- Home

- »

- Clothing, Footwear & Accessories

- »

-

Leather Goods Market Size & Share, Industry Report, 2033GVR Report cover

![Leather Goods Market Size, Share & Trends Report]()

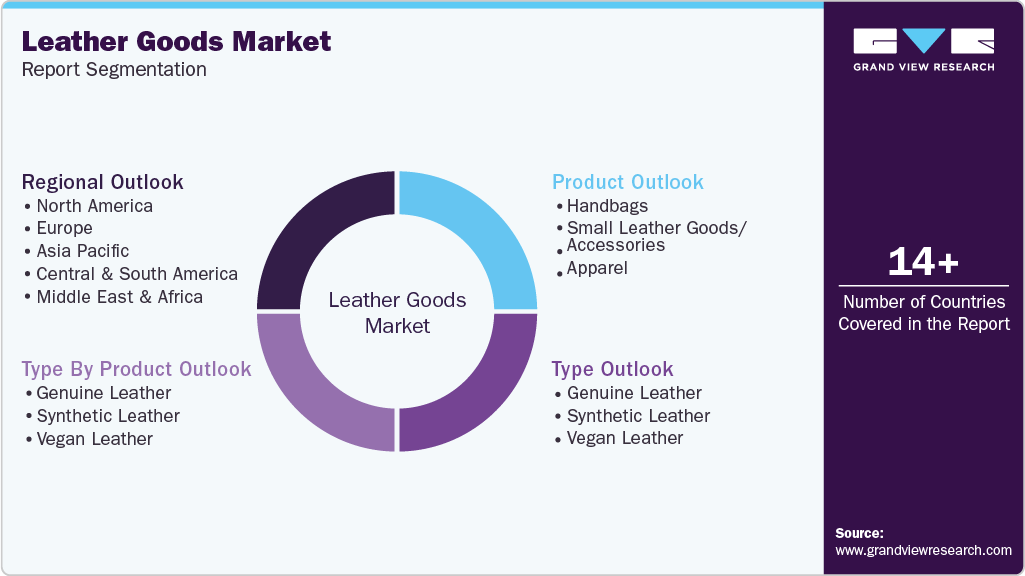

Leather Goods Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Genuine Leather, Synthetic Leather, Vegan Leather), By Product (Handbags, Small Leather Goods/ Accessories, Apparel, Footwear, Home Décor and Furnishing, Pet Accessories, Automotive Accessories), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-061-3

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Leather Goods Market Summary

The global leather goods market size was valued at USD 266.82 billion in 2024 and is expected to reach USD 538.23 billionby 2033, growing at a CAGR of 8.4% from 2025 to 2033. The global leather goods market is driven by rising consumer demand for premium fashion accessories, increasing disposable incomes, and the growing influence of luxury branding.

Key Market Trends & Insights

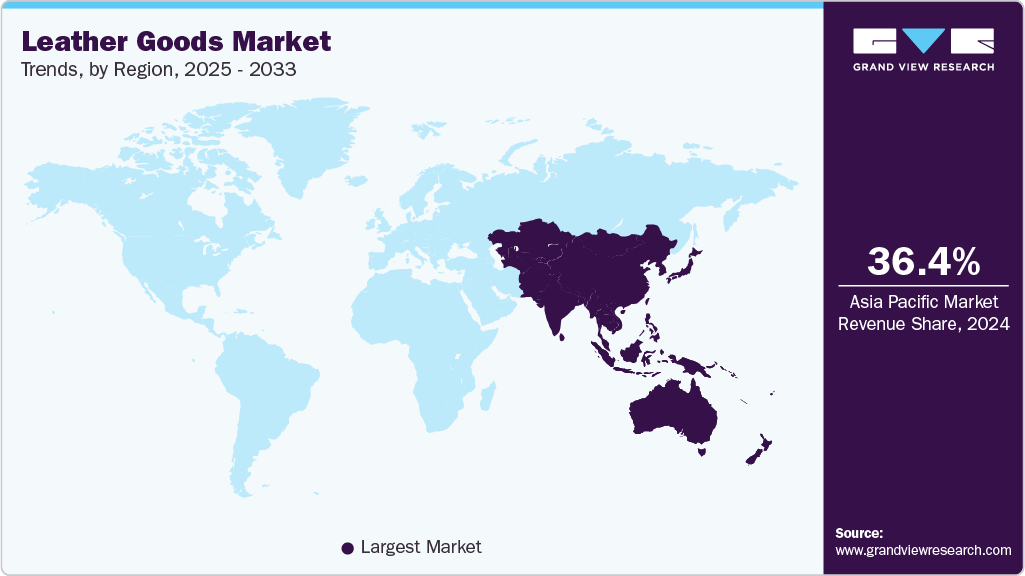

- Asia Pacific held the largest share of the global leather goods in 2024, accounting for 36.4%.

