 2025 to 2033 in terms of revenue.

- By application, the packaging segment is expected to grow at a considerable CAGR of 9.2% from 2025 to 2033 in terms of revenue.

- By end use, the food & beverage segment is expected to grow at a considerable CAGR of 9.4% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 7.66 Billion

- 2033 Projected Market Size: USD 16.09 Billion

- CAGR (2025-2033): 8.7%

- Asia Pacific: Largest market in 2024

This makes bio-based plastics more competitive with fossil-based alternatives. As technology maturity increases and capital intensity decreases, more manufacturers can justify commercial-scale investments and accelerate market adoption. Bio-based plastics are evolving from simple drop-in substitutes to higher-value applications that require tailored performance and traceable sustainability.

Manufacturers invest in novel raw materials such as agricultural residues, industrial byproducts, and engineered microbial products to reduce dependence on food crops and lower lifecycle emissions. This shift is accompanied by strategic partnerships along the value chain that connect waste stream owners, polymer producers, and brand owners to ensure consistent raw materials. The market is therefore evolving from raw material substitution to differentiated solutions that combine material functionality with certified environmental credentials.

Drivers, Opportunities & Restraints

Major consumer goods brands and retailers increasingly integrate circular economy and low-carbon targets into their procurement policies, creating predictable demand for certified bio-based polymers. At the same time, regulatory developments, including recycled content targets and restrictions on certain fossil-based plastics, are strengthening the commercial case for bio-based alternatives. These two factors reduce adoption risk for processors and retailers, accelerate capital allocation for scale-up projects, and encourage long-term offtake agreements. As a result, investment flows are shifting from pilot projects to commercial capacity.

The greatest benefits lie in combining bio-based polymers with circular design and advanced recycling to achieve premium pricing and a lower carbon footprint. Companies that make recyclable materials recyclable, specify clear disposal pathways, and offer product-as-a-service models can generate profits along the entire value chain. There is also scope for product innovation in high-growth segments such as flexible barrier packaging, disposable medical devices, and durable composites, as bio-based chemicals offer unique performance advantages. Leaders who secure access to raw materials and demonstrate proven sustainability can tap into brand partnerships and long-term revenue streams.

Inconsistent raw material supplies, seasonal fluctuations, and competition with other industries for biomass and waste streams hamper widespread adoption. These constraints lead to volatile raw material prices and make it difficult for producers of bio-based products to achieve the unit costs of established petrochemical processes at scale.

