- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Antimicrobial Coatings Market Size & Share Report, 2030GVR Report cover

![Antimicrobial Coatings Market Size, Share & Trends Report]()

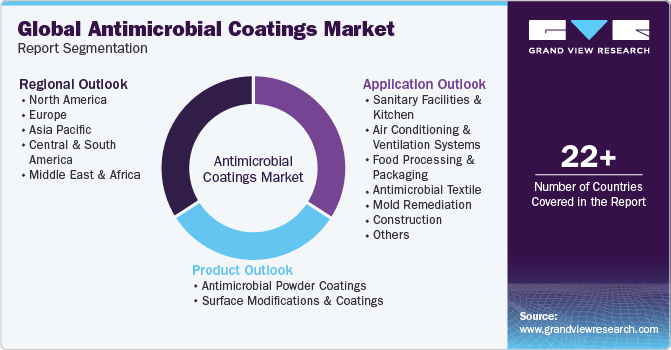

Antimicrobial Coatings Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Antimicrobial Powder Coatings, Surface Modifications & Coatings), By Application (Construction, Medical Devices), By Region, And Segment Forecasts

- Report ID: 978-1-68038-098-9

- Number of Report Pages: 97

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Antimicrobial Coatings Market Summary

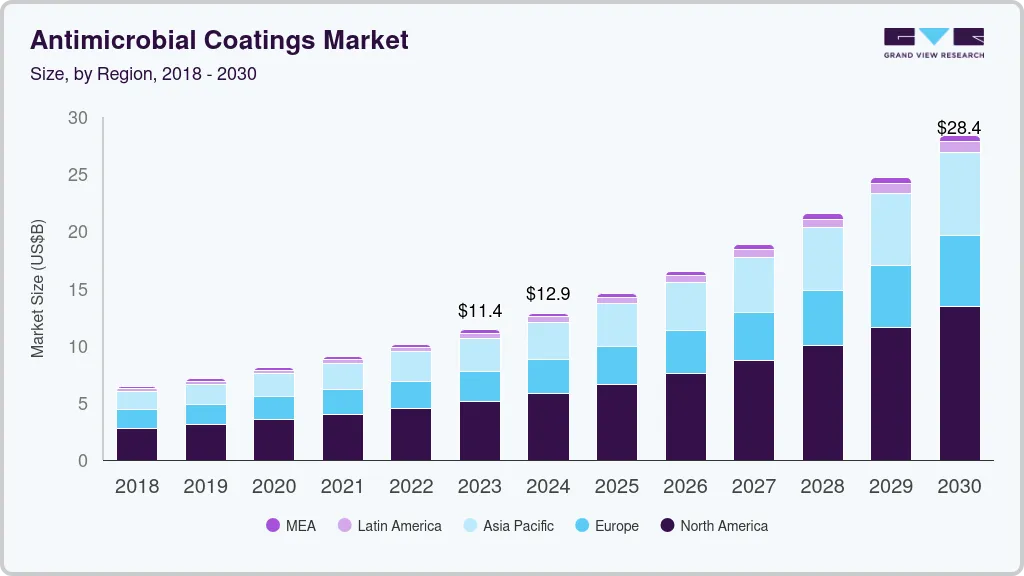

The global antimicrobial coatings market size was estimated at USD 11.39 billion in 2023 and is projected to reach USD 28.40 billion by 2030, growing at a CAGR of 13.9% from 2024 to 2030. Growing concern regarding cleanliness in various professional industries has led to the rapid development of this industry.

Key Market Trends & Insights

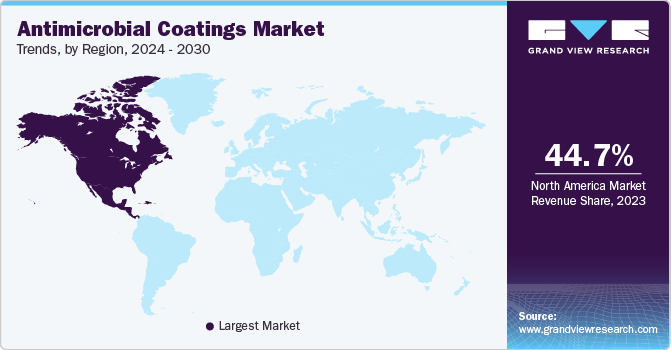

- North America region dominated the market with a revenue share of 44.7% in 2023.

- Country-wise, Germany is expected to register the highest CAGR from 2024 to 2030.

