- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Medical Device Coatings Market Size, Industry Report, 2033GVR Report cover

![Medical Device Coatings Market Size, Share & Trends Report]()

Medical Device Coatings Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Hydrophilic Coatings, Antimicrobial Coatings, Drug-eluting Coatings, Anti-thrombogenic Coatings), By Application (Neurology, Orthopedics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-231-0

- Number of Report Pages: 81

- Format: PDF

- Historical Range: 2018 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Device Coatings Market Summary

The global medical device coatings market size was estimated at USD 16.27 billion in 2025 and is projected to reach USD 30.01 billion by 2033, growing at a CAGR of 7.9% from 2026 to 2033. Market growth is driven by the rising global demand for ventilators, catheters, cardiovascular devices, guidewires, sutures, syringes, mandrels, stents, and other medical equipment used across various healthcare settings.

Key Market Trends & Insights

- Asia Pacific is expected to grow at the fastest rate with a revenue CAGR of 8.7% from 2026 to 2033.

- The anti-microbial coatings segment dominated the market and accounted for the largest revenue share of 31.8% in 2025.

- The neurology segment is expected to grow at the fastest rate with a CAGR of 8.7% from 2026 to 2033.

Market Size & Forecasts

- 2025 Market Size: USD 16.27 Billion

- 2033 Projected Market Size: USD 30.01 Billion

- CAGR (2026-2033): 7.9%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Besides, the expanding geriatric population, increasing focus on early disease detection, growing adoption of minimally invasive and non-invasive procedures, and the overall rise in demand for high-quality healthcare services are expected to further accelerate the demand for medical device coatings over the forecast period.The product is crucial for protecting several types of devices used in the medical sector. These coatings enhance the maneuverability and performance of medical devices while also protecting them from pathogens and microbial factors. In addition, it offers excellent thermal stability, dielectric properties, and dry-film lubricity. This is expected to provide tremendous market potential over the forecast years. A rise in the frequency of Hospital-acquired Infections (HAIs) is fueling the growth of the market.

For instance, the use of contaminated devices can spread HAIs, requiring medical device coatings to stop the spread of the infection, as these coatings have antimicrobial properties. These coatings are materials that enhance a medical device’s performance & mobility and are used to protect the surfaces of several medical devices, including those used in dentistry, neurology, and other fields. Moreover, it provides excellent thermal stability, dry-film lubricity, and dielectric properties, which are likely to generate significant market potential over the forecast period.

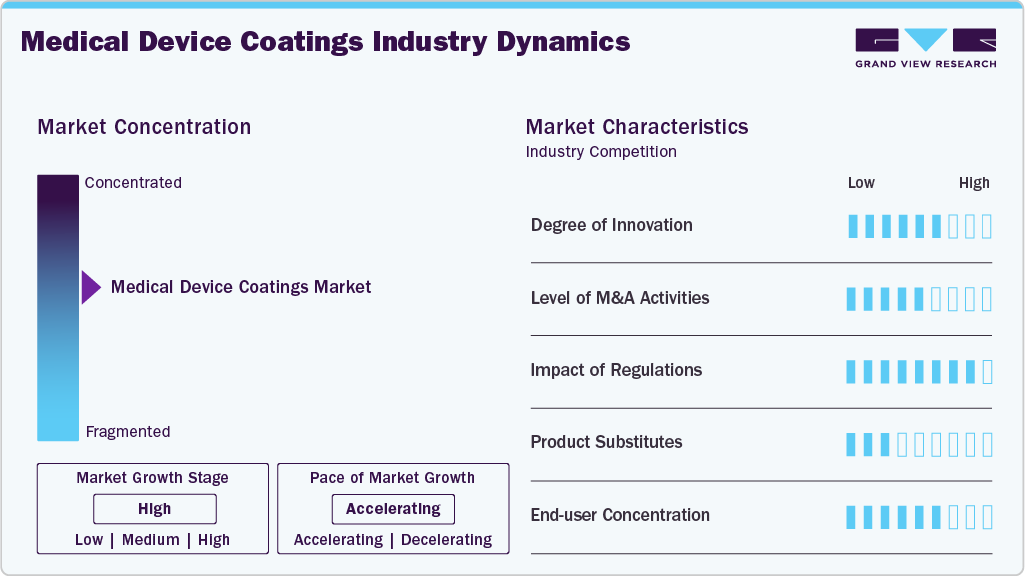

Market Concentration & Characteristics

The medical device coatings industry is characterized by a moderately concentrated structure, with a mix of specialized coating companies, raw material suppliers, and large medical device manufacturers participating in the value chain. Key players such as Surmodics, DSM Biomedical, Hydromer Inc., Harland Medical Systems, Covalon Technologies, and Biocoat Inc. lead the market through technological innovation, proprietary coating platforms, and strong partnerships with OEMs. The presence of barrier-to-entry technologies, such as hydrophilic and drug-eluting coatings, further contributes to market consolidation.

