- Home

- »

- Next Generation Technologies

- »

-

Intelligent Virtual Assistant Market Size & Growth Report, 2030GVR Report cover

![Intelligent Virtual Assistant Market Size, Share & Trend Report]()

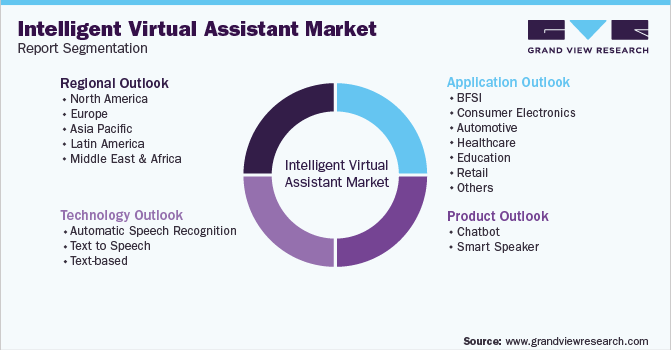

Intelligent Virtual Assistant Market (2023 - 2030) Size, Share & Trend Analysis Report By Technology (Text-to-Speech, Text-based), By Product (Chatbot, Smart Speaker), By Application (IT & Telecom, Consumer Electronics), And Segment Forecasts

- Report ID: 978-1-68038-059-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Intelligent Virtual Assistant Market Summary

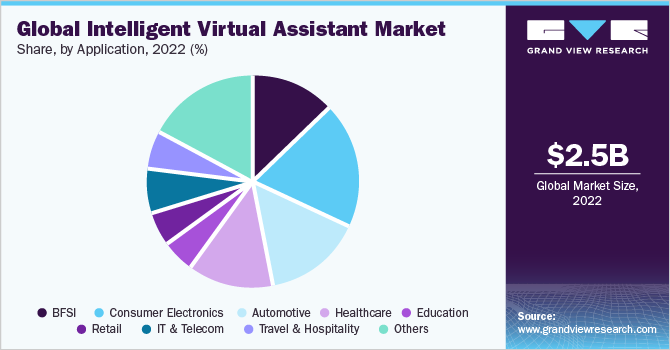

The global intelligent virtual assistant market size was estimated at USD 2.48 billion in 2022 and is projected to reach USD 14.10 billion by 2030, growing at a CAGR of 24.3% from 2023 to 2030. The need for increased efficiency across service-based businesses and the integration of Virtual Assistants (VAs) powered by AI across numerous devices, including computers, tablets, and smartphones, is expected to boost product demand.

Key Market Trends & Insights

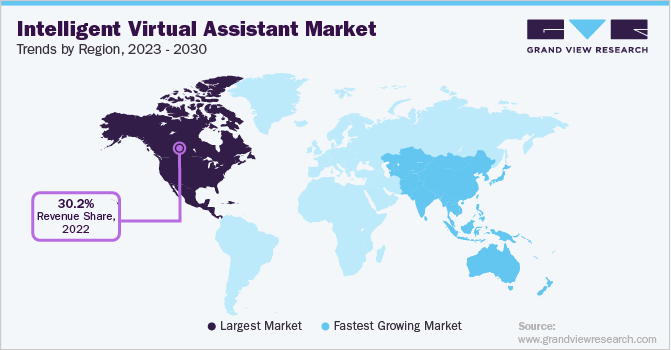

- North America dominated the industry in 2022 with the largest revenue share of 30.20%.

- The APAC region is expected to register the fastest CAGR over the forecast period owing to China’s growing retail and consumer electronics sectors.

- The chatbot segment dominated the industry in 2022 and accounted for the maximum share of more than 67.80% of the overall revenue.

- The text-to-speech segment dominated the industry in 2022 and accounted for the maximum share of more than 61.40% of the overall revenue.

- In terms of market size, the consumer electronics segment dominated the industry in 2022 and accounted for the maximum share of more than 18.60% of the overall revenue.

Market Size & Forecast

- 2022 Market Size: USD 2.48 Billion

- 2030 Projected Market Size: USD 14.10 Billion

- CAGR (2023-2030): 24.3%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Intelligent Virtual Assistant (IVA) can fulfill various customer service roles, like offering product information, ease of navigation, helping consumers in paying bills, and directing problem queries to human agents in customer service.Such factors are prompting financial institutions worldwide to integrate VAs, leading to industry growth. IVAs are efficient and perform various functions for enterprises across retail, I.T., banking, automotive, etc. In addition, they provide better conversational responses, which enhances the customer experience. IVA providers are actively working to support regional languages and offer specialized VAs so that consumers from various regions may communicate with ease. IVA has enhanced smart home and security solutions. For instance, Amazon.com, Inc. acquired Ring (U.S.), a company offering solutions to home security with a range of video doorbells and smart cameras.

