- Home

- »

- Medical Devices

- »

-

Catheter Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Catheter Market Size, Share & Trends Report]()

Catheter Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Cardiovascular Catheters, Urology Catheters, Intravenous Catheters, Neurovascular Catheters, Specialty Catheters), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-115-3

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Catheter Market Summary

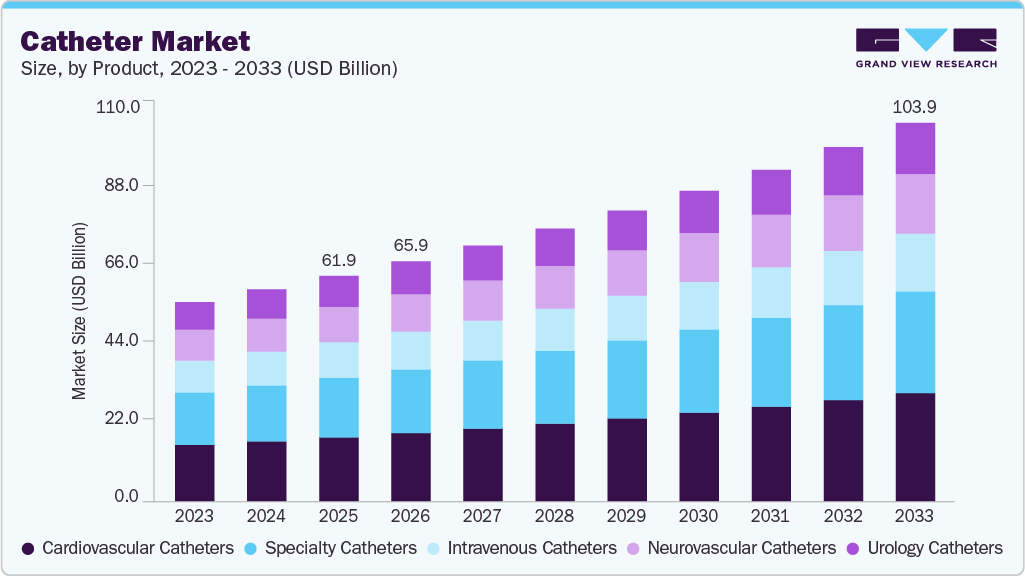

The global catheter market size was estimated at USD 61.89 billion in 2025 and is projected to reach USD 103.91 billion by 2033, growing at a CAGR of 6.72% from 2026 to 2033. The increasing cases of chronic disorders, such as neurological, cardiovascular, and urological disorders, requiring hospitalization, boost the expansion of the market.

Key Market Trends & Insights

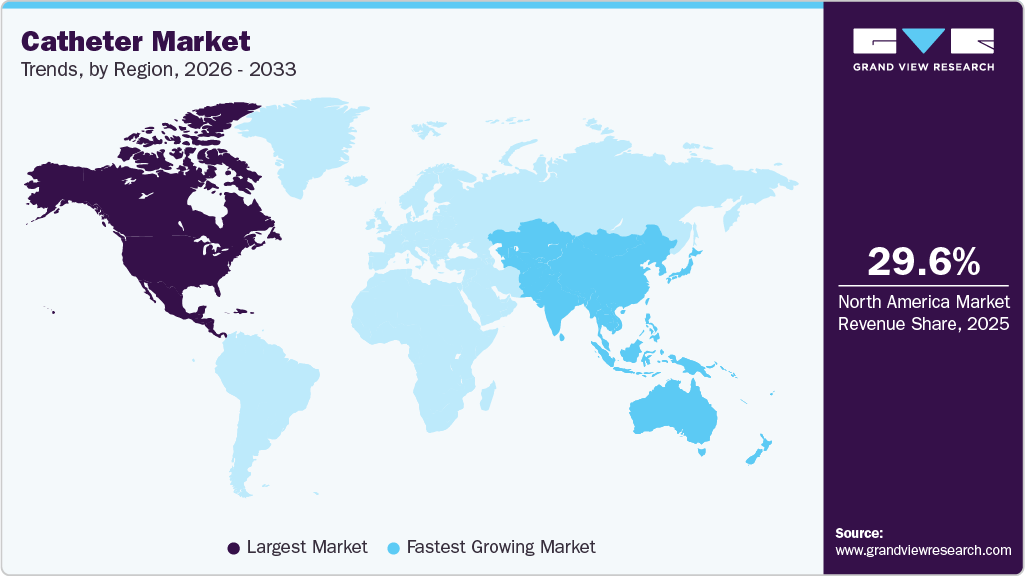

- North America dominated the global catheter market with the largest revenue share of 29.65% in 2025.

- By product, the cardiovascular catheters segment led the market with the largest revenue share of 28.39% in 2025.

