- Home

- »

- Healthcare IT

- »

-

Telemedicine Market Size And Share, Industry Report, 2030GVR Report cover

![Telemedicine Market Size, Share & Trends Report]()

Telemedicine Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Products, Services), By Modality (Store & Forward, Real Time), By Application (Teleradiology, Telepsychiatry), By Delivery Mode, By Facility, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-313-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Telemedicine Market Summary

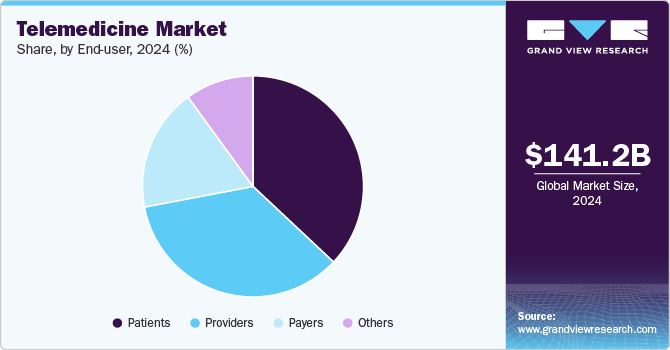

The global telemedicine market size was estimated at USD 141.19 billion in 2024 and is projected to reach USD 380.33 billion by 2030, growing at a CAGR of 17.55% from 2025 to 2030. The global telemedicine market is experiencing a transformative surge, propelled by industry consolidation, strategic partnerships, and a growing wave of healthcare consumerism.

Key Market Trends & Insights

- North America telemedicine market held a dominant revenue share of 33.36% in 2024.

- U.S. telemedicine market accounted for North America's largest telemedicine market share in 2024.

- Based on component, the product segment accounted for the largest revenue share of 51.57% in 2024.

- Based on modality, real-time segment accounted for the largest revenue share of 38.23% in 2024.

- Based on application, teleradiology segment held largest revenue share of 24.30% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 141.19 Billion

- 2030 Projected Market Size: USD 380.33 Billion

- CAGR (2025-2030): 17.55%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As leading organizations join forces and invest in innovative care models, the landscape is being reshaped to deliver more accessible, efficient, and patient-centered healthcare. The collaboration between MedStar Health and DispatchHealth in April 2024-designed to bring acute care directly to recently discharged patients-exemplifies how strategic initiatives are expanding telemedicine’s reach and impact.

Drivers of Telemedicine Market Growth

The demand for telemedicine services has surged in recent years, primarily due to technological advancements, increased accessibility, and the need to address persistent healthcare challenges such as cost containment, access limitations, and chronic disease management. Telemedicine encompasses a broad range of services including remote consultations, virtual visits, remote patient monitoring, and wearable health technologies. These services facilitate diagnosis of common illnesses, follow-up care post-procedures or hospitalizations, behavioral health therapy, and chronic condition management, among others. While telehealth adoption is increasing among clinicians and patients, certain clinical scenarios still necessitate in-person visits due to the nature of the condition or provider preference.

The COVID-19 pandemic accelerated telemedicine adoption globally, underscoring its strategic value in healthcare delivery. As healthcare systems transition into the post-pandemic era, frameworks such as “Leading Practices for the Future of Telemedicine” have emerged to support sustainable and scalable telemedicine integration. Key recommendations include:

-

Data-Driven Decision-Making: Collection and analysis of granular telemedicine usage and outcome data to inform policy and operational decisions.

-

Innovative Financing Models: Development of sustainable funding mechanisms to support telemedicine services.

-

Inclusive Governance: Engagement of all stakeholders, including patients and providers, in telemedicine policy formulation and implementation.

-

Integration into Care Models:

Embedding telemedicine within routine healthcare delivery to enhance accessibility and operational efficiency.

