- Home

- »

- Advanced Interior Materials

- »

-

Metal Stamping Market Size, Share, Industry Report, 2033GVR Report cover

![Metal Stamping Market Size, Share & Trends Report]()

Metal Stamping Market (2026 - 2033) Size, Share & Trends Analysis Report By Process (Blanking, Embossing), By Application (Automotive & Transportation, Industrial Machinery), By Press Type, By Thickness, By Region, And Segment Forecasts

- Report ID: 978-1-68038-615-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal Stamping Market Summary

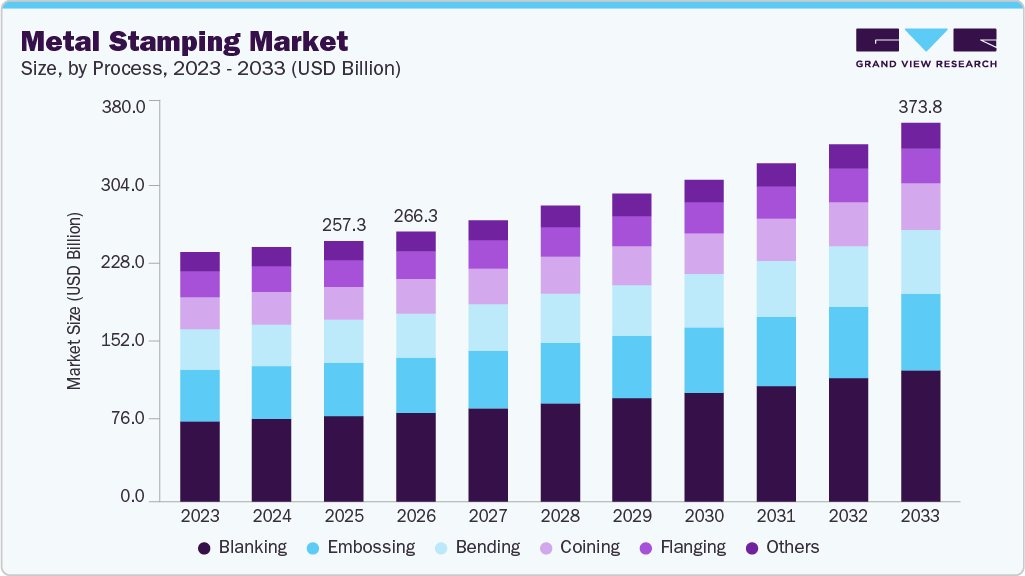

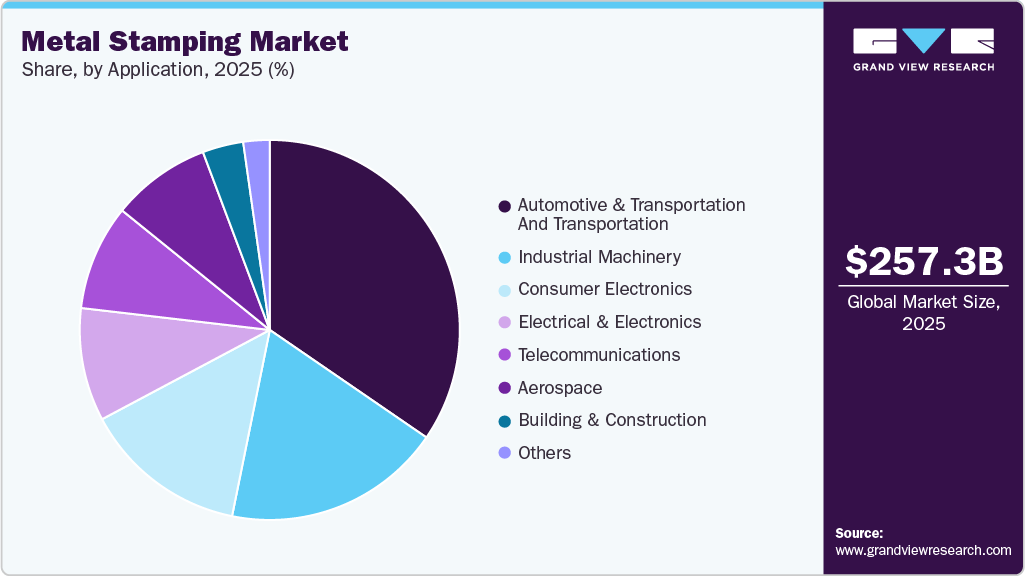

The global metal stamping market size was estimated at USD 257.26 billion in 2025 and is expected to reach USD 373.85 billion by 2033, growing at a CAGR of 5.0% from 2026 to 2033. The market is expected to be driven by the increasing demand for precision-formed components across various industries, including automotive & transportation, consumer electronics, industrial machinery, and electrical applications.

