- Home

- »

- Plastics, Polymers & Resins

- »

-

Insulated Shippers Market Size, Share & Trends Report 2030GVR Report cover

![Insulated Shippers Market Size, Share & Trends Report]()

Insulated Shippers Market Size, Share & Trends Analysis Report By Material (Paper-based, Wool, EPS, EPP, Polyurethane), By Type (Single Use, Multiple Use), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-454-3

- Number of Report Pages: 220

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Insulated Shippers Market Size & Trends

The global insulated shippers market size was valued at USD 8.72 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.3% from 2024 to 2030. Rising demand for organic fruits and vegetables across the globe is among the key driving factors for the industry. Rising demand for pharmaceutical products is prominent factor fueling the demand for insulated shippers. Global pharmaceutical market is on growth path owing to rising prevalence of chronic diseases and increasing aging population in countries such as China and Japan. Pharmaceutical products, such as blood, vaccines, and temperature-sensitive drugs, are usually transported in insulated shippers.

Manufacturers of insulated shippers use various types of liner material including paper, EPS, and metalized bubble wrap, among other materials. The application area of such materials is taken into consideration while they are manufactured. ABBE CORRUGATED PTY. LTD.; Sonoco Products Company; ICEE insulated folding boxes; and CP Cases Ltd. are among key manufacturers of insulated shippers. Manufacturers in the market also majorly offer products to the food and pharmaceutical industries.

Development of modified atmosphere packaging (MAP) is generating significant traction in the packaging industry and is anticipated to limit the employment of insulated shippers around the world. MAP helps lock-in freshness and extend shelf life of food products inside packaging. In addition, it controls the blend of gases such as oxygen, carbon dioxide, and nitrogen inside thermoform packaging. However, the high cost associated with the technology is discouraging clients from opting for MAP solutions.

Market Concentration & Characteristics

Prominent reusable shipper companies operating in the market include Sonoco Products Company, FEURER Group GmbH (Kango Box), Cool Pac, ICEE Insulated Folding Boxes, Cambro, SOFRIGAM, Liviri, Overath GmbH, Barth GmbH, and Olivo. Companies predominantly offer EPP based shippers which last over 2-3 years. Growing issues of single use shipper disposal are paving the way for reusable shippers in the market.

Companies are increasingly focusing on the introduction of sustainable packaging practices in insulated shipper space. For instance, In September 2023, Atlas Molded Products, a division of Atlas Roofing Corporation, introduced Biodegradable Technology DuraTherm BDT® to their product line-up. DuraTherm BDT products are more landfill-friendly packaging solutions designed for cold chain shipping, handling, and storage needs.

In November 2023, Hydropac launched PharmaPac, a range of thermal packaging solutions designed to overcome delivery challenges and meet regulatory requirements for temperature-sensitive medications and vaccines. PharmaPac Genesis consists of a polystyrene box, ice packs, a universal payload tray, and a thermal filter pack. As Hydropac’s first PQS/Validated ‘pre-qualified system’, it protects refrigerated payloads at temperatures of 2 - 8°C for at least two days.

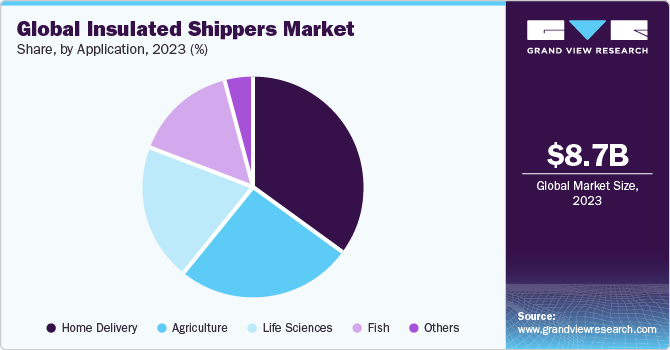

Application Insights

Home delivery segment dominated the market and accounted for the largest revenue share of 35.4% in 2023. The segment is likely to retain its pole position over the forecast period. The mushrooming growth of retail chains, most notably supermarkets, has been contributing to the increased adoption rate of insulated shippers around the world. In this regard, rising consumption of frozen food products, such as cheese and meat, has been contributing to growth of home delivery segment while also strengthening the market.

