- Home

- »

- Next Generation Technologies

- »

-

Additive Manufacturing Market Size Report, 2030GVR Report cover

![Additive Manufacturing Market Size, Share & Trends Report]()

Additive Manufacturing Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Printer Type, By Technology, By Software, By Application, By Vertical, By Material, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-922-9

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Additive Manufacturing Market Summary

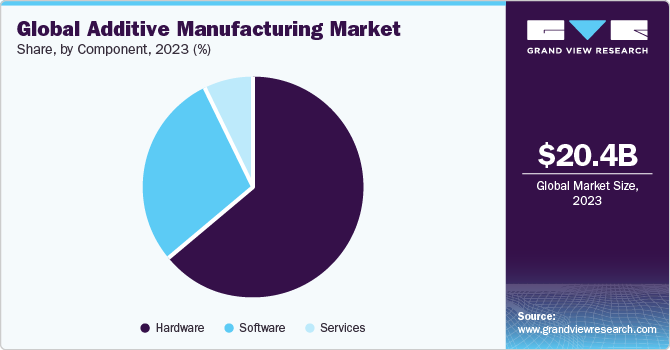

The global additive manufacturing market size was estimated at USD 20.37 billion in 2023 and is projected to reach USD 88.28 billion by 2030, growing at a CAGR of 23.3% from 2024 to 2030. A total of 2.2 million units of 3D printers were shipped globally in 2021 and the unit shipments are expected to reach 21.5 million units by 2030.

Key Market Trends & Insights

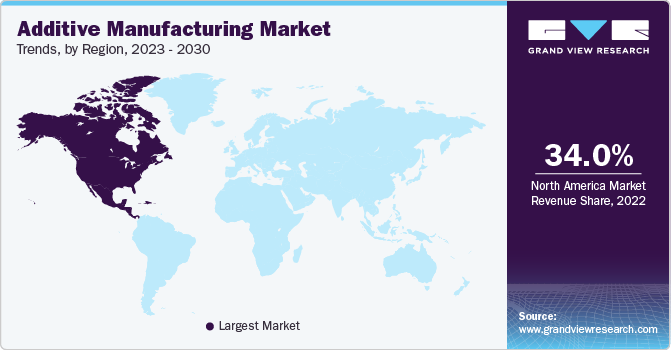

- North America was the largest revenue generating market in 2023.

- Country-wise, Brazil is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, hardware accounted for a revenue of USD 12,960.9 million in 2023.

- Hardware is the most lucrative printer component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 20.37 Billion

- 2030 Projected Market Size: USD 88.28 Billion

- CAGR (2024-2030): 23.3%

- North America: Largest market in 2023

Factors such as the growing demand for prototyping applications from various industries and industry verticals, particularly healthcare, automotive, and aerospace & defense, and the aggressive research and development in 3D printing are expected to drive the growth of the market.

Additive Manufacturing (AM) is different from the subtractive method of production, which envisages grinding out unnecessary material from a block of material. The use of additive manufacturing in industrial applications usually refers to 3D printing. Additive manufacturing involves a layer-by-layer addition of material to form an object while referring to a three-dimensional file with the help of a 3D printer and 3D printer software. A suitable additive manufacturing technology is selected from the available set of technologies depending upon the application.

The deployment of additive manufacturing includes providing installation services, offering consultation solutions and customer support, and handling various aspects related to copyrights, licensing, and patenting. Additive manufacturing is helping manufacturers in prototyping, designing the structure and end products, modeling, and shortening the time to market. As a result, the production expenses have reduced considerably, and manufacturers are in a better position to offer products at reasonable prices. The adoption of 3D printers is expected to increase as a result of these benefits.

However, misconceptions among small- and medium-scale manufacturers about the prototyping processes are hindering the adoption of additive manufacturing. These manufacturers are deliberating before considering investments in prototyping as accountable investments rather than trying to realize the benefits of prototyping. The general notion is that prototyping is merely an expensive phase before manufacturing. Such perceptions and the looming lack of technical knowledge and standard process controls are expected to restrain the growth of the market.