This market is driven by performance-critical applications, where coatings enhance biocompatibility, lubricity, antimicrobial resistance, corrosion protection, and drug delivery. Hydrophilic coatings are prevalent in minimally invasive devices, such as catheters and guidewires, while antimicrobial and drug-eluting coatings are rapidly gaining prominence in orthopedic implants and cardiovascular devices due to growing concerns about hospital-acquired infections (HAIs).

Product Insights

Antimicrobial coatings dominated the product segment in 2025, with the largest revenue share of 31.8%, driven by their critical role in reducing infection risks associated with medical devices, such as catheters, surgical instruments, implants, and wound care products. Their ability to inhibit bacterial growth and enhance device safety has led to strong adoption across hospitals and clinical settings. Growing emphasis on infection-control standards and the rising use of invasive medical devices continue to reinforce the dominance of this segment.

Hydrophilic coatings are projected to be the fastest-growing segment with a revenue CAGR of 8.3% over the forecast period, due to their superior lubricity, biocompatibility, and performance in devices requiring smooth insertion, such as guidewires, catheters, and delivery systems. Their ability to reduce friction, minimize tissue irritation, and improve procedural efficiency is driving rapid uptake. Increasing preference for minimally invasive procedures and advancements in coating technologies are further accelerating the growth of this segment.

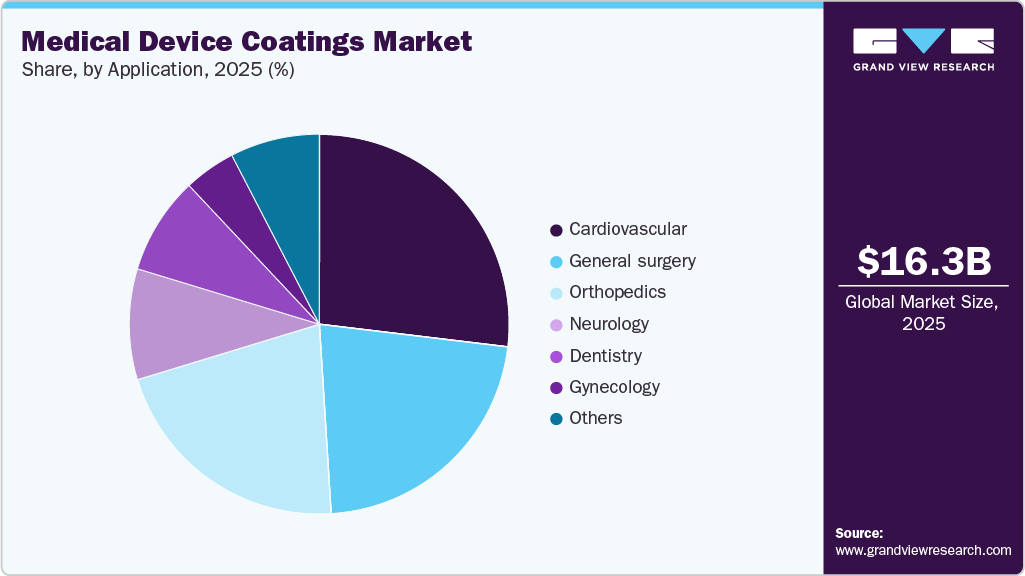

Application Insights

The cardiovascular segment held the largest share of 26.9% in 2025, supported by the widespread use of coated stents, guide wires, catheters, and implantable cardiac devices. The high prevalence of cardiovascular diseases, the expansion of interventional cardiology procedures, and the need for coatings that enhance biocompatibility, reduce friction, and prevent thrombosis all contribute to this segment’s dominance. Continuous innovation in coated cardiovascular devices further strengthens its leading position.

The neurology segment is expected to record the fastest growth with a revenue CAGR of 8.7% over the forecast period, due to increasing adoption of coated microcatheters, neurovascular guide wires, clot retrieval devices, and implantable neurostimulation systems. The rising incidence of stroke and neurological disorders, along with the rapid shift toward minimally invasive neuro-interventions, is driving demand. Advancements in ultra-thin, highly lubricious, and biocompatible coatings tailored for delicate neurovascular procedures are further accelerating growth in this segment.

