- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Flexible Packaging Market Size, Share Report, 2030GVR Report cover

![Medical Flexible Packaging Market Size, Share & Trends Report]()

Medical Flexible Packaging Market Size, Share & Trends Analysis Report By Material (Plastic, Paper, Aluminum, Bioplastics), By Product, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-893-0

- Number of Pages: 220

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

Medical Flexible Packaging Market Trends

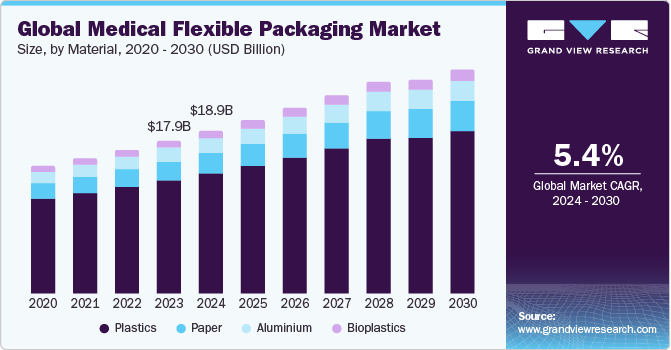

The global medical flexible packaging market size was estimated at USD 18.99 billion in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2030. The growing pharmaceutical industry in emerging economies coupled with increasing demand for drug delivery devices and blister packaging is triggering the demand for medical flexible packaging solutions across the globe.

The healthcare sector has witnessed a significant shift towards portability and convenience, fueling the demand for flexible packaging solutions. Flexible packaging offers lightweight and compact alternatives to traditional rigid packaging, making it easier for patients to carry and store medical products, such as inhalers, bandages, and injectable drugs. This convenience factor has become particularly important in today's fast-paced and mobile lifestyle, driving the adoption of flexible packaging in the medical field.

The pharmaceutical and biotechnology industries are major contributors to the global market. The continued expansion of these industries and introduction of new drug formulations created the need for effective and reliable packaging solutions, thus driving the demand for flexible packaging solutions in medical applications. Flexible packaging materials, such as foils, films, and pouches, offer excellent barrier properties, protecting sensitive pharmaceutical products from moisture, oxygen, and other environmental factors that can compromise their efficacy and shelf life.

There is a growing emphasis on sustainability and reducing the environmental impact of packaging materials across various industries, including healthcare. Flexible packaging solutions often require less material and generate less waste compared to traditional rigid packaging options. Therefore, the manufacturers of medical flexible packaging solutions are striving to incorporate recycled material and offer sustainable and recyclable packaging solutions. For instance, in October 2023, Amcor Plc entered a Memorandum of Understanding (MOU) with SK geo-centric Co., Ltd., a prominent petrochemical company located in South Korea. As per the MOU, starting from 2025, Amcor will procure advanced recycled material primarily from SK in the Asia Pacific region. This strategic partnership is expected to enable Amcor to offer packaging solutions with recycled content to its food and healthcare customers in key markets across Asia Pacific and around the world.

Medical flexible packaging plays a crucial role in maintaining product safety and sterility, which are paramount concerns in the healthcare industry. Flexible packaging materials can be designed with advanced barrier properties, preventing contamination and ensuring the integrity of medical products during transportation and storage. Moreover, certain flexible packaging solutions can incorporate features such as tamper-evident seals, enhancing product security and patient safety.

Market Concentration & Characteristics

Prominent medical flexible packaging solutions companies operating in industry include Amcor plc, AptarGroup, Inc., BD (Becton, Dickinson, and Company), Berry Global Inc., WINPAK LTD., Sealed Air, Mondi, Huhtamaki Oyj, Coveris, WestRock Company, Datwyler Holding Inc., Catalent, Inc., CCL Industries, Inc., Gerresheimer, Bemis Company, Inc.

Companies are increasingly focusing on the introduction of sustainable packaging practices in the global market. For instance, in November 2023, Amcor launched a next generation of more sustainable packaging for medical devices. The company has introduced new medical laminates packaging solutions that enable the development of all-film packaging that is recyclable in the polyethylene stream. This innovation is part of Amcor's commitment to create more sustainable packaging solutions for various industries, including medical devices.

