- Home

- »

- Plastics, Polymers & Resins

- »

-

Thermoform Packaging Market Size, Industry Report, 2033GVR Report cover

![Thermoform Packaging Market Size, Share & Trends Report]()

Thermoform Packaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (PET, PE, PP), By Product (Containers, Clamshell), By End Use (Pharmaceuticals, Food & Beverage), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-931-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermoform Packaging Market Summary

The global thermoform packaging market size was estimated at USD 54.72 billion in 2025 and is projected to reach USD 83.58 billion by 2033, growing at a CAGR of 5.5% from 2026 to 2033. Increasing demand for packaged food, including prepared food and packaged meat & seafood products, coupled with rising penetration of the organized and e-retail networks worldwide, is expected to drive the market growth during the forecast period.

Key Market Trends & Insights

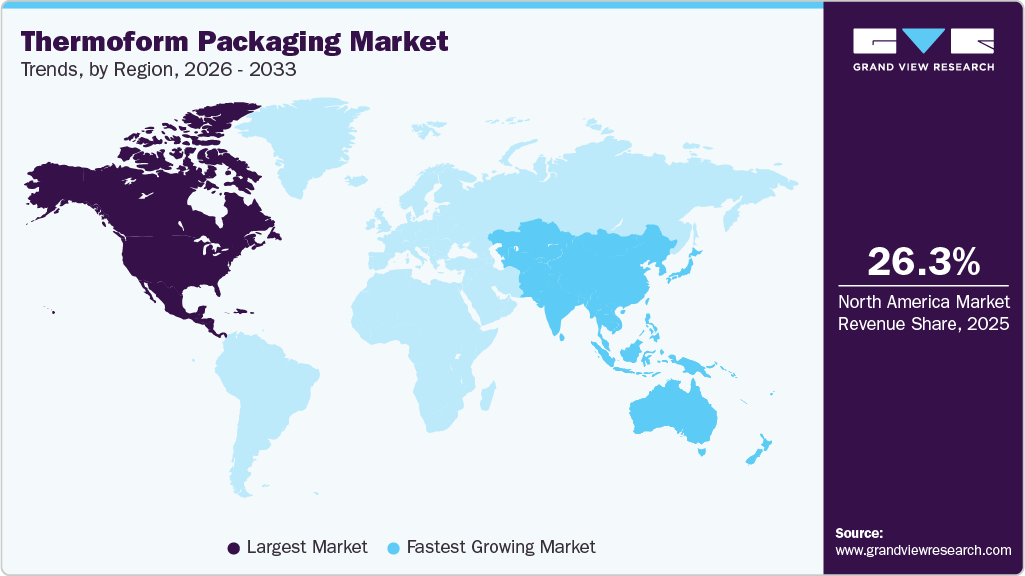

- North America dominated the market with a revenue share of 26.3% in 2025.

- Asia Pacific is forecast to grow at the fastest CAGR of 7.0% from 2026 to 2033.

- Based on material, the Polyethylene Terephthalate (PET) segment led the market, accounting for 44.8% of the global revenue share in 2025.

- In terms of product, the containers segment dominated the global market with a revenue share of over 25.8% in 2025.

- Based on end use, the food & beverage segment accounted for the largest revenue share of over 51.2% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 54.72 Billion

- 2033 Projected Market Size: USD 83.58 Billion

- CAGR (2026-2033): 5.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In the thermoforming process, the thermoplastic sheet is heated up to its softening temperature, and then it is converted into the desired shape with the help of molds. Most commonly, heat, vacuum, and pressure are employed on these sheets to produce the final products. The process is primarily bifurcated into two types: thin-gauge and thick-gauge thermoforming. Thin-gauge thermoformed products, including trays, blisters, and clamshells, are widely used for the packaging of various food, pharmaceuticals, electronics, and home care products.

The U.S. pharmaceutical industry has been witnessing a shift towards blister packaging from traditional bottles for the packaging of oral solid doses. This shift is primarily attributed to the heightened protection offered by blisters against moisture and oxygen for individual solid doses. Moreover, the low cost and ease of transportation of blisters are also attracting pharmaceutical manufacturers to use the product.

Thermoformed products, such as trays, containers, cups, plates, and others, are extensively utilized by the foodservice industry for table offerings as well as for parcel packaging. The rising penetration of e-food delivery platforms, coupled with changing lifestyles across the world, has been significantly contributing to the expansion of the foodservice industry, which, in turn, is anticipated to fuel the product demand.

Thermoform packaging products are cost-effective, lightweight, and offer high aesthetic appeal; thus, they are widely utilized by packaged food manufacturers. In addition, the increasing popularity of Modified Atmosphere Packaging (MAP) for food products, wherein a controlled gaseous mixture is employed within thermoform containers to extend the shelf life of the food products, is expected to boost the market growth in the coming years.