The outbreak of the COVID-19 pandemic has taken a severe toll on the overall economy, and subsequently, the global market for additive manufacturing. The lockdowns and the restrictions on the movement of people and goods imposed by various governments worldwide as part of the efforts to arrest the spread of coronavirus typically disrupted the logistics and supply chain, triggered a shortage of labor, and affected the production of additive manufacturing printers. These lockdowns and restrictions particularly restrained the growth of the market during Q1/2020 and Q2/2020.

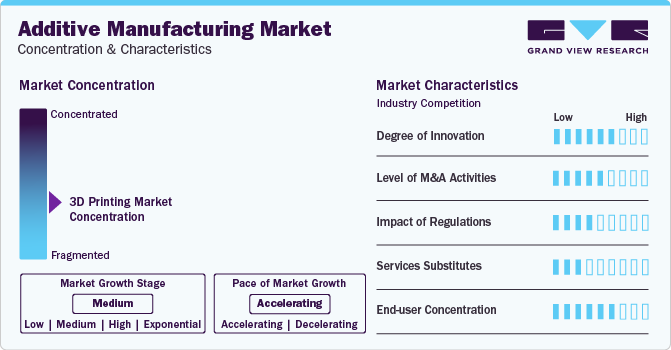

Market Concentration & Characteristics

The additive manufacturing market growth stage is high. The additive manufacturing market has witnessed a significant degree of innovation, marked by continuous advancements in printing materials, printing technologies, and the expansion of applications across diverse industries. Ongoing research and development efforts have led to the introduction of more sophisticated and efficient 3D printers, enabling the production of complex and functional objects with improved speed and precision. The dynamic landscape reflects a continuous quest for innovation, with additive manufacturing increasingly positioned as a transformative technology driving advancements in manufacturing and design processes.

The target market is also characterized by a high level of mergers & acquisitions by the leading players. The high level of mergers and acquisitions (M&A) in the additive manufacturing market is driven by the pursuit of market consolidation and strategic expansion. Companies engage in these transactions to access complementary technologies, broaden their product portfolios, and achieve economies of scale. The dynamic nature of the industry, coupled with the need for innovation and global competitiveness, motivates businesses to pursue mergers and acquisitions as a strategic approach to enhance their position in the evolving additive manufacturing market.

The additive manufacturing market faces regulatory scrutiny, with authorities focusing on ensuring the safety and quality of printed products, especially in industries like healthcare, where medical devices are produced. Impactful regulations play a role in shaping industry standards and influencing the adoption of additive manufacturing technologies, particularly in fields where stringent quality control is paramount. As additive manufacturing continues to advance, ongoing regulatory developments and adherence to standards become crucial factors in determining the market's trajectory and acceptance across various sectors.

Substitutes for Additive Manufacturing in the manufacturing sector include traditional manufacturing methods like injection molding and CNC machining, offering alternatives for certain production needs. Additionally, rapid prototyping services using alternative technologies such as stereolithography or selective laser sintering may serve as substitutes in specific applications. Emerging additive manufacturing technologies and advancements in traditional manufacturing methods also contribute to the evolving landscape of alternatives for the Additive Manufacturing market.

End user concentration is one of the significant factors in the Additive Manufacturing Market. The end-user industry concentration in the Additive Manufacturing market exhibits diversification, with significant adoption observed in sectors such as healthcare, aerospace, and automotive. Healthcare applications include the production of customized medical implants, while aerospace leverages Additive Manufacturing for lightweight and complex components. In the automotive sector, Additive Manufacturing is increasingly utilized for prototyping, production tooling, and the creation of lightweight structures, showcasing a broad spectrum of applications across various industries

Printer Type Insights

The industrial 3D printer segment dominated the market in 2022 and accounted for a revenue share of more than 76%. Industrial 3D printers are being adopted extensively across various industries and industry verticals, including automotive, electronics, aerospace & defense, and healthcare, among others, for some of the common applications, such as prototyping, designing, and tooling. Given the extensive adoption of additive manufacturing for prototyping, designing, and tooling, the industrial 3D printer segment is expected to continue dominating the market over the forecast period.