In June 2022, Constantia Flexibles introduced a new recycle-ready laminate called PERPETUA ALTA, which is made from polypropylene and features improved chemical resistance. This laminate is designed for use in pharmaceutical products and is claimed to be a mono-material, making it easier to recycle. PERPETUA ALTA can withstand various chemical conditions, including hydro-alcoholic gel under accelerated aging conditions, which is similar to the performance of aluminum-containing multi-material packaging.

Material Insights

Based on material, the market has been segmented into plastics, paper, aluminium, and bioplastics. The plastics segment led the market with the largest revenue share of over 73.0% in 2023 Plastic materials offer a wide range of properties that can be tailored to meet specific requirements for medical packaging, such as moisture barrier, oxygen barrier, sterilization compatibility, and durability.

The paper material segment is expected to witness at the fastest CAGR of 6.5% over the forecast period. The demand for this material-based packaging is driven by its lightweight property and its availability in various shapes and sizes. The temperature resistance exhibited by this material-based packaging is expected to drive the demand for this packaging material over the forecast period.

Product Insights

The market is segmented into seals, high barrier films, wraps, pouches & bags, lids & labels, and other products. The pouches & bags segment led the market with the largest revenue share of over 35.0% in 2023. Pouches and bags offer a convenient packaging solution for hospitals, clinics, and other healthcare facilities. They are easy to open, dispense, and dispose of, which simplifies the handling and usage of medical products, especially in critical care environments.

The high barrier films segment is expected to witness at the fastest CAGR of 6.2% during the forecast period. High barrier films act as effective microbial barriers, preventing the ingress of microorganisms, bacteria, and other contaminants that could compromise the sterility of medical products.

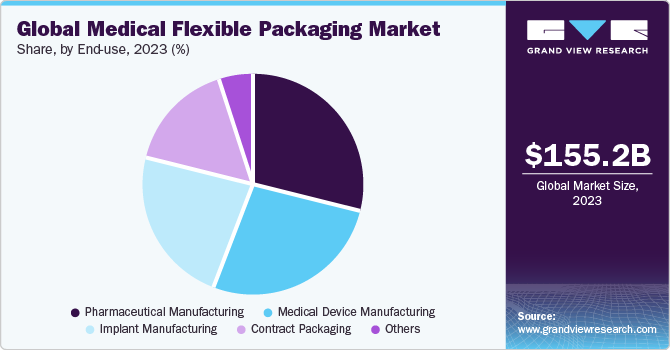

End-use Insights

Based on end-use, the market is segmented into pharmaceutical manufacturing, medical device manufacturing, implant manufacturing, contract packaging, and others. The pharmaceutical manufacturing segment led the market with the largest revenue share of over 29.0% in 2023. The global pharmaceutical industry is continuously expanding, driven by factors such as an aging population, increasing prevalence of chronic diseases, and the development of new drugs and therapies. This growth in pharmaceutical production directly translates into a higher demand for flexible packaging solutions to ensure the safe and effective delivery of these products.

The contract packaging segment is projected to grow at the fastest CAGR of 5.9% over the forecast period. Contract packaging services offer cost advantages to medical device manufacturers and pharmaceutical companies. By outsourcing their packaging operations, these companies avoid the substantial capital investments required for setting up in-house packaging facilities and infrastructure. Contract packagers can leverage economies of scale and specialized expertise, resulting in cost savings.

Regional Insights

The medical flexible packaging market in North America is anticipated to grow at a fastest CAGR during the forecast period. The significant increase in the production of pharmaceuticals and their sales in North American countries, namely the U.S., Canada, and Mexico, is positively impacting the growth of the healthcare blister packaging market in the region. For instance, according to the European Federation of Pharmaceutical Industries and Associations (EFPIA), North America accounted for a share of 52.30% of global pharmaceutical sales, whereas Europe accounted for a share of 22.40% in 2022. In addition, according to EFPIA, 64.4% of sales of new medicines launched from 2017 to 2022 were in the U.S. market. Hence, the launch of new medicines in the form of tablets, capsules, and pills creates the need for reliable packaging solutions, which, in turn, is expected to drive the market growth over the forecast period.