Market for insulated shippers has been witnessing a significant rise in adoption of shipping boxes in meal kits space over the past decade. Increasing demand for meal kits across globe has increased number of players in meal kits space. EPS-based insulated shipping boxes are among most widely used packaging options in industry owing to various factors including light weight, cost reduction, and ease-of-use.

Key manufacturers of insulated shippers in market are offering boxes manufactured from biodegradable materials. For instance, Nature-Pack, U.S.-based bioplastic manufacturer, makes insulated shipping boxes from renewable plant starches to emulate conventional oil-based materials for packaging of chocolate and chocolate-based products. Such first-to-market developments are expected to surface in market over the forecast period in a bid to reduce or eliminate environmental impact.

Insulated shippers score high when it comes to domestic shipments of meat products. Meat segment is also driven by presence of various regulations on packaging and movement of these products. For instance, Perishable Cargo Regulations (PCR) requires meat producers to use insulated materials within shipping boxes to ensure retention of quality of meat and meat-based products. Such regulations are expected to increase the adoption rate of insulated shippers over the forecast period.

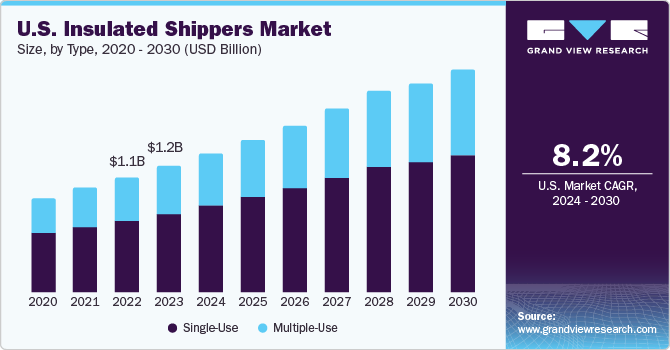

Type Insights

Single-use segment dominated the market and accounted for the largest revenue share of 62.8% in 2023. Single-use shippers with insulation are ideal for packaging a wide variety of products including seafood, laboratory samples, blood, medicines, cakes, chocolates, breast milk, cosmetics, vaccines, insulin, chemicals, and perishable products such as dairy items. These boxes also offer a broad spectrum of printing options including embossing, matt lamination, varnishing, glossy lamination, and UV coating.

Multiple use insulated shippers segment is projected to progress at the fastest CAGR of 10.4% over the forecast period. Sustainability has emerged as an operative word contributing to the growth of this segment over the years. Logisticians and pharmaceutical companies, particularly, have taken an interest in adopting multiple-use boxes owing to various beneficial factors including lower logistical costs (temperature-controlled), sustainability, and simpler Product Lifecycle Management (PLM).

Material Insights

Paper-based insulated shippers emerged as significant segment with a market share of 18.7% in 2023 and is expected to witness robust growth over the forecast period. Paper-based packaging mainly involves concept of cellulose insulation. Production process of cellulose provides consistency to insulation material that is similar to traditionally employed packaging materials, most notably wool-based materials. Notwithstanding the increasing production and consumption of paper-based insulation materials employing recycled content, their adoption rate has been declining over the years owing to the problem of wastepaper disposal across the globe.

Expanded Polypropylene (EPP) shippers segment is anticipated to grow at fastest rate over the forecast period. Ascending demand for efficient cold supply chain solutions has been boosting growth of this segment. EPP-based boxes is designed to mainly target food professionals and players operating in logistics and health sectors. Performance of EPP boxes can be further improved by incorporating eutectic plates in EPP box.

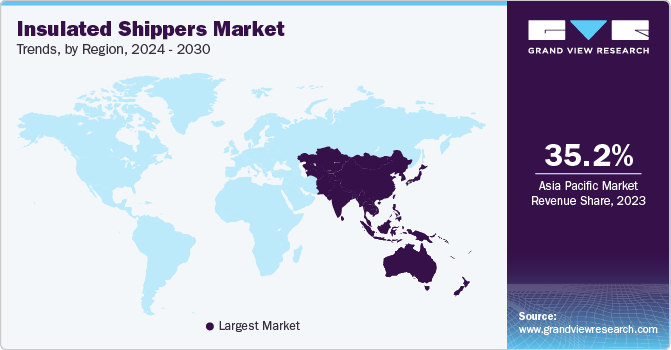

Regional Insights

In North America, the market is marked by a significant presence of online grocery stores that primarily prefer insulated shippers for the transportation of fruits and vegetables and processed foods. Paper-based solutions including corrugated box and insulated liners such as cellulose are expected to generate significant traction in region over the forecast period. Growing environmental concerns in North American market over use of plastic packaging materials, such as EPS, EPP, polyurethane, and others, are expected to further trigger demand for sustainable packaging solutions such as paper in coming years.