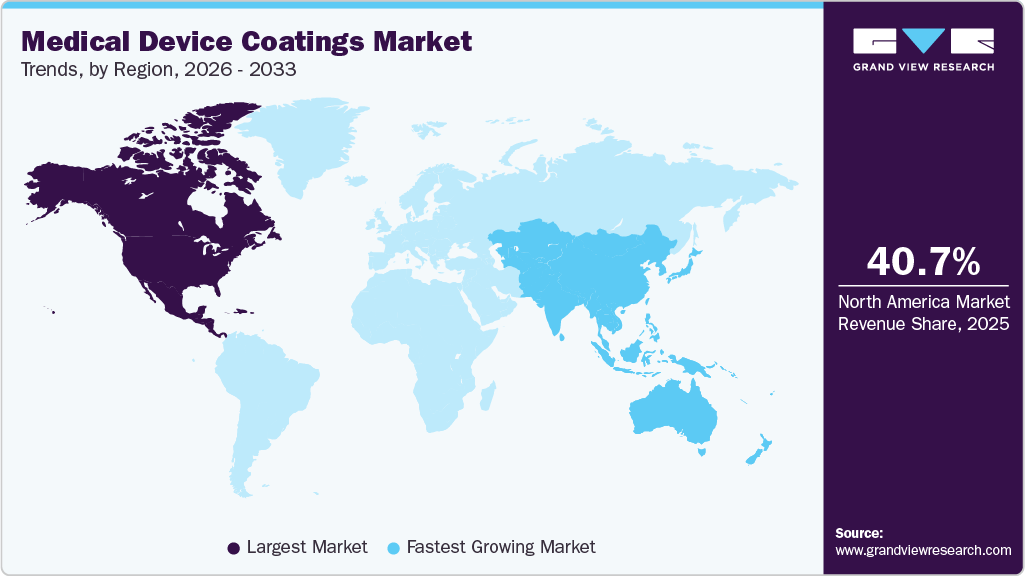

Regional Insights

The North America medical device coatings industry dominated the global market in 2025, accounting for around 40.7% of total revenue. The region’s strong position is supported by advanced healthcare infrastructure, high adoption of minimally invasive and robotic surgical procedures, and the growing prevalence of cardiometabolic conditions such as Deep Vein Thrombosis and Pulmonary Embolism. The rising use of antimicrobial, hydrophilic, and drug-eluting coatings in medical devices, along with stringent U.S. FDA regulatory standards, continues to drive innovation and demand. Increasing collaboration between coating technology providers and medical device OEMs further strengthens market growth across the region.

U.S. Medical Device Coatings Market Trends

The U.S. medical device coatings industry remains the largest and most technologically advanced, driven by a robust healthcare infrastructure, strong R&D spending, and a high concentration of medical device manufacturers, particularly in the U.S.

Asia Pacific Medical Device Coatings Market Trends

The medical device coatings industry in the Asia Pacific is anticipated to witness the fastest CAGR of 8.7% over the forecast period, in terms of revenue. The growth outlook is attributed to expanding healthcare infrastructure, increasing medical tourism, and government support for domestic medical device manufacturing, particularly in China, India, South Korea, and Japan.

The China medical device coatings industry is driven by the rapid expansion of healthcare infrastructure, rising demand for minimally invasive procedures, and strong domestic manufacturing of medical devices. Government support for medical technology modernization is further boosting adoption of advanced coatings.

Europe Medical Device Coatings Market Trends

The medical device coatings industry in Europe is characterized by sustainability, safety compliance, and innovation in advanced materials. The region is strongly regulated under REACH and MDR (Medical Device Regulation), prompting manufacturers to invest in coatings that meet rigorous biocompatibility and performance standards. Countries such as Germany, Switzerland, and the Netherlands are leading hubs for the development of precision medical devices and coatings. Trends include rising demand for bioresorbable coatings in orthopedic and cardiovascular implants, and antithrombogenic coatings in vascular access devices. There is also a growing interest in plasma surface treatments and nanostructured coatings that enhance device functionality while ensuring regulatory conformity.

The Germany medical device coatings industry is supported by a highly developed healthcare system, a strong focus on infection control, and increasing use of coated cardiovascular and neurovascular devices. Continuous innovation in biocompatible and high-performance coatings also drives market demand.

Middle East & Africa Medical Device Coatings Market Trends

The medical device coatings industry in the Middle East & Africa shows emerging potential in the medical device coatings sector, primarily driven by growing healthcare investments, infrastructure modernization, and government-led diversification programs in countries such as Saudi Arabia, the UAE, and South Africa.

Latin America Medical Device Coatings Market Trends

The medical device coatings industry in Latin America is growing steadily, albeit from a smaller base, driven by improvements in public and private healthcare systems and rising procedural volumes in countries such as Brazil, Mexico, and Colombia.

Key Medical Device Coatings Company Insights

Some of the key players operating in the market include SurModics Inc., Sono-Tek Corp., DSM, and Hydromer, Inc., among others.

-

Surmodics Inc. is a leading provider of surface modification and drug delivery technologies for medical devices. The company specializes in hydrophilic, antimicrobial, and drug-coated technologies, which enhance the performance and biocompatibility of vascular and interventional devices. Surmodics serves major OEMs across cardiovascular, peripheral, and neurovascular markets by offering customizable coating platforms and end-to-end development services.