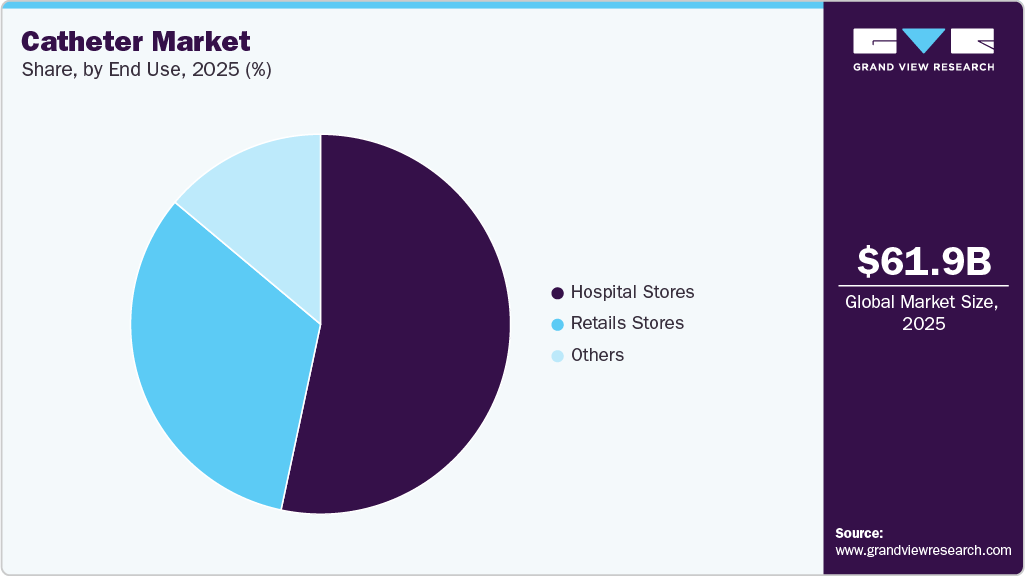

- By end use, the hospital stores segment led the market with the largest revenue share of 53.34% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 61.89 Billion

- 2033 Projected Market Size: USD 103.91 Billion

- CAGR (2026-2033): 6.72%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

For instance, the study published by the Lancet in May 2024 reports that urinary tract infections (UTIs) affect approximately 250 million people annually worldwide. With the increasing prevalence of such urological conditions, the demand for catheterization for short-term or long-term management of these ailments is anticipated to increase in the coming years, propelling market growth over the forecast period.The growing innovations in catheter manufacturing and the increasing number of related product launches are expected to drive market growth. Several companies in the industry are focused on developing catheters that deliver better outcomes.

For instance, in February 2024, Junkosha, a materials specialist company, launched the 1.8:1 shrink ratio Translucent PHST solution, which aids catheter manufacturers. This product allows for the easy addition of complex shapes and designs to the catheter, streamlining the manufacturing process and boosting efficiency. As a result, it enables a more cost-effective and streamlined production of intricate catheter designs. Such ongoing innovations in catheter manufacturing are anticipated to propel market growth in the coming years further.

The global catheter industry is characterized by a strong demand for high-precision diagnostic and therapeutic products. Growth is primarily driven by the increasing prevalence of chronic cardiovascular and urological conditions, alongside a rapid shift toward minimally invasive surgical procedures.

Urological and Vascular Access Segments

The urinary catheter industry and the foley catheter industry remain high-volume segments. Manufacturers are currently focusing on "infection-resistant" products, such as 100% silicone and antimicrobial-coated devices, to reduce hospital-acquired infections (HAIs). Simultaneously, the central venous catheter industry is seeing a transition toward peripherally inserted central catheters (PICCs) for long-term oncology and nutrition therapies.

Interventional Cardiology and Radiology

The balloon catheter industry continues to lead in value, specifically within the angiographic catheter industry. These products are essential for facilitating clear visualization and treatment of vascular occlusions. Furthermore, the catheter introducer sheaths market has evolved to offer "low-profile" designs, allowing for radial artery access which significantly reduces patient recovery times and post-operative bleeding.

Specialized Therapeutic and Support Devices

Innovation in the bronchial thermoplasty catheter industry remains a niche yet high-growth area, specifically for treating severe refractory asthma. To support these various clinical applications, the catheter stabilization devices market is providing advanced adhesive and mechanical securement solutions that ensure device integrity and minimize the risk of accidental dislodgement.

The increasing awareness of controlling catheter-related bloodstream infections (CRBSI) among the people will contribute to a greater demand for catheters in the coming forecast period. A significant factor leading to catheter-related bloodstream infections (CRBSI) is the lack of proper care and maintenance for these devices. Healthcare professionals prefer the use of catheters that pose minimal infection risks due to their increased awareness and emphasis on infection control.

For instance, in May 2023, BD introduced a convenient prefilled flush syringe for customers. This innovative BD PosiFlush SafeScrub syringe is designed to enhance patient care by expediting the flushing and disinfection of IV catheters during clinical procedures. Ensuring the cleanliness and disinfection of catheters is crucial in preventing CRBSIs. As a result, healthcare professionals are becoming more aware of the significance outlined in infection prevention guidelines, enhancing the need for the proper flushing, and disinfecting of catheters.