Key Market Trends & Insights

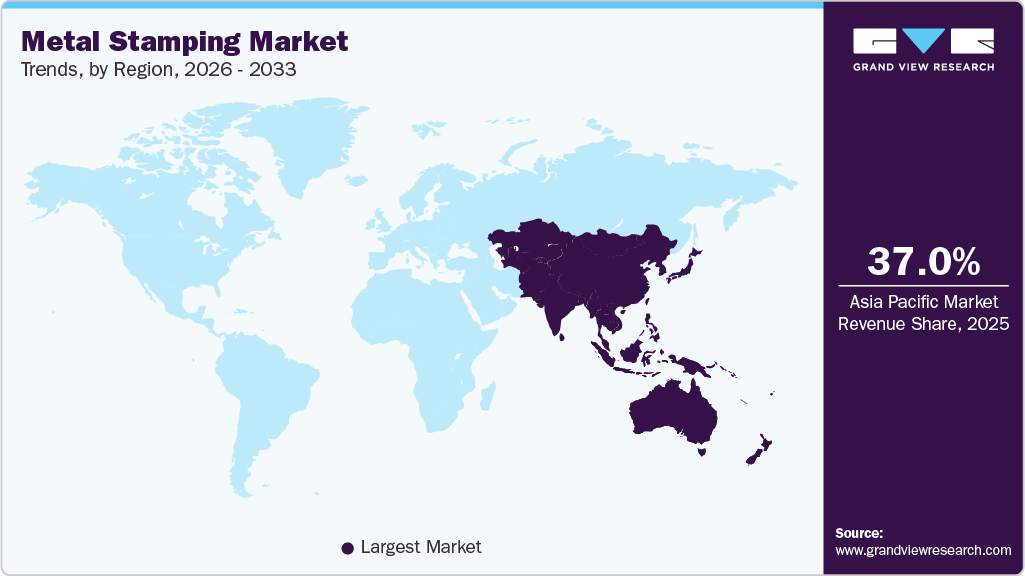

- Asia Pacific held the largest share of over 37.0% in 2025 of the global metal stamping market.

- The metal stamping market in the Asia Pacific is expected to grow at a substantial CAGR of 6.1% from 2026 to 2033.

- Based on process, blanking held the largest share of over 32.0% in 2025 of the global metal stamping market.

- Based on applications, consumer electronics is expected to register the fastest growth rate of 6.2% across the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 257.26 Billion

- 2033 Projected Market Size: USD 373.85 Billion

- CAGR (2026-2033): 5.0%

- Asia Pacific: Largest market in 2025

Growth in lightweight vehicle production is encouraging manufacturers to adopt advanced stamping technologies that enable the production of complex shapes with consistent dimensional accuracy. Sustainability has emerged as a significant growth catalyst for the metal stamping market, as OEMs across the automotive & transportation, consumer appliances, and industrial sectors strive for environmentally responsible manufacturing. Stamped metal components support circularity because they are fully recyclable, and the production process generates minimal scrap, much of which is reused in the value chain. The increasing adoption of lightweight metals, such as aluminum and high-strength steel, is helping manufacturers reduce carbon emissions by improving fuel efficiency and lowering material usage. Global regulations on sustainability and waste reduction are accelerating the shift toward greener stamping processes, including the use of energy-efficient presses, reduced lubrication consumption, and the incorporation of recycled metal feedstock.