U.S. Insulated Shippers Market Trends

U.S. Insulated shippers market is driven by the presence of the some of the key online grocery providers such as SPUD.ca; Longo Brothers Fruit Markets Inc.; Fresh City Farms, Inc.; Mama Earth Organics; Farm Fresh To You; and Imperfect Produce.

Asia Pacific Insulated Shippers Market Trends

Asia Pacific dominated the market and accounted for largest revenue share of 35.2% in 2023. Region is likely to dominate industry over the forecast period. E-commerce companies in Asia Pacific, especially in China, largely prefer this product for delivery of fresh produce and processed food. Some of prominent companies present in the southeast Asia market are Cold Chain Technologies, Snyder Industries, Pelican Biothermal, Saeplast Americas, Tempack Packaging Solutions, Cryopak Industries, American Aerogel, and EcoCool. These companies are key players in providing reliable packaging solutions for transportation of temperature-sensitive products, and they contribute to growth and development of insulated shippers market in region.

Japan has been a significant producer as well as consumer of seafood over the years. Some of the largest fish producing companies including Maruha Nichiro Corporation, NISSUI, and Suiken Incorporated are based out of Japan. The presence of a large fish market in Japan presents lucrative opportunities for insulated shippers manufacturers.

Insulated Shippers Market in Southeast Asia is experiencing growth, driven by various factors such as increasing demand for temperature-sensitive product shipping, and surge in e-commerce activities, including online sale of perishable goods and medicines.

Europe Insulated Shippers Market Trends

Key insulated shippers companies operating in Europe include Softbox Systems Ltd., ECOCOOL, eutecma gmbh, and SmartCAE. These companies primarily serve most of pharmaceutical companies across the region.

Insulated Shippers Market in Germany is anticipated to offer lucrative growth opportunities, as Pre-prepared kit meal category is developing in Germany owing to busy lifestyle of the Germans. Key players such as SicherSatt AG and CONVAR Europe Ltd. have been offering pre-prepared kit meals in country. These companies emphasize the freshness of meals and thus mostly prefer insulated shippers for transportation of meal kits.

Central & South America Insulated Shippers Market Trends

Insulated shippers market in Central & South America is estimated to grow rapidly over the coming years owing to increasing demand from the pharmaceutical sector for long distance transportation. Key insulated shippers manufacturers operating in country include EMBALL'ISO, Celsure, and Storopack Hans Reichenecker GmbH.

Brazil insulated shippers market is emerged as an attractive and promising market for insulated shippers as the wine consumption rate is anticipated to increase in Brazil owing to high demand from the millennials with average consumption per capita of 2.37 liters. This is expected to boost application scope of insulated shippers for wine packaging and transportation.

Middle East & Africa Insulated Shippers Market Trends

The insulated shippers market in MEA is growing due to the Meat consumption is on rise owing to increasing ex-pat population in country. Presence of major players like Americana group, and Halwani Brothers Company in the meat market is driving demand for sustainable packaging solutions like insulated shippers.

Saudi Arabia Insulated Shippers Market is expected to grow at a lucrative rate due to high consumption of red meat, with around 54 kg/person consumption of meat in 2022. With rising investment from government in production, technologies have enabled meat exporters to compete in global market.

Key Insulated Shippers Company Insights

The market is highly fragmented with presence of a sizable number of medium-sized companies. Key players mainly cater to food and beverage, pharmaceuticals, and cosmetics industries. Insulated shippers industry has been witnessing a significant number of new product launches and expansions over the past few years. This can be attributed to rising demand for shippers with proper insulation, mainly from dairy, confectionery, meat, fish, and general produce industries.

