- Home

- »

- Biotechnology

- »

-

Molecular Cytogenetics Market Size, Industry Report, 2033GVR Report cover

![Molecular Cytogenetics Market Size, Share & Trends Report]()

Molecular Cytogenetics Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Genetic Disorders, Oncology, Personalized Medicine), By Technology (Comparative Genomic Hybridisation), By Product, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-023-1

- Number of Report Pages: 136

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Molecular Cytogenetics Market Summary

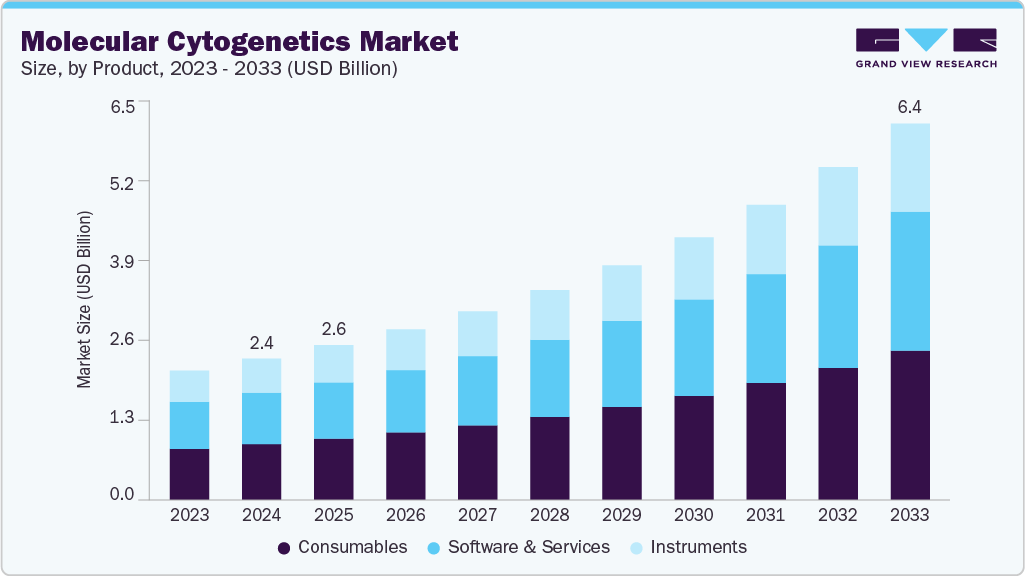

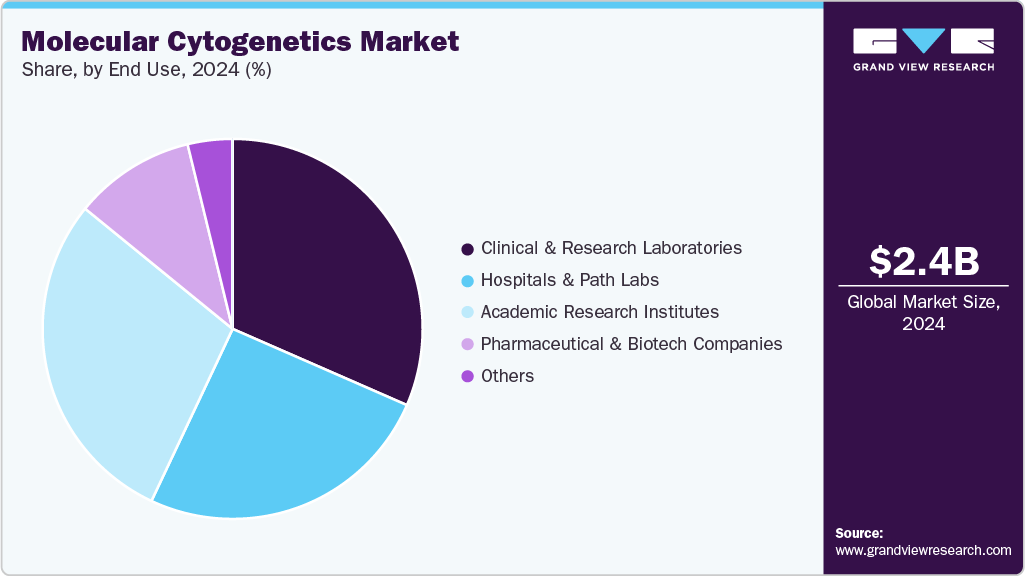

The global molecular cytogenetics market size was estimated at USD 2.40 billion in 2024 and is projected to reach USD 6.39 billion by 2033, growing at a CAGR of 11.7% from 2025 to 2033. The market expansion is supported by the increasing use of molecular cytogenetic techniques in clinical diagnostics and research, particularly in oncology, genetic disorders, and prenatal testing.