Moreover, companies are expanding their manufacturing capacities and facilities to meet the growing demand for catheters. For instance, in April 2023, Zeu completed the construction of a catheter manufacturing facility in Arden Hills. The on-site capabilities across development, design and research will advance catheter innovation and strengthen strategic partnerships with OEMs and medical device customers. In addition, this facility allows for the significant scale of catheter manufacturing to meet growing global customer and market demand. Such rising launches and expansion of catheter manufacturing capabilities are anticipated to boost market growth in the coming years.

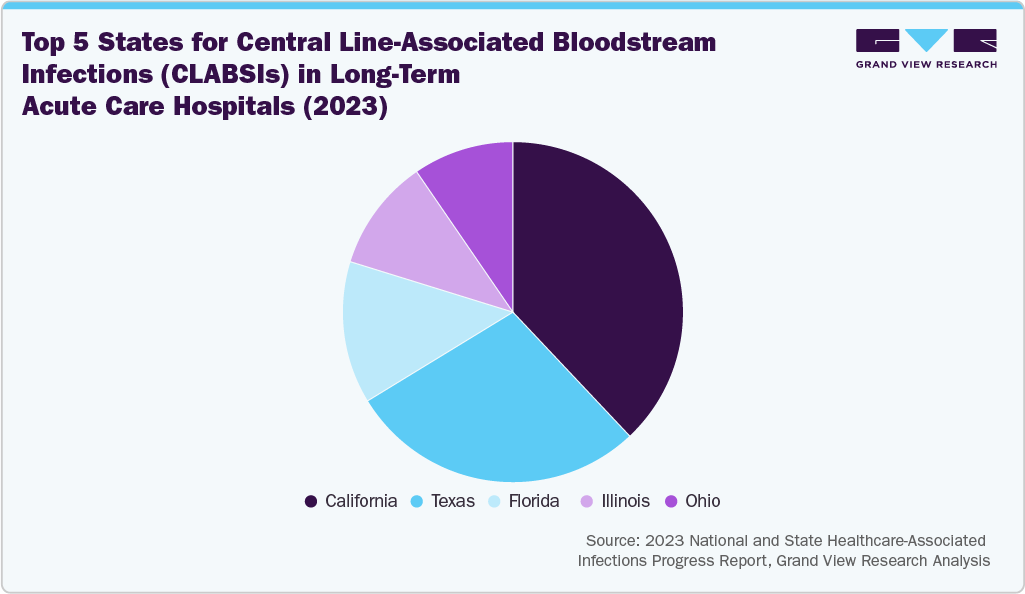

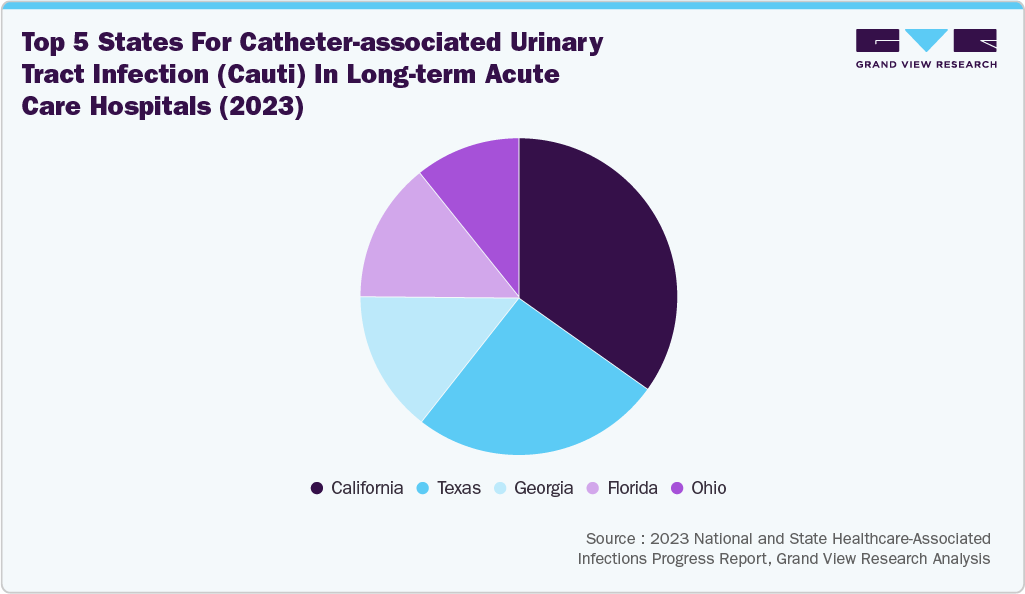

The use of catheters can lead to healthcare-associated infections (HAIs), particularly Catheter-associated Urinary Tract Infections (CAUTIs) and Central Line-Associated Bloodstream Infections (CLABSIs). Increasing awareness and initiatives to prevent these infections are expected to drive market growth in the coming years. According to data published by the CDC in July 2024, approximately 75% of urinary tract infections (UTIs) acquired in hospitals are associated with urinary catheters, and around 15-25% of hospitalized patients receive these catheters during their stay.

