- Home

- »

- Clothing, Footwear & Accessories

- »

-

Handbag Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Handbag Market Size, Share & Trends Report]()

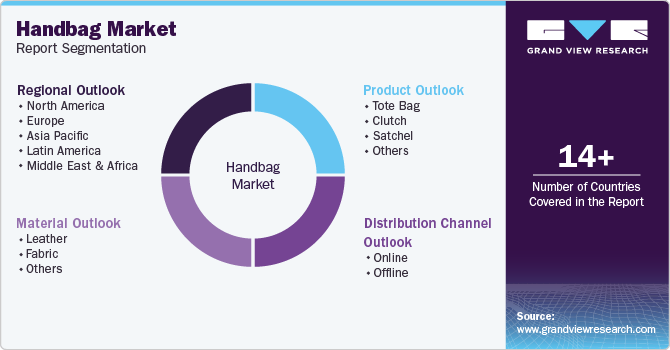

Handbag Market Size, Share & Trends Analysis Report By Raw Material (Leather, Fabric), By Product (Tote Bag, Clutch), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-927-2

- Number of Report Pages: 139

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Handbag Market Size & Trends

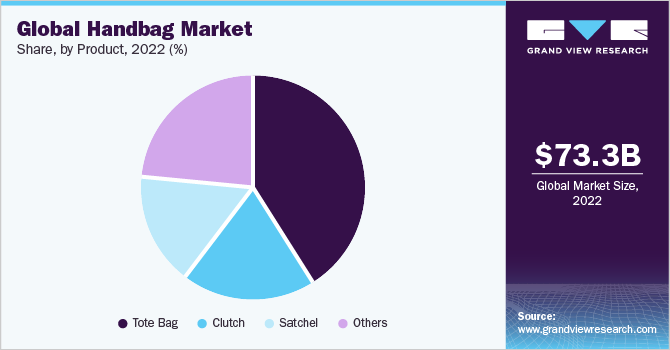

The global handbag market size was estimated at USD 73.32 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. The global workforce has seen a significant rise in women's participation over the years, with women now integral to various industries in diverse roles, from corporate executives to entrepreneurs. This increased participation drives the demand for accessories, which meet the needs of working women. Handbags have evolved from accessories to essential tools, addressing the multifaceted demands of modern professional life.

Modern working women seek a blend of style and practicality, making handbags vital to their daily routines. They need to transition seamlessly between professional and personal settings, and handbags fulfill this role adeptly. These versatile companions carry work-related items like laptops, documents, and planners, along with personal essentials such as wallets, cosmetics, and electronic devices. Results of the Omnibus survey conducted by Circana, a media company, in June 2023, indicated that 39% of American women aged 18 to 34 carry a handbag to work or school. Moreover, over 60% of women aged 35 and older always have a handbag with them for activities beyond work or school.

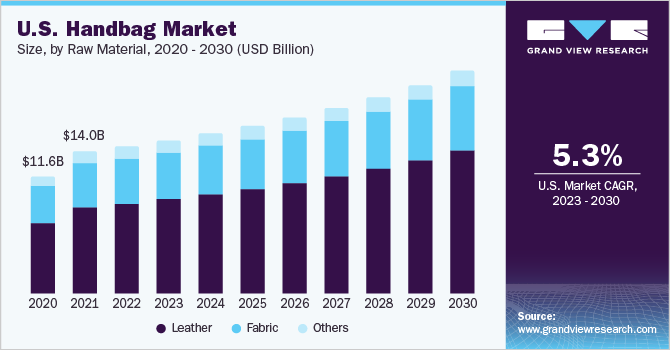

The increasing use of handbags by working women is projected to be a prominent trend in the market. For instance, according to the data released by the U.S. Bureau of Labor Statistics in April 2021, American women held 57.4% of American jobs in 2019 as compared to 57.1% in 2018. The growth of the market can be attributed to the significant rise in the female working population in the country. Furthermore, the product's demand in the U.S. has been fueled by the tremendous growth of the corporate and organized sectors.

According to a survey conducted by The International Council of Societies of Industrial Design (ICSID) in November 2021, an American woman owns an average of 11 handbags and spends approximately USD 160 on a bag. Thus, the high expenditure by women on handbags in the country contributes to the growth of the market, making it the largest market in the region.

In addition, luxury and premium handbags have evolved beyond their utilitarian role, transforming into symbols of status and personal style. The growing purchasing power of consumers, particularly in emerging economies, combined with aspirational buying tendencies, is propelling the desire for high-end handbags. Notably, alongside well-established luxury brands, emerging designers and niche players are entering the market, introducing distinctive designs and craftsmanship. These brands cater to consumers seeking exclusivity and individuality, thus enriching the diversity of the luxury handbag industry.