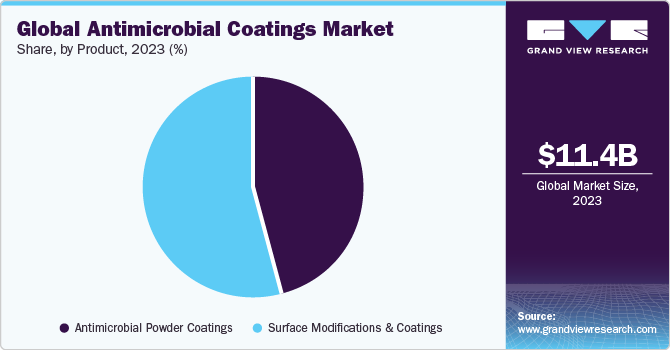

- By product, the Surface modifications and coatings product segment dominated the market with a revenue share of 53.6% in 2023.

- By application, the medical devices application segment dominated the market with a revenue share of 39.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 11.39 Billion

- 2030 Projected Market Size: USD 28.40 Billion

- CAGR (2024-2030): 13.9%

- North America: Largest market in 2023

These are used to protect surfaces against micro-organisms, which primarily include parasites, germs, bacteria, and unwanted micro-organisms. However, the segment is expected to grow at a higher rate than the sanitary facilities, kitchen, and air conditioning and ventilation systems application segment. Rising concerns regarding Hospital-acquired Infections (HAIs) are also boosting the overall industry growth. Doctors prefer antimicrobial coatings over disinfectants and cleaning agents.

This would also help reduce both cost and time for the hospitals in which they are prominently used. They help in curbing the spread of germs, which can otherwise cause weakened immune systems among people. Nevertheless, health concerns related to silver usage in various applications along with strict regulations in the European Union and the U.S. are presumed to create a hindrance to the overall demand.

In the recent past, the antibiotic application directly on the local surface is considered more efficient as compared to the antibiotics penetration through biofilm. The bacteria are killed instantly before the biofilm is formed. These antibiotics can be applied in bone cement that is used to fix implants associated with orthopedic and orthodontic implants.

The SHER-NAR coating must conform to the requirements of the American Architectural Manufacturers Association, which primarily involves a three-coat finishing procedure. The most efficient coatings option, AAMA 2605-13, is frequently used in architectural applications.

Product Insights

Surface modifications and coatings product segment dominated the market with a revenue share of 53.6% in 2023. This high share is attributed to its ability to modify the surface of a material by bringing physical, chemical, or biological characteristics different from the ones originally found on the surface of a material. This modification is usually made to solid materials, but it is possible to find examples of the modification to the surface of specific liquids.

The modification can be done by different methods to alter a wide range of characteristics of the surface, such as roughness, hydrophilicity, surface charge, surface energy, and biocompatibility. The formation of biofilm on an orthopedic implant surface is one of the major problems for the patient prognosis and increases the overall cost associated with the treatment of patients.

The use of surface modifications in a manner would help in imparting antimicrobial benefits to the implant devices. Owing to their unique properties, such as surface adhesion prevention, antimicrobial-eluting, bactericidal, and Osseo integration promotion, surface modifications, and coatings are expected to drive demand during the forecast period. Based on the products, the antimicrobial powder coatings market can be categorized into silver, copper, and others.

Silver has the largest consumption among all these coatings. This is owing to the use of silver in coatings has experienced a dramatic revival. Inorganic silver antimicrobial coating systems based on silver salts, colloidal silver, silver zeolite or ion exchange resins, complex glasses containing metal ions, and Nano-silver have been in high demand in the healthcare industry.

Application Insights

Medical devices application segment dominated the market with a revenue share of 39.6% in 2023. Its high share is attributable to the rising demand for antimicrobial coatings in catheters, implantable, and surgical instruments, as they are biocompatible, non-toxic, and biostable, which will promote industry development over the forecast period. The presence of key medical equipment players including GE Healthcare Technologies, Johnson & Johnson, Baxter International Inc., and Stryker Corp. is likely to boost the production of antimicrobial coated medical devices.

This, in turn, is expected to drive the market during the forecast period. North America will witness immense market growth owing to the rising healthcare expenditure in the U.S. The presence of various coating manufacturers in the U.S. including SurModics, Inc., Hydromer, Inc., Materion Corp., Specialty Coating Systems, Inc., and Precision Coating Co., Inc., will also propel industry expansion during the forecast period.