Several organizations have released guidance documents to address CAUTIs and other catheter-related HAIs. For instance, in May 2023, the Indiana Department of Health published guidelines for the care and management of central venous catheters. These guidelines cover best practices before, during, and after catheter insertion. They also identify the four recognized routes for catheter contamination and outline interventions to prevent Central Line-Associated Bloodstream Infections (CLABSIs). Such initiatives are anticipated to contribute significantly to market growth over the forecast period.

The pie chart below illustrates the distribution of Central Line-Associated Bloodstream Infections (CLABSIs) and Catheter-Associated Urinary Tract Infections (CAUTIs) in long-term acute care hospitals in 2023. California has the highest incidence of both infections, followed by Texas, with Ohio ranking fifth. This increasing prevalence indicates a growing patient population at risk, which in turn leads to a greater demand for advanced catheter products. One effective solution is the BIP Foley Catheter, which features Bactiguard technology. This technology reduces the risk of CAUTIs by 69% through a noble metal alloy coating that minimizes microbial adhesion. As the need for effective infection prevention grows, the catheter industry is expected to expand.

With an increasing emphasis on preventing catheter-associated infections, such as CAUTI and CLABSIs, manufacturers have a significant opportunity to enhance their market position by introducing innovative antimicrobial catheters. For instance, in November 2023, CorMedix Inc. received FDA approval for its DefenCath catheter. It was designed to reduce catheter-related bloodstream infections in a limited population of adult patients with kidney failure undergoing chronic hemodialysis via a central venous catheter (CVC). DefenCath is the only FDA-approved antimicrobial central line in the U.S., demonstrating up to a 71% reduction in CRBSI risk in a Phase 3 clinical study. In addition, the increasing number of clinical trials assessing the efficacy and safety of antimicrobial catheters is expected to drive market growth further.

Some clinical trials for antimicrobial catheters are listed in the table below:

Study Name

Intervention

Enrollment

Completion Date

Sponsor

Efficacy & Cost Effectiveness of Antimicrobial-impregnated CVCs in CLABSI Prevention in a Malaysia Adult ICU

Device: Arrow Three-Lumen Central Venous Catheter

Device: Arrowg+ard Blue Plus Three-Lumen Central Venous Catheter

110

2025-12

University of Malaya

Comparing The Safety And Efficacy Of DEFENCATH In Reducing Central-Line Bloodstream Infections (CLABSIs) In Adults Receiving Total Parenteral Nutrition Through A Central Venous Catheter (CVC)

Drug: (taurolidine and heparin) catheter lock solution

Drug: Heparin

140

2027-01

CorMedix

Safety and Effectiveness of 4% Tetrasodium Ethylenediaminetetraacetic Acid Catheter Lock Solution in Preventing Central Venous Catheter Occlusions in Children with Intestinal Failure: a Randomized Controlled Trial

Device: KiteLock 4% Sterile Catheter Lock Solution

Device: Heparin Lock Solution

124

2026-06

SterileCare Inc.

Source: ClinicalTrials.gov

Market Concentration & Characteristics

The market growth stage is moderate, and pace is accelerating. The catheter industry is characterized by a moderate-to-high degree of growth owing to increasing investment in R&D programs, prevalence of conditions such as urinary incontinence, cardiovascular diseases, and neurovascular disorders has led to a rise in the usage of catheters. Furthermore, the growing recognition among both healthcare professionals and patients regarding the advantages of catheterization in the treatment of diverse medical conditions is contributing significantly to the expansion of the market.

Key strategies implemented by players in catheter industry are new product launches, regulatory approval, acquisitions, partnerships, and other strategies. For instance, in January 2024, Cook Medical's Tip Hydrophilic Selective catheter, the Slip-Cath Beacon, was made available for use in both the Canada and U.S. This hydrophilic angiographiccatheter is specifically designed to cater to a broad spectrum of vascular and non-vascular procedures. It is used during angiographic procedures, working in tandem with vascular access sheaths, wire guides, and various treatment devices.

Companies are making significant investments in advanced technologies to gain a competitive edge and drive market growth. For instance, in February 2025, Johnson & Johnson MedTech launched the next-generation CEREGLIDE 92 Catheter System, which features a .092” inner diameter. This innovative catheter incorporates several design elements, including the co-packaged INNERGLIDE 9 Delivery Aid, complete catheter visibility through BRITE-LINE Technology, and TruCourse Technology, enhancing distal tip flexibility for improved trackability. The system is designed to track the M1 and offers large distal placement for better procedural control and complete visibility under fluoroscopy. These advancements are expected to foster further innovation in the market.

Mergers and acquisition activities in the catheter industry are increasing and witness similar growth during the analysis timeframe. Several companies are acquiring development-stage companies to enhance the company’s product portfolio to cater large patient pool. Moreover, these firms are integrating advanced facilities and form strategic alliances to achieve synergies in capabilities and resources, enhancing their competitiveness. For instance, in September 2024, Quasar Medical acquired Ridgeback Technologies, an Ireland-based developer of balloon catheters. This acquisition enhanced Quasar Medical's capacity to deliver customized balloon catheter solutions while improving efficiency and cost-effectiveness.