The rising demand for single-serve packaging, driven by increasing on-the-go food consumption, is expected to be a pivotal factor in market growth. However, increasing traction around sustainable packaging is prompting manufacturers to opt for flexible packaging that requires fewer raw materials and can be transported and handled efficiently. This factor is expected to hinder the growth of the market over the forecast period.

Market Concentration & Characteristics

The thermoform packaging industry exhibits a moderate to high degree of innovation, largely driven by material advancements and sustainability requirements. Innovation is centered on developing lightweight, mono-material, and recyclable solutions that still meet performance standards across food, pharmaceutical, and industrial applications. The shift toward rPET adoption, bio-based polymers, and high-barrier coatings has accelerated R&D spending, especially among large converters.

Thermoform packaging production is moderately capital-intensive, requiring investments in sheet extrusion, forming machines, trimming systems, and custom tooling. As a result, the market comprises a mix of large multinational packaging companies and mid-sized regional converters that cater to specific industries. Competition is based on customization capability, speed-to-market, quality consistency, and price management, particularly important because resin price volatility directly influences margins. Sustainability regulations are reshaping competitive strategies, pushing companies to adopt recycled content, reduce plastic usage, and redesign packaging to meet circularity goals. Industry consolidation is increasing as large players acquire specialized thermoformers to expand capabilities in medical packaging, rPET-based solutions, and high-speed automated formats. Partnerships across the value chain, between resin suppliers, converters, recyclers, and brand owners, are becoming more common, reflecting a shift toward integrated, closed-loop packaging ecosystems.

Regulations have a high and rising impact on the thermoform packaging industry. Global plastic reduction mandates, EPR (Extended Producer Responsibility) frameworks, and recycled-content requirements directly influence material choices and design strategies. Europe’s stringent packaging waste directives, U.S. state-level plastics bans, and Asia’s tightening environmental norms are prompting companies to adopt recycled PET solutions, shift away from PVC, and design mono-material packages that simplify recycling. Food safety regulations also shape product design, especially for MAP trays, meat packaging, and pharmaceutical blisters, where compliance with FDA, EFSA, and GMP standards is mandatory. Regulatory pressure elevates compliance costs but simultaneously stimulates innovation and pushes the industry toward more circular and sustainable business models.

Material Insights

The Polyethylene Terephthalate (PET) segment dominated the market, accounting for 44.8% of global revenue share in 2025. PET’s inherent advantages, such as high strength-to-weight ratio, excellent clarity, low moisture absorption, and chemical inertness, continue to drive its widespread adoption, particularly in food and beverage applications where safety and product visibility are critical. Its strong recyclability profile further enhances its appeal as brands increasingly prioritize circular packaging solutions.

Multiple PET grades, including A-PET, C-PET, and R-PET, serve diverse thermoforming requirements. Amorphous PET (A-PET), known for its crystal-clear transparency, is widely used for bakery, confectionery, and display-oriented packaging. Crystalline PET (C-PET) offers superior temperature resistance, making it suitable for dual-ovenable and freezer-to-oven meal trays. Recycled PET (R-PET) continues to gain traction as end use industries adopt higher recycled-content packaging to meet sustainability commitments and regulatory mandates.

Polyvinyl Chloride (PVC) is projected to exhibit notable growth given its strong barrier properties, shatter resistance, lightweight nature, and cost competitiveness relative to materials such as high-density polyethylene (HDPE) and polypropylene (PP). Meanwhile, polypropylene (PP) remains a key material in thermoforming due to its excellent toughness, thermal tolerance, and ability to maintain food freshness, making it especially suitable for microwavable and heat-resistant food packaging. Collectively, these material characteristics shape their positioning across end use sectors and support the continued expansion of thermoform packaging solutions.

Polyethylene (PE) holds a steady and strategically important position in the thermoform packaging industry due to its durability, cost-effectiveness, and adaptability across large-volume, everyday packaging applications. Its strong impact resistance, excellent moisture barrier properties, and ease of processing make PE a preferred choice for producing lightweight trays, lids, and protective inserts. The material’s compatibility with mono-material designs aligns well with global sustainability mandates, enabling easier recyclability compared to multi-layer structures.

Product Insights

The containers product segment led the global market, accounting for 25.8 % of the revenue share in 2025. Its dominance is driven by the extensive use of thermoformed containers across the foodservice industry, where they offer convenience, durability, and cost efficiency. The segment is expected to grow steadily in the coming years as food delivery platforms continue to expand, particularly in developing economies where urbanization and rising disposable incomes are increasing demand for ready-to-eat and takeout meals.

Blister packs represent another key product category and are widely adopted in the pharmaceutical, personal care, and electronics sectors. A blister pack features a formed cavity or pocket that holds the product securely in place and is sealed using materials such as paperboard, aluminum foil, or plastic. Their protective properties, tamper evidence, and compatibility with high-speed packaging lines contribute to their strong presence in regulated and high-volume industries.