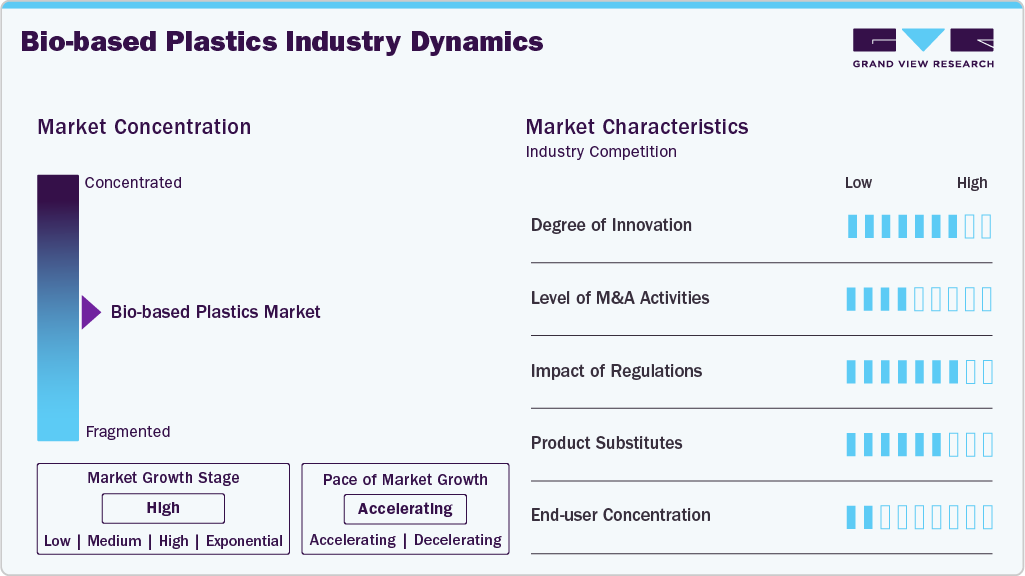

Market Concentration & Characteristics

The market growth stage of the bio-based plastics industry is high, and the pace is accelerating. The market exhibits slight fragmentation, with key players dominating the industry landscape. Major companies like NatureWorks LLC, Braskem S.A., BASF SE, TotalEnergies Corbion PLA, Novamont S.p.A., Arkema S.A., Danimer Scientific, Inc., Mitsubishi Chemical Group Corporation, Avantium N.V., Biome Bioplastics Limited, and others play a significant role in shaping the market dynamics. These leading players often drive innovation, introducing new products, technologies, and applications to meet evolving industry demands.

Innovations in bio-based plastics today focus on the intersection of biology, materials science, and digital tools: Startups and established companies are using genetically engineered microbes, advanced catalytic processes, and AI-powered formulations to transform biomass and non-food waste streams into higher-performance polymers. In parallel, we are working on polymer development to close the gaps in barrier properties and thermal stability, enabling bio-based grades to meet technical specifications for packaging and durable goods. System innovations are equally important; pilot projects integrating raw material sourcing, on-site preprocessing, and downstream recycling create justifiable cost advantages and shorten time-to-market. This multi-layered approach transforms once-niche chemicals into scalable platforms with clearer industrial development paths.

Alternatives to bio-based plastics range from enhanced mechanical recycling of fossil-based polymers to chemical recycling, paper- and fiber-based formats, and new biomaterials such as algal and mycelium products. Each option has distinct performance, cost, and lifetime profiles. Economic decision-making, therefore, depends on the total cost of ownership, which considers lifecycle emissions, collection infrastructure, and consumer acceptance, rather than solely on unit price.

Product Insights

Bio-PET (polyethylene terephthalate) dominated the market across the product segmentation in revenue, accounting for a market share of 24.56% in 2024, and is forecasted to grow at a 7.6% CAGR from 2025 to 2033. This can be attributed to its ability to deliver verifiably renewable ingredients while seamlessly integrating into existing PET manufacturing and collection systems. Brands favor bio-PET because it enables rapid swapping in bottle-to-bottle and thermoforming applications without line retooling. This reduces friction and shortens time to market.

This ease of implementation, combined with large beverage and personal care volumes, drives increased investment in bio-PET feedstock and commercial-scale processing capacity, making bio-PET the pragmatic frontrunner among bio-based polyesters for mass use.

The PLA (polylactic acid) segment is anticipated to grow at a substantial CAGR of 9.8% through the forecast period, driven by material properties clearly aligned with near-term use cases: compostability, where industrial composting is possible, good printability for 3D and flexible packaging, and fast formulation cycles for medical and disposable items. Regulators and brands pursuing certified end-of-life solutions are accelerating procurement pilot projects, while lower technical hurdles for polymerization and scaling are shortening commercialization times. These factors create a structural growth perspective that positions PLA as the fastest-growing biopolymer niche.

Application Insights

Packaging dominated the market across the application segmentation in terms of revenue, accounting for a market share of 59.17% in 2024, and is forecasted to grow at a 9.2% CAGR from 2025 to 2033. Demand for packaging is driving the market for bio-based plastics, as this sector offers the largest addressable volume and clear branding and regulatory mechanisms for change.