Medical device manufacturers are required to adhere to strict quality and safety regulations set by regulatory agencies such as the European Medicines Agency and the U.S. FDA. Manufacturers must follow specific guidelines to gain regulatory clearance for their intravenous catheters. Many companies in the industry are working to obtain approvals for their innovative products. For example, in January 2025, Simpson Interventions, Inc. received an Investigational Device Exemption from the U.S. FDA for its Acolyte Image-Guided Crossing and Re-Entry Catheter System. In addition, the company announced that the FDA has granted its Shadow Catheter 510(k) clearance.

The market comprises a large number of medical device manufacturers specialized in catheters manufacturing leads to a highly fragmented market scenario. Some of the emerging players operating in the industry include Flow Medical, S3V Vascular Technologies, and Liquet Medical Inc., among others.

Companies are concentrating on broadening the availability of their products across different regions and countries. For example, in June 2022, Teleflex Incorporated, a global manufacturer of medical technologies, introduced Arrow Pressure Injectable Midline Catheter in the Middle East, Europe, and Africa. This new pressure injectable catheter enhances the Midline portfolio to better meet clinicians' evolving needs and is designed to improve patient safety.

Product Insights

The cardiovascular catheter segment led the market with the largest revenue share of 28.39% in 2025. Rising prevalence of cardiovascular disorders and increasing demand for interventional cardiac procedures, coupled with growing adoption of cardiac catheters, are expected to boost the growth of the market for cardiovascular catheters during the forecast period. For instance, according to data released by the American College of Cardiology in July 2023, around 200 million individuals globally, and over 12 million people in the U.S., are dealing with peripheral artery disease (PAD). The increasing demand for these catheters can be attributed to the increasing incidence of cardiac conditions such as coronary artery disease, congenital heart problems, and cardiac arrhythmia. As the occurrence of these conditions rises, there is an increased need for diagnostic and interventional procedures, with cardiovascular catheters playing a pivotal role in performing minimal invasive procedures.

The specialty catheters segment is projected to witness at the fastest CAGR over the forecast period, owing to the increasing demand for minimally invasive procedures, coupled with rising prevalence of target diseases, Moreover, increasing regulatory approvals are expected to contribute to segment growth. For instance, in January 2024, FDA-cleared Dual Lumen Extended Length Peripheral Catheter (dELC) by Nuwellis is considered a specialty catheter. It is specifically designed with the Aquadex ultrafiltration system, which helps manage patient fluid overload. Specialty catheters are equipped with features such as smoother surfaces, reduced friction, and materials that minimize irritation. This customization enhances patient satisfaction and compliance, particularly in cases where long-term catheterization is necessary.

End Use Insights

The hospital stores segment accounted for the largest market revenue share in 2025. Hospital stores are situated in the hospital premises where they store and dispenses a wide range of catheters required for the surgical and minimal invasive procedures. Unlike regular pharmacies catering to outpatients, hospital stores prioritize the needs of patients admitted to the hospital. These cater to specific and often rare medical conditions, requiring precise storage and handling protocols. Moreover, due to the critical nature of their function, hospital stores operate under strict regulations. These regulations govern everything from storage conditions and dispensing procedures to personnel qualifications and record-keeping practices. This stringent framework ensures patient safety and medication accuracy. In addition, modern hospital stores leverage cutting-edge technology to streamline operations and optimize medication management. Automated dispensing systems, electronic prescribing platforms, and advanced inventory tracking software are just a few examples. These technologies minimize errors, improve efficiency, and enhance patient care. Time is often of the essence in healthcare, and hospital stores ensure immediate access to the needed catheters. This reduces delays in treatment and potentially improves patient outcomes. These factors boost the demand for catheters in the hospital stores, driving the market growth.

The retail stores segment is projected to witness at the fastest CAGR over the forecast period. This is attributed to the availability of various e-commerce platforms that sell catheters. These platforms offer a convenient, choice-filled, and often cost-effective way to purchase the catheters. For instance, Shop Catheters, Allegro Medical Supplies Inc., and Amazon are e-commerce sites that offer warranties, discounts, and prompt customer service for catheters. This has a positive impact on the sales of the products through these sales channels, thus supporting the segment growth during the forecast period.

Regional Insights

North America dominated the global catheter market with the largest revenue share of 29.65% in 2025 and is expected to continue its dominance over the forecast period. This can be ascribed to various factors, including the growing incidence of chronic illnesses and an aging population, and the favorable impact of major manufacturers like Teleflex Incorporated, Medtronic, and Boston Scientific Corporation, enhancing regional growth. The market for catheters in North America has expanded due to favorable government regulations, rising public awareness, many highly competent healthcare providers, and the presence of prominent healthcare facilities.