Prominent market players are also focusing on development of different liner materials owing to rising product demand and increasingly stringent regulations over use of EPS across the world.

-

In September 2023, phase-change material (PCM) and Pluss Advanced Technologies (PLUSS) has jointly launch two new temperature-controlled packaging solutions for pharmaceutical industry namely, Celsure® XL Pallet Shipper series and Celsure® VIP Multi-Use Parcel Shipper series. These newly developed products are superior alternative to conventional gel pack solutions and expensive leased containers.

-

In March 2023, Peli BioThermal, announced an expansion of its renowned reusable Crēdo shipper range providing deep frozen payload protection. Products will help to meet growing demand to transport temperature-sensitive biologics and time-sensitive cell and gene therapies safely to patients. Newly launched Crēdo Cube Dry Ice shippers deliver deep frozen payload protection for durations of up to and often exceeding 144 hr. Range of shippers offers payload volumes between 1.8 L to 55 L and a temperature of minus 80°C to minus 60°C.

Key Insulated Shippers Companies:

The following are the leading companies in the insulated shippers market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these insulated shippers companies are analyzed to map the supply network.

- Sonoco Products Company

- Sealed Air Corporation

- FEURER Group GmbH

- Sancell

- The Wool Packaging Company Limited

- Cool Pac

- Cascades, Inc.

- ICEE Insulated Folding Boxes

- Dinkhauser Kartonagen GmbH

- TemperPack

- Icertech

- Insulated Products Corporation

- Cambro

- PED Technologies Ltd

- Overath GmbH

- Barth GmbH

- Pelican BioThermal

- Softbox

- Olivo

- Cryopak

- Liviri

- SOFRIGAM

- Polar Tech Industries, Inc.

Insulated Shippers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.57 billion

Revenue forecast in 2030

USD 15.41 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Volume in million units; revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Sonoco Products Company; Sealed Air; FEURER Group GmbH; Sancell; The Wool Packaging Company Limited; Cool Pac; Cascades, Inc.; ICEE Insulated Folding Boxes; Dinkhauser Kartonagen GmbH; TemperPack; Icertech; Insulated Products Corporation; Cambro; PED Technologies Ltd.; Overath GmbH; Barth GmbH; Pelican BioThermal; Softbox; Olivo; Cryopak; Liviri; Sofrigam; Polar Tech Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insulated Shippers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the insulated shippers market report based on material, type, application, and region:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Paper-based

-

Wool

-

Expanded Polystyrene (EPS)

-

Expanded Polypropylene (EPP)

-

Polyurethane (PU)

-

Metalized Bubble Wrap

-

Vacuum Insulated Panels

-

Biodegradables

-

Others

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Single-Use

-

Multiple-Use

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Home Delivery

-

Grocery

-

Meal Kits

-

Pre-Prepared Meals

-

Chocolates

-

Wine

-

Cheese

-

Meat

-

Others

-

-

Agriculture

-

Grapes

-

Broccoli

-

Tomatoes

-

Corn

-

Sprouts

-

Strawberries

-

Others

-

-

Fish

-

Salmon

-

Prawn/Shrimp

-

Oyster

-

Others

-

-

Life Sciences

-

Pharmaceuticals

-

Blood

-

Clinical Trials

-

Drug Testing

-

Pathology

-

Organ Transplantation

-

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global insulated shippers market size was estimated at USD 8.72 billion in 2023 and is expected to reach USD 9.57 billion in 2024.

b. The global insulated shippers market is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030 to reach USD 15.41 billion by 2030.

b. Single-use segment dominated the market and accounted for the largest revenue share of 62.8% in 2023. Single-use shippers with insulation are ideal for packaging a wide variety of products, including seafood, laboratory samples, blood, medicines, cakes, chocolates, breast milk, cosmetics, vaccines, insulin, chemicals, and perishable products such as dairy items.

b. Some of the key players in the insulated shippers market are Sonoco Products Company, Sealed Air, FEURER Group GmbH, Sancell, The Wool Packaging Company Limited, Cool Pac, Cascades, Inc., ICEE Insulated Folding Boxes, Dinkhauser Kartonagen GmbH, TemperPack, and Icertech.

b. The key factors that are driving the insulated shippers market include the increasing penetration of e-food delivery services coupled with the rising expansion of e-grocery distributors across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."