- Home

- »

- Advanced Interior Materials

- »

-

Geomembrane Market Size, Share & Growth Report, 2030GVR Report cover

![Geomembrane Market Size, Share & Trends Report]()

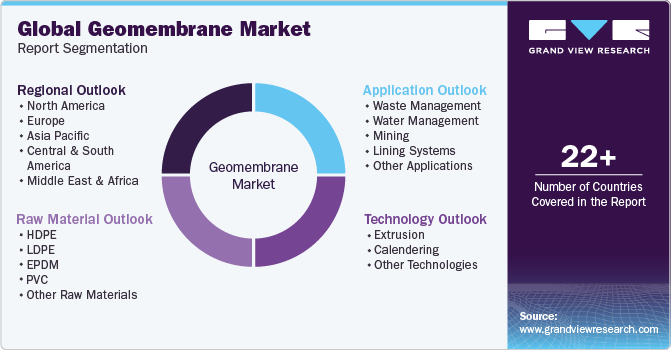

Geomembrane Market (2024 - 2030) Size, Share & Trends Analysis Report By Raw Material (HDPE, LDPE, EPDM, PVC), By Technology (Extrusion, Calendering), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-782-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Geomembrane Market Summary

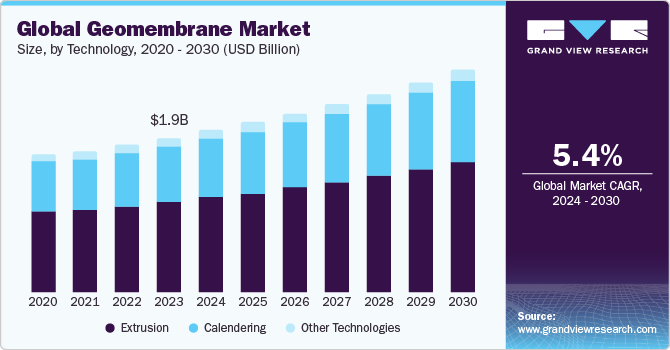

The global geomembrane market size was estimated at USD 1.98 billion in 2023 and is projected to reach USD 2.85 billion by 2030, growing at a CAGR of 5.4% from 2024 to 2030. Increasing shale gas production capacity in the U.S. and Canada and the growth in mining activities in South America are expected to drive the market for geomembranes over the forecast period.

Key Market Trends & Insights

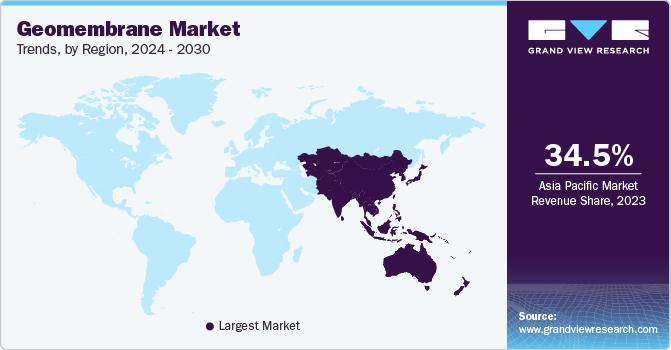

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- The geomembrane market in China is expected to grow over the forecast period.

- Based on raw material, the HDPE raw material segment led the geomembrane market, accounting for 31.3% of the global revenue in 2023.

- Based on technology, the extrusion technology segment led the market and accounted for 58.6% of the global revenue in 2023.

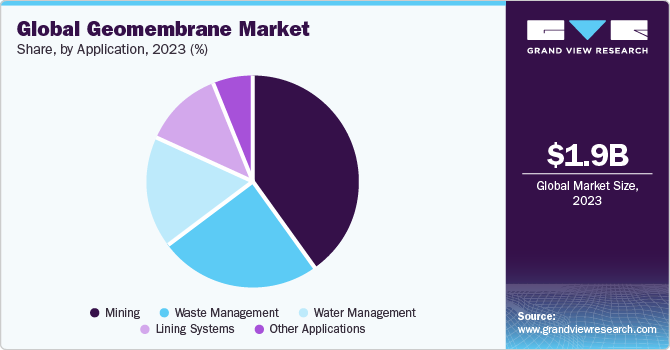

- Based on application, the mining segment led the market and accounted for 39.6% of the global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.98 Billion

- 2030 Projected Market Size: USD 2.85 Billion

- CAGR (2024-2030): 5.4%

- Asia Pacific: Largest market in 2023

In the U.S., widespread use of geomembranes for waste and water treatment, as well as for collection of leachates, is driving the market growth.