U.S. Catheter Market Trends

The catheter market in the U.S. accounted for the largest market revenue share in North America in 2025. The demand for catheters positively impacted by greater patient and healthcare community understanding of the importance of early identification and treatment for chronic illnesses. The Centers for Medicare & Medicaid Services (CMS), for instance, predicted that in 2022, health spending in the U.S. will be 7.5% of GDP. It was predicted to cross USD 1 trillion in 2023. In addition, high disposable income in developed economies & skilled professionals are some factors responsible for the large share of the market of the country.

Europe Catheter Market Trends

The catheter market in Europe is anticipated to grow at a significant CAGR during the forecast period. Key drivers of this growth include the increasing incidence of cardiovascular diseases, urological disorders, and diabetes, which necessitate catheter usage for diagnosis and treatment. Europe's aging population further contributes to the demand, as elderly individuals are more susceptible to conditions requiring catheterization. According to data published by Eurostat, as of 1 January 2024, the estimated population of the EU was 449.3 million people, with more than one-fifth (21.6%) aged 65 years or older.

The UK catheter market is expected to grow at a moderate CAGR over the forecast period, driven by factors such as an aging population, increasing prevalence of chronic diseases, and advancements in catheter technology. The demand for urinary catheters, particularly, is rising due to the growing incidence of urinary incontinence and bladder-related disorders. For instance, according to the data published by Incontinence UK in December 2023, it is estimated that around 7 million people in the UK have urinary incontinence. The high prevalence of urological disorders in the UK is expected to drive the country's urinary catheters market growth in the coming years.

The catheter market in France is experiencing steady growth due to factors such as an aging population, rising cases of chronic diseases such as cardiovascular disorders, diabetes, and urological conditions, and advancements in catheter technology. The country's well-established healthcare system, along with government initiatives to improve patient care and medical device accessibility, further supports market expansion.

The Germany catheter market is experiencing steady growth. As Europe's largest healthcare market, Germany benefits from a well-established healthcare system, a significant aging population, and increasing incidences of chronic diseases. These factors contribute to the expanding demand for various types of catheters, including urinary, cardiovascular, and neurovascular.

Asia Pacific Catheter Market Trends

The catheter market in Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period. This can be attributed to presence of large population suffering from kidney & cardiovascular diseases, improvement in medical facilities, and availability of insurance policies. Increased surgical volume, growing government partnerships, and a developing medical device portfolio all contribute to regional growth. In addition, an increase in government initiatives contributes to market developments in the region.

For instance, in July 2022, the Asia Pacific Society of Infection Control introduced the APSIC guide on the prevention of catheter-linked UI infections. The program focuses on offering practical recommendations provided in a brief format to help healthcare facilities in Asia Pacific maintain high standards of infection prevention & management. Its primary objective was to guide the management and care of patients with a urinary catheter. Moreover, the presence of a large patient pool and the growing need for technologically advanced & cost-efficient healthcare solutions are expected to present significant regional growth opportunities in the market.

The India catheter market is expected to grow at a significant CAGR over the forecast period. Key factors driving the growth of this market include the adoption of new technologies in catheter manufacturing, the increasing prevalence of various diseases, and rising research and development efforts aimed at enhancing the product portfolio. For example, in November 2024, Lubrizol, a specialty chemicals company, and Polyhose, a global leader in fluid conveyance systems, signed a Memorandum of Understanding (MoU) to manufacture medical tubing in India. This medical tubing will be used in neurovascular and cardiovascular applications, such as balloon catheters and catheters.

The catheters market in China expected significant growth during forecast period. China is one of the fastest-growing healthcare markets globally, and the catheter segment is benefiting from this rapid development. The key drivers of this growth include demographic trends, increasing healthcare needs, and advancements in medical technologies.

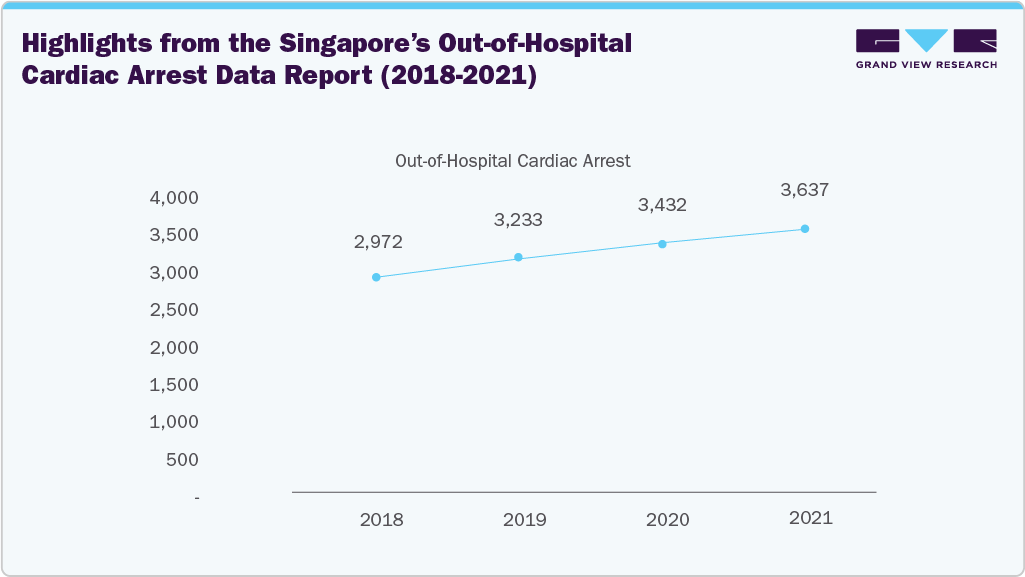

Highlights from the Singapore’s Out-of-Hospital Cardiac Arrest Data Report (2018-2021)