U.S. Medical Flexible Packaging Market Trends

The U.S. medical flexible packaging market is growing due to an increase in the establishment of new chemical and biological companies in the country. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), the country saw the introduction of 65 new chemical and biological entities between 2008 and 2012. This positive trend continued with the launch of an additional 100 new chemical and biological entities from 2013 to 2017, followed by 159 more entities from 2018 to 2022. These statistics indicate a promising future for pharmaceutical and healthcare industries, creating growth opportunities for healthcare packaging solutions, including medical flexible packaging, within the country.

The medical flexible packaging market in Canada is expected to grow at a fastest CAGR during the forecast period, due to the growing geriatric population, which has grown significantly since the 2001 Census. According to Statistics Canada, over 861,000 people aged 85 years and above were counted in the 2021 Census. The population belonging to this age group is continuously growing owing to the improved healthcare infrastructure in the country. This number is expected to reach approximately 2.5 million by 2046, as reported by Statistics Canada. Therefore, older adults may have multiple medications prescribed to manage their health conditions. This overall outlook is expected to increase the demand for the medications and medical devices across the country, which in turn is anticipated to boost the market growth.

Asia Pacific Medical Flexible Packaging Market Trends

Asia Pacific dominated the medical flexible packaging market with the revenue share of over 57.0% in 2023. The Asia Pacific region has a massive population base, which translates into a large patient pool and increased demand for healthcare products and services, including medical flexible packaging solutions. Many countries in the Asia Pacific region, such as China, India, Japan, and South Korea, have experienced significant growth in their healthcare industries, driven by rising disposable incomes, increasing healthcare expenditure, and government initiatives to improve healthcare infrastructure, thus benefitting the market growth in the region.

The medical flexible packaging market in India is anticipated to grow at a fastest CAGR during the forecast period. The market growth is positively impacted by the establishment of new pharmaceutical companies and the expansion of existing production capabilities. For instance, in February 2021, the Punjab government announced plans to establish three pharma parks within the state. One of these parks, located in Bhatinda, is expected to span approximately 1,300 acres, and require an investment of around USD 245.58 million. These developments indicate a favorable outlook for the healthcare blister packaging market as it aligns with the expansion of the pharmaceutical industry in the country.

Europe Medical Flexible Packaging Market Trends

The medical flexible packaging market in Europe held a substantial revenue share in 2023, owing to stringent regulations and standards. Europe has stringent regulations and standards for medical packaging, such as the EU's Medical Device Regulation (MDR) and Good Manufacturing Practices (GMP) guidelines. These regulations ensure the safety and quality of medical products, driving the demand for high-quality and compliant flexible packaging solutions.

The Germany medical flexible packaging market is primarily driven by the increasing efforts made by the Government and flexible packaging solutions manufacturers to develop and offer sustainable packaging products in the healthcare industry. For instance, in February 2024, Graphic Packaging International launched a Centre of Excellence for Pharmaceutical Leaflets in Germany, enhancing its offerings in sustainable paperboard packaging solutions for pharmaceutical products. This move allows the company to provide a comprehensive range of leaflet solutions, including ousters, catering to the pharmaceutical and medical sectors. The Magdeburg site in Germany has been transformed into this Centre of Excellence, showcasing the company's commitment to delivering high-quality packaging solutions for its customers in the healthcare industry.

Central & South America Medical Flexible Packaging Market Trends

The medical flexible packaging market in Central & South America is projected to grow at a moderate CAGR during 2024 to 2030. The aging population, ongoing globalization and urbanization, and rising instances of obesity cardiovascular diseases caused by physical inactivity drive the demand for medications in the form of oral pharmaceutical dosages. This, in turn, is anticipated to positively influence the market growth in the region.

The Brazil medical flexible packaging market is expected to grow at a fastest CAGR over the forecast period. Numerous pharmaceutical companies are broadening their footprint in Brazil to secure a portion of the growing pharmaceutical market. For instance, in July 2023, Neuraxpharm, a prominent European specialty pharmaceutical company specializing in the treatment of central nervous system (CNS) disorders, declared the initiation of its affiliates in Brazil and Mexico. These strategic moves mark Neuraxpharm's initial steps in extending its presence beyond the European market and contributing to the growth of the pharmaceutical market. Hence, the entry of Neuraxpharm into Brazil is expected to drive the adoption of international packaging standards, potentially boosting the demand for medical flexible packaging that aligns with these standards.