Raw Material Insights

Based on raw material, the leather handbag segment held the largest market share of 56.27% in 2022. Growing consumer preference for luxury goods and accessories is a major factor driving the demand for leather handbags. Leather is the primary raw material for luxury handbags and accessories. Rising consumer spending on luxury items in developed and developing economies can be attributed to the growing number of working women, who are increasingly willing to invest in leather handbags to create a versatile wardrobe collection. The rise in people’s discretionary income is also expected to create the demand for leather goods in developing countries like Thailand, Egypt, UAE, Saudi Arabia, and India. The demand for leather handbags is also supported by the advent of online shopping, particularly in Asia Pacific.

The fabric handbag segment is projected to grow at a CAGR of 5.8% from 2023 to 2030. Fabric handbags include bags made of cotton, silk, canvas, velvet, jute, and nylon. Key players in the market are investing in developing innovative raw materials to create handbags with different textures and appearances. Concerns regarding sustainability are encouraging players to adopt natural fibers like jute and cotton. Several retailers and supermarkets are increasingly using cotton tote and jute bags to reduce the use of single-use plastic.

Distribution Channel Insights

In terms of distribution channel, the online distribution channel segment is projected to grow at the fastest CAGR of 8.6% over the forecast period owing to the rising popularity of e-commerce and social media channels. Younger consumers increasingly prefer online shopping owing to the digitalization of services. Companies operating in the market are constantly improving customer databases and digital stores to cater to a larger set of consumers. They are also utilizing social media platforms such as WeChat, Pinterest, Instagram, Twitter, and Sina Weibo as a way of communicating with customers to increase traffic for both online and offline distribution channels.

For instance, Capri Holdings, owner of leading brands like Michael Kors, Versace, and Jimmy Choo, has been expanding its global retail footprint by accelerating its omnichannel and e-commerce development. Companies such as Coach and Kate Spade have informational websites in China, Malaysia, Singapore, Taiwan, and Hong Kong to reach their consumers in Asia Pacific.

The offline distribution channel held the largest market share of 77.7% in 2022. The offline distribution channel for handbags includes department stores, specialty stores, and other retail stores. Consumers prefer offline stores as they offer a wide product variety with better convenience and accessibility than online stores. Leading handbag makers are partnering with wholesale stores like Macy’s, Bloomingdale’s, and Saks Fifth Avenue in the U.S. and Selfridges, Printemps, and Galeries Lafayette in Europe. Such collaborations help in accessing a larger customer base. Companies are also investing in larger spaces, along with decorative items, flooring, and wall casings, to attract consumers and increase footfall and sales via offline channels.

Product Insights

In terms of product, the Tote bag segment held the largest market share of 41.13% in 2022. Tote bags are multi-purpose bags that can be used for a variety of tasks. Tote bags are popular among consumers due to their size and material. Tote bags are larger than other types of purses. These bags make it easier for consumers to carry essentials to offices, universities, and other places. The rising influence of Korean fashion and aesthetics among younger consumers is also driving the sale of tote bags. In addition, the stylish nature of totes helps consumers make a style statement on formal occasions.

Tote bags are considered more environment-friendly because they can be used multiple times, reducing the need for disposable bags. This aligns with sustainability goals to reduce plastic pollution. For instance, in 2021, Anya Hindmarch, a fashion designer based in England, collaborated with Sainsbury's and Waitrose supermarket chains in the UK to reuse shopping tote bags to tackle sustainability challenges.

The satchel bags market is projected to grow at a CAGR of 8.1% from 2023 to 2030. Satchel bags are available in different sizes from mid to large sizes with a flat bottom and two short handles. The bag can be worn either diagonally across the body or can be hung on the side. Satchel bags are versatile bags, which can be used by both men and women. These bags are gaining preference among consumers as they are useful for carrying multiple everyday work items like tablets, wallets, and laptops. The pandemic haltered the demand for satchel bags owing to work-from-home orders. In March 2021, the shopping platform Lyst, in its Year in Fashion Report, revealed that at the end of 2020, Telfar depicted a 270% week-on-week rise for its satchel bags and other handbags since August 2020.

Regional Insights

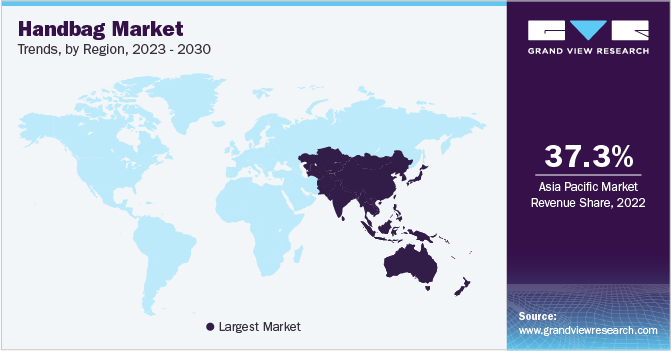

Asia Pacific dominated the market in 2022 with a revenue share of 37.30%. The rise in consumer buying power, combined with the increase in online shopping portals, has fueled the demand for handbags across Asia Pacific. Growing fashion consciousness and spending on personal items and accessories have also been observed to be major factors driving the market growth. For instance, according to data released by Net-a-Porter in May 2020, the sales of handbags in Asia Pacific saw a strong growth of 261% compared to 2019.