Market Trends and Consumer Preferences

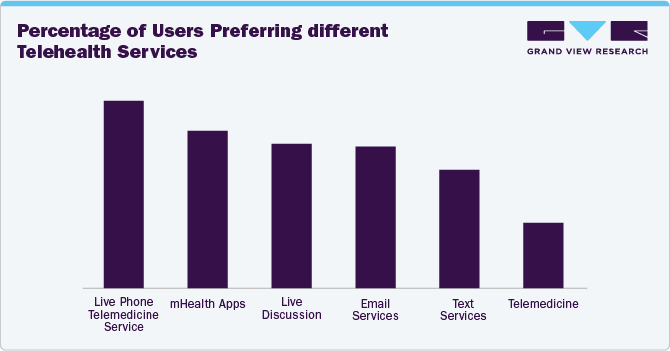

Recent trends show a growing preference for non-video telehealth options like audio calls and messaging, which enhance accessibility for underserved populations such as older adults, rural residents, and the uninsured. Rock Health’s 2022 survey found that 80% of consumers have used telemedicine, highlighting its role in reducing healthcare disparities. This shift is driving demand for multi-modal telehealth platforms that support quality care and build patient trust. Telemedicine-including virtual visits, remote monitoring, and wearable tech is reshaping healthcare by supporting services like diagnosis, post-procedure follow-ups, talk therapy, and chronic care management. While widely accepted, some services still require in-person visits due to clinical needs or provider preferences.

Funding and Investment Outlook

The telemedicine market has attracted substantial public and private investment, particularly following the COVID-19 pandemic. Venture capital and private equity funding have accelerated the development of telemedicine platforms, virtual consultation services, remote monitoring solutions, and AI-driven diagnostic tools. Government initiatives, such as expanded telehealth coverage under the Centers for Medicare & Medicaid Services (CMS), have further incentivized telemedicine adoption, especially among underserved populations.

Major Consolidation Moves in Post-Acute Care

Significant market consolidation has occurred in the post-acute care sector, reflecting investor confidence in remote and cost-effective healthcare delivery. Notable transactions include CVS Health’s acquisition of Signify Health for USD 8 billion and ATI Physical Therapy’s USD 2.5 billion merger. Additional key deals in 2025 include:

Table 1 Top Deals of the Telemedicine Market

Target

Acquirer

Acquirer Sector

Year

Amount (USD Million)

Catapult Health

Teladoc Health

Preventative Care

2025

65

AGNES Connect

UniDoc Health Corp.

Telemedicine

2025

0.175

Further analyses of acquisitions involving Amedisys, Nichii Holdings, Kindred at Home, LHC Group, Apria, DigitalBridge Group, AeroCare Holdings, and others will be included in the final deliverable.

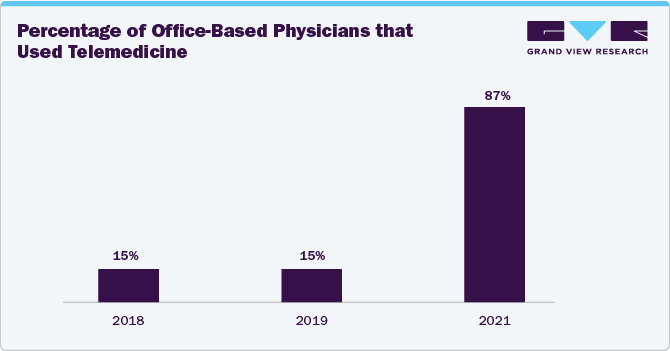

Impact of the COVID-19 Pandemic

The COVID-19 pandemic significantly accelerated telemedicine adoption. Teladoc Health reported a 109% year-on-year growth from Q3 2019 to Q3 2020. Similarly, American Well Corporation expanded its provider base to approximately 68,000 active providers by December 2020, facilitating specialist visits, primary care, and chronic care management. The surge in online visit volumes contributed to a revenue increase of approximately USD 76.5 billion in 2020 for American Well.