Extensive use of calendaring technology due to its capability to process engineering polymers, is expected to aid market growth in the coming years. Furthermore, easy availability of polypropylene, which is a major raw material, due to the high growth of petrochemical industries is expected to remain a favorable driver. Increasing infrastructure spending and awareness regarding water management are projected to fuel the market for geomembranes.

Increasing activities related to environment protection, civil construction, and groundwater protection are expected to drive the market over the forecast period. However, variation in crude oil prices is a major factor limiting the growth of geomembranes. Most raw materials used for geomembrane manufacturing are petroleum-based, making them subject to crude oil price fluctuations. The price of raw materials is directly affected by changes in crude oil prices.

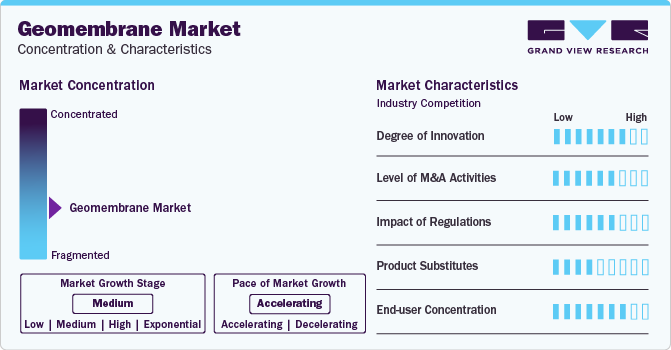

The key strategies used by market players are technology launches, acquisitions, and R&D operations. There are several companies, and no single business has a majority share to influence the market. However, it is consolidated by the top few businesses accounting for a dominant share.

Market Concentration & Characteristics

The market growth stage is medium with an accelerating pace of growth. Industry is fragmented on account of involvement of many large players with high production capacities. The establishment of strategic partnerships with buyers for developing geomembrane products for novel applications, including solar power plants, wind turbines, and hydropower projects, is anticipated to remain a critical success factor for geomembrane vendors over the forecast period.

Stringent environmental regulations regarding waste management, pollution control, and environmental protection have led to a high demand for geomembranes on a global level. Authorities across the globe, such as Geosynthetic Institute, ASTM Standards, and United States Environmental Protection Agency, enforce regulations to ensure safe containment of hazardous substances released from several industries. Regulatory framework varies across regions impacting the product demand in different parts of the world.

The use of bitumen-based waterproofing membranes in construction applications is expected to pose a credible threat to the geomembrane market. Furthermore, rising demand for geosynthetic clay liners in lining applications is anticipated to remain a concerning factor for geomembrane manufacturers.

Growth of geomembranes in landfill, mining, and waste management applications is expected to drive their adoption. Buyers are likely to establish partnerships with installers to tailor products to suit their requirements. As a result, installers could offer geomembranes at a relatively higher price. However, the presence of substitutes such as polymer bitumen is likely to restrain market growth.

Raw Material Insights

The HDPE raw material segment led the geomembrane market, accounting for 31.3% of the global revenue in 2023. It is expected to grow steadily from 2024 to 2030. High Density Poly Ethylene (HDPE) is expected to dominate the raw material segment to produce geomembranes on account of its easy installation and good thermal stability. HDPE is preferred over other raw materials as it exhibits high strength required in various applications. It is commonly used for manufacturing geomembranes for mining and construction applications, in which they have a huge growth potential.

The EPDM raw material segment accounted for a significant market share in 2023 and is expected to witness the fastest CAGR of 6.6% from 2024 to 2030 with increasing use of Ethylene Propylene-diene Monomer (EPDM) on account of its good flexibility, excellent mechanical strength, and effective UV resistance. Rising awareness regarding the use of EPDM as a raw material in emerging economies is expected to complement its market growth over projected period. However, its high price compared to HDPE, LDPE, and PP is anticipated to have a negative impact on the segment growth.

Technology Insights

The extrusion technology segment led the market and accounted for 58.6% of the global revenue in 2023. This technology is extensively used in environment protection, civil construction, water consumption, and groundwater protection activities. An increase in these activities across the globe is expected to boost the segment over the forecast period. Extruded geomembranes are manufactured using Linear Low-density Polyethylene (LLDPE) and High Density Poly Ethylene (HDPE). In addition, extruded geomembranes are manufactured by thermal welding of thermoplastic compounds such as HDPE. Extensive use of these materials, which have high growth potential, is expected to strengthen the extrusion technology segment.

