- Home

- »

- Green Building Materials

- »

-

Waterproofing Membranes Market Size, Share Report, 2030GVR Report cover

![Waterproofing Membranes Market Size, Share & Trends Report]()

Waterproofing Membranes Market (2024 - 2030) Size, Share & Trends Analysis Report By Product ((Liquid Applied), Sheet (PVC, EPDM)), By Application (Roofing, Building), By Raw Material, By Construction, And Segment Forecasts

- Report ID: 978-1-68038-470-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Waterproofing Membranes Market Summary

The global waterproofing membranes market size was estimated at USD 24.54 billion in 2023 and is projected to reach USD 40.15 billion by 2030, growing at a CAGR of 8.5% from 2024 to 2030. Growing demand from the waste and water management sector coupled with the increasing development in water conservation infrastructure is anticipated to positively impact the growth.

Key Market Trends & Insights

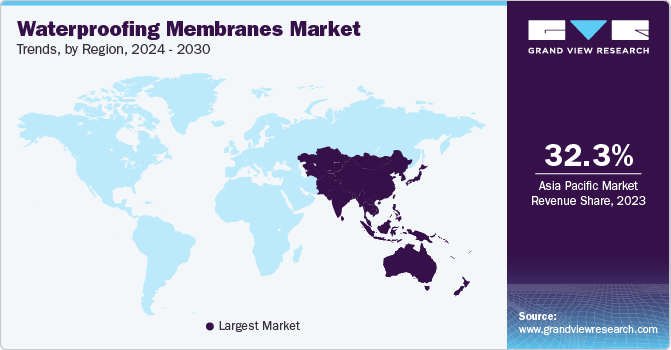

- Asia Pacific was the largest regional market in 2023, holding 32.3% of the revenue share.

- The Central & South America is likely to witness a CAGR of 8.4% in terms of volume from 2024 to 2030.

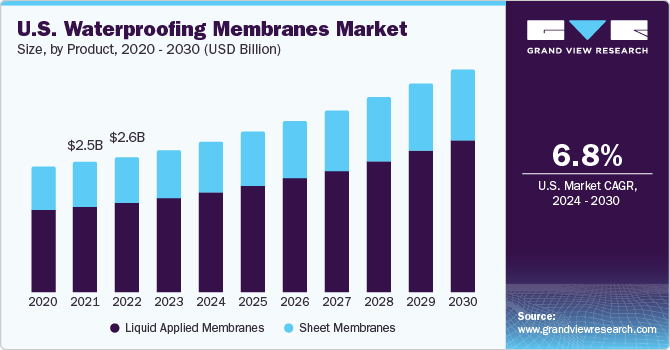

- In terms of product segments, liquid applied membranes led the market in 2023, accounting for over 64.1% of global revenue.

- The building structure application is anticipated to witness a CAGR of 9.4% in terms of revenue.

Market Size & Forecast

- 2023 Market Size: USD 24.54 Billion

- 2030 Projected Market Size: USD 40.15 Billion

- CAGR (2024-2030): 8.5%

- Asia Pacific: Largest market in 2023

Additionally, uneven distribution of water precipitation both geographically and seasonally increases the need for water conservation, transportation, and treatment.

Waterproofing membranes find a wide array of uses including wet rooms, roofs, water & sewage treatment plants, retaining walls, building foundations, and tunnels. Rising consumer consciousness regarding the product advantages along with the adoption of new materials such as geo membranes is expected to further propel the product demand over the projected time.

The U.S. is expected to be the largest market for waterproofing membranes in North America. Rapid industrialization on account of increasing construction projects and housing developments is expected to fuel the demand for sheet membranes in the region. Furthermore, growing consumer preference towards increasing the shelf life of paint jobs on buildings is expected to drive the sheet membrane market in the region.

Factors including low manufacturing costs coupled with rising mining activities in various regions are likely to increase the utilization of the product in the forthcoming years. In addition, the increasing trend of the wastewater management market is likely to augment the product demand over the forecast period.

Several regulations have been enforced for the production and use of waterproofing membranes. For instance, use for various applications, including designing and installing membranes, and flashings located in kitchens, bathrooms, and laundries located in residential buildings should be made and tested as per AS/NZS 4858:2004, wet area membranes.

However, the market is subjected to the lack of experts regarding the use of the right type of membrane for durable structures such as basements, decks, watercraft, and others. This is expected to act as a restraint for the market during the forecast period. In addition, fluctuating raw materials prices of polypropylene and bitumen obtained from crude oil further affecting the waterproofing membrane price, thereby, restrict the market growth.