-

Sono-Tek Corporation is a global leader in ultrasonic spray coating systems, serving medical device, electronics, and industrial markets. In the medical field, Sono-Tek's precision coating solutions are used for applying thin, uniform layers of drug-eluting, antimicrobial, and lubricious coatings on stents, catheters, and diagnostic tools.

Key Medical Device Coatings Companies:

The following are the leading companies in the medical device coatings market. These companies collectively hold the largest market share and dictate industry trends.

- SurModics Inc.

- Sono-Tek Corp.

- DSM

- Hydromer, Inc.

- Covalon Technologies Ltd.

- Infinita Biotech Private Ltd.

- Materion Corp.

- Biocoat Incorporated

- Harland Medical Systems

- Medicoat AG

Recent Developments

-

In January 2025, VitaTek entered into a strategic agreement with Chamfr to launch its VitaCoat hydrophilic coatings on the Chamfr marketplace to make these coatings accessible to engineers globally.

Medical Device Coatings Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 17.57 billion

Revenue forecast in 2033

USD 30.01 billion

Growth rate

CAGR of 7.9% from 2026 to 2033

Historical data

2018 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

SurModics Inc.; Sono-Tek Corp.; DSM; Hydromer; Inc.; Covalon Technologies Ltd.; Infinita Biotech Pvt. Ltd.; Materion Corp.; Biocoat Incorporated; Harland Medical Systems; Medicoat AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Device Coatings Market Report Segmentation

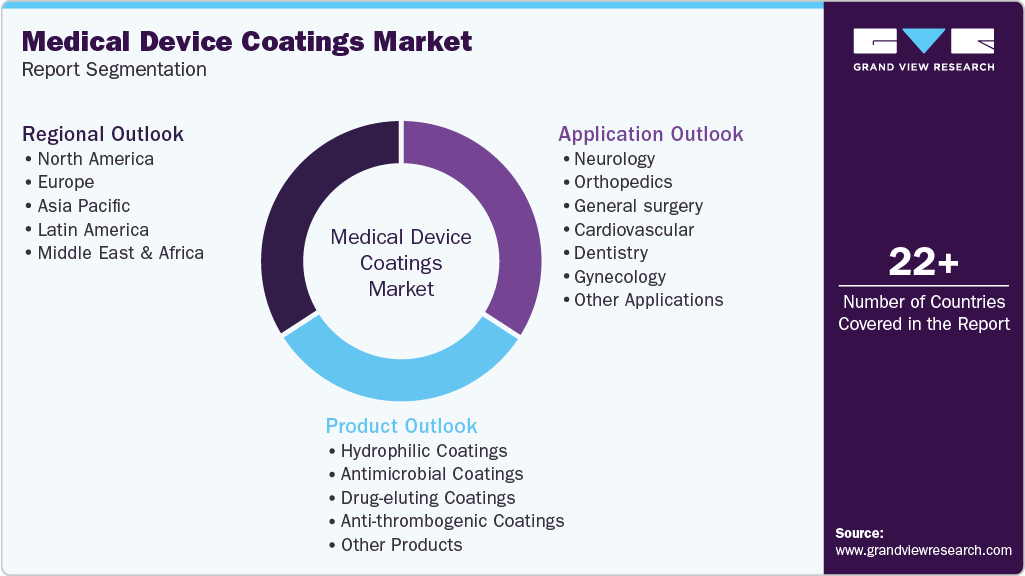

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global medical device coatings market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Hydrophilic Coatings

-

Antimicrobial Coatings

-

Drug-eluting Coatings

-

Anti-thrombogenic Coatings

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Neurology

-

Orthopedics

-

General surgery

-

Cardiovascular

-

Dentistry

-

Gynecology

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global medical device coatings market size was estimated at USD 16.27 billion in 2025 and is expected to reach USD 17.57 billion in 2026.

b. The global medical device coatings market is expected to grow at a compound annual growth rate of 7.9% from 2026 to 2033 to reach USD 30.01 billion by 2033.

b. Antimicrobial coatings dominated the product segment in 2025, with the largest revenue share of 31.8%, driven by their critical role in reducing infection risks associated with medical devices such as catheters, surgical instruments, implants, and wound care products.

b. Some of the key players operating in the medical device coatings market include SurModics Inc.; Sono-Tek Corp.; DSM; Hydromer; Inc.; Covalon Technologies Ltd.; Infinita Biotech Pvt. Ltd., Materion Corp., Biocoat Incorporated, Harland Medical Systems, Medicoat AG

b. Market growth is driven by the rising global demand for ventilators, catheters, cardiovascular devices, guide wires, sutures, syringes, mandrels, stents, and other medical equipment used across healthcare settings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.