In Singapore, over 3,000 individuals experience sudden cardiac arrest each year, with nearly 80% occurring in residential and public settings, outside of healthcare facilities. Here, we track the out-of-hospital cardiac arrest situation in Singapore with data from the Unit for Pre-hospital Emergency Care (UPEC).

Out-of-hospital cardiac arrest cases have increased from 3,432 in 2020 to 3,637 in 2021. This increase is due to the growing proportion of the elderly population in Singapore. Age is a major risk factor for cardiac arrest.

The growing number of Out-of-Hospital Cardiac Arrest (OHCA) cases in Singapore, primarily due to the aging population, will create a sustained demand for advanced catheter-based solutions used in cardiac arrest treatment, resuscitation, and post-cardiac arrest care. This trend will positively influence the catheter market, driving demand for both existing catheter technologies (such as cardiac catheters, central venous catheters, and Intra-Aortic Balloon Pump) and innovations in emergency and minimally invasive procedures. As the healthcare system continues to focus on improving cardiac arrest survival rates, especially outside healthcare facilities, the market for catheter-based devices is poised for growth.

Middle East And Africa Catheter Market Trends

The catheter market in the MEA is anticipated to grow at a significant CAGR over the forecast period. Key growth drivers include the increasing elderly population, which is more prone to conditions that require catheterization, and the rise in chronic diseases like cardiovascular issues, diabetes, and urological disorders. In terms of regional growth, the Gulf Cooperation Council (GCC) countries, including Saudi Arabia and the UAE, are experiencing significant expansion due to advanced healthcare infrastructure and high healthcare spending. South Africa is also expected to grow rapidly, driven by increasing healthcare expenditure and awareness of urological disorders.

The Saudi Arabia catheter market is expected to grow at a significant CAGR during forecast period. Saudi Arabia has invested in its healthcare infrastructure as part of its Vision 2030 plan. This includes enhancing medical facilities, modernizing hospitals, and improving the overall quality of healthcare. These improvements lead to greater access to advanced medical devices such as catheters.

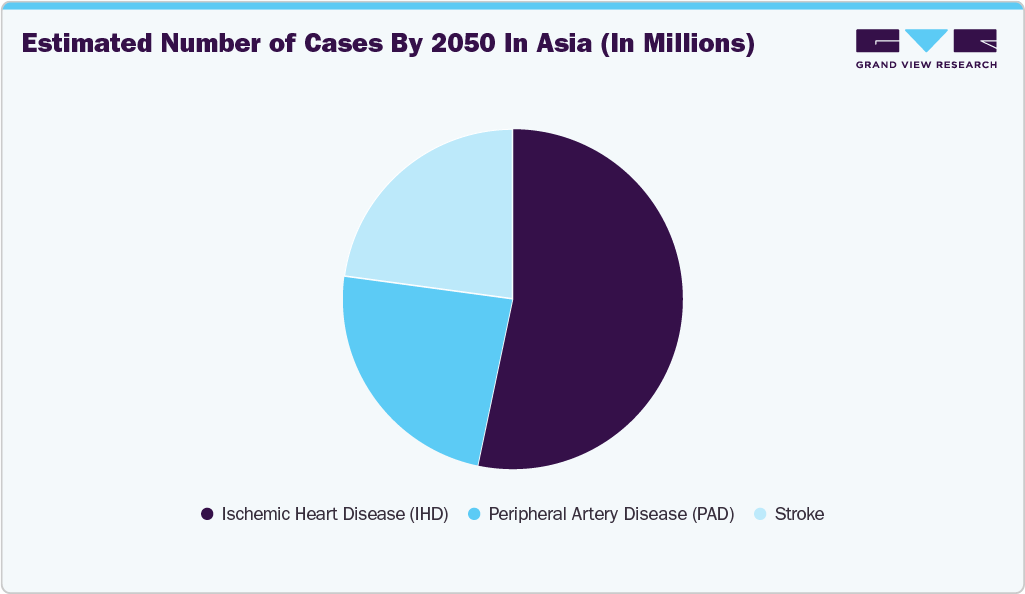

Estimated Burden of Cardiovascular Diseases in Asia

The rising prevalence of cardiovascular disease (CVD) is expected to increase the demand for catheterization and related catheters. A study published by The Lancet in August 2024 estimated that the prevalence of CVD in Asia is projected to reach 729.5 million by 2050, representing a 109% increase from 2025. Some of the most common CVDs include stroke, ischemic heart disease, and peripheral artery disease. In the treatment of these conditions, catheters are used as a minimally invasive tool to access and treat blockages in affected blood vessels. This allows for procedures such as angioplasty and stent placement, which restore blood flow by removing clots or widening narrowed arteries. Therefore, the increasing burden of CVDs in Asia presents a significant opportunity for market players to expand their presence in this region and address the needs of the large patient population.