The clamshell segment is projected to record the fastest CAGR of 6.2 % from 2026 to 2033. Strong visual appeal and product visibility make clamshells highly attractive in retail settings. A clamshell consists of two connected halves that close together, providing structure, protection, and ease of handling. These containers are widely used in food and beverage applications as well as in electronics and household goods packaging.

Thermoformed trays also hold a significant position in the market, with broad usage in the food sector. Supermarkets rely on trays to display meat, poultry, fresh produce, and other perishable items. The growing availability of frozen and chilled meat products in emerging markets, supported by the expansion of cold chain infrastructure and modern retail formats, is expected to drive continued growth in this segment during the forecast period.

End Use Insights

The food and beverage segment held the largest share of the global thermoform packaging industry, accounting for 51.2 % of the revenue in 2025. Its dominance is supported by the extensive use of containers, trays, and clamshells across packaged food manufacturers, quick-service restaurants, and foodservice establishments. As consumer lifestyles continue to shift toward greater convenience, demand for ready-to-eat meals, on-the-go snacks, and packaged grocery items is expected to further strengthen the adoption of thermoformed solutions within this segment. However, the growing transition toward sustainable alternatives, including molded fiber and paper-based formats, may moderate the pace of growth over the long term.

The pharmaceutical segment is expected to record the fastest CAGR of 6.2 % from 2026 to 2033. The expansion of the global pharmaceutical sector, rising cases of chronic illnesses, and a rapidly aging population are driving the need for secure, hygienic, and compliant packaging formats. Thermoformed blisters are particularly favored due to their effectiveness in unit-dose packaging, product protection, and compatibility with stringent regulatory standards.

Electronics remains another important end use category, relying on thermoformed containers, clamshells, and blister packs to package products such as headphones, batteries, mobile accessories, and small gadgets. The continued rise of e-commerce has significantly broadened the distribution footprint of consumer electronics, stimulating demand for protective, lightweight, and tamper-resistant packaging. This trend is expected to positively influence the growth of thermoform packaging within the electronics industry in the years ahead.

Regional Insights

The North America thermoform packaging industry dominated the market with a revenue share of 26.3% in 2025. The widespread presence of large-sized packaged food companies and strong penetration of organized retail contributed to the high share of the regional market in 2025. Moreover, the presence of large-sized thermoform packaging manufacturers that strive for a higher share within the market by introducing innovative products also supported the region’s growth. Other factors that contributed to the regional market include high consumption of frozen meat and packaged bakery products.

U.S. Thermoform Packaging Market Trends

The U.S. thermoform packaging industry is expanding due to the maturity and scale of its packaged food, healthcare, and retail sectors. The U.S. market places strong emphasis on convenience, portion-controlled meals, and ready-to-eat products, which rely heavily on thermoformed containers, trays, and blister formats. Growth is also driven by the presence of one of the world’s largest pharmaceutical and medical device industries, where strict regulatory compliance makes thermoformed blisters and medical trays essential. The continued rise of meal-kit delivery services, increased at-home consumption, and a strong focus on automation in packaging operations further support domestic demand. Sustainability mandates implemented by individual states are also prompting manufacturers to adopt recyclable materials, such as rPET, driving product innovation and material upgrades.

Europe Thermoform Packaging Market Trends

The thermoform packaging industry in Europe is closely linked to the ongoing expansion of cross-border retail networks, processed food consumption, and harmonized packaging safety standards under EU directives. Countries such as France, Italy, Spain, and the Netherlands exhibit a significant demand for thermoformed food trays, clamshells, and portion packs, driven by their robust private-label retail segments and well-developed chilled food markets. Europe’s pharmaceutical production centers, particularly in Belgium, Ireland, and Switzerland, also contribute to the sustained demand for blister packaging. The region’s aggressive regulatory stance on plastics, including targets for recycled content and restrictions on certain polymers, is accelerating a shift toward rPET and recyclable PP-based thermoform formats, thereby shaping the material and design preferences of the market.

The Germany thermoform packaging industryis primarily fueled by its advanced manufacturing landscape, high-quality standards, and strong orientation toward environmentally responsible packaging. Food processors and retailers in Germany prioritize precise, hygienic, and visually appealing packaging for meat, dairy, and fresh produce, all of which extensively utilize thermoformed trays. Germany is also a major European hub for pharmaceuticals and medical technology, which reinforces demand for high-barrier blister packaging and sterile, thermoformed components. In addition, Germany’s stringent recycling and waste management regulations accelerate the adoption of mono-material solutions and recycled PET, prompting companies to invest in next-generation thermoforming technologies that align with the country’s circular economy goals.

