- Home

- »

- Plastics, Polymers & Resins

- »

-

Nylon Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Nylon Market Size, Share & Trends Report]()

Nylon Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Nylon 6, Nylon 66), By Application (Automobile, Electrical & Electronics, Engineering Plastics, Textile), By Region And Segment Forecasts

- Report ID: GVR-1-68038-960-9

- Number of Report Pages: 114

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Nylon Market Summary

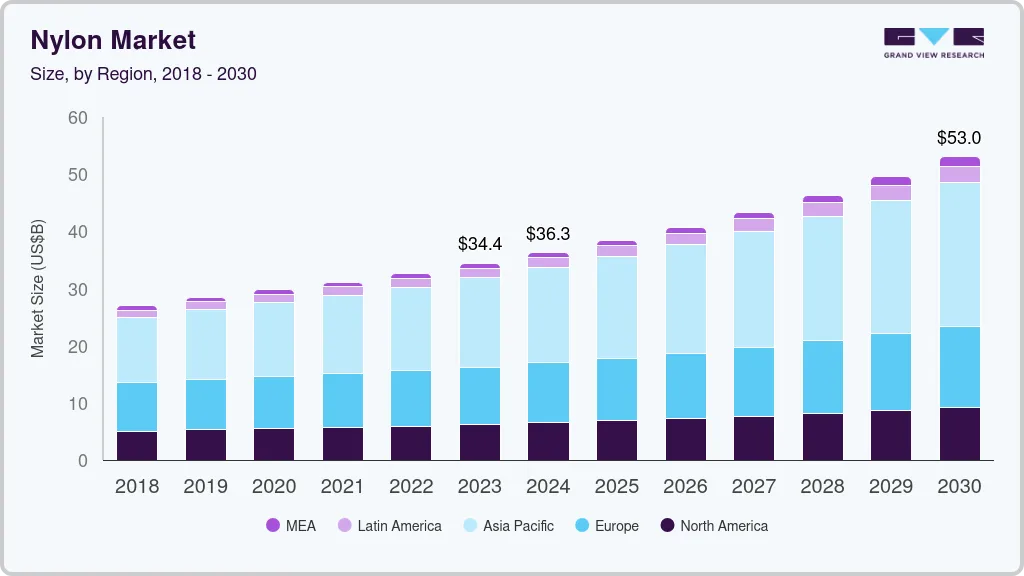

The Global Nylon Market size was estimated at USD 34,390.3 Million in 2023 and is projected to reach USD 53,037.2 Million by 2030, growing at a CAGR of 6.4% from 2024 to 2030. Increasing demand for nylon in automobile applications is expected to propel the growth.

Key Market Trends & Insights

- Asia Pacific dominated the nylon industry and accounted for more than 45.0% share of the global revenue in 2023.

- By product, the nylon 6 product segment led the market and accounted for more than 56.0% share of the global revenue in 2023.

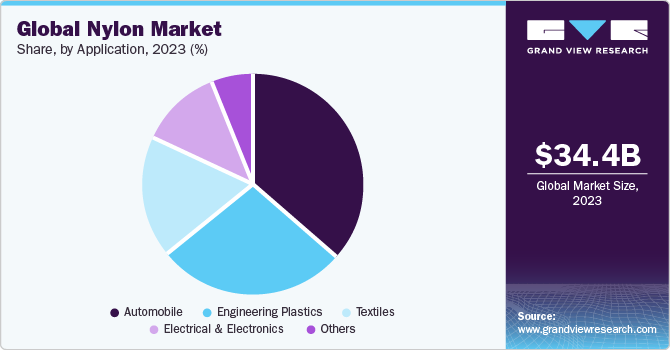

- By application, the automobile application segment led the market and accounted for more than 36.0% share of the global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 34,390.3 Million

- 2030 Projected Market Size: USD 53,037.2 Million

- CAGR (2024-2030): 6.4%

- Asia Pacific: Largest market in 2023

The automobile is a highly concentrated industry. Even though the product range is high owing to a large number of market participants, approximately 49% of the market is dominated by top players including GM, Toyota, Ford, and Volkswagen. Nylon is used in engine components such as bushings, bearing, oil containers, wire harness connectors, fuse boxes, cylinder head covers, crankcases, and timing belts.