In addition, China has seen exponential growth in terms of economic development and household consumption of consumer goods during the last decade. The rise in sales of luxury goods in China is expected to fuel the demand for handbags.

However, the North America handbag industry is expected to grow at a CAGR of 5.4% from 2023 to 2030. The growing influence of the fashion industry over a wider population and increased discretionary spending are expected to fuel the demand for handbags in the North America region. For instance, according to the data released by Trading Economics in July 2023, disposable personal income in the U.S. increased from USD 19,873.52 billion in May 2023 to USD 19,941.02 billion in June 2023.

Furthermore, clearance sales and Black Friday deals are popular in the U.S., with women, in particular, purchasing accessories like purses. During these events, international suppliers in the North America market see a boost in sales. Therefore, the consistent appeal of accessories is expected to drive market growth over the forecast period.

Europe is expected to witness a growth rate of 6.1% over the forecast period. The handbag industry in Europe is driven by a recovering economy, rising disposable income, and the growing use of handbags. Apart from this, increasing opportunities to use a range of handbags and the rising demand for aesthetically appealing handbags are also contributing toward market growth. Furthermore, domestic brands such as Louis Vuitton, Chanel, and Gucci have a robust presence in the region and are continuously gaining traction among local customers. This has a positive impact on the regional market growth.

The market in Germany has been fueled by the rising purchasing power of consumers and the growth of online shopping platforms. Furthermore, growing fashion consciousness and expenditure on accessories are key factors driving the market growth. According to data released by Trading Economics in 2023, Germany’s disposable personal income increased from EUR 578.39 billion in the initial quarter of 2023 to EUR 591.06 billion in the second quarter of 2023. The rise in disposable income leads to increased spending capacity in the country, thus leading to a surge in product sales in the country.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

-

In June 2023, Michael Kors announced the launch of the Pride capsule collection that included an Elliot backpack, Slater sling pack, and sparkling Raquel pavé watch. In addition, the company announced its partnership with the Stonewall National Monument Visitor Center (SNMVC), which will involve a cobranded tote and charitable donation. The black canvas tote will carry the SNMVC logo on the inside, with a rainbow MK logo on the outside.

-

In March 2023, Hermès International S.A. announced the launch of six new handbags for Fall/Winter 2023: Sac Mini Médor, Sac So Medor, Drawstring Tote Bag, Arcon Bag, Fringe Birkin, and Harness Birkin. The collection was classic and modern at the same time, with an entirely feminine look.

Some prominent players in the global handbag market include:

-

Louis Vuitton

-

Hermès International S.A.

-

Michael Kors

-

Fossil Group, Inc.

-

Guccio Gucci S.p.A.

-

Prada S.p.A.

-

Burberry Group Plc

-

Tapestry, Inc.

-

Chanel

-

Compagnie Financière Richemont SA

Handbag Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 77.39 billion

Revenue forecast in 2030

USD 124.10 billion

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, distribution channel, region

Regional scope

North America; Europe; Middle East and Africa; Asia Pacific; Central and South America

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

Louis Vuitton; Hermès International S.A.; Michael Kors; Fossil Group, Inc.; Guccio Gucci S.p.A.; Prada S.p.A.; Burberry Group Plc; Tapestry, Inc.; Chanel; Compagnie Financière Richemont SA

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Handbag Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global handbag market report based on raw material, product, distribution channel, and region:

-

Raw Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Leather

-

Fabric

-

Others

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Tote Bag

-

Clutch

-

Satchel

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global handbag market size was estimated at USD 73.32 billion in 2022 and is expected to reach USD 77.39 billion in 2023.

b. The global handbag is expected to grow at a compounded growth rate of 6.8% from 2023 to 2030 to reach USD 124.10 billion by 2030.

b. In terms of revenue, tote bag held a market share of 41.20% in 2022. Tote bags are multi-purpose bags that can be used for a variety of tasks. Tote bags are popular among consumers due to their size and material. Tote bags are larger than other types of purses. These bags make it easier for consumers to carry essentials to offices, universities, and other places. The rising influence of Korean fashion and aesthetics among younger consumers is also driving the sale of tote bags. Additionally, the stylish nature of totes helps consumers make a style statement on formal occasions.

b. Some key players operating in handbag market are Louis Vuitton, Hermès International S.A., Michael Kors, Fossil Group, Inc., Guccio Gucci S.p.A., Prada S.p.A., Burberry Group Plc, Tapestry, Inc., Chanel, Compagnie Financière Richemont SA

b. The global workforce has seen a significant rise in women's participation over the years, with women now integral to various industries in diverse roles, from corporate executives to entrepreneurs. This increased participation drives the demand for accessories meeting the needs of working women. Handbags have evolved from accessories to essential tools, addressing the multifaceted demands of modern professional life.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."