Such factors are prompting financial institutions worldwide to integrate VAs, leading to industry growth. IVAs are efficient and perform various functions for enterprises across retail, I.T., banking, automotive, etc. In addition, they provide better conversational responses, which enhances the customer experience. IVA providers are actively working to support regional languages and offer specialized VAs so that consumers from various regions may communicate with ease. IVA has enhanced smart home and security solutions. For instance, Amazon.com, Inc. acquired Ring (U.S.), a company offering solutions to home security with a range of video doorbells and smart cameras.

The acquisition will assist Amazon.com, Inc. in integrating voice-based technologies into the home security products provided by Ring. Bring Your Own Device (BYOD) trends and technological advancements have led to the advent of working distantly. The improvements over the years have increased the usage of cloud-based tools, such as Skype and M.S. Office Online. With these cloud-based tools, an increasing number of people are working remotely and are highly dependent on VAs to perform their tasks. Therefore, it offers enormous opportunities for market growth.

The IVA is crucial in mitigating driver distraction as various infotainment commands can execute through voice-enabled VAs. Businesses are installing AI-based VAs in automobiles that can do tasks like recommend locations based on the calendar and maximize driver productivity by reading out emails and messages & delivering news. For instance, in September 2019, Automakers: Skoda announced the integration of VAs in its vehicles, which can be accessed through vocal commands and currently supports six languages.

COVID-19 Impact Insights

The pandemic caused significant disruption in various industries, including the technology industry. The COVID-19 pandemic affected the service domain in the technology industry significantly. Meanwhile, the advanced technology solutions are anticipated to substantially contribute while responding to the COVID-19 pandemic and focus on continuously evolving challenges. The existing situation owing to the pandemic outbreak will inspire healthcare and pharmaceutical vendor establishments to improve their R&D investments, expand & launch products in AI, and act as a core technology for enabling several initiatives.

With the global pandemic, various marketing agencies, financial organizations, and grocery outlets have initiated the full implementation of conversational AI tools and virtual internet assistants to enhance customer service in the crisis. Amid the pandemic, businesses face challenges in sustaining and are willing to try new technological avenues, such as VAs. Also, virtual internet assistants have assisted various industry verticals in these difficult times. Several medical insurance companies and public health institutions worldwide have deployed chatbots to assist users/patients in providing proper COVID-19 advice.

Product Insights

The chatbot segment dominated the industry in 2022 and accounted for the maximum share of more than 67.80% of the overall revenue. On the other hand, the smart speaker segment is projected to grow at the fastest CAGR over the forecast period. Residential consumers mainly use smart speakers for day-to-day tasks. In addition, there has been a substantial demand for adopting smart speakers in smart offices and automotive applications. For instance, Alexa (Amazon) can turn lights on/off, control smart appliances, such as HVAC systems & music systems, stream music, setting alarms & reminders.

The increasing need for a convenient lifestyle has led to the wide adoption of smart speakers and is anticipated to drive the market in the coming years. Chatbot has broad adoption in the banking and insurance sectors, the retail industry, and educational portals. They help access the required information and facilitate end-users with ease of operation. Chatbot has gained market attraction and had the highest adoption in the healthcare industry. With the help of text/speech/audio, these bots help physicians, nurses, patients, and their families at various levels of life. The growing number of social media platforms and the need to understand customer behavior is anticipated to drive the chatbot segment in the coming years.

Technology Insights

The text-to-speech segment dominated the industry in 2022 and accounted for the maximum share of more than 61.40% of the overall revenue. Automatic speech recognition technology is expected to register the fastest growth rate over the forecast period owing to the wide adoption of smart speakers in various sectors. Smart speakers recognize the speech and respond to the speech generated by consumers in a predefined manner. The rising adoption of mobile computing technology worldwide is expected to boost the demand for automatic speech recognition segments. It makes it easier for customers to interact with smartphones and their applications.

Major smart speaker manufacturers, such as Bose, Google Home, and Amazon-Alexa, are based in the U.S., hence most of the products are launched and shipped early in the region. The text-to-speech recognition segment is expected to grow at a steady CAGR owing to the useful application of the technology that benefits educational institutes, consumers, personal users, and businesses. Moreover, it allows owners to respond to the desires and different needs of users and the way they interact with the content. Meanwhile, virtual internet assistants are designed to provide marketing, support, order placing, sales, and other customer services.

Application Insights

In terms of market size, the consumer electronics segment dominated the industry in 2022 and accounted for the maximum share of more than 18.60% of the overall revenue. Automotive is emerging as one of the fastest-growing application segments. The integration of virtual assistants with the infotainment system contributes to delivering personalized content and improves comfort and convenience. Several companies like Daimler, BMW, and Hyundai have integrated voice enable infotainment systems. In January 2020, Amazon introduced Echo Auto, a voice assistant device that improves the driving experience. Several companies are investing in developing advanced VAs for the automotive platform to tap the full potential of the segment.

VA in healthcare enables connectivity and interaction between providers and patients, resulting in increasing demand across the segment. It provides continuous tracking of the patient’s condition through their smartphones and captures data through their voices. Moreover, it uses Natural Language Processing (NLP) to understand the need and conditions of the patient and reports with meaningful data. Furthermore, hospitals use IVR to perform tasks, such as scheduling appointments and requesting lab results. This improves patient engagement and reduces healthcare inefficiencies. Moreover, they provide round-the-clock assistance, which fuels the demand.