Packaging teams can replace bio-based formats in multiple places, such as primary films, rigid containers, and protective sleeves, and are under direct pressure from extended producer responsibility schemes and consumer expectations to reduce lifecycle impacts. As material performance converges and supply partnerships mature, procurement shifts from experimental purchases to repeatable commercial contracts.

The textile & fibers segment is anticipated to grow at a substantial CAGR of 8.9% through the forecast period. The sector's particular driver is the urgent need for decarbonization and traceability among clothing brands and buyers of technical textiles. Bio-based fibers such as PLA and regenerated cellulose reduce third-sector emissions while enabling new labels that differentiate in terms of origin and circularity.

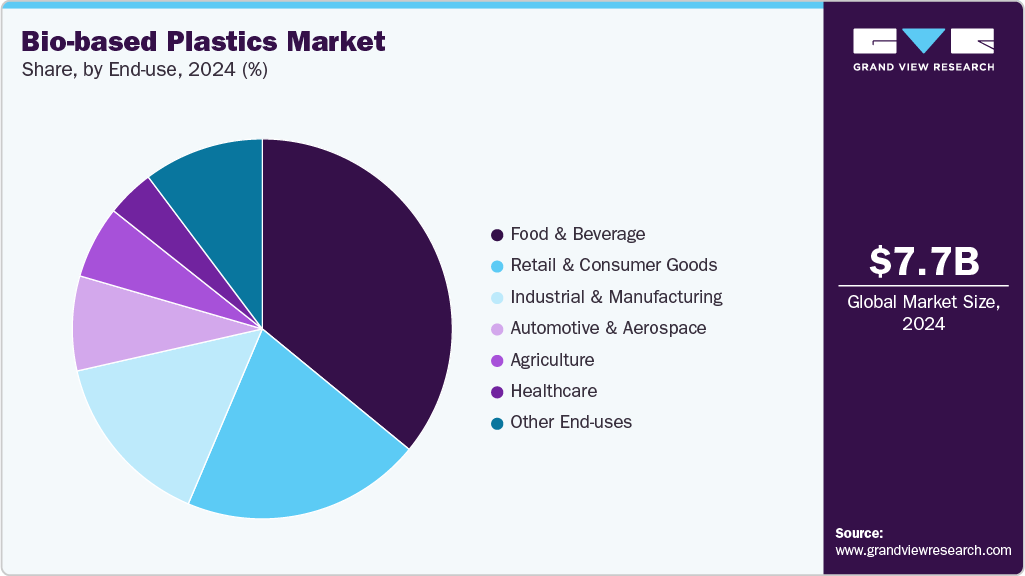

End Use Insights

Food & beverage led the market across the end use segmentation in terms of revenue, accounting for a market share of 35.94% in 2024, and is expected to grow at a CAGR of 9.4% through the forecast period. In the food and beverage sector, risk management is the key driver. Companies are seeking packaging solutions that mitigate the risk of future plastic restrictions, comply with food contact safety regulations, and meet strict supply chain traceability requirements.

The retail & consumer goods segment is expected to expand at a substantial CAGR of 9.1% through the forecast period. Retailers and consumer brands drive adoption by translating sustainability claims into differentiated shelf positions and loyalty offers. Where verified bio-based ingredients can be credibly communicated, retailers use assortment and private label strategies to test premium price points and build consumer acceptance. They are backing out of credibility tests that fail. This dynamic pushes suppliers to invest in certification, supply chain transparency, and material performance to translate retail pilot projects into broader assortments.

Regional Insights

Asia Pacific held the largest share of 42.02% in terms of revenue of the bio-based plastics market in 2024 and is expected to grow at the fastest CAGR of 9.3% over the forecast period. In Asia-Pacific, aggressive anti-plastics laws, industrial incentives, and high production throughput are accelerating demand for bio-based alternatives. Countries with strict single-use restrictions and subsidy programs are creating immediate domestic markets, while large packaging and textile production hubs provide the volume boost that makes local polymer production economically attractive. The result is a regionally diverse but fast-moving market where policy and production capacity work together to drive adoption.