The calendering technology segment accounted for a substantial market share in 2023 and is expected to witness the fastest CAGR of over 5.7% from 2024 to 2030. This technology is used for processing both polymeric and rubber-based geomembranes. Due to its widespread use, calendaring can witness significant growth prospects. The demand for calendered geomembranes is estimated to witness stable growth over the forecast period owing to the presence of stringent federal regulation in the U.S., on the use of these materials. The regulations are estimated to support product penetration in waste management applications.

Application Insights

The mining application segment led the market and accounted for 39.6% of the global revenue in 2023. The rising output of mining industries in Peru, Chile, Nigeria, and South Africa due to regulatory support and promotion of foreign direct investments is expected to fuel segment growth over the forecast period. Geomembrane is used as a solution for lining evaporation ponds and heap leach pads to provide containment control in the mining industry. Furthermore, it is utilized in pond liners to check for leaks and prevent effluent and gas movement.

The waste management application segment accounted for a significant market share in 2023. Governments are promoting the use of geomembranes using strict regulations to implement waste management practices in municipal and industrial sectors. The adoption of geomembranes in water management is expected to witness significant growth over the forecast period owing to the booming shale gas industry in the U.S. and Canada. Furthermore, a positive outlook toward the construction sector in Asia Pacific is expected to boost the demand for geomembranes in water management.

Regional Insights

The North America geomembrane market is expected to witness a CAGR of 3.7% from 2024 to 2030. The presence of a robust silver mining industry in Mexico is expected to promote the use of PVC geomembranes in heap leach mining applications. In addition, increased production of shale gas and the increasing focus on waste management applications are expected to drive the market.

U.S. Geomembrane Market Trends

Geomembrane market in the U.S. is expected to grow on account of easy availability of raw materials, such as polypropylene, due to the presence of petrochemical companies, such as Chevron Phillips, ExxonMobil, Shell, and BP. These factors are anticipated to drive the demand for geomembranes in the U.S. over the forecast period.

Mexico geomembrane market is expected to grow over the forecast period, due to the gradual recovery of Mexico’s economy and rising awareness regarding the benefits of geomembranes in several construction projects involving dams, canals, landfills, and tunnels.

Asia Pacific Geomembrane Market Trends

The Asia Pacific geomembrane market dominated with 34.5% share in the global revenue in 2023 and is expected to continue the growth trend over the forecast period. This can be attributed to the growing industrialization and the rising awareness regarding the benefits of polymer-based geomembranes in construction and mining industries of China and India.

The geomembrane market in China is expected to grow over the forecast period. This growth is anticipated to be driven by abundant reserves of rare earth elements, such as copper, steel, and aluminum, which will increase investments in mining, boosting the application of geosynthetic products including geomembranes over the forecast period. The regulatory support is expected to accelerate the growth of power industry in China through solar and wind energy installation to promote the application of geomembranes for earth reinforcement in the foundation work at a domestic level.

The India geomembrane market is expected to witness growth from 2024 to 2030. This growth is anticipated to be driven by favorable government initiatives such as "Make in India" to boost investments in electronics, medical, and automotive manufacturing industries, thereby complementing the growth of the construction industry. These developments are likely to contribute significantly to the market growth.

Europe Geomembrane Market Trends

The Europe geomembrane market accounted for a significant share of the global market in 2023. This region comprises developed economies, such as Germany, the UK, Russia, Italy, and France, with well-established construction sectors. Furthermore, the presence of an established automotive sector is expected to contribute to the product demand over the forecast period.

The geomembrane market in Germany is expected to grow from 2024 to 2030, due to several significant factors. The country is known as the financial powerhouse of Europe, with construction industry as a major contributor to its GDP. Increasing public infrastructure spending in Germany and low-interest rate are anticipated to further drive construction activities, fueling the product demand.

Middle East & Africa Geomembrane Market Trends

The geomembrane market in the Middle East & Africa is expected to grow at a significant rate over the forecast period. This growth can be attributed to the flourishing construction and automotive end-use industries in the region that are the key consumers of geomembranes.

The Saudi Arabia geomembrane market growth is driven by the country’s advanced infrastructure sector with highways and expressways connecting significant cities and well-connected railways and waterways. This indicates high investments in construction and industrial sectors, which, in turn, is likely to propel the demand for geomembranes in the country over the forecast period.

Central & South America Geomembrane Market Trends

The geomembrane market in Central & South America is expected to grow during the forecast period as the construction industry in the region is expected to witness substantial growth in the coming years with increasing investments in various infrastructure projects by foreign and domestic private players. This, in turn, is expected to propel the demand for geomembranes for reinforcement in construction projects over the forecast period.

The Brazil geomembrane market is anticipated to witness significant growth over the forecast period, with the growth of the construction industry on account of increasing efforts by the government to revive the economy, followed by improvements in consumer and investor confidence.