Key Market Trends & Insights

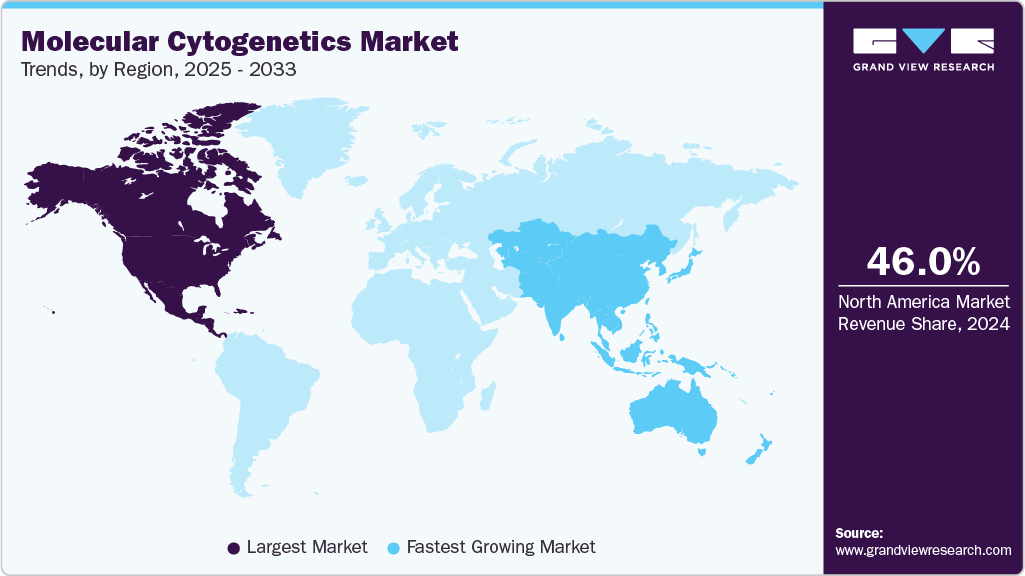

- North America molecular cytogenetics market held the largest share of 46.01% of the global market in 2024.

- The molecular cytogenetics market in the U.S. is expected to grow significantly over the forecast period.

- By product, the consumables segment held the largest market share of 39.54% in 2024.

- By application, the oncology segment dominated the market with the largest revenue share of 39.84% in 2024.

- By technology, the comparative genomic hybridization (CGH) segment dominated the market with the largest revenue share of 36.20% in 2024.

- By end use, the clinical & research laboratories segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.40 Billion

- 2033 Projected Market Size: USD 6.39 Billion

- CAGR (2025-2033): 11.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These tools offer high-resolution analysis of chromosomal abnormalities, making them essential in modern laboratory and clinical workflows. The growing application of fluorescence in situ hybridization (FISH), comparative genomic hybridization (CGH), and array-based methods contributes to the rising adoption of molecular cytogenetics. Expanding use in personalized medicine and technological improvements in automation and imaging continue to strengthen market demand across hospitals, academic institutions, and research centers.

With the growing volume of genomic data, integrating multi-omics approaches and advancements in bioinformatics tools significantly enhances the molecular cytogenetics field. These enhancements facilitate better management, analysis, and interpretation of large genomic datasets, making it easier to discover meaningful links between chromosomal alterations and diseases. As a result, demand for molecular cytogenetics is expected to grow, with laboratories increasingly relying on these tools for both research and diagnostic applications.

In December 2023, Lupin Diagnostics unveiled a new state-of-the-art Regional Reference Laboratory in Chennai, Tamil Nadu. This laboratory offers a wide range of services, including molecular diagnostics and especially cytogenetics, alongside flow cytometry, cytology, and more. This expansion enhances regional access to high-quality molecular cytogenetic testing and supports better diagnostic capabilities in southern India. Such investments by major diagnostic providers validate cytogenetics' significance in routine clinical practice and reflect growing market confidence in the technology's utility and future growth potential.

