- Home

- »

- Healthcare IT

- »

-

mHealth Market Size, Share & Growth Analysis Report 2030GVR Report cover

![mHealth Market Size, Share & Trends Report]()

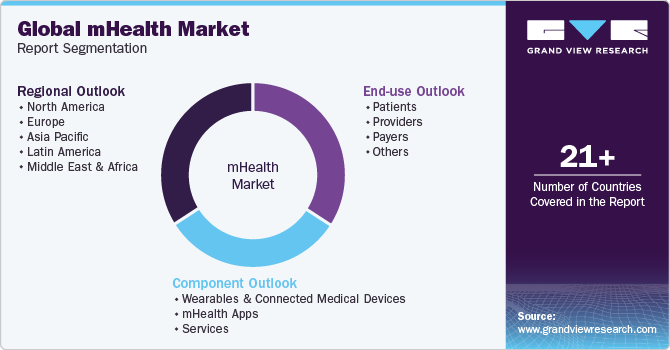

mHealth Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Wearables & Connected Wearable Devices, mHealth Apps, Services), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-076-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

mHealth Market Summary

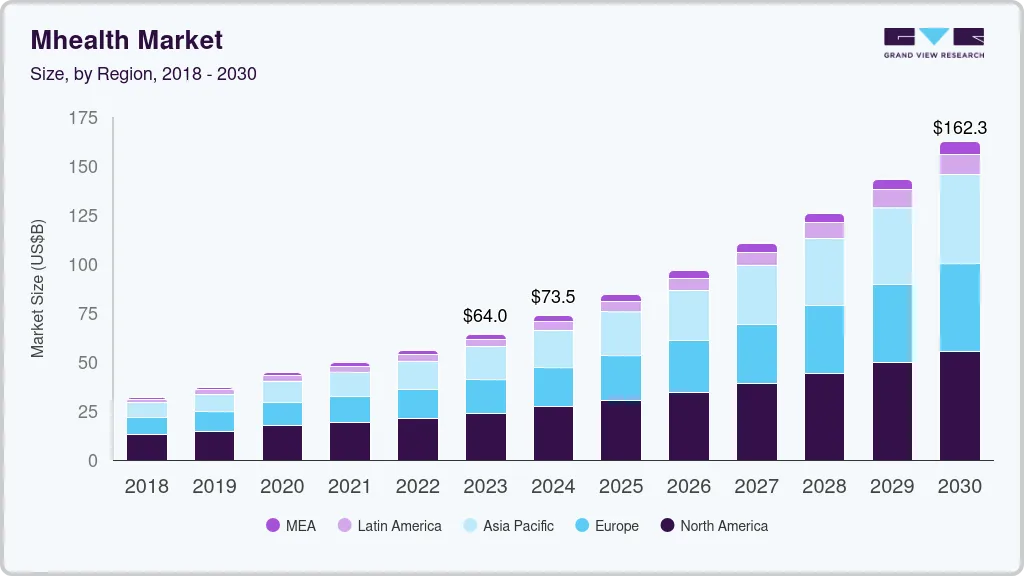

The global mHealth market size was estimated at USD 62.7 billion in 2023 and is expected to reach USD 158.3 billion by 2030, growing at a CAGR of 14.1% from 2024 to 2030. The demand for mHealth apps is increasing with the growing use of digital health services for remote patient monitoring.

Key Market Trends & Insights

- North America dominated the global mHealth market and accounted for the largest revenue share of nearly 40% in 2023.

- The U.S. dominated North America’s mHealth market with a market share of above 85%.

- Based on component, the mHealth apps segment accounted for the largest revenue share of over 50% in 2023.

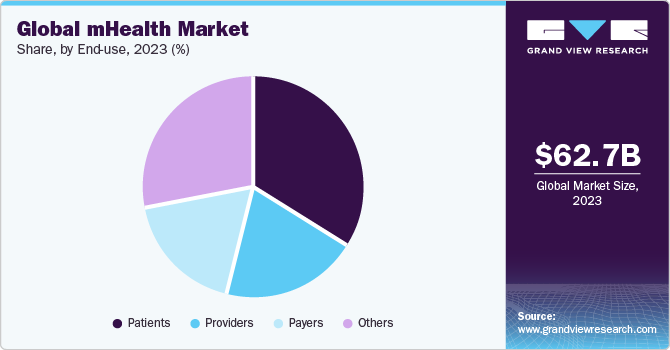

- Based on end-use, the patient segment held the largest share in 2023 and is expected to witness the fastest CAGR of 15.2% from 2024 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 71.9 Billion