China Bio-based Plastics Market Trends

The bio-based plastics market in China is driven by a deliberate policy approach that combines phased bans on problematic single-use plastics with the pragmatic promotion of biodegradable and bio-based substitutes through technology incentives and industrial policy. This alignment of regulation, subsidies, and domestic scaling has led to rapid capacity expansion and a national market preference for alternatives that comply with evolving restriction lists and procurement rules.

North America Bio-based Plastics Market Trends

The bio-based plastics market in North America is driven by procurement commitments from major brands and coordinated public investments to improve collection and waste paper infrastructure. Beverage, retail, and personal care companies are setting targets for responsibly sourced or bio-based ingredients, while government and multi-stakeholder programs are channeling capital into recycling, composting, and alternatives to single-use plastics. This combination reduces the risk of scaling for processors and attracts investors into commercial capacities rather than pilot projects.

U.S. Bio-based Plastics Market Trends

The U.S. bio-based plastics market's explicit policy instruments and procurement programs act as leverage for trade: The US Department of Agriculture's (USDA) BioPreferred Framework and federal initiatives to reduce plastic pollution create preferential demand and transparency for producers of bio-based polymers. Together with government regulations and incentives for waste management, these government signals shorten payback periods for equipment investments and promote vertically integrated supply agreements with agricultural suppliers.

Europe Bio-based Plastics Market Trends

The bio-based plastics market in Europe is propelled by harmonizing regulations that translate sustainability commitments into binding obligations. The new EU Packaging and Packaging Waste Regulation and the associated policy framework mandate recyclability, restrict the use of virgin material, and tighten regulations on product claims and provenance. These measures enforce design for recovery and open up opportunities for bio-based polymers where recycling streams cannot meet food contact or recycled content requirements. This leads to faster commercial adoption in the portfolios of major brands.

Key Bio-based Plastics Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include NatureWorks LLC, Braskem S.A., BASF SE, TotalEnergies Corbion PLA, Novamont S.p.A., Arkema S.A., Danimer Scientific, Inc., Mitsubishi Chemical Group Corporation, Avantium N.V., and Biome Bioplastics Limited. The market is characterized by a competitive landscape with several key players driving innovation and growth. Major companies in this sector invest heavily in research and development to enhance their products' performance, cost-effectiveness, and sustainability.

Key Bio-based Plastics Companies:

The following are the leading companies in the bio-based plastics market. These companies collectively hold the largest market share and dictate industry trends.

- NatureWorks LLC

- Braskem S.A.

- BASF SE

- TotalEnergies Corbion PLA

- Novamont S.p.A.

- Arkema S.A.

- Danimer Scientific, Inc.

- Mitsubishi Chemical Group Corporation

- Avantium N.V.

- Biome Bioplastics Limited

Recent Developments

-

In April 2025, Thyssenkrupp Uhde's polymer specialists, Uhde Inventa-Fischer, partnered with Praj Industries Ltd. to offer an integrated technology solution for producing polylactic acid (PLA), a sustainable alternative to conventional plastics.

-

In February 2025, Balrampur Chini Mills announced it planned to set up India's first industrial-scale Polylactic Acid (PLA) biopolymer manufacturing unit in Kumbhi, Uttar Pradesh, with an investment of about USD 342 million (Rs 2,850 crore). The plant, expected to start operations by October 2026, would produce 80,000 tonnes annually of 100% bio-based and industrially compostable PLA, powered entirely by renewable energy.