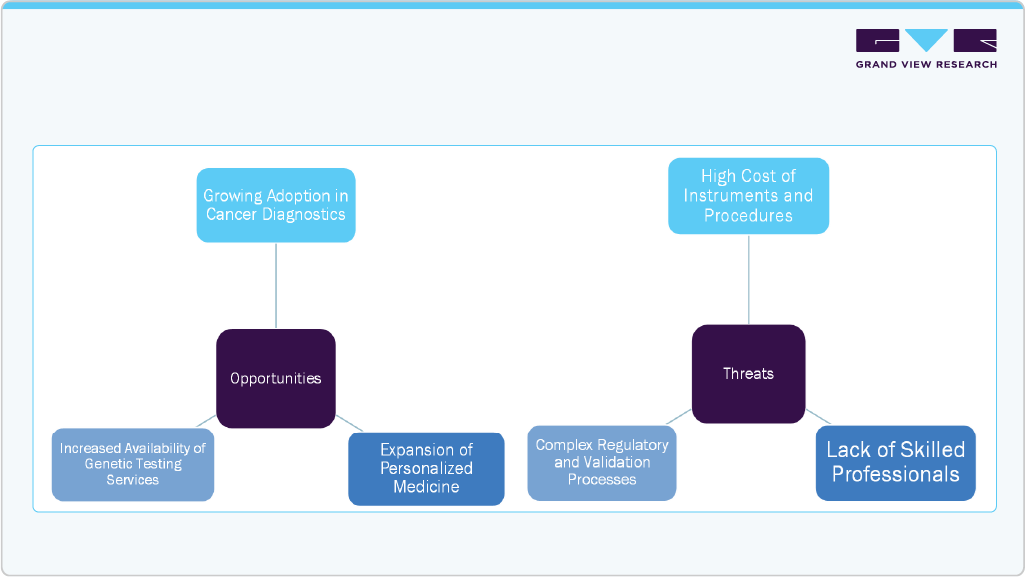

Opportunities

Growing Adoption in Cancer Diagnostics: The rising use of molecular cytogenetic tools such as FISH and array CGH in cancer diagnostics offers strong growth potential. These technologies help identify chromosomal abnormalities in solid tumors and blood cancers, enabling more accurate diagnosis and targeted treatment.

Expansion of Personalized Medicine: As healthcare systems increasingly shift toward personalized treatment, there is a rising demand for tools that detect individual genetic variations. Molecular cytogenetics plays a key role in guiding therapy decisions, especially in oncology and genetic disorder management.

Increasing Availability of Genetic Testing Services: The growing number of diagnostic laboratories and partnerships between hospitals and genetic testing providers is improving access to cytogenetic testing. This trend is especially visible in emerging markets, where improving infrastructure and awareness are driving market expansion.

Threats

High Cost of Instruments and Procedures: Molecular cytogenetic systems and reagents are expensive, and many laboratories, especially in low-resource settings, may not be able to afford them. This can limit market reach, particularly in smaller or rural healthcare setups.

Lack of Skilled Professionals: The techniques used in molecular cytogenetics require trained personnel for accurate analysis and interpretation. A shortage of skilled cytogeneticists or lab technicians can affect testing quality and slow adoption.

Complex Regulatory and Validation Processes: Molecular cytogenetic tests, particularly those used for clinical diagnostics, must undergo strict regulatory review and validation. Delays in approvals or inconsistent global standards can act as barriers to product launch and adoption.

Despite these challenges, the molecular cytogenetics market is expected to benefit from ongoing technological improvements, better awareness about genetic testing, and increased research in rare and complex diseases. Continued investments in lab automation and digital imaging, along with collaborations between research institutions and diagnostic firms, are likely to support the broader adoption of molecular cytogenetic tools in both developed and developing regions.