Technological advancements are reshaping metal stamping capabilities through the integration of automation, servo-press technology, and simulation-based die design. Smart stamping facilities now deploy robotics, in-die sensing, and AI-enabled quality inspection to achieve zero-defect production and higher productivity. Servo stamping enables the creation of deeper, more complex forms with reduced spring-back and greater material precision, allowing for sophisticated geometries in EV body structures, aerospace components, and compact electronic housings. Innovations in tooling, such as high-speed progressive dies and 3D-printed dies, further shorten lead times and enhance design flexibility, positioning technology as a core enabler of next-generation metal stamping solutions.

Drivers, Opportunities & Restraints

The automotive & transportation sector remains the largest consumer of metal stamping worldwide, with applications spanning body-in-white structures, closures, transmission systems, braking assemblies, seating frames, and interior brackets. In 2025, global vehicle production, encompassing passenger cars, commercial vehicles, two-wheelers, and off-road machinery, continues to recover and expand, supporting consistent demand for precision-stamped components. Automakers are adopting lightweighting strategies to improve efficiency and meet increasingly stringent emission norms, which in turn increases the use of high-strength steel, aluminum, and advanced stamping technologies.

The availability of substitutes, particularly advanced polymers and composite materials, continues to pose a structural restraint on the metal stamping market. Automotive & Transportation OEMs are increasingly prioritizing lightweighting strategies to meet stringent fuel-efficiency and emission standards, including evolving Corporate Average Fuel Economy (CAFE) requirements. As a result, manufacturers are actively replacing conventional stamped metal components with polymers that offer comparable performance at significantly lower weight, directly affecting long-term metal stamping demand.

Additive manufacturing (AM) continues to create strong growth opportunities for the metal stamping industry, particularly as manufacturers seek alternatives that reduce waste, optimize energy consumption, and lower labor intensity. AM enables the production of complex, lightweight, and small-batch components that are traditionally difficult or costly to achieve through conventional stamping. As global R&D investments accelerate in 2025, industries are increasingly integrating AM technologies to complement and enhance metal forming operations.

Process Insights

Based on process, blanking held the largest share of over 32.0% in 2025 of the global metal stamping market. Blanking holds the largest share in the metal stamping process landscape due to its critical role in producing accurately shaped metal pieces at high speed and low cost. It enables manufacturers to generate base components with precise dimensions and clean edges, serving as the foundational step for automotive & transportation body panels, appliance enclosures, EV battery casings, and electronic housing. Its compatibility with a wide range of metals, including aluminum, stainless steel, copper, and high-strength steel, along with suitability for progressive die stamping, makes blanking indispensable for mass production. The growing shift toward lightweight vehicles and compact electronics continues to drive demand for high-accuracy blanking operations in both OEM and tier supplier environments.

The remaining stamping processes play equally essential roles across end-use applications by delivering shape, functionality, and strength to components after blanking. Bending is widely used in automotive & transportation structural parts and electrical housing, where angular forms and rigid support are required. Embossing enhances both aesthetics and functionality by adding patterns, text, and textures to appliance panels, fuel caps, and interior automotive & transportation trims. Coining supports ultra-tight tolerances and edge finishing for precision parts used in medical devices, connectors, and microelectronics, while flanging strengthens edges for assembly and fastening in chassis frames and household equipment. Together, these value-added processes complement blanking, allowing manufacturers to deliver complete parts that meet structural, mechanical, and visual specifications across diverse applications.

Application Insights

Based on applications, consumer electronics is expected to register the fastest growth rate of 6.2% across the forecast period. The automotive and transportation sector continues to dominate the metal stamping market, driven by the extensive use of stamped components in vehicle body panels, structural frames, transmission systems, exhaust assemblies, and safety reinforcements. The transition toward electric and hybrid vehicles has further intensified demand for lightweight and high strength stamped parts to enhance battery protection, improve crashworthiness, and optimize vehicle weight. Automakers favor stamping because it enables large-scale production with consistent dimensional accuracy and cost efficiency, making it essential across OEM and Tier-1 manufacturing networks worldwide.

Industrial machinery relies heavily on metal stamping for fabricating gears, brackets, housing, and mechanical supports that must withstand high mechanical loads and harsh operating environments. In the aerospace industry, stamping has gained momentum due to the growing demand for lightweight alloy parts that enhance fuel efficiency and structural safety, including brackets, shielding plates, and interior fittings. Building & construction also adopts stamped components such as roofing fixtures, door and window frames, and fastening systems, where durability and long service life are critical for structural applications.