Market Concentration & Characteristics

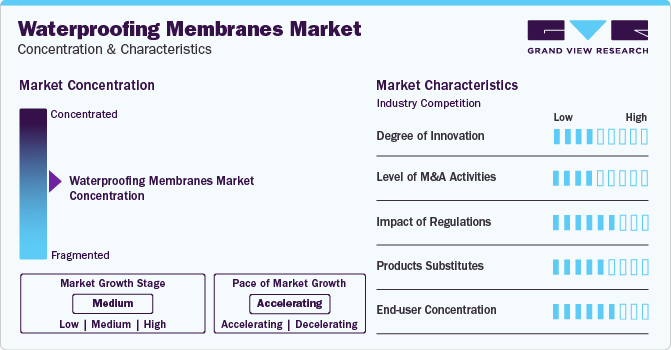

Market growth stage is medium, and pace of market growth is accelerating. Waterproofing membrane market is consolidated by a few numbers of companies that hold a majority of share. This concentration is influenced by variety of factors such as technological advancements, brand recognition, and global reach. Market players participate in moderate level of merger & acquisition, and expansion activities to gain technological advancements, global reach, and expand portfolio. Large market players absorb the small players with an aim to gain market share and intensify competition in industry.

Waterproofing membrane industry is evolving owing to moderate level of innovations that primarily involve advanced installation methods, eco-friendly solutions, new materials including self-healing membranes. Companies invest in R&D with focus on such innovations to enhance product durability, sustainability, and gain competitive edge over competitors.

Waterproofing membrane industry is highly impacted by stringent regulatory standards pertaining to quality, environmental impact, production methods, among others. Companies exceeding regulations and standards have competitive edge and non-compliant players face challenges. It has further induced innovation and adaption of new materials.

Waterproofing membrane has a few direct substitutes available in the market that are restraining and challenging the growth of the market. Consumer preferences impact demand and vary based on budget constraints, construction, and desired application method, therefore it is necessary to enhance performance of waterproofing membrane to sustain in a competitive environment.

End-user concentration in market is moderate and serves end-use industries such as construction & infrastructure, and water & wastewater management. Understanding and catering to the requirements of these industries across diverse regions with different climate conditions is necessary to influence demand for waterproofing membrane.

Product Insights

The liquid applied membrane product segment led the market and accounted for more than 64.1% share of the global revenue in 2023. The growth can be attributed to the growing awareness about the advantages of the product such as cost-effectiveness and ease of installation.

In addition, increasing global infrastructural in terms of water conservation and treatment is expected to rise the demand for the liquid applied membrane during the fore coming period. In terms of region, Asia Pacific, North America, and Europe have been the largest markets for liquid applied membranes; however, Asia Pacific is projected to emerge as the fastest-growing regional market over the forecast period, followed by Europe.

Polyurethane liquid applied membrane is expected to grow at a significant rate of 10.8% in terms of revenue during the forecast period. It features uniform thickness making its utilization easy across various applications. These membranes are typically utilized for applications such as the waterproofing of roofs, wet rooms, water & sewage treatment plants, and stadium stands.

Demand for the bituminous liquid membrane is expected to grow at a CAGR of 8.8% in terms of volume over the projected period, owing to its unique properties such as high resistance to weathering and aging. It increases product viability in terms of flexibility at low temperatures, high UV resistance properties, and improved flow resistance at high temperatures.

Polyvinyl chloride membrane is expected to achieve a notable market share in 2023 and is likely to register a prominent share over the forecast period owing to the product advantages such as resistance to UV radiation and precipitation.

In addition, the product’s ability to withstand heavy loads is expected to add growth prospects to the market. Various advantages of PVC membranes such as resistance to precipitation, UV radiation, and ability to withstand heavy loads are anticipated to provide positive scope for product demand over the forecast period.

Application Insights

The roofing application segment held the largest revenue share of 37.9% in 2023. The growth can be attributed to its rising application in the Asia-Pacific region for residential housing construction. In addition, demand for sheet membranes for roofs due to high exposure to rainwater and environmental moisture is expected to drive the growth of the roofing segment over the next seven years.

The building structure is expected to witness a CAGR of 9.4% in terms of revenue over the forecasted period which can be attributed due to its application in buildings to improve the shelf life and protection at varying temperatures. In addition, the increasing use of sheet membranes for flooring in buildings is expected to contribute to growth prospects.

Landfill and tunnels accounted for USD 2.13 billion in 2023 and is expected to witness substantial growth during the forecast period owing to the rise in demand for cleaning methods in the tunnels. Rising demand for waterproofing membranes in developing countries on account of increasing industrial activity which in turn leads to a rising amount of waste is expected to drive the market growth on a positive note.

Other application segments of the waterproofing membrane include usage in wet rooms, kitchen floors, bathrooms, and areas surrounding the swimming pool. In addition, increasing awareness such as long-term cost-effectiveness and risk mitigation by applying waterproofing membrane is further expected to add positive growth to the market.

Regional Insights

Asia Pacific accounted for the largest revenue share of 32.3% in 2023. The growth can be attributed to the growing infrastructural developments and rapid industrialization, especially in China and India. In addition, the trend will increase the congestion in the city which in turn will increase the demand for utilities in a domestic application for water requirement, thus adding growth to the market. In addition, the rising roofing and waste management industries are driving regional growth. The use of waterproofing membranes in mining application is further expected to fuel the growth.

The market in North America was estimated to be USD 5.60 billion in 2023 and is expected to grow at a significant rate over the forecast period, which can be attributed to the rise in construction activities in Mexico and Canada. In addition, rising investment in warehouse construction for the healthcare, retail, and automotive application industry requiring waterproofing solutions is positively impacting the industry’s growth.