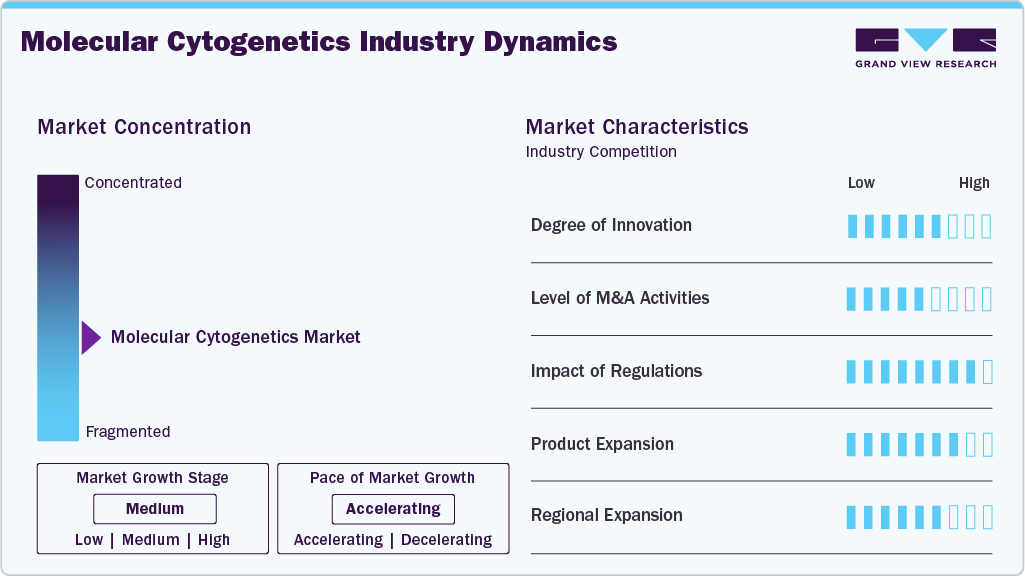

Market Concentration & Characteristics

Innovation remains strong in the molecular cytogenetics market, with continuous improvements in probe design, imaging systems, and data interpretation software. The integration of AI-driven image analysis and automated workflows is making cytogenetic testing faster and more accurate. High-resolution and multiplex FISH techniques are also expanding the scope of analysis, enabling better disease characterization.

Mergers and acquisitions are moderately active, especially among diagnostic technology firms looking to expand their genetic testing capabilities. Companies are acquiring specialized players in cytogenetics to strengthen their portfolios in oncology, reproductive health, and rare disease testing. Partnerships with academic institutions and clinical laboratories are also increasing to accelerate research and product validation.

Regulatory frameworks play a crucial role in the adoption of molecular cytogenetic tests, particularly those intended for clinical diagnostics. Agencies such as the U.S. FDA and the European Medicines Agency (EMA) set rigorous standards for approval, impacting timelines and market entry. While strict regulations ensure test quality, they can slow innovation and increase development costs, especially for new probe technologies or platform integrations.

Product development is focused on expanding test menus, improving automation, and integrating digital technologies. Newer FISH and array CGH kits offer greater resolution and target detection flexibility, supporting more complex genetic analyses. Companies are also introducing companion diagnostic kits that align with targeted therapies, particularly in oncology, to support precision medicine initiatives.

Growth is accelerating in Asia-Pacific, Latin America, and parts of the Middle East, supported by improvements in healthcare infrastructure and rising awareness of genetic diseases. These regions are experiencing increased investments in molecular labs, training programs, and diagnostic technologies. While North America and Europe continue to lead in revenue, emerging markets offer strong volume potential due to unmet clinical needs and expanding reimbursement support.

Application Insights

The oncology segment dominated the market for molecular cytogenetics and accounted for the largest revenue share of 39.84% in 2024, driven by the rising number of cancer diagnoses globally. Molecular cytogenetics plays a key role in understanding chromosomal abnormalities and genomic changes that contribute to cancer development. FISH and array CGH techniques are widely used to detect gene rearrangements, amplifications, and deletions in solid tumors and hematological malignancies. In addition, the shift toward personalized oncology care has strengthened the segment’s growth. Molecular cytogenetic analysis supports treatment planning by identifying specific genetic markers that influence disease progression and drug response. This enables oncologists to tailor therapies to individual patient profiles, improving outcomes. As cancer cases continue to rise and precision medicine becomes more integrated into clinical care, the oncology segment is expected to maintain its strong position over the forecast period.