Desktop 3D printers were initially limited to hobbyists and small enterprises. However, desktop 3D printers are increasingly being used for household and domestic purposes. Schools, educational institutes, and universities are also adopting desktop 3D printers for technical training and research purposes. Smaller businesses are typically adopting desktop 3D printers and diversifying their business operations to offer additive manufacturing and other related services. Hence, the demand for desktop printers is expected to rise significantly over the forecast period.

Technology Insights

The stereolithography segment dominated the market in 2022 and accounted for a revenue share of more than 10%. Stereolithography happens to be one of the oldest and most conventional printing technologies. Apart from ease of operations, there are several other advantages associated with stereolithography, which are encouraging the adoption of the technology. However, advances in technology and aggressive research & development activities being pursued by industry experts and researchers are opening opportunities for several other efficient and reliable technologies.

Apart from stereolithography, there are several other additive manufacturing technologies used in the market. They include fuse deposition modeling (FDM), direct metal laser sintering (DMLS), selective laser sintering (SLS), inkjet printing, polyjet printing, laser metal deposition, and electron beam melting (EBM), digital light processing (DLP), laminated object manufacturing, and others. While FDM is also adopted significantly; DLP, EBM, inkjet printing, and DMLS are also gaining significant traction as these technologies are applicable in specialized additive manufacturing processes.

Software Insights

The design software segment dominated the market in 2022 and accounted for a revenue share of more than 36%. The segment is also expected to continue dominating the market over the forecast period. Design software is used for constructing the designs of the object to be printed, particularly in the automotive, aerospace & defense, and construction & engineering industries. There are several advantages associated with design software. One of the advantages is the capability of design software to serve as a bridge between the object to be printed and the printer’s hardware.

Apart from design software, there are other different types of software used in the market. They include scanning software, printer software, and inspection software. The demand for scanning software is poised for significant growth over the forecast period in line with the growing trend of scanning objects and storing scanned documents. The ability to store the scanned images of the objects irrespective of their sizes and dimensions for 3-dimensional printing is expected to drive the demand for scanning software. The scanning software segment is expected to grow at the highest CAGR of 24% from 2023 to 2030.

Application Insights

The prototyping segment dominated the market in 2022 and accounted for a revenue share of more than 54%. The prototyping process is used extensively across several industries and industry verticals. Incumbents of the automotive and aerospace & defense industries particularly use prototyping to precisely design and develop parts, components, and complex systems. Prototyping allows manufacturers to achieve higher accuracy and develop reliable end products. Hence, the prototyping segment is expected to continue dominating the market over the forecast period.

Other applications considered as part of the study include tooling and functional parts. Functional parts include smaller joints and other metallic hardware required for connecting components. The accuracy and precise sizing of these functional parts are of paramount importance while developing machinery and systems. As a result, incumbents of several industries and industry verticals are putting a strong emphasis on designing and building functional parts with utmost precision. Hence, the functional parts segment is expected to grow at a significant CAGR of 24% from 2023 to 2030.

Vertical Insights

The automotive segment dominated the market in 2022 and accounted for a revenue share of more than 23%. Based on vertical, the market has been further segmented into industrial additive manufacturing and desktop additive manufacturing. The automotive segment falls under industrial additive manufacturing along with aerospace & defense and healthcare, among others. The healthcare segment is poised for significant growth in line with the growing adoption of additive manufacturing to develop artificial tissues and muscles replicating natural tissues for use in replacement surgeries.

The desktop additive manufacturing segment has been further segmented into educational purposes, fashion & jewelry, objects, dental, food, and others. The dental, fashion & jewelry, and food segments are anticipated to contribute significantly to the growth of the desktop additive manufacturing segment over the forecast period. The dental segment accounted for the largest revenue share in 2021 and is expected to continue dominating the segment over the forecast period. Additive manufacturing is also gaining traction in imitation jewelry, miniatures, art & craft, and clothing & apparel.

Component Insights

The hardware segment dominated the market in 2022 and accounted for a revenue share of more than 63%. The strong emphasis manufacturing entities continued to put on pursuing advanced manufacturing practices and rapid prototyping allowed the hardware segment to dominate the market. The hardware segment is poised for significant growth over the forecast period owing to various factors, such as rapid industrialization, the growing demand for consumer electronics products, the continued development of civil infrastructure, rapid urbanization, and optimized labor costs.