The product demand in Europe is dominated by product penetration in advanced countries such as the U.K., Germany, and France. In addition, the increasing adoption of waste management and water conservation demanding liquid applied and sheet membrane products in residential & buildings is further expected to increase the product demand in the region over the forecast period. Revival of the construction industry coupled with increasing investment in Eastern European economies is expected to have a positive impact on liquid applied membranes market demand over the forecast period.

The demand for waterproofing membranes in Central & South America is likely to witness a CAGR of 8.4% in terms of volume from 2024 to 2030. In addition, the investment in infrastructural projects by various regional governments is expected to boost the commercial and industrial application segment requiring waterproofing solutions, thereby, further fueling the market growth.

Key Companies & Market Share Insights

The market has been characterized by integration through raw material procurement and waterproofing membrane manufacturing. The waterproofing membrane manufacturers through mergers & acquisitions, capacity expansion, partnerships, and others are trying to increase their sales to facilitate the respective market across the globe.

A large set of companies are involved in waterproofing system market which makes the market highly competitive. Major companies operate their business through a dedicated distribution network to differentiate themselves in the value chain and against competitors.

-

In January 2023, Saint-Gobain announced the acquisition of Brazil’s Matchem, along with an agreement to acquire the Egypt-based IDP Chemicals. The acquisitions are aimed at strengthening Saint-Gobain’s position in the construction chemicals space, with both the acquisitions becoming a part of the Construction Chemicals segment in High-Performance Solutions.

-

In May 2023, ALCHIMICA announced the development of the Humidity Activated Accelerator Technology (HAA) technology, through the combination of ACCELERATOR-3000A and HYPERDESMO. The formulation enables the formation of a membrane that is defect-free and possesses strong elastomeric and mechanical properties.

Key Waterproofing Membranes Companies:

- BASF SE

- Kemper System America, Inc.

- GAF Materials Corporation

- Paul Bauder GmbH & Co. KG

- CICO Technologies Ltd.

- Fosroc Ltd

- GAF Materials Corporation

- Alchimica Building Chemicals

- Maris Polymers

- Isomat S.A.

- Bayer MaterialScience AG

Waterproofing Membrane Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.12 billion

Revenue forecast in 2030

USD 40.15 billion

Growth rate

CAGR of 8.5% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million square meters, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

raw material, product, application, construction, region

Regional scope

North America, Europe, Asia Pacific, South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Russia; Spain; Netherlands; China; India; Japan; South Korea; Australia; Singapore; Philippines; Malaysia; Indonesia; Vietnam; Thailand; Brazil; Argentina; Chile; Saudi Arabia; UAE; Kuwait; Qatar; South Africa;

Key companies profiled

BASF SE; Kemper System America, Inc.; GAF Materials Corporation; Paul Bauder GmbH & Co. KG; CICO Technologies Ltd.; Fosroc Ltd; GAF Materials Corporation; Alchimica Building Chemicals; Maris Polymers; Isomat S.A.; Bayer MaterialScience AG;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Waterproofing Membrane Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global waterproofing membrane market report on the basis of raw material, product, application, construction, and region:

-

Raw Material Outlook (Volume, Million Square Meters; Revenue, USD Million; 2018 - 2030)

-

Modified Bitumen

-

SBS

-

APP

-

-

PVC

-

EPDM

-

TPO

-

Acrylic

-

Polyurea

-

Polyurethane

-

PMMA

-

EVA

-

PE

-

HDPE

-

LDPE

-

-

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million; 2018 - 2030)

-

Liquid Applied Membranes

-

Cementitious

-

Bituminous

-

Polyurethane

-

Acrylic

-

PMMA

-

Elastomeric

-

-

Sheet Membranes

-

Bituminous

-

Polyvinyl Chloride (PVC)

-

Ethylene Propylene Diene Monomer (EPDM)

-

Other

-

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million; 2018 - 2030)

-

Roofing

-

Walls

-

Building Structure

-

Commercial

-

Residential

-

-

Tunnel & Landfills

-

Other

-

-

Construction Outlook (Volume, Million Square Meters; Revenue, USD Million; 2018 - 2030)

-

New Construction

-

Refurbishment

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Russia

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Singapore

-

Philippines

-

Malaysia

-

Indonesia

-

Vietnam

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global waterproofing membranes market size was estimated at USD 23.18 billion in 2022 and is expected to reach USD 24.54 billion in 2023.

b. The waterproofing membranes market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 40.15 billion by 2030.

b. Liquid applied membrane product dominated the waterproofing membranes market with a share of 69.9% in 2022, owing to its distinct advantage over traditional waterproofing systems, particularly where seamless systems are desired.

b. Some of the key players operating in the waterproofing membranes market include BASF SE; Kemper System America, Inc.; GAF Materials Corporation; Paul Bauder GmbH & Co. KG; CICO Technologies Ltd.; and Fosroc Ltd.

b. The key factors that are driving the waterproofing membranes market include growing demand for residential and commercial spaces coupled with increasing investments in the development of water conservation and wastewater treatment infrastructure

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.