The personalized medicine segment is anticipated to witness the fastest CAGR during the forecast period. The growing focus on individualized treatment approaches and the increasing availability of genomic data are contributing to the rising use of molecular cytogenetics in this field. Tools such as FISH and array-based platforms allow clinicians to detect patient-specific chromosomal changes, which are critical for guiding targeted therapies. Rapid advancements in genomic technologies, combined with the development of therapies that address specific molecular alterations, have strengthened the role of cytogenetics in clinical decision-making. In addition, the rising number of clinical trials evaluating gene-targeted drugs is expected to further increase the demand for precise diagnostic methods. These factors are likely to drive sustained growth in the personalized medicine segment throughout the forecast period.

Technology Insights

The comparative genomic hybridization (CGH) segment dominated the molecular cytogenetics market and accounted for the largest revenue share of 36.20% in 2024. Technology has significantly improved the detection of chromosomal abnormalities, offering high-resolution analysis of copy number variations (CNVs), deletions, duplications, and amplifications that are often missed by traditional karyotyping. CGH is widely used in clinical diagnostics and cancer research for identifying submicroscopic chromosomal changes.

Array-based CGH (aCGH) has further advanced the use of this technique by enabling the analysis of DNA extracted from non-dividing cells. This has expanded its applicability across a range of sample types and clinical settings. As laboratories seek more efficient and precise tools for genomic analysis, ongoing technological improvements in CGH platforms are expected to support segment growth during the forecast period.

The technology segment also comprises fluorescence in situ hybridization (FISH), karyotyping, immunohistochemistry, and other emerging techniques. The “other technologies” segment is anticipated to register the fastest CAGR over the forecast period, driven by innovations in single-cell sequencing and digital cytogenetics. These technologies allow for deeper insights into genetic heterogeneity at the individual cell level, particularly in tumor profiling. In addition, the growing use of bioinformatics tools to manage and interpret large-scale data is supporting the adoption of newer platforms, expanding the market’s technological landscape.

Product Insights

The consumables segment dominated the molecular cytogenetics market, accounting for a share of 39.54% of total revenue in 2024. The continuous requirement for single-use items such as probes, reagents, slides, and buffers essential for FISH, CGH, and array-based tests drives this strong performance. As awareness of genetic disorders, cancer diagnostics, and personalized medicine grows worldwide, so does the recurring use of these consumables in clinical and research settings.

Meanwhile, the software & services segment is projected to experience the fastest CAGR over the forecast period. Laboratories increasingly invest in bioinformatics platforms, AI‑driven image analysis, and cloud-native tools to process vast cytogenetics datasets. A notable example is the release of CHROMA, a foundation model trained on 4 million chromosomal images and launched in May 2025, which automates metaphase spread interpretation and supports remote case sign-out. This deployment highlights the growing shift toward digital solutions that improve lab efficiency, reduce manual workload, and enable decentralized diagnostics.

End Use Insights

The clinical & research laboratories segment dominated the molecular cytogenetics market in 2024. These labs are central to diagnostic and research workflows, using molecular cytogenetic techniques-such as FISH, aCGH, and karyotyping-to detect chromosomal abnormalities in genetic disorders, cancer, and prenatal testing. In May 2024, Thermo Fisher Scientific announced that its CytoScan Dx Assay and Chromosomal Analysis Suite (ChAS) Dx software achieved compliance with the European Union’s In Vitro Diagnostic Regulation (IVDR 2017/746). This approval enables clinical cytogenetic laboratories across Europe to deploy these tools under the latest safety and performance standards, enhancing test reliability and facilitating consistent adoption of molecular cytogenetics solutions.

The pharmaceutical & biotechnology companies segment is projected to witness the fastest CAGR over the forecast period. Molecular cytogenetics enables the identification of specific chromosomal abnormalities and genetic changes that play a role in disease progression, particularly in oncology and rare genetic disorders. This insight is crucial for pharmaceutical firms developing targeted therapies and precision treatments based on individual genetic profiles. Technological advancements-such as high-resolution array platforms, automated FISH systems, and integration with next-generation sequencing (NGS)-have further improved the utility of cytogenetic data in drug discovery and translational research. As these companies continue to prioritize the development of personalized medicines and biomarker-driven therapies, demand for accurate genomic profiling tools is expected to support segment expansion throughout the forecast period.

