- Home

- »

- Plastics, Polymers & Resins

- »

-

Polypropylene Market Size & Share, Industry Report, 2033GVR Report cover

![Polypropylene Market Size, Share & Trends Report]()

Polypropylene Market (2026 - 2033) Size, Share & Trends Analysis Report By Polymer Type (Homopolymer, Copolymer), By Process (Injection Molding, Blow Molding, Extrusion Molding), By Application (Fiber, Film & Sheet, Raffia), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-493-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polypropylene Market Summary

The global polypropylene market size was estimated at USD 135.15 billion in 2025 and is projected to reach USD 227.33 billion by 2033, growing at a CAGR of 7.1% from 2026 to 2033. The market is expected to be driven by the increasing consumption of polypropylene in the automotive, packaging, and building & construction end use industries.

Key Market Trends & Insights

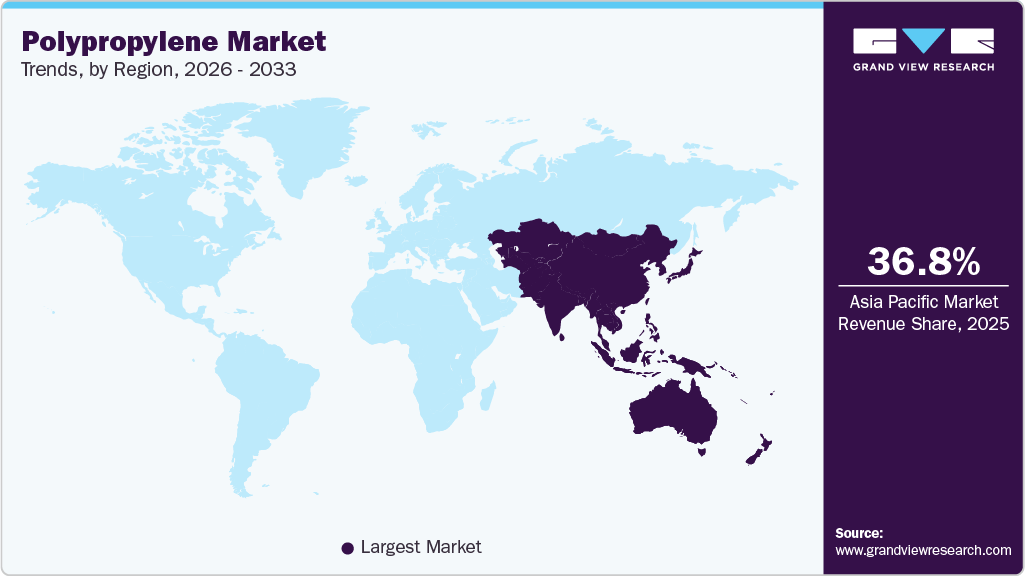

- Asia Pacific dominated the polypropylene market with the largest revenue share of 36.79% in 2025.

- The polypropylene market in the China accounted for the largest market revenue share in Asia Pacific in 2025.

- By polymer type, the homopolymer segment is expected to grow at the fastest CAGR of 7.4% from 2026 to 2033.

- By process, the injection molding segment is expected to grow at the fastest CAGR of 7.4% from 2026 to 2033.

- By application, the film & sheet segment is expected to grow at the fastest CAGR of 7.5% from 2026 to 2033.

- By end use, the automotive segment is expected to grow at the fastest CAGR of 7.6% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 135.15 Billion

- 2033 Projected Market Size: USD 227.33 Billion

- CAGR (2026-2033): 7.1%

- Asia Pacific: Largest market in 2025

The growing use of PP in the automotive sector to manufacture lightweight vehicles for improved fuel efficiency is expected to be a major factor driving the market over the forecast period. The polypropylene industry is a cornerstone of the global plastics industry, representing one of the most widely used thermoplastics due to its versatility, cost-effectiveness, and broad range of applications. Polypropylene is produced via polymerization of propylene monomer, typically sourced from crude oil or natural gas derivatives. It is available in various grades, including homopolymers, random copolymers, and block copolymers to suit specific performance needs.

The market exhibits a strong global footprint, with production and consumption concentrated in the Asia Pacific, North America, and Europe. Growth in manufacturing, infrastructure development, and end-use sectors like packaging and automotive strongly influences regional demand patterns. Supply dynamics are shaped by integrated petrochemical complexes that combine cracker output with PP polymerization units. At the same time, downstream converters tailor PP grades to specific product formats, including films, fibers, injection-molded parts, and composite blends, reinforcing the material’s role as a key industrial polymer.