- 2030 Projected Market Size: USD 158.3 Billion

- CAGR (2024-2030): 14.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

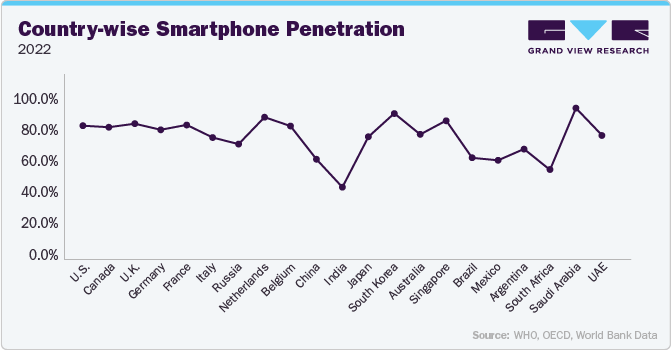

People are becoming more aware of the benefits of mHealth solutions, and governments are also promoting remote digital healthcare, which is expected to boost the market further. The widespread use of smartphones among teenagers and adults is also anticipated to drive the growth of mHealth platforms and technologies. For instance, as per The Mobile Economy 2023, smartphone penetration was 76% in 2022 and is expected to reach 92% by 2030.

The rising demand for patient-centric care drives the adoption of mHealth apps and services globally. The healthcare industry is shifting its focus from provider-centric care to patient-centric care. mHealth solutions empower patients to actively participate in managing their health by providing them with access to their medical records, medication reminders, wellness programs, and remote consultations. The demand for personalized, convenient, and accessible healthcare services drives the adoption of mHealth solutions globally. The growing utilization of mobile health (mHealth) applications for diverse purposes is significantly fueling the expansion of the mHealth market.

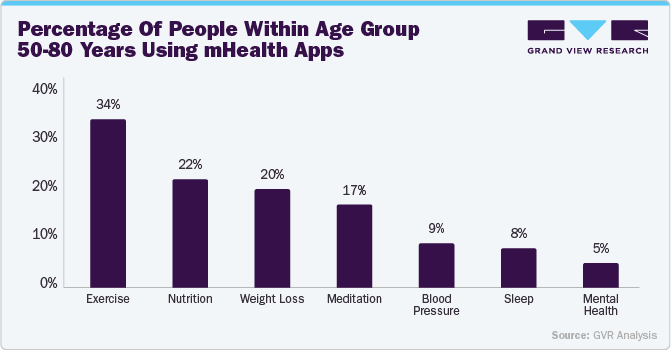

Some statistics related to mHealth applications

Vicert, a software development company, states that while mHealth technologies are prevalent, their use significantly varies among different population groups. As of February 2022, there were over 350,000 available apps, and adults between the ages of 50 and 80 years were their primary users. A survey showed that 3 out of 10 adults have used at least one health app, 16% have used them in the past and 56% are yet to utilize them.

Favorable government initiatives, including awareness campaigns and research funding for healthcare IT, to improve medical care accessibility are expected to drive the mHealth services market growth. According to data published by GenomSys in May 2023, mHealth initiatives in Italy have demonstrated the efficacy of using mobile devices to deliver health solutions cost-effectively. Some of the mHealth services applications using mobile devices include:

-

Patients utilize smartphones for health education and to communicate with healthcare professionals.

-

Healthcare providers can easily access updated clinical guidelines, collaborate with peers, analyze data, receive diagnostic support, and engage with patients.

-

Adherence and disease management are facilitated through smart alerts, which notify physicians of noncompliance with prescribed medications based on remote monitoring data, prompting timely intervention.

Moreover, mHealth services collect patient data to add it to national health information systems. These services serve as remote information tools, primarily on smartphones or tablets, offering support to the healthcare system and aiding in identifying individual & community health needs within clinical settings.