Regional Insights

North America molecular cytogenetics market held the largest share of the molecular cytogenetics market in 2024. Advanced healthcare systems, modern lab facilities, and substantial investments in research supported this. The region also has a high demand for genetic testing, which grows as awareness increases and more people seek early diagnosis for genetic and chronic conditions. In the U.S., the National Human Genome Research Institute (NHGRI) was allocated USD 663.7 million in the President’s 2025 budget, slightly higher than in 2023. This funding supports research in genomics and cytogenetics, helping improve disease detection and treatment approaches.

In Canada, the government announced a ~USD 130 million investment in February 2025 for the new Canadian Genomics Strategy. This plan aims to support genetic testing, personalized medicine, and the development of genomics-based health tools. The strong funding support, growing awareness of genetic disorders, and better access to modern diagnostic tools are key factors helping the North American market grow.

U.S. Molecular Cytogenetics Market Trends

The U.S. leads the molecular cytogenetics market due to strong investment in genomic research, high demand for genetic testing, and widespread use of advanced diagnostic technologies. The country benefits from a well-developed healthcare infrastructure and active support from federal agencies such as the National Institutes of Health (NIH) and the National Human Genome Research Institute (NHGRI). These institutions fund large-scale genomic initiatives and promote the use of molecular cytogenetics in both clinical and research settings.

Increased focus on personalized medicine, cancer diagnostics, and rare disease detection continues to drive the use of molecular cytogenetic tools across U.S. laboratories and hospitals. The availability of automated platforms, digital imaging systems, and bioinformatics support is also helping expand adoption. Alongside this, public health initiatives and rising awareness of genetic disorders are encouraging more routine use of cytogenetic tests in both prenatal and oncology applications.

Europe Molecular Cytogenetics Market Trends

Europe is witnessing steady growth in the molecular cytogenetics market, supported by rising demand for genetic testing, expanding clinical research, and increasing focus on rare and inherited diseases. Countries such as Germany, the UK, and France are leading adoption, especially in cancer diagnostics, prenatal screening, and personalized medicine programs. Public healthcare systems and academic institutions across Europe are actively integrating molecular cytogenetic tools into routine diagnostics and research workflows. Government support for genomics initiatives, favorable reimbursement policies, and growing investments in advanced diagnostic labs are also contributing to market expansion. The use of techniques such as FISH and array-based CGH is increasing in both hospital and research settings. In addition, the adoption of automated platforms and digital analysis tools is improving testing efficiency and helping laboratories meet growing demand across the region.

Molecular cytogenetics market in UK is growing steadily, driven by increased focus on early diagnosis of genetic and rare diseases, as well as expanding applications in oncology and reproductive health. Public health awareness, combined with strong academic and clinical research infrastructure, is encouraging the use of cytogenetic tools in both hospital and research settings. Government support for genomic medicine, such as through the NHS Genomic Medicine Service, is boosting access to molecular testing technologies. Techniques such as FISH and array-CGH are being adopted for cancer profiling, prenatal screening, and personalized treatment planning. With a growing demand for precise, data-driven diagnostics, the UK continues to strengthen its position as a key growth market in Europe.

Germany molecular cytogenetics market shows strong growth in the molecular cytogenetics market, supported by a well-established healthcare system and widespread integration of genetic testing into clinical practice. The country’s focus on precision diagnostics, particularly in oncology and prenatal care, has driven the adoption of advanced cytogenetic tools such as FISH, array-CGH, and karyotyping. Public and private investment in genomic research, along with collaborations between hospitals, universities, and biotech firms, continue to strengthen the diagnostic ecosystem. Molecular cytogenetics is increasingly being used in rare disease detection, reproductive health, and personalized treatment planning. With growing emphasis on laboratory automation and digital analysis, Germany remains one of the most prominent markets for molecular cytogenetics in Europe.

Asia Pacific Molecular Cytogenetics Market Trends

Asia Pacific is the fastest-growing region in the molecular cytogenetics market, driven by growing awareness of genetic disorders, increasing access to advanced diagnostics, and expanding healthcare infrastructure. Countries like China, India, and Japan are investing in birth defect screening and personalized medicine, which boosts the use of cytogenetic tools in both clinical and research labs. A notable example occurred in January 2023, when Redcliffe Labs opened new satellite laboratories in Bathinda, Ludhiana, and Jalandhar in Punjab, India. These labs are equipped with state-of-the-art diagnostic equipment, including cytogenetics testing capabilities, making advanced services more widely available at the regional level. These developments, alongside increased public health programs and the adoption of automated and digital cytogenetics platforms, are fueling rapid market growth across Asia Pacific.