Based on component, the market has been further segmented into hardware, software, and services. Technology proliferation, the growing adoption of rapid manufacturing processes, such as rapid prototyping, and the widening application portfolio of additive manufacturing across various industries and industry verticals are expected to propel the demand for all the components associated with additive manufacturing. The technology allows layer-by-layer procedural manufacturing of three-dimensional objects that are connected through a system comprising applicable digital files.

Material Insights

The metal segment dominated the market in 2022 and accounted for a revenue share of more than 54%. Looking forward, the metal segment is anticipated to continue dominating the market and expand at the highest CAGR of more than 28% over the forecast period. Based on material, the market has been further segmented into polymer, metal, and ceramic. The polymer segment accounted for the second-largest revenue share in 2021. On the other hand, the ceramic segment is poised for significant growth over the forecast period.

Although additive manufacturing using ceramic is a relatively newer technique, the R&D initiatives market players are pursuing for AM technologies, such as FDM and inkjet printing, are driving the demand for ceramic AM. Opting for the AM methodology can allow manufacturers to produce complicated, delicate parts at greater ease and with high precision and accuracy. Moreover, enhanced material usage is also allowing manufacturers to reduce their production expenditures significantly. All these benefits and advantages associated with the technology are driving the adoption of AM.

Regional Insights

North America dominated the additive manufacturing market in 2022 and accounted for a revenue share of more than 34%. North America is home to developed economies, such as the U.S. and Canada. These economies are considered among the prominent and early adopters of the latest technologies. On the other hand, Europe emerged as the second-largest regional market. Europe happens to be the largest region in terms of geographical footprint. Europe is also home to several companies holding strong technological expertise in additive manufacturing.

Asia Pacific is poised for remarkable growth. The regional market is expected to grow at the highest CAGR over the forecast period. The growth of the regional market can be attributed particularly to the continued developments and upgrades being pursued by the incumbents of the manufacturing industry across the region. Asia Pacific is emerging as a manufacturing hub for the automotive, healthcare, and consumer electronics industries. Rapid urbanization is also expected to play a vital role in driving the adoption of three-dimensional printing across the region over the forecast period.

Key Companies & Market Share Insights

Some of the key players operating in the market include 3D Systems, Inc. and Materialise among others.

-

3D Systems, Inc. is the U.S.-based technology company. The company is involved in the development of Desktop Additive Manufacturing products and services such as 3D printers, materials, software, 3D scanners and virtual surgical simulators and haptic design tools. Additionally, the company serves its customers with 3D solutions to manufacture and design complex and unique parts, produce parts locally to reduce the lead time, and eliminate expensive tooling, among others. The company caters to numerous industries and verticals such as aerospace & defense, automotive, healthcare, educational, durable goods, and entertainment.

-

Materialise is a Belgium-based technology company operating in the additive manufacturing industry. The company is actively involved in the field of Desktop Additive Manufacturing to develop a broad range of software solutions, Desktop Additive Manufacturing services, and engineering. The company primarily caters to the industries such as healthcare, aerospace, automotive, consumer goods, and art & design.

-

madeinspace.us and Voxeljet AG are some of the emerging market participants in the target market.

-

madeinspace.us is an American company engaged in the space-based Desktop Additive Manufacturing technology. The company specializes in the engineering, designing, and development of the 3D printers and solutions. The company’s 3D printers are majorly used in spatial environments such as microgravity and vacuum conditions.

-

Voxeljet AG is a German technology company indulged in the mechanical and industrial engineering practices. The company is a manufacturer of three-dimensional printing systems. In addition, the company is operative in the on-demand manufacturing services of models & molds for the metal casting purposes worldwide. The company’s 3D printers operate based on the technologies such as powder binding and additive manufacturing to develop parts by utilizing different sets of materials such as particulate materials or proprietary chemical binding agents. Its major product offerings consist Desktop Additive Manufacturing a broad range of Desktop Additive Manufacturing systems and Desktop Additive Manufacturing materials.