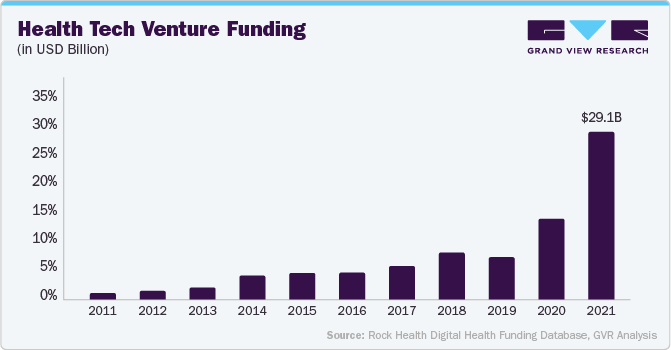

The surge in initiatives and investments supporting mHealth & digital health involves significant backing from venture capitalists, private equity firms, and healthcare organizations. The global health-tech investment landscape witnessed a substantial boost in 2021, reaching over USD 44 billion, which represents a twofold increase compared to the previous year. This influx of capital underscores the growing importance of technological innovation in healthcare. Notably, large tech-enabled platform companies are emerging as key players, offering the potential to enhance hospital and health system efficiencies, rapidly scale operations, and modernize existing systems & delivery models. In addition, these platforms are positioned to play a pivotal role in addressing health equity concerns through a comprehensive and inclusive approach to healthcare delivery.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including industry competition, degree of innovation, level of M&A activities, impact of regulations, and geographic expansion. For instance, the mHealth market is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is high, and the level of M&A activities is also high. The impact of regulations on the market is medium, and the geographic expansion of the market is low.

The global mHealth market is characterized by continuous innovation, with a strong focus on user-friendly telehealth technologies. These advancements aim to simplify the adoption process for both patients and healthcare providers. The widespread use of mobiles and tablets allows convenient access to telemedicine services, health apps, and wearable health tech. Various prominent players are introducing innovative products, solutions, and services to sustain a competitive advantage. For instance, in March 2023, Google introduced an open-source initiative called Open Health Stack, which aims to assist developers in creating health-related applications that integrate AI partnerships to improve cancer screening.

Several companies are involved in merger and acquisition activities. These companies want to expand their reach and explore new territories through M&A deals. For instance, Google, Inc. bought Sound Life Science Services in October 2022. Sound Life Science Services is a small start-up from the University of Washington that created an app to monitor breathing. Google's acquisition has helped them enhance their application by integrating with Sound Life Science's breathing app.

The regulations governing the use of mHealth technologies vary across different countries and regions. However, having a well-structured regulatory framework can positively impact market accessibility, growth, and compliance. For instance, the regulatory landscape for the MEA mHealth market is complex and diverse. This is due to differences in healthcare systems, regulatory priorities, and technological adoption across different countries. Saudi Arabia, the UAE, Qatar, and other key MEA countries have established regulatory frameworks for telemedicine, digital health, and data protection.

The mHealth industry is growing globally due to its potential to improve accessibility, cost-effectiveness, and outcomes. This growth is fueled by established industry leaders expanding into emerging markets and indigenous startups experiencing growth. Companies are expanding by launching facilities or plants in new geographies merging with or acquiring companies based in different locations. For example, Telefonica Tech acquired Incremental, a digital transformation and data analysis company. This acquisition helped both companies increase their scale and offering of Microsoft technologies in the UK.

Component Insights

The mHealth apps segment accounted for the largest revenue share of over 50% in 2023. The segment is also projected to witness the fastest CAGR during the forecast period. The growing reach of the internet & smartphones, coupled with the increasing adoption of mobile health applications among medical practitioners & patients, contributes significantly to the substantial market valuation of this segment. Moreover, the expanding recognition of mobile health apps for purposes such as remote patient monitoring, medication management, disease tracking, fitness & wellbeing, women's health, and personal health record management, among others, is also driving growth.

The mHealth services segment is expected to witness the second-fastest CAGR from 2024 to 2030. mHealth services utilize the widespread use of mobile devices to improve healthcare accessibility, delivery, and management. These services include health monitoring apps, wearable devices that track vital signs, and telemedicine platforms enabling remote consultations with healthcare professionals. mHealth technology is crucial in preventive care, chronic disease management, and health education. It encourages proactive engagement in personal well-being, making healthcare more efficient and patient centric.

End-use Insights

The patient segment held the largest share in 2023 and is expected to witness the fastest CAGR of 15.2% from 2024 to 2030, owing to the shift toward patient-centered care and high awareness of managing health among individuals. Patients are increasingly drawn to mHealth due to their convenience and accessibility. With the rise in smartphone usage globally, patients can easily access healthcare services from the comfort of their homes, reducing the need for physical visits to healthcare facilities. For instance, there were 6.8 billion smartphone users worldwide as of 2023, and this number is projected to grow to 7.34 billion by 2025.

The providers segment held a significant market share in 2023 and is expected to maintain this share over the forecast period. This can be attributed to the widespread adoption of innovative technologies, such as telemedicine and digital therapeutics. Healthcare providers are increasingly leveraging digital solutions to offer remote consultations, personalized treatment plans, and evidence-based therapies outside traditional care settings. The integration of digital tools allows providers to deliver more accessible and tailored care, contributing to improved patient outcomes.