The production growth can mainly be attributed to a rapid increase in China market, as well as the consistent growth of the European automotive industry. In recent years, the automobile industry has witnessed robust growth, especially in the Asia Pacific. Infrastructure development and improving socioeconomic trends are some of the major factors that have contributed to the growth of this sector. Favorable regulations, availability of workforce, and initiatives by the government to provide attractive FDI regulations have resulted in major players shifting their manufacturing bases to regions such as China, India, and Indonesia.

Currently, raw materials account for over 45% of the overall manufacturing cost of the vehicles. Steel and aluminum are the preferred raw materials in the automobile industry. However, owing to the stringent regulations focusing on improving fuel efficiency and maintaining CO2 emissions at manageable levels, raw material trends are expected to undergo a drastic change. Nylon 6 finds descriptive use as films and coatings to prevent the raw materials from undergoing corrosion.

These trends have resulted in the adoption of nylon in the automobile industry as it is environment-friendly in comparison to plastics. Apart from being lightweight and versatile, the materials also facilitate higher design flexibility that facilitates the production of advanced shapes without compromising the safety and stability of the vehicle. Nylon is anticipated to play a key role in the development of the automobile industry over the forecast period.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The nylon market is characterized by a high degree of innovation owing to the rapid technological advancements.

The nylon market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new production technologies and talent, need to consolidate in a rapidly growing market.

The nylon market is also subject to increasing regulatory scrutiny. The global nylon market is subject to numerous regulations, guidelines, and restrictions such OSHA (Occupational Safety & Health Administration) - Code of Federal Regulations, European registration, evaluation, authorization, and restriction of chemicals (REACH) standards, European Chemical Agency (ECHA), and NESHAP (National Emission Standard for Hazardous Air Pollutants), among others.

The threat of substitutes from other products such aspolypropylene, bioabsorbable polymers, para-aramid synthetic fibers, and polyvinylidene fluorideis anticipated to hamper the growth of the global nylon market owing to their lower competitive prices. PVF is gaining acceptance as a major substitute for nylon fishing lines. Other environment-friendly substitutes such as bioabsorbable polymers pose a key threat due to their biodegradable nature

End-user concentration is a significant factor in the nylon market. Automobile manufacturers are expected to use them on a larger scale owing to the environmental benefits and the advantages offered by Nylon 6 are in line with the emission regulations laid down across the globe.

Product Insights

The nylon 6 product segment led the market and accounted for more than 56.0% share of the global revenue in 2023. The unique properties of PA 6 make the product a cost-effective substitute for materials such as steel, bronze, brass, gunmetal, aluminum, plastics, and rubbers. These properties attract electrical protection device manufacturers to use PA 6 in their offerings. The use of nylon 6 in various applications over the past few years has established its reliability, utility, and supportive economics based on cost and performance. The excellent surface finish of the product even under reinforced conditions makes it a suitable product for applications where aesthetics is important.

Nylon 6 also attracts substantial demand from the premium carpet industry which finds its base in Europe. Turkey is one of the largest importers of nylon for its extensive nylon-based textile industry. The clothing and apparel industry is also witnessing staggering growth owing to the consumer preference for experimenting with different types of raw materials. Nylon 6 fabrics are smooth, dry quickly, and require minimal care.

They have low absorbency which can be both advantageous and disadvantageous. The advantage being water remains on the surface of the fabrics and runs off quickly. Nylon’s low permeability has a disadvantage in that the fabric feels clammy and uncomfortable in warm, moist weather. They also retain their shape after washing. All these factors make it a suitable fabric for apparel.