Drivers, Opportunities & Restraints

A primary driver of the polypropylene industry is the robust growth in packaging applications, particularly in flexible and rigid formats. Packaging accounts for a significant share of global PP consumption due to its lightweight nature, moisture resistance, and recyclability potential, making it a preferred choice for consumer goods, food & beverage, and e-commerce packaging. As global demand for packaged goods expands-driven by urbanization, rising disposable incomes, and increased retail penetration-brand owners favor PP for its cost-effectiveness, printability, and ability to maintain product freshness over extended supply chains.

In both developed and emerging regions, the growth of modern retail and logistics networks has accelerated the use of polypropylene in corrugated plastic sheets, strapping, and protective packaging. In addition, the surge in e-commerce following the pandemic has intensified demand for PP-based mailing bags and protective wraps, supporting sustained volumetric growth. The combination of structural demand fundamentals and broad application versatility positions packaging as a persistent growth engine for the polypropylene industry.

A significant opportunity for the polypropylene industry lies in the development of advanced material formulations and performance-enhanced polypropylene composites. As industries such as automotive, electronics, and construction pursue lightweighting and durability, high-impact PP grades, glass fiber-reinforced PP, and PP blends with improved thermal or flame resistance are gaining traction. In the automotive industry, for example, PP composites are increasingly used for bumpers, interior trims, and under-the-hood components, contributing to vehicle weight reduction and improvements in fuel efficiency. This technical evolution expands polypropylene’s addressable applications beyond commodity segments into higher-value engineering plastics domains.

A significant restraint on the polypropylene industry is the volatility of raw material feedstock prices, primarily propylene, which is derived from naphtha or lighter hydrocarbons. Fluctuations in crude oil and natural gas prices are transmitted through to propylene production economics, influencing PP pricing and margins. Sudden feedstock cost spikes or supply disruptions, resulting from refinery outages, geopolitical tensions, or energy market volatility, can compress producer profitability and increase market uncertainty, particularly for smaller players with limited hedging capacity.

Market Concentration & Characteristics

The polypropylene industry is currently in a stage of medium growth, with an accelerating pace. The degree of innovation is moderate and increasingly application-driven, focusing on advanced PP copolymers, reinforced and modified formulations, and specialized processing techniques. Innovations such as high-impact block copolymers, nanoparticle-enhanced PP composites, and compatibilized blends with recycled content aim to expand performance boundaries in automotive, industrial, and consumer electronics applications.

M&A activity in the polypropylene industry is strategic and consolidation-oriented, with major petrochemical players acquiring or merging with complementary production assets, compounding businesses, and recyclers to strengthen their feedstock integration, geographic reach, and product portfolios. These deals often aim to secure scale, technological capabilities, and access to growing regional markets while optimizing supply chains in a cyclically driven commodity environment.

The regulatory impact is significant for polypropylene, particularly in relation to plastic waste management, recycled content mandates, and restrictions on single-use plastics. Policies like the EU’s Plastics Strategy and extended producer responsibility (EPR) frameworks are driving demand for recyclable and recycled PP while also imposing compliance costs on producers and converters. Food contact approvals and chemical safety standards further shape market access and product development strategies.

Polypropylene faces competitive substitutions from polymers such as polyethylene, polyethylene terephthalate, polyvinyl chloride, and engineering resins in applications where alternative materials offer better performance, barrier properties, or cost advantages. For example, PET is often preferred in rigid containers demanding high clarity and gas barrier performance, while PE dominates film applications where moisture resistance and flexibility are prioritized.

End-user concentration in the polypropylene industry is diversified, with packaging, automotive, consumer goods, and construction segments representing the largest volume consumers. Packaging remains the most dominant segment due to high usage in flexible films, rigid containers, and protective industrial packaging, followed by automotive applications where PP’s lightweight and performance attributes support fuel efficiency and design flexibility. This diversified user base helps mitigate demand volatility tied to any single sector.

Polymer Type Insights

The homopolymer segment led the market with the largest revenue share of 81.59% in 2025 and expected to grow at the fastest CAGR of 7.4% over the forecast period. The polypropylene produced by using a single type of monomer is known as a homopolymer. Homopolymers are widely used by various end users, including medical, automotive, electrical, building & construction, packaging, and others.

Copolymers are produced by using more than one type of monomer and are further classified into random copolymers and block copolymers. Ethylene random copolymer is formed by the polymerization of propene. It is flexible and optically clear, which makes it suitable for applications that require high transparency.

Process Insights

The injection molding segment led the market with the largest revenue share of 48.99% in 2025, and is expected to grow at the fastest CAGR of 7.4% over the forecast period. The injection molding process comprises the injection of molten polypropylene into a mold and then freezing it at a low temperature. These properties are expected to propel the demand for polypropylene polymer types made using the injection molding process.