Regional Insights

The Mobile Economy 2023 report by the GSM Association reveals that the number of people connected to mobile services stood at 5.4 billion in 2022, and this number is expected to increase to 6.3 billion by 2030, representing 73% of the global population. Also, the use of smartphones is rapidly increasing, with a projected penetration rate of 92% by 2030 from 76% in 2022. In low-income countries, mHealth has gained significant momentum due to the high prevalence of mobile phone usage.

The health app market has also witnessed a significant surge in recent years, with over 350,000 health, medical, and fitness apps available as of 2021. These apps enhance communication between patients and healthcare providers, especially those residing in remote areas. Additionally, physicians' use of mobile devices is also on the rise, with 82% of healthcare providers using mobile phones for patient engagement, according to a BMC Health report. The increasing significance of mobile phones and mHealth in improving health outcomes and patient care drives the market.

North America mHealth Market Trends

North America dominated the global mHealth market and accounted for the largest revenue share of nearly 40% in 2023. Factors such as rapid growth in the use of smartphones, advancements in coverage networks, prevalence of chronic diseases, and in geriatric population are expected to drive mHealth technology & solutions in North America. As per data by the United Health Foundation in 2022, the population of adults aged 65 years & above in the U.S. was nearly 58 million, equivalent to 17.3% of the total population. By 2040, this percentage is expected to rise to 22%.

U.S. mHealth Market Trends

The U.S. dominated North America’s mHealth market with a market share of above 85% owing to the presence of a large number of players operating in various areas, such as mobile & network operations, healthcare management, and software development. Market players are involved in introducing innovative healthcare apps, building network infrastructure, and increasing adoption of various mHealth services in the U.S. As per a Demandsage report, in 2023, around 82.2% of the U.S. population owned smartphones, which can be used to access mHealth apps; these devices accounted for 70% of digital media time in the country. The U.S. is a leading market for mHealth applications across the globe.

Europe mHealth Market Trends

The Europe mHealth market is expected to witness significant growth over the forecast period. An increasing number of mHealth apps and services are being launched in Europe, focusing mainly on monitoring patients with chronic diseases and aiding independent aging solutions. According to Eurostat, in January 2023, the estimated population of the EU was 448.8 million, with 21.3% of it aged 65 years and above. The aging population is expected to drive the demand for mHealth services in chronic care management, diagnostic solutions, and post-acute care management.

Germany mHealth market is one of the largest in Europe, with a significant expenditure on health. According to World Bank statistics, its total healthcare expenditure accounted for 12.8% of GDP in 2021. Furthermore, rising geriatric population and increasing incidence of chronic diseases are expected to drive the market growth in Germany. According to an AARP International report, Germany’s population aged 65 years and above is expected to reach 24 million by 2050, accounting for almost one-third of the total population.

Asia Pacific mHealth Market Trends

Asia Pacific mHealth market is expected to witness the fastest CAGR of 15.2% over the forecast period, owing to the increasing penetration of smartphones & smart wearables and increasing adoption of mHealth services. According to The Mobile Economy 2023 by GSMA, unique mobile subscriptions in Asia Pacific reached 1.73 billion by the end of 2022, estimated to reach 2.11 billion by 2023.

The mHealth market in China is expected to witness significant growth from 2024 to 2030, owing to the rising patient population and increasing internet penetration. According to the data from the China Internet Network Information Center (CNNIC), as of December 2022, China has 1.067 billion internet users, an increase of 35.49 million since December 2021. The internet penetration rate has also increased by 2.6 percentage points, reaching 75.6%.

Middle East & Africa mHealth Market Trends

The mHealth market in the Middle East and Africa (MEA) is expected to witness significant growth in the coming years. The mHealth solutions are transforming healthcare in MEA, driven by the expanding internet connectivity and government initiatives. Telemedicine, mHealth apps, wearable devices, and Artificial Intelligence (AI) are the major trends revolutionizing healthcare accessibility, costs, and outcomes in MEA.

Saudi Arabia mHealth market is undergoing substantial growth. The adoption of mHealth technologies in Saudi Arabia is in its nascent stage. Increasing smartphone penetration and improving internet connectivity are some of the major drivers boosting the adoption. According to Ubuy estimates, approximately 92% of the Saudi population either has access to or owns a smartphone. The number of smartphone users was 33.55 million individuals in 2024.

Key mHealth Company Insights

The demand for advanced mobile health platforms and services has led to increased competition among the market players. Growing acceptance and awareness of adopting healthcare applications is likely to provide opportunities for the entry of new players in the coming years. Furthermore, increasing industry consolidation activities such as acquisitions and mergers by the top market players as well as growing initiatives in R&D of mobile health applications by key players are also anticipated to increase their share in the market.