The Japan molecular cytogenetics market is expanding gradually, driven by the country’s focus on early disease detection, aging population, and growing use of genetic testing in cancer and prenatal care. Hospitals and research institutes are increasingly adopting techniques like FISH and array-CGH for accurate chromosomal analysis, especially in oncology and rare genetic conditions.

Although the regulatory environment is highly structured, the demand for precise, reliable cytogenetic tools continues to rise. Supportive government programs in genomics and personalized medicine, along with strong academic collaborations, are helping expand access to advanced diagnostics. Japan is also seeing growing interest in automated platforms and software integration, making molecular cytogenetics more accessible across clinical and diagnostic laboratories.

China molecular cytogenetics market represents a major growth opportunity in the molecular cytogenetics market, driven by a strong focus on genomics, increasing healthcare spending, and rising awareness of genetic disorders. The government is promoting precision medicine and large-scale genomic initiatives, which are encouraging hospitals and research centers to adopt cytogenetic tools for cancer, prenatal screening, and rare disease diagnostics.

The rapid development of healthcare infrastructure, along with a growing middle class, is supporting broader access to advanced diagnostics. Local companies are also investing in affordable and scalable cytogenetics solutions, boosting domestic availability. As demand rises for personalized healthcare and early disease detection, China continues to play an increasingly important role in the global molecular cytogenetics market.

Latin America Molecular Cytogenetics Market Trends

Latin America is experiencing moderate but rising demand in the molecular cytogenetics market, supported by improved access to diagnostics, increasing awareness of genetic diseases, and growing investment in public healthcare systems. Countries such as Brazil, Mexico, and Argentina are gradually adopting cytogenetic testing for oncology, prenatal screening, and rare disease identification.

Affordability and the need for scalable, efficient diagnostic solutions are key drivers of adoption in this region. Public and private healthcare institutions are working to expand laboratory infrastructure and bring advanced testing capabilities to underserved areas. As training programs and awareness campaigns improve, the region is expected to see continued growth in the use of molecular cytogenetic tools across clinical and research settings.

The Brazil molecular cytogenetics market is expanding, driven by rising awareness of genetic conditions, increasing cancer rates, and efforts to strengthen diagnostic services across public and private healthcare sectors. The country is seeing greater adoption of cytogenetic tools such as FISH and karyotyping, particularly in oncology and prenatal care.

Government-backed healthcare initiatives, improved laboratory infrastructure, and growing demand for personalized medicine are supporting the use of advanced genetic testing. As more diagnostic centers adopt automated and cost-effective solutions, Brazil is becoming a key contributor to regional growth. The focus on accessible and early diagnostics is expected to further increase the role of molecular cytogenetics in Brazil's evolving healthcare system.

Middle East and Africa Molecular Cytogenetics Market Trends

The Middle East and Africa region is showing emerging growth in the molecular cytogenetics market, supported by rising awareness of genetic disorders, gradual improvements in healthcare access, and increasing adoption of modern diagnostic tools. Countries such as South Africa, the UAE, and Saudi Arabia are expanding the use of cytogenetic testing in hospitals and specialized centers, especially for cancer diagnostics and prenatal screening.

Although infrastructure limitations and cost challenges persist, government efforts to modernize healthcare systems and international collaborations are helping improve access to genetic testing. Mobile diagnostic units, public health campaigns, and regional investments in genomics research are also contributing to the growing adoption of molecular cytogenetics in underserved areas. As awareness and accessibility increase, the region is expected to see steady market expansion over the coming years.

Key Molecular Cytogenetics Company Insights

Companies in the molecular cytogenetics market are focusing on expanding their global presence, launching innovative diagnostic platforms, and improving testing accuracy through technological advancements. Strategic moves such as partnerships, mergers, and acquisitions are commonly adopted to strengthen research capabilities and develop novel cytogenetic solutions. These efforts aim to enhance product portfolios, enter emerging markets, and meet the growing demand for precise and scalable genetic testing technologies.

Key Molecular Cytogenetics Companies:

The following are the leading companies in the molecular cytogenetics market. These companies collectively hold the largest market share and dictate industry trends.