Furthermore, injection molding is being widely adopted by multiple end-use industries, including automotive, medical equipment, housewares, consumer goods, storage container packaging, musical instruments, and furniture.

The blow molding process is used for manufacturing plastic containers. It involves the injection of molten plastics into a resonating container design. Then, air is blown into the mold to expand the plastic into the shape of the resonating container design. Properties such as enhanced chemical resistance, stability at high temperatures, excellent moisture barrier, and clarity at low temperatures are fueling the adoption of the blow molding process in the polypropylene industry.

Application Insights

The film and sheet segment led the market with the largest revenue share of 36.36% in 2025 and is expected to grow at the fastest CAGR of 7.5% over the forecast period. Polypropylene films and sheets are essential in packaging, labeling, and lamination due to their clarity, flexibility, and barrier properties against moisture and chemicals. In the medical and food industries, PP films ensure sterile packaging and extended shelf life. In industrial applications, they serve as insulation layers and protective coverings.

Polypropylene fibers are widely used in nonwoven fabrics for medical masks, hygiene products, and geotextiles due to their lightweight, chemical resistance, and hydrophobic properties. In textiles, PP fibers provide durability and comfort, making them suitable for carpets, upholstery, and sportswear, while their recyclability supports sustainability initiatives.

Polypropylene raffia is primarily used in woven sacks, ropes, and mats, offering high tensile strength, low weight, and resistance to wear and tear. It is a preferred material for agricultural packaging, cement bags, and bulk commodity storage, where durability and cost‑effectiveness are critical. Its recyclability also makes raffia products increasingly aligned with circular economy practices.

End Use Insights

The automotive segment led the market with the largest revenue share of 28.91% in 2025 and is expected to grow at the fastest CAGR of 7.6% over the forecast period. Polypropylene is extensively used in the automotive sector for interior trims, bumpers, dashboards, battery cases, and under‑the‑hood components. Its lightweight design, impact resistance, and cost-effectiveness help manufacturers reduce vehicle weight, improve fuel efficiency, and meet sustainability targets. With the rise of electric vehicles, PP is also gaining traction in battery housing and lightweight structural parts.

In construction, polypropylene finds applications in pipes, insulation materials, roofing membranes, and geotextiles. Its chemical resistance, durability, and thermal stability make it suitable for long‑life infrastructure projects. PP is also used in flooring and wall panels, offering both functional strength and recyclability, aligning with green building initiatives.

Packaging remains the largest end‑use segment for polypropylene, where it is used in rigid containers, films, sheets, and caps/closures. PP’s clarity, moisture resistance, and versatility make it ideal for food, beverage, and consumer goods packaging. Increasing demand for recyclable and lightweight packaging solutions continues to drive PP innovation in this sector.

Polypropylene is widely applied in the medical industry for syringes, IV bottles, diagnostic devices, and sterile packaging. Its biocompatibility, chemical resistance, and ability to withstand sterilization processes make it a preferred choice for disposable medical products. With a growing emphasis on sustainability and circular healthcare packaging, PP is being adapted for recyclable and eco-friendly medical applications.

Regional Insights

The polypropylene market in North America holds a significant share of the global market, underpinned by strong demand from automotive, packaging, and consumer goods sectors. The region continues to invest in advanced polymer processing and sustainability initiatives, including the development of recycled polypropylene, while the United States remains the major contributor to regional consumption.

U.S. Polypropylene Market Trends

The polypropylene market in the U.S. held a significant share in North America in 2025, with strong demand across various applications, including packaging, automotive, construction, and consumer goods. Innovation in PP processing technologies, an emphasis on lightweight materials, and the growth of recycling infrastructure are key factors supporting stable market growth in the country.

Asia Pacific Polypropylene Market Trends

Asia Pacific dominated the global polypropylene market with the largest revenue share of 36.79% in 2025 and is expected to grow at the fastest CAGR of 7.5% over the forecast period. The market is driven by rapid industrialization, the expansion of the packaging and automotive sectors, and strong manufacturing bases in China, India, Japan, and Southeast Asia. Increasing consumer demand for packaged goods, growth in infrastructure projects, and government support for petrochemical investments have collectively sustained polypropylene demand, making the region the largest and fastest-growing market globally.

The polypropylene market in China accounted for the largest market revenue share in the Asia Pacific in 2025. China is the one of the largest producers and consumers of polypropylene worldwide, driven by its massive industrial sector and high demand in packaging, automotive, electronics, and construction industries. Strategic investments in domestic polypropylene capacity, combined with policies that promote manufacturing and recycling, support continued growth and reinforce China’s position as the key market within the Asia Pacific region.