Quality, Safety, and Efficiency Enhancements

Telemedicine solutions contribute to improved healthcare accessibility, quality, and patient safety. Technologies such as electronic Intensive Care Units (e-ICU) and electronic care (eCare) systems enable continuous patient monitoring, reducing the risk of undetected adverse events. According to the Agency for Healthcare Research and Quality (AHRQ), telemedicine adoption has improved patient care delivery by minimizing missed symptoms and adverse effects.

Telemedicine also supports health education and information dissemination, facilitating advanced patient-centered care and improving access in remote areas. Additionally, telemedicine has demonstrated potential to reduce emergency room visits and hospitalization rates, contributing to overall healthcare cost containment.

Case Study: UnityPoint Health

UnityPoint Health’s partnership with Access TeleCare illustrates telemedicine’s operational and financial benefits. Initially launched in 2017 across three hospitals, the program expanded to eight facilities in Iowa, Illinois, and Wisconsin, addressing challenges in recruiting neurology and behavioral health providers, particularly in rural settings.

The telemedicine program included acute stroke care, remote EEG readings, inpatient neurohospitalist care, psychiatric consultations, and consultation-liaison psychiatry. Key outcomes included:

-

300% increase in neurology revenue

-

130% increase in revenue from the teleStroke program

-

281% return on investment from behavioral health services

-

USD 1.7 million reduction in emergency department boarding costs

-

11.8-hour reduction in average length of stay for behavioral health patients

The initiative improved care outcomes, operational efficiency, and financial performance, demonstrating the value of telemedicine integration in specialty care.

Challenges and Market Restraints

Despite the positive outlook, the telemedicine market faces challenges including regulatory variability, reimbursement complexities, technology integration issues, and cybersecurity concerns. The digital divide remains a barrier to equitable access, particularly among older adults and socioeconomically disadvantaged populations. Addressing these challenges requires coordinated efforts in policy development, technology standardization, and workforce training.

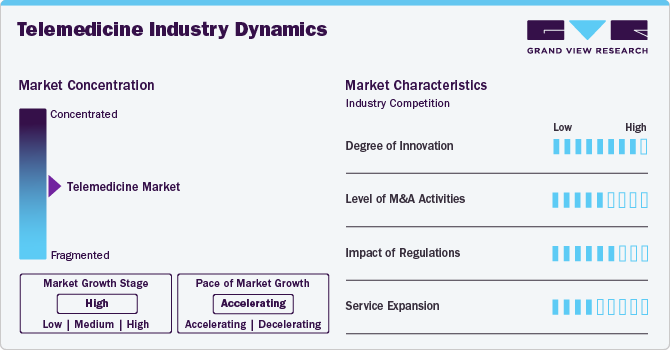

Market Concentration & Characteristics

Advancements in telecommunications and integrated medical technologies, such as AI diagnostics, IoT-enabled wearables, and remote monitoring are revolutionizing telemedicine. These innovations enhance real-time care, improve chronic disease management, and support proactive interventions. Cloud-based EMRs and AI-driven triage tools further streamline operations and improve patient outcomes, making telemedicine a scalable, cost-effective solution for rising healthcare demands. For instance, in May 2024, Apollo Telehealth, in partnership with the Government of Manipur, inaugurated a telemedicine-driven Primary Health Centre (PHC) in Borobeka. This initiative addresses the healthcare challenges faced by communities in conflict-affected and remote areas of Manipur.

M&A activity is strong, with key players such as Teladoc Health, American Well, and MDLive expanding through strategic acquisitions. Deals including Teladoc’s purchase of Livongo and CVS Health’s acquisition of Signify Health illustrate efforts to diversify services and strengthen chronic care and post-acute offerings. For instance, in March 2025, UniDoc Health Corp. acquired AGNES Connect software from AMD Telemedicine, a move aimed at enhancing its NEIL Connect platform. The acquisition includes AGNES Connect's software, intellectual property, trademarks, customer subscriptions, and the AMD Telemedicine brand.