The automotive industry in China is expected to grow significantly over the forecast period. Nylon is gradually replacing metal components in light vehicles to make vehicles lighter and more fuel efficient. This trend is also in line with making vehicles compliant with environmental standards in which utilizing nylon components is a perfect fit for the cause. Fishing nets are another lucrative application segment of nylon 6. A key aspect that makes it an ideal fabric for fishing nets has been its resistance to knotting, which increases strength and durability.

Application Insights

The automobile application segment led the market and accounted for more than 36.0% share of the global revenue in 2023. Nylon composites are used to increase the environmental sustainability of automotive parts and to reduce the weight of automotive components. The composites are used to manufacture hydraulic clutch lines, headlamp bezels, automotive cooling systems, air intake manifolds, and airbag containers. They are also used in exterior parts such as wheel covers, fuel caps, tailgate handles, doors, front-end grilles, and exterior mirrors. Nylon composites are expected to drive demand in the automotive industry due to factors such as excellent mechanical properties, wear resistance, and the growing need for lightweight vehicles to improve fuel efficiency.

Nylon has been extensively used in the automotive engine compartment to replace steel parts, owing to the benefits derived from them such as lower weight and greater design flexibility as against traditional metals. The trend of engine downsizing has been prevailing in the automotive industry for a long time and can be attributed to the ability of small-cylinder capacity engines to toggle between the air charge temperatures.

Several market participants have positively responded to this trend by developing oil & heat resistant polymer compounds for a wide array of automotive designs. The Ultramid Endure produced by BASF SE is one such example of a glass fiber-reinforced PA66. Not only is the material super resistant to continuous thermal loads but also has good processability for under-hood automotive composites to be manufactured from it.

Regional Insights

Asia Pacific dominated the nylon industry and accounted for more than 45.0% share of the global revenue in 2023. Availability of low-cost raw materials & labor coupled with increased spending power is a major growth driver in this region. The availability of a huge untapped market and supportive government policies are luring global nylon makers to set up manufacturing and distribution facilities in the region.

Nylon is gaining attention from electrical & electronics manufacturers as plastic parts are more compact and can be easily integrated with other components, thus simplifying the design procedure. It enables manufacturers to develop smarter MCBs having thinner walls. Increasing concerns about the size and carbon footprint of electrical devices are majorly driving product demand.

As the market reaches out to new entrants and new consumers, most of the countries within Asia Pacific are witnessing a fall in the unit price of nylon. In contrast, in developed markets such as South Korea and Japan, a premium approach regarding offerings and pricings is becoming a new trend as mainstream trademarks lose market share in affordable and mid-range product segments owing to changing consumer preferences.

The nylon industry in North America is primarily driven by developments in automobile, aerospace, and key manufacturing industries. Increased application of engineering plastics in various industries such as aerospace, automobile, defense, and electrical & electronics is boosting the demand for nylon (PA) in North America.

End-use companies in Canada are contemplating including sustainable products in their product portfolio and entering into collaborations with bio-based nylon manufacturers, which will further contribute to the market growth. For instance, in August 2021, Lululemon Athletica, a Canadian apparel company, collaborated with Genomatica to create plant-based nylon to make lululemon products. Through this collaboration, companies would seek to develop sustainable products that can drive nylon's market to grow positively in the coming years.

Key Nylon Company Insights

Some of the key players operating in the market include BASF SE and LANXESS

-

BASF SE caters to the needs of its consumers through five business segments, namely chemicals, performance products, functional materials & solutions, agricultural solutions, and oil & gas. The company comprises 11 operating divisions and around 75 strategic business units (SBUs) operating in various business segments. It caters its products to various industries including agriculture, automotive & transportation, pharmaceuticals, oil & gas, food & beverages, and construction. Chemicals segment of the company deals with the demand for polyamide and polyamide intermediates such as nylon 6 and 66, which are used in various applications including oil & gas transportation, construction & electronic applications, industrial, assorted textiles, and automobile parts