Middle East & Africa Medical Flexible Packaging Market Trends

The medical flexible packaging market in Middle East & Africa dynamics are influenced by expanding healthcare industry. Many countries in the Middle East, such as Saudi Arabia, the United Arab Emirates, and Qatar, have witnessed significant economic growth and have been investing heavily in improving their healthcare infrastructure and services. This increased healthcare spending has led to a higher demand for medical products, including flexible packaging solutions for pharmaceuticals, medical devices, and other healthcare products.

The UAE medical flexible packaging market growth can be ascribed to initiatives taken by UAE government to bolster the medical sector in the country. For instance, in 2022, Saudi Arabia's Ministry of Investment (MISA) entered into a partnership with GSK plc. A British pharmaceutical company, with the aim of strengthening the healthcare and life sciences sector in the Kingdom. This collaboration serves to solidify the country’s standing as a center for research and innovation in the field of life sciences. This collaboration is expected to positively influence the healthcare industry, which is anticipated to benefit the market growth.

Key Medical Flexible Packaging Company Insights

The key strategies adopted by major industry players include mergers & acquisitions, new product development, and regional expansion. Furthermore, manufacturers are looking at emerging countries as their market share is expected to grow over the forecast period. The growing demand for pharmaceuticals and medical devices in emerging countries is expected to positively influence the global market.

Key Medical Flexible Packaging Companies:

The following are the leading companies in the medical flexible packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- AptarGroup, Inc.

- BD (Becton, Dickinson and Company)

- Berry Global Inc.

- WINPAK LTD.

- Sealed Air

- Mondi

- Huhtamaki Oyj

- Coveris

- WestRock Company

- Datwyler Holding Inc.

- Catalent, Inc.

- CCL Industries, Inc.

- Gerresheimer

- Bemis Company, Inc.

Recent Developments

-

In November 2023, Coveris launched a new recyclable thermoforming film packaging solution called MonoFlex Thermoform. This innovative product offers excellent puncture resistance and is designed to provide optimal protection for various applications, including medical devices. The MonoFlex Thermoform film is a sustainable option that aligns with Coveris' commitment to environmental responsibility

-

In August 2023, Amcor plc announced the acquisition of a scalable flexible packaging plant in the high-growth Indian market. This strategic move involves the acquisition of Phoenix Flexibles, expanding Amcor's capacity in India. The company already operates four flexible packaging plants in India. This acquisition aligns with Amcor's position as a global leader in developing sustainable packaging solutions

Medical Flexible Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 20.22 billion

Revenue forecast in 2030

USD 27.72 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons; Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Amcor plc; AptarGroup, Inc.; BD (Becton, Dickinson and Company); Berry Global Inc.; WINPAK LTD.; Sealed Air; Mondi; Huhtamaki Oyj; Coveris; WestRock Company; Datwyler Holding Inc.; Catalent, Inc.; CCL Industries, Inc.; Gerresheimer; Bemis Company, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Flexible Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the medical flexible packaging market report based on material, product, end-use, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Paper

-

Aluminium

-

Bioplastics

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Seals

-

High Barrier Films

-

Wraps

-

Pouches & Bags

-

Lids & Labels

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Manufacturing

-

Medical Device Manufacturing

-

Implant Manufacturing

-

Contract Packaging

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global medical flexible packaging market size was estimated at USD 18.99 billion in 2023 and is expected to reach USD 20.22 billion in 2024.

b. The global medical flexible packaging market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 27.72 billion by 2030.

b. The pouches & bags segment led the medical flexible packaging market and accounted for more than 35.0% share of the global revenue in 2023.

b. The pharmaceutical manufacturing segment dominated the medical flexible packaging market and accounted for the largest revenue share of more than 29.0% in 2023.

b. Asia Pacific was the largest regional market in 2023 accounting for a revenue share of more than 57.0%.

b. The key player in the medical flexible packaging market includes Amcor plc, AptarGroup, Inc., BD (Becton, Dickinson and Company), Berry Global Inc., WINPAK LTD., Sealed Air, Mondi, Huhtamaki Oyj, Coveris, WestRock Company, Datwyler Holding Inc., Catalent, Inc., CCL Industries, Inc., Gerresheimer, and Bemis Company, Inc.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."