Key Geomembrane Company Insights

Some of the key players operating in market are Minerals Technologies Inc.; Solmax; and Officine Maccaferri Spa.

-

Minerals Technologies Inc. operates through two business segments, namely, consumer & specialties and engineered solutions. Furthermore, it sells its products via various brands such as CETCO, CONCEPT PET, MINTEQ, and NORMERICA.

-

Officine Maccaferri Spa provides advanced solutions for erosion control, soil reinforcement, stabilization of the soil, and infrastructure development in applications such as roads, railways, canals, rivers, coastal defenses, and landfills. It owns over 70 subsidiaries in 130 countries.

Plastika Kritis S.A. and Global Synthetics are some of the emerging participants in market.

-

Plastika Kritis S.A. is engaged in manufacturing and marketing masterbatches, plastic films, geomembranes, polyethylene pipes, recycled pipes, and green energy. The company’s product portfolio is tailored for a wide range of applications including horticulture, agriculture, plastics, water management, and environmental engineering.

-

Global Synthetics is an Australian conglomerate involved in the business of geosynthetic products meant for the engineering, procurement, and construction (EPC) sector and hydraulic applications in various industries. The company’s offices are located in Sydney, Perth, Brisbane, Darwin, Hobart, Adelaide, and Melbourne.

Key Geomembrane Companies:

The following are the leading companies in the geomembrane market. These companies collectively hold the largest market share and dictate industry trends.

- Minerals Technologies Inc.

- Plastika Kritis S.A.

- Geofabrics Australasia Pty Ltd.

- Naue GmbH & Co. KG

- Juta Ltd.

- Solmax

- Officine Maccaferri Spa

- Terrafix Geosynthetics Inc.

- Carlisle SynTec Systems

- Carthage Mills, Inc.

- Propex Operating Company, LLC

- Global Synthetics

- Gayatri Polymers & Geo-synthetics

Recent Development

-

In December 2022, terrafix acquired Nilex, Inc., a manufacturer of geosynthetics for environmental and civil projects. This acquisition will allow terrafix to increase its customer base and help consumers by offering innovative solutions.

Geomembrane Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.07 billion

Revenue forecast in 2030

USD 2.85 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million square meters, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Raw material, technology, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada, Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Brazil; Argentina; Saudi Arabia

Key companies profiled

Minerals Technologies Inc.; Plastika Kritis S.A.; Geofabrics Australasia Pty Ltd.; Naue GmbH & Co. KG, Juta Ltd.; Solmax; Officine Maccaferri Spa; Terrafix Geosynthetics Inc; Carlisle SynTec Systems; Carthage Mills, Inc.; Propex Operating Company, LLC; Global Synthetics; Gayatri Polymers & Geo-synthetics

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geomembrane Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the geomembrane market report based on raw material, technology, application, and region:

-

Raw Material Outlook (Volume, Million Sq. Meter; Revenue, USD Million, 2018 - 2030)

-

HDPE

-

LDPE

-

EPDM

-

PVC

-

Other Raw Materials

-

-

Technology Outlook (Volume, Million Sq. Meter; Revenue, USD Million, 2018 - 2030)

-

Extrusion

-

Calendering

-

Other Technologies

-

-

Application Outlook (Volume, Million Sq. Meter; Revenue, USD Million, 2018 - 2030)

-

Waste Management

-

Water Management

-

Mining

-

Lining Systems

-

Other Applications

-

-

Regional Outlook (Volume, Million Sq. Meter; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The key factors driving the Geomembrane market include increasing product use in sectors like Mining, construction and also in Water management and Waste management sectors. The increasing infrastructural spending and rising awareness regarding water management is expected to offer lucrative opportunities to the geomembrane market during the forecast period.

b. The global geomembrane market size was estimated at USD 1.98 billion in 2023 and is expected to reach USD 2.07 billion in 2024.

b. The global geomembrane market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 2.85 billion by 2030.

b. HDPE raw materials segment dominated the market and accounted for more than 31.3% share of the global revenue in 2023. On account of exhibiting key features including Easy installation and good thermal stability during exposure, HDPE is expected to remain the favourable choice as raw material for the production of geomembrane.

b. Some of the key players operating in the geomembrane market include GSE Environmental, CETCO, Geofabrics Australasia Pty Ltd., Carthage Mils Erosion Control Company, Inc, NAUE GmbH & Co., KG, JUTA Ltd, Solmax International Inc., Officine Maccaferri S.p.A, Plastika Kritis S.A., Nilex, Inc., Bridgestone America, Carlisle SynTec Systems, Anhui Huifeng New Synthetic Materials Co., Ltd.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.