-

LANXESS’s business operations are divided into four segments, namely advanced intermediates, specialty additives, consumer protection, and engineering materials. The company also supplies rubber under the brand name ARLANXEO, which is a joint venture with Saudi Aramco. The company further operates and manufactures leather, inorganic pigments, rheinchemie, saltigo, and urethane systems. It pursues e-business solutions to increase efficiency in customer reach & accessibility, vendor purchase management, and inventory management

AdvanSix and Ascend Performance Materials LLC are some of the emerging market participants in the nylon market.

-

AdvanSix is an integrated manufacturer of nylon resins, ammonium sulfate fertilizer, and chemical intermediates. The company was formed in May 2016, when Honeywell converted its resins and chemicals business into a standalone publicly-traded company. The company manufactures and distributes various other products that are a part of the nylon 6 resin manufacturing process

-

Ascend Performance Materials LLC’s product portfolio includes polyamide intermediate chemicals such as acrylonitrile, adipic acids, adiponitrile, hexamethylene diamine, and hydrogen cyanide; specialty chemicals, including acids and esters, amines, and nitriles; resins, including extrusion grade, compounding feedstock, general-purpose injection molding, and fiber spinning. The company also provides product solutions for carpets, industrial fibers, and compounds that are ignition resistant, impact modified, and glass reinforced. The company operates through seven manufacturing locations spread across the world

Key Nylon Companies:

The following are the leading companies in the nylon market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these nylon companies are analyzed to map the supply network.

- BASF SE

- Lanxess

- Huntsman International LLC

- AdvanSix

- Ube Industries Ltd.

- Domo Chemicals

- TORAY INDUSTRIES, INC.

- Ashley Polymers, Inc.

- Ascend Performance Materials

- TOYOBO CO., LTD.

- Goodfellow

Recent Developments

-

In June 2023, Advansix, a U.S.-based company, announced the launch of a new product featuring 100% post-consumer and post-industrial recycled content nylon, namely Aegis Resins and Capran BOPA Films. This initiative is aimed at assisting customers in achieving their sustainability goals

-

In November 2021, LANXESS announced an investment of USD 36.85 million (EUR 30.0 million) to build a second compounding line for Pocan and Durethan branded plastics at its manufacturing site in Changzhou. This is expected to bring the company’s total compounding capacity in China to 110,000 metric tons per year and the facility is expected to be operational by 2023

Nylon Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 36.28 billion

Revenue forecast in 2030

USD 53.04 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD billion/million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Netherlands; Norway; China; Japan; India; South Korea; Australia; Malaysia; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

BASF SE; Lanxess; Huntsman International LLC; AdvanSix; Ube Industries Ltd.; Domo Chemicals; Toray Industries, Inc.; Ashley Polymers, Inc.; Ascend Performance Materials; Toyobo Co., Ltd.; Goodfellow

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nylon Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nylon market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Nylon 6

-

Nylon 66

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automobile

-

Electrical & Electronics

-

Engineering Plastics

-

Textiles

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global nylon market size was estimated at USD 34.39 billion in 2023 and is expected to reach USD 36.28 billion in 2023.

b. The global nylon market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 53.4 billion by 2030.

b. The nylon 6 product segment dominated the nylon market with a share of 56.0% in 2023. This is attributed to the rising product demand from various applications such as textile, electrical & electronics, and automotive.

b. Some key players operating in the nylon market include BASF SE, LANXESS, Huntsman Corporation, AdvanSix Inc., Ube Industries Ltd., INVISTA, Domo Chemicals, Toray Industries, Inc., Ashley Polymers Inc., and Ascend Performance Materials LLC.

b. Key factors that are driving the nylon market growth include nylon application for travel accessories, clothing & apparel, hydraulic clutch lines, headlamp bezels, automotive cooling systems, air intake manifolds, and airbag containers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.