In consumer electronics and electrical components, stamping plays a crucial role in producing micro-precision parts, such as connectors, casings, thermal management plates, and electromagnetic shielding modules, which are essential in compact devices. The telecommunications industry is increasingly adopting metal stamping for high-density electrical contact systems, antenna frames, and protective housing to support the expansion of 5G infrastructure and high-speed data transmission. Other applications, including household equipment, medical devices, and renewable energy hardware, continue leveraging stamping due to its ability to provide repeatable quality, thin-profile parts, and tight tolerances suitable for both compact and performance-critical products.

Regional Insights

Housing investments remain a priority across North America. In 2024, Canada reinforced its infrastructure and housing commitments with the USD 4.42 billion Canada Housing Infrastructure Fund, which aims to accelerate the construction and upgrading of residential units nationwide. Meanwhile, Mexico is required to invest approximately 4% of its GDP annually to build nearly 800,000 housing units per year over the next two decades.

U.S. Metal Stamping Market Trends

Residential construction, particularly single-family units, is a key driver of metal stamping consumption. Despite economic uncertainties and stringent mortgage requirements, the demand for well-maintained single-family rental properties is increasing as a growing population opts for renting over homeownership. Monthly single-family construction in 2023 rose steadily from 823 units in January to 1,027 units in December, demonstrating robust sectoral activity.

Asia Pacific Metal Stamping Market Trends

Asia Pacific held the largest share of over 37.0% in 2025 of the global metal stamping market. The automotive & transportation industry is one major contributor to metal stamping demand in the region. The Asia Pacific region leads global vehicle production, with China, India, and Japan accounting for over 60% of the regional output. Electric vehicles (EVs) are gaining prominence, particularly in China, where sales of over 7.5 million EVs were recorded in 2024, up from 6 million in 2023. Governments are supporting EV adoption through incentives, tax benefits, and infrastructure development, creating a rising need for lightweight stamped components such as chassis parts, body panels, and battery enclosures.

Europe Metal Stamping Market Trends

The construction sector remains a major driver for metal stamping demand in Europe. Despite labor shortages and high wage costs in key cities such as Munich and Dublin in 2024, the industry is benefiting from government initiatives to support infrastructure development, urban expansion, and connectivity projects. The growth in residential, commercial, and industrial construction activities is expected to sustain demand for metal stamping components, particularly in structural and finishing applications.

Key Metal Stamping Company Insights

Some of the key players operating in the market include AAPICO Hitech, Acro Metal Stamping, Clow Stamping, and Others.

-

AAPICO Hitech Public Company Limited was established in 1996 and is headquartered in Ayutthaya, Thailand. It was listed on the Stock Exchange of Thailand in 2002. The company’s primary businesses include OEM auto parts manufacturing, car dealerships, and IoT connectivity and mobility solutions. OEM auto parts manufacturing is further segmented into stamped or pressed parts, forged & machined parts, and plastic parts & plastic fuel tanks.

-

Acro Metal Stamping was founded in 1936 and incorporated in 1942. The company is headquartered in Wisconsin, U.S. It is engaged in metal stamping and specializes in producing progressive and compound dies. The company provides metal stamping sheets made of various materials, including copper, plastic, and brass; deep drawn enclosures & cans made from a variety of materials, including steel, aluminum, brass, nickel alloys, copper, and stainless steel; electrical components; and washers.

-

Clow Stamping Company was established in 1970 and is headquartered at Merrifield, Minnesota, U.S. The precision stamping and fabrication company specializes in the fabrication and stamping of metal components for the hydraulic, commercial refrigeration, exercise equipment, light & heavy equipment, recreational, and agricultural industries. It also offers a range of additional services, including weldments, fabrication, assemblies, hardware attachment, parts washing, special packaging, and value-added machining, to its customers.

Key Metal Stamping Companies:

The following are the leading companies in the metal stamping market. These companies collectively hold the largest market share and dictate industry trends.

- AAPICO Hitech Public Company Limited

- Acro Metal Stamping

- Caparo

- Clow Stamping Company

- D&H Industries, Inc.