- BIOVIEW

- Danaher

- MetaSystems

- Agilent Technologies, Inc.

- Abbott

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Oxford Gene Technology IP Limited

- F. Hoffmann-La Roche Ltd

- PerkinElmer

Recent Developments

-

In March 2025, researchers at Hangzhou Diagens Biotechnology Co., Ltd. introduced iMedImage, an AI-based model developed to automate chromosome segmentation, karyotyping, and abnormality detection. The model achieved 92.7% sensitivity and 91.5% specificity, reflecting its strong diagnostic performance. Designed to reduce manual workload in cytogenetics laboratories, iMedImage supports faster and more accurate diagnostics. This development reflects the growing integration of AI-powered tools in the molecular cytogenetics market, helping laboratories scale their workflows efficiently.

-

In April 2024, Bionano Genomics teamed with Hangzhou Diagens Biotechnology to introduce China’s first clinical cytogenetic workflow that integrates optical genome mapping (OGM) with AI-based karyotype analysis, under an OEM partnership approved by the NMPA.

-

In October 2023, Manipal HealthMap completed a 100% acquisition of Medcis PathLabs, a Hyderabad-based diagnostic lab specializing in molecular cytogenetics, histopathology, and microbiology. This deal enhances Manipal’s diagnostic network across 16 states, adding over 100 centers under its belt.

-

In August 2023, the American Institute of Pathology & Laboratory Sciences (Ampath) opened a new 7,000 sq. ft. reference laboratory in Gurgaon, India. This advanced facility offers a wide range of diagnostic services, including molecular cytogenetics. The expansion aims to improve access to specialized genetic testing across North India and strengthen Ampath’s presence in the country. The lab also provides services such as next-generation sequencing (NGS), histopathology, and other high-end diagnostic tests, helping meet the growing demand for precision diagnostics in clinical settings.

-

In June 2023, Oxford Gene Technology (OGT) entered into a collaboration with Applied Spectral Imaging (ASI) to strengthen its molecular cytogenetics offerings in the UK. This partnership integrates ASI’s automated imaging and analysis tools-such as its HiFISH platform-with OGT’s CytoCell FISH probes, aiming to improve accuracy and efficiency in cytogenetic testing. The collaboration is expected to assist diagnostic labs streamline workflows and deliver faster, more reliable genetic test results across clinical and research settings in Great Britain.

Molecular Cytogenetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.63 billion

Revenue forecast in 2033

USD 6.39 billion

Growth rate

CAGR of 11.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, technology, product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BIOVIEW; Danaher; MetaSystems; Agilent Technologies, Inc.; Abbott; Bio-Rad Laboratories, Inc.; Illumina, Inc.; Oxford Gene Technology IP Limited; F. Hoffmann-La Roche Ltd; PerkinElmer

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Molecular Cytogenetics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global molecular cytogenetics market based on application, technology, product, end use, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Genetic Disorders

-

Oncology

-

Personalized Medicine

-

Other Applications

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Comparative Genomic Hybridization

-

aCGH

-

sCGH

-

-

FISH

-

Immunohistochemistry

-

Karyotyping

-

Spectral

-

Virtual

-

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Consumables

-

Software & Services

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical & Research Laboratories

-

Hospitals & Path Labs

-

Academic Research Institutes

-

Pharmaceutical & Biotech Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global molecular cytogenetics market size was estimated at USD 2.39 billion in 2024 and is expected to reach USD 2.62 billion in 2025.

b. The global molecular cytogenetics market is expected to grow at a compound annual growth rate of 11.7% from 2025 to 2033 to reach USD 6.39 billion by 2033.

b. Comparative genomic hybridization dominated the molecular cytogenetics market with a share of 36.6% in 2024. This is attributable to its wide adoption across various applications such as diagnostics, research activities, and medicine development.

b. Some key players operating in the molecular cytogenetics market include Agilent Technologies, Inc.; Abbott; Bio-Rad Laboratories, Inc.; Illumina, Inc.; Oxford Gene Technology; F. Hoffmann-La Roche Ltd.; PerkinElmer Inc.; Quest Diagnostics Incorporated; Applied Spectral Imaging; and Biological Industries USA, Inc.

b. Key factors that are driving the market growth include growth in utilization of genetic information in predictive models for disease traits coupled with increasing incidence of cancer and related growth in mortality per year.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.