Key Catheter Company Insights

Hollister Incorporated, Medtronic, Edwards Lifesciences, Boston Scientific Corporation, Smith Medical Inc., ConvaTec Group Plc, Teleflex Incorporated, Cure Medical LLC, Terumo Corporation, Cook Medical Inc., and BD are some of the major players in the catheter industry. Companies are expanding their catheter portfolios by innovating their coating materials and integrating novel features to gain a competitive edge in the years to come. Moreover, industry players are also expanding their manufacturing facilities to meet the growing demand for catheters used in various medical applications, including cardiology, urology, and neurology.

Key Catheter Companies:

The following are the leading companies in the catheter market. These companies collectively hold the largest market share and dictate industry trends.

- Hollister Incorporated

- Medtronic

- Boston Scientific Corporation

- Edward Lifesciences

- Smith Medical Inc.

- Teleflex Incorporated

- ConvaTec Group Plc

- Cure Medical LLC

- Terumo Corporation

- Cook Medical Inc.

- BD

Recent Developments

-

In January 2025, B. Braun Medical Inc. announced the launch of its new Clik-FIX Epidural/Peripheral Nerve Block (PNB) Catheter Securement Device. This addition to the Clik-FIX family is designed to be soft, low-profile, and secure. It aims to reduce the risk of catheter displacement and dislodgement during regional anesthesia procedures. The device is designed for straightforward application and secure attachment, addressing the challenges faced by patients and healthcare professionals.

-

In January 2025, Radical Catheter Technologies announced that its 8F Neurovascular Catheter has received 510(k) clearance from the FDA. The 8F catheter is built upon Radical's patented ribbon technology platform, offering an enlarged inner diameter to expand therapeutic options in neurovascular procedures. This design provides flexibility, stability, and durability, potentially leading to quicker procedures with reduced risks and costs.

-

In January 2025, Dr. Bruce Gardner, a radiologist at Sanford Health, received U.S. FDA approval for his innovative catheter design to prevent accidental dislodgement injuries. The new catheter features a mechanism that allows the retention balloon to deflate rapidly when excessive tension is applied, thereby minimizing potential harm to the patient.

-

In December 2024, Terumo Interventional Systems (TIS), a division of Terumo Corporation, announced the U.S. launch of its R2P NaviCross Peripheral Support Catheter, further expanding its radial-to-peripheral (R2P) portfolio. Available in a 200 cm length, the catheter features a double-braided, stainless-steel construction designed to provide superior trackability and torque control, facilitating lesion crossing in complex procedures.

Catheter Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 65.89 billion

Revenue forecast in 2033

USD 103.91 billion

Growth rate

CAGR of 6.72% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Hollister Incorporated; Medtronic; Boston Scientific Corporation; Edward Lifesciences; Smith Medical Inc.; Teleflex Incorporated; ConvaTec Group Plc; Cure Medical LLC; Terumo Corporation; Cook Medical Inc.; BD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Catheter Market Report Segmentation

This report forecasts revenue growth at the regional and country levels, providing an analysis of the latest industry trends in each sub-segment from 2021 to 2030. For this study, Grand View Research has segmented the global catheter market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiovascular Catheters

-

Electrophysiology Catheters

-

PTCA Balloon Catheters

-

IVUS Catheters

-

PTA Balloon Catheters

-

-

Urology Catheters

-

Hemodialysis Catheters

-

Peritoneal Catheters

-

Foley Catheters

-

Intermittent Catheters

-

External Catheters

-

-

Intravenous Catheters

-

Peripheral Catheters

-

Midline Peripheral Catheters

-

Central Venous Catheters

-

-

Neurovascular Catheters

-

Specialty Catheters

-

Wound/Surgical Catheters

-

Oximetry Catheters

-

Thermodilution Catheters

-

IUI Catheters

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Stores

-

Retail Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global catheter market size was estimated at USD 61.89 billion in 2025 and is expected to reach USD 65.89 billion in 2026.

b. The global catheter market is expected to grow at a compound annual growth rate of 6.72% from 2026 to 2033 to reach USD 103.91 billion by 2033.

b. North America dominated the catheter market with a share of 29.65% in 2025. This is attributable to the presence of multinational manufacturers and sophisticated healthcare infrastructure along with high product awareness levels.

b. Some of the key players operating in the catheter market include Hollister Incorporated, Medtronic, Boston Scientific Corporation, Edward Lifesciences, Smith Medical Inc., Teleflex Incorporated, ConvaTec Group Plc.

b. Key factors that are driving the market growth include rising demand for antimicrobial catheters, increasing prevalence of cardiovascular, neurology, and urology disorders, and growing usage of advanced materials in the catheters.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.