- Rock Fall (UK) LTD

- Ford Motor Company

- Gestamp

- Goshen Stamping Company

- Interplex Holdings Pte. Ltd.

- Kenmode, Inc

- Klesk Metal Stamping Co

- Manor Tool & Manufacturing Company

- Nissan Motor Co., Ltd.

- Tempco Manufacturing Company, Inc.

Recent Developments

-

Gestamp inaugurated its second Gestamp Technology Institute (GTI) in February 2025, in Mexico, marking a significant step in the company's commitment to developing technical talent. This new institute is part of Gestamp's strategic efforts to strengthen its leadership in the automotive & transportation industry and contribute to the advancement of future mobility solutions.

-

In June 2024, Martinrea International Inc., a global automotive & transportation supplier specializing in engineered lightweight structures and propulsion systems, announced an investment of approximately USD 35 million to expand its 100,000-square-foot facility in Ontario. The expansion will include a new SIMPAC 3000 metric ton stamping press and is expected to be completed by early 2025.

-

In March 2023, Toyota Boshoku Tennessee, LLC (TBTN), a subsidiary of Toyota Boshoku America, focused on metal stamping for the automotive & transportation sector, will expand its Tennessee facility. With an investment of USD 54.4 million, the company will expand its metal stamping plant by 87,000 square feet.

Metal Stamping Market Report Scope

Report Attribute

Details

Market Definition

The market size represents the annual sales value of metal-stamped components/products manufactured using various processes, including blanking, embossing, bending, coining, flanging, and others, all of which fall under the metal stamping category.

Market size value in 2026

USD 266.27 billion

Revenue forecast in 2033

USD 373.85 billion

Growth rate

CAGR of 5.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD Billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Process, Press Type, Thickness, Application, and Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Germany; UK; Italy; China; India; Japan

Key companies profiled

Acro Metal Stamping; Manor Tool & Manufacturing Company; D&H Industries, Inc.; Kenmode, Inc.; Klesk Metal Stamping Co; Clow Stamping Company; Goshen Stamping Company; Tempco Manufacturing Company, Inc.; Interplex Holdings Pte. Ltd.; CAPARO; Nissan Motor Co., Ltd; AAPICO Hitech Public Company Limited; Gestamp; Ford Motor Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Stamping Market Report Segmentation

This report forecasts global, country, and regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global metal stamping market report by process, press type, thickness, application and region.

-

Process Outlook (Revenue, USD Billion, 2021 - 2033)

-

Blanking

-

Embossing

-

Bending

-

Coining

-

Flanging

-

Others

-

-

Press Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Mechanical Press

-

Hydraulic Press

-

Servo Press

-

Others

-

-

Thickness Outlook (Revenue, USD Billion, 2021 - 2033)

-

Less than & up to 2.5 mm

-

More than 2.5 mm

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Automotive & Transportation

-

Industrial Machinery

-

Consumer electronics

-

Aerospace

-

Electrical & Electronics

-

Building & Construction

-

Telecommunications

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2021 - 2033)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global metal stamping market size was estimated at USD 257.26 billion in 2025 and is expected to reach USD 266.27 billion in 2026.

b. The global metal stamping market is projected to grow at a compound annual growth rate (CAGR) of 5.0% from 2026 to 2033, reaching USD 373.85 billion by 2033.

b. Based on process, blanking held the largest share of over 32.0% in 2025 of the global metal stamping market.

b. Some of the key vendors in the global metal stamping market are Acro Metal Stamping, Manor Tool & Manufacturing Company, D&H Industries, Inc., Kenmode, Inc., Klesk Metal Stamping Co., Clow Stamping Company, Goshen Stamping Company, Tempco Manufacturing Company, Inc., and Interplex Holdings Pte. Ltd.; CAPARO; Nissan Motor Co., Ltd; AAPICO Hitech Public Company Limited; Gestamp; Ford Motor Company, and others.

b. The global metal stamping market is driven by rising demand for precision-engineered and lightweight metal components across automotive & transportation, consumer electronics, and industrial machinery sectors. Surging EV production, miniaturization in electronics, and automation of manufacturing lines are accelerating the adoption of stamping for cost-efficient, high-volume output.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.