Asia Pacific Thermoform Packaging Market Trends

The thermoform packaging industry in the Asia Pacific region is growing rapidly due to rising incomes, urbanization, and the surge in modern retail and foodservice channels. Countries such as India, Japan, South Korea, Indonesia, and Australia are witnessing an increase in the consumption of packaged food, frozen meals, fresh produce, and ready-to-cook products, all of which rely heavily on thermoformed trays and containers. Pharmaceutical manufacturing is also expanding across the region, particularly in India and Southeast Asia, creating strong demand for blister packaging. Moreover, the rise of e-commerce and domestic electronics production is driving an uptick in the usage of clamshells and thermoformed inserts. The region’s evolving regulatory landscape is gradually pushing manufacturers to adopt more sustainable materials, with rPET and lightweight PP solutions becoming increasingly prominent.

The China thermoform packaging industry represents one of the fastest-growing markets for thermoform packaging, driven by its enormous food processing sector, rapidly expanding cold chain infrastructure, and the dominance of large-scale e-commerce platforms. The country’s accelerating demand for packaged meat, seafood, dairy, bakery, and fresh produce has led to the widespread adoption of thermoformed trays and containers, particularly in urban centers. China is also a global powerhouse in electronics manufacturing, which drives high demand for blister packs, clamshells, and protective thermoformed inserts used for consumer devices and accessories. The government’s strong push toward environmental protection and recycling is encouraging companies to transition to PET- and PP-based thermoformed solutions with higher recycled content. Besides, China’s growing pharmaceutical industry is boosting demand for high-quality blister packaging and sterile medical trays, further broadening the market’s growth base.

Key Thermoform Packaging Company Insights

The market is moderately consolidated, with a mix of global packaging leaders, regional converters, and specialty thermoformers competing across food and beverage, pharmaceutical, and industrial applications. Market share is influenced primarily by material integration, geographic reach, end use specialization, and the ability to offer sustainable, high-performance packaging solutions. Large multinational players typically command a strong presence in North America and Europe due to their comprehensive product portfolios, access to recycled PET streams, and long-term contracts with major FMCG and healthcare companies.

Leading companies in the market include Amcor plc, Huhtamaki, Sonoco Products Company, Georgia-Pacific, and Sealed Air, among others. These players maintain a competitive advantage through vertically integrated operations, including sheet extrusion, thermoforming, and post-consumer recycling capabilities. Their strategic focus lies in the development of lightweight, recyclable PET and PP-based thermoform solutions, as well as expansion into high-margin segments such as medical trays, blister packs, and customized electronics packaging.

- In January 2024, Amcor declared an increase in the manufacturing capacity of thermoforming in order to accommodate the development of healthcare customers in North America. The increased capacity will provide a streamlined option for companies seeking to collaborate with Amcor to facilitate their expansion goals.

Key Thermoform Packaging Companies:

The following are the leading companies in the thermoform packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Huhtamaki

- Sonoco Products Company

- Georgia-Pacific

- Sealed Air

- Coveris

- Greiner Packaging

- Pactiv Evergreen Inc.

- Silgan Holdings Inc.

- Plastipak Holdings, Inc.

- Sabert Corporation

Thermoform Packaging Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 57.63 billion

Revenue forecast in 2033

USD 83.58 billion

Growth rate

CAGR of 5.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; Saudi Arabia

Key companies profiled

Amcor plc; Huhtamaki; Sonoco Products Company; Georgia-Pacific; Sealed Air; Coveris; Greiner Packaging; Pactiv Evergreen Inc.; Silgan Holdings Inc.; Plastipak Holdings, Inc.; Sabert Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Thermoform Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global thermoform packaging market report on the basis of material, product, end use, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

PET

-

PVC

-

PS

-

PP

-

PE

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Blister Packaging

-

Clamshell Packaging

-

Skin Packaging

-

Trays & Lids

-

Containers

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverage

-

Personal Care & Cosmetics

-

Pharmaceuticals

-

Electronics

-

Homecare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global thermoform packaging market size was estimated at USD 54.72 billion in 2025 and is expected to reach USD 57.63 billion in 2026

b. The thermoform packaging market is expected to grow at a compound annual growth rate of 5.5% from 2026 to 2033 reach USD 83.58 billion by 2033.

b. The containers segment dominated the thermoform packaging market with a share of 25.8% in 2025, owing to high product adoption by processed food companies and foodservice outlets to pack food products.

b. Some of the key players operating in the thermoform packaging market include D Amcor Sonoco Products Company, Placon Corporation, Display Pack Inc., Pactiv LLC, Dart Container Corporation, Constantia, and Tray-Pak Corporation.

b. The key factors that are driving the thermoform packaging market include the increasing demand for packaged food products such as meat, seafood, ready meals, and others. Besides, expanding foodservice industry coupled with the rising prevalence of e-food delivery platforms are also driving the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.