Bio-based Plastics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.28 billion

Revenue forecast in 2033

USD 16.09 billion

Growth rate

CAGR of 8.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

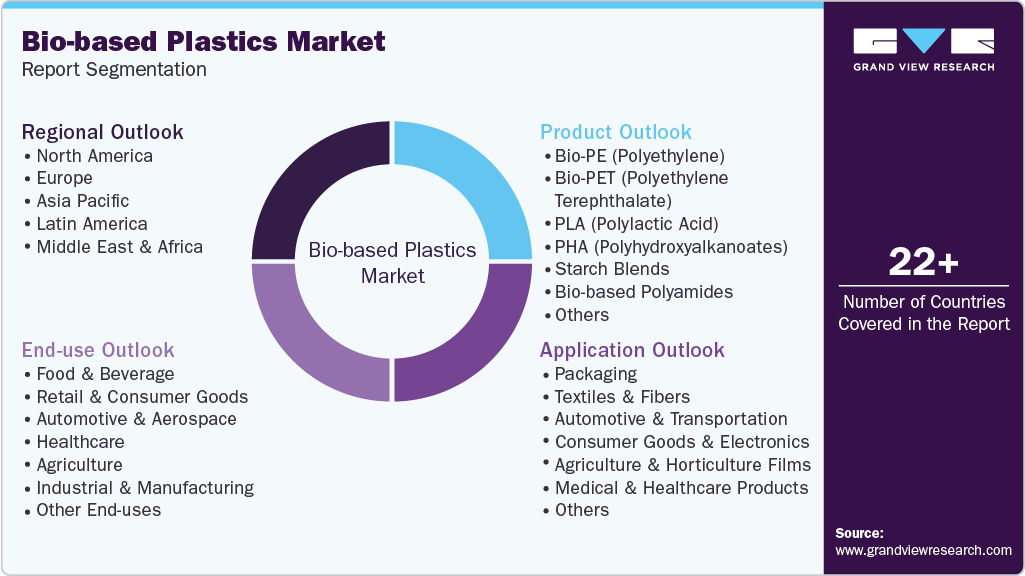

Report Segmentation

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

NatureWorks LLC; Braskem S.A.; BASF SE; TotalEnergies Corbion PLA; Novamont S.p.A.; Arkema S.A.; Danimer Scientific, Inc.; Mitsubishi Chemical Group Corporation; Avantium N.V.; Biome Bioplastics Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bio-based Plastics Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global bio-based plastics market report based on product, application, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Bio-PE (Polyethylene)

-

Bio-PET (Polyethylene Terephthalate)

-

PLA (Polylactic Acid)

-

PHA (Polyhydroxyalkanoates)

-

Starch Blends

-

Bio-based Polyamides

-

Bio-based Polyurethanes

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Packaging

-

Textiles & Fibers

-

Automotive & Transportation

-

Consumer Goods & Electronics

-

Agriculture & Horticulture Films

-

Medical & Healthcare Products

-

Construction & Building Materials

-

Other Applications

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Food & Beverage

-

Retail & Consumer Goods

-

Automotive & Aerospace

-

Healthcare

-

Agriculture

-

Industrial & Manufacturing

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global bio-based plastics market size was estimated at USD 7.66 billion in 2024 and is expected to reach USD 8.28 billion in 2025.

b. The global bio-based plastics market is expected to grow at a compound annual growth rate of 8.7% from 2025 to 2033 to reach USD 16.09 billion by 2033.

b. Food & beverage led the bio-based plastics market across the end use segmentation in terms of revenue, accounting for a market share of 35.94% in 2024 and is expected to grow at a CAGR of 9.4% through the forecast period.

b. Some key players operating in the bio-based plastics market include NatureWorks LLC, Braskem S.A., BASF SE, TotalEnergies Corbion PLA, Novamont S.p.A., Arkema S.A., Danimer Scientific, Inc., Mitsubishi Chemical Group Corporation, Avantium N.V., Biome Bioplastics Limited

b. Improvements in bioprocessing and chemical conversion are continually reducing production costs and improving yields. This makes bio-based plastics more competitive with fossil-based alternatives. As technology maturity increases and capital intensity decreases, more manufacturers can justify commercial-scale investments and accelerate market adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.