Key Additive Manufacturing Companies:

- 3D Systems, Inc.

- 3DCeram

- Arcam AB

- Autodesk, Inc.

- Canon, Inc.

- Dassault Systemes

- EnvisionTec, Inc.

- EOS (Electro Optical Systems) GmbH

- ExOne

- GE Additive

- HP Inc.

- madeinspace.us

- Materialise NV

- Optomec, Inc.

- Organovo Holdings Inc.

- Proto Labs, Inc.

- Shapeways, Inc.

- Stratasys Ltd.

- Tiertime

- Voxeljet AG

Recent Developments

-

In March 2023, 3D Systems, Inc. announced the launch of NextDent Cast and NextDent Base, two new printing materials, and NextDent LCD1, a printing platform. The materials are designed to enhance material properties, and the printing platform is an easy-to-use small-format printer. With these launches, the company aimed to aid its customers in accelerating additive manufacturing adoption.

-

In November 2023, Autodesk Inc. announced the launch of Autodesk AI. This new technology is available in Autodesk products and is designed to provide customers with generative capabilities and intelligent assistance. With the launch of this new technology in Autodesk products, the company aimed to minimize errors by automating repetitive tasks and the needs of its customers.

-

In February 2022, Dassault Systèmes has announced a strategic partnership with Cadence Design Systems, Inc. to provide integrated solutions for the development of high-performance electronic systems to enterprise customers in a variety of vertical markets, such as high tech, industrial equipment, and transportation and mobility, aerospace and defense, and healthcare.

Additive Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 20,369.7 million

Revenue forecast in 2030

USD 88.28 billion

Growth rate

CAGR of 23.3% from 2023 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, printer type, technology, software, application, vertical, material, region

Regional scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, South Korea, Singapore, Brazil

Key companies profiled

Stratasys, Ltd., Materialise, EnvisionTec, Inc., 3D Systems, Inc., GE Additive, Autodesk Inc., madeinspace.us, Canon Inc., and Voxeljet AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Additive Manufacturing Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. Additionally, the report covers shipment estimates and forecasts as well as ASP qualitative analysis from 2017 to 2030. For this study, Grand View Research has segmented the global additive manufacturing market report based on component, printer type, technology, software, application, vertical, material, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Printer Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Desktop 3D Printer

-

Industrial 3D Printer

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Stereolithography

-

Fuse Deposition Modeling

-

Selective Laser Sintering

-

Direct Metal Laser Sintering

-

Polyjet Printing

-

Inkjet Printing

-

Electron Beam Melting

-

Laser Metal Deposition

-

Digital Light Processing

-

Laminated Object Manufacturing

-

Others

-

-

Software Outlook (Revenue, USD Million, 2017 - 2030)

-

Design Software

-

Inspection Software

-

Printer Software

-

Scanning Software

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Prototyping

-

Tooling

-

Functional Parts

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Industrial Additive Manufacturing

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Consumer Electronics

-

Power & Energy

-

Others

-

-

Desktop Additive Manufacturing

-

Educational Purpose

-

Fashion & Jewelry

-

Objects

-

Dental

-

Food

-

Others

-

-

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Polymer

-

Metal

-

Ceramic

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Singapore

-

-

South America

-

Brazil

-

-

MEA

-

Frequently Asked Questions About This Report

b. The global additive manufacturing market size was estimated at USD 13.84 billion in 2021 and is expected to reach USD 16.75 billion in 2022.

b. The global additive manufacturing market is expected to grow at a compound annual growth rate of 20.8% from 2022 to 2030 to reach USD 76.16 billion by 2030.

b. The metal segment led the global additive manufacturing market and accounted for more than 50.6% share of the global revenue in 2021.

b. Some key players operating in the additive manufacturing market include Stratasys, Ltd.; Materialise; EnvisionTec, Inc.; 3D Systems, Inc.; GE Additive; Autodesk Inc.; Made In Space; Canon Inc.; and Voxeljet AG.

b. The stereolithography segment led the global additive manufacturing market and accounted for more than an 8.9% share of the global revenue in 2021.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.