Regional Insights

North America dominated the industry in 2022 with the largest revenue share of 30.20%. Changing BYOD trends have led to the emergence of working remotely. Working remotely provides flexibility to the employees and allows a VA to speed up the work allotted. These further drive overall work efficiency and productivity. Similarly, the healthcare industry within the North America region has recognized the benefits of IVAs and is focused on improving healthcare systems’ efficiency. The America Medical Association of Medical Colleges has projected a shortfall of 40,000 primary care physicians, thus, the use of IVAs in the healthcare industry is expected to fulfill the shortage and deliver efficient and reliable solutions for health monitoring.

The APAC region is expected to register the fastest CAGR over the forecast period owing to China’s growing retail and consumer electronics sectors. The AI-powered development of IVAs for professional conversation has shown that they are highly effective in providing services and performing business functions, such as appointment scheduling and consulting, across various industries. Companies are launching products that enable an app or device to act as an AI agent. For instance, in July 2018, SBI Card (India) announced the launch of Electronic Live Assistant (ELA), a virtual assistant for customer services and support. It is driven by AI and Machine Learning (ML) and is designed to improve customer experience by providing appropriate and immediate replies to customer queries.

Key Companies & Market Share Insights

Key companies focus on new product launches and expansions and are heading toward innovation. IBM Corp. provides an IVA named Watson Assistant and offers a solution to automotive, retail, healthcare, travel & hospitality applications. Nuance Communications offers an IVA named Nina to automotive, healthcare, and other applications. The IVAs integrated with AI has created a massive storm and have exhibited various business and services across the globe. For instance, in August 2018, [24]7 Customer Inc. launched a Virtual Agent with Emotional Intelligence. In November 2018, [24]7 Customer Inc. launched a virtual agent named [24]7 AIVA.

Companies have introduced VA in smartphones, desktops, tablets, and other handheld devices. Some prominent companies, such as Amazon Inc. and Baidu, have introduced VAs for their devices and provide customized solutions supporting multiple platforms. New product launches and partnerships are the major strategies undertaken by players. For instance, in July 2018, Google Inc. began working with partners like Genesys and Cisco to build AI technology, replacing the work in call centers. The new software, Contact Center AI, installs virtual agents and initially picks up the phone when a customer connects to a call center. Some of the prominent players in the global intelligent virtual assistant market include:

-

[24]7 Customer Inc.

-

Amazon.com, Inc.

-

Apple Inc.

-

Baidu, Inc.

-

Clara Labs

-

CSS Corp.

-

Creative Virtual

-

CodeBaby Corp.

-

eGain Corp.

-

Google Inc.

-

IBM Corporation

-

Kognito

-

Microsoft Corp.

-

MedRespond

-

Next IT Corp.

-

Nuance Communications, Inc.

-

Oracle Corp.

-

True Image Interactive, Inc.

-

Verint

-

Welltok, Inc.

Intelligent Virtual Assistant Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.07 billion

Revenue forecast in 2030

USD 14.10 billion

Growth rate

CAGR of 24.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Mexico

Key companies profiled

[24]7 Customer Inc.; Amazon.com, Inc.; Apple Inc.; Baidu, Inc.; Clara Labs; CSS Corp.; Creative Virtual; CodeBaby Corp.; eGain Corp.; Google Inc.; IBM Corp.; Kognito; Microsoft Corp.; MedRespond; Next IT Corp.; Nuance Communications, Inc.; Oracle Corp.; True Image Interactive, Inc.; Verint; Welltok, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intelligent Virtual Assistant Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global intelligent virtual assistant market report on the basis of product, technology, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Chatbot

-

Smart Speaker

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Automatic Speech Recognition

-

Text to Speech

-

Text-based

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Consumer Electronics

-

Automotive

-

Healthcare

-

Education

-

Retail

-

IT & Telecom

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include the need for improved efficiency across service-based companies and the integration of Artificial Intelligence (AI) powered intelligent virtual assistant (IVA) among various devices such as tablets, computers, and smartphones.

b. The global intelligent virtual assistant market size was estimated at USD 2.48 billion in 2022 and is expected to reach USD 3.07 billion in 2023.

b. The global intelligent virtual assistant market is expected to grow at a compound annual growth rate of 24.3% from 2023 to 2030 to reach USD 14.10 billion by 2030.

b. In terms of market size, North America dominated the intelligent virtual assistant market with a revenue share of 30.25% in 2022.

b. Some key players operating in the intelligent virtual assistant market include Intel Corporation; Amazon.com Inc.; Google Inc.; Nuance Communications, Inc.; Apple Inc.; eGain Corporation; Amazon; IBM Corporation; CodeBaby Corporation; CSS Corporation; and True Image Interactive Inc.

b. In terms of intelligent virtual assistant market size, the chatbot segment dominated the market with a revenue share of 67.83% in 2022.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.