Medical devices have been one of the leading applications of antimicrobial coatings over the past few years. The rising number of hospitals along with the increasing requirement for healthcare facilities creates a need for sophisticated devices and equipment, which will augment product demand.

Regional Insights

North America region dominated the market with a revenue share of 44.7% in 2023. North America construction industry is expected to witness considerable growth owing to increasing demand for non-residential construction projects, such as hospitals, schools, and colleges, during the forecast period. The implementation of the “Affordable Healthcare Act” in the U.S. has triggered the construction of healthcare units and hospitals. The growing population is expected to further boost the construction of office spaces, industrial plants, schools, and colleges, thereby, driving the demand for antimicrobial coatings in construction applications.

The robust manufacturing base of the packaging products industry in China, Japan, and India coupled with increased sales of e-commerce and packed food products is anticipated to augment the market growth in the near future. In addition, favorable policies, such as Foreign Direct Investments (FDI) and Make in India, implemented by the government of India are expected to create ample growth opportunities for the food processing and healthcare industry, which, in turn, is expected to increase the consumption of antimicrobial coatings in the region.

Key Companies & Market Share Insights

Companies in the global antimicrobial coatings market compete based on the product quality offered and the technology used for the production. Major players focus on infrastructural development and expansion of their manufacturing facilities. Companies also invest in R&D and seek opportunities to vertically integrate across the value chain. These initiatives help them cater to the increasing global demand, ensure competitive effectiveness, enhance their sales & operations planning, develop innovative products & technologies, bring down their production costs, and expand their customer base.

For, instance, in March 2023, AkzoNobel formed a strategic partnership with BioCote to extend the reach of their antimicrobial powder coatings under the “Interpon” brand. This collaboration enables the application of these coatings on a wide range of internal surfaces including ceiling tiles, window frames, metal doors, metal office partitions, and elevator doors. By expanding its product portfolio in this manner, AkzoNobel aims to meet the diverse needs of its customers and enhance its market presence in the anti-microbial coatings industry

Key Antimicrobial Coatings Companies:

- AkzoNobel N.V.

- AK Steel Corp.

- Lonza

- Diamond Vogel

- DuPont

- Axalta Coating Systems

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Koninklijke DSM N.V.

- Burke Industrial Coatings

- The Sherwin-Williams Company

- Troy Corporation

Antimicrobial Coatings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.85 billion

Revenue forecast in 2030

USD 28.40 billion

Growth rate

CAGR of 13.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion, volume in kilotons, CAGR from 2024 to 2030

Report coverage

Volume, and revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; UK; Germany; France; China; India

Key companies Listed

AkzoNobel N.V.; AK Steel Corp.; Lonza; Diamond Vogel; DuPont; Axalta Coating Systems; Nippon Paint Holdings Co., Ltd.; PPG Industries, Inc.; RPM International Inc.; Koninklijke DSM N.V.; Burke Industrial Coatings; The Sherwin-Williams Company; Troy Corp.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antimicrobial Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global antimicrobial coatings market report based on the product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Antimicrobial Powder Coatings

-

Silver

-

Copper

-

Others

-

-

Surface Modifications & Coatings

-

Silver

-

Copper

-

Others

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Sanitary Facilities And Kitchen

-

Air Conditioning And Ventilation Systems

-

Food Processing And Packaging

-

Antimicrobial Textile

-

Mold RemediationConstruction

-

Medical Devices

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the antimicrobial coatings market include AkzoNobel N.V.; AK Steel Corporation; Lonza; Diamond Vogel; DuPont; Axalta Coating Systems; Nippon Paint Holdings Co., Ltd.; PPG Industries, Inc.; RPM International Inc.; Koninklijke DSM N.V.; Burke Industrial Coatings; The Sherwin-Williams Company; Troy Corporation.

b. The global antimicrobial coatings market size was estimated at USD 11.39 billion in 2023 and is expected to reach USD 12.85 billion in 2024.

b. The global antimicrobial coatings market is expected to grow at a compound annual growth rate of 13.9% from 2024 to 2030 to reach USD 28.40 billion by 2030.

b. The surface modifications and coatings product segment led the global antimicrobial coatings market and accounted for more than 53.60% share of the global revenue in 2023.

b. North America dominated the antimicrobial coatings market with a share of 44.70% in 2023. Rising demand for minimally invasive surgeries, the presence of advanced implant devices, and the availability of sophisticated healthcare infrastructure in the U.S. are expected to be among the favorable growth factors over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.