Europe Polypropylene Market Trends

The polypropylene market in Europe is shaped by stringent sustainability regulations and a growing emphasis on recyclable and eco-friendly polymer solutions, alongside established demand from packaging, automotive, and construction sectors. EU policies such as recycled content mandates are driving market transformation, while demand from automotive lightweighting and durable goods contributes to moderate expansion.

The Germany polypropylene market is a leading European region, benefiting from its strong automotive industry, advanced manufacturing base, and innovation in sustainable polymer uses. Investments in renewable and recycled polypropylene production also underscore the country’s strategic role in driving regional demand within Europe.

Latin America Polypropylene Market

The polypropylene market in Latin America is expanding steadily, supported by rising demand in packaging, automotive, and industrial applications, with countries such as Brazil driving regional consumption. Infrastructure development and increasing production capabilities in key markets contribute to a positive growth outlook.

Middle East & Africa Polypropylene Market Trends

The polypropylene market in the Middle East & Africa held the significant share in 2025, driven by abundant petrochemical feedstock, expanding industrialization, and increasing demand from the packaging and construction sectors. Growth in GCC countries, characterized by low production costs and increased downstream investment, continues to enhance the region’s competitive position.

The Saudi Arabia polypropylene market plays a pivotal role in the Middle East landscape, driven by large petrochemical capacities, increased export activity, and growing domestic demand from the packaging, automotive, and construction industries. Strategic investments in petrochemical expansions and infrastructure developments further support market growth in the country.

Key Polypropylene Company Insights

Strategic partnerships, capacity expansions, and the development of new polymer types are popular strategies adopted by the majority of players operating in the global polyisobutylene market. Recently, researchers at the University of Tokyo have developed a material called isotactic polar polypropylene (iPPP), which, compared to traditional polypropylene, exhibits higher isotacticity.

Key Polypropylene Companies:

The following are the leading companies in the polypropylene market. These companies collectively hold the largest market share and dictate industry trends.

- SABIC

- Exxon Mobil Corporation

- Borealis AG

- BASF SE

- INEOS Group

- Reliance Industries Limited

- LG Chem

- LyondellBasell Industries Holdings B.V.

- DuPont

- Braskem

Recent Developments

-

In August 2025, ABB announced a partnership with Citroniq to develop the world’s first full commercial‑scale facility producing 100% bio‑based polypropylene in Nebraska, USA. The plant will utilize corn-based ethanol feedstock to produce biogenic polypropylene, aiming to reduce greenhouse gas emissions and strengthen domestic supply chains significantly. Under the agreement, ABB will provide advanced automation, electrification, and digitalization technologies to enable efficient operations. The project is expected to create skilled jobs, support U.S. manufacturing, and mark a major milestone in sustainable plastics innovation.

-

In October 2025, Lummus Technology announced that Vioneo had selected it as the polypropylene technology partner for the world’s first industrial‑scale facility producing fossil‑free plastics from green methanol. The project utilizes Lummus’ Novolen polypropylene technology to convert green methanol into sustainable polypropylene, marking a breakthrough in decarbonizing the plastics industry.

Polypropylene Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 140.64 billion

Revenue forecast in 2033

USD 227.33 billion

Growth rate

CAGR of 7.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Polymer type, process, applications, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

SABIC; Exxon Mobil Corporation; Borealis AG; BASF SE; INEOS Group; Reliance Industries Limited; LG Chem; LyondellBasell Industries Holdings B.V.; DuPont; Braskem

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polypropylene Market Report Segmentation

This report forecasts revenue growth at the global,, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global polypropylene market report based on the polymer type, process, application, end use, and region:

-

Polymer Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Homopolymer

-

Copolymer

-

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Injection Molding

-

Blow Molding

-

Extrusion Molding

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Fiber

-

Film & sheet

-

Raffia

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Building & construction

-

Packaging

-

Medical

-

Electrical & electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global polypropylene market size was estimated at USD 135.15 billion in 2025 and is expected to reach USD 140.64 billion in 2026 owing to the increasing use of polypropylene for lightweight vehicles across the automotive industry.

b. The global polypropylene market is expected to grow at a compound annual growth rate of 7.1% from 2026 to 2033 to reach USD 227.33 billion by 2033.

b. Asia pacific dominated the polypropylene market with a share of 36.66% in 2025. This is attributable to growing demand for polypropylene from automotive and packaging sector, especially in the countries such as India, China and Japan.

b. Some key players operating in the polypropylene market include SABIC; Exxon Mobil Corporation; Borealis AG; BASF SE; INEOS Group; Reliance Industries Limited; LG Chem; LyondellBasell Industries Holdings B.V.; DuPont; and Borealis.

b. Key factors that are driving the market growth include rising application of polypropylenes in fiber, raffia, and film & sheet coupled with the rising trend towards the application of polypropylene in the automotive sector to manufacture lightweight vehicles for increased fuel efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.