Regulatory flexibility post-COVID-19 has significantly boosted telehealth adoption. Extensions of Medicare/Medicaid reimbursement relaxed cross-state licensing, and broader service coverage have increased provider participation and patient access, though regional disparities and compliance challenges remain.

Service expansion in the telemedicine market is evident in Hyundai Motor India Foundation’s July 2024 launch of five telemedicine clinics in Pune, Maharashtra, under the Sparsh Sanjeevani program. This initiative enhances healthcare access in underserved areas and reflects the sector's rapid growth, with India’s telemedicine market projected to hit USD 5.5 billion by 2025.

Component Insights

Product segment dominated the market and is further divided into software, hardware, and others. Product segment accounted for the largest revenue share of 51.57% in 2024. This can be attributed to the widespread adoption of various medical peripheral devices, audio equipment, microphones, display screens, and videoconferencing devices used to facilitate virtual visits. For instance, Teladoc Health, Inc. provides several devices, including Xpress & Xpress Cart, TV Pro & TV Pro+, Lite with Boom Camera, and Viewpoint Cart, to facilitate clinical collaboration and point-of-care visits.

Service segment is expected to witness fastest growth with a CAGR of 18.90% over the forecast period, owing to expanding field of remote patient monitoring, widespread use of teleconsulting between patients and clinicians, between physicians, and between surgeons and students is estimated to propel the segment growth. In December 2021, the Common Services Centre of the Ministry of Electronics and Information Technology in India launched CSC Health Services Helpdesk chatbot-based helpline on WhatsApp. This solution provides teleconsultation services for people living in rural parts of India.

Modality Insights

Modality segment is divided into real-time, store and forward, and other technologies such as remote patient monitoring. Real-time segment accounted for the largest revenue share of 38.23% in 2024. This growth can be attributed to increasing demand for on-demand medical consultations, adoption of mHealth and virtual video visits, and availability of services from major market players.

Other segments, including patient monitoring from remote locations such as homes or hospitals, are expected to experience significant growth, with fastest CAGR over the forecast period. As of 2018, Fitbit Health Solutions announced that Cedars-Sinai Hospital in Los Angeles had begun distributing Fitbit wearables to patients who had undergone hip replacements, knee replacements, and other surgical procedures. This facilitated patient activity monitoring and encouraged patients to begin walking short distances as part of their rehabilitation process. Moreover, in October 2020, Fitbit (now a subsidiary of Google) announced its intention to expand the premium health and fitness subscription service line by venturing into virtual care over the forecast period.

Application Insights

Teleradiology segment held largest revenue share of 24.30% in 2024. As healthcare providers adopt teleradiology workflows, service offerings within radiology sub-segments expand, and teleradiology practices are regulated, this segment is expected to grow. Key growth drivers for this segment include integrating Artificial Intelligence (AI) into teleradiology, implementing a Picture Archiving and Communication System (PACS), and increasing R&D activities in eHealth. For instance, telemedicine service provider Heidelberg Medical Consultancy & Health Tourism Pvt. Ltd. specializes in providing customized, affordable, high-quality radiology reporting solutions for dental specialists and practices.

Telepsychiatry is projected to grow fastest at a rate over the forecast period due to increasing prevalence of mental and behavioral health disorders, growing awareness, and adoption of telepsychiatry services. For instance, MD Live provides counseling and psychiatric sessions for a range of conditions such as anxiety, depression, trauma & PTSD, panic disorders, and more.

Delivery Model Insights

The web/mobile segment accounted for largest revenue share of 78.90% by delivery model in 2024 and is predicted to grow at fastest rate during the forecast period, owing to increasing prevalence of smartphone usage, mHealth adoption, and healthcare consumerism. This segment is further subdivided into audio/text-based and visualized access to care. Tech companies that provide mobile and web-based solutions are the key players in this segment. The adoption of visualized care delivery solutions is expected to be driven by increasing user awareness, introducing technologically advanced solutions, and penetrating cloud-based solutions.