Key mHealth Companies:

The following are the leading companies in the mHealth market. These companies collectively hold the largest market share and dictate industry trends.

- Apple, Inc.

- AT&T Intellectual Property

- AirStrip Technologies, Inc.

- Veradigm LLC (formerly, Allscripts Healthcare Solutions)

- Qualcomm Technologies, Inc.

- Vodafone Group PLC

- Google, LLC

- Telefonica S.A.

- SoftServe, Inc

- Samsung Electronics Co., Ltd.

- Orange

- SeekMed

Recent Developments

-

In October 2023, Cedars-Sinai recently launched a mobile health application called Cedars-Sinai Connect app, which utilizes artificial intelligence technology to provide virtual care solutions for different clinical matters. This app enables patients to schedule primary care visits on the same day and offers 24/7 virtual access to medical specialists for urgent treatment.

-

In November 2022, Hartford HealthCare entered into a long-term partnership with Google Cloud for the advancement of healthcare systems with improvement in data analytics, digital transformation, and enhancement of delivery care & access.

-

In April 2022, AirStrip Technologies, Inc. teamed up with FifthEye to merge and market the AHI System, which has received FDA approval, as Fifth Eye's AHI System. This system is designed to detect and forecast hemodynamic instability in real time.

-

In March 2022, Epic Systems Corporation launched Garden Plot, which provides small independent healthcare groups access to Epic software solutions and an interoperability network.

-

In March 2022, Vocera Communications, a part of Stryker, introduced Minibadge. This compact, portable, voice-driven wearable device integrates with clinical and operational workflows of healthcare facilities & enables hands-free communication.

-

In June 2021, Orange launched Future4care, a start-up accelerator program with an aim to support 150 start-ups in developing e-health solutions with the motive of benefiting both healthcare professionals and patients.

mHealth Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 71.9 billion

Revenue forecast in 2030

USD 158.3 billion

Growth rate

CAGR of 14.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; China; India; Japan; Australia; Singapore; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Apple, Inc.; AT&T Intellectual Property; AirStrip Technologies, Inc.; Veradigm LLC (formerly, Allscripts Healthcare Solutions); Qualcomm Technologies, Inc.; Vodafone Group PLC; Google, LLC; Telefonica S.A.; SoftServe, Inc.; Samsung Electronics Co., Ltd.; Orange; SeekMed

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global mHealth Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global mHealth market report based on component, end-use, and region:

-

Component Outlook (Revenue,USD Million, 2018 - 2030)

-

Wearables & Connected Medical Devices

-

Vital Sign Monitoring Devices

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep Monitoring Devices

-

Sleep trackers.

-

Wrist Actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs Fetal and Obstetric Devices

-

Neuromonitoring Devices

-

Electroencephalographs

-

Electromyographs

-

Others

-

-

-

mHealth Apps

-

Medical Apps

-

Women's Health

-

Fitness & Nutrition

-

Menstrual Health

-

Pregnancy Tracking & Postpartum Care

-

Menopause

-

Disease Management

-

Others

-

-

Chronic Disease Management Apps

-

Diabetes Management Apps

-

Blood Pressure and ECG Monitoring Apps

-

Mental Health Management Apps

-

Cancer Management Apps

-

Obesity Management Apps

-

Other Chronic Disease Management Apps

-

-

Personal Health Record Apps

-

Medication Management Apps

-

Diagnostic Apps

-

Remote Monitoring Apps

-

Others (Medical Reference, Professional Networking, Healthcare Education)

-

-

Fitness Apps

-

-

Services

-

Monitoring Services

-

Independent Aging Solutions

-

Chronic Disease Management & Post-Acute Care Services

-

-

Diagnosis Services

-

Healthcare Systems Strengthening Services

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Patients

-

Providers

-

Payers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mHealth market size was estimated at USD 62.7 billion in 2023 and is expected to reach USD 71.9 billion in 2024.

b. The global mHealth market is expected to grow at a compound annual growth rate of 14.1% from 2024 to 2030 to reach USD 158.3 billion by 2030.

b. mHealth apps segment dominated the mHealth market with a share of 51.8 % in 2023. This is attributable to the increasing penetration of the internet and smartphones and the growing adoption of mobile health apps by healthcare professionals and the patient population

b. Some key players operating in the mHealth market include Apple Inc.; AT&T; Allscripts Healthcare Solutions; Orange; Google Inc.; AirStrip Technologies; Qualcomm Inc.; Softserve; mQure; Telefonica; Vodafone Group; and Samsung Electronics.

b. Key factors that are driving the mHealth market growth include the increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and obesity, and the rising adoption of digital health technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.