- The European leather goods market is experiencing significant growth, projecting a CAGR of 8.5%.

- By type, the genuine leather segment held the largest market share, accounting for 54.3%.

- By product, in the small leather goods/ accessories the wallet segment led the market and accounted for a share of 36.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 266.82 Billion

- 2033 Projected Market Size: USD 538.23 Billion

- CAGR (2025-2033): 8.4%

- Asia Pacific: Largest market in 2024

Additionally, advancements in leather processing technologies and the expansion of e-commerce platforms further fuel market growth. The global leather goods market is propelled by the rising popularity of sustainable and ethically sourced leather products, along with innovations in design and functionality. Expanding urbanization and changing lifestyle preferences are increasing the demand for stylish and durable leather items. Moreover, collaborations between fashion brands and designers are enhancing product appeal and market visibility. For instance, in September 2024, TOD'S SPA collaborated with the designer Rahul Mishra to introduce a capsule collection, emphasizing artisanal craftsmanship from Italy and Indian embroidery.The global leather goods market is driven by consumers' growing focus on purchasing environmentally friendly products. The growing demand for vegan leather is propelling the growth of the leather goods market. These leathers are not made from animal skin, which is a major factor that attracts consumers to products made from vegan leather. According to the Alliance for Sustainability data published in July 2025, about 70% Americans agree that the companies should invest in vegan alternatives.

The increasing adoption of designers worldwide develops and showcases new apparel through fashion shows & events, thereby attracting more consumers toward leather clothing is a major trend in the market. The fashion shows are the highlight, which showcase the versatility and luxury of leather goodskets, pants,including handbags, wallets, and footwear. Additionally, these fashion shows are becoming animal-friendly and banning all the goods made from animal skins. For instance, in November 2024, London Fashion Week banned products made from animal skins such as crocodiles, alligators, and snakes from their collection and became the first of four fashion weeks.

Some of the prominent trends related to leather goods in 2025 include sustainability, minimalistic design, versatility, and traditional excellence. The manufacturers of leather goods are banking on developing leather goods that are sourced ethically and are eco-friendly in nature. For instance, in April 2024, vegan handbag brand HIE launched a new collection of crossbody and tote bags crafted with 100% vegan leather (animal-free) and emphasised sustainable manufacturing practices. Apart from aesthetics, manufacturers are focusing on developing goods that are not only spacious or large in size but also symbolize the sophistication of fine craftsmanship.