The growth of the call centers segment is evident from the establishment of a COVID-19 telemedicine consultation call center by the Hyderabad Police in Telangana, India, in April 2021. The call center was launched to provide prompt responses to COVID-related queries from citizens.

Facility Insights

Telehome care solutions segment accounted for the largest revenue share of 50.11% in 2024 and is anticipated to experience fastest growth rate as adoption of remote patient monitoring devices increases. Furthermore, the growing geriatric population, increased prevalence of chronic diseases, and awareness of telemedicine solutions fuel the market growth.

Tele-hospitals segment is anticipated to experience sigificant growth rate as adoption of remote patient monitoring devices increases. This growth can be attributed to government initiatives, rising patient awareness of health concerns, and widespread access to internet-based solutions. For instance, Koninklijke Philips N.V. has a Tele-ICU program allowing doctors to remotely monitor ICU beds. The beds have cameras and special tools to help predict what might happen to patients.

End-user Insights

The patients segment held largest revenue share of 37.21% in 2024. This can be attributed to patients using telemedicine services for various health issues, from mild to emergency situations. To cater to diverse needs of patients, market players such as VSee offer a range of solutions, including telemedicine software, remote patient monitoring dashboards, and API & SDKs across various clinical specialties.

Provider segment is expected to grow at fastest growth rate during the forecast period, driven by ability of telemedicine solutions to improve the quality of healthcare services and provide healthcare providers with convenient access to patient records, improved decision support, workflows, and analytics. For instance, eHealth solutions offer healthcare professionals the convenience of patient scheduling and data management, which is expected to drive providers' adoption of telemedicine solutions over the forecast period.

Regional Insights

North America telemedicine market held a dominant revenue share of 33.36% in 2024. This can be attributed to region's advanced healthcare facilities, and a strong presence of key market players. Companies such as Teladoc Health, American Well Corporation, and Zoom Video Communications are based in the U.S., implementing strategic initiatives to increase their market share.

U.S. Telemedicine Market Trends

U.S. telemedicine market accounted for North America's largest telemedicine market share in 2024. Increasing home care adoption by patients, growing demand for mobile technologies, and increased healthcare expenditure are expected to drive the market's growth over the forecast period. For instance, according to the National Health Expenditure (NHE) Fact Sheet, the U.S. spent USD 4.3 Trillion on healthcare.

Asia Pacific Telemedicine Market Trends

Asia Pacific is expected to experience fastest growth at fastest CAGR of during forecast period. This is due to a large patient population, growing internet usage, and high demand for healthcare assistance, particularly in rural areas. India and China are predicted to lead the regional growth, with India's telemedicine service, eSanjeevani, already completing around 3 billion consultations across the country, according to a report from the India Brand Equity Foundation in March 2021.

Rising geriatric population, rapid technological advancements, favorable government initiatives to promote telemedicine use, and a shortage of healthcare specialists drive Japan’s telemedicine market. By implementing Internet of Things (IoT) and Artificial Intelligence (AI) technologies, the government plans to replace traditional treatments in healthcare and reduce costs. Thus, such factors propel growth of the market.

Key Telemedicine Company Insights

MDlive, Inc. (Evernorth), American Well Corporation, and Teladoc Health, Inc. are some of the dominant players operating in telemedicine market.

-

MDlive, Inc. (Evernorth) offers affordable, predictable, and simple healthcare solutions.

-

American Well Corporation delivers providers, payers, and Amwell Converge platform solutions.

-

Teladoc Health, Inc. has more than 12,000 clients across the globe and provides virtual care, such as mental health, primary care, and chronic condition management.

Key Telemedicine Companies:

The following are the leading companies in the telemedicine market. These companies collectively hold the largest market share and dictate industry trends.

- MDlive, Inc. (Evernorth)

- American Well Corporation

- Twilio Inc.

- Teladoc Health, Inc.

- Doctor On Demand, Inc. (Included Health)

- Zoom Video Communications, Inc.

- SOC Telemed, Inc.

- NXGN Management, LLC

- Plantronics, Inc.

- Practo

- VSee

Recent Developments

-

In October 2024, AMD Global Telemedicine partnered with Carefluence, an innovator in interoperability solutions, to enhance AMD’s robust telehealth solutions, provide continuity of care, and enhance clinical outcomes.

-

In April 2024, MedStar Health, the hospital system based in Columbia, Maryland, announced its collaboration with the in-home care service DispatchHealth. This partnership aimed to deliver acute care services to individuals recently discharged from MedStar facilities in Washington, D.C.

-

In March 2024, RamSoft, a provider of cloud-based PACS /RIS radiology solutions, entered into a 5-year agreement with Premier Radiology Services to utilize RamSoft’s OmegaAI and PowerServer PACS platform across its network of more than 1,000 teleradiology locations.

-

In June 2023, Twilio Inc. declared a partnership with Frame AI to leverage AI for the enhancement of customer engagement. The partnership resulted in the strengthening of AI-powered insights for sharing recommendations, and summarizing health cases.

-

In April 2023, Teladoc Health Inc. launched a provider-based care service with the use of telemedicine as a technology for prediabetes and weight management programs.

Telemedicine Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 169.45 billion

The revenue forecast in 2030

USD 380.33 billion

Growth rate

CAGR of 17.55% from 2025 to 2030

Actual estimates

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, modality, application, delivery model, facility, end-user, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Netherlands; Sweden; Russia; Switzerland; Japan; China; India; South Korea; Australia; Singapore; Malaysia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Israel

Key companies profiled

MDlive, Inc. (Evernorth); American Well Corporation; Twilio Inc.; Teladoc Health, Inc.; Doctor On Demand, Inc. (Included Health); Zoom Video Communications, Inc.; SOC Telemed, Inc.; NXGN Management, LLC; Plantronics, Inc.; Practo; VSee

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Telemedicine Market Report Segmentation

This report forecasts revenue growth at the global, regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global telemedicine market report based on component, modality, application, delivery model, facility, end-user, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Product

-

Hardware

-

Software

-

Others

-

-

Services

-

Tele-consulting

-

Tele-monitoring

-

Tele-education

-

-

-

Modality Outlook (Revenue, USD Billion, 2018 - 2030)

-

Store and forward

-

Real time

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Teleradiology

-

Telepsychiatry

-

Telepathology

-

Teledermatology

-

Telecardiology

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Web/Mobile

-

Audio/ Text-based

-

Visualized

-

-

Call Centers

-

-

Facility Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tele-hospital

-

Tele-home

-

-

End User Outlook (Revenue, USD Billion, 2018 - 2030)

-

Providers

-

Payers

-

Patients

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global telemedicine market size was estimated at USD 141.19 billion in 2024 and is expected to reach USD 169.45 billion in 2025.

b. The global telemedicine market is expected to grow at a compound annual growth rate of 17.55% from 2025 to 2030 to reach USD 380.3 billion by 2030.

b. North America dominated the telemedicine market in 2024 with a share of over 33.36%. This is owing to rising digitalization across healthcare, advanced healthcare facilities, and the adoption of telemedicine solutions.

b. Some key players operating in the telemedicine market include MDlive, Inc. (Evernorth); American Well Corporation; Twilio Inc.; Teladoc Health, Inc.; Doctor On Demand, Inc. (Included Health); Zoom Video Communications, Inc.; SOC Telemed, Inc.; NXGN Management, LLC; Plantronics, Inc.; Practo; and VSee.

b. Key factors driving the telemedicine market include the growing need to reduce the cost of care, consolidation across the industry, and other strategic initiatives by key companies, as well as healthcare consumerism.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.