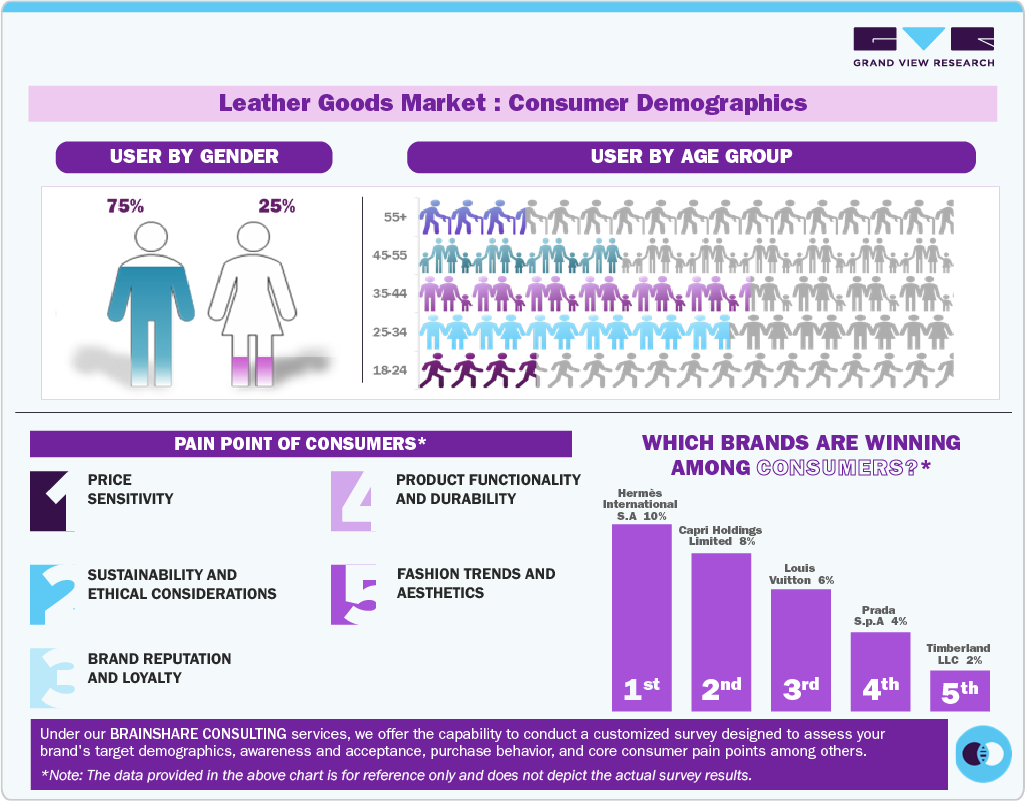

Consumer Insights for Leather Goods

Type Insights

Genuine leather accounted for the largest share of revenue in the global leather goods market, 54.3%, in 2024. The global genuine leather goods market is being driven by rising disposable incomes and growing consumer appetite for luxury products, particularly in emerging regions like Asia-Pacific and the Middle East. Genuine leather’s association with durability, craftsmanship, and timeless style continues to sustain its appeal in premium fashion and accessory segments. Expanding automotive and furniture industries also fuel demand for leather interiors and upholstery that signify comfort and status. Technological advances, including eco-certified and waterless tanning methods, are improving sustainability without compromising quality. Additionally, omnichannel retail strategies and digital branding are helping global labels reach a broader base of affluent and aspirational consumers.

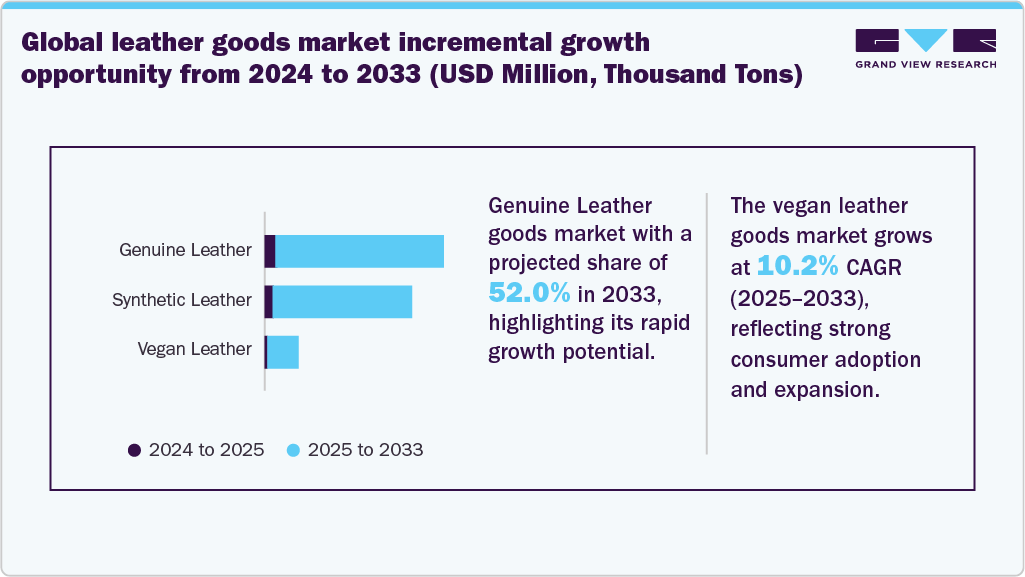

The vegan leather in the global leather goods market is projected to register the highest CAGR of 10.2% during the forecast period. The growth of vegan leather in the global leather goods market is fueled by increasing consumer demand for cruelty-free and sustainable fashion alternatives. Innovations in bio-based and plant-derived materials, such as pineapple leaves, mushrooms, and cactus, are enhancing product quality and variety. In October 2024, Allen Solly introduced a PETA-approved collection of vegan handbags, crafted from biobased apple-leather (69%) and cactus-leather (66% biobased carbon content), a shift towards high-end cruelty-free accessories. The rise of conscious consumerism, especially among younger demographics, is also reshaping purchasing preferences. Additionally, improvements in manufacturing technology are making vegan leather more durable, affordable, and widely accessible.

Product Insights

Leather footwear accounted for the largest share of revenue in the global leather goods market, 39.6%, in 2024. The growth of leather footwear in the global leather goods market is driven by increasing consumer preference for durable and stylish shoes that combine comfort with long-lasting quality. Rising participation in professional and formal settings boosts demand for premium leather dress shoes. Athletic and casual leather footwear segments are expanding due to the blending of fashion with functionality. Technological innovations in sole design, cushioning, and water resistance enhance performance and appeal. Additionally, collaborations between footwear brands and designers are creating trend-driven collections that attract fashion-conscious consumers worldwide. In July 2025, an Italian luxury fashion house collaborated with Indian artisans to introduce a limited-edition “Made in India” leather sandal line inspired by traditional Kolhapuri craftsmanship.

The leather automotive accessories in the global leather goods market are projected to register the highest CAGR of 9.1% during the forecast period. The demand for leather automotive accessories in the global leather goods market is fueled by the growing automotive industry and rising consumer preference for luxury and premium vehicle interiors. Increasing awareness of comfort, aesthetics, and ergonomic design drives the adoption of leather seat covers, steering wheel wraps, and interior trims. OEMs are focusing on high-quality, durable materials to enhance vehicle value and customer satisfaction. The trend of customization and personalized car interiors is boosting market growth. In October 2023, Lexus India launched the ‘Lexus ES crafted collection’ featuring limited-edition offerings and handcrafted leather enhancements. The collection also featured a backpack, a sleek laptop bag, a laptop sleeve, and a duffle bag in tan shade with a multi-box watch case. Additionally, the expansion of electric and high-end vehicles is encouraging the use of sustainable and innovative leather alternatives for interiors.

Regional Insights

North America accounted for the largest market share of 23.6% in 2024. The North American leather goods market is driven by the growing preference for premium and customized products that reflect personal style and quality craftsmanship. Increasing disposable incomes and a strong culture of luxury consumption support steady demand. The rise of e-commerce and direct-to-consumer brands has improved product accessibility and consumer engagement. Technological integration in design and production, such as smart wearables and sustainable sourcing, is also fueling market growth. Furthermore, collaborations between designers and lifestyle brands are broadening the appeal of leather goods across demographics. For instance, in November 2023, Roots Corporation, a global lifestyle brand, introduced its 20th design partnership with CLOT, a Hong Kong-based brand, featuring leather goods such as leather varsity jackets and leather bags.

U.S. Leather Goods Market Trends

The U.S. led the North American leather goods market in 2024, holding the largest market share with 83.1% of the region’s total revenue. In the U.S., the demand for leather goods is propelled by fashion-conscious consumers seeking a blend of functionality and aesthetics in accessories. A strong retail infrastructure, coupled with advanced logistics, enhances product distribution nationwide. The trend of personalization and limited-edition collections appeals to younger consumers looking for exclusivity. Increased awareness of sustainable and locally sourced materials is influencing purchasing decisions. Additionally, high participation in outdoor and travel activities boosts sales of leather luggage, backpacks, and footwear. In June 2025, Coach announced a global 3D design contest, “The Handbag Edit,” in collaboration with CLO, inviting designers worldwide to reimagine Coach handbags and lean into digital innovation and consumer‑co-creation.

Europe Leather Goods Market Trends

The leather goods market in Europe is projected to grow at a CAGR of 8.5% from 2025 to 2033. Europe’s leather goods market is characterized by its rich heritage in craftsmanship and strong presence of luxury fashion houses. The demand is reinforced by the region’s global reputation for quality, design, and artistry. Growth in tourism and international luxury spending supports retail performance in fashion capitals such as Paris, Milan, and London. Rising focus on traceable and ethically sourced materials aligns with the region’s sustainability standards. Moreover, the integration of digital fashion platforms is expanding consumer access to premium European brands.

Asia Pacific Leather Goods Market Trends

Asia Pacific accounted for the largest market share of 36.4% in 2024, and it is expected to witness the highest growth rate of 8.9% during the forecast period. The Asia Pacific leather goods market is experiencing rapid growth due to rising urbanization and increasing disposable income in emerging economies. Expanding middle-class populations are fueling demand for both affordable and luxury leather accessories. Global brands are strengthening their presence through regional collaborations and localized marketing strategies.

The influence of fashion-conscious youth and social media trends is driving faster product adoption. Additionally, domestic manufacturers are improving production capabilities to meet international quality standards and export demand. In January 2023, designer Anita Dongre introduced a plant-based vegan luxury handbag line made with the material “Mirum”, a 100% natural, 0% plastic, cruelty-free material for bags and belts.

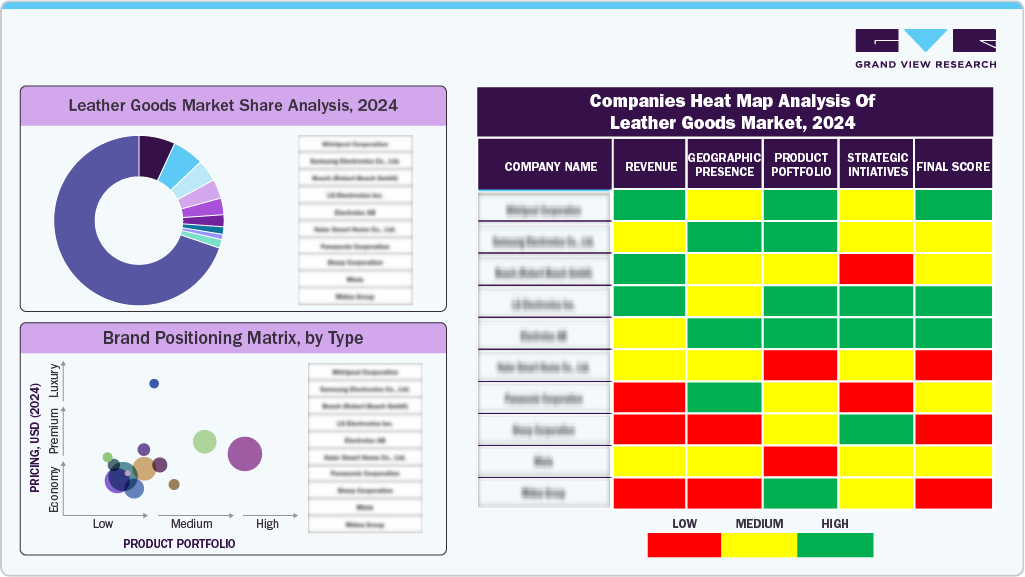

Key Leather Goods Company Insights

Many brands in the global leather goods industry have recognized untapped opportunities within their product portfolios and are actively working to capitalize on these gaps. This includes launching innovative designs, expanding customization options, and tailoring marketing strategies to align with evolving consumer tastes and cultural trends. By addressing niche segments and emerging preferences, these brands aim to increase their market share and strengthen their competitive positioning worldwide.

Key Leather Goods Companies:

The following are the leading companies in the leather goods market. These companies collectively hold the largest Market share and dictate industry trends.

- Adidas AG

- American Leather Holdings, LLC

- Capri Holdings Limited

- Chanel

- Fila, Inc.

- Hermès International S.A.

- Johnston & Murphy

- Knoll, Inc.

- Kering

- Lear Corporation

- Louis Vuitton Malletier SAS

- Lucrin SA

- Nappa Dori

- New Balance Athletics, Inc.

- Nike, Inc.

- Puma SE

- Prada S.p.A.

- Samsonite International S.A.

- VF Corporation

- VIP Industries Ltd.

- Woodland Worldwide

Recent Developments

-

In April 2025, Hermès announced the opening of a new leather goods hub in Normandy, France, creating about 260 new jobs for artisans. The company is investing in the expansion of its production capacity to cater to the demand for leather goods. The new project is an addition to the company’s existing leather workshop sites, which are currently under development, located in Charente, Gironde, and Ardennes.

-

In April 2025, Loewe, the brand of LVMH, has recently introduced ‘the Madrid’, a leather bag. It has a trapezoidal silhouette, which increases elegance and provides a modern touch to its customers.

-

In December 2023, Cocorose London launched vegan footwear made from cactus and 30% recycled cork material, packaged in a recyclable box, contributing their bit towards sustainability.

Leather Goods Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 282.08 billion

Revenue Forecast in 2033

USD 538.23 billion

Growth rate

CAGR of 8.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in thousand tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Adidas AG; American Leather Holdings, LLC; Capri Holdings Limited; Chanel; Fila, Inc.; Hermès International S.A.; Johnston & Murphy; Knoll, Inc.; Kering; Lear Corporation; Louis Vuitton Malletier SAS; Lucrin SA; Nappa Dori; New Balance Athletics, Inc.; Nike, Inc.; Puma SE; Prada S.p.A.; Samsonite International S.A.; VF Corporation; VIP Industries Ltd.; Woodland Worldwide

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Leather Goods Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global Leather Goods report on the basis of type, type by product, product, and region.

-

Type Outlook (Revenue, USD Million; Volume, Thousand Tons, 2021 - 2033)

-

Genuine Leather

-

Synthetic Leather

-

Vegan Leather

-

-

Type By Product Outlook (Revenue, USD Million; Volume, Thousand Tons, 2021 - 2033)

-

Genuine Leather

-

Handbags

-

Small Leather Goods/ Accessories

-

Apparel

-

Footwear

-

Home Décor and Furnishing

-

Pet Accessories

-

Automotive Accessories

-

-

Synthetic Leather

-

Polyurethane Leather

-

Handbags

-

Small Leather Goods/ Accessories

-

Apparel

-

Footwear

-

Home Décor and Furnishing

-

Pet Accessories

-

Automotive Accessories

-

-

PVC Leather

-

Handbags

-

Small Leather Goods/ Accessories

-

Apparel

-

Footwear

-

Home Décor and Furnishing

-

Pet Accessories

-

Automotive Accessories

-

-

-

Vegan Leather

-

Handbags

-

Small Leather Goods/ Accessories

-

Apparel

-

Footwear

-

Home Décor and Furnishing

-

Pet Accessories

-

Automotive Accessories

-

-

-

Product Outlook (Revenue, USD Million; Volume, Thousand Tons, 2021 - 2033)

-

Handbags

-

Tote Bag

-

Clutch

-

Satchel

-

Others

-

-

Small Leather Goods/ Accessories

-

Wallets

-

Pouches

-

Phone Covers/Cases

-

Watch Straps

-

Others (Luggage Tags, Pencil Cases, etc.)

-

-

Apparel

-

Men

-

Shirts

-

Pants

-

Suits, Coats & Jacket

-

Overalls

-

Others (Kilts, Vests, Chaps, etc.)

-

-

Women

-

Skirts

-

Coats & Jackets

-

Pants

-

Others (Vests, Chaps, etc.)

-

-

Children

-

Suits, Coats & Jackets

-

Vests

-

Pants

-

Skirts

-

Chaps

-

-

-

Footwear

-

Athletic

-

Men

-

Women

-

Children

-

-

Non-athletic

-

Men

-

Women

-

Children

-

-

-

Home Décor and Furnishing

-

Decorative Wall Hangings

-

Tabletop decorative items

-

Hanging Storage

-

Leather Furniture

-

Others

-

-

Pet Accessories

-

Pet Collar and Leads

-

Leather Pet Toys

-

-

Automotive Accessories

-

Seating Systems

-

Others

-

-

-

Regional Outlook (Revenue, USD Million; Volume, Thousand Tons, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global leather goods market size was estimated at USD 266.82 billion in 2024 and is expected to reach USD 282.08 billion in 2025.

b. The global leather goods market is expected to grow at a compound annual growth rate (CAGR) of 8.4 % from 2025 to 2033 to reach USD 538.23 billion by 2033.

b. The genuine leather goods market accounted for a revenue share of 54.3% in 2024, driven by rising consumer preference for high-quality, durable, and premium accessories that offer long-term value. It is further supported by increasing disposable incomes and a growing inclination toward branded, fashion-forward leather products.

b. Some key players operating in the leather goods market include Adidas AG, American Leather Holdings, LLC, Capri Holdings Limited, Chanel, Fila, Inc., Hermès International S.A., Johnston & Murphy, Knoll, Inc., Kering, Lear Corporation, Louis Vuitton Malletier SAS, Lucrin SA, Nappa Dori, Nike Inc., Samsonite International S.A., and Prada S.p.A.

b. Key factors driving growth in the leather goods market include rising demand for premium, durable, and fashion-forward products across footwear and accessories. Increasing disposable incomes and urbanization are boosting consumer spending on high-quality branded items. The growing influence of global fashion trends and celebrity